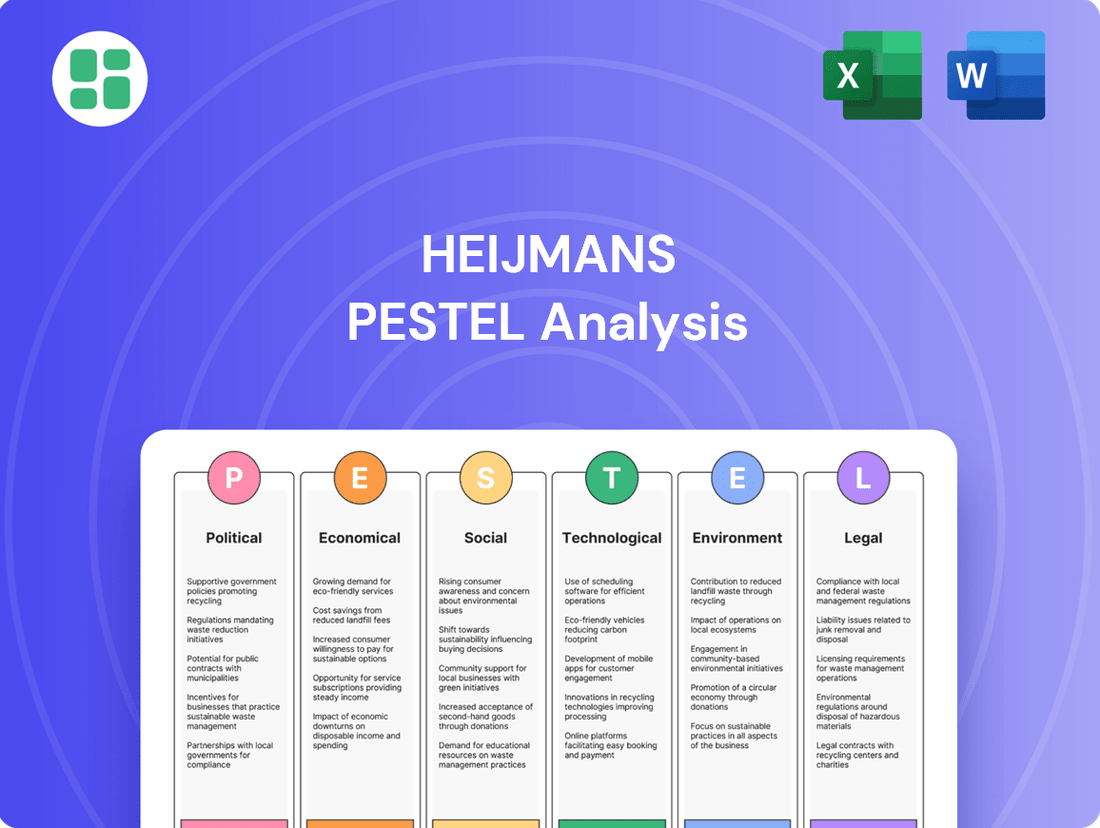

Heijmans PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heijmans Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Heijmans's trajectory. Our comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and identify opportunities. Empower your decision-making with expert-level insights. Download the full version now for actionable intelligence.

Political factors

The Dutch government's commitment to building 100,000 new homes annually, supported by substantial financial backing, directly shapes Heijmans' residential development business. This policy is a response to a persistent housing deficit in the Netherlands.

Further influencing the market are regulations like the Affordable Rent Act, which affects the attractiveness and feasibility of different housing types for developers and buyers alike.

The Netherlands is significantly boosting its infrastructure spending, with Rijkswaterstaat (RWS), the national road authority, seeing its annual budget increase. This creates a predictable stream of work for Heijmans' infrastructure division, a key political driver for the company.

Government backing for major national projects, such as reinforcing the energy grid and expanding key transportation routes, is substantial. For instance, the Dutch government has allocated billions towards the energy transition, directly benefiting companies involved in grid modernization.

The political landscape in the Netherlands is marked by growing polarization, which can introduce policy volatility and complicate long-term strategic planning for construction firms like Heijmans. This environment means that government priorities and regulatory frameworks could change more frequently, impacting project timelines and investment decisions.

A notable development is the ongoing discussion around relaxing certain building regulations to boost housing construction. While intended to expedite delivery, these proposed changes could ignite public and industry debate regarding the potential impact on construction quality and safety standards. For example, a 2023 government target aimed to construct 900,000 new homes by 2030, highlighting the political pressure to accelerate development, which may involve regulatory adjustments.

EU Policy Influence and Green Deal

European Union policies, especially the ambitious European Green Deal, are fundamentally reshaping the construction sector. This includes directives like the Corporate Sustainability Reporting Directive (CSRD), which came into full effect for many companies in 2024, demanding more transparent and detailed sustainability disclosures. These regulations push companies like Heijmans towards greater sustainability, circular economy principles, and significant emissions reductions across their operations and supply chains.

The Green Deal's influence is tangible, driving demand for sustainable building materials and energy-efficient construction methods. For instance, the EU's Energy Performance of Buildings Directive (EPBD) revisions, agreed upon in early 2024, set stricter energy efficiency standards for new and existing buildings, directly impacting construction project specifications and renovation requirements. This regulatory push encourages innovation in green technologies and practices within the industry.

- EU Green Deal Mandates: Increased focus on decarbonization and circularity in construction projects.

- CSRD Impact: Enhanced reporting requirements for sustainability performance, effective from 2024 onwards for many.

- EPBD Revisions: Stricter energy efficiency standards for buildings, driving demand for sustainable construction.

- Circular Economy Push: Policies encouraging the reuse of materials and waste reduction in the building sector.

Public Spending and Budget Priorities

Government budgetary decisions, particularly those concerning housing, infrastructure, and sustainability, directly shape the landscape of public sector projects available to companies like Heijmans. For instance, the Dutch government's commitment to energy transition and climate goals, as evidenced by the Climate Agreement, translates into significant investment opportunities in sustainable infrastructure and renovation projects.

While some public spending areas might face scrutiny or reductions, substantial funds remain allocated to sectors directly aligned with Heijmans' core business. The 2024 Dutch budget, for example, continued to prioritize investments in infrastructure upgrades and housing development, recognizing their critical role in economic growth and societal well-being.

- Housing: Continued government focus on addressing housing shortages creates demand for construction and development projects.

- Infrastructure: Investments in road, rail, and water management projects remain a key budgetary item, offering opportunities for Heijmans' infrastructure division.

- Sustainability: Growing allocations for renewable energy infrastructure and energy-efficient building retrofits align with Heijmans' strategic direction.

- Public-Private Partnerships: Government initiatives encouraging PPPs in large-scale projects can provide Heijmans with access to significant, long-term contracts.

Political factors significantly influence Heijmans' operations, driven by Dutch government housing targets and infrastructure spending. The EU's Green Deal, with directives like the CSRD and EPBD revisions, is pushing for greater sustainability and energy efficiency, impacting construction standards and material choices. The 2024 Dutch budget continued to prioritize housing and infrastructure, with billions allocated to the energy transition, creating opportunities for companies like Heijmans involved in grid modernization and sustainable projects.

| Policy Area | Government Initiative | Impact on Heijmans | 2024/2025 Data/Target |

|---|---|---|---|

| Housing | Annual Housing Construction Target | Directly supports residential development business | 100,000 homes annually |

| Infrastructure | National Infrastructure Spending | Predictable work for infrastructure division | Increased annual budget for Rijkswaterstaat (RWS) |

| Sustainability | EU Green Deal / EPBD Revisions | Drives demand for sustainable materials and energy-efficient construction | Stricter energy efficiency standards for buildings |

| Budgetary Allocation | Dutch Government Budget | Funds allocated to housing, infrastructure, and energy transition | Continued prioritization of infrastructure upgrades and housing development |

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Heijmans, providing a comprehensive understanding of its operating landscape.

The Heijmans PESTLE Analysis offers a streamlined, actionable framework to identify and mitigate external threats, thereby alleviating the pain of unforeseen market shifts and regulatory changes.

Economic factors

The Dutch housing market is demonstrating a robust recovery in 2025, marked by a notable increase in home sales and upward pressure on property prices. This trend directly benefits Heijmans' property development segment, creating a more favorable environment for project viability and profitability.

Furthermore, a surge in building permits issued during early 2024 provides a strong indicator of an anticipated upswing in new construction output throughout 2025. For instance, the number of permits for new dwellings granted by Dutch municipalities rose by approximately 15% in the first half of 2024 compared to the same period in 2023, suggesting a pipeline of future projects for construction firms like Heijmans.

While the Dutch construction sector experienced a downturn in 2024, with output contracting, a rebound is anticipated for 2025. This recovery is expected to be driven by increased spending on non-residential projects and significant infrastructure development.

The construction and infrastructure sector is a vital component of the Netherlands' economy, consistently making a substantial contribution to its Gross Domestic Product. For instance, in 2023, the sector's output represented approximately 7.8% of the Dutch GDP, highlighting its foundational role.

Interest rate fluctuations directly affect Heijmans' operational landscape. For instance, a rise in interest rates, as seen with the European Central Bank's policy rate increasing from 0% to 4.5% between July 2022 and September 2023, makes financing larger construction projects more expensive. This also impacts potential homebuyers, potentially reducing demand for new housing due to decreased mortgage affordability.

Material and Labor Costs

Construction material prices have shown signs of stabilization and even decreases in some areas since the latter half of 2023. For instance, global steel prices saw a notable dip in late 2023, and lumber futures also experienced downward trends, offering some relief to project budgets.

Despite this stabilization in materials, the construction sector, including companies like Heijmans, continues to grapple with the persistent challenge of skilled labor availability and its associated costs. This shortage directly impacts project execution, potentially leading to delays and increased expenses, which can erode profit margins.

- Stabilizing Material Costs: Reports indicated a cooling in construction material inflation through 2023, with some key commodities like steel and timber showing price reductions.

- Labor Shortage Impact: The ongoing scarcity of skilled tradespeople remains a significant operational hurdle, affecting project timelines and increasing labor expenditure.

- Wage Pressures: To attract and retain talent in a competitive market, companies are likely facing continued upward pressure on wages for skilled construction workers.

- Project Profitability: The interplay between stabilizing material costs and rising labor expenses creates a complex environment for managing overall project profitability.

Inflationary Pressures and Consumer Purchasing Power

Inflationary pressures are a key consideration for Heijmans. While specific 2025 construction inflation figures are not yet finalized, broader economic outlooks for 2024 and early 2025 indicate a potential for moderate increases in household purchasing power. This could translate into improved consumer confidence and a stronger demand for new residential properties, which directly impacts Heijmans' sales volumes.

The interplay between inflation and purchasing power significantly shapes the housing market. As incomes potentially rise more than inflation, consumers may feel more financially secure, leading them to invest in new homes. This positive sentiment can boost demand for Heijmans' development projects.

- Consumer Confidence: Forecasts suggest a gradual recovery in consumer confidence through 2024 and into 2025, potentially supporting higher spending on durable goods like housing.

- Disposable Income: Expected modest wage growth, outpacing inflation in some sectors, could lead to an increase in real disposable income for households.

- Housing Demand: An uptick in purchasing power generally correlates with increased demand for new residential construction, a core market for Heijmans.

- Material Costs: While consumer purchasing power is a factor, Heijmans must also monitor construction material costs, which can be influenced by inflation and supply chain dynamics, impacting project profitability.

Economic factors present a mixed but generally improving outlook for Heijmans in 2025. While interest rate hikes in 2023 made financing more expensive, the stabilization of construction material prices since late 2023 offers some relief. The anticipated rebound in the Dutch construction sector, driven by infrastructure and non-residential projects, alongside a recovering housing market, suggests increased opportunities.

The Dutch housing market's recovery, with rising sales and prices in 2025, directly benefits Heijmans' property development. This is supported by a 15% increase in new dwelling permits in early 2024. Despite a 2024 construction output contraction, a rebound is expected in 2025, fueled by infrastructure spending, which constituted 7.8% of Dutch GDP in 2023.

Inflationary pressures remain a concern, though forecasts for 2024-2025 suggest moderate increases in purchasing power. This could boost consumer confidence and housing demand, positively impacting Heijmans. However, the persistent shortage of skilled labor continues to drive up costs and potentially delay projects.

| Economic Factor | 2023 Data/Trend | 2024 Outlook | 2025 Outlook | Impact on Heijmans |

|---|---|---|---|---|

| Housing Market Recovery | Robust recovery in 2025 | Upward trend | Continued growth | Increased property development viability |

| Construction Output | 7.8% of Dutch GDP (2023) | Anticipated rebound | Further growth | Increased project opportunities |

| Interest Rates | ECB rate 4.5% (Sept 2023) | Potential stabilization/slight decrease | Monitoring required | Affects project financing and mortgage affordability |

| Material Prices | Stabilizing/decreasing (late 2023) | Continued stabilization | Potential for slight increases | Cost management benefits |

| Labor Market | Skilled labor shortage | Persistent shortage | Continued challenge | Increased labor costs, potential delays |

Full Version Awaits

Heijmans PESTLE Analysis

The Heijmans PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of Heijmans' operating environment.

Sociological factors

The Netherlands is experiencing significant demographic shifts, with ongoing urbanization and an aging population. By 2023, over 90% of the Dutch population lived in urban areas, a trend expected to continue. This concentration fuels a substantial demand for housing and commercial spaces in cities.

Heijmans' strategic focus on creating attractive living environments directly addresses these societal trends. The company's commitment to developing diverse residential and commercial projects aligns with the growing need for quality urban development, catering to an increasingly urbanized and aging populace.

Societal values are increasingly prioritizing sustainability, directly impacting the demand for eco-friendly living and working spaces. This trend is evident in the growing preference for green buildings, with a significant portion of new construction projects in Europe now incorporating sustainable features. For instance, in 2024, over 60% of new commercial real estate developments in the Netherlands, Heijmans' primary market, were designed to meet high energy efficiency standards, reflecting a clear consumer and business push for environmentally conscious construction.

The construction sector's significant footprint on local communities necessitates a strong focus on public acceptance and engagement. Heijmans, recognizing this, actively involves itself in community initiatives, aiming to build trust and foster goodwill. For instance, their 2024 sustainability report highlighted a 15% increase in community consultation hours compared to the previous year.

Heijmans' commitment to community engagement is demonstrated through projects that directly benefit local areas, such as infrastructure upgrades and the creation of improved public spaces. This proactive approach helps to build positive relationships and enhance their social license to operate. In 2024, Heijmans completed 30 community-focused projects across its operating regions, with a reported 85% positive feedback rate from local stakeholders.

Workforce Attraction and Retention

The construction industry, including companies like Heijmans, grapples with a significant shortage of skilled workers, impacting its ability to attract and keep talent. This is a critical sociological factor affecting operational capacity.

Heijmans recognizes this challenge and actively works on recruiting new technical service employees while also focusing on retaining its current workforce. These efforts are vital for ensuring they have the necessary manpower to deliver projects successfully.

For instance, in 2024, the Dutch construction sector reported a shortage of approximately 50,000 skilled workers, a figure that continues to put pressure on companies. Heijmans' investment in employee development and creating a positive work environment is a strategic response to this trend.

- Skilled Labor Shortage: The construction sector, a key area for Heijmans, faces a persistent deficit in skilled personnel.

- Recruitment Efforts: Heijmans is actively seeking to hire new technical service employees to bolster its workforce.

- Retention Strategies: Retaining existing colleagues is a priority for Heijmans to maintain operational continuity.

- Impact on Operations: Addressing workforce challenges is essential for Heijmans to ensure project delivery and maintain its competitive edge.

Safety and Well-being in Construction

Societal expectations for workplace safety are particularly high in the construction industry due to its inherent risks. Heijmans actively cultivates a robust safety culture, prioritizing employee well-being through rigorous adherence to safety protocols. This commitment can even lead to project delays if safety standards are not fully met, reflecting a deep-seated societal value placed on preventing accidents.

Heijmans' dedication to safety is not just a compliance issue but a core value that resonates with public perception and employee trust. In 2023, the company reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR), aiming for zero incidents. This focus on safety contributes to Heijmans' reputation as a responsible employer and partner.

- Societal Demand for Safety: Public and employee pressure for safe working environments in construction is a significant driver for companies like Heijmans.

- Heijmans' Safety Culture: The company invests in training and strict protocols to foster a proactive safety mindset among its workforce.

- Impact of Safety Standards: Adherence to high safety standards, even at the cost of project timelines, demonstrates a commitment to well-being that aligns with societal expectations.

- Performance Metrics: Heijmans tracks safety performance closely, with a goal of continuous improvement in reducing workplace incidents.

The Dutch population is increasingly urbanized, with over 90% residing in urban areas by 2023, driving demand for housing and commercial spaces. Societal values increasingly prioritize sustainability, influencing a preference for green buildings; in 2024, over 60% of new Dutch commercial real estate developments met high energy efficiency standards. Heijmans addresses these trends by developing diverse residential and commercial projects that cater to urban living and environmental consciousness.

The construction sector faces a significant skilled labor shortage, with the Netherlands reporting a deficit of approximately 50,000 workers in 2024. Heijmans actively recruits and retains technical service employees to counter this, investing in employee development and a positive work environment to ensure project delivery. This focus on workforce management is crucial for maintaining operational capacity and competitiveness.

Societal expectations for workplace safety are paramount in construction. Heijmans cultivates a robust safety culture, prioritizing employee well-being through strict protocols, which aligns with public perception and employee trust. The company's commitment to safety is reflected in its continuous efforts to reduce workplace incidents, aiming for zero accidents, as evidenced by a reported reduction in its Lost Time Injury Frequency Rate (LTIFR) in 2023.

| Sociological Factor | Heijmans' Response/Strategy | Supporting Data (2023-2024) |

|---|---|---|

| Urbanization & Housing Demand | Developing diverse residential and commercial projects in urban areas. | Over 90% of Dutch population urbanized (2023); strong demand for urban spaces. |

| Sustainability Values | Focus on eco-friendly construction and green buildings. | Over 60% of new Dutch commercial developments met high energy efficiency standards (2024). |

| Skilled Labor Shortage | Active recruitment and retention of technical staff; employee development. | Netherlands construction sector shortage of ~50,000 skilled workers (2024). |

| Workplace Safety Expectations | Cultivating a robust safety culture and adhering to strict protocols. | Reported reduction in LTIFR (2023); goal of zero incidents. |

Technological factors

Heijmans is actively embracing digital construction, pouring resources into a comprehensive digital transformation. This includes the widespread implementation of Building Information Modeling (BIM) across its projects, which allows for a more integrated and detailed approach to design and construction. They are also rolling out new digital platforms designed to streamline project management, from initial planning to final delivery, aiming for significant efficiency gains.

The strategic adoption of these digital tools is already yielding tangible benefits for Heijmans. By enhancing collaboration among project stakeholders through shared digital environments, the company is improving communication and reducing potential errors. This digital integration ultimately contributes to smoother project execution and a higher quality of project delivery, a key factor in their competitive strategy.

Heijmans is a leader in sustainable construction, pioneering materials like geopolymer concrete and self-healing concrete. These innovations are crucial for reducing the significant CO2 footprint associated with traditional concrete production, which accounts for roughly 8% of global CO2 emissions. Their commitment to these green materials directly supports the burgeoning circular construction movement.

Heijmans is increasingly adopting modular and industrialized construction methods, especially for new housing projects. This shift aims to significantly speed up building timelines and lower overall costs, directly addressing the urgent need to meet national housing targets. For instance, in 2024, the company reported progress in its modular housing initiatives, contributing to the efficient delivery of hundreds of homes.

Smart Infrastructure and Energy Solutions

Technological advancements in smart city concepts and energy infrastructure present significant opportunities for Heijmans. The company's expertise in managing and operating complex systems, such as energy grids and traffic installations, is particularly relevant as cities increasingly adopt integrated smart solutions. For instance, the European Union's push for smart grid deployment, with investments projected to reach tens of billions of euros by 2030, creates a fertile ground for Heijmans' capabilities.

Heijmans' proficiency in energy infrastructure is crucial for addressing challenges like grid congestion. As renewable energy sources become more prevalent, the need for intelligent grid management to balance supply and demand intensifies. In 2024, the Netherlands alone saw a substantial increase in renewable energy capacity, highlighting the growing demand for sophisticated energy solutions that Heijmans can provide.

- Smart City Integration: Heijmans can leverage technological advancements to offer integrated solutions for smart city infrastructure, including energy management and traffic flow optimization.

- Energy Grid Modernization: The company's expertise in energy infrastructure is vital for upgrading and managing complex energy grids, a growing need driven by renewable energy integration.

- Addressing Congestion: Heijmans' capabilities directly address grid congestion issues, a critical challenge in modernizing energy systems.

- Digitalization in Construction: The broader trend of digitalization in the construction sector, including the use of BIM and IoT, offers Heijmans opportunities to improve efficiency and project delivery in smart infrastructure projects.

Data Analytics and Monitoring Tools

Heijmans leverages advanced data analytics and monitoring tools, such as the Waste Monitor dashboard, to gain granular insights into waste management across its projects. This technology provides real-time data on waste streams, separation rates, and associated CO2e emissions.

These data-driven insights empower Heijmans to make more informed decisions regarding sustainability initiatives and to effectively track progress towards its environmental targets. For instance, by monitoring separation percentages, the company can identify areas for improvement in recycling and resource efficiency, directly impacting its environmental footprint.

The implementation of such tools is crucial in the current landscape, where regulatory bodies and stakeholders increasingly demand transparency and measurable performance in sustainability. Heijmans' proactive adoption of these technologies positions it to meet these evolving expectations and to drive operational excellence.

- Waste Monitor Dashboard: Provides project-level data on waste flows and separation rates.

- CO2e Emission Tracking: Enables monitoring of carbon emissions linked to waste management.

- Data-Driven Decision Making: Facilitates informed choices for improving sustainability performance.

- Performance Tracking: Allows for continuous assessment of progress against environmental goals.

Heijmans is heavily invested in digital transformation, implementing Building Information Modeling (BIM) and new digital platforms to boost efficiency and collaboration. This focus on digitalization is key to their strategy for smoother project execution and higher quality delivery.

The company is also leveraging technology for sustainability, using tools like its Waste Monitor dashboard to track waste streams and CO2e emissions, enabling data-driven decisions for environmental improvements.

Heijmans' expertise in energy infrastructure and smart city concepts aligns with significant market opportunities, such as the EU's smart grid deployment, projected to attract tens of billions of euros by 2030, and the increasing need for intelligent grid management due to renewable energy growth.

| Technological Factor | Heijmans' Action/Capability | Market Opportunity/Impact |

|---|---|---|

| Digitalization in Construction | BIM implementation, digital platforms | Improved efficiency, collaboration, project delivery |

| Data Analytics for Sustainability | Waste Monitor dashboard, CO2e tracking | Informed sustainability decisions, performance tracking |

| Smart City & Energy Infrastructure | Smart grid integration, energy management | Leveraging EU smart grid investments, addressing renewable energy integration needs |

Legal factors

The Omgevingswet, implemented in January 2024, streamlines Dutch environmental and planning legislation, promising quicker permit processes for construction projects. This consolidation of over 25 existing laws is designed to simplify regulations for companies like Heijmans.

However, the practical application of the Omgevingswet varies significantly between Dutch municipalities, meaning Heijmans must adapt its approach to local interpretations and procedures. This uneven rollout presents a challenge in predicting and managing project timelines consistently across different regions.

The Building Quality Assurance Act (Wkb) is set to increase builder liability starting in 2025, meaning Heijmans will face greater accountability for construction defects. This new legislation demands a significant ramp-up in their internal quality control measures to ensure compliance and mitigate risks.

Heijmans must adapt by implementing more rigorous checks throughout the construction lifecycle, from material sourcing to final handover. Failure to do so could result in substantial financial penalties and reputational damage, especially as enforcement tightens.

The Nearly Energy Neutral Buildings (BENG) standards, in effect since 2021, are slated for further tightening in 2025. This means new buildings will face even stricter limits on energy consumption and will be required to incorporate a larger proportion of renewable energy sources. This regulatory shift directly encourages more sustainable and energy-efficient architectural approaches.

For Heijmans, this presents a clear imperative to innovate in sustainable construction methods. The anticipated 2025 BENG updates are expected to demand a reduction in the maximum energy performance coefficient (EPC) by approximately 10-15%, pushing the envelope for energy-neutral designs. Companies failing to adapt risk non-compliance and potential market disadvantage.

Affordable Rent Act and Housing Market Regulations

The Affordable Rent Act, implemented in July 2024, extends rent control to the mid-rental market. This move could influence the supply of rental units and necessitate developers to re-evaluate their approaches. For instance, in the Netherlands, where Heijmans operates, the housing market has seen significant shifts, with rental prices in some cities increasing by over 10% year-on-year in early 2024, making such regulations particularly impactful.

Future governmental policies are likely to involve further adjustments to rental calculations as a strategy to foster market stability. This regulatory environment demands that companies like Heijmans remain agile, adapting their development plans and investment strategies to comply with evolving housing market regulations.

- Affordable Rent Act Impact: Expanded rent regulation to mid-rent segment from July 2024.

- Developer Strategy Adjustment: Potential reduction in rental property availability, requiring strategic shifts.

- Market Stabilization Efforts: Government may further revise rental calculation methods.

- Economic Context: Rental price inflation in key European markets (e.g., Netherlands) highlights the significance of these regulations.

Labor Laws and Safety Regulations

The Netherlands has robust labor laws and stringent health and safety regulations specifically tailored for the construction industry. These legal frameworks dictate everything from working hours and employee rights to site safety protocols and accident prevention measures. Heijmans, like other construction firms, must adhere strictly to these mandates to ensure a safe working environment and avoid legal repercussions.

Heijmans' proactive approach to safety, including instances where they have paused operations due to safety concerns, highlights their dedication to complying with these legal requirements. For example, in 2023, the Dutch Inspectorate SZW reported a decrease in fatal accidents in the construction sector, attributing this in part to increased enforcement of safety regulations. This underscores the critical nature of compliance for companies like Heijmans.

- Compliance with Dutch labor laws is non-negotiable for Heijmans, covering aspects like fair wages, working hours, and employee benefits.

- Health and safety regulations, such as those outlined by the Arbowet (Working Conditions Act), mandate risk assessments and the implementation of safety measures on all construction sites.

- Failure to comply can result in significant fines, project delays, and reputational damage. In 2024, the Inspectorate SZW continued its focus on construction site safety, issuing numerous fines for violations.

The Dutch legal landscape presents both opportunities and challenges for Heijmans. The Omgevingswet, effective January 2024, aims to simplify environmental and planning permits, potentially speeding up project approvals. However, its varied municipal implementation requires Heijmans to navigate local nuances. The Building Quality Assurance Act (Wkb), starting in 2025, will elevate builder liability, necessitating enhanced quality control to avoid penalties.

Stricter Nearly Energy Neutral Buildings (BENG) standards, anticipated for 2025, will push for greater energy efficiency, requiring Heijmans to invest in sustainable building innovations. The Affordable Rent Act, active since July 2024, extends rent controls, potentially impacting rental property development strategies and demanding agility in response to housing market regulations.

Heijmans must also strictly adhere to Dutch labor laws and construction site safety regulations, as enforced by bodies like the Inspectorate SZW. Non-compliance can lead to substantial fines and reputational harm. For instance, the Inspectorate SZW continued its focus on construction site safety in 2024, issuing numerous fines for violations.

| Legislation | Effective Date | Key Impact on Heijmans | Regulatory Focus (2024-2025) |

|---|---|---|---|

| Omgevingswet | January 2024 | Streamlined permits, but requires adaptation to municipal differences. | Permit process efficiency, environmental compliance. |

| Building Quality Assurance Act (Wkb) | 2025 | Increased builder liability, demanding enhanced quality control. | Construction defect prevention, accountability. |

| Nearly Energy Neutral Buildings (BENG) | Ongoing (Stricter 2025) | Need for innovation in sustainable and energy-efficient construction. | Energy performance standards, renewable energy integration. |

| Affordable Rent Act | July 2024 | Potential impact on rental property development strategies. | Rent control, housing market stability. |

| Labor & Safety Laws (e.g., Arbowet) | Ongoing | Strict adherence to worker rights and site safety protocols. | Worker safety, accident prevention, compliance enforcement. |

Environmental factors

Heijmans is pushing hard to achieve climate neutrality across its operations and supply chain by 2040, setting a benchmark ahead of many national goals. This commitment is backed by concrete actions, as evidenced by their substantial reductions in Scope 1 and 2 CO2e emissions. The company actively tracks and shares its progress, demonstrating a dedication to transparency in its environmental efforts.

The Dutch government's ambitious target of 50% circularity in public tenders by 2030 significantly impacts Heijmans, pushing for greater emphasis on recycled and reusable materials in its construction projects. This directive directly shapes how Heijmans sources its materials and manages waste streams, encouraging innovation in sustainable building practices.

Heijmans is actively investing in developing and implementing circular construction processes and comprehensive material registers. For example, by 2024, Heijmans reported increasing its use of secondary materials in projects, aiming to reduce reliance on virgin resources and minimize environmental impact.

Heijmans is actively enhancing its environmental stewardship by prioritizing water management and biodiversity. This includes a keen focus on water quality, maintaining ecological balance, optimizing water usage, and ensuring water safety across its operations. A notable initiative is their experimentation with rainwater reuse at residential construction sites, aiming to reduce reliance on potable water sources.

Furthermore, Heijmans collaborates on developing robust principles designed to protect and improve soil conditions. These efforts directly contribute to fostering biodiversity and bolstering climate adaptation strategies, recognizing the interconnectedness of healthy ecosystems and sustainable development.

Sustainable Materials and Waste Management

Heijmans is actively integrating sustainable materials, such as geopolymer concrete, into its projects to reduce its environmental footprint. This focus extends to waste management, exemplified by their Waste Monitor dashboard, which helps track and minimize construction waste. In 2023, Heijmans reported a 12% reduction in waste generated per cubic meter of concrete produced compared to the previous year, showcasing tangible progress in this area.

The company's commitment to circularity is further demonstrated by the construction of Europe's most sustainable asphalt plant. This facility is designed for significantly lower emissions, targeting a 70% reduction in CO2 compared to conventional plants. By 2024, Heijmans aims to have 50% of its asphalt production utilize recycled materials.

- Sustainable Material Innovation: Heijmans' adoption of geopolymer concrete contributes to a lower carbon footprint in construction.

- Waste Reduction Technology: The Waste Monitor dashboard provides actionable data for minimizing construction site waste.

- Circular Economy Leadership: Operating Europe's most sustainable asphalt plant underscores a commitment to resource efficiency and reduced emissions.

- Recycled Material Targets: Heijmans aims to increase the use of recycled materials in asphalt production to 50% by 2024.

Energy Transition and Green Infrastructure

Heijmans is actively contributing to the energy transition by developing essential energy infrastructure. This involves creating and managing energy grids for clients, a critical step in accommodating the growing demand for renewable energy sources.

The company is also focused on innovative solutions to address challenges like grid congestion, a common issue as more intermittent renewable energy is brought online. By integrating renewable energy solutions into its diverse projects, Heijmans is helping clients navigate this complex landscape.

- Grid Development: Heijmans is involved in building and maintaining energy grids, supporting the integration of renewables.

- Renewable Integration: The company incorporates green energy solutions into its construction and development projects.

- Grid Congestion Solutions: Heijmans is developing innovative approaches to manage and alleviate grid congestion.

For instance, in 2024, the Dutch government continued to emphasize investments in grid expansion and modernization, with significant funding allocated to tackle grid congestion, creating a favorable environment for Heijmans' expertise in this area.

Heijmans is actively driving sustainability by aiming for climate neutrality by 2040, significantly reducing CO2 emissions and increasing the use of recycled materials. The company's commitment to circularity is evident in initiatives like Europe's most sustainable asphalt plant, targeting a 70% CO2 reduction. By 2024, Heijmans aims for 50% recycled material use in asphalt production, demonstrating tangible progress in environmental stewardship and resource efficiency.

| Environmental Factor | Heijmans' Action/Target | Data/Year |

|---|---|---|

| Climate Neutrality | Achieve climate neutrality across operations and supply chain | By 2040 |

| Circular Economy | Increase use of recycled materials in asphalt production | 50% by 2024 |

| Emissions Reduction | Target CO2 reduction at sustainable asphalt plant | 70% compared to conventional plants |

| Waste Management | Reduce waste generated per cubic meter of concrete | 12% reduction reported in 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable international organizations, national statistical agencies, and leading market research firms. This ensures a comprehensive understanding of political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks relevant to your business.