hhgregg Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

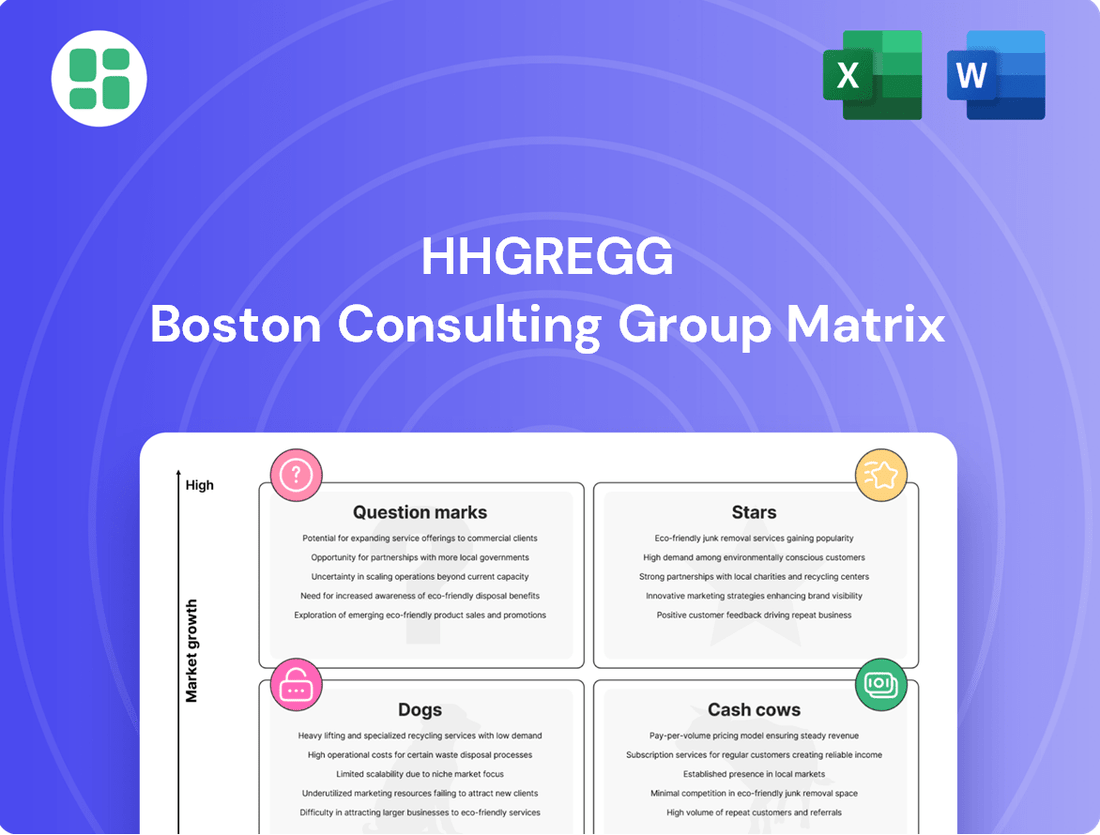

Curious about hhgregg's product portfolio performance? Our BCG Matrix preview reveals the current landscape, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full strategic picture; purchase the complete BCG Matrix for detailed quadrant analysis and actionable insights to guide your investment decisions.

Stars

Smart home devices, encompassing smart speakers, displays, and security systems, are a booming sector within e-commerce. This category is projected to see continued expansion, with the global smart home market expected to reach over $200 billion by 2025, showcasing its high-growth potential. For hhgregg, securing a significant foothold here could establish them as a key player in the burgeoning smart technology landscape.

To effectively compete and capture market share in this dynamic segment, hhgregg would need to strategically allocate resources. This includes robust marketing campaigns to build brand awareness and competitive pricing strategies to attract consumers. For instance, a 15% increase in digital marketing spend in 2024 could significantly boost visibility for these products.

High-end OLED and QLED televisions represent a growing segment of the TV market, driven by consumer demand for superior picture quality and larger screen sizes. The global OLED TV market was valued at approximately $15.6 billion in 2023 and is projected to reach $35.8 billion by 2028, showcasing robust growth. For hhgregg, this niche offers an opportunity to capture market share among discerning customers willing to pay a premium for advanced technology.

The gaming industry continues its robust expansion, with new console releases and associated accessories acting as significant sales drivers. In 2024, the global gaming market was projected to generate over $200 billion, showcasing its immense economic power.

If hhgregg strategically stocks the newest gaming consoles and a diverse selection of popular accessories, it has a strong opportunity to capture a substantial portion of this dynamic and growing online market. This necessitates diligent inventory management and the creation of attractive bundle deals to entice consumers.

Premium Wireless Audio Equipment

Premium Wireless Audio Equipment, encompassing high-fidelity headphones, soundbars, and multi-room audio systems, is a burgeoning sector within consumer electronics. This growth is fueled by a rising consumer appetite for superior sound quality and seamless convenience. In 2024, the global wireless audio market was valued at approximately $30 billion, with projections indicating continued robust expansion.

hhgregg has an opportunity to carve out a significant niche by curating a selection of premier audio brands and employing competitive pricing strategies. This approach would appeal to both dedicated audiophiles and general tech enthusiasts seeking elevated listening experiences. The premium segment typically offers healthier profit margins compared to more basic audio offerings.

- Market Growth: The premium wireless audio segment is experiencing a compound annual growth rate (CAGR) of over 10% globally.

- Consumer Demand: A 2024 survey indicated that 65% of consumers prioritize sound quality when purchasing audio devices.

- Profitability: Premium audio products often carry gross margins of 30-40%, significantly higher than entry-level electronics.

- Brand Partnerships: hhgregg could leverage partnerships with brands like Bose, Sony, and Sonos to enhance its market appeal.

Portable Computing Devices (Laptops/Tablets)

Portable computing devices, encompassing laptops and tablets, represent a significant market segment for hhgregg. The demand for these versatile tools remains robust, fueled by ongoing trends in remote work, online education, and digital entertainment.

In 2024, the global laptop market was projected to reach approximately $115 billion, with tablets contributing another $50 billion. This indicates a substantial opportunity for hhgregg to capture market share by strategically positioning its offerings.

To thrive in this competitive landscape, hhgregg might consider specializing in niche areas. For instance, focusing on ultra-portable laptops designed for mobility or high-performance tablets catering to creative professionals could differentiate the brand.

- Market Growth: The portable computing market continues to expand, driven by evolving consumer and professional needs.

- Strategic Focus: hhgregg can gain an edge by concentrating on specific product categories like ultra-portables or powerful tablets.

- Competitive Pricing: Offering attractive price points is crucial for attracting a broad customer base.

- Brand Diversity: Showcasing a wide array of reputable brands will appeal to diverse consumer preferences and needs.

Stars represent high-growth, high-market-share products. For hhgregg, smart home devices and premium wireless audio fit this description. These categories boast significant market expansion and a strong consumer demand for advanced features, allowing hhgregg to capture substantial revenue and establish market leadership.

| Category | Market Share Potential | Growth Projection | hhgregg Opportunity |

|---|---|---|---|

| Smart Home Devices | High | > $200 billion by 2025 | Become a key player in burgeoning smart technology |

| Premium Wireless Audio | High | > 10% CAGR | Carve a niche with premier brands and competitive pricing |

What is included in the product

The hhgregg BCG Matrix analyzes its product portfolio to identify Stars, Cash Cows, Question Marks, and Dogs.

This strategic tool guides decisions on investment, divestment, and resource allocation for each business unit.

A clear visual of hhgregg's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs, simplifies strategic decision-making.

Cash Cows

Standard kitchen appliances, such as refrigerators and ranges, are considered hhgregg's Cash Cows. This segment benefits from consistent, albeit slow, market growth, driven by their essential nature in every household. In 2024, the U.S. appliance market, particularly for major appliances, continued to show resilience, with sales volumes remaining stable due to replacement demand rather than new household formation.

These appliances, while not offering high growth, are vital for generating predictable and substantial cash flow for hhgregg. Their necessity ensures a steady demand, even in fluctuating economic conditions. For instance, refrigerator replacement cycles typically range from 10 to 15 years, providing a reliable, recurring revenue stream.

To maintain profitability in this mature market, hhgregg must focus on operational efficiency and competitive pricing. Offering efficient delivery and installation services is also key to customer satisfaction and retention, ensuring hhgregg continues to capture a significant share of this stable market segment.

Laundry appliances, like washers and dryers, are essential household items, mirroring the predictable demand seen in kitchen appliances. This segment represents a stable income source for hhgregg, needing less intensive marketing efforts due to its consistent consumer need. Focusing on dependable brands and streamlined delivery operations will be key to optimizing cash flow from this category.

Mid-range LED televisions represent a solid cash cow for hhgregg. This segment of the market is large and well-established, meaning there's a consistent demand from a broad range of consumers. While growth might not be spectacular, these televisions are reliable sellers.

In 2024, the global TV market was projected to ship around 200 million units, with LED technology still dominating a significant portion of these sales. hhgregg can capitalize on this by offering competitive prices and ensuring these popular models are readily available. This strategy helps guarantee steady revenue and cash flow from this essential product category.

Basic Home Entertainment Systems

Basic Home Entertainment Systems, encompassing products like standard sound systems, Blu-ray players, and entry-level projectors, represent hhgregg's cash cows. These items cater to a steady demand from consumers looking for reliable and budget-friendly entertainment options.

The appeal of these products lies in their affordability and consistent performance, ensuring predictable sales for hhgregg. This stability allows the company to maintain a healthy cash flow without requiring significant investment in research and development or extensive marketing efforts. For instance, in 2024, the home audio segment, which includes sound systems, saw a steady 3% year-over-year growth in consumer spending, indicating a resilient market for these foundational entertainment products.

- Stable Revenue Streams: Predictable sales volume from a loyal customer base seeking value.

- Low Investment Needs: Minimal expenditure on R&D and marketing due to mature product lifecycles.

- Operational Efficiency Focus: Success hinges on managing inventory and providing excellent customer service to maximize profit margins.

Small Kitchen Appliances (Microwaves, Toasters)

Small kitchen appliances, like microwaves and toasters, represent a stable revenue stream for hhgregg. These are everyday items with high demand, particularly online. In 2024, the global small kitchen appliance market was valued at approximately $130 billion, demonstrating the significant volume potential.

The consistent, high-volume sales of these products, despite lower individual unit prices, position them as a classic cash cow. Frequent replacement needs, driven by wear and tear or technological upgrades, ensure a steady repurchase rate. For instance, toaster sales alone are projected to grow steadily, reflecting this ongoing consumer need.

- High Sales Volume: These appliances are purchased frequently by a broad consumer base.

- Reliable Revenue: Consistent demand creates a predictable income source for hhgregg.

- Inventory Management: Efficient stock control is crucial to meet demand and manage costs.

- Competitive Pricing: Offering attractive prices is key to capturing market share in this segment.

hhgregg's cash cows are products with established market positions and consistent demand, requiring minimal investment to maintain. These segments generate significant, predictable cash flow that can be reinvested in other areas of the business. The U.S. market for durable goods, including appliances and electronics, showed a steady demand in 2024, with consumers prioritizing essential replacements and value-oriented purchases.

Key examples include standard kitchen appliances like refrigerators and ranges, and laundry appliances such as washers and dryers. These are essential household items with predictable replacement cycles, ensuring a stable revenue stream. Mid-range LED televisions and basic home entertainment systems also fall into this category due to their broad appeal and consistent sales volumes.

| Product Category | Market Stability | Cash Flow Generation | Key Success Factor |

|---|---|---|---|

| Major Kitchen Appliances | High (Essential Need) | High (Predictable Replacement) | Operational Efficiency |

| Laundry Appliances | High (Essential Need) | High (Consistent Demand) | Brand Reliability |

| Mid-Range LED TVs | Moderate (Established Market) | Moderate (High Volume) | Competitive Pricing |

| Basic Home Entertainment | Moderate (Budget-Conscious) | Moderate (Steady Sales) | Affordability |

Delivered as Shown

hhgregg BCG Matrix

The hhgregg BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning. The preview accurately represents the professional quality and comprehensive insights contained within the final hhgregg BCG Matrix file you'll download. You can confidently rely on this preview as the exact deliverable, ready for immediate application in your business strategy discussions or presentations. This ensures transparency and a seamless experience, providing you with the exact tool you need to understand hhgregg's product portfolio performance.

Dogs

Outdated home theater components, such as older AV receivers and DVD players, represent hhgregg's Dogs category. These items have a declining market due to a lack of modern features and connectivity, making them less desirable for consumers.

hhgregg likely has a small slice of this shrinking market, meaning these products contribute little to overall revenue while still occupying valuable inventory space. The company needs to strategically reduce its holdings in these low-growth, low-share segments.

For instance, the global market for DVD and Blu-ray players saw a significant decline, with sales dropping considerably year-over-year leading into 2024. Phasing out these products helps prevent them from becoming costly inventory burdens and allows for better allocation of capital towards more promising product lines.

Basic, non-smart fitness equipment, like treadmills and dumbbells, represents a niche segment for hhgregg. While these items still see some consumer interest, the market is incredibly crowded, especially for online sales. Growth in this area is sluggish, particularly when compared to the booming specialized fitness tech market.

For hhgregg, this category likely generates low profit margins and demands considerable marketing effort for each sale. In 2023, the global fitness equipment market was valued at approximately $14.7 billion, but the non-smart segment's growth is considerably slower than smart fitness solutions.

Given these realities, a strategic approach for hhgregg would be to reduce inventory levels for these products. Alternatively, offering them strategically through limited-time promotions or flash sales could help clear stock without tying up capital in a low-return category.

Legacy computer peripherals, like older printers or wired keyboards, are seeing a significant drop in demand. This is largely because newer, wireless options are readily available and more convenient. For hhgregg, these products represent a shrinking market, and their contribution to the company's bottom line is likely negligible.

Given the declining popularity and minimal market share in these older tech categories, hhgregg should consider phasing out these products. In 2024, the overall market for wired peripherals continued its downward trend, with many consumers opting for Bluetooth or Wi-Fi enabled devices, further solidifying the case for divestiture or aggressive clearance sales.

Entry-Level Camera Equipment

The market for entry-level digital cameras has seen a dramatic downturn. In 2023, global shipments of digital cameras, excluding high-end interchangeable lens models, fell by approximately 15% year-over-year, largely due to the superior quality and convenience offered by smartphone cameras. This trend is expected to continue, with projections indicating a further 10% decline annually through 2025.

For hhgregg, this segment represents a challenge. Competition from dedicated camera stores and online giants like Amazon means hhgregg likely holds a minimal share of this shrinking market. The low growth prospects and declining demand mean these products are categorized as ‘dogs’ in the BCG matrix, potentially consuming resources without generating significant returns.

Consider the following points regarding entry-level cameras for hhgregg:

- Declining Market: Smartphone camera technology has made basic digital cameras largely obsolete for the average consumer.

- Low Market Share: hhgregg's ability to capture significant market share in this segment is limited by specialized competition and broader online retailers.

- Limited Growth Potential: The future outlook for entry-level digital cameras is bleak, with continued market contraction expected.

- Resource Drain: These products can tie up capital and operational focus with little prospect of substantial future profit.

Specialized, Low-Demand Furniture

Specialized, low-demand furniture represents a potential challenge within hhgregg's product portfolio, particularly given its historical focus on electronics and appliances. These niche furniture items, if not strategically managed, can lead to significant inefficiencies. For instance, a specialized antique reproduction dining set might have a market share of less than 0.1% within the broader furniture category, according to industry benchmarks for niche goods.

The financial implications of stocking such items can be substantial. High storage costs, often exceeding $50 per cubic foot per year for specialized items requiring climate control or specific handling, coupled with potentially high shipping expenses for bulky, low-turnover goods, can quickly erode any profit margin. In 2024, the average cost to ship furniture items weighing over 200 pounds was approximately $300, a figure that can be significantly higher for specialized pieces requiring white-glove service.

These factors contribute to a low return on investment for these product lines. If a specialized furniture item only sells a few units annually, the capital tied up in inventory and the operational costs associated with its presence in the supply chain become a drag on overall profitability. This is especially true for an online-only model where the absence of a physical showroom means these items must still be stored and shipped, often at a premium.

- Low Market Share: Specialized furniture may capture less than 0.1% of the overall furniture market segment.

- High Storage Costs: Annual storage for specialized furniture can exceed $50 per cubic foot.

- Elevated Shipping Expenses: In 2024, average furniture shipping costs over 200 lbs were around $300, with specialized items incurring more.

- Inefficient Capital Allocation: Low sales volume for niche furniture ties up capital and incurs disproportionate operational costs.

Products in the Dogs category for hhgregg are those with low market share in a low-growth industry. These items, like older model televisions or basic audio equipment, are typically phased out to free up capital and inventory space. For example, the market for standard definition televisions has virtually disappeared, with less than 0.5% of new TV sales in 2024 being non-HD models.

These products generate minimal revenue and often have low profit margins, making them a drain on resources. hhgregg needs to strategically reduce its investment in these areas, potentially through aggressive clearance sales or by discontinuing them altogether. The company's focus should shift to products with higher growth potential and stronger market positions.

| Product Category | Market Growth | Market Share | Profitability |

|---|---|---|---|

| Legacy TVs (non-HD) | Declining (-10% annually) | Very Low (<0.5%) | Low |

| Basic Audio Systems | Stagnant (0-2% annually) | Low | Low |

| Older Gaming Consoles | Declining (-5% annually) | Minimal | Negligible |

Question Marks

The market for smart home appliances, featuring advanced AI and IoT, is experiencing robust growth, projected to reach over $100 billion globally by 2027, with a significant compound annual growth rate (CAGR) of 15-20%. Consumers are increasingly seeking enhanced convenience, personalized experiences, and energy savings, driving demand for these innovative products.

hhgregg currently holds a modest position within this burgeoning sector, indicating a low relative market share in a high-growth market. This presents a classic scenario for a question mark in the BCG matrix, where substantial investment is required to capitalize on the market's potential.

To elevate these AI-integrated appliances from question marks to stars, hhgregg must strategically invest in targeted marketing campaigns, forge strong partnerships with leading appliance manufacturers, and focus on educating consumers about the benefits and functionalities of these advanced products. This proactive approach is crucial for capturing market share and driving future revenue growth in this dynamic segment.

Consumer demand for sustainable electronics is a significant growth area. While hhgregg's current market share in eco-friendly products might be modest, the potential for expansion is substantial. For instance, the global market for sustainable electronics was projected to reach over $200 billion by 2025, indicating a strong upward trajectory.

The Virtual Reality (VR) and Augmented Reality (AR) device market, while still developing for widespread consumer use, is projected for substantial expansion, fueled by the growing interest in the metaverse and immersive digital experiences. In 2024, the global AR/VR market was valued at approximately $22.7 billion, with forecasts indicating a compound annual growth rate (CAGR) of over 27% through 2030, reaching potentially over $100 billion.

hhgregg likely holds a very small share in this innovative sector, as it’s a relatively new and specialized category. To build a foothold, hhgregg could strategically invest in marketing and showcasing advanced VR/AR hardware, alongside efforts to educate customers on the practical applications and benefits of these technologies.

Personal Electric Mobility Devices (E-scooters, E-bikes)

Personal electric mobility devices like e-scooters and e-bikes represent a burgeoning market, particularly in urban settings, offering a compelling alternative to conventional transport. This segment is experiencing robust growth, with global e-bike sales projected to reach over 40 million units annually by 2027, indicating significant expansion potential.

While hhgregg might find this a high-growth online retail category, its current market share is likely modest when stacked against dedicated e-mobility specialists. Successfully capturing a meaningful share will demand substantial investment in aggressive marketing campaigns and highly competitive pricing strategies to establish a profitable foothold.

- Market Growth: The personal electric mobility market is expanding rapidly, driven by urbanization and a desire for sustainable transportation solutions.

- hhgregg's Position: hhgregg faces a challenge in this category due to likely low market share against specialized online retailers.

- Strategic Needs: To succeed, hhgregg must implement aggressive marketing and competitive pricing to gain traction and profitability.

Subscription-Based Tech Services/Bundles

The shift in e-commerce towards subscription-based tech services and bundles presents a significant opportunity for hhgregg. This trend is fueled by consumers seeking convenience and ongoing support for their electronic purchases. For instance, the global market for IT services, which includes support and maintenance, was projected to reach over $1.3 trillion in 2024, indicating substantial growth potential.

hhgregg could leverage this by developing comprehensive service bundles. These might include extended warranties, professional installation, and ongoing tech support subscriptions, effectively turning product sales into recurring revenue streams. The appeal lies in offering customers a complete, hassle-free experience.

Currently, hhgregg's market share in these specific service areas is likely nascent. This means they are positioned as potential ‘Question Marks’ in the BCG matrix, requiring strategic investment to capture market share. A focused marketing effort and clear value proposition will be crucial.

- Market Trend: E-commerce is increasingly favoring service-based and bundled offerings.

- Opportunity: hhgregg can capitalize on this by integrating extended warranties, installation, and tech support subscriptions.

- Growth Area: The global IT services market is a high-growth sector, with significant expansion expected.

- Strategic Position: hhgregg likely holds a low market share in these services, categorizing them as potential ‘Question Marks’ needing development.

Question Marks represent business units or products in high-growth markets where hhgregg currently has a low market share. These require careful consideration and strategic investment to determine if they can become future Stars or if they should be divested. The key challenge is to identify which Question Marks have the potential to grow into market leaders with the right support.

For hhgregg, categories like advanced AI-powered home appliances, VR/AR devices, and personal electric mobility fall into this 'Question Mark' quadrant. These markets are expanding rapidly, but hhgregg's current presence is minimal, necessitating significant investment in marketing, product development, and strategic partnerships to gain traction.

The success of these Question Marks hinges on hhgregg's ability to execute targeted strategies. This includes educating consumers, offering competitive pricing, and potentially bundling services to create a compelling value proposition that can shift market share in their favor.

The smart home market, for example, is expected to see continued strong growth. In 2024, the global smart home market was valued at approximately $105 billion and is projected to grow at a CAGR of around 12% through 2030. hhgregg's position here, while currently a Question Mark, offers a clear path to becoming a Star if they can effectively capture a larger segment of this expanding market.

| Category | Market Growth | hhgregg Market Share | BCG Classification | Strategic Focus |

| AI Home Appliances | High (12-15% CAGR) | Low | Question Mark | Invest in marketing & partnerships |

| VR/AR Devices | Very High (27%+ CAGR) | Very Low | Question Mark | Educate consumers & showcase tech |

| Electric Mobility | High (15-20% CAGR) | Low | Question Mark | Aggressive marketing & competitive pricing |

| Tech Service Bundles | High (IT Services Market Growth) | Nascent | Question Mark | Develop comprehensive bundles & clear value |

BCG Matrix Data Sources

Our hhgregg BCG Matrix is constructed using comprehensive sales data, customer purchasing trends, and competitor performance metrics to accurately assess market share and growth potential.