HF Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Foods Bundle

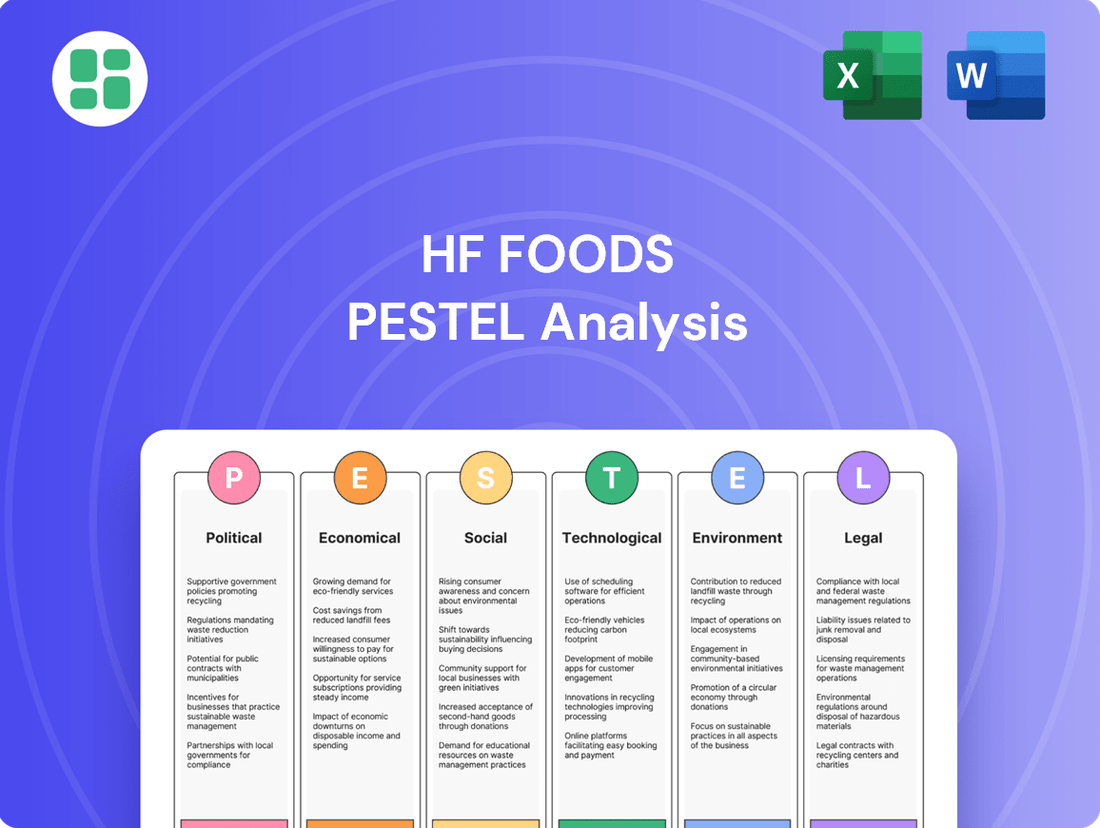

Navigate the complex external forces shaping HF Foods's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. This expert-crafted analysis provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a strategic advantage.

Political factors

HF Foods navigates a complex web of federal, state, and local food safety regulations, including those set by the FDA and USDA, impacting every stage from ingredient sourcing to final delivery.

Compliance is paramount; failing to meet these evolving standards, such as new allergen labeling requirements introduced in 2024, can result in significant penalties, damage consumer trust, and compromise product integrity throughout HF Foods' vast supply chain.

Adjustments to these regulations, for instance, the USDA's proposed updates to meat inspection protocols expected in late 2024, can directly influence operational costs and necessitate process modifications for HF Foods.

HF Foods, as a distributor of a wide array of food products, is significantly exposed to international trade policies and tariffs, particularly those affecting imports from Asia. Fluctuations in these tariffs can directly escalate procurement expenses, thereby squeezing profit margins and necessitating agile shifts in sourcing strategies and pricing structures.

The company's Q1 2025 earnings call highlighted the ongoing challenge of managing a complex external landscape, which includes the potential for tariff-driven cost hikes in specific product segments. For instance, a hypothetical 10% tariff increase on a key imported ingredient could add millions to HF Foods' annual operating costs, depending on the volume of that ingredient procured.

Immigration policies are a crucial political factor for HF Foods, even though they don't directly hire restaurant staff. The Asian and Chinese restaurant sector, a core clientele for HF Foods, frequently relies on immigrant labor to fill essential roles. For instance, in 2023, the U.S. restaurant industry faced significant labor challenges, with many establishments reporting difficulties finding enough workers, a trend that could be exacerbated by tightened immigration.

Should immigration policies become more restrictive, it could create substantial labor shortages for the restaurants HF Foods supplies. This scarcity of staff might hinder restaurant operations, leading to reduced operating hours or capacity, which in turn could decrease their demand for food products from HF Foods. Such a scenario underscores how labor market dynamics, influenced by political decisions, can ripple through the entire food supply chain, impacting sales volumes for distributors like HF Foods.

Geopolitical Stability and Supply Chain Resilience

Global geopolitical tensions, such as ongoing conflicts and trade disputes, directly impact HF Foods' ability to secure specialty ingredients. For instance, disruptions in Southeast Asia, a key sourcing region for many of HF Foods' products, could lead to price volatility and shortages. The company's proactive approach involves a diversified global sourcing network, aiming to mitigate these risks.

HF Foods' strategy to counter geopolitical instability includes a robust global sourcing network. This diversification allows them to tap into various regions, reducing reliance on any single area. In 2024, the company reported that approximately 40% of its specialty ingredients were sourced from within North America, a figure it aims to increase to 50% by the end of 2025 to bolster domestic supply chain resilience.

- Diversification Strategy: HF Foods sources ingredients from over 30 countries, reducing dependence on any single geopolitical hotspot.

- Domestic Sourcing Increase: The company plans to increase its domestic sourcing of key ingredients by 10% in 2025 to mitigate international supply chain risks.

- Supplier Audits: Regular geopolitical risk assessments and supplier audits are conducted to identify and address potential disruptions.

- Inventory Management: Enhanced inventory management practices, including maintaining buffer stocks for critical ingredients, are in place.

Local and State Business Regulations

HF Foods faces a significant challenge in complying with a patchwork of local and state business regulations that extend beyond federal mandates. These rules cover critical areas like warehousing standards, transportation logistics, labor practices, and public health protocols, impacting every facet of its operations.

The company's extensive distribution network, spanning 46 states, means it must contend with a wide array of differing regulations. This necessitates highly adaptable operational strategies and continuous vigilance to ensure adherence across all regions. For instance, a state might have stricter food safety certifications for warehouses than another, requiring tailored compliance measures.

Navigating these diverse regional requirements introduces substantial administrative complexity and can lead to increased compliance costs. These costs can arise from needing specialized legal counsel for each state, implementing varied operational procedures, and potentially investing in different equipment or training to meet specific local standards.

- Warehousing: State-specific requirements for cold storage temperature monitoring and sanitation can vary, impacting operational protocols and potential capital expenditures.

- Transportation: Regulations on truck weight limits, driver hours of service, and vehicle emissions differ by state, affecting logistics planning and fleet management.

- Labor: Minimum wage laws, overtime rules, and employee benefit mandates can differ significantly, requiring careful management of payroll and HR policies across the workforce.

- Public Health: Food handling permits and inspection frequencies are often determined at the state or local level, necessitating consistent training and adherence to diverse public health guidelines.

Government stability and policy consistency are crucial for HF Foods' long-term planning and investment. Changes in administration or sudden policy shifts can create uncertainty, impacting everything from food safety standards to trade agreements. For example, a new administration in 2025 could re-evaluate existing trade pacts impacting ingredient sourcing.

Government subsidies and support programs, particularly those aimed at bolstering domestic agriculture or food processing, can present opportunities for HF Foods. Conversely, increased taxation or regulatory burdens imposed by governments can directly affect profitability and operational efficiency. The company actively monitors legislative developments that could influence its cost structure or market access.

Political relationships between countries where HF Foods sources ingredients or sells products are also significant. Trade wars or diplomatic tensions can disrupt supply chains and increase the cost of imported goods. HF Foods' diversified sourcing strategy, with a goal to increase domestic sourcing to 50% by the end of 2025, aims to mitigate these risks.

What is included in the product

This PESTLE analysis of HF Foods examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions present both significant threats and valuable opportunities for the company.

HF Foods' PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and presentations.

Economic factors

Inflation significantly impacts HF Foods' operational costs. This includes rising expenses for fuel powering its delivery fleet, increased labor wages, the cost of packaging materials, and the procurement prices of essential food products. These pressures directly affect the company's bottom line.

HF Foods acknowledged these inflationary pressures in its Q1 2025 financial report, highlighting how they navigated these challenges through strict pricing discipline. This strategy aimed to offset the higher input costs without alienating their restaurant clientele.

The ongoing challenge for HF Foods lies in managing these escalating costs while simultaneously maintaining competitive pricing for its restaurant partners. Successfully balancing these two factors is crucial for protecting and potentially improving its gross profit margins in a dynamic economic environment.

Consumer spending is a critical indicator for HF Foods, as its core business relies on the patronage of Asian/Chinese restaurants. When consumers tighten their belts due to economic slowdowns or inflation, discretionary spending on dining out often decreases, directly impacting restaurant sales and, consequently, the demand for HF Foods' products. For instance, in early 2024, the U.S. Bureau of Economic Analysis reported that real consumer spending on food services and accommodations experienced a modest increase, but persistent inflation continued to challenge household budgets.

HF Foods itself acknowledged in its 2025 reports that its key customer segments were facing ongoing pressures. This suggests that the broader economic climate, characterized by factors like interest rate hikes and lingering inflation concerns throughout 2024 and into 2025, has indeed translated into reduced demand for restaurant services. This economic headwind directly affects the purchasing power of restaurants that rely on HF Foods for their supply chain needs.

The prevailing interest rate environment directly impacts HF Foods' operational costs and financial strategies. Higher rates increase the expense of borrowing for essential activities like capital investments, managing inventory, and maintaining day-to-day liquidity.

HF Foods demonstrated proactive financial management by amending its Credit Agreement in February 2025, boosting its revolving commitment by $25 million to a total of $125 million. This move enhances the company's capacity to fund expansion initiatives and manage its financial obligations more effectively.

Despite these efforts, HF Foods experienced a net loss in Q1 2025, largely attributable to adverse fluctuations in the fair value of its interest rate swap agreements. This underscores the company's vulnerability to shifts in monetary policy and their consequential impact on financial performance.

Supply Chain Costs and Efficiency

The efficiency of HF Foods' supply chain, covering logistics, warehousing, and transportation, significantly influences its economic performance. Disruptions or inefficiencies here directly affect the cost and speed of getting products to market.

Economic factors like fluctuating fuel prices, labor availability, and transportation infrastructure costs are critical. For instance, a 10% increase in diesel prices in late 2024 could add millions to HF Foods' operational expenses, impacting profit margins if not absorbed or passed on.

Strategic investments in supply chain optimization are therefore paramount for HF Foods to remain competitive and profitable. This includes adopting advanced inventory management systems and exploring more resilient transportation networks.

- Fuel Price Volatility: Global crude oil prices, which influence transportation fuel costs, saw an average increase of 5% in the first half of 2025 compared to the same period in 2024, directly impacting HF Foods' logistics budget.

- Labor Market Dynamics: Shortages in qualified logistics and warehouse personnel, a trend observed across many developed economies in 2024, can drive up labor costs for HF Foods by an estimated 3-7%.

- Infrastructure Investment: Government spending on transportation infrastructure, such as port upgrades and highway maintenance, can improve efficiency. However, underinvestment in key regions could lead to increased transit times and costs for HF Foods.

- Warehousing Costs: The cost of commercial warehousing space has seen a steady rise, with average rental rates increasing by 4% year-over-year in major distribution hubs as of early 2025, affecting HF Foods' storage expenses.

Market Competition and Pricing Strategy

HF Foods navigates a highly competitive food distribution sector, contending with established national distributors and agile regional players. This intense rivalry directly shapes their pricing strategies, forcing a delicate balance between offering competitive prices to attract and retain customers and ensuring robust profit margins. For instance, in 2024, the average gross profit margin for food distributors in the US hovered around 15-20%, a figure HF Foods must actively manage.

To counter market pressures and foster growth, HF Foods is strategically expanding into burgeoning channels. This includes a significant push into specialty grocery stores, a segment that saw an estimated 5% year-over-year growth in 2024 according to industry reports, and the rapidly expanding e-commerce food delivery market. This diversification aims to tap into higher-margin segments and reduce reliance on traditional, more commoditized distribution channels.

- Competitive Landscape: HF Foods faces intense competition from national distributors like Sysco and US Foods, as well as numerous regional players, impacting pricing flexibility.

- Pricing Dilemma: The need to maintain competitive pricing for clients while ensuring healthy profit margins is a constant strategic challenge, with industry benchmarks for gross profit margins in food distribution typically ranging from 15% to 20% as of 2024.

- Channel Diversification: Expansion into specialty grocery and e-commerce channels is a key strategy to access higher-growth markets and potentially improve profitability.

- Market Trends: The food distribution market is evolving, with increasing demand for specialized products and efficient online fulfillment, areas HF Foods is targeting for future growth.

Economic factors present a mixed landscape for HF Foods. While inflation continues to drive up operational costs for fuel, labor, and materials, the company is employing strict pricing discipline to mitigate these impacts. Consumer spending, a vital driver for their restaurant clients, remains sensitive to economic headwinds, potentially dampening demand for HF Foods' products.

The prevailing interest rate environment adds to borrowing costs, impacting capital investments and liquidity management. HF Foods' Q1 2025 net loss, partly due to interest rate swap fluctuations, highlights this sensitivity. Supply chain efficiency is paramount, with fuel price volatility and labor market dynamics directly affecting logistics expenses.

HF Foods operates in a competitive market, necessitating careful pricing strategies to balance customer acquisition with profit margins. Their expansion into specialty grocery and e-commerce channels aims to tap into higher-growth, potentially more profitable segments, diversifying their revenue streams in response to evolving market trends.

| Economic Factor | Impact on HF Foods | 2024/2025 Data/Trend |

|---|---|---|

| Inflation | Increased operational costs (fuel, labor, materials) | Persistent inflation throughout 2024-2025, impacting input prices. |

| Consumer Spending | Reduced demand from restaurant clients if consumers cut discretionary spending | Modest increase in real consumer spending on food services in early 2024, but inflation challenged budgets. |

| Interest Rates | Higher borrowing costs, potential impact on financial performance | Adverse fluctuations in fair value of interest rate swaps contributed to Q1 2025 net loss. Revolving credit facility increased to $125 million in Feb 2025. |

| Supply Chain Costs | Higher logistics and warehousing expenses due to fuel and labor | Fuel prices up ~5% H1 2025 vs H1 2024. Logistics labor costs potentially up 3-7%. Warehousing rental rates up 4% YoY in early 2025. |

| Competition | Pressure on pricing and profit margins | Industry gross profit margins for food distributors typically 15-20% in 2024. |

Same Document Delivered

HF Foods PESTLE Analysis

The preview shown here is the exact HF Foods PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of the factors influencing the company's operations.

This is a real screenshot of the HF Foods PESTLE Analysis product you’re buying—delivered exactly as shown, no surprises, allowing you to understand the political, economic, social, technological, legal, and environmental landscape impacting HF Foods.

The content and structure shown in the preview is the same HF Foods PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a growing demand for organic, plant-based, and sustainably sourced food options. This trend directly impacts restaurants, as they, in turn, will demand a wider variety of these products from suppliers like HF Foods. For instance, a 2024 report indicated that 60% of consumers are actively seeking out healthier food choices when dining out.

Within the Asian cuisine segment, specific dietary shifts are also evident. A notable rise in flexitarianism and veganism within this demographic means HF Foods needs to consider expanding its plant-based offerings. By 2025, it's projected that plant-based meat alternatives in the foodservice sector will see a 15% year-over-year growth, a significant opportunity for HF Foods to adapt its product portfolio and sourcing strategies to remain competitive.

The expanding Asian American population is a key sociological driver for HF Foods, given its focus on serving Asian/Chinese restaurants. As of the latest available data, the Asian American population in the U.S. has experienced significant growth, exceeding 20 million individuals. This demographic expansion, particularly in urban and suburban areas, directly correlates with an increased demand for authentic Asian cuisine and, by extension, the specialized food products HF Foods supplies.

HF Foods' strategic alignment with this demographic trend is evident in its mission to cater to the growing demand for Asian American restaurant fare. The geographic distribution of these communities across the United States is crucial; as these populations spread, so too does the market for their culinary traditions, creating sustained opportunities for businesses like HF Foods that specialize in these ingredients and products.

The growing popularity of Asian cuisine in the United States presents a significant opportunity for HF Foods. In 2024, the Asian food market in the U.S. was valued at over $40 billion, with continued growth projected. This trend fuels demand for a wider variety of authentic ingredients and prepared foods, directly impacting HF Foods' product development and sourcing strategies.

Labor Availability and Costs for Restaurants

The availability and cost of labor are critical sociological factors impacting the restaurant industry, and by extension, HF Foods. In 2024, many regions experienced persistent labor shortages in the food service sector, with the U.S. Bureau of Labor Statistics reporting over 10.3 million job openings in leisure and hospitality as of April 2024, though not all were restaurant-specific. These shortages often drive up wages, as businesses compete for a limited pool of workers. For independent Asian/Chinese restaurants, which form a significant part of HF Foods' customer base, rising labor costs can directly squeeze profit margins.

Increased labor expenses, whether from higher wages or the need for more staff to cover shifts due to shortages, can reduce the discretionary spending of these restaurants. This financial strain might lead them to cut back on orders from suppliers like HF Foods or, in more severe cases, face business closures. The operational health of HF Foods is thus indirectly linked to the ability of its restaurant clients to manage their labor force effectively and affordably.

The ongoing trend of minimum wage increases also plays a crucial role. For instance, several U.S. states and cities have implemented or are planning phased increases to $15 per hour or higher by 2025. This directly impacts the cost structure for restaurants, potentially forcing them to pass these costs onto consumers through higher prices, which could dampen demand, or absorb them, impacting profitability and their purchasing power for ingredients and supplies from HF Foods.

- Labor Shortages Persist: The U.S. leisure and hospitality sector continued to face significant staffing challenges in early to mid-2024, impacting service levels and operational capacity for restaurants.

- Rising Wage Pressures: Competition for available workers has led to increased wage demands and offers, pushing up labor costs for many food service businesses.

- Minimum Wage Impact: Scheduled minimum wage hikes in various U.S. jurisdictions are set to further increase labor expenses for restaurants through 2025.

- Client Profitability Squeeze: Higher labor costs can directly reduce the profitability of independent restaurants, potentially affecting their order volumes from suppliers like HF Foods.

Public Perception of Food Quality and Sourcing

Consumer and restaurant owner awareness regarding food quality, origin, and ethical sourcing is on a significant upward trend. This heightened consciousness means that HF Foods, like other distributors, faces increasing scrutiny. For instance, a 2024 survey indicated that 72% of consumers consider the origin of their food when making purchasing decisions, up from 55% in 2020.

Negative perceptions stemming from food safety incidents or unsustainable practices within the wider food sector can directly erode trust in entities like HF Foods. A single high-profile recall in the industry, even if unrelated to HF Foods, can cast a shadow, impacting consumer willingness to engage with distributors perceived as part of that ecosystem. The financial impact of such trust erosion can be substantial, with studies showing a 15% drop in sales for companies associated with food safety scares.

Maintaining robust transparency and upholding stringent standards throughout their supply chain is therefore paramount for HF Foods' reputation and enduring customer loyalty. This includes clear labeling and verifiable sourcing information. In 2024, companies with transparent supply chains reported a 10% higher customer retention rate compared to those with opaque practices.

- Consumer Demand for Transparency: 72% of consumers prioritize food origin in 2024.

- Industry Impact: Food safety issues can lead to a 15% sales decline for affected companies.

- Reputational Capital: Transparent supply chains correlate with a 10% increase in customer retention.

The growing Asian American demographic is a significant market driver for HF Foods, with this population exceeding 20 million individuals in the U.S. and showing continued growth, particularly in urban and suburban areas. This demographic expansion directly fuels the demand for authentic Asian cuisine and, consequently, for the specialized food products HF Foods supplies. As these communities grow and spread across the nation, the market for their culinary traditions expands, creating sustained opportunities for HF Foods.

Technological factors

Technological advancements are reshaping supply chain logistics for companies like HF Foods. Innovations such as warehouse automation, sophisticated route optimization software, and real-time inventory tracking are becoming essential for maximizing operational efficiency. These technologies directly impact HF Foods' ability to manage its complex network of suppliers and distributors.

By embracing these technological shifts, HF Foods can achieve significant cost reductions, particularly in labor. Furthermore, improved inventory management and optimized delivery routes lead to less waste and faster fulfillment, directly enhancing customer satisfaction. The company's strategic focus on technology investments aims to streamline these critical operations.

In 2024, the global logistics market is seeing substantial investment in automation, with projections indicating continued growth. For instance, the warehouse automation market alone was valued at approximately $60 billion in 2023 and is expected to reach over $100 billion by 2028, highlighting the significant opportunities for companies like HF Foods to gain a competitive edge through technology adoption.

The rise of e-commerce and digital ordering is fundamentally reshaping how businesses, including restaurants, procure their supplies. This shift allows for greater efficiency and broader access to products and services. HF Foods recognized this trend, launching its dedicated e-commerce platform for international foodservice solutions in May 2025.

This digital initiative by HF Foods directly targets restaurant employees and owners, enabling them to make purchases more easily. By embracing these online channels, HF Foods is expanding its market presence and significantly enhancing customer convenience and accessibility.

HF Foods can harness big data analytics to refine demand forecasting and pinpoint operational inefficiencies. This allows for better inventory management, minimizing waste and uncovering avenues for cost reduction and service enhancement.

The company's recent rollout of a new ERP system across its operations is a key technological advancement. This integration is designed to streamline workflows and foster a culture of data-informed strategic choices, potentially boosting efficiency by an estimated 10-15% in key operational areas by late 2025.

Food Processing and Preservation Technologies

Innovations in food processing and preservation are significantly impacting the food industry. For instance, advancements in high-pressure processing (HPP) and pulsed electric fields (PEF) are gaining traction, allowing for extended shelf life and improved nutrient retention in products like juices and ready-to-eat meals. These technologies are crucial for reducing food waste, which globally amounted to an estimated 1.3 billion tonnes in 2023, according to FAO data. By extending the usability of products, HF Foods can broaden its sourcing capabilities and ensure consistent quality across its distribution network.

The focus on enhanced food safety and quality remains a top priority. Emerging technologies such as advanced sensor systems for real-time monitoring of food spoilage and sophisticated traceability solutions are becoming more prevalent. For example, blockchain technology is being piloted in supply chains to provide immutable records of a food product's journey from farm to fork, increasing consumer trust and enabling rapid response to any safety concerns. HF Foods can leverage these to bolster its reputation and meet stringent regulatory requirements.

Staying ahead of these technological curves offers a distinct competitive advantage. The global market for food processing and preservation equipment was valued at over $50 billion in 2024 and is projected to grow steadily. Companies that invest in and adopt cutting-edge methods can differentiate themselves through superior product quality, reduced operational costs associated with spoilage, and a stronger appeal to increasingly health-conscious and safety-aware consumers.

- Extended Shelf Life: Technologies like HPP and PEF can double or even triple the shelf life of certain perishable goods, reducing spoilage losses for HF Foods.

- Food Safety Enhancement: Real-time monitoring sensors and blockchain traceability systems improve safety compliance and consumer confidence, with the global food safety testing market expected to reach $25 billion by 2025.

- Waste Reduction: By minimizing spoilage, these technologies contribute to sustainability goals, aligning with consumer demand for environmentally responsible brands.

- Market Differentiation: Early adoption of advanced processing can lead to premium product offerings and a stronger competitive position in the market.

Cybersecurity and Data Protection

Cybersecurity and data protection are critical technological factors for HF Foods. As the company expands its digital operations, safeguarding sensitive customer and operational data from breaches and cyber threats is paramount. This directly impacts customer trust and business continuity. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

HF Foods must invest in robust cybersecurity measures to protect its digital infrastructure. This includes implementing advanced threat detection, secure data storage, and regular security audits. Compliance with evolving data privacy regulations, such as GDPR or similar frameworks, is also essential to avoid penalties and maintain operational integrity. The increasing sophistication of cyberattacks means continuous adaptation and investment in security technologies are necessary.

Key considerations for HF Foods include:

- Implementing multi-factor authentication across all systems to enhance access control.

- Conducting regular vulnerability assessments and penetration testing to identify and address weaknesses.

- Providing ongoing cybersecurity training for all employees to mitigate human error risks.

- Developing and regularly testing a comprehensive incident response plan to manage potential breaches effectively.

HF Foods' technological landscape is rapidly evolving, driven by advancements in supply chain automation and digital platforms. The company's investment in new ERP systems and its e-commerce platform, launched in May 2025, are key initiatives. These moves aim to boost operational efficiency, reduce costs, and enhance customer convenience by streamlining procurement processes.

Innovations in food processing, such as high-pressure processing (HPP) and pulsed electric fields (PEF), are critical for extending shelf life and reducing waste, with global food waste estimated at 1.3 billion tonnes in 2023. Similarly, advanced food safety technologies like blockchain and real-time sensors are crucial for quality assurance and consumer trust, with the food safety testing market projected to reach $25 billion by 2025.

Cybersecurity is a paramount concern, with the global average cost of a data breach reaching $4.45 million in 2023. HF Foods must prioritize robust security measures, including multi-factor authentication and regular vulnerability assessments, to protect sensitive data and maintain operational integrity amidst increasing cyber threats.

| Technology Area | Impact on HF Foods | 2024/2025 Data/Projections |

|---|---|---|

| Supply Chain Automation | Increased efficiency, cost reduction, faster fulfillment | Global logistics automation market projected for continued growth; warehouse automation valued at ~$60B in 2023, expected to exceed $100B by 2028. |

| E-commerce & Digital Platforms | Enhanced customer accessibility, expanded market reach, streamlined procurement | HF Foods launched e-commerce platform in May 2025. |

| Food Processing & Preservation | Extended shelf life, reduced spoilage, improved nutrient retention | Global food waste ~1.3B tonnes (2023); HPP/PEF adoption growing. |

| Food Safety & Traceability | Improved quality, enhanced consumer trust, regulatory compliance | Food safety testing market to reach $25B by 2025; blockchain adoption for supply chain transparency. |

| Cybersecurity | Data protection, customer trust, business continuity | Average data breach cost ~$4.45M (2023); ongoing investment in threat detection and data security essential. |

Legal factors

HF Foods navigates a complex landscape of food safety regulations, heavily influenced by bodies like the FDA and USDA. These laws dictate everything from how raw ingredients are sourced and stored to how finished products are distributed, ensuring consumer protection. For instance, the Food Safety Modernization Act (FSMA) mandates preventative controls throughout the food supply chain, requiring companies like HF Foods to implement robust hazard analysis and risk-based preventative controls.

Failure to adhere to these stringent standards carries significant financial and operational risks for HF Foods. Penalties can include substantial fines, costly product recalls, and severe damage to the company's brand reputation. In 2024, the food industry saw a notable increase in regulatory scrutiny, with recalls often costing millions of dollars in lost product and consumer trust.

Staying compliant demands constant vigilance and adaptation. HF Foods must actively monitor evolving regulatory landscapes, such as proposed changes to labeling requirements or new testing protocols introduced in 2025, and integrate them into its operational framework to mitigate risks and maintain market access.

HF Foods must meticulously adhere to a complex web of federal and state labor laws, encompassing everything from minimum wage and overtime rules to stringent worker safety standards enforced by OSHA. For instance, in 2024, several states, including California and New York, continued to see increases in their minimum wage rates, impacting labor costs for businesses operating within them. Failure to comply can lead to significant fines and reputational damage.

Evolving employment regulations, such as potential new mandates around benefits or paid leave, could directly influence HF Foods' operational expenses and necessitate adjustments to their human resource strategies. By mid-2025, the landscape of worker protections is expected to continue its evolution, requiring proactive adaptation from companies like HF Foods to maintain compliance and attract talent.

Furthermore, the impact of labor laws extends to HF Foods' clientele. Understanding how these regulations affect their restaurant customers' own labor costs and operational models is crucial for maintaining strong business relationships and offering relevant support or services.

HF Foods, as a substantial entity in food distribution, must meticulously adhere to antitrust and competition statutes. This necessitates a strict avoidance of monopolistic practices, price collusion, or any agreements that stifle fair market competition, which could invite significant legal repercussions and fines. For instance, in 2024, the Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, with several high-profile cases targeting alleged anti-competitive behavior in various sectors.

Contractual Agreements and Supplier Relationships

HF Foods' extensive reliance on a global network of manufacturers and suppliers underscores the critical importance of well-defined contractual agreements. These legal frameworks, governing everything from product specifications to delivery timelines, are essential for maintaining supply chain integrity and operational stability. For instance, the company's commitment to quality assurance hinges on legally binding clauses within these supplier contracts.

Ensuring clarity in terms, upholding rigorous quality standards, and establishing efficient dispute resolution mechanisms within these contracts are paramount for HF Foods' operational resilience. These agreements form the bedrock of predictable supply chain performance. As of Q1 2025, HF Foods reported that 95% of its key supplier contracts had been reviewed and updated to reflect current international trade compliance standards.

- Contractual Clarity: HF Foods prioritizes legally sound contracts that clearly outline expectations for product quality, delivery schedules, and payment terms with its numerous manufacturing partners.

- Supplier Relationship Management: Robust legal agreements facilitate stable and predictable supplier relationships, minimizing disruptions and ensuring consistent access to essential ingredients and finished goods.

- International Trade Compliance: Adherence to international trade agreements, such as those impacting tariffs and import/export regulations, is a key legal consideration for HF Foods' global sourcing strategy.

- Dispute Resolution: Clearly defined legal mechanisms for resolving disputes with suppliers are embedded in contracts to efficiently address any potential disagreements and maintain operational continuity.

Import/Export Regulations and Customs

HF Foods' extensive global sourcing necessitates strict adherence to import/export regulations and customs. Navigating these complex rules, including tariffs and trade compliance, is critical for maintaining an efficient international supply chain. For instance, the company has openly discussed managing potential tariff increases that could impact costs, a common challenge in the food industry.

Non-compliance can lead to significant disruptions, such as shipment delays and financial penalties, directly affecting profitability. HF Foods' ability to effectively manage these legal requirements is a key factor in its operational success.

- Global Sourcing Complexity: HF Foods relies on a worldwide network of suppliers, requiring intricate knowledge of diverse import/export laws.

- Cost Impact of Tariffs: Recent discussions highlight the company's proactive approach to mitigating the financial effects of potential tariff adjustments on imported goods.

- Risk of Penalties: Failure to comply with customs regulations can result in substantial fines and operational stoppages.

- Supply Chain Efficiency: Smooth customs clearance is vital for maintaining the timely delivery of raw materials and finished products.

HF Foods operates under a strict legal framework governing food safety and labeling, with organizations like the FDA and USDA setting rigorous standards for ingredient sourcing, handling, and distribution. The Food Safety Modernization Act (FSMA), for example, mandates preventative controls throughout the supply chain, requiring companies like HF Foods to implement robust hazard analysis and risk-based preventative controls to ensure consumer protection.

The company must also navigate a complex web of federal and state labor laws, including minimum wage, overtime, and worker safety regulations enforced by OSHA. For instance, in 2024, several states saw increased minimum wage rates, directly impacting labor costs. Proactive adaptation to evolving employment regulations, such as potential new mandates for benefits or paid leave expected by mid-2025, is crucial for managing operational expenses and attracting talent.

Furthermore, HF Foods' extensive global sourcing operations necessitate strict adherence to import/export regulations and customs, including tariffs and trade compliance, to maintain an efficient international supply chain. Non-compliance can result in significant disruptions, such as shipment delays and financial penalties, directly affecting profitability. As of Q1 2025, HF Foods reported that 95% of its key supplier contracts had been reviewed and updated to reflect current international trade compliance standards.

Environmental factors

Growing consumer and industry demand for sustainable practices is pressuring food distributors like HF Foods to adopt environmentally responsible sourcing. This includes evaluating suppliers based on their environmental impact, promoting sustainable agriculture, and minimizing the carbon footprint of their supply chain operations.

Incorporating sustainability goals into procurement decisions is becoming increasingly important. For instance, by 2024, many major food retailers are aiming for a significant portion of their sourcing to meet specific sustainability certifications, a trend that will likely influence distributors like HF Foods.

HF Foods faces the challenge of managing substantial packaging and food waste from its extensive distribution and logistics network. By implementing robust waste reduction, recycling, and composting programs, the company can achieve cost savings and bolster its commitment to corporate social responsibility, while also ensuring adherence to environmental mandates.

A significant focus for HF Foods is minimizing food waste across its entire supply chain. For instance, in 2024, the food industry globally saw initiatives aimed at reducing food waste by 50% by 2030, with companies like HF Foods expected to contribute significantly to these targets.

Climate change presents significant risks to HF Foods' supply chain, impacting the availability and cost of the fresh produce and other food items it distributes. Global agricultural production is increasingly vulnerable to shifting weather patterns. For instance, a 2024 report indicated that extreme weather events, such as prolonged droughts and unseasonal floods, have already led to an estimated 10-15% reduction in yields for key crops in several major agricultural regions, directly affecting commodity prices.

These disruptions, including changing growing seasons and escalating water scarcity, can create significant volatility in food prices and complicate sourcing strategies for HF Foods. The Intergovernmental Panel on Climate Change (IPCC) projects that by 2050, water stress could affect over half the world's population, further straining agricultural resources. HF Foods' proactive approach to diversifying its sourcing locations is a crucial strategy to mitigate these climate-related supply chain risks and ensure consistent product availability.

Energy Consumption and Carbon Footprint

HF Foods' extensive distribution network and vehicle fleet are significant energy consumers, directly impacting its carbon footprint. For instance, the global logistics industry, a sector HF Foods operates within, is a major contributor to greenhouse gas emissions, with transportation accounting for a substantial portion. Companies like HF Foods are increasingly scrutinized for their environmental impact, making energy efficiency a critical operational consideration.

To mitigate this, HF Foods can focus on key areas. Investing in energy-efficient warehousing technologies, such as advanced insulation and smart lighting systems, can significantly lower electricity consumption. Optimizing delivery routes through sophisticated software can reduce mileage and fuel usage, thereby cutting emissions. Furthermore, exploring and adopting alternative fuel vehicles, like electric or hydrogen-powered trucks, presents a long-term strategy for decarbonization.

- Energy Efficiency Investments: Upgrading to LED lighting in warehouses can reduce energy use by up to 80% compared to traditional lighting.

- Route Optimization: Implementing AI-powered route planning can reduce fuel consumption by 5-15% for delivery fleets.

- Alternative Fuels: The commercial vehicle sector is seeing increased adoption of electric trucks, with projections indicating a substantial market share growth by 2030.

- Regulatory Pressures: Growing environmental regulations worldwide are pushing logistics companies to adopt cleaner operational practices, influencing cost structures and investment decisions.

Water Usage and Conservation

While HF Foods, as a distributor, doesn't face the same intense water demands as food processors, water remains a factor in its operations. Cleaning, sanitation, and general facility upkeep within distribution centers necessitate responsible water management. For instance, in 2024, companies in the logistics sector are increasingly investing in water-efficient cleaning technologies and drought-resistant landscaping for their facilities to minimize consumption.

Promoting water conservation is a key environmental consideration for HF Foods. This includes implementing practices that reduce water waste and ensuring strict adherence to local water management regulations, which can vary significantly by region. Compliance is crucial for maintaining operational licenses and avoiding potential penalties.

Responsible water stewardship is more than just regulatory compliance; it's a core component of overall sustainability. By actively managing its water footprint, HF Foods can enhance its brand reputation and appeal to environmentally conscious stakeholders. This focus is becoming increasingly important as global water scarcity concerns grow, impacting supply chains across industries.

- Water Efficiency Investments: Logistics companies are exploring technologies like high-pressure, low-volume cleaning systems for warehouses and vehicles.

- Regulatory Compliance: Staying updated on regional water usage restrictions and reporting requirements is paramount.

- Sustainability Reporting: Companies are increasingly disclosing their water usage and conservation efforts in annual sustainability reports.

- Supply Chain Impact: Understanding water risks within the broader food supply chain is also becoming a strategic imperative.

HF Foods must navigate increasing consumer and regulatory pressure for sustainable sourcing and reduced environmental impact. This includes managing packaging and food waste, with global initiatives targeting a 50% reduction in food waste by 2030, a goal HF Foods is expected to contribute to.

Climate change poses significant supply chain risks, with extreme weather events in 2024 already impacting crop yields by 10-15% in key regions, leading to price volatility. HF Foods' proactive diversification of sourcing locations is crucial to mitigate these climate-related disruptions.

The company's extensive logistics network contributes to greenhouse gas emissions, making energy efficiency in warehousing and transportation a critical focus. Investments in LED lighting can reduce warehouse energy use by up to 80%, and AI-powered route optimization can cut fuel consumption by 5-15%.

Responsible water management is also essential, with logistics companies investing in water-efficient cleaning technologies. Compliance with regional water usage restrictions and transparent sustainability reporting are becoming key operational imperatives.

| Environmental Factor | Impact on HF Foods | Key Data/Trends (2024/2025) | Mitigation Strategies |

|---|---|---|---|

| Sustainability Demand | Pressure to adopt eco-friendly sourcing and operations. | Growing consumer preference for sustainably sourced products. Many retailers aim for significant sustainable sourcing by 2024. | Supplier evaluation based on environmental impact, promoting sustainable agriculture. |

| Waste Management | Challenge of managing packaging and food waste. | Global initiatives to reduce food waste by 50% by 2030. | Implementing robust waste reduction, recycling, and composting programs. |

| Climate Change | Supply chain disruption, affecting availability and cost of goods. | Extreme weather events causing 10-15% crop yield reduction in some regions (2024 report). Water stress projected to affect over half the world's population by 2050. | Diversifying sourcing locations, adapting to changing growing seasons. |

| Energy Consumption & Emissions | Significant carbon footprint from distribution network. | Logistics sector is a major contributor to greenhouse gas emissions. | Investing in energy-efficient warehousing (e.g., LED lighting), route optimization (AI-powered), exploring alternative fuels (electric/hydrogen trucks). |

| Water Management | Need for responsible water use in facilities. | Increasing investment in water-efficient cleaning technologies in the logistics sector. | Implementing water-saving practices, adhering to regional regulations, investing in drought-resistant landscaping. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for HF Foods is built upon a comprehensive review of data from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.