Heijmans SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heijmans Bundle

Heijmans' strategic position is shaped by its strong market presence and innovative approach, but also faces challenges in a competitive landscape. Understanding these internal capabilities and external threats is crucial for anyone looking to invest or strategize within the construction sector.

Want the full story behind Heijmans' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Heijmans demonstrated exceptional financial strength in 2024, achieving €2.6 billion in revenue and a 7.7% underlying EBITDA margin, exceeding their initial goals. This robust performance underscores effective operational execution and strategic financial stewardship.

Looking ahead to 2025, Heijmans anticipates continued growth, with revenue projected to reach approximately €2.75 billion. Furthermore, the company has raised its outlook for the underlying EBITDA margin to around 9.0%, a significant increase from its previous target of at least 8.0%, driven by strong first-half results.

Heijmans boasts a diversified business portfolio, operating across property development, building & technology, and infrastructure. This broad operational base acts as a significant strength, effectively mitigating risks tied to downturns in any single market segment.

The company's strategic diversification translates into financial resilience. As of the close of 2024, Heijmans maintained a robust order book valued at €2.8 billion, underscoring the sustained demand across its various business lines.

Furthermore, Heijmans is increasingly deriving revenue from recurring business models within its Working and Connecting segments. This growing predictable income stream enhances overall stability and bolsters the company's financial predictability.

Heijmans stands out for its dedication to sustainable building, guided by its 'Together towards 2030' strategy aimed at a positive environmental footprint. This commitment is backed by tangible results, as evidenced by their 30% reduction in Scope 1 and 2 CO2e emissions in 2024 compared to the previous year.

The company actively integrates energy-efficient technologies into 75% of its ongoing projects, demonstrating a practical approach to sustainability. Furthermore, Heijmans is making significant investments in eco-friendly materials and cutting-edge technologies like Building Information Modeling (BIM) to enhance project efficiency and environmental performance.

Their forward-thinking approach is further solidified by initiatives such as the development of Europe's most sustainable asphalt plant, underscoring their leadership in driving innovation within the construction sector.

Established Market Position in the Netherlands

Heijmans holds a formidable position within the Dutch construction sector, leveraging extensive local market knowledge and robust client relationships built over years of operation. This established presence allows them to consistently secure substantial projects, reflecting their strong competitive advantage. For instance, in July 2025, Heijmans was awarded a significant contract for the upgrade of a high-voltage substation in Limburg, a testament to their recognized expertise and reliability in the Netherlands.

Their deep roots in the Dutch market translate into a distinct understanding of regional nuances, regulatory landscapes, and client needs, which are crucial for successful project execution. This localized strength is a key differentiator, enabling Heijmans to navigate complex projects efficiently and maintain a leading edge. The company's consistent ability to win major infrastructure and development tenders further solidifies its market leadership.

Key aspects of their established market position include:

- Deep Local Market Expertise: A comprehensive understanding of Dutch construction regulations, logistics, and client expectations.

- Strong Client Relationships: Long-standing partnerships with key public and private sector clients across the Netherlands.

- Proven Track Record: A history of successfully delivering complex and large-scale projects, building trust and a strong reputation.

- Contract Wins: Continued success in securing significant contracts, such as the July 2025 Limburg substation upgrade, demonstrating ongoing market demand and competitive strength.

Effective Management and Shareholder Value Creation

Heijmans' management has shown exceptional execution, consistently meeting and surpassing financial targets. A prime example is the early repayment of debt stemming from the Van Wanrooij acquisition, showcasing strong financial discipline.

This effective stewardship has directly translated into tangible shareholder benefits. The company's share price saw a notable increase in 2024, reflecting investor confidence in the management's strategic direction and operational prowess.

Furthermore, Heijmans has committed to a high cash dividend payout policy. This strategy aims to directly reward shareholders and enhance overall value creation, reinforcing the company's commitment to its investors.

- Strong Debt Management: Early repayment of acquisition debt demonstrates financial prudence.

- Share Price Appreciation: Significant increase in share price during 2024, indicating market confidence.

- Shareholder Returns: Commitment to a high cash dividend payout policy enhances shareholder value.

Heijmans' diversified business model, spanning property development, building & technology, and infrastructure, provides significant resilience against market fluctuations. This strategic breadth is supported by a substantial order book of €2.8 billion at the end of 2024, indicating consistent demand across its various segments.

The company's commitment to sustainability is a key strength, with a 30% reduction in Scope 1 and 2 CO2e emissions in 2024 and the integration of energy-efficient technologies in 75% of ongoing projects. Their leadership in sustainable innovation, such as Europe's most sustainable asphalt plant, positions them favorably for future market trends.

Heijmans possesses deep expertise and strong relationships within the Dutch construction market, evidenced by securing significant contracts like the July 2025 Limburg substation upgrade. This established local presence allows for efficient navigation of complex projects and reinforces their competitive edge.

Exceptional management execution is a core strength, demonstrated by exceeding financial targets and early debt repayment, leading to a notable share price increase in 2024. The commitment to a high cash dividend payout policy further enhances shareholder value and reflects strong financial discipline.

| Metric | 2024 (Actual) | 2025 (Projected) |

|---|---|---|

| Revenue | €2.6 billion | €2.75 billion |

| Underlying EBITDA Margin | 7.7% | ~9.0% |

| Order Book | €2.8 billion | N/A |

What is included in the product

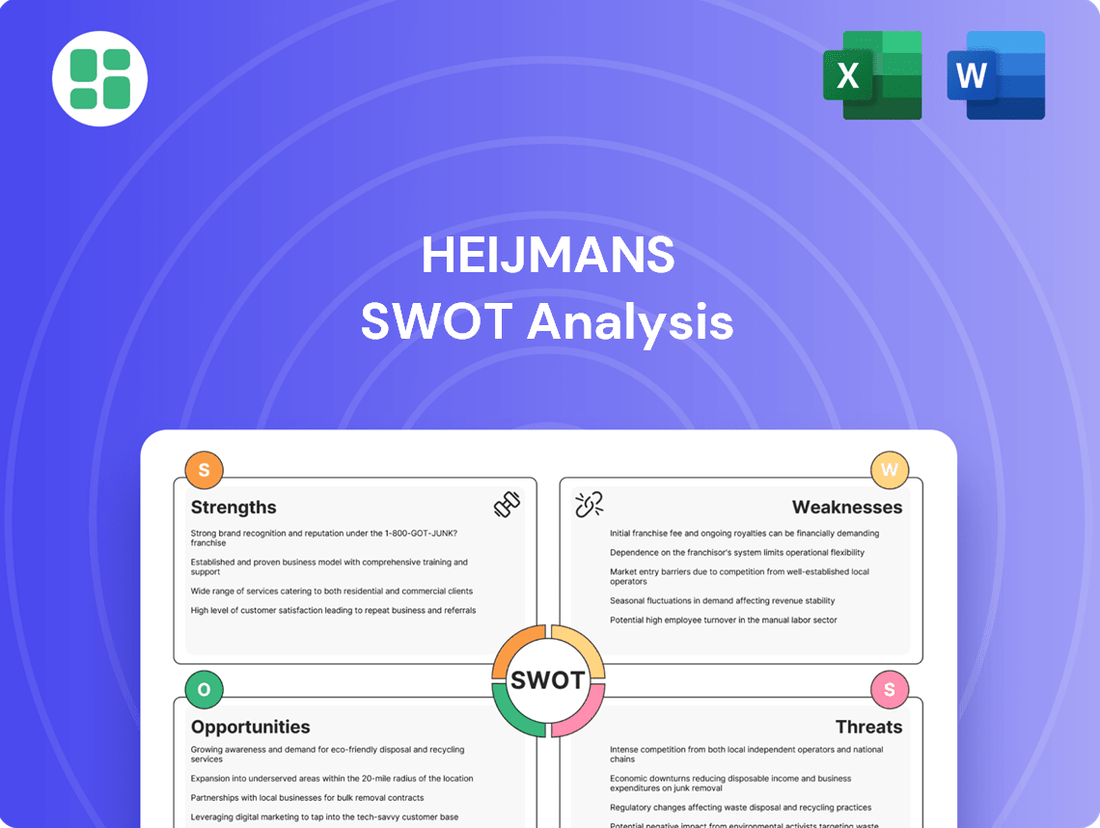

Delivers a strategic overview of Heijmans’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address potential challenges, transforming weaknesses into opportunities.

Weaknesses

Heijmans' significant reliance on the Dutch market, while a strength in its home territory, presents a notable weakness. This concentration exposes the company to heightened risks associated with national economic fluctuations and sector-specific Dutch regulations. For instance, a downturn in the Dutch construction sector, which significantly impacts Heijmans, could disproportionately affect its overall performance compared to more geographically diversified peers.

Heijmans, like many in the Dutch construction sector, grapples with significant structural challenges. A persistent shortage of developable land severely restricts the pipeline of new projects. For instance, in 2024, the Dutch government continued to highlight land availability as a primary constraint for housing construction, impacting the sector's growth potential.

Furthermore, the lengthy and intricate nature of development processes, often exacerbated by legal hurdles, slows down project execution. Issues such as complex permitting procedures and ongoing debates around nitrogen emissions, which saw continued regulatory scrutiny throughout 2024, contribute to project delays and cost overruns. These systemic bottlenecks directly impact Heijmans' ability to deliver projects on time and within budget, limiting overall output.

Heijmans faces significant challenges due to a widespread shortage of skilled labor within the Dutch construction sector. This scarcity directly impacts the company's ability to secure and retain qualified professionals, potentially leading to higher labor costs and operational inefficiencies.

The ongoing deficit in skilled workers, a trend observed across the industry, can hinder Heijmans' project execution capabilities. For instance, reports from early 2024 indicated that over 60% of Dutch construction companies struggled to find sufficient skilled personnel, a situation that directly affects project timelines and profitability.

Impact of Regulatory Complexities

The evolving regulatory landscape in the Netherlands, particularly with the introduction of the Wet kwaliteitsborging voor het bouwen (Wkb) and the Omgevingswet (Environment and Planning Act), presents a significant challenge for Heijmans. These new frameworks introduce increased complexity and compliance burdens, directly impacting project timelines and budgets. For instance, the Wkb, fully implemented in 2024, places greater responsibility on builders for quality assurance, requiring more rigorous documentation and oversight, which translates to higher operational costs.

Navigating these intricate regulations demands substantial investment in expertise and resources, potentially diverting attention from core construction activities. The uncertainty surrounding the precise interpretation and application of these laws can also create risks in project planning and financial forecasting. Heijmans, like other construction firms, must adapt by strengthening internal compliance processes and potentially absorbing increased costs, which could affect profitability in the short to medium term.

- Increased Compliance Costs: The Wkb and Omgevingswet necessitate additional administrative and quality control measures, raising project expenses.

- Project Delays: Navigating new permitting processes and quality assurance requirements under these acts can lead to unforeseen project schedule extensions.

- Resource Allocation Strain: Significant internal resources must be dedicated to understanding and implementing new regulatory requirements.

Potential for Project-Specific Risks

Even with strong risk management, large construction and property development projects naturally face potential issues like unexpected technical problems, budget blowouts, or schedule slippages. Heijmans' experience with the A13 motorway work postponement in 2024, stemming from safety concerns, serves as a clear example. This incident underscores that despite rigorous safety and quality checks, unique challenges can emerge on a project-by-project basis.

These specific project risks can impact Heijmans' financial performance and operational efficiency. For instance, delays can lead to increased labor costs and penalties, while unforeseen technical issues might necessitate costly rework. The company's 2023 annual report indicated that project-specific challenges contributed to certain financial variances, reinforcing the ongoing nature of these potential weaknesses.

- Project-Specific Risks: Unforeseen technical challenges, cost overruns, or delays are inherent in large-scale developments.

- Past Incidents: The 2024 postponement of A13 motorway work due to safety concerns highlights this vulnerability.

- Financial Impact: Delays can lead to increased costs and potential penalties, affecting profitability.

- Operational Strain: Technical issues may require costly rework, straining resources and timelines.

Heijmans' financial performance is susceptible to fluctuations in interest rates and inflation. Rising interest rates can increase borrowing costs, impacting the affordability of new projects and potentially dampening demand for housing. Similarly, inflationary pressures can drive up material and labor costs, squeezing profit margins if not passed on to customers. For example, the European Central Bank's interest rate hikes throughout 2023 and into 2024 have made financing more expensive for developers and buyers alike.

The company's profitability can be significantly affected by the cyclical nature of the construction and property development industries. Economic downturns typically lead to reduced investment in new builds and infrastructure projects, directly impacting Heijmans' order book and revenue streams. The lingering effects of global economic uncertainties observed in 2024, including supply chain disruptions and geopolitical instability, continue to pose risks to the sector's stability.

| Economic Factor | Impact on Heijmans | 2024/2025 Relevance |

|---|---|---|

| Interest Rates | Increased borrowing costs, reduced buyer affordability | Continued upward pressure on financing costs |

| Inflation | Higher material and labor costs, margin pressure | Persistent cost increases impacting project budgets |

| Economic Cycles | Reduced project pipeline during downturns | Vulnerability to potential slowdowns in Dutch economy |

Full Version Awaits

Heijmans SWOT Analysis

This is a real excerpt from the Heijmans SWOT analysis. Once purchased, you’ll receive the full, editable version, providing comprehensive insights into their strategic positioning.

Opportunities

The Netherlands is grappling with a persistent housing shortage, a situation the government is actively addressing with ambitious targets. Initiatives are in place to construct 100,000 homes each year, backed by significant financial commitments. This sustained demand for new housing directly benefits Heijmans' Living segment, offering a stable and expanding market for its residential development and construction services.

The Netherlands faces a significant maintenance backlog across its infrastructure, encompassing roads, bridges, and viaducts. This presents a substantial opportunity for Heijmans to leverage its expertise in infrastructure renewal and repair.

Government initiatives are driving considerable investment in transport, energy, and utility projects, including crucial electricity grid reinforcement. These ongoing projects directly align with Heijmans' core capabilities, particularly within its Connecting segment.

The Dutch Transportation Infrastructure Construction Market is anticipated to experience robust growth. Projections indicate a significant expansion, creating a fertile ground for Heijmans to secure new contracts and enhance its market position in infrastructure development and maintenance.

The construction industry's increasing commitment to sustainability and circular economy principles, driven by climate change concerns, creates a fertile ground for growth. This shift is not just a trend; it's becoming a core requirement for many projects.

Heijmans is well-positioned to benefit from this demand, thanks to its ongoing investments in green technologies and sustainable materials. For instance, in 2024, the company continued to expand its portfolio of energy-efficient homes and renovation projects, aligning with market expectations for reduced environmental impact.

Technological Advancement and Digitalization

Heijmans is well-positioned to capitalize on the ongoing technological advancements and digitalization within the construction sector. The company's continued integration of Building Information Modeling (BIM), modular construction techniques, and other digital tools promises to significantly boost operational efficiency and shorten project delivery times. These digital solutions are not just about speed; they also drive innovation, allowing for more sophisticated and sustainable building practices.

Heijmans' proactive investments and strategic partnerships in these technological domains provide a solid bedrock for future expansion. By leveraging these existing capabilities, the company can secure a distinct competitive edge and unlock new avenues for growth in an increasingly digitalized market. For instance, in 2024, the construction industry saw a notable increase in the adoption of AI-powered project management software, with reports indicating a potential 15-20% reduction in project overheads when implemented effectively.

- Enhanced Efficiency: BIM and digital platforms streamline workflows, reducing errors and rework, which can translate to significant cost savings and improved project margins.

- Faster Project Delivery: Modular construction and advanced planning tools accelerate build times, allowing Heijmans to take on more projects and improve capital turnover.

- Innovation Driver: Embracing new technologies facilitates the development of smarter, more sustainable, and cost-effective building solutions, appealing to a broader client base.

- Competitive Advantage: Early and effective adoption of digital construction methods positions Heijmans as an industry leader, attracting talent and clients seeking cutting-edge solutions.

Urban Regeneration and Energy Transition Projects

Opportunities in urban regeneration and the energy transition are significant, driven by the need to revitalize existing urban areas and implement large-scale green energy infrastructure. Heijmans is well-positioned to capitalize on these trends due to its integrated approach spanning property development, building, and infrastructure. For instance, the Dutch government's commitment to the energy transition, including ambitious targets for renewable energy and sustainable building, creates a robust market for Heijmans' expertise.

These complex, integrated projects, such as developing collective heating networks and upgrading high-voltage substations, align perfectly with Heijmans' core competencies. The company's ability to manage diverse project phases, from initial planning and development to construction and maintenance, provides a competitive edge. This integrated model allows Heijmans to deliver comprehensive solutions for urban renewal and sustainable energy initiatives.

- Urban regeneration projects are gaining momentum across Europe, with significant investment planned in revitalizing aging city centers and brownfield sites.

- Energy transition initiatives, such as the expansion of district heating and cooling networks, are a key focus for many European municipalities aiming to reduce carbon emissions.

- Heijmans' integrated approach allows it to tackle multifaceted projects, combining property development with infrastructure upgrades, a strategy supported by increasing demand for sustainable urban living.

The persistent housing shortage in the Netherlands, with government targets for 100,000 new homes annually, offers a stable and expanding market for Heijmans' Living segment. This demand is further bolstered by substantial government investment in infrastructure renewal and energy transition projects, aligning directly with Heijmans' capabilities in its Connecting segment. The Dutch transportation infrastructure market is projected for robust growth, creating opportunities for new contracts. Furthermore, the construction industry's increasing focus on sustainability and circular economy principles, supported by Heijmans' investments in green technologies, provides a significant growth avenue.

Heijmans is well-positioned to leverage technological advancements and digitalization in construction, with BIM and modular construction enhancing efficiency and project delivery times. The company's proactive investments in these areas, coupled with strategic partnerships, offer a competitive edge in an increasingly digitalized market. For instance, the adoption of AI in project management in 2024 showed potential for 15-20% overhead reduction.

Urban regeneration and the energy transition present substantial opportunities, driven by the need to revitalize urban areas and implement green energy infrastructure. Heijmans' integrated approach, covering property development, building, and infrastructure, is ideal for these multifaceted projects, such as collective heating networks and substation upgrades. The Dutch government's commitment to renewable energy and sustainable building further supports this market.

| Opportunity Area | Market Driver | Heijmans Alignment | 2024/2025 Data/Trend |

|---|---|---|---|

| Housing Shortage | Government target of 100,000 homes annually | Living segment strength | Sustained high demand for residential construction |

| Infrastructure Renewal | Maintenance backlog across Dutch infrastructure | Connecting segment expertise | Significant ongoing projects in road and bridge repair |

| Energy Transition & Urban Regeneration | Government investment in green energy and urban revitalization | Integrated property development and infrastructure capabilities | Growth in district heating networks and sustainable building mandates |

| Digitalization in Construction | Industry-wide adoption of BIM, modular construction, AI | Investment in digital tools and techniques | Projected efficiency gains and faster delivery times |

Threats

Broader macroeconomic instability, including potential shifts in interest rates, could impact Heijmans' affordability of housing and the overall investment climate for property development. For instance, the European Central Bank's policy rate stood at 4.00% as of early 2024, a significant increase from previous years, which directly affects borrowing costs for developers and homebuyers.

Rising interest rates, like those seen through 2023 and into 2024, can dampen demand in the housing market by making mortgages more expensive. This could lead to slower sales cycles and potentially lower profit margins for Heijmans' residential projects.

Furthermore, increased financing costs for large-scale projects, driven by higher interest rates, can strain Heijmans' capital expenditure plans and reduce the attractiveness of new development opportunities. The sensitivity of the construction sector to economic cycles means such fluctuations pose a direct threat to project viability and profitability.

The Dutch construction sector is a crowded arena, with many companies, both local and global, competing fiercely for projects. This means Heijmans often faces situations where multiple bidders are present, driving down prices and potentially squeezing profitability.

For instance, in 2023, the Dutch construction output was estimated to be around €85 billion, a figure that attracts many participants. This high volume market, while offering opportunities, also intensifies the pressure to secure contracts, often through competitive pricing, which can impact Heijmans' margins.

To stand out, Heijmans must continuously innovate and focus on cost-effectiveness. The threat of intensified competition requires a strategic approach to differentiation, whether through specialized services, sustainable building practices, or technological advancements, to maintain its market position and profitability.

Heijmans, like many in the construction sector, faces the persistent threat of fluctuating material and energy costs. For instance, the price of lumber, a key component in many builds, saw significant spikes in early 2024, with some reports indicating increases of over 20% compared to the previous year. This volatility directly impacts project profitability, potentially leading to budget overruns and making accurate long-term financial forecasting a considerable challenge.

Regulatory and Environmental Policy Changes

Evolving government regulations and environmental policies present a significant threat. For instance, stricter nitrogen emission standards, as seen in the Netherlands impacting the construction sector, could directly affect Heijmans' project feasibility and timelines. The Dutch government's ongoing efforts to address nitrogen deposition, for example, have led to significant uncertainty and potential project cancellations in the construction industry throughout 2023 and into 2024.

Such policy shifts may necessitate costly adjustments to construction methods or materials, increasing compliance costs. Furthermore, new building standards aimed at achieving climate targets could require substantial upfront investment in sustainable technologies, impacting project profitability. These changes could lead to project delays or even the outright cancellation of developments, directly affecting Heijmans' project pipeline and revenue streams.

- Nitrogen emission regulations: Continued or intensified Dutch regulations could directly constrain new construction projects, particularly those near sensitive natural areas.

- Climate targets: Ambitious EU and national climate goals may impose new energy efficiency or material sourcing requirements on building projects.

- Building code updates: Changes to safety, fire, or accessibility standards could require costly redesigns and retrofits for ongoing or future developments.

Geopolitical and Political Instability

Global geopolitical events and domestic political uncertainty can introduce unpredictability into government spending on infrastructure and housing policies, which are critical drivers for Heijmans' business. The recent fall of the Dutch cabinet in July 2023, while not immediately impacting Heijmans' positive outlook, highlights the potential for shifts in policy and funding. For instance, a change in government could alter the pace of planned infrastructure projects, impacting Heijmans' order book and revenue streams. This instability creates a risk that previously anticipated government contracts might be delayed or re-evaluated.

This political flux can directly affect Heijmans' ability to secure future projects. For example, changes in national or regional priorities following a cabinet reshuffle might lead to a reallocation of funds away from sectors where Heijmans is active. The company’s reliance on public tenders for a significant portion of its work means that any disruption to government planning cycles poses a direct threat to its pipeline.

Further complicating matters, international conflicts or trade disputes could indirectly impact Heijmans through supply chain disruptions or increased material costs. While Heijmans has demonstrated resilience, sustained geopolitical instability could strain its operational efficiency and profitability.

- Potential for delayed or canceled government projects due to policy shifts.

- Uncertainty in future government infrastructure and housing spending.

- Risk of supply chain disruptions and increased material costs from global events.

Intensified competition within the Dutch construction market, estimated at €85 billion in 2023, puts pressure on Heijmans' pricing and profit margins due to numerous local and global bidders vying for projects.

Fluctuating material and energy costs, exemplified by a potential 20% increase in lumber prices in early 2024, directly impact project profitability and financial forecasting accuracy.

Stricter environmental regulations, such as Dutch nitrogen emission standards affecting construction, can lead to project delays, increased compliance costs, and potential cancellations, impacting Heijmans' pipeline.

Geopolitical instability and domestic political uncertainty, like the Dutch cabinet's fall in July 2023, can disrupt government spending on infrastructure and housing, directly threatening Heijmans' project secures and revenue streams.

SWOT Analysis Data Sources

This Heijmans SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry evaluations to ensure a well-rounded and accurate assessment.