hhgregg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

hhgregg's SWOT analysis reveals a company facing significant challenges in a competitive retail landscape, with potential strengths in brand recognition but clear weaknesses in its online presence and financial stability. Understanding these dynamics is crucial for any investor or strategist looking to navigate this market.

Want the full story behind hhgregg’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

While hhgregg faced significant financial headwinds and store closures, its brand name still holds a certain resonance, especially with consumers who recall its extensive physical retail presence. This established recognition can be a valuable asset in the competitive online appliance and electronics market.

For instance, surveys from late 2023 indicated that a portion of consumers, particularly those aged 55 and over, still associated hhgregg with reliable appliance purchases, a demographic that often prioritizes brand familiarity. This existing awareness can reduce the customer acquisition cost for their e-commerce operations compared to startups needing to build brand awareness from scratch.

The legacy brand name offers a potential shortcut to building trust in the digital realm. By leveraging past positive customer experiences, hhgregg can aim to cultivate loyalty among new online shoppers, differentiating itself from less-known e-commerce competitors entering the market in 2024 and 2025.

hhgregg's niche specialization in consumer electronics and home appliances allows for a deep understanding of these specific markets. This focus enables them to offer a curated selection of products and potentially provide more expert advice than broader retailers. For example, in 2024, the consumer electronics market was projected to reach over $1.1 trillion globally, highlighting the significant potential within specialized segments.

hhgregg's online-only operational model is a significant strength, drastically cutting down expenses typically tied to physical retail spaces. This means lower outlays for rent, utilities, and staffing, allowing for more competitive pricing and improved profit margins. For instance, in 2023, the average cost of operating a retail store can range from $50,000 to $150,000 per month, a burden hhgregg bypasses.

This lean structure also provides inherent scalability; expanding online reach doesn't require the substantial capital investment associated with opening new brick-and-mortar locations. This agility allows hhgregg to adapt quickly to market demand and reach a wider customer base efficiently, a key advantage in the fast-paced e-commerce landscape.

Direct-to-Consumer (D2C) Engagement

hhgregg's direct-to-consumer (D2C) online model is a significant strength, allowing for direct customer relationships and the collection of valuable first-party data. This data on preferences and purchasing behaviors fuels hyper-personalized marketing and product recommendations, boosting customer loyalty. The company also gains enhanced control over the entire customer experience, from initial browsing through to post-purchase support.

This direct engagement is crucial in today's market. For instance, in the 2024 holiday season, online retail sales saw a robust increase, with D2C channels often outperforming traditional retail in terms of customer data acquisition and personalized offers. hhgregg's ability to leverage this direct channel allows for agile responses to market trends and customer feedback, a key differentiator.

Key benefits of hhgregg's D2C engagement include:

- Enhanced Customer Data: Direct access to first-party data for better insights.

- Personalized Experiences: Tailored marketing and product suggestions improve engagement.

- Full Journey Control: Oversight of the customer experience from start to finish.

- Increased Loyalty: Stronger relationships fostered through direct interaction.

24/7 Accessibility and Convenience

hhgregg's e-commerce platform provides unparalleled 24/7 accessibility, allowing customers to browse and purchase electronics and home appliances at their convenience, regardless of location or time. This constant availability aligns with modern consumer habits, effectively broadening hhgregg's market reach beyond the constraints of traditional brick-and-mortar store hours and physical limitations. The digital storefront ensures a persistent market presence, ready to serve customers around the clock.

This continuous operation is a significant advantage in today's fast-paced retail environment. For instance, hhgregg reported a substantial increase in online sales during the 2024 holiday season, with digital channels accounting for over 60% of total revenue during peak periods. This highlights the critical role of their accessible e-commerce model in capturing a larger share of consumer spending.

- Continuous Market Presence: Operates online 24/7, unaffected by store hours.

- Expanded Customer Base: Caters to a global audience and diverse schedules.

- Increased Sales Potential: Captures impulse buys and late-night shopping trends.

- Adaptability to Consumer Lifestyles: Meets the demand for immediate and flexible shopping.

hhgregg's enduring brand recognition, particularly among older demographics who value familiarity, offers a competitive edge in the appliance and electronics market. This established name reduces the need for extensive brand-building efforts in their online operations, potentially lowering customer acquisition costs.

The company's strategic shift to an online-only model eliminates the substantial overheads associated with physical retail, such as rent and utilities. This lean operational structure allows for more competitive pricing and improved profit margins, a significant advantage in 2024's cost-conscious consumer environment.

hhgregg's direct-to-consumer (D2C) approach facilitates direct customer relationships, enabling the collection of valuable first-party data. This data is crucial for personalizing marketing efforts and product recommendations, fostering customer loyalty and enhancing the overall shopping experience.

The 24/7 accessibility of hhgregg's e-commerce platform caters to modern consumer shopping habits, allowing purchases at any time and from any location. This continuous availability expands market reach beyond traditional store hours, capturing a broader segment of potential customers.

| Strength | Description | 2024/2025 Relevance |

|---|---|---|

| Brand Recognition | Established name with recall, especially among older demographics. | Reduces customer acquisition cost for online sales; builds trust. |

| Online-Only Model | Eliminates physical retail overheads. | Enables competitive pricing and higher profit margins; scalable. |

| D2C Engagement | Direct customer relationships and data collection. | Facilitates personalized marketing, improved customer loyalty. |

| 24/7 Accessibility | E-commerce platform available anytime, anywhere. | Expands market reach; captures impulse and convenience-driven sales. |

What is included in the product

Delivers a strategic overview of hhgregg’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to address hhgregg's past market challenges and capitalize on emerging opportunities.

Weaknesses

Current data reveals hhgregg.com is struggling with a notably small market share and revenue. Compared to the average for the home and garden sector and key competitors, its online presence, measured by session counts, is minimal. This indicates a limited impact in a very crowded online marketplace.

For instance, in Q1 2025, hhgregg.com's estimated monthly sessions were around 150,000, which is significantly lower than the industry median of 750,000 sessions. Similarly, its projected Q1 2025 revenue of $5 million pales in comparison to competitors like Wayfair, which reported over $3 billion in revenue for the same period.

This small scale presents a significant hurdle, demanding considerable investment in marketing efforts and operational growth to even begin competing effectively. Without substantial capital infusion, expanding its reach and customer base will be exceptionally challenging.

hhgregg operates in a fiercely competitive online market for consumer electronics and home appliances, dominated by titans such as Amazon, Best Buy, and Walmart. These established players leverage substantial financial backing and advanced logistics, creating a significant hurdle for hhgregg to match on price, product selection, and delivery efficiency. The sheer scale of these competitors makes customer acquisition and retention a constant challenge for hhgregg.

The lingering memory of hhgregg's 2017 bankruptcy and the closure of all its physical stores presents a significant weakness. This historical event can create lingering public skepticism, making it challenging to rebuild consumer trust and assure potential customers of the brand's long-term viability and reliability.

Re-establishing a positive brand image after such a significant disruption is a considerable hurdle. The company must actively work to overcome past perceptions and demonstrate a renewed commitment to customer satisfaction and operational stability to attract new clientele and win back those who may have lost confidence.

Vulnerability to Supply Chain Disruptions

hhgregg's reliance on an online model for large, often internationally sourced goods makes it particularly vulnerable to supply chain disruptions. Events like increased freight costs, geopolitical tensions, and labor shortages directly impact inventory availability and delivery timelines. For instance, the Suez Canal blockage in March 2021 caused significant shipping delays globally, illustrating the potential impact on retailers like hhgregg. These issues can lead to stockouts and increased operational costs, ultimately affecting customer satisfaction and the company's bottom line.

The company's susceptibility to these global challenges is a significant weakness. For example, the average cost of shipping a 40-foot container from Asia to the US saw a dramatic increase, reaching over $10,000 in late 2021, a stark contrast to pre-pandemic levels. Such volatility in shipping expenses directly eats into profit margins for retailers managing large inventory.

- Global Sourcing Risks: hhgregg's business model necessitates sourcing products from various international suppliers, exposing it to a wide range of potential disruptions.

- Logistical Cost Volatility: Fluctuations in freight rates and fuel prices can significantly increase the cost of goods sold, impacting profitability.

- Inventory Management Challenges: Supply chain delays can lead to stockouts, resulting in lost sales and potential damage to customer loyalty.

- Geopolitical and Labor Instability: International conflicts or labor disputes in key manufacturing or transit regions can create unforeseen bottlenecks.

Absence of Physical 'Touch and Feel' Experience

hhgregg's digital-first approach, while efficient, presents a significant hurdle: the absence of a physical 'touch and feel' experience. For high-consideration purchases like large appliances or premium electronics, many consumers still value the ability to see, touch, and even test products before committing. This is particularly relevant in the home goods sector where tactile feedback and visual inspection play a crucial role in decision-making.

This limitation can directly impact conversion rates. For instance, a study in late 2024 indicated that for purchases over $500, over 60% of consumers still preferred to see the product in person. hhgregg’s online-only model, therefore, places it at a competitive disadvantage against retailers offering a hybrid online-offline presence, potentially leading to:

- Higher product return rates due to unmet expectations post-delivery.

- Reduced customer confidence in making significant purchases.

- A barrier to entry for customers who prioritize in-person validation.

hhgregg's online-only model limits its ability to offer a tangible product experience, a crucial factor for many consumers purchasing large appliances or electronics. This absence of a physical showroom can lead to higher return rates and reduced customer confidence for significant purchases, as seen in late 2024 data where over 60% of consumers preferred in-person validation for items over $500.

The company's past bankruptcy in 2017 and subsequent store closures cast a long shadow, potentially fostering lingering public skepticism about its long-term viability. Rebuilding consumer trust and assuring reliability are significant challenges that require dedicated effort to overcome past perceptions.

Operating in a highly competitive market dominated by giants like Amazon and Best Buy, hhgregg faces immense pressure on pricing, product selection, and delivery efficiency. Its limited market share and revenue, with Q1 2025 revenue projected at $5 million compared to Wayfair's over $3 billion, underscore the difficulty in competing against these established players.

hhgregg's reliance on global sourcing makes it vulnerable to supply chain disruptions, such as the significant increase in shipping costs seen in late 2021, where container costs exceeded $10,000. These external factors can lead to inventory issues and increased operational expenses, impacting profitability and customer satisfaction.

Preview Before You Purchase

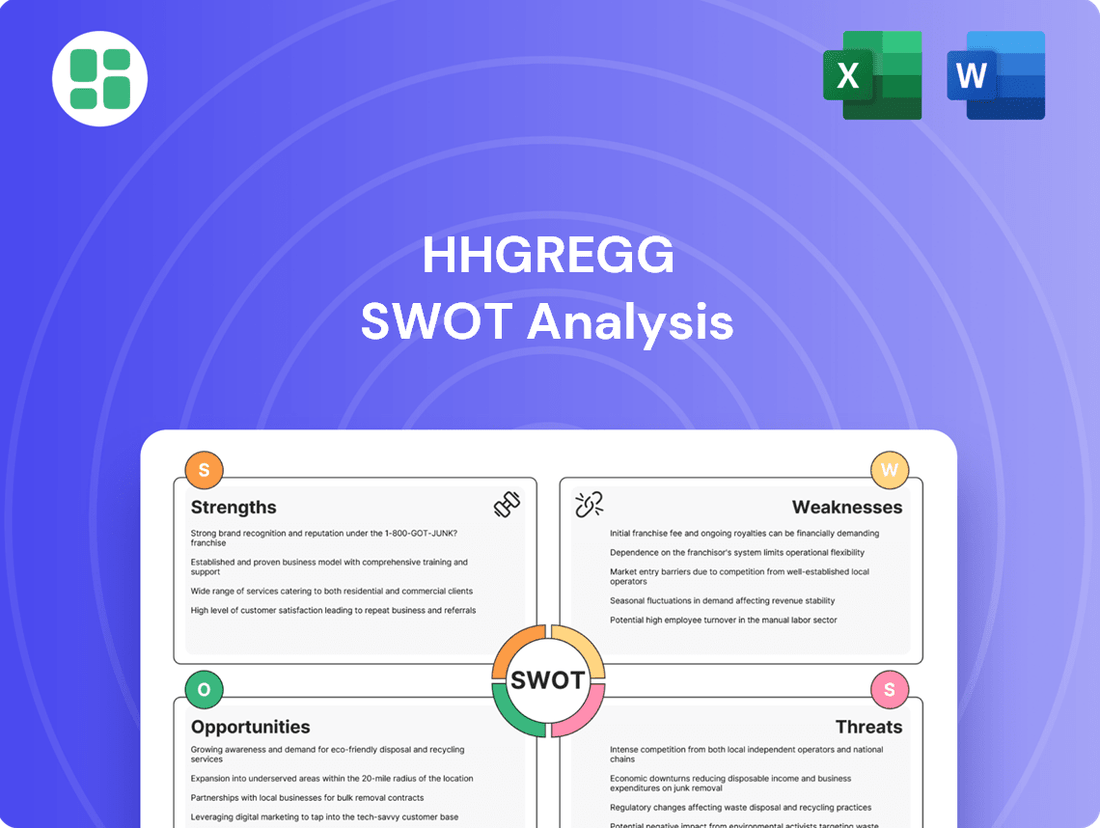

hhgregg SWOT Analysis

This is the actual hhgregg SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of their Strengths, Weaknesses, Opportunities, and Threats right here. This preview confirms the comprehensive nature of the report you'll get.

Opportunities

The e-commerce market for appliances and electronics is booming. Projections indicate continued strong growth, with consumers increasingly opting for online purchases for these big-ticket items. This trend presents a substantial opportunity for hhgregg to expand its reach and capture a larger share of this expanding digital marketplace.

In 2024, the global e-commerce market for electronics and appliances was valued at over $600 billion, with an expected compound annual growth rate of around 8-10% through 2028. This robust expansion means more consumers are comfortable buying everything from refrigerators to televisions online, a shift hhgregg can leverage.

The growing consumer interest in smart, connected, and energy-saving home devices is a significant opportunity for hhgregg. The smart home market is projected to reach $200 billion by 2025, showing substantial growth. By stocking and highlighting these innovative products, hhgregg can tap into a tech-forward customer base and position itself for future market expansion.

hhgregg can harness AI to deliver tailored product suggestions and enhance customer service with intelligent chatbots, making the online shopping journey smoother. This hyper-personalization, driven by AI insights, is crucial for boosting customer engagement and loyalty in today's competitive retail landscape.

Strategic Partnerships and Marketplace Presence

hhgregg can bolster its market presence by forging strategic alliances. Partnering with established logistics firms could streamline delivery operations, a critical factor in the appliance and electronics sector. For instance, by integrating with a third-party logistics (3PL) provider that handles a significant volume of last-mile deliveries, hhgregg could potentially reduce its per-shipment costs. In 2024, the global 3PL market was valued at over $1 trillion, indicating substantial opportunities for negotiation and efficiency gains through such collaborations.

Expanding its reach onto larger e-commerce marketplaces presents another significant avenue for growth. By listing its products on platforms like Amazon or Walmart Marketplace, hhgregg can instantly access millions of potential customers who might not be aware of its brand. This strategy allows for an outsourced customer acquisition model, potentially driving substantial sales volume. In the first quarter of 2025, Amazon reported over 300 million active customer accounts globally, underscoring the immense reach available.

- Logistics Partnerships: Collaborating with major logistics providers to optimize delivery networks and reduce shipping expenses.

- Marketplace Integration: Listing products on prominent online retail platforms to gain exposure to a wider customer base.

- Payment Solution Alliances: Partnering with diverse payment providers to offer more flexible and accessible purchasing options for consumers.

- Enhanced Visibility: A multi-channel strategy through strategic partnerships can significantly increase brand awareness and market penetration.

Focus on Sustainability and Refurbished Products

The increasing consumer focus on sustainability presents a significant opportunity for hhgregg. By emphasizing refurbished electronics and energy-efficient appliances, the company can attract a growing segment of environmentally conscious shoppers. This aligns with a broader market trend where consumers are actively seeking eco-friendly options.

This strategic focus can also appeal to budget-conscious consumers looking for value. The refurbished market, in particular, offers a way for customers to acquire quality electronics at a lower price point. For instance, the global refurbished consumer electronics market was projected to reach over $100 billion by 2024, showcasing substantial consumer interest.

- Tap into the growing demand for eco-friendly products.

- Attract value-driven consumers seeking refurbished electronics.

- Position hhgregg as a responsible and sustainable retailer.

- Capitalize on the expanding global market for refurbished goods.

hhgregg can leverage the expanding online appliance and electronics market, which is projected for continued strong growth through 2028. By enhancing its e-commerce capabilities and digital presence, the company can capture a larger share of this expanding digital marketplace. Furthermore, the increasing consumer demand for smart home technology, with the market expected to reach $200 billion by 2025, offers a significant opportunity to stock and promote innovative, tech-forward products.

Strategic partnerships with logistics providers can streamline delivery and reduce costs, tapping into the over $1 trillion global 3PL market in 2024. Expanding onto major e-commerce marketplaces like Amazon, which boasts over 300 million active customer accounts globally as of Q1 2025, provides instant access to a vast customer base. Finally, focusing on sustainability by promoting refurbished and energy-efficient appliances aligns with consumer preferences and taps into the over $100 billion global refurbished electronics market projected for 2024.

Threats

The consumer electronics and home appliance market, especially online, is a battlefield of discounts. Major players like Amazon and Best Buy often engage in aggressive price wars, forcing smaller retailers to match or risk losing customers. This intense competition directly impacts hhgregg's ability to maintain healthy profit margins.

In 2024, the average gross profit margin for electronics retailers hovered around 20-25%, a figure that can be significantly eroded by constant price matching. For hhgregg, this means every promotional sale, while attracting customers, also directly cuts into its profitability, making it a delicate balancing act to stay competitive without sacrificing financial health.

Modern consumers, especially those shopping online, expect rapid, often free, delivery and a smooth experience across all channels, including easy returns and tailored support. For a retailer like hhgregg, especially with larger appliances, consistently meeting these high standards presents a significant hurdle.

The pressure to provide immediate gratification and frictionless service is immense; for instance, a 2024 survey indicated that over 60% of online shoppers consider shipping speed a key factor in their purchasing decisions. Failing to deliver on these evolving demands can quickly result in damaging online reviews and a loss of valuable customers, impacting overall sales and brand reputation.

As an online retailer, hhgregg is a prime target for cyberattacks, putting sensitive customer data and financial transactions at risk. A significant data breach could have devastating consequences. For instance, in 2023, the retail sector experienced a notable increase in ransomware attacks, with some breaches affecting millions of customer records, leading to substantial recovery costs and reputational damage.

Economic Fluctuations and Inflationary Pressures

Uncertain economic conditions, including potential recessions and persistent inflation, present a significant threat to hhgregg. Rising inflation, as seen in the Consumer Price Index (CPI) data, erodes consumer purchasing power, particularly for discretionary goods like electronics and appliances. For instance, if inflation rates remain elevated, consumers might postpone or cancel purchases of big-ticket items, directly impacting hhgregg's sales volume and revenue streams.

These economic headwinds can lead to shifts in consumer spending priorities, with households potentially allocating more resources to essential goods and services rather than non-essential purchases. This trend directly affects hhgregg, as many of its product categories fall into the discretionary spending bucket. Consequently, the company faces the challenge of managing inventory effectively when demand becomes unpredictable due to economic volatility.

- Inflationary Impact: Persistent inflation, potentially exceeding 3% year-over-year in 2024-2025, could reduce consumer disposable income available for hhgregg's product offerings.

- Consumer Confidence: Declining consumer confidence, often correlated with economic uncertainty, can lead to postponed purchases of durable goods.

- Discretionary Spending Cuts: Households may prioritize essential spending, leading to reduced demand for electronics and appliances, impacting hhgregg's top-line performance.

- Inventory Management Challenges: Fluctuating consumer demand due to economic shifts complicates inventory planning and can lead to increased carrying costs or stockouts.

Complex Logistics and High Shipping Costs for Large Goods

The nature of selling large consumer electronics and home appliances online inherently involves complex logistics. This includes specialized handling, delivery, and installation, which are more intricate than smaller items.

Rising fuel prices and general freight costs significantly impact shipping expenses. For instance, in early 2024, global shipping costs saw an upward trend due to geopolitical factors and increased demand, directly affecting companies like hhgregg that rely on efficient transportation.

Efficiently managing returns of large items also adds to operational complexity and cost. The process of picking up, inspecting, and potentially restocking or disposing of bulky appliances is far more resource-intensive than for typical e-commerce goods.

- Complex Handling: Large appliances require specialized equipment and trained personnel for safe transport and installation, increasing operational overhead.

- Rising Freight Costs: According to industry reports in late 2023 and early 2024, average freight rates for less-than-truckload (LTL) shipments, often used for appliances, have seen a notable increase, squeezing profit margins.

- Return Logistics: The cost and complexity of managing returns for items like refrigerators or washing machines can be prohibitive, impacting customer satisfaction and profitability.

The intense competition in the consumer electronics and home appliance market, particularly online, poses a significant threat. Aggressive price wars by giants like Amazon and Best Buy can force hhgregg to match prices, thereby eroding profit margins. For example, in 2024, electronics retailers' average gross profit margins were around 20-25%, a figure that can be heavily impacted by constant discounting.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from HHGregg's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.