HF Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HF Foods Bundle

HF Foods operates in a dynamic market shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry among competitors. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping HF Foods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the bargaining power of suppliers. The food distribution sector, where HF Foods operates, features a diverse array of suppliers, from fresh produce farmers to makers of packaged goods. While some agricultural markets might have many small suppliers, specialized providers of Asian food ingredients could possess greater influence due to their niche market position.

HF Foods' strategy of building a broad network and fostering strong relationships with growers and manufacturers across both the United States and Asia is designed to counter potential supplier concentration. This diversified approach helps to ensure that no single supplier or small group of suppliers can exert undue leverage over HF Foods, thereby maintaining a more balanced power dynamic.

Switching suppliers for HF Foods presents significant hurdles, including intricate logistical adjustments and the risk of compromising product consistency, which are critical for maintaining brand trust. Renegotiating terms with new partners also adds a layer of complexity and potential cost.

HF Foods' commitment to a fully integrated supply chain solution highlights deep-seated relationships with existing suppliers, meaning that altering these arrangements would likely involve substantial upfront investment and operational disruption.

While the broader food industry's digital transformation is simplifying data exchange and potentially reducing future switching costs, HF Foods' current operational structure still reflects considerable inertia against rapid supplier changes.

Suppliers who offer highly specialized or unique Asian food products, or those with strong brand recognition, generally hold more bargaining power. This is because buyers have fewer alternatives for these specific items. For instance, if a supplier controls a unique spice blend essential for a popular HF Foods dish, they can command higher prices. In 2024, the global specialty food market continued its growth trajectory, with Asian flavors showing particular strength, indicating that suppliers in this niche could indeed exert significant influence.

Threat of Forward Integration by Suppliers

Suppliers might consider integrating forward by distributing their products directly to restaurants, effectively cutting out intermediaries like HF Foods. This strategy, while theoretically possible, is generally a low threat for most food manufacturers because establishing and managing a direct distribution network is incredibly capital-intensive and logistically challenging. For instance, a single truck route can cost tens of thousands of dollars annually to operate, and building a fleet requires millions in upfront investment.

However, for larger, more diversified food producers with substantial resources and a focus on high-volume products, forward integration could become a more viable option. These companies might have the scale and existing infrastructure to absorb the costs and complexities associated with direct-to-restaurant distribution, potentially impacting players like HF Foods by reducing their market share for specific product lines.

- Threat of Forward Integration: Suppliers could bypass distributors like HF Foods by delivering directly to restaurants.

- Capital Intensity Barrier: This move is typically low for most food manufacturers due to high costs and logistical hurdles in direct distribution.

- Potential for Large Producers: Diversified, high-volume food companies may find forward integration feasible.

- Impact on HF Foods: Direct distribution by suppliers could reduce HF Foods' market share for certain products.

Importance of HF Foods to Suppliers

For many smaller or niche suppliers, HF Foods' expansive distribution network, reaching Asian and Chinese restaurants throughout the United States, positions the company as an indispensable customer. This reach provides suppliers with access to a broad market they might otherwise struggle to penetrate.

While HF Foods is a considerable buyer for larger manufacturers, it may not represent their sole or dominant sales channel. Nonetheless, the company's significant purchasing power cannot be overlooked.

HF Foods' substantial revenue, exceeding $1.2 billion in 2024, underscores its importance as a major buyer in the food supply chain. This financial scale grants HF Foods considerable leverage when negotiating with its suppliers.

- Crucial Customer: HF Foods' extensive US distribution network makes it vital for smaller, specialized suppliers.

- Significant Channel: For large manufacturers, HF Foods is an important, though not necessarily dominant, sales outlet.

- Purchasing Power: With over $1.2 billion in 2024 revenue, HF Foods wields considerable influence as a buyer.

Suppliers' bargaining power at HF Foods is moderated by the company's vast distribution network, which is crucial for smaller, niche suppliers seeking market access. While HF Foods is a significant buyer for larger manufacturers, it's not always their sole or dominant sales channel. However, HF Foods' substantial 2024 revenue, exceeding $1.2 billion, grants it considerable leverage in negotiations.

Specialized Asian food ingredient suppliers with unique offerings or strong brand recognition can command higher prices, as alternatives are limited. The growing global specialty food market in 2024, with a particular surge in Asian flavors, reinforces the potential influence of these niche suppliers.

| Factor | Impact on HF Foods | Key Data/Observation |

|---|---|---|

| Supplier Concentration | Moderate; diversified sourcing mitigates risk, but niche suppliers have leverage. | Asian ingredient suppliers may have higher influence due to market specialization. |

| Switching Costs | High; logistical complexity and product consistency risks deter easy supplier changes. | Integrated supply chains create inertia against rapid supplier shifts. |

| Supplier Differentiation | High for unique/branded products; low for commoditized goods. | Suppliers of unique spice blends or recognized brands can command premium pricing. |

| Purchasing Power | High; HF Foods' scale provides significant negotiation leverage. | 2024 Revenue: Over $1.2 billion. |

| Threat of Forward Integration | Low for most; high capital and logistical barriers. | Direct distribution is capital-intensive; large producers may pose a future threat. |

What is included in the product

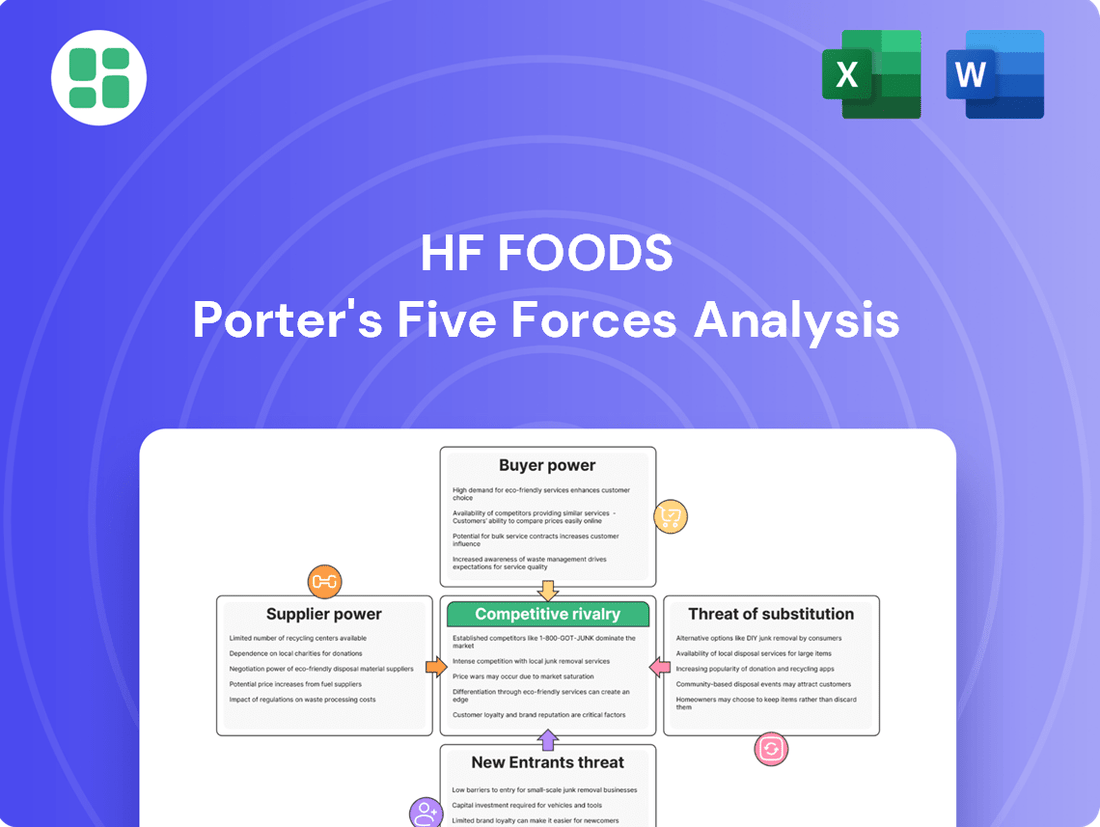

Tailored exclusively for HF Foods, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize HF Foods' competitive landscape with a dynamic, interactive Porter's Five Forces model that highlights key pressure points and opportunities.

Customers Bargaining Power

HF Foods caters to a broad spectrum of independent and chain Asian/Chinese restaurants throughout the United States. This typically suggests a fragmented customer base, which generally limits the bargaining power of any single customer.

However, the presence of large chain restaurant groups, which represent significant volume buyers, could introduce a degree of concentrated buying power. These larger entities might negotiate more favorable terms due to their substantial purchasing commitments.

HF Foods' strategic move into wholesale accounts and specialty grocery channels is likely to further diversify its customer base. For instance, in 2023, the company reported that its top 10 customers accounted for approximately 25% of its total revenue, indicating a moderate level of customer concentration.

Customer switching costs for restaurants, while present, are not insurmountable. These costs can include the effort to update ordering systems, coordinate new delivery schedules, and verify the consistent quality and availability of products from a new food distributor. For instance, in 2024, a typical mid-sized restaurant might spend an estimated $500 to $2,000 in administrative and operational adjustments when switching primary food suppliers.

HF Foods’ strategy to build a comprehensive supply chain solution is designed to increase customer loyalty and make switching more burdensome. By offering integrated services that go beyond simple product delivery, HF Foods aims to embed itself more deeply into its clients' operations, thereby raising the perceived switching costs.

However, the competitive landscape of the food distribution market plays a significant role in mitigating these customer switching costs. With numerous distributors vying for market share, competitors often actively work to lower barriers to entry and encourage customers to switch, which can limit HF Foods' ability to fully capitalize on these costs.

Restaurants, particularly in today's competitive foodservice landscape, exhibit significant price sensitivity. This means customers are keenly aware of menu prices and readily switch to alternatives if they perceive better value elsewhere.

In 2024, inflationary pressures and economic uncertainties amplified this customer price sensitivity. For HF Foods, this was evident as their gross profit margin saw a decline, suggesting they might be absorbing higher costs rather than passing them on, a direct response to customer price expectations.

Customer Information Availability

Customer access to information is rapidly increasing, significantly boosting their bargaining power. Digital platforms now provide readily available data on product pricing, competitor offerings, and emerging industry trends. This transparency allows customers to easily compare options and negotiate from a stronger position.

The food distribution sector, in particular, has seen a dramatic rise in e-commerce. This shift further amplifies customer awareness and their ability to seek out the best deals. For instance, online grocery platforms in 2024 often feature price comparison tools, giving consumers unprecedented insight into market value.

- Increased Information Access: Customers can easily find pricing, supplier alternatives, and market trends online.

- Enhanced Negotiation Power: Greater transparency empowers customers to demand better terms.

- E-commerce Impact: Online food distribution platforms further facilitate price comparisons and supplier discovery.

- Digital Transparency: Roughly 85% of consumers in developed markets use online resources to research food product prices before purchasing in 2024.

Threat of Backward Integration by Customers

The threat of backward integration by customers, meaning customers producing their own food products, is generally low for HF Foods. Most independent restaurants, a significant customer segment, lack the scale and capital to establish direct procurement from farms or manufacturers. For instance, the U.S. food distribution industry is highly fragmented, with many small to medium-sized players, making it challenging for individual restaurants to replicate the infrastructure.

However, large chain restaurants, with their substantial purchasing power and operational scale, might explore backward integration for specific high-volume ingredients or to control their supply chain more tightly. This could involve setting up their own distribution centers or even direct sourcing agreements for key items.

- Limited Scale: Most independent restaurants lack the necessary volume for cost-effective backward integration.

- Capital Intensity: Establishing food production or distribution capabilities requires significant investment.

- Industry Complexity: The food supply chain involves intricate logistics and regulatory hurdles.

- Potential for Chains: Large restaurant groups might consider integration for strategic high-volume products.

The bargaining power of customers for HF Foods is influenced by several factors, including customer concentration, switching costs, price sensitivity, and access to information. While a fragmented customer base generally limits individual customer power, larger chains can exert influence due to volume. Price sensitivity is high, especially given 2024 economic conditions, forcing distributors like HF Foods to manage margins carefully.

Increased digital transparency in 2024 empowers customers, with approximately 85% using online resources to compare food prices. This makes it easier for them to switch suppliers if better terms are offered. While backward integration is low for most, large chains could potentially pursue it for specific items, though the capital and complexity involved remain significant deterrents.

| Factor | Impact on HF Foods | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | Moderate, with top 10 customers representing ~25% of revenue in 2023. Large chains have more power. | Top 10 customers still represent a significant portion, but diversification is ongoing. |

| Switching Costs | Present but not insurmountable for restaurants; estimated $500-$2,000 for mid-sized restaurants in 2024. | HF Foods aims to increase these costs through integrated supply chain solutions. |

| Price Sensitivity | High, amplified by 2024 inflation. | Gross profit margins may be pressured as HF Foods absorbs some cost increases. |

| Information Access | High, with ~85% of consumers researching prices online in 2024. | E-commerce platforms facilitate easy comparison, increasing customer negotiation power. |

Full Version Awaits

HF Foods Porter's Five Forces Analysis

This preview showcases the complete HF Foods Porter's Five Forces Analysis, offering a thorough examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The food distribution landscape is intensely competitive, populated by giants like Sysco and US Foods, alongside a multitude of regional and niche distributors. HF Foods, while focusing on the Asian restaurant sector, contends with both these broadline players and other specialized suppliers vying for the same customer base.

For instance, Sysco reported over $72 billion in revenue for its fiscal year ending July 1, 2023, highlighting the sheer scale of some competitors. This intense rivalry means HF Foods must constantly differentiate itself to capture and retain market share within its specialized segment.

The foodservice industry is expected to experience modest real growth in 2025, with inflation contributing to nominal growth. This overall stability, however, masks significant variations within specific market segments.

The Asian food market in the U.S. presents a more dynamic picture, with a projected compound annual growth rate (CAGR) of 4.7% through 2031. This robust expansion signals a burgeoning demand for these culinary offerings.

Such a growing segment naturally attracts more players, intensifying competitive rivalry as businesses strive to capture a larger share of this expanding market. Companies will likely increase their marketing efforts and product innovation to stand out.

HF Foods carves out its niche by specializing in Asian food products, a key differentiator from broadline distributors who offer more general staples. This focus allows HF Foods to provide a more tailored and comprehensive supply chain solution for businesses seeking these specific ingredients.

While competitors like Sysco and JFC International also carry Asian food selections, HF Foods must continually innovate its product range, maintain superior quality, and enhance its customer service to stand out. For instance, as of the first quarter of 2024, HF Foods reported a 15% increase in its specialty Asian product offerings, aiming to capture a larger market share within this segment.

Exit Barriers

The food distribution industry, including segments like HF Foods operates within, often presents substantial exit barriers due to high fixed costs. Significant investments in distribution infrastructure, encompassing warehouses, delivery fleets, and sophisticated logistics technology, mean that companies face substantial losses if they attempt to divest these assets. For example, in 2024, the average cost for a new refrigerated truck can range from $100,000 to $150,000, and warehouse leases or ownership represent millions in capital outlay.

These high exit barriers can unfortunately fuel intensified competitive rivalry. When it's very costly to leave the market, companies that are struggling financially may choose to continue operating, even at very low profit margins, rather than incur the full cost of exiting. This can lead to increased price competition as these firms try to maintain revenue streams, putting downward pressure on profitability for all players in the sector.

Consider these factors contributing to exit barriers:

- High Capital Investment: Substantial upfront costs for warehouses, cold storage facilities, and transportation fleets.

- Specialized Assets: Distribution infrastructure is often highly specialized and difficult to repurpose or sell quickly at a favorable price.

- Contractual Obligations: Long-term leases for facilities or service contracts with suppliers and customers can create ongoing financial commitments.

Strategic Stakes

The Asian American cuisine market is a hotbed of activity, with demand surging and making it a prime target for food distributors. HF Foods' strategic focus here, coupled with its ongoing operational overhaul, underscores the significant stakes. This intense focus naturally fuels fierce competition as companies vie for market share and growth within this lucrative segment.

The strategic importance of the Asian American food market is evident in its growth trajectory. For instance, the U.S. market for Asian food products was valued at approximately $10 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2028. This robust expansion creates a fertile ground for competition.

- Growing Demand: The U.S. Asian food market reached an estimated $10 billion in 2023.

- High Stakes for HF Foods: The company's specialization and transformation plan highlight the importance of this segment.

- Intense Rivalry: Increased demand drives fierce competition among distributors for market dominance.

- Future Growth: The market is expected to see a CAGR of over 5% through 2028, intensifying future competition.

The competitive rivalry within the food distribution sector, particularly for HF Foods specializing in Asian cuisine, is substantial. Major players like Sysco, with revenues exceeding $72 billion in fiscal year 2023, and US Foods, alongside numerous regional and niche distributors, create a crowded marketplace. This intense competition necessitates constant differentiation through product innovation, quality, and customer service to capture and maintain market share.

| Competitor | Approximate 2023 Revenue (USD Billions) | Focus Area |

|---|---|---|

| Sysco | 72.0+ | Broadline Foodservice |

| US Foods | 33.0+ | Broadline Foodservice |

| JFC International | N/A (Specialized Asian) | Specialized Asian Food Products |

SSubstitutes Threaten

Restaurants, especially major chains or those with specialized product requirements, can choose to buy directly from producers, cutting out distributors like HF Foods. This direct sourcing strategy bypasses the need for intermediary services, potentially impacting a distributor's business volume. For instance, in 2024, the restaurant industry continued to explore supply chain efficiencies, with some larger entities actively seeking direct relationships with agricultural producers to secure fresher ingredients and potentially lower costs.

The threat of substitutes for HF Foods is amplified by cash-and-carry wholesalers. Restaurants can bypass traditional distribution channels by directly purchasing supplies from these wholesale stores, which offer immediate product availability without the need for delivery. This provides a viable alternative, particularly for independent establishments or those with smaller, urgent orders, as exemplified by companies like Pitco Foods.

The proliferation of meal kit services and a growing consumer inclination towards preparing meals at home, often spurred by economic considerations, present a significant threat of substitution for traditional restaurant dining. This shift could indirectly dampen demand for the foodservice industry, impacting distributors like HF Foods by potentially moderating the pace of restaurant expansion. For instance, in 2024, the global meal kit delivery market was valued at approximately $17.2 billion, indicating a substantial and growing consumer base opting for at-home preparation.

Broadline Distributors Expanding Ethnic Offerings

The threat of substitutes is heightened as large broadline distributors, such as Sysco and US Foods, are actively expanding their ethnic and specialty food selections, including Asian products. These industry giants, with their extensive supply chains and existing customer relationships, can increasingly offer a more comprehensive "one-stop shop" experience, directly competing with HF Foods' specialized model.

While HF Foods focuses on a niche, the sheer scale and purchasing power of these broadline distributors allow them to absorb costs and offer competitive pricing on a wider range of goods. For instance, Sysco reported approximately $37.1 billion in net sales for their fiscal year ending July 2, 2023, demonstrating their significant market presence and ability to invest in product diversification.

- Broadline distributors' expanding ethnic portfolios present a direct substitution threat to HF Foods.

- Leveraging economies of scale, these larger players can offer a wider array of products, potentially at lower prices.

- Sysco's $37.1 billion in net sales (FY 2023) underscores their capacity to invest in and broaden their ethnic food offerings.

- Customer convenience in sourcing multiple product types from a single, established supplier can divert business from specialized distributors.

Digital Platforms for Direct Purchase

The rise of digital platforms for direct purchasing presents a significant threat of substitutes for traditional food distributors like HF Foods. E-commerce growth in food distribution empowers restaurants to bypass intermediaries and order directly from a wider array of suppliers and online marketplaces.

This digital shift increases price transparency and offers more diverse sourcing options, directly challenging the value proposition of established distributors. For instance, in 2024, online grocery sales in the US alone were projected to reach over $200 billion, indicating a substantial shift towards digital channels across the food sector.

- Increased Price Transparency: Online marketplaces allow for easy comparison of prices from multiple suppliers, pressuring traditional distributors to remain competitive.

- Expanded Sourcing Options: Restaurants can access a broader range of specialty or niche ingredients directly from producers or specialized online vendors.

- Reduced Lead Times: Some digital platforms offer faster delivery options compared to traditional distribution networks.

- Lowered Transaction Costs: Direct online ordering can potentially reduce the overhead associated with traditional sales interactions for both buyers and sellers.

The threat of substitutes for HF Foods is multifaceted, stemming from direct sourcing by restaurants, the convenience of cash-and-carry wholesalers, the growing popularity of meal kits, and the expanding reach of broadline distributors. Digital platforms further intensify this by offering increased transparency and diverse sourcing options.

| Substitute Type | Key Characteristics | Impact on HF Foods | Relevant Data/Example (2023-2024) |

|---|---|---|---|

| Direct Sourcing | Restaurants bypass distributors, buying directly from producers. | Reduces volume for distributors. | Restaurant industry explored supply chain efficiencies in 2024, seeking direct producer relationships. |

| Cash-and-Carry Wholesalers | Immediate product availability, no delivery needed. | Viable alternative for smaller or urgent orders. | Companies like Pitco Foods offer this model. |

| Meal Kits & Home Cooking | Consumer shift to preparing meals at home. | Potentially moderates restaurant expansion, indirectly impacting distributors. | Global meal kit market valued at ~$17.2 billion in 2024. |

| Broadline Distributors | Expanding ethnic/specialty food offerings, economies of scale. | Direct competition, offering a "one-stop shop." | Sysco's FY 2023 net sales were ~$37.1 billion. |

| Digital Platforms | Online marketplaces for direct purchasing. | Increases price transparency, offers diverse sourcing. | US online grocery sales projected over $200 billion in 2024. |

Entrants Threaten

The capital required to establish a food distribution business, particularly one aiming for a national reach similar to HF Foods, is immense. Think about the costs involved: building or leasing numerous warehouses, acquiring and maintaining a fleet of refrigerated trucks to ensure product freshness, and stocking significant inventory. These aren't small figures; in 2024, the average cost to build a new food-grade distribution center could easily run into tens of millions of dollars, not to mention the ongoing operational expenses for transportation and inventory management.

This substantial upfront investment acts as a formidable barrier for any new player looking to enter the market. For instance, a company would need to secure hundreds of millions in capital just to get a basic nationwide distribution infrastructure in place. This financial hurdle significantly limits the number of potential new entrants capable of competing with established giants like HF Foods, thereby reducing the threat of new competition.

Economies of scale present a significant barrier for new entrants in the food distribution industry. Established players like HF Foods leverage their immense purchasing power to secure lower prices from suppliers. For instance, in 2024, major food distributors often negotiate discounts of 5-10% on bulk orders, a level difficult for newcomers to match.

This cost advantage extends to logistics and operational efficiencies. HF Foods' extensive distribution network, optimized through years of operation, allows for lower per-unit shipping costs. A new entrant would face substantial upfront investment to build a comparable infrastructure, making it challenging to compete on price against HF Foods' established cost structure.

HF Foods possesses a significant advantage with its established network of distribution centers and deep-rooted relationships with thousands of Asian restaurants. This extensive infrastructure is a formidable barrier for any newcomer aiming to penetrate the market. For instance, in 2023, HF Foods reported servicing over 10,000 restaurant locations, a testament to its widespread reach.

The sheer scale and reliability of HF Foods' distribution capabilities make it incredibly difficult and costly for new entrants to replicate. Developing a comparable network, securing logistics, and building trust with a vast number of clients would require substantial time and capital investment, likely running into tens of millions of dollars.

Product Differentiation and Brand Loyalty

HF Foods' focus on Asian food products and its role as a comprehensive solution provider creates a barrier for new entrants. To compete effectively, newcomers must offer significantly differentiated products or a superior customer experience, as established brand loyalty is a strong deterrent. For instance, in the broader food service distribution sector, companies with strong brand recognition often command premium pricing and enjoy higher customer retention rates.

Brand loyalty is a critical factor in the food industry, making it challenging for new players to gain market share. HF Foods has cultivated this loyalty by consistently delivering quality and specialized offerings. In 2023, the global food and beverage market saw continued growth, with consumer preference for specialized ethnic cuisines on the rise, underscoring the importance of niche specialization and brand building.

- Specialized Niche: HF Foods' specialization in Asian food products creates a distinct market position.

- Brand Loyalty: Established brand recognition and customer loyalty are significant hurdles for new entrants.

- Differentiation Requirement: New competitors must offer highly differentiated products or superior service to attract customers.

- Market Dynamics: The growing consumer interest in ethnic cuisines highlights the value of specialized offerings and strong brand building in the food sector.

Regulatory and Compliance Hurdles

The food distribution sector faces significant regulatory and compliance challenges that deter new entrants. For instance, the Food Safety Modernization Act (FSMA) in the United States, particularly the FSMA 204 rule focusing on traceability, imposes rigorous record-keeping and supply chain visibility requirements. New companies must invest heavily in systems and processes to meet these standards, a considerable upfront cost.

Navigating these complex regulations, which often vary by region and product type, demands specialized expertise and can lead to substantial delays and expenses. These hurdles effectively raise the barrier to entry, protecting established players like HF Foods from immediate competitive pressure.

- FSMA 204: Mandates enhanced traceability for food, increasing compliance costs for new entrants.

- Food Safety Standards: Strict adherence to safety protocols requires significant investment in infrastructure and training.

- Regional Variations: Different regulatory landscapes across states or countries add complexity and cost.

- Compliance Costs: The financial burden of meeting these requirements acts as a significant deterrent.

The threat of new entrants for HF Foods is relatively low due to substantial capital requirements and established economies of scale. Building a national food distribution network, complete with refrigerated warehouses and a logistics fleet, demands hundreds of millions of dollars. For example, in 2024, the cost of a single food-grade distribution center could exceed tens of millions.

Newcomers struggle to match the cost efficiencies HF Foods achieves through its massive purchasing power, often securing 5-10% discounts on bulk orders in 2024. Furthermore, HF Foods' extensive network, serving over 10,000 restaurant locations in 2023, represents a significant barrier that would require immense time and capital to replicate.

| Barrier Type | Description | Estimated Cost Impact (2024) |

| Capital Requirements | Establishing national distribution infrastructure (warehouses, fleet) | $100M+ |

| Economies of Scale | Supplier discounts due to bulk purchasing | 5-10% cost advantage |

| Network & Relationships | Existing distribution network and client base | Difficult to replicate; significant time/capital investment |

| Regulatory Compliance | Meeting food safety and traceability standards (e.g., FSMA 204) | Increased operational and system costs |

Porter's Five Forces Analysis Data Sources

Our HF Foods Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports to capture the competitive landscape.

We also leverage insights from trade publications and economic databases to provide a comprehensive understanding of the forces impacting HF Foods' market position.