HDFC Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HDFC Bank Bundle

HDFC Bank boasts a formidable market presence and a robust digital infrastructure, but faces increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any stakeholder looking to navigate the Indian banking sector.

Want the full story behind HDFC Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HDFC Bank's extensive physical footprint, comprising thousands of branches and ATMs nationwide, including expanding into semi-urban and rural regions, ensures broad customer accessibility and supports diversified revenue generation. This vast network is a significant strength, fostering financial inclusion across India.

As India's largest bank by assets and a globally significant player by market capitalization, HDFC Bank commands a leading position in the private banking sector. This market leadership underscores its robust financial health and the strong confidence investors place in its operations, a testament to its strategic positioning and consistent performance.

HDFC Bank consistently delivers strong financial results, showcasing impressive year-on-year growth in net profit and net interest income. For the fiscal year ending March 31, 2024, the bank reported a net profit of ₹46,074 crore, a notable increase from the previous year.

The bank's commitment to maintaining high asset quality is evident in its consistently low non-performing asset (NPA) ratio, which stood at 1.26% as of March 31, 2024. This positions HDFC Bank favorably within the Indian banking sector, highlighting effective risk management practices.

This robust financial performance, coupled with superior asset quality, creates a strong foundation for HDFC Bank's sustained growth and resilience, even amidst economic volatility.

HDFC Bank boasts a formidable brand reputation, consistently earning high customer satisfaction ratings and a plethora of industry accolades. This strong brand equity is a significant advantage, allowing the bank to attract and retain a loyal customer base in a competitive landscape. For instance, HDFC Bank was recognized as India's Best Bank by Euromoney Awards for Excellence in 2023, underscoring its market standing.

Strategic Merger with HDFC Ltd.

The strategic merger with HDFC Ltd., completed in July 2023, was a monumental step for HDFC Bank. This amalgamation immediately boosted its market capitalization, making it one of India's largest banks by market value. The integration significantly broadened its product offerings, especially in housing finance, a segment where HDFC Ltd. held a dominant position.

This merger has transformed HDFC Bank into a more comprehensive financial services powerhouse. Customers now benefit from a wider array of integrated solutions, from banking to home loans, all under a single umbrella. The combined entity is expected to leverage cross-selling opportunities and achieve significant cost synergies, further solidifying its market leadership.

- Enhanced Market Capitalization: Post-merger, HDFC Bank's market capitalization surged, positioning it among the top global banks.

- Expanded Product Portfolio: The integration brought HDFC Ltd.'s extensive housing finance business into HDFC Bank's fold, creating a formidable presence in the mortgage market.

- Increased Customer Base: The combined entity now serves an even larger customer base, offering a more holistic suite of financial products.

- Synergy Potential: Significant operational and cost synergies are anticipated from the merger, driving future profitability and efficiency.

Advanced Digital Transformation & Technology Adoption

HDFC Bank's advanced digital transformation is a significant strength. The bank has poured substantial resources into building a cutting-edge digital banking infrastructure, integrating technologies like artificial intelligence. This commitment is evident in programs like the Digital Factory, designed to streamline operations, and improvements to customer-facing platforms such as PayZapp and SmartHub Vyapar.

These digital initiatives directly translate into enhanced operational efficiency and a superior customer experience. For instance, by the end of FY24, HDFC Bank's digital channels accounted for a substantial portion of its retail loan disbursements, showcasing the success of its tech-first approach. This focus positions HDFC Bank to effectively leverage emerging digital opportunities within the financial sector.

Key aspects of HDFC Bank's digital prowess include:

- Significant Investment: Consistent and substantial capital allocation towards digital infrastructure and AI integration.

- Platform Enhancements: Continuous improvement of platforms like PayZapp for retail payments and SmartHub Vyapar for merchant services.

- Operational Efficiency: Digital Factory model driving faster product development and streamlined internal processes.

- Customer Experience: Digital channels are increasingly the primary touchpoint for customers, improving accessibility and convenience.

HDFC Bank's extensive physical reach, with thousands of branches and ATMs across India, including in semi-urban and rural areas, ensures widespread customer access and diverse revenue streams. This vast network is a key strength, promoting financial inclusion throughout the country.

As India's largest bank by assets, HDFC Bank holds a dominant position in the private banking sector, reflecting its strong financial health and investor confidence. Its market leadership is a testament to its strategic positioning and consistent performance.

The bank consistently reports robust financial results, with strong year-on-year growth in net profit. For the fiscal year ending March 31, 2024, HDFC Bank announced a net profit of ₹46,074 crore.

HDFC Bank maintains high asset quality, evidenced by its low non-performing asset (NPA) ratio of 1.26% as of March 31, 2024, highlighting effective risk management.

The bank's formidable brand reputation, backed by high customer satisfaction and industry awards such as being named India's Best Bank by Euromoney Awards for Excellence in 2023, allows it to attract and retain a loyal customer base.

The strategic merger with HDFC Ltd. in July 2023 significantly boosted HDFC Bank's market capitalization and expanded its product offerings, particularly in housing finance, creating a more comprehensive financial services provider.

HDFC Bank's significant investment in digital transformation, including AI integration and platform enhancements like PayZapp and SmartHub Vyapar, drives operational efficiency and improves customer experience. Digital channels accounted for a substantial portion of retail loan disbursements by the end of FY24.

| Metric | Value (as of March 31, 2024) | Significance |

| Net Profit (FY24) | ₹46,074 crore | Demonstrates strong profitability and growth. |

| NPA Ratio | 1.26% | Indicates superior asset quality and effective risk management. |

| Market Capitalization | One of India's largest banks (post-merger) | Reflects significant scale and investor confidence. |

What is included in the product

Maps out HDFC Bank’s market strengths, operational gaps, and risks, offering a comprehensive view of its competitive landscape and strategic positioning.

Uncovers key vulnerabilities and competitive threats, enabling proactive risk mitigation and strategic adjustments for HDFC Bank.

Weaknesses

The strategic merger with HDFC Limited, while beneficial long-term, has introduced immediate integration hurdles. This has led to a temporary deceleration in loan expansion and a noticeable increase in the bank's credit-deposit ratio, which stood at 110.1% as of March 31, 2024.

HDFC Bank is diligently working to recalibrate its credit-deposit ratio, aiming to bring it down to a more sustainable level, currently targeting around 100%. The bank is also focused on managing the elevated cost of borrowings inherited from the acquired entity, a key challenge in this post-merger phase.

Successfully navigating this period necessitates astute balance sheet management and forward-thinking strategic planning to ensure financial stability and continued growth momentum.

While HDFC Bank has made strides in expanding its network, its penetration in deeply rural areas remains less robust compared to certain public sector banks. A significant portion of its customer base and business volume is still concentrated in metropolitan and Tier-1 urban centers.

This limited footprint in underserved rural markets, a segment experiencing increasing economic activity, represents a missed opportunity for HDFC Bank to capture new customers and diversify its market share. As of the fiscal year ending March 31, 2024, HDFC Bank operated 8,343 branches, with a substantial number located in urban and semi-urban areas, highlighting the ongoing challenge of reaching the deepest rural segments.

While HDFC Bank is a digital banking leader, occasional system outages have impacted customer experience, as seen in reports of service disruptions. These technical glitches, though infrequent, can erode customer trust and create operational hurdles. The bank's heavy reliance on sophisticated digital infrastructure also presents significant cybersecurity vulnerabilities.

Intensifying Competition and Market Share Growth

HDFC Bank operates in an increasingly crowded Indian banking landscape. The sector is seeing intensified competition not only from traditional public sector banks modernizing their operations but also from nimble new-age digital banks and established Non-Banking Financial Companies (NBFCs). This dynamic environment presents a significant challenge for HDFC Bank in its pursuit of aggressive market share expansion.

For instance, by the end of fiscal year 2024, the Indian banking sector saw a notable rise in digital transactions and a growing presence of fintech players, directly impacting traditional banking models. HDFC Bank, despite its strong market position, must continually adapt its strategies to fend off rivals who are often quicker to adopt new technologies and customer acquisition models.

The bank's ability to maintain its leadership hinges on its capacity for relentless innovation and the implementation of robust competitive strategies. This includes:

- Developing unique digital offerings to attract and retain customers.

- Leveraging its extensive branch network while enhancing digital accessibility.

- Formulating agile pricing and product strategies to counter competitor moves.

- Focusing on customer-centricity to build loyalty in a price-sensitive market.

Aggressive Cross-Selling Practices

HDFC Bank has faced scrutiny regarding its cross-selling strategies. While aiming to deepen customer relationships and increase revenue, an overly aggressive approach to pushing products like credit cards and personal loans has drawn criticism. For instance, in the fiscal year ending March 2024, HDFC Bank's retail loan book grew by a significant 21.3%, indicating strong product uptake, but this rapid expansion necessitates careful monitoring to ensure customer satisfaction isn't compromised.

Such practices, if not balanced with customer needs, can lead to negative perceptions. A potential consequence is a decline in customer loyalty and an increase in complaints, impacting the bank's reputation. This could manifest in lower net promoter scores or an uptick in customer service escalations, as observed in industry-wide trends where aggressive sales targets sometimes outweigh customer suitability assessments.

The challenge lies in striking a balance. Effective cross-selling should align with customer financial goals and not feel intrusive. For HDFC Bank, this means ensuring sales teams are adequately trained on product suitability and ethical sales practices. The bank's focus on digital channels in 2024 offers an opportunity to personalize product recommendations, potentially mitigating aggressive sales perceptions.

- Customer Dissatisfaction Risk: Aggressive cross-selling can alienate customers, leading to negative experiences and potential churn.

- Reputational Damage: Persistent aggressive tactics can harm the bank's brand image and trustworthiness in the market.

- Regulatory Scrutiny: Overly aggressive sales practices can attract attention from financial regulators, potentially leading to penalties.

- Increased Operational Costs: Managing customer complaints and resolving issues arising from mis-sold products can increase operational expenses.

The integration of HDFC Limited has led to a higher credit-deposit ratio, reaching 110.1% as of March 31, 2024, necessitating careful balance sheet management. While the bank is a digital leader, occasional system outages and cybersecurity vulnerabilities pose risks to customer trust and operations. Intense competition from public sector banks, new-age digital banks, and NBFCs requires continuous innovation to maintain market share.

What You See Is What You Get

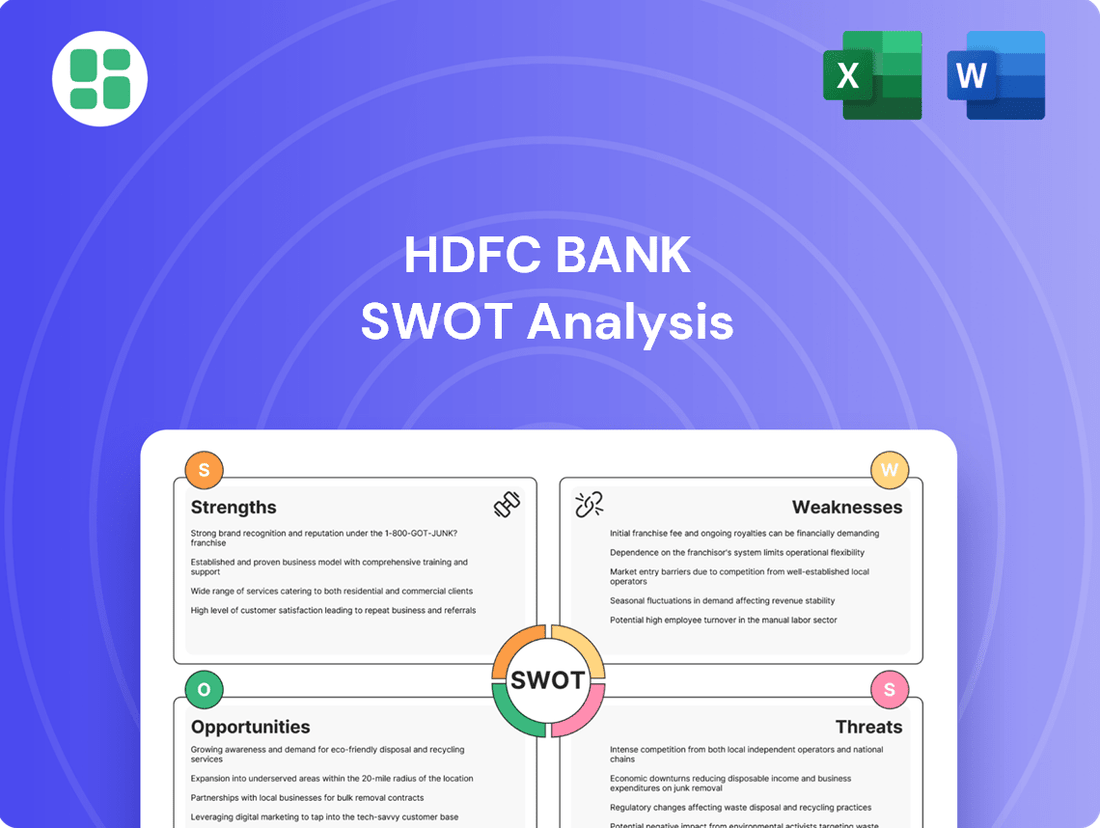

HDFC Bank SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at HDFC Bank's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details HDFC Bank's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for HDFC Bank's strategic planning.

Opportunities

India's sustained economic expansion, projected to be one of the fastest among major economies in 2024 and 2025, creates a fertile ground for HDFC Bank's corporate banking services. The banking sector is anticipated to see credit growth in the double digits, providing a substantial opportunity for HDFC Bank to deepen its relationships with businesses of all sizes.

HDFC Bank can capitalize on this by offering tailored financial solutions to meet the evolving needs of small, medium, and large enterprises, thereby capturing a larger share of this expanding market. This growth trajectory in the Indian economy directly translates into significant avenues for business development within HDFC Bank's corporate banking division.

As urban banking markets become increasingly saturated, the untapped potential in semi-urban and rural areas presents a significant growth opportunity for HDFC Bank. Increased financial literacy and rising disposable incomes in these regions are paving the way for greater adoption of banking services.

HDFC Bank's strategy to leverage its hybrid digital-physical network is well-suited to capture this market. This approach allows for efficient customer acquisition and substantial deposit growth, effectively extending its reach into previously underserved populations.

This strategic expansion not only champions financial inclusion but also diversifies HDFC Bank's customer base, reducing reliance on mature urban markets and fostering more resilient growth.

HDFC Bank can tap into India's burgeoning fintech sector through strategic alliances, enabling the co-creation of novel intellectual property and investments in nimble fintech ventures. For instance, the bank's digital initiatives, such as its mobile banking app, already serve millions, and further integration with fintech solutions could unlock new revenue streams and customer segments.

Embracing Artificial Intelligence and Machine Learning presents a significant avenue for growth, allowing HDFC Bank to develop deeply personalized financial products and services. This technological leap can also streamline internal operations, potentially reducing costs, and bolster customer data security, a critical factor in maintaining trust in the digital age.

Cross-Selling Synergies Post-Merger

The merger of HDFC Bank with HDFC Limited unlocks substantial cross-selling opportunities, leveraging a combined customer base and an expanded product suite. This integration allows the bank to offer a wider array of financial services, from retail loans and wealth management to credit cards, to millions of new customers, particularly those within HDFC Limited's strong mortgage segment.

Post-merger, HDFC Bank can capitalize on several key synergies:

- Expanded Customer Reach: The combined entity now serves over 120 million customers, presenting a vast pool for upselling and cross-selling banking and financial products.

- Mortgage-Led Growth: HDFC Limited's significant mortgage portfolio, representing approximately ₹6.7 trillion as of March 31, 2023, provides a strong foundation to offer other banking products like savings accounts, credit cards, and personal loans to these home loan customers.

- Wealth Management Integration: The merger facilitates the integration of HDFC Limited's wealth management services with HDFC Bank's offerings, creating a more comprehensive proposition for high-net-worth individuals and affluent customers.

- Digital Platform Enhancement: Opportunities exist to integrate HDFC Limited's customer base onto HDFC Bank's digital platforms, enhancing engagement and enabling seamless cross-selling of digital banking services.

International Market Expansion

While HDFC Bank holds a commanding position within India, its international footprint remains comparatively modest. This presents a significant opportunity for growth, leveraging its robust financial standing and well-recognized brand to explore expansion into global markets.

The bank can strategically pursue international ventures through various avenues, including forging partnerships with established foreign financial institutions or undertaking targeted acquisitions to broaden its revenue base and global reach. For instance, by the end of fiscal year 2024, HDFC Bank had a presence in 14 countries, a number that could be substantially increased.

- Expanding into high-growth emerging markets in Asia and Africa could tap into new customer segments.

- Establishing digital banking hubs in key financial centers like London or Singapore can enhance global accessibility.

- Acquiring smaller, regional banks in developed markets could offer a faster route to market penetration and customer acquisition.

- The bank's strong capital adequacy ratio, reported at 19.17% as of March 31, 2024, provides a solid foundation for such international investments.

India's robust economic growth, projected to be among the fastest globally in 2024 and 2025, fuels significant opportunities for HDFC Bank's corporate banking services, with credit growth expected in the double digits.

The bank can leverage its hybrid digital-physical model to capture untapped potential in semi-urban and rural markets, driving deposit growth and financial inclusion.

Strategic alliances with fintech firms and the adoption of AI/ML can unlock new revenue streams and enhance personalized customer offerings.

The merger with HDFC Limited presents substantial cross-selling opportunities, expanding its customer base to over 120 million and leveraging a ₹6.7 trillion mortgage portfolio for growth.

HDFC Bank can also explore international expansion into emerging markets, supported by its strong capital adequacy ratio of 19.17% as of March 31, 2024.

Threats

HDFC Bank faces a growing challenge from agile digital-first banks and modernized public sector banks (PSBs) in India. These competitors are rapidly expanding their reach and customer base, often with more competitive pricing and innovative digital offerings, directly impacting HDFC Bank's market share and profitability.

The increasing digital penetration and the rise of fintech solutions mean that traditional banking models are under pressure. For instance, by Q4 FY24, digital transactions constituted a significant portion of banking activity across the industry, a trend that PSBs are also leveraging through their modernization efforts, presenting a direct threat to HDFC Bank's established customer relationships and revenue streams.

The banking sector faces constant evolution in regulations from bodies like the Reserve Bank of India (RBI). For instance, recent directives in 2024 concerning capital adequacy ratios or digital lending norms could necessitate adjustments to HDFC Bank's operational framework and product offerings, potentially impacting its growth strategies.

Maintaining compliance with these dynamic regulatory landscapes presents a substantial and continuous challenge. The cost associated with implementing new compliance measures, such as enhanced data security protocols or reporting requirements, adds to the operational burden and can affect the bank's bottom line.

Any misstep in adhering to these evolving rules can lead to penalties, reputational damage, or even operational restrictions. For HDFC Bank, staying ahead of these changes is crucial to avoid disruptions and maintain its market position, especially as the regulatory environment tightens on areas like cybersecurity and customer data protection.

Economic slowdowns in India and globally pose a significant threat. Rising interest rates and tightening liquidity can curb loan demand and increase borrowing costs for HDFC Bank, potentially impacting its net interest margins. For instance, the Reserve Bank of India’s repo rate has seen adjustments, influencing the cost of funds for banks.

The bank's asset quality could also be tested during periods of economic contraction, as borrowers may struggle to repay loans. The post-merger integration phase, while promising, adds a layer of complexity, making the bank potentially more susceptible to these macroeconomic headwinds. HDFC Bank’s performance is intrinsically linked to the overall health of the Indian economy.

Increasing Non-Performing Assets (NPAs)

While HDFC Bank has historically managed its asset quality well, a significant rise in non-performing assets (NPAs) poses a notable threat. This risk is amplified by the recent large-scale merger with HDFC Ltd. and potential economic headwinds. An increase in NPAs could strain the bank's profitability and weaken its balance sheet.

For instance, as of March 31, 2024, HDFC Bank's gross NPAs stood at 1.26% of gross advances. A material deterioration from this level, perhaps driven by sectors heavily impacted by economic slowdowns, would necessitate more robust provisioning and could reduce lending capacity.

- Asset Quality Deterioration: An increase in NPAs beyond current manageable levels could significantly impact profitability.

- Merger Integration Challenges: Integrating the merged entity's loan book could reveal underlying asset quality issues.

- Economic Sensitivity: A broad economic downturn could lead to higher defaults across various loan segments.

- Credit Risk Management: Maintaining vigilant credit monitoring and prudent lending practices is paramount to mitigate this threat.

Reputation Management Issues & Cyber

HDFC Bank faces significant threats from reputation management issues and cyber risks. High-profile technical outages, such as the ones experienced in late 2023 impacting mobile banking services, can severely damage its strong brand reputation and erode customer trust. A data breach, similar to those affecting other financial institutions globally, could expose sensitive customer information, leading to substantial financial and reputational fallout.

In today's digital landscape, the risk of cyber fraud is ever-present. For instance, phishing scams and malware attacks continue to evolve, posing a constant threat to customer accounts and bank systems. Proactive communication and robust cybersecurity investments are therefore crucial to mitigate these substantial threats and maintain customer confidence.

- Reputational Damage: Incidents like the reported technical glitches in late 2023, which affected mobile banking access for a period, highlight the vulnerability of digital services to outages.

- Cybersecurity Threats: The increasing sophistication of cyberattacks, including ransomware and phishing, demands continuous vigilance and investment in advanced defense mechanisms.

- Customer Trust Erosion: A significant data breach could lead to a loss of customer confidence, impacting account holdings and transaction volumes, a scenario no financial institution can afford.

HDFC Bank faces intense competition from digital-native banks and modernized public sector banks, which are rapidly gaining market share with innovative digital offerings and competitive pricing. The increasing reliance on digital transactions, a trend evident across the industry by Q4 FY24, puts pressure on traditional banking models and HDFC Bank's established customer base.

Navigating the evolving regulatory landscape, including directives from the RBI on capital adequacy and digital lending in 2024, requires continuous adaptation and investment, potentially impacting operational efficiency and growth strategies. Failure to comply can result in penalties and reputational damage.

Economic slowdowns and rising interest rates pose a threat to loan demand and increase borrowing costs, potentially squeezing net interest margins. Furthermore, the integration of the HDFC Ltd. merger could expose underlying asset quality issues, with gross NPAs standing at 1.26% as of March 31, 2024, a figure that could worsen during economic contractions.

Reputational damage from technical outages, like those impacting mobile banking in late 2023, and the ever-present risk of sophisticated cyberattacks and data breaches, pose significant threats to customer trust and operational stability.

SWOT Analysis Data Sources

This HDFC Bank SWOT analysis draws from comprehensive financial statements, in-depth market research reports, and expert industry commentary to provide a robust and insightful assessment.