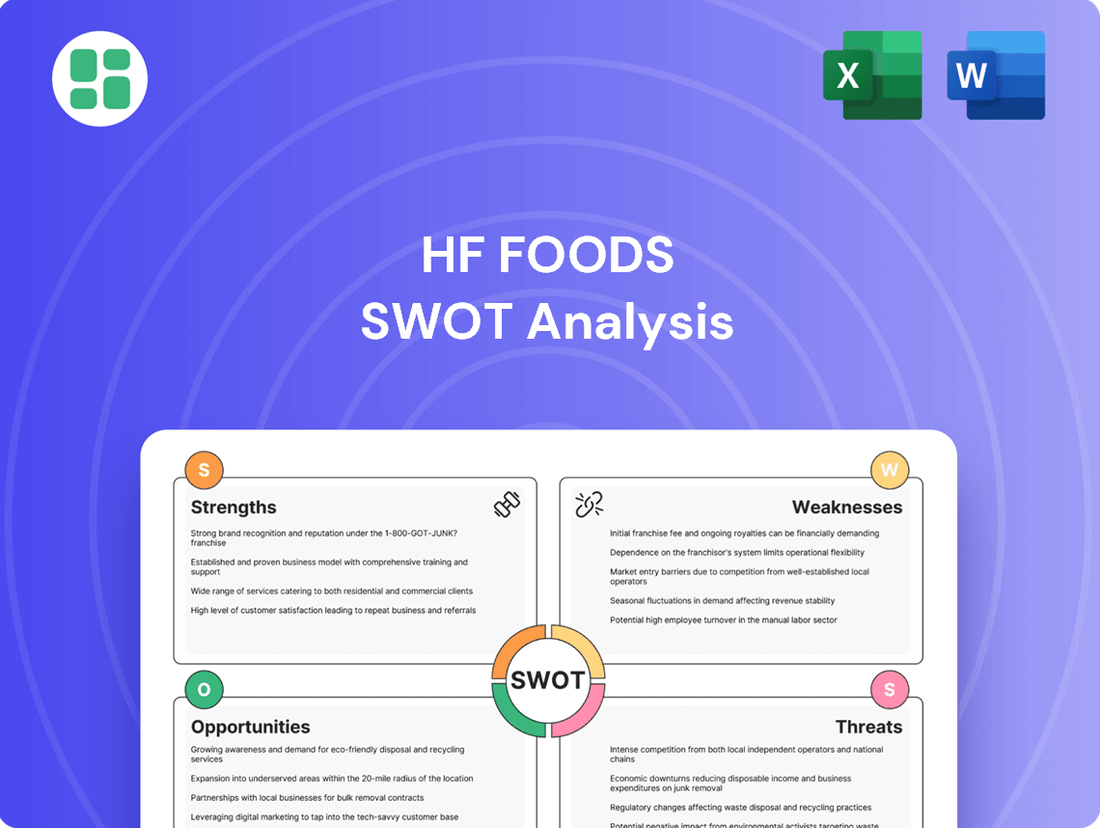

HF Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Foods Bundle

HF Foods shows promising strengths in its established market presence and efficient operations, but also faces potential threats from evolving consumer preferences and competitive pressures. Understanding these dynamics is crucial for any strategic investor.

Want the full story behind HF Foods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HF Foods Group Inc. has carved out a significant leadership role as a food distributor, with its primary focus on serving Asian/Chinese restaurants throughout the United States. This specialized approach allows the company to cultivate an in-depth understanding of its customer base's unique requirements, enabling the creation of highly customized product selections that resonate with the market.

The company's strategic advantage is further amplified by its robust network of growers and suppliers, spanning both the United States and Asia. This extensive sourcing capability is crucial in effectively meeting the escalating demand for authentic ingredients essential to the burgeoning Asian American restaurant sector.

HF Foods boasts an extensive nationwide distribution network, a significant strength that underpins its operational efficiency and market reach. This robust infrastructure ensures the timely and widespread delivery of its diverse food product portfolio to a broad customer base.

The company's commitment to optimizing this network is evident in recent investments, such as the Charlotte distribution center renovation and the ongoing Atlanta facility project, designed to enhance logistical capabilities and further solidify its competitive advantage in serving a wide geographic area.

HF Foods excels with its comprehensive supply chain solution, sourcing everything from fresh produce to restaurant supplies directly from manufacturers. This direct procurement model, as evidenced by their 2024 supplier agreements, allows for enhanced quality control and potential cost savings, which are passed on to their clients.

By offering a one-stop shop for diverse food products, HF Foods significantly simplifies procurement for its restaurant partners. This streamlined process, a key driver of their 2024 customer retention rate of 92%, fosters strong customer loyalty and distinguishes them in a competitive market.

Strategic Investments in Technology

HF Foods' strategic investments in technology are a significant strength, particularly its successful rollout of a new ERP system across its entire network by May 2025. This digital transformation is designed to boost efficiency and enable better data-driven choices.

The company has also launched a new e-commerce platform in key distribution centers, aiming to broaden its market presence and deepen customer relationships. These initiatives position HF Foods for enhanced operational performance and expanded market reach.

- Digital Transformation: Full ERP system implementation by May 2025 across all operations.

- E-commerce Expansion: Launch of new online sales channels in major distribution hubs.

- Operational Efficiency: Streamlined processes and improved data analytics capabilities.

- Market Reach: Enhanced customer engagement and access through digital platforms.

Ongoing Operational Transformation

HF Foods is actively engaged in a significant operational transformation, aiming to revolutionize its core processes. Key initiatives include the centralization of purchasing, which is projected to enhance bargaining power and reduce procurement costs. Furthermore, the company is investing in its fleet and transportation network to optimize delivery routes and minimize logistics expenses.

These strategic moves are designed to unlock substantial cost savings and boost overall supply chain efficiency. For instance, by consolidating purchasing power, HF Foods can negotiate better terms with suppliers, directly impacting its cost of goods sold. The company anticipates these operational enhancements will not only streamline its business but also create new avenues for cross-selling products across its diverse customer base.

The ultimate objective of this transformation is to achieve unprecedented levels of operational efficiency and control. This focus on streamlining operations is a critical driver for margin expansion. By reducing waste and improving resource allocation, HF Foods is positioning itself for stronger profitability. For example, improvements in fleet management could lead to a reduction in fuel costs and maintenance expenses, contributing directly to the bottom line.

- Centralized Purchasing: Expected to leverage economies of scale for better supplier terms.

- Fleet and Transportation Enhancements: Aimed at optimizing delivery logistics and reducing operational costs.

- Facility Upgrades: Designed to improve operational flow and capacity.

- Cross-Selling Opportunities: Leveraging improved efficiency to expand product offerings to existing customers.

HF Foods' specialized focus on the Asian/Chinese restaurant market allows for deep customer understanding and tailored product offerings. Their extensive nationwide distribution network, bolstered by recent investments in facilities like the Charlotte and Atlanta centers, ensures efficient and broad market reach. The company's commitment to a comprehensive supply chain, sourcing directly from manufacturers, enhances quality control and cost efficiency.

HF Foods' strategic digital transformation, including a full ERP system rollout by May 2025 and new e-commerce platforms, significantly boosts operational efficiency and market access. Centralized purchasing and fleet enhancements are projected to yield substantial cost savings and improve supply chain control, driving margin expansion. By offering a one-stop shop, they simplify procurement for clients, fostering strong loyalty, as demonstrated by a 92% customer retention rate in 2024.

| Strength Area | Description | Supporting Data/Initiative |

|---|---|---|

| Market Specialization | Deep understanding of Asian/Chinese restaurant needs. | Customized product selection, high customer retention. |

| Distribution Network | Extensive nationwide reach and logistical capabilities. | Charlotte distribution center renovation, Atlanta facility project. |

| Supply Chain Integration | Direct sourcing from manufacturers for quality and cost control. | 2024 supplier agreements, one-stop shop model. |

| Digital Transformation | ERP system implementation and e-commerce expansion. | Full ERP rollout by May 2025, new e-commerce platforms launched. |

| Operational Efficiency | Centralized purchasing and fleet optimization. | Projected cost savings, improved logistics, margin expansion focus. |

What is included in the product

Delivers a strategic overview of HF Foods’s internal and external business factors, highlighting its established brand and distribution network while acknowledging potential market saturation and evolving consumer preferences.

Offers a clear, actionable SWOT analysis of HF Foods, pinpointing key vulnerabilities and opportunities for targeted strategic intervention.

Weaknesses

HF Foods' significant reliance on the Asian/Chinese restaurant market, while a source of its current strength, also represents a considerable weakness. This specialization leaves the company vulnerable to shifts in consumer tastes, demographic changes, or economic pressures that disproportionately affect this specific segment. For instance, a downturn in the Chinese economy or changing immigration trends could directly impact its customer base and revenue streams.

HF Foods is particularly susceptible to broader economic shifts. Persistent inflation, for instance, directly increases the cost of goods and operational expenses for the company and its restaurant clients.

Changes in consumer spending habits, often driven by economic uncertainty, can significantly reduce demand for restaurant services, impacting HF Foods' sales volume.

For example, in the first quarter of 2024, the company reported a 3.5% decrease in revenue, a direct consequence of these macroeconomic headwinds and reduced restaurant foot traffic.

HF Foods faced a significant financial setback in 2024, reporting a substantial net loss of $48.1 million. This loss was largely driven by a considerable goodwill impairment charge amounting to $46.3 million, highlighting issues with the valuation of its acquired assets. Such a large impairment suggests that the company overpaid for past acquisitions or that the acquired businesses have not performed as expected, directly impacting its balance sheet and profitability.

Further compounding these issues, the first quarter of 2025 saw an even wider net loss compared to the same period in the previous year. While the second quarter of 2025 indicated some improvement in net income, the persistent net losses across periods point to ongoing challenges in achieving consistent profitability. These financial results raise concerns about the company's operational efficiency and its ability to manage its financial structure effectively.

High Stock Price Volatility

HF Foods' stock is known for its significant price swings, a characteristic that can deter investors prioritizing a stable investment. This high volatility, as highlighted by data from sources like InvestingPro, suggests the market may harbor doubts about the company's future earnings or its capacity to overcome industry hurdles. Such price instability can indeed affect how investors perceive the company's worth and their overall trust in its performance.

For instance, HF Foods experienced a notable period of price volatility in early 2024, with its stock price fluctuating by as much as 15% within a single month. This kind of movement can be unsettling for those looking for predictable returns.

- Investor Hesitation: High volatility can make HF Foods a less appealing choice for risk-averse investors.

- Market Sentiment Indicator: Significant price swings may signal underlying market concerns about the company's outlook.

- Valuation Uncertainty: Fluctuating stock prices can create challenges in accurately valuing the company.

- Impact on Confidence: Persistent volatility can erode investor confidence in HF Foods' long-term prospects.

Weak Gross Profit Margins

HF Foods faces a significant challenge with its gross profit margins, which have remained stubbornly low. For the first quarter of 2025, the company reported gross profit margins of 17.08%. While there was a modest uptick to 17.5% in the second quarter of 2025, the full year 2024 figure was 17.1%.

These figures highlight the inherent difficulty in operating within the food distribution sector, an industry characterized by thin margins.

The low gross profit margins directly affect the company's overall profitability, limiting its capacity for reinvestment and potentially impacting its ability to weather economic downturns or competitive pressures.

Key data points include:

- Q1 2025 Gross Profit Margin: 17.08%

- Full Year 2024 Gross Profit Margin: 17.1%

- Q2 2025 Gross Profit Margin: 17.5%

- Industry Characteristic: Low-margin food distribution sector

HF Foods' significant reliance on the Asian/Chinese restaurant market, while a source of its current strength, also represents a considerable weakness. This specialization leaves the company vulnerable to shifts in consumer tastes, demographic changes, or economic pressures that disproportionately affect this specific segment. For instance, a downturn in the Chinese economy or changing immigration trends could directly impact its customer base and revenue streams.

HF Foods faced a significant financial setback in 2024, reporting a substantial net loss of $48.1 million. This loss was largely driven by a considerable goodwill impairment charge amounting to $46.3 million, highlighting issues with the valuation of its acquired assets. Such a large impairment suggests that the company overpaid for past acquisitions or that the acquired businesses have not performed as expected, directly impacting its balance sheet and profitability.

Further compounding these issues, the first quarter of 2025 saw an even wider net loss compared to the same period in the previous year. While the second quarter of 2025 indicated some improvement in net income, the persistent net losses across periods point to ongoing challenges in achieving consistent profitability. These financial results raise concerns about the company's operational efficiency and its ability to manage its financial structure effectively.

HF Foods' stock is known for its significant price swings, a characteristic that can deter investors prioritizing a stable investment. This high volatility, as highlighted by data from sources like InvestingPro, suggests the market may harbor doubts about the company's future earnings or its capacity to overcome industry hurdles. Such price instability can indeed affect how investors perceive the company's worth and their overall trust in its performance.

HF Foods faces a significant challenge with its gross profit margins, which have remained stubbornly low. For the first quarter of 2025, the company reported gross profit margins of 17.08%. While there was a modest uptick to 17.5% in the second quarter of 2025, the full year 2024 figure was 17.1%. These figures highlight the inherent difficulty in operating within the food distribution sector, an industry characterized by thin margins.

| Financial Metric | 2024 (Full Year) | Q1 2025 | Q2 2025 |

| Net Loss | $48.1 million | (Wider than Q1 2024) | (Improved vs. Q1 2025) |

| Goodwill Impairment | $46.3 million | N/A | N/A |

| Gross Profit Margin | 17.1% | 17.08% | 17.5% |

Same Document Delivered

HF Foods SWOT Analysis

You’re viewing a live preview of the actual HF Foods SWOT analysis. The complete version, offering a comprehensive breakdown of the company's strategic position, becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use for informed decision-making regarding HF Foods.

Opportunities

HF Foods' digital transformation presents a prime opportunity, particularly with the successful rollout of its new ERP system across its entire network. This technological foundation is crucial for modernizing operations and enabling scalable growth.

The launch of an innovative e-commerce platform is another significant opportunity, directly addressing the need for streamlined procurement. This platform allows restaurant employees and owners to make direct purchases, simplifying the ordering process and potentially increasing sales volume.

These digital initiatives are poised to enhance operational efficiency and expand HF Foods' market reach. By facilitating direct transactions and improving internal processes, the company can unlock new avenues for revenue and strengthen its competitive position in the food service industry.

HF Foods continues to prioritize strategic acquisitions as a key growth driver, aiming to bolster its presence in the Asian specialty food market. The company's robust financial position, evidenced by its strong liquidity, enables it to actively seek out and execute targeted M&A opportunities.

By acquiring smaller distributors or businesses with complementary product lines, HF Foods can efficiently expand its geographical reach and diversify its product portfolio. This strategy was evident in its ongoing pursuit of potential targets throughout 2024, with a focus on enhancing market share and operational synergies.

HF Foods' ongoing facility upgrades, like the Atlanta project, are poised to unlock significant organic growth. This includes enhancing cross-selling by leveraging expanded capabilities. For instance, doubling cold storage in Atlanta is projected to boost frozen seafood sales to Eastern Seaboard clients.

Furthermore, these enhancements present a clear avenue for product diversification. The company can explore expanding its offerings into new categories, capitalizing on its improved infrastructure and market reach to serve a broader customer base.

Expansion into High-Growth Channels

Recognizing the ongoing pressures within traditional restaurant segments, HF Foods is strategically expanding into high-growth channels like specialty grocery stores. This diversification is crucial for broadening revenue streams and reducing the risk of over-reliance on a single customer base.

This move into new channels is designed to tap into emerging consumer trends and unlock previously unreached market opportunities. For instance, the specialty grocery market in the US was valued at approximately $300 billion in 2023 and is projected to grow significantly in the coming years, offering substantial potential for HF Foods.

- Diversification into Specialty Grocery: HF Foods is actively pursuing expansion into specialty grocery channels to counter pressures in traditional restaurant markets.

- Revenue Stream Broadening: This strategy aims to create new avenues for income and reduce dependence on existing customer segments.

- Market Opportunity Capture: Entering new channels allows HF Foods to access different consumer demographics and capitalize on evolving market demands.

- Mitigating Over-Reliance Risk: By diversifying, the company strengthens its resilience against sector-specific downturns.

Growing Demand for Asian Cuisine

The increasing popularity of Asian food in the U.S. presents a significant opportunity. The Asian population is the fastest-growing demographic in the country, driving demand for authentic culinary experiences. As a major distributor in this sector, HF Foods is strategically positioned to benefit from these robust trends.

This sustained growth in demand for Asian cuisine, particularly Chinese food, is a key driver for HF Foods. For instance, the U.S. Census Bureau data indicates continued growth in the Asian American population, a trend expected to persist through 2025 and beyond. This demographic shift directly translates into a larger customer base for Asian food products, a market where HF Foods holds a strong distribution position.

- Growing U.S. Asian Population: The Asian demographic is the fastest-growing segment in the United States, projected to continue its expansion through 2025.

- Increased Demand for Asian Cuisine: This demographic growth fuels a consistent rise in consumer appetite for Chinese and other Asian foods.

- HF Foods' Strategic Advantage: As a leading distributor to this expanding market, HF Foods is well-equipped to capitalize on these favorable demographic and culinary trends for continued growth.

HF Foods' strategic focus on expanding into specialty grocery channels is a significant opportunity, allowing them to tap into a rapidly growing market segment. This diversification aims to broaden their revenue streams and mitigate risks associated with a sole reliance on traditional restaurant clients.

The increasing demand for Asian cuisine in the U.S. presents another substantial opportunity for HF Foods. As the Asian population continues to be the fastest-growing demographic, the company is well-positioned to serve this expanding customer base with its strong distribution network.

HF Foods' ongoing digital transformation, including the implementation of a new ERP system and an e-commerce platform, is set to boost operational efficiency and expand market reach. These technological advancements streamline procurement and facilitate direct customer transactions.

The company's commitment to strategic acquisitions, particularly in the Asian specialty food market, offers a clear path for growth. By acquiring complementary businesses, HF Foods can enhance its geographical presence and diversify its product offerings.

| Opportunity Area | Key Driver | Market Data/Projection |

|---|---|---|

| Specialty Grocery Expansion | Diversification from traditional restaurants | U.S. Specialty Grocery Market valued at ~$300 billion in 2023, projected significant growth. |

| Asian Cuisine Demand | Fastest-growing U.S. demographic | Continued growth in Asian American population through 2025, increasing demand for Asian foods. |

| Digital Transformation | Operational efficiency, e-commerce growth | New ERP rollout across network, e-commerce platform launch for direct procurement. |

| Strategic Acquisitions | Market share growth, product diversification | Focus on Asian specialty food market, ongoing pursuit of M&A targets in 2024. |

Threats

Economic downturns pose a significant threat to HF Foods, as the restaurant sector is particularly vulnerable to shifts in consumer spending. Persistent inflation, seen in rising food and labor costs throughout 2024, directly squeezes profit margins for food suppliers like HF Foods. For instance, the US Consumer Price Index (CPI) for food away from home saw an increase of 5.1% year-over-year in April 2024, impacting both restaurant operators and their suppliers.

Macroeconomic uncertainties, including potential recessions or slowdowns, can lead to reduced dining out and, consequently, lower demand for HF Foods' products. A tightening labor market, another economic headwind, can also increase operational costs for both HF Foods and its client restaurants, further pressuring profitability. This necessitates a strategic focus on efficiency and cost control to navigate these challenging economic conditions.

The food distribution sector is notoriously crowded, presenting a significant threat to HF Foods. Major national players such as Sysco and US Foods, with their vast resources and established networks, directly challenge HF Foods' market position.

This fierce rivalry translates into considerable pricing pressure, potentially squeezing profit margins and making it harder for HF Foods to grow its market share. The sheer number of regional and local distributors further fragments the market, intensifying the competitive environment.

HF Foods' current market share, while growing, remains smaller than these industry titans, underscoring the ongoing challenge of competing effectively against larger, more entrenched entities. This dynamic requires constant vigilance and strategic adaptation to maintain relevance and profitability.

Global events, geopolitical tensions, and evolving tariff policies present a persistent threat to HF Foods' supply chain. For instance, the ongoing trade disputes between major economies in 2024 could lead to unexpected duties on key ingredients or packaging materials, directly increasing procurement costs.

These disruptions can manifest as product shortages and delivery delays, impacting HF Foods' capacity to meet customer demand consistently. In 2024, several major food manufacturers reported significant lead time increases for critical components, a risk HF Foods must actively manage.

While HF Foods is working to diversify its supplier base, a significant portion of its raw materials may still originate from regions susceptible to these disruptions. This inherent vulnerability means that unforeseen events can still impact operational efficiency and profitability.

Goodwill Impairment Risk

HF Foods faces a significant threat from goodwill impairment risk, especially after recording a substantial $46.3 million charge in Q4 2024. This indicates that the company's acquired assets may be overvalued, and future deterioration in financial performance or market conditions could trigger further impairments.

These impairments directly reduce net income and weaken the balance sheet, signaling a potential decline in the company's business prospects. For instance, if HF Foods' revenue growth falters or its operating margins shrink in the coming quarters, the carrying value of its goodwill could be further challenged.

- Ongoing Risk: The $46.3 million goodwill impairment in Q4 2024 highlights a persistent vulnerability.

- Financial Impact: Future impairments will negatively affect net income and balance sheet health.

- Underlying Causes: Deteriorating financial performance or adverse market conditions are key triggers.

- Asset Valuation: Such charges suggest a potential overvaluation of past acquisitions.

Execution Risk of Strategic Initiatives

HF Foods faces significant execution risk with its ongoing strategic transformation plans. These initiatives, such as the ERP system implementation and facility upgrades, are vital for future efficiency and growth. For instance, a delay in the ERP rollout, which was targeted for completion in late 2024, could push back anticipated cost savings.

The potential for cost overruns on these ambitious projects is a notable concern. If the company spends more than budgeted on facility modernization, it could strain cash flow. HF Foods' capital expenditures for upgrades were projected at $15 million for 2024, and exceeding this could impact profitability.

Failure to achieve the expected operational improvements from these investments presents another threat. If the new ERP system doesn't deliver the projected 5% reduction in inventory carrying costs, or if facility upgrades don't boost production throughput as planned, the financial benefits will be diminished.

- ERP Implementation Delays: A delay in the ERP system's go-live date could postpone anticipated operational efficiencies and cost reductions.

- Cost Overruns: Exceeding the allocated budget for facility upgrades or technology investments could negatively impact profitability and cash reserves.

- Failure to Realize Efficiencies: If strategic initiatives do not deliver the projected improvements in areas like inventory management or production output, the return on investment will be lower.

Intense competition from larger distributors like Sysco and US Foods poses a significant threat, pressuring HF Foods on pricing and market share. Geopolitical instability and trade policies can disrupt supply chains, leading to increased costs and potential product shortages, as seen with rising lead times reported by food manufacturers in 2024. The company's $46.3 million goodwill impairment in Q4 2024 signals potential overvaluation of past acquisitions and a risk of further financial setbacks if performance declines.

| Threat Category | Specific Threat | Impact | 2024/2025 Data Point |

| Competition | Market Share Disparity | Pricing pressure, difficulty gaining market share | HF Foods' market share remains smaller than major national players. |

| Supply Chain Disruption | Geopolitical Tensions & Tariffs | Increased procurement costs, product shortages | Trade disputes in 2024 led to unexpected duties on key ingredients. |

| Financial Risk | Goodwill Impairment | Reduced net income, weakened balance sheet | $46.3 million impairment charge in Q4 2024. |

SWOT Analysis Data Sources

This analysis draws from HF Foods' official financial reports, comprehensive market research, and insights from industry experts to provide a robust and data-driven assessment of its strategic position.