Heijmans Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heijmans Bundle

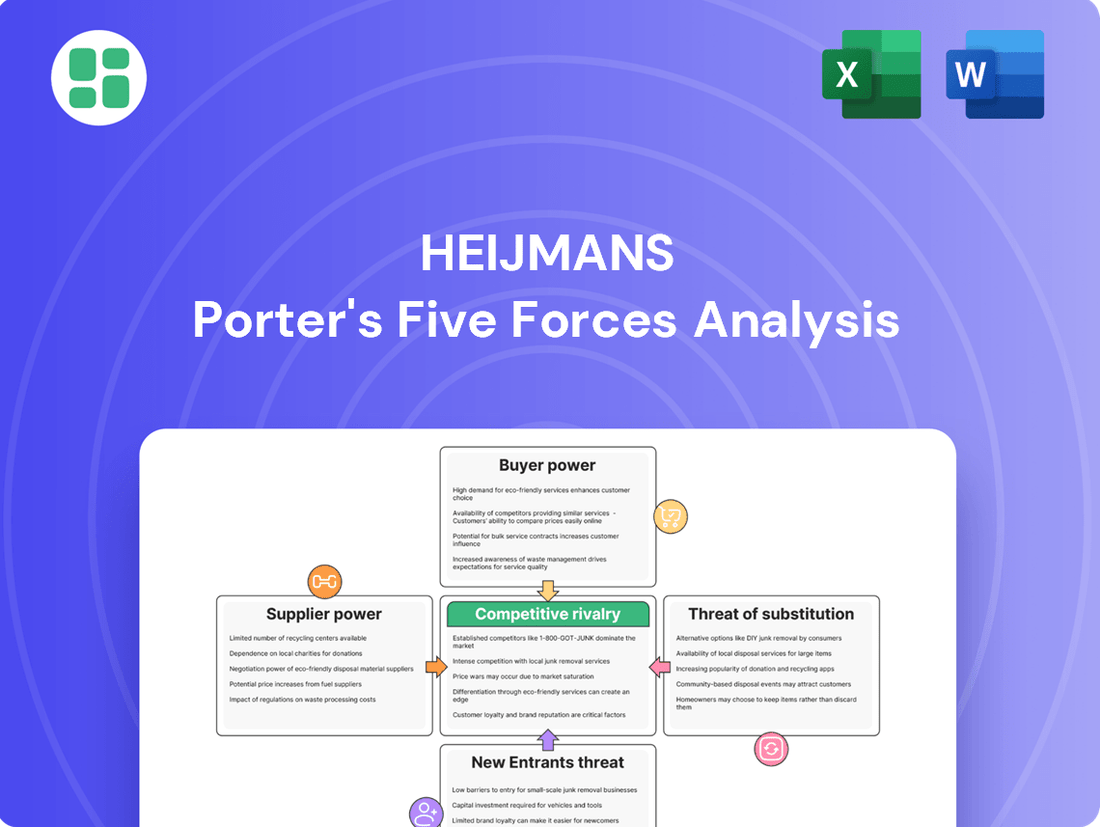

Heijmans's Porter's Five Forces Analysis reveals the intricate web of competitive pressures shaping its operational landscape, from the formidable threat of new entrants to the subtle influence of substitute products. Understanding these forces is crucial for navigating the construction and infrastructure sector effectively. This brief overview only scratches the surface of the strategic insights available.

Unlock the full Porter's Five Forces Analysis to explore Heijmans’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to anticipate industry shifts and capitalize on opportunities.

Suppliers Bargaining Power

The construction industry, including companies like Heijmans, depends heavily on suppliers for essential materials like concrete, steel, and timber, as well as specialized equipment and skilled labor. When a small number of suppliers control the market for these crucial inputs, their ability to dictate terms and prices significantly strengthens, potentially driving up costs for Heijmans.

In 2024, the global construction materials market, valued at approximately $1.5 trillion, saw significant price volatility for key commodities. For instance, steel prices experienced fluctuations, with average prices for rebar in Europe ranging from €700 to €900 per ton throughout the year, influenced by global demand and production levels. This concentration among a few major steel producers can indeed amplify their bargaining power.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Heijmans. If Heijmans can readily access alternative materials or find different subcontractors, the power of any single supplier diminishes. For instance, the growing market for geopolymer concrete, a sustainable alternative to traditional cement, directly challenges the dominance of established cement suppliers.

Heijmans' strategic commitment to circular construction and sustainable sourcing further bolsters its ability to mitigate supplier power. By actively seeking out and developing relationships with suppliers of recycled materials or innovative, lower-impact alternatives, Heijmans can diversify its input streams. This proactive approach reduces dependence on any one supplier, thereby strengthening Heijmans' position in negotiations.

Heijmans' potential vulnerability to supplier power is influenced by switching costs. If Heijmans is locked into long-term contracts with specific suppliers for specialized components or machinery, it becomes more difficult and expensive to change providers, thereby enhancing supplier leverage.

However, Heijmans' strategic push towards modular construction and the use of prefabricated elements could actually mitigate these switching costs. This approach allows for greater standardization and potentially a wider pool of suppliers capable of meeting their needs, offering more flexibility in sourcing and reducing reliance on any single entity.

Uniqueness of Supplier's Products/Services

Suppliers who offer unique or highly specialized products and services naturally command more influence. For Heijmans, this could manifest in their reliance on proprietary Building Information Modeling (BIM) software or specialized equipment for complex infrastructure projects. When alternatives are scarce or non-existent, these suppliers can dictate terms more effectively.

The uniqueness of a supplier's offering directly translates to their bargaining power. If Heijmans needs a specific type of sustainable building material that only a few suppliers can provide, or advanced construction technology that is patented, those suppliers are in a stronger position. This leverage allows them to potentially command higher prices or impose less favorable contract conditions.

- Specialized BIM Software: If Heijmans relies on proprietary BIM software, the developer of that software has significant leverage.

- Unique Sustainable Materials: Suppliers of novel, eco-friendly materials with limited competition can exert greater pricing power.

- Proprietary Infrastructure Equipment: For specialized maintenance or construction, suppliers of unique, patented machinery can dictate terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Heijmans' construction business can significantly bolster their bargaining power. While less common for basic material providers, this risk is more pronounced with sophisticated, integrated subcontractors who might venture into project development, directly competing with Heijmans. For instance, a large modular construction supplier could potentially offer end-to-end solutions, bypassing traditional general contractors.

Heijmans' robust market standing and its diversified business model, encompassing property development, building & technology, and infrastructure, serve as a crucial buffer against this threat. This diversification allows Heijmans to absorb or counter potential forward integration attempts by suppliers. In 2024, Heijmans continued to emphasize its integrated approach, aiming to capture more value across the construction lifecycle, thereby diminishing the leverage of individual suppliers seeking to move up the value chain.

- Forward Integration Threat: Suppliers moving into the construction sector increases their power.

- Subcontractor Risk: Integrated subcontractors pose a greater risk than raw material suppliers.

- Heijmans' Mitigation: Diversified operations across property development, building & technology, and infrastructure reduce this threat.

- Strategic Focus: Heijmans' 2024 strategy aimed at capturing more value across the construction lifecycle.

The bargaining power of suppliers for Heijmans is influenced by several factors, including market concentration, the availability of substitutes, switching costs, the uniqueness of offerings, and the threat of forward integration. In 2024, the construction sector continued to navigate supply chain complexities, with material price volatility impacting negotiation leverage.

| Factor | Impact on Heijmans | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Steel prices in Europe averaged €700-€900/ton in 2024, reflecting the influence of major producers. |

| Availability of Substitutes | Readily available substitutes weaken supplier power. | Growth in geopolymer concrete offers alternatives to traditional cement suppliers. |

| Switching Costs | High switching costs empower suppliers. | Modular construction aims to reduce these costs by promoting standardization. |

| Uniqueness of Offering | Unique or proprietary offerings enhance supplier leverage. | Specialized BIM software or patented construction equipment can dictate terms. |

| Forward Integration Threat | Suppliers integrating forward increase their power. | Integrated subcontractors pose a greater risk than raw material suppliers. |

What is included in the product

Heijmans Porter's Five Forces Analysis dissects the competitive landscape, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products.

Pinpoint key competitive pressures with a visual breakdown, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Heijmans' customer base is quite varied, ranging from individual homeowners to large institutional investors, housing corporations, and even government entities for infrastructure work. This diversity is key, but certain customer segments hold more sway.

When Heijmans secures large government contracts or significant property development deals, these major clients represent substantial portions of the company's revenue. The sheer volume of business these customers bring means they have considerable bargaining power, influencing terms and pricing.

In the Dutch housing market, particularly for private buyers and housing corporations, price sensitivity is a significant factor. Heijmans' success hinges on its capacity to deliver competitive pricing for its housing solutions. For instance, in 2024, the average price for a new-build home in the Netherlands saw increases, making cost-effectiveness a paramount concern for purchasers.

Heijmans' strategic focus on energy-neutral homes and sustainable building practices, coupled with efficient construction methods like modular concepts, directly addresses this customer price sensitivity. By optimizing its construction processes, Heijmans aims to offer value that resonates with buyers looking for both affordability and long-term benefits, influencing their purchasing decisions in a competitive landscape.

The Dutch construction market is highly fragmented, meaning customers have a wide array of choices beyond Heijmans. This abundance of alternative construction service providers, ranging from large national firms to smaller specialized contractors, significantly empowers customers.

For instance, in 2023, the Dutch construction sector saw a significant number of new company formations, indicating a competitive landscape. If Heijmans' pricing, quality, or service delivery falls short of customer expectations, clients can readily explore and switch to competitors, thereby limiting Heijmans' pricing power.

Customer's Threat of Backward Integration

The threat of backward integration by customers for a company like Heijmans, which operates across development, building, and infrastructure, is generally low. While large property developers or government bodies possess the financial capacity to consider in-house construction, the intricate nature and specialized skills required for complex projects typically deter them. For instance, a 2024 report indicated that the average lead time for securing specialized construction equipment for large infrastructure projects can extend to over 12 months, highlighting the significant operational hurdles for potential backward integration.

Heijmans' diversified business model, encompassing everything from initial project planning and development to the actual construction and infrastructure management, further mitigates this threat. Customers benefit from a single, integrated provider, making it impractical and less cost-effective for them to replicate Heijmans' comprehensive capabilities internally. This integration reduces the perceived need for customers to bring construction in-house, as they are already receiving a full-service offering.

- Low Likelihood of Backward Integration: Complex projects demand specialized expertise and substantial capital, making it rare for customers to build capabilities in-house.

- Heijmans' Integrated Offering: The company's broad service scope across development, building, and infrastructure makes it difficult for customers to replicate these services internally.

- Operational Hurdles: Barriers such as securing specialized equipment and managing complex supply chains deter customers from undertaking construction themselves.

Information Availability to Customers

Customers today have unprecedented access to information, significantly boosting their bargaining power. They can easily compare market prices, research alternative solutions, and scrutinize contractor reputations. This transparency means companies like Heijmans must clearly demonstrate their value proposition.

For Heijmans, understanding this shift is critical. Customers are more informed about project costs and the long-term advantages of sustainable building practices. Effectively communicating these benefits is no longer optional; it's a necessity to retain clients and secure new business.

- Informed Decision-Making: Customers can now access vast amounts of data on pricing, product features, and competitor offerings, empowering them to negotiate more effectively.

- Reputation Scrutiny: Online reviews and industry reports allow customers to easily assess a contractor's past performance and reliability, influencing their choice and willingness to pay.

- Value Communication: Heijmans needs to highlight not just the initial cost but also the lifecycle benefits of their projects, particularly concerning sustainability, to justify their pricing and approach.

- Market Transparency: The digital age has dramatically increased market transparency, reducing information asymmetry and leveling the playing field for customer negotiations.

Heijmans faces significant customer bargaining power due to the fragmented nature of the Dutch construction market, offering clients numerous alternatives. In 2023, the formation of new construction companies in the Netherlands increased, intensifying competition. This means Heijmans must maintain competitive pricing and high service standards to prevent customers from switching. For example, the average price of a new-build home in the Netherlands rose in 2024, making cost-effectiveness a key customer concern.

Large institutional clients, such as government bodies and major property developers, wield considerable influence due to the substantial volume of business they represent. These clients can negotiate favorable terms and pricing, impacting Heijmans' profitability. The threat of backward integration by customers is generally low, given the specialized skills and capital required for complex construction projects, although the lead time for specialized equipment in 2024 could exceed 12 months, presenting an operational hurdle.

Increased market transparency, driven by readily available information, further empowers customers. They can easily compare prices, research solutions, and assess contractor reputations, compelling Heijmans to clearly articulate its value proposition, particularly regarding the long-term benefits of sustainable building practices.

Full Version Awaits

Heijmans Porter's Five Forces Analysis

This preview shows the exact Heijmans Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual document, which details the competitive landscape for Heijmans, covering all five forces. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

The Dutch construction sector is quite crowded, featuring a mix of large, established companies and many smaller, local businesses. This means Heijmans, despite being a prominent listed entity, faces stiff competition from a wide array of players.

In 2023, the Dutch construction industry saw a significant number of companies, with over 130,000 registered construction businesses. This high density of firms, especially in areas like residential and commercial building, intensifies rivalry.

The market's maturity contributes to this intense competition, as growth opportunities are often fought over. This fragmentation means Heijmans must constantly differentiate itself to maintain its market position.

The Dutch construction sector faced a challenging 2024, with a notable contraction. However, projections indicate a rebound with moderate growth anticipated for 2025 and the subsequent years. This recovery is expected to be fueled by renewed investments in both residential building and crucial infrastructure projects.

As the market begins to mend, competitive rivalry within the industry is likely to intensify. Companies will be more aggressively pursuing new projects and seeking to capture a greater share of the increasing demand. This heightened competition can lead to pressure on pricing and margins for established players like Heijmans.

In the construction sector, differentiation is key to standing out. This can be achieved through specialization in niche areas, a commitment to superior quality in materials and workmanship, embracing innovative building techniques, or prioritizing sustainable and eco-friendly practices. These factors allow companies to command premium pricing and build strong brand loyalty.

Heijmans, for instance, actively differentiates itself by focusing on creating enhanced living environments. Their strategy emphasizes sustainable building practices and the integration of technical solutions, aiming to provide more than just structures but complete living experiences. This approach is further solidified by their 'Together towards 2030' strategy, which places a significant emphasis on sustainability and the producibility of their projects, setting them apart from competitors focused solely on cost.

Exit Barriers

Heijmans faces significant competitive rivalry due to high exit barriers in the construction sector. These barriers include substantial investments in fixed assets like heavy machinery and specialized construction equipment, along with long-term contractual obligations for ongoing projects. These factors make it economically challenging for companies to simply shut down operations, even when unprofitable, forcing them to remain active competitors.

The capital-intensive nature of construction means that firms often absorb losses and continue operating through downturns rather than incurring the high costs associated with exiting the market. This persistence of even struggling companies intensifies the competitive landscape. For instance, the average construction company in the Netherlands, where Heijmans operates, often has a significant portion of its assets tied up in plant, property, and equipment, making liquidation a less attractive option than weathering a storm.

- High Fixed Asset Investment: Construction firms typically possess substantial investments in specialized machinery and real estate, creating significant capital tied up that discourages quick exits.

- Long-Term Project Commitments: Existing contracts and multi-year projects bind companies to ongoing operations, making immediate cessation of business impractical and costly.

- Industry Resilience Through Adversity: The construction industry's structure often compels companies to endure periods of low profitability rather than exit, thereby sustaining a higher level of competitive intensity.

Industry Structure and Strategic Commitments

Heijmans operates within a competitive landscape featuring both broad general contractors and highly specialized firms. This dual nature of the industry means Heijmans must strategically position itself across diverse market segments.

With its operations spanning property development, building & technology, and infrastructure, Heijmans faces distinct competitive pressures in each area. The company’s strategic commitments are therefore spread across these varied business units, requiring tailored approaches to market engagement and resource allocation.

The acquisition of Van Wanrooij in 2024, for instance, was a significant strategic commitment aimed at bolstering Heijmans' capacity and competitiveness within the residential building sector. This move directly addresses the intense rivalry in this particular segment of the construction industry.

- Industry Segmentation: Heijmans competes against both large, diversified general contractors and smaller, niche specialized firms.

- Strategic Diversification: Heijmans' presence in property development, building & technology, and infrastructure necessitates distinct strategic commitments in each sector to manage competitive pressures effectively.

- Acquisition Impact: The 2024 acquisition of Van Wanrooij, a key player in residential building, highlights Heijmans' strategic intent to strengthen its competitive position in a crucial market segment.

The Dutch construction market is highly fragmented, with numerous players ranging from large corporations to smaller local businesses, leading to intense rivalry for Heijmans. This crowded environment means companies must actively differentiate themselves to stand out and secure projects.

The industry's high exit barriers, stemming from substantial fixed asset investments and long-term contracts, compel even less profitable firms to remain active competitors. This persistence fuels ongoing competitive pressure, as companies are reluctant to divest significant capital tied up in machinery and ongoing projects.

Heijmans faces competition across its diverse business segments: property development, building & technology, and infrastructure. The 2024 acquisition of Van Wanrooij, for example, was a strategic move to bolster its position in the highly competitive residential building sector, underscoring the need for targeted strategies to navigate varied market pressures.

| Competitive Factor | Description | Impact on Heijmans |

|---|---|---|

| Market Fragmentation | Over 130,000 construction businesses in the Netherlands in 2023. | Intensifies rivalry, requiring strong differentiation strategies. |

| High Exit Barriers | Significant investment in fixed assets (machinery, equipment). | Ensures continued competition from existing players, even during downturns. |

| Industry Segmentation | Competition from general contractors and specialized firms. | Requires tailored strategies for property development, building & technology, and infrastructure. |

SSubstitutes Threaten

Alternative construction methods, such as modular and prefabricated building, pose a growing threat to traditional on-site construction. These methods offer advantages like accelerated project timelines and enhanced quality control, appealing to a market increasingly focused on efficiency. For instance, the modular construction market was valued at approximately $155.7 billion in 2023 and is projected to reach $257.9 billion by 2030, highlighting its significant growth potential.

Heijmans, recognizing this shift, actively incorporates innovative modular concepts into its housing and apartment building projects. This strategic approach allows Heijmans to not only mitigate the threat of substitutes but also to capitalize on the demand for faster, more sustainable, and higher-quality construction solutions, demonstrating an adaptive business model.

The option to renovate or refurbish existing structures poses a significant threat of substitution to new construction. This is particularly relevant in markets like the Netherlands, where there's a strong emphasis on sustainability and achieving CO2 neutrality in existing housing stock. For instance, by 2030, the Dutch government aims to have 1.5 million homes renovated for energy efficiency, directly impacting demand for new builds.

This trend is driven by both environmental concerns and economic considerations. Renovations can often be more cost-effective than new builds, especially when factoring in the preservation of valuable architectural heritage. In 2024, the cost of a major renovation project can be substantially lower than a complete new construction, making it an attractive alternative for many property owners.

For smaller residential or commercial projects, clients might indeed choose DIY approaches or hire less formal contractors. This can be seen in the growing trend of home improvement, where individuals tackle tasks themselves, potentially saving on labor costs. For instance, in 2023, the global home improvement market was valued at over $800 billion, indicating a significant portion of work being handled outside traditional professional channels.

However, for Heijmans' core business areas – large-scale property development, building and technology, and infrastructure – DIY solutions are not a realistic substitute. The sheer complexity, immense scale, and stringent regulatory frameworks governing these projects, such as those for new highway construction or large residential complexes, make them impossible for individuals or informal groups to undertake effectively or legally.

Shifting Housing Preferences

Shifting housing preferences present a significant threat of substitutes for Heijmans. As societal tastes evolve, a move towards smaller, more sustainable living spaces or a greater demand for urban regeneration projects could divert customers from Heijmans' traditional suburban home developments. For instance, in 2024, reports indicated a growing interest in co-living arrangements and compact urban apartments across Europe, potentially reducing the appeal of larger, single-family homes.

Heijmans' broad residential portfolio, encompassing everything from conceptual houses designed for modern living to multi-unit apartment complexes, is strategically positioned to mitigate this threat. This diversification allows the company to cater to a wider range of consumer needs and preferences. In 2023, Heijmans reported a notable increase in sales for its urban development projects, demonstrating its ability to adapt to changing market demands.

- Changing Consumer Demands: A rise in demand for smaller, eco-friendly homes or shared living spaces can be seen as a substitute for traditional, larger Heijmans properties.

- Urbanization Trends: Increased preference for city living and existing urban dwellings over new suburban construction offers alternative housing solutions.

- Heijmans' Portfolio Adaptation: The company's diverse offerings, including apartment complexes and innovative housing concepts, aim to meet these evolving preferences.

- Market Data: In 2024, rental yields for compact urban apartments in key Dutch cities showed a steady increase, signaling a potential shift in investment and living priorities away from traditional housing models.

Non-Construction Solutions to Infrastructure Needs

The threat of substitutes for traditional infrastructure projects is growing. For instance, instead of building new roads, optimizing existing networks with smart traffic management systems can significantly improve traffic flow and reduce congestion. In 2024, investments in smart city technologies, including intelligent transportation systems, are projected to reach billions globally, indicating a strong market for these alternatives.

Similarly, shifting freight transportation from road to rail or water offers a more sustainable and often cost-effective substitute for road expansion. This trend is supported by increasing environmental regulations and a focus on reducing carbon emissions. For example, in Europe, there's a concerted effort to move more freight by rail, with targets to increase its modal share by 2030.

Heijmans is well-positioned to address these evolving market dynamics. Their involvement in smart infrastructure solutions and technology development allows them to adapt to shifts away from purely physical construction. By offering integrated solutions that combine traditional building with digital enhancements, Heijmans can capture value in this changing landscape.

- Smart Traffic Management: Reduces need for new road construction by optimizing existing infrastructure. Global spending on ITS is expected to exceed $100 billion by 2025.

- Freight Modal Shift: Encourages movement of goods via rail and water, lessening reliance on road networks. European Union aims to shift 30% of road freight over 300 km to other modes by 2030.

- Heijmans' Adaptation: Focus on integrated and smart infrastructure solutions leverages technology to meet evolving client needs.

Alternative construction methods, like modular and prefabricated building, present a significant threat. These methods offer faster timelines and improved quality control, appealing to efficiency-focused markets. The modular construction sector was valued at around $155.7 billion in 2023 and is expected to grow substantially.

Renovating existing buildings is another key substitute for new construction, especially in regions prioritizing sustainability. The Dutch government's goal to make 1.5 million homes energy-efficient by 2030 directly impacts new build demand. Renovations can also be more cost-effective in 2024 compared to new builds.

Shifting housing preferences, such as a move towards smaller, eco-friendly homes or urban regeneration, also substitute traditional suburban developments. Heijmans' diverse portfolio, including urban projects which saw notable sales increases in 2023, helps mitigate this threat.

For infrastructure, smart traffic management and shifting freight to rail or water are growing substitutes for new road construction. Global investment in smart city technologies, including intelligent transportation systems, is projected to exceed $100 billion by 2025.

| Substitute Type | Key Characteristic | Market Impact/Trend | Heijmans' Response |

|---|---|---|---|

| Modular/Prefab Construction | Speed, Quality Control | Market valued at $155.7B in 2023; significant growth projected. | Incorporating modular concepts into projects. |

| Renovation/Refurbishment | Sustainability, Cost-Effectiveness | Dutch target: 1.5M homes energy-efficient by 2030. | Focus on adaptive building and sustainable solutions. |

| Changing Housing Preferences | Smaller, Eco-friendly, Urban Living | Increased interest in co-living and compact urban apartments. | Diversified portfolio including successful urban projects. |

| Smart Infrastructure | Efficiency, Sustainability | ITS spending to exceed $100B globally by 2025. | Developing integrated and smart infrastructure solutions. |

Entrants Threaten

Entering the construction sector, particularly for significant property development and infrastructure, demands immense upfront capital for machinery, land acquisition, and operational expenses. This substantial financial hurdle effectively discourages many aspiring competitors from entering the market.

For instance, a major infrastructure project can easily require hundreds of millions of euros in initial investment, a sum that many smaller firms simply cannot access. Heijmans, as a key player in this space, benefits from this high barrier to entry, which limits the competitive landscape.

Established players like Heijmans enjoy significant cost advantages due to economies of scale in procurement, project execution, and overhead management. For instance, in 2024, large construction firms often secure bulk discounts on materials, which can be 5-10% lower than what smaller, new entrants can achieve.

New companies entering the market would find it difficult to replicate this cost efficiency. They would also lack the deep operational experience and established supply chain relationships that Heijmans has cultivated over years, making it challenging to compete on price for complex infrastructure or development projects.

New entrants into the construction sector often struggle to build robust supply chains and forge crucial relationships with subcontractors and clients. This is a significant barrier, as securing reliable material flow and dependable partners is fundamental to project success.

Heijmans, by contrast, benefits from deeply entrenched networks and a substantial order book, which currently stands at €1.5 billion as of the first quarter of 2024. This established infrastructure and secured future work give them a considerable competitive edge over any newcomers attempting to penetrate the market.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the Dutch construction sector. Stringent environmental regulations, such as the Dutch Environment Act and the upcoming Corporate Sustainability Reporting Directive (CSRD) guidelines, impose substantial compliance costs and complexities. These rules necessitate specialized knowledge and resources that can be prohibitive for newcomers. For instance, navigating the lengthy permitting processes often requires dedicated legal and technical expertise, acting as a considerable barrier.

The regulatory landscape creates a high barrier to entry for new construction firms. New entrants must invest heavily in understanding and implementing complex environmental standards and obtaining necessary permits. This can involve substantial upfront capital for compliance technology and personnel.

- Environmental Compliance Costs: New entrants face significant costs in meeting Dutch environmental regulations, potentially running into hundreds of thousands of euros for initial compliance measures.

- Permitting Delays: The average time for obtaining major construction permits in the Netherlands can extend to over a year, creating cash flow challenges and operational delays for new firms.

- CSRD Implementation: As of 2024, the phased implementation of CSRD means new entrants must immediately prepare for extensive sustainability reporting, demanding new systems and expertise.

- Specialized Expertise Required: Adherence to building codes and safety regulations demands technical staff with specific certifications, a resource pool that established firms already possess.

Brand Loyalty and Switching Costs for Customers

Customers, particularly large institutional or governmental clients, often exhibit brand loyalty towards established firms like Heijmans that have a demonstrated history of successful project delivery and reliability. This preference stems from a desire to mitigate risk, especially when awarding high-value contracts.

The perceived risk associated with engaging new, unproven entrants for significant projects acts as a substantial barrier. For instance, in the Dutch construction sector, where Heijmans operates, major infrastructure projects often require extensive pre-qualification and a proven ability to handle complex, large-scale undertakings. A 2024 report indicated that over 70% of public tenders for infrastructure valued above €50 million favored bidders with at least five years of continuous, similar project experience.

- Brand Loyalty: Clients often stick with known entities due to trust and past performance.

- Switching Costs: The effort and risk involved in vetting and onboarding a new supplier for critical projects are high.

- Risk Aversion: For large contracts, the potential cost of failure with an unknown entity outweighs the potential benefits of a new entrant.

- Industry Norms: Sectors like construction frequently have established relationships and tendering processes that favor incumbents.

The threat of new entrants in the construction sector, particularly for large-scale projects, remains relatively low due to significant capital requirements and established relationships. Heijmans benefits from these substantial barriers, which limit the number of viable competitors.

New companies face considerable hurdles in securing the necessary financing and building the trust required by clients for major projects. This makes it difficult for them to compete effectively against established players like Heijmans, who have proven track records and strong client bases.

The need for specialized expertise, compliance with stringent regulations, and the development of robust supply chains further solidify the position of incumbents. These factors collectively create a challenging environment for new entrants seeking to gain a foothold.

| Barrier Type | Description | Impact on New Entrants | Heijmans Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for machinery, land, and operations. | Prohibitive for many smaller firms. | Access to financing and existing asset base. |

| Economies of Scale | Cost advantages from bulk purchasing and efficient operations. | Difficulty competing on price. | Lower material costs (5-10% in 2024) and optimized overhead. |

| Supply Chains & Relationships | Need for established networks with suppliers and subcontractors. | Challenges in securing materials and reliable partners. | Deeply entrenched networks and a substantial order book (€1.5 billion Q1 2024). |

| Regulatory Compliance | Adherence to environmental laws and permitting processes. | Significant costs and time delays. | Existing expertise and resources to manage compliance. |

| Customer Loyalty & Risk Aversion | Client preference for proven track records and reliability. | Difficulty in winning bids against established firms. | Demonstrated history of successful project delivery, favored in tenders (70%+ for large infrastructure projects in 2024). |

Porter's Five Forces Analysis Data Sources

Our Heijmans Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, company annual filings, and expert interviews to capture the nuances of competitive dynamics.