hhgregg Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

hhgregg faces significant competitive pressures, with a moderate threat from new entrants and substantial buyer power influencing pricing. Understanding these dynamics is crucial for any player in the home appliance and electronics retail space.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore hhgregg’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For hhgregg, key suppliers are major manufacturers of electronics and appliances such as Samsung, LG, Whirlpool, and GE. These brands hold considerable market sway due to their robust brand equity and unique technologies.

This concentrated supplier landscape can restrict hhgregg's choices, particularly for in-demand products, thereby granting suppliers greater leverage in negotiating prices and contract terms. For instance, in 2024, major appliance manufacturers continued to experience strong demand, allowing them to dictate terms more effectively.

For hhgregg, switching primary suppliers presents significant hurdles. These include the expenses tied to renegotiating existing agreements, overhauling inventory management systems, and the potential for temporary disruptions in product stock. In 2015, hhgregg faced declining sales, with revenue falling by 14.6% to $1.3 billion, highlighting the need for stable supply chains.

Many major appliance and electronics manufacturers are increasingly embracing direct-to-consumer (DTC) sales models. This shift allows them to bypass traditional retailers, a trend notably observed in the appliance sector where brands are investing heavily in their online storefronts and logistics. For instance, in 2024, several leading appliance brands reported significant growth in their DTC sales, with some seeing double-digit increases year-over-year.

This growing supplier forward integration directly enhances their bargaining power. By establishing their own sales channels, manufacturers can choose to sell directly to end customers, thereby reducing their dependence on intermediaries like hhgregg. This capability gives them leverage, as they can dictate terms or even withdraw supply if retail partners are not meeting their expectations, impacting the retailer's ability to secure favorable terms or even maintain product availability.

Proprietary Technology and Brand Strength

Suppliers of advanced consumer electronics and smart home appliances often possess proprietary technologies, such as sophisticated AI integration or unique display innovations, which are vital for hhgregg's product lineup. This technological distinctiveness, coupled with established brand loyalty for certain manufacturers, significantly limits hhgregg's capacity to readily switch suppliers.

For instance, in 2024, major component suppliers for high-end televisions, like those specializing in OLED or Mini-LED technology, maintained strong pricing power due to the limited number of entities capable of producing these advanced panels. This reliance on a few key suppliers for critical, differentiated components directly impacts hhgregg's cost structure and product availability.

- Proprietary Tech: Suppliers with unique AI or IoT capabilities create essential product features that hhgregg needs.

- Brand Loyalty: Strong consumer preference for specific brands means hhgregg has less leverage to negotiate prices.

- Limited Substitutes: The difficulty in finding alternative suppliers for cutting-edge components strengthens supplier bargaining power.

- Component Dependence: Reliance on a few key suppliers for advanced parts, like those for premium displays, gives these suppliers significant influence.

Impact of Supply Chain Disruptions

Ongoing global supply chain challenges, while showing signs of easing, continue to bolster supplier bargaining power. This means suppliers can still dictate terms, limit product availability, and extend lead times. For retailers like hhgregg, this translates to a heightened need to secure inventory, especially for in-demand products, giving suppliers more leverage in negotiations.

These disruptions can lead to increased costs for businesses. For instance, in early 2024, shipping costs saw fluctuations, with some routes experiencing significant price hikes due to geopolitical events and port congestion. This directly impacts the cost of goods sold for retailers and can force them to accept less favorable payment terms from suppliers.

- Limited Product Availability: Suppliers can restrict the quantity of goods offered, creating scarcity that benefits them.

- Extended Lead Times: Longer delivery periods empower suppliers by allowing them to manage production schedules more effectively, often at higher prices.

- Increased Pricing Power: With demand often outstripping supply, suppliers are in a stronger position to command higher prices for their products.

- Inventory Allocation Control: Suppliers can choose which customers receive limited stock, prioritizing those offering better terms or higher volumes.

Suppliers to hhgregg, particularly major electronics and appliance manufacturers, wield significant bargaining power. This is driven by factors like proprietary technology, strong brand loyalty, and the limited availability of substitutes for advanced components. For instance, in 2024, manufacturers of cutting-edge display technologies maintained strong pricing power due to the scarcity of producers.

The trend of suppliers moving towards direct-to-consumer sales further amplifies their leverage, reducing their reliance on retailers like hhgregg. This forward integration allows them to dictate terms more assertively. Ongoing global supply chain issues in 2024, including fluctuating shipping costs, also contributed to suppliers' ability to command higher prices and impose less favorable terms.

| Factor | Impact on hhgregg | 2024 Relevance |

| Proprietary Technology | Limits supplier switching; increases reliance | High demand for AI-enabled appliances |

| Brand Loyalty | Reduces hhgregg's negotiation leverage | Established brands continue strong consumer preference |

| Supplier Forward Integration | Weakens retailer's position; potential for bypassed sales | Double-digit DTC growth reported by major brands |

| Supply Chain Disruptions | Increases costs, extends lead times, limits availability | Fluctuating shipping costs impacting COGS |

What is included in the product

hhgregg's Porter's Five Forces analysis dissects the competitive intensity within the consumer electronics and appliance retail sector, examining threats from new entrants, the bargaining power of buyers and suppliers, and the prevalence of substitute products.

hhgregg's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick, data-driven decision-making.

Customers Bargaining Power

Customers in the consumer electronics and home appliance sectors are notably sensitive to price. This means they actively hunt for the best deals, frequently comparing prices across various online retailers. For hhgregg, this translates into a constant pressure to offer competitive pricing, especially on larger ticket items or during major promotional periods.

For instance, in 2024, the average consumer spent considerable time researching appliance prices, with surveys indicating that over 70% of shoppers compared prices online before making a purchase. This high degree of price sensitivity directly impacts hhgregg’s ability to command premium prices and necessitates a strategic focus on cost management and promotional activities to attract and retain customers.

The ease with which customers can compare prices and products online, especially from competitors of hhgregg, dramatically reduces their switching costs. This accessibility empowers consumers, giving them more leverage in price negotiations and demanding better terms.

In 2024, the online retail sector continued to see a proliferation of comparison shopping engines and review sites, making it simpler than ever for consumers to find the best deals. For instance, a study by Statista indicated that over 60% of online shoppers in the US actively use price comparison tools before making a purchase, directly impacting retailers like hhgregg.

Customers today are incredibly well-informed, with access to a wealth of product reviews, detailed specifications, and easy price comparisons online. This abundance of information means they can thoroughly research options before making a purchase, significantly increasing their bargaining power.

The retail landscape, particularly in electronics and appliances where hhgregg operated, is characterized by numerous competitors, both online and in brick-and-mortar stores. For instance, in 2024, the U.S. e-commerce market alone was projected to reach over $1.7 trillion, showcasing the vast number of platforms consumers can turn to for similar goods.

This wide availability of alternatives means that if a customer isn't satisfied with the price or terms offered by one retailer, they can easily find another. This competitive environment inherently shifts power towards the buyer, forcing businesses to offer competitive pricing and superior value to retain customers.

Dominance of Online Marketplaces

The dominance of online marketplaces significantly amplifies customer bargaining power. Platforms like Amazon and Walmart, which command substantial market share in consumer electronics and appliances, offer consumers an unparalleled breadth of product choices and aggressive pricing. For instance, in 2024, online retail sales in the U.S. are projected to reach over $1.7 trillion, with marketplaces playing a critical role in this growth.

These marketplaces act as consolidated shopping destinations, making it easier for customers to compare prices and features across numerous retailers, thereby fragmenting hhgregg's customer base. This increased accessibility to alternatives empowers consumers to demand better terms, forcing retailers to compete more intensely on price and service.

- Marketplace Dominance: Major online platforms offer vast selections and competitive pricing, attracting a significant portion of consumer electronics and appliance sales.

- Customer Fragmentation: These platforms lead to a more fragmented customer base for individual retailers like hhgregg, diminishing customer loyalty to a single brand.

- Price Sensitivity: Easy price comparison on marketplaces heightens customer price sensitivity, increasing their bargaining power.

- Information Access: Consumers have readily available information on product reviews and competitor pricing, further strengthening their negotiating position.

Growth of E-commerce and Direct-to-Consumer Channels

The escalating growth of e-commerce and direct-to-consumer (DTC) channels significantly amplifies customer bargaining power in the appliances and electronics sector. As of early 2024, online retail continues its robust expansion, offering consumers a wider array of choices and price comparisons than ever before.

This trend means customers are no longer solely reliant on traditional brick-and-mortar stores. Manufacturers increasingly leveraging DTC models bypass intermediaries, presenting consumers with direct purchasing options that often come with competitive pricing and greater transparency. This shift empowers buyers by providing more information and alternative suppliers, forcing retailers to compete more aggressively on price and service.

- Increased Price Transparency: Online platforms allow for easy price comparison across numerous retailers and brands.

- Expanded Product Availability: E-commerce offers access to a broader selection of models and brands, including niche or specialized products.

- Direct Manufacturer Access: DTC channels enable customers to purchase directly from manufacturers, potentially securing better deals and direct support.

- Convenience and Choice: The ease of online shopping and the sheer volume of available options enhance customer leverage.

Customers possess significant bargaining power in the consumer electronics and home appliance sectors due to high price sensitivity and readily available information. The proliferation of online comparison tools and marketplaces in 2024, with over 60% of US online shoppers using price comparison tools, empowers consumers to easily find the best deals, forcing retailers like hhgregg to maintain competitive pricing. The growth of e-commerce and direct-to-consumer channels further amplifies this power by increasing transparency and providing more purchasing alternatives.

| Factor | Impact on hhgregg | 2024 Data Point |

|---|---|---|

| Price Sensitivity | Pressure to offer competitive pricing | 70%+ consumers compared prices online before purchase |

| Information Access | Enhanced customer knowledge and negotiation leverage | 60%+ online shoppers used price comparison tools |

| Availability of Alternatives | Reduced customer loyalty, increased switching | US e-commerce market projected over $1.7 trillion |

| Marketplace Dominance | Customer fragmentation, intensified price competition | Major marketplaces capture significant electronics sales |

Preview the Actual Deliverable

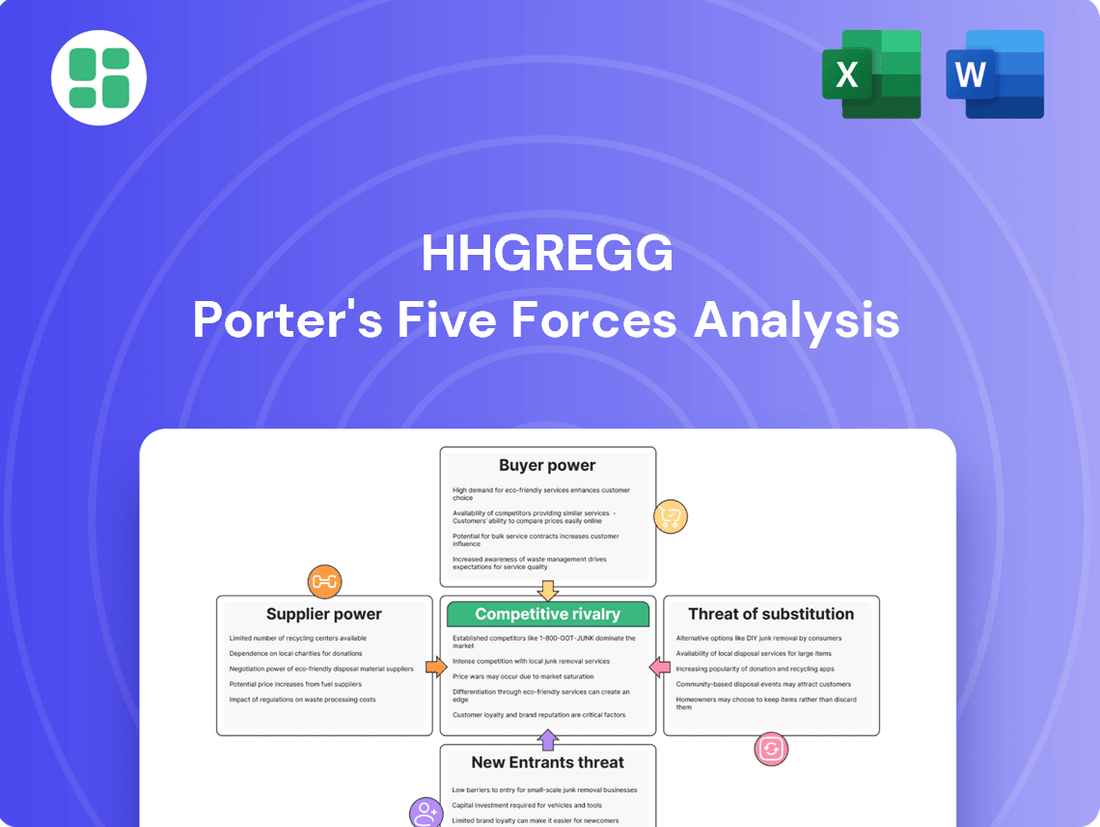

hhgregg Porter's Five Forces Analysis

This preview showcases the complete hhgregg Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the electronics retail sector. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The online consumer electronics and home appliance sector is a battlefield of price wars. Retailers like hhgregg are locked in a constant struggle, slashing prices and running frequent promotions to capture customer attention and market share. This aggressive pricing environment means that staying competitive often hinges on offering the lowest possible price point.

Consumers in this space are highly price-sensitive, readily comparing deals across multiple platforms. For hhgregg, this translates into a critical need for pricing strategies that are not only competitive but also sustainable, balancing the drive for sales with the imperative of profitability. For instance, in 2024, the average online consumer electronics purchase saw a price reduction of 8% compared to the previous year, driven by these competitive pressures.

hhgregg operates in a highly competitive landscape, contending with giants like Amazon, which reported over $574 billion in net sales for 2023, and Best Buy, a significant omnichannel player. These large, diversified competitors leverage massive economies of scale, offering broader product selections and often more aggressive pricing strategies.

Furthermore, even big-box retailers such as Home Depot and Lowe's, with their substantial market presence in home improvement, also carry significant appliance and electronics categories. In 2023, Home Depot's revenue was approximately $152.7 billion, highlighting their capacity to compete across multiple product segments.

In the consumer electronics and appliance sector, many products are largely standardized, meaning retailers like hhgregg struggle to stand out based on the product alone. While innovations like smart home integration and enhanced energy efficiency are emerging, the core functionality of many appliances remains similar across brands. This lack of significant product differentiation forces competition to pivot towards other areas.

Consequently, the battle for market share often centers on factors such as competitive pricing, efficient delivery services, and the quality of customer support. For instance, in 2024, the average consumer electronics retailer experienced a significant portion of their sales influenced by promotional pricing, with discounts often exceeding 15% on popular items to attract price-sensitive buyers.

Rapid Technological Advancements

The consumer electronics and appliance sector is in a constant state of flux, fueled by rapid technological advancements. Innovations like artificial intelligence (AI), the Internet of Things (IoT), and enhanced energy efficiency are not just trends; they are fundamental drivers of product evolution. Retailers, including those like hhgregg, must stay ahead of this curve, ensuring their product lines reflect the newest models and features to remain competitive.

This relentless pace of innovation directly impacts competitive rivalry. Retailers face pressure to invest heavily in new inventory and marketing to showcase these cutting-edge products. For instance, in 2024, the global consumer electronics market was projected to reach over $1 trillion, with a significant portion driven by new product cycles and feature upgrades, underscoring the financial commitment required to keep pace.

- AI Integration: Features like AI-powered smart home devices and personalized user experiences are becoming standard, demanding constant product updates.

- IoT Connectivity: The growing interconnectedness of appliances and electronics necessitates retailers stocking devices compatible with evolving IoT ecosystems.

- Energy Efficiency Standards: Increasingly stringent energy efficiency regulations push manufacturers to release new models, creating a continuous refresh cycle.

- Product Lifecycles: Shorter product lifecycles in electronics mean retailers must manage inventory turnover more aggressively to avoid obsolescence.

High Fixed Costs and Inventory Management Challenges

Operating an online appliance retail business, like hhgregg once did, carries substantial fixed costs. These include expenses for maintaining warehouses, managing complex logistics networks, and investing heavily in online marketing to reach customers. For instance, a typical large appliance distribution center can cost millions annually in rent, utilities, and staffing.

The challenge of managing vast inventories of diverse products, from refrigerators to washing machines, is immense. This complexity is amplified in a market where product cycles are shortening and consumer preferences shift rapidly. In 2024, the electronics and appliance retail sector saw inventory turnover rates vary significantly, with some major players managing stock turns between 4-6 times per year, highlighting the capital tied up and the risk of obsolescence.

- Warehousing and Logistics: Significant overheads associated with storing and transporting bulky items.

- Marketing Investment: High spend required to gain visibility in a crowded online marketplace.

- Inventory Turnover: The speed at which stock is sold impacts capital efficiency; slower turns increase risk.

- Product Obsolescence: Rapid technological advancements can devalue existing inventory.

Competitive rivalry is exceptionally intense in the online consumer electronics and home appliance sector, with hhgregg facing formidable opponents. Giants like Amazon, which generated over $574 billion in net sales in 2023, and Best Buy, a strong omnichannel player, exert significant pressure through economies of scale and aggressive pricing. Even diversified retailers such as Home Depot, with its 2023 revenue of approximately $152.7 billion, compete in appliance and electronics categories.

The market is characterized by price sensitivity, where consumers frequently compare deals, driving down margins. For instance, in 2024, online consumer electronics purchases saw an average price reduction of 8% year-over-year. Many products lack significant differentiation, forcing competition to focus on price, delivery efficiency, and customer service, with promotional pricing often exceeding 15% on popular items in 2024.

Rapid technological advancements, including AI and IoT integration, necessitate continuous product updates and inventory management. The global consumer electronics market, projected to exceed $1 trillion in 2024, is heavily influenced by new product cycles. This environment demands substantial investment in new inventory and marketing to stay relevant, as shorter product lifecycles increase the risk of obsolescence.

| Competitor | 2023 Net Sales / Revenue | Key Competitive Factor |

|---|---|---|

| Amazon | $574+ billion | Economies of scale, broad selection, aggressive pricing |

| Best Buy | Not specified (significant omnichannel player) | Omnichannel presence, customer service |

| Home Depot | ~$152.7 billion | Diversified product categories, market presence |

SSubstitutes Threaten

The threat of substitutes is amplified by the repair and refurbished markets. Consumers increasingly choose to repair their existing appliances or opt for refurbished electronics and appliances as a more budget-friendly option than purchasing new items. This trend is particularly noticeable in the electronics sector, where the refurbished market provides a sustainable and significantly cheaper alternative.

The global refurbished electronics market is a substantial and growing segment. For instance, the market was valued at approximately $52.9 billion in 2023 and is projected to reach $116.9 billion by 2030, growing at a CAGR of 12.0%. This robust growth indicates a strong consumer preference for cost-effective and environmentally conscious options, directly impacting the demand for new products.

While outright purchase remains dominant for major appliances, the rise of rental or subscription services for certain electronics presents a potential threat of substitutes. These models cater to consumers needing items for short durations or those prioritizing flexibility over ownership. For instance, the growing popularity of gadget subscription boxes, which allow users to cycle through devices like smartphones or gaming consoles, offers an alternative to buying new products outright.

Technological leaps are blurring the lines between appliances. For instance, smart ovens in 2024 often boast air frying, steaming, and even dehydrating functions, directly challenging the market for standalone air fryers or steamers. This convergence means consumers might opt for one sophisticated appliance, thereby reducing the demand for several specialized ones.

Do-It-Yourself (DIY) Solutions and Component Purchases

For certain consumer electronics, especially smaller gadgets or individual parts, technically inclined consumers might choose to assemble their own devices or buy separate components instead of purchasing a fully assembled retail product. This represents a smaller, yet present, substitute for specific product lines within the electronics market.

This DIY trend, while not a mass-market substitute for all hhgregg products, does pose a threat by offering an alternative for consumers seeking customization or cost savings on specific components. For instance, the market for DIY computer building or custom audio setups allows consumers to bypass traditional retail channels for certain parts.

- DIY Electronics Market Growth: While specific data for hhgregg's direct impact is proprietary, the broader consumer electronics component market has seen steady growth, with online retailers specializing in DIY parts reporting increased sales. For example, sites like Digi-Key and Mouser, major distributors of electronic components, saw revenue growth in the high single digits in 2023.

- Niche Appeal: This substitute is most potent for components like sound system parts, custom PC builds, or smart home device modules where consumers can source individual pieces and assemble them, potentially at a lower cost or with greater personalization.

- Impact on Lower-Margin Items: The threat is more pronounced for lower-margin, easily replicable components rather than complex, integrated systems that require specialized manufacturing and support.

Delaying Purchases Due to Economic Factors

Economic headwinds can significantly influence consumer behavior, leading to a pronounced threat of substitutes for hhgregg. When faced with inflation or economic uncertainty, consumers often postpone discretionary purchases like new electronics and appliances. This delay effectively turns the continued use of existing, albeit older, products into a powerful substitute for buying new ones.

For instance, in 2024, persistent inflation and concerns about interest rates may encourage consumers to hold onto their current appliances longer. This 'non-purchase' substitute directly erodes hhgregg's potential sales volumes. A survey in early 2024 indicated that over 60% of consumers were delaying major purchases due to economic concerns, a clear signal of this substitute threat.

- Consumer Postponement: Economic uncertainty prompts consumers to delay buying new electronics and appliances.

- Extended Product Lifespan: Consumers opt to use existing items for longer periods as a substitute.

- Impact on Sales: This 'non-purchase' substitute directly reduces hhgregg's sales volumes and revenue potential.

- 2024 Trend: Over 60% of consumers reported delaying major purchases in early 2024 due to economic factors.

The threat of substitutes for hhgregg is multifaceted, encompassing repair services, refurbished goods, rental models, and even DIY solutions. Consumers are increasingly finding value in extending the life of their current appliances through repairs or opting for more affordable refurbished electronics, especially given economic pressures. For instance, the global refurbished electronics market was valued at approximately $52.9 billion in 2023 and is projected to grow significantly.

Technological convergence also plays a role, where a single advanced appliance can replace multiple specialized ones, diminishing the need for separate purchases. Furthermore, economic headwinds in 2024, such as inflation, are prompting consumers to postpone discretionary spending, leading them to use existing products longer, effectively making non-purchase a potent substitute.

| Substitute Type | Description | Market Data/Trend | Impact on hhgregg |

|---|---|---|---|

| Repair & Refurbished Market | Consumers opt to fix existing items or buy pre-owned electronics/appliances. | Refurbished electronics market valued at ~$52.9B in 2023, projected to reach $116.9B by 2030 (12.0% CAGR). | Reduces demand for new products, especially in electronics. |

| Rental/Subscription Services | Consumers use electronics for short periods or prioritize flexibility over ownership. | Growing popularity of gadget subscription boxes for smartphones, gaming consoles. | Alternative to outright purchase for certain electronics. |

| Technological Convergence | Advanced appliances with multiple functions replace specialized devices. | Smart ovens in 2024 offer air frying, steaming, dehydrating. | Decreases demand for single-function appliances. |

| DIY & Component Assembly | Consumers build their own devices or buy separate components. | Online component distributors like Digi-Key saw high single-digit revenue growth in 2023. | Threat for lower-margin, easily replicable components. |

| Economic Headwinds (Non-Purchase) | Consumers delay purchases due to inflation and economic uncertainty. | Over 60% of consumers delayed major purchases in early 2024 due to economic concerns. | Erodes potential sales by encouraging extended use of existing products. |

Entrants Threaten

While building a full-scale online retail operation with established logistics and supplier networks presents significant hurdles, the initial cost and complexity of launching a basic e-commerce platform are considerably lower than opening physical stores. This reduced barrier allows new players to enter the online market more readily, potentially increasing competition for established businesses.

While launching an online store seems accessible, the appliance and electronics sector demands significant upfront capital. For instance, establishing robust inventory management and a reliable logistics network capable of handling bulky items like refrigerators or televisions can easily run into millions of dollars. This high capital requirement for warehousing and delivery infrastructure effectively deters many potential new competitors.

New entrants into the appliance and electronics retail space would find it incredibly difficult to establish strong relationships with key suppliers. Established players like Best Buy and even regional chains have decades-long partnerships that grant them preferential pricing and access to in-demand products. For instance, in 2024, major electronics manufacturers often allocate limited inventory of high-demand items, like the latest OLED televisions or premium home appliances, to retailers with proven sales histories and significant order volumes. A new entrant would likely face higher wholesale costs and a restricted product selection, hindering their ability to compete effectively against established brands.

Brand Recognition and Customer Trust

Incumbent retailers, including online-only players, hold a significant advantage due to their established brand recognition and customer trust, cultivated over years of operation. For instance, in 2024, major electronics retailers continued to leverage their long-standing reputations, with brand loyalty programs playing a crucial role in customer retention.

New entrants face a substantial hurdle in replicating this level of credibility. They would require considerable investment in marketing and a significant timeframe to build comparable trust in a highly competitive retail landscape. The cost of acquiring new customers can be upwards of five times more than retaining existing ones, highlighting the financial barrier for newcomers.

- Brand Loyalty: Established brands benefit from repeat purchases, a key metric in the retail sector.

- Marketing Costs: New entrants must allocate substantial budgets to build brand awareness and trust.

- Time to Credibility: Developing a reputation for reliability and quality takes years, not months.

Regulatory Compliance and Product Safety Standards

New entrants face significant challenges in meeting stringent regulatory compliance and product safety standards, particularly within the electronics and appliance sectors. These regulations, covering areas like consumer protection, data privacy, and product safety certifications, are not static and often require substantial investment in testing and adherence. For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued to emphasize rigorous testing for electronic devices to prevent fire hazards and electrical shock, adding to the compliance burden for any new player entering the market.

Navigating these evolving frameworks presents a considerable barrier to entry. Companies must dedicate resources to understanding and implementing compliance measures, which can divert capital and attention from core business development. The ongoing updates to regulations, such as those concerning energy efficiency standards for appliances or cybersecurity protocols for smart home devices, demand continuous adaptation. In 2024, the Federal Trade Commission (FTC) also increased scrutiny on data privacy practices, requiring new entrants to implement robust data protection policies from the outset.

- Complex Regulatory Frameworks: New entrants must comply with consumer protection, data privacy, and product safety laws.

- Evolving Standards: Regulations are continuously updated, requiring ongoing investment in adaptation and testing.

- Cost of Compliance: Adhering to these standards can be expensive, impacting profitability for new businesses.

- Market Entry Barrier: The need for specialized knowledge and resources to meet compliance requirements deters potential new entrants.

While online retail may seem accessible, the appliance and electronics sector requires substantial capital for inventory, warehousing, and logistics, acting as a significant deterrent for new entrants. Established players also benefit from long-standing supplier relationships, securing better pricing and access to popular products, which new competitors struggle to replicate.

Brand loyalty and the high cost of customer acquisition present another formidable barrier, as new entrants must invest heavily in marketing to build trust and recognition. Furthermore, navigating complex and evolving regulatory landscapes, including product safety and data privacy standards, demands considerable resources and expertise, effectively limiting the threat of new competitors.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for inventory, warehousing, and logistics. | Deters entry due to significant upfront investment. |

| Supplier Relationships | Established players have preferential pricing and product access. | New entrants face higher costs and limited product selection. |

| Brand Recognition & Loyalty | Incumbents possess established trust and repeat customers. | High marketing costs and time needed to build credibility. |

| Regulatory Compliance | Adherence to safety, privacy, and consumer protection laws. | Requires specialized knowledge, investment, and ongoing adaptation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for hhgregg is built upon a foundation of publicly available financial statements, industry-specific market research reports, and news archives detailing competitor activities and market trends.