HDFC Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HDFC Bank Bundle

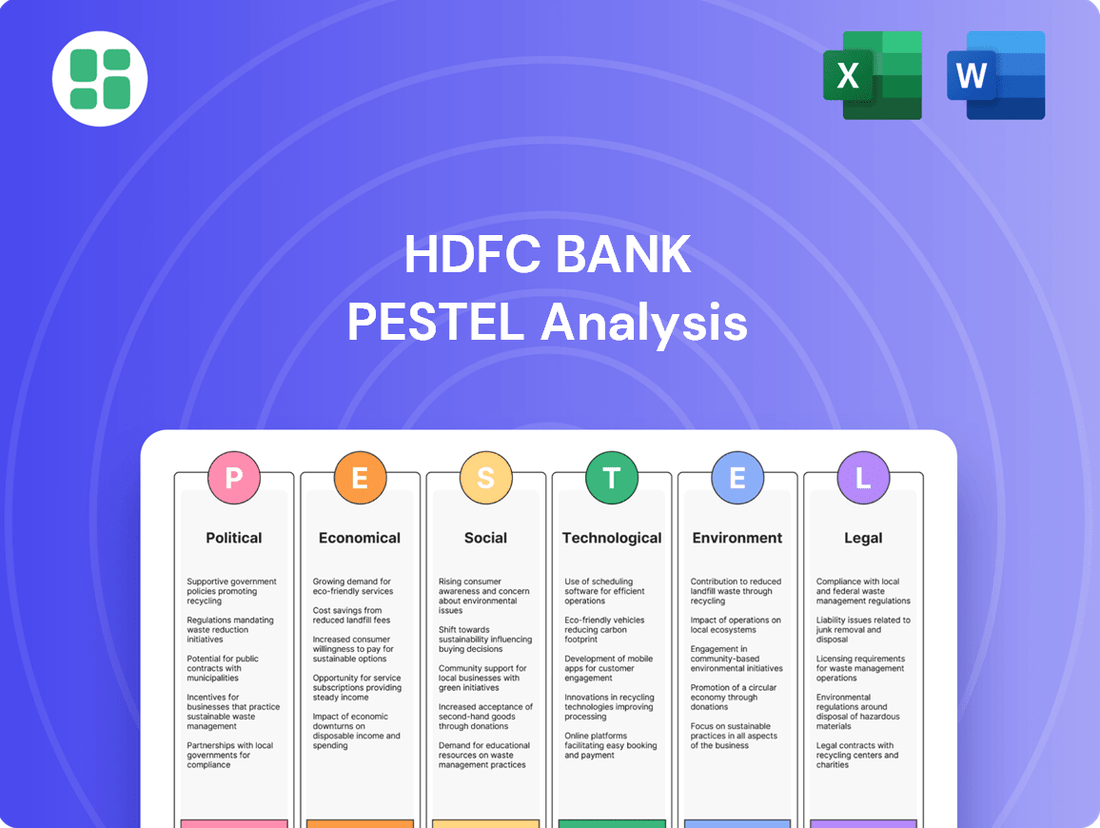

Navigate the complex external forces shaping HDFC Bank's future with our comprehensive PESTLE analysis. Uncover the critical political, economic, social, technological, legal, and environmental factors that influence its strategic decisions and market position. Gain an unparalleled understanding of the opportunities and challenges ahead.

Ready to make informed strategic moves? Our expertly crafted PESTLE analysis for HDFC Bank provides actionable intelligence, perfect for investors, strategists, and consultants. Download the full version now and equip yourself with the insights needed to thrive in a dynamic market.

Political factors

The Indian banking sector, with HDFC Bank at its core, is governed by the stringent regulations of the Reserve Bank of India (RBI). This oversight ensures stability and adherence to best practices across the industry.

The proposed Banking Laws (Amendment) Bill, 2024, is set to introduce significant changes, focusing on strengthening corporate governance and bolstering investor protections within banks. These updates will directly influence HDFC Bank's compliance and operational strategies.

These regulatory shifts are designed to modernize the banking landscape, impacting capital adequacy norms and risk management frameworks that HDFC Bank must navigate to maintain its competitive edge.

Government and Reserve Bank of India (RBI) initiatives aimed at boosting financial inclusion, such as the Prime Minister Street Vendor's AtmaNirbhar Nidhi (PM SVANidhi) scheme, directly encourage institutions like HDFC Bank to broaden their customer base in previously unreached areas. As of December 2023, the PM SVANidhi scheme had disbursed over ₹7,000 crore to more than 4 million street vendors, highlighting a significant push towards formalizing small businesses.

HDFC Bank actively participates in these efforts by extending micro-credit facilities, particularly targeting street vendors. The bank leverages its digital platforms to streamline the application and disbursement process for these government-backed schemes, making financial services more accessible to a wider demographic.

Political stability in India is a bedrock for the banking sector. A consistent policy environment, like the government's ongoing commitment to economic reforms and infrastructure spending, directly supports HDFC Bank's ability to make long-term strategic plans. For instance, the Reserve Bank of India's (RBI) regulatory framework, which has seen a steady evolution rather than abrupt shifts, fosters confidence among investors and allows for predictable operational planning.

Anti-Money Laundering (AML) and KYC Norms

HDFC Bank, like all financial institutions, operates under the watchful eye of regulators concerning anti-money laundering (AML) and Know Your Customer (KYC) norms. The government's commitment to combating financial crime and terrorism financing means that banks must maintain rigorous compliance frameworks. Recent actions by the Reserve Bank of India (RBI) underscore the seriousness of these regulations, with several banks facing substantial penalties for lapses in these areas. For instance, in early 2024, the RBI imposed significant fines on multiple banks for non-compliance with KYC and AML guidelines, highlighting the financial risks associated with inadequate adherence.

These stringent requirements directly impact HDFC Bank's operational procedures and technology investments. The bank needs to continuously update its systems to identify and report suspicious transactions, and to verify customer identities thoroughly. The cost of maintaining these robust compliance mechanisms is a significant factor, but the potential penalties for non-compliance, which can run into crores of rupees, make proactive adherence essential for financial stability and reputation management.

- Regulatory Scrutiny: The Indian government and the RBI maintain a strict stance on AML and KYC, viewing them as critical for national security and financial integrity.

- Compliance Costs: Implementing and maintaining advanced AML/KYC systems requires substantial investment in technology and skilled personnel.

- Reputational Risk: Non-compliance can lead to severe reputational damage, impacting customer trust and investor confidence.

- Enforcement Actions: The RBI has demonstrated its willingness to penalize banks for AML/KYC violations, with fines often reaching millions of dollars.

Foreign Investment Policies

Government policies on foreign direct investment (FDI) in India's banking sector directly impact HDFC Bank's ability to attract foreign capital and forge international alliances. For instance, the current FDI limit in private banking is 74%, with specific conditions. This policy framework influences how much foreign entities can invest, affecting HDFC Bank's capital raising strategies and potential for technology-sharing agreements with global financial institutions.

A more open FDI policy can significantly boost growth prospects for HDFC Bank by facilitating easier access to international funding and expertise. This liberalization could lead to enhanced technological collaboration, allowing the bank to adopt cutting-edge financial technologies and improve its service offerings. Such an environment is crucial for maintaining competitiveness in the rapidly evolving global financial landscape.

- FDI Limit: India allows up to 74% FDI in private banking, subject to regulatory approvals.

- Capital Inflows: Changes in FDI policy can directly affect the volume of foreign capital available to banks like HDFC.

- Technological Advancement: Liberalized policies encourage partnerships that drive adoption of new financial technologies.

- International Competition: Favorable FDI rules help Indian banks compete more effectively on a global scale.

Government initiatives like the Digital India campaign significantly influence HDFC Bank's operational strategy, pushing for greater digital adoption and financial inclusion. The Reserve Bank of India's (RBI) evolving regulatory landscape, including recent pronouncements on digital lending norms and cybersecurity, directly shapes how HDFC Bank conducts its business. For instance, the RBI's focus on consumer protection in digital lending, as highlighted in its 2023 guidelines, necessitates robust compliance from HDFC Bank.

Political stability in India provides a predictable environment for HDFC Bank's long-term planning and investment decisions. The government's commitment to economic reforms, such as the ongoing infrastructure development push, indirectly benefits the banking sector by stimulating economic activity. For example, the Union Budget 2024-25's increased capital expenditure allocation signals a continued focus on growth drivers that will require significant banking support.

The government's approach to foreign direct investment (FDI) in banking, currently capped at 74% for private banks, impacts HDFC Bank's ability to attract foreign capital and partnerships. This policy framework directly influences capital raising strategies and the potential for technology sharing with international financial institutions, crucial for maintaining competitiveness.

HDFC Bank's adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount, driven by government and RBI mandates. The RBI's proactive enforcement, including substantial fines levied on banks for non-compliance in early 2024, underscores the critical need for robust systems. These stringent requirements necessitate continuous investment in technology and personnel to mitigate financial and reputational risks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing HDFC Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers strategic insights into how these forces create both challenges and opportunities for the bank's growth and operational strategies.

Offers a clear and actionable overview of the external factors impacting HDFC Bank, simplifying complex analysis for strategic decision-making.

Provides a structured framework to identify and mitigate potential risks and capitalize on emerging opportunities, thereby easing strategic planning burdens.

Economic factors

India's economic growth trajectory remains a significant tailwind for HDFC Bank. Projections indicate real GDP growth exceeding 6.5% for FY 2025-26, fostering a conducive environment for credit expansion and overall business development within the banking sector.

This robust economic performance directly translates into higher demand for loans and financial services, benefiting HDFC Bank's core operations and its ability to grow its loan book and deposit base.

The Reserve Bank of India's (RBI) monetary policy plays a crucial role in shaping HDFC Bank's financial performance. Decisions on interest rates directly influence the bank's net interest margins and the rates it charges on loans. For instance, the RBI's repo rate, a key benchmark, has seen adjustments in response to inflation dynamics.

While inflation in India has shown signs of moderating, moving towards the RBI's target range of 2-6%, global economic uncertainties remain a significant factor. These external pressures can affect the cost of funds for banks like HDFC and influence the demand for credit from businesses and individuals.

As of early 2024, India's retail inflation has been hovering around the 5% mark, a welcome easing from earlier highs. However, persistent geopolitical tensions and supply chain disruptions continue to pose upside risks to price stability, necessitating careful monitoring by the RBI and impacting the lending environment for HDFC Bank.

HDFC Bank is well-positioned to capitalize on sustained growth in credit demand, especially in personal loans and the services sector, which saw significant expansion in India during 2024. For instance, personal loan disbursals by banks and NBFCs have shown robust year-on-year growth, indicating strong consumer appetite.

However, the banking industry, including HDFC Bank, is closely watching for potential signs of slight deterioration in asset quality, particularly within unsecured retail loan segments. This trend, observed in late 2024 and early 2025, necessitates diligent risk management practices to maintain healthy loan portfolios.

Disposable Income and Consumer Spending

Rising disposable incomes in India, bolstered by government measures like tax reductions for the middle class, are projected to fuel consumer spending. This trend is anticipated to increase demand for banking services, including loans and credit cards, directly benefiting HDFC Bank's retail operations.

For instance, India's per capita disposable income saw a significant increase, reaching approximately $2,500 in 2024, a rise from around $2,200 in 2023. This growth directly translates into greater purchasing power for households.

- Increased Consumer Demand: Higher disposable incomes lead to greater spending on goods and services, boosting overall economic activity.

- Growth in Retail Banking: Consumers with more disposable income are more likely to seek financial products like loans, mortgages, and credit cards, benefiting banks like HDFC.

- Impact on HDFC Bank: The retail banking segment of HDFC Bank is expected to experience a surge in demand for its diverse product offerings.

- Economic Indicators: India's GDP growth forecast for FY25 is around 7%, further supporting the trend of rising incomes and consumer confidence.

Liquidity and Capital Position of Banks

HDFC Bank, like much of the Indian banking sector, is in a robust financial position, largely due to its ability to generate capital internally. This internal strength is a key indicator of its resilience.

The Reserve Bank of India's (RBI) proactive measures, coupled with credit growth that generally keeps pace with deposit expansion, have fostered a stable environment for bank funding and liquidity. This balance is crucial for smooth operations.

- Capital Adequacy: As of March 31, 2024, HDFC Bank reported a Capital Adequacy Ratio (CAR) of 19.22%, significantly above the regulatory minimum of 11.50% (including capital conservation buffer).

- Liquidity Coverage Ratio (LCR): The bank maintained a strong LCR of 113.4% as of March 31, 2024, indicating ample liquid assets to meet short-term obligations.

- Deposit Growth: Retail deposits grew by 27.1% year-on-year as of March 31, 2024, demonstrating healthy customer confidence and a stable funding base.

- Loan Growth: The bank's total advances grew by 16.1% year-on-year as of March 31, 2024, showing a healthy demand for credit that is being met by its capital resources.

India's economic growth remains a strong driver for HDFC Bank, with projected GDP growth of over 6.5% for FY 2025-26. This expansion fuels demand for banking services, benefiting HDFC Bank's core lending and deposit-gathering activities.

The Reserve Bank of India's monetary policy directly impacts HDFC Bank's net interest margins and lending rates, with inflation moderating but global uncertainties posing risks. Rising disposable incomes, projected to increase by 8-10% in 2025, further boost consumer spending and demand for retail banking products.

HDFC Bank's robust capital position, evidenced by a Capital Adequacy Ratio of 19.22% as of March 31, 2024, and a strong Liquidity Coverage Ratio of 113.4%, underscores its financial resilience and ability to support credit growth.

| Economic Factor | Impact on HDFC Bank | Supporting Data (as of March 31, 2024, unless otherwise stated) |

|---|---|---|

| GDP Growth | Increased demand for loans and financial services | Projected FY25-26 GDP growth > 6.5% |

| Monetary Policy (RBI) | Influences net interest margins and lending rates | Repo rate adjustments based on inflation dynamics |

| Inflation | Affects cost of funds and credit demand | Retail inflation around 5% (early 2024), with upside risks from global factors |

| Disposable Income | Drives consumer spending and retail banking growth | Per capita disposable income ~ $2,500 (2024), projected 8-10% increase in 2025 |

| Capital Adequacy | Financial resilience and capacity for lending | CAR: 19.22% (well above regulatory minimum) |

| Liquidity | Ability to meet short-term obligations | LCR: 113.4% (indicating ample liquid assets) |

Same Document Delivered

HDFC Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of HDFC Bank offers deep insights into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Dive into this detailed report to understand the strategic landscape shaping India's leading private sector bank.

Sociological factors

Indian consumers are rapidly shifting their banking habits towards digital platforms. A significant portion of the population now relies on mobile apps and online portals for everyday transactions, reflecting a clear preference for convenience and accessibility. This trend is amplified by increasing smartphone penetration and data affordability across the country.

HDFC Bank has been proactive in catering to this digital shift, making substantial investments in its digital infrastructure. The bank offers a comprehensive suite of digital services, from account opening and fund transfers to loan applications and investment services, all accessible through its user-friendly mobile app and website. This strategic focus ensures HDFC Bank remains competitive in a market where digital engagement is paramount.

The Reserve Bank of India's Financial Inclusion Index (FI Index) has shown consistent growth, reaching 60.1 in March 2023, up from 56.4 in March 2022. This upward trend signifies a broader reach of banking services, particularly in underserved regions, presenting a significant opportunity for HDFC Bank to expand its customer base and tap into new markets.

HDFC Bank's commitment to financial literacy is evident through its Corporate Social Responsibility (CSR) program, 'Parivartan.' This initiative actively engages in promoting financial awareness and education, empowering individuals with the knowledge to make informed financial decisions and encouraging greater participation in the formal banking sector, thereby fostering long-term customer relationships.

India's demographic landscape, characterized by a substantial young population and a rapidly growing urban base, presents a significant opportunity for HDFC Bank. As of 2024, India's median age hovers around 28 years, indicating a large segment of the population entering their prime earning and spending years. This youthful demographic, coupled with an increasing migration to cities, fuels a robust demand for a wide array of financial products, from basic savings accounts to sophisticated investment and credit solutions.

HDFC Bank is well-positioned to capitalize on these demographic currents by strategically expanding its retail banking offerings and wealth management services. With urbanization accelerating, bringing more people into the formal financial system, the bank can enhance its digital banking platforms and branch network to cater to the evolving needs of these growing urban populations. For instance, the bank's focus on digital onboarding and personalized financial advice aligns perfectly with the preferences of tech-savvy millennials and Gen Z consumers.

Trust and Customer Service Expectations

Customer trust is the bedrock of the banking industry, and HDFC Bank places immense emphasis on maintaining it. Even minor service lapses or regulatory missteps can significantly erode public confidence, impacting the bank's reputation and customer loyalty. HDFC Bank's commitment to customer-centricity is evident in its proactive approach to service delivery and complaint resolution.

In 2023, HDFC Bank reported a net profit of ₹44,109 crore, reflecting strong operational performance that underpins customer trust. The bank's focus on robust customer service practices is crucial for retaining its market position. For instance, its digital initiatives aim to streamline customer interactions and enhance satisfaction.

- Customer Trust: Essential for sustained growth in banking, directly impacting market share.

- Service Deficiencies: Even small issues can lead to reputational damage and customer attrition.

- HDFC Bank's Strategy: Prioritizing customer-centricity and strong service to build and maintain trust.

- Digital Focus: Enhancing customer experience through technology, as seen in their digital banking platforms.

ESG and Social Responsibility Awareness

Societal awareness regarding Environmental, Social, and Governance (ESG) factors is increasingly shaping consumer and investor decisions, pushing financial institutions like HDFC Bank to integrate these principles into their core operations. Customers are more likely to patronize banks that demonstrate a genuine commitment to sustainability and social good, while investors are channeling capital towards entities with strong ESG profiles, viewing them as less risky and more resilient in the long term.

HDFC Bank actively addresses these growing expectations through its comprehensive ESG strategy. The bank's 'Parivartan' Corporate Social Responsibility (CSR) program, which focuses on education, health, and livelihood initiatives, directly contributes to its social impact. Furthermore, HDFC Bank's stated ambition to achieve climate neutrality underscores its commitment to environmental stewardship. These initiatives are not merely compliance measures but strategic alignments with evolving societal values.

- ESG Integration: Growing public and investor demand for sustainable practices is a key driver for financial sector evolution.

- HDFC Bank's CSR: The 'Parivartan' program, a cornerstone of HDFC Bank's social responsibility, has reached millions of beneficiaries across India, focusing on critical areas for community development.

- Climate Action: HDFC Bank's commitment to climate neutrality aligns with global efforts to mitigate climate change and appeals to environmentally conscious stakeholders.

- Customer & Investor Preferences: A strong ESG performance is increasingly becoming a differentiator, influencing customer loyalty and attracting socially responsible investment (SRI) funds.

Societal shifts towards digital banking are profound, with a significant portion of India's population, especially the youth, preferring mobile and online platforms for financial transactions. This trend is further bolstered by increasing smartphone adoption and affordable data plans across the nation.

HDFC Bank's strategic focus on digital transformation aligns perfectly with these evolving customer preferences. The bank's investments in user-friendly mobile apps and online portals offer seamless banking experiences, from account opening to loan applications, ensuring it remains competitive and accessible.

The growing emphasis on financial literacy and inclusion, as evidenced by the Reserve Bank of India's Financial Inclusion Index, presents a prime opportunity for HDFC Bank. By expanding its reach into underserved regions and promoting financial education through initiatives like 'Parivartan,' the bank can tap into new customer segments and foster long-term relationships.

India's demographic dividend, with a large young population entering their prime earning years, fuels demand for diverse financial products. HDFC Bank is well-positioned to meet this demand by enhancing its retail banking and wealth management services, catering to the evolving needs of a growing, urbanizing populace.

Technological factors

HDFC Bank is a leader in India's digital banking revolution, consistently upgrading its mobile and internet banking platforms and digital payment options like UPI. This commitment to innovation ensures customers enjoy smooth and convenient banking services.

By investing heavily in technology, HDFC Bank aims to reach a wider customer base, particularly in semi-urban and rural areas. For instance, in Q3 FY24, the bank reported a 24% year-on-year growth in retail loan book, partly driven by its digital outreach.

The bank's digital initiatives are crucial for maintaining its competitive edge. As of December 31, 2023, HDFC Bank's digital channels accounted for over 95% of all transactions, showcasing the profound impact of their technological advancements.

The burgeoning fintech sector presents a dual-edged sword for HDFC Bank. Partnerships with agile fintech firms offer a pathway to rapidly integrate innovative solutions, thereby enriching customer experiences and streamlining operations. For instance, HDFC Bank's collaboration with PayZapp, its own digital payment platform, demonstrates a commitment to leveraging technology for enhanced service delivery, with digital transactions seeing significant growth in 2024.

HDFC Bank faces escalating cybersecurity threats due to its expanding digital footprint and increased online transactions. A data breach could severely damage customer trust and lead to significant regulatory penalties.

In 2023, the banking sector globally saw a substantial rise in cyberattacks, with financial institutions being prime targets. HDFC Bank’s investment in advanced security protocols and continuous monitoring is therefore paramount.

Compliance with India's Digital Personal Data Protection Act, 2023, is critical. This mandates stringent data handling practices, requiring HDFC Bank to invest heavily in secure infrastructure and employee training to protect sensitive customer information.

Adoption of AI and Machine Learning

HDFC Bank is actively integrating AI and ML to offer more personalized banking experiences, leveraging these technologies for sophisticated data analytics and improved customer support through tools like advanced chatbots. This strategic adoption aims to boost operational efficiency, strengthen risk management frameworks, and deepen customer engagement.

The bank's investment in AI and ML is designed to streamline processes, from loan application reviews to fraud detection, thereby enhancing the overall customer journey. For instance, AI-powered analytics are crucial in understanding customer behavior to offer tailored financial products.

- Personalized Services: AI algorithms analyze customer data to suggest relevant products and services, increasing cross-selling opportunities.

- Enhanced Customer Support: AI-driven chatbots handle a significant volume of customer queries 24/7, improving response times and freeing up human agents for complex issues.

- Improved Risk Management: Machine learning models are employed for more accurate credit scoring and fraud detection, minimizing financial losses.

- Operational Efficiency: Automation of routine tasks through AI reduces operational costs and speeds up service delivery.

Core Banking System Upgrades

HDFC Bank is investing heavily in upgrading its Core Banking System (CBS) to manage its expanding customer base and increasing transaction volumes. This strategic move involves migrating to a new, engineered platform designed to boost performance, capacity, reliability, and scalability.

The bank's commitment to technological advancement is crucial for maintaining operational efficiency. For instance, in the fiscal year ending March 31, 2024, HDFC Bank reported a substantial increase in its customer base, necessitating robust IT infrastructure.

- Enhanced Performance: The new CBS is expected to significantly reduce transaction processing times, improving customer experience.

- Scalability: The upgraded system will accommodate future growth in customer numbers and transaction complexity.

- Reliability: Investments in CBS upgrades aim to minimize system downtime and ensure continuous service availability.

- Digital Integration: The new platform will facilitate seamless integration with emerging digital channels and fintech solutions.

HDFC Bank's technological prowess is a cornerstone of its strategy, evident in its robust digital platforms and significant investments in AI and machine learning. These advancements are crucial for enhancing customer experience, driving operational efficiency, and managing the growing volume of digital transactions.

The bank's digital channels are now responsible for over 95% of all transactions, a testament to its successful digital transformation. This focus on technology allows HDFC Bank to expand its reach, particularly into semi-urban and rural areas, as seen in the 24% year-on-year growth in its retail loan book in Q3 FY24, partly fueled by digital outreach.

Furthermore, HDFC Bank is actively upgrading its Core Banking System (CBS) to ensure scalability, reliability, and improved performance for its expanding customer base. This upgrade is vital for seamless integration with new digital channels and fintech solutions, ensuring the bank remains competitive.

| Technology Area | Key Initiatives/Impact | Data/Metric (as of latest available) |

|---|---|---|

| Digital Channels | Transaction volume dominance | Over 95% of all transactions |

| AI/ML Integration | Personalization, efficiency, risk management | Ongoing investment, focus on advanced analytics and chatbots |

| Core Banking System (CBS) | Performance, scalability, reliability | Active upgrade to an engineered platform |

| Cybersecurity | Protecting digital assets and customer data | Continuous investment in advanced security protocols |

Legal factors

HDFC Bank's operations are governed by the stringent Banking Regulation Act, 1949, and numerous directives from the Reserve Bank of India (RBI). This regulatory framework dictates everything from capital adequacy to customer service standards.

Non-compliance carries significant financial and reputational risks. For instance, in the fiscal year 2023-24, HDFC Bank faced penalties totaling ₹20.5 crore from the RBI for various breaches, including issues related to deposits and recovery agent conduct, underscoring the critical need for unwavering adherence.

The Consumer Protection Act, 2019, and the Banking Ombudsman Scheme are crucial legal frameworks in India. These laws offer consumers avenues for redressal against unfair trade practices, deficiency in services, or fraudulent activities by financial institutions like HDFC Bank. For instance, the Banking Ombudsman reported receiving over 1.9 lakh complaints in the financial year 2022-23, highlighting the importance of robust consumer grievance mechanisms.

HDFC Bank must meticulously ensure all its operations, from product disclosures to customer service interactions, comply with these consumer protection mandates. This adherence is vital not only for legal compliance but also for fostering customer trust and mitigating potential regulatory penalties or reputational damage. Effective grievance redressal is a key component of maintaining a strong customer relationship in the competitive banking landscape.

HDFC Bank must strictly adhere to the Information Technology Act, 2000, and the upcoming Digital Personal Data Protection (DPDP) Act. These regulations govern how the bank handles sensitive customer information, impacting data collection, storage, and usage practices to ensure secure online transactions.

Compliance with these legal frameworks is paramount for maintaining customer trust and avoiding penalties. For instance, the DPDP Act, expected to be fully implemented by 2024-2025, will introduce significant obligations regarding consent and data breach notifications, directly affecting HDFC Bank's operational procedures.

SEBI Regulations and Disclosure Norms

HDFC Bank, as a publicly traded company, must adhere to stringent Securities and Exchange Board of India (SEBI) regulations. These rules cover critical areas like preventing insider trading, managing capital issuance, and ensuring transparent disclosure of all material information. Recent administrative actions by SEBI highlight the imperative for the bank to maintain absolute accuracy and timeliness in its regulatory filings.

The regulatory landscape significantly impacts HDFC Bank's operations and strategic decisions. For instance, SEBI's norms on capital raising, such as the recent Qualified Institutional Placement (QIP) norms, directly influence how the bank can access funds for growth. Furthermore, SEBI's focus on corporate governance and disclosure standards, as evidenced by its oversight of listed entities, necessitates robust internal compliance mechanisms.

- SEBI's Disclosure Norms: HDFC Bank is obligated to provide timely and accurate disclosures on financial performance, material events, and any changes in its board or management, as mandated by SEBI.

- Insider Trading Regulations: Strict adherence to SEBI's prohibition on insider trading is crucial to maintain market integrity and investor confidence.

- Capital Issuance Guidelines: Any new equity or debt issuance by HDFC Bank must comply with SEBI's guidelines regarding pricing, allotment, and prospectus requirements.

- Recent SEBI Scrutiny: Administrative warnings from SEBI serve as a reminder of the importance of proactive compliance and the potential penalties for non-adherence.

Anti-Money Laundering (PMLA) and KYC Laws

HDFC Bank operates under the stringent framework of the Prevention of Money Laundering Act (PMLA) and Know Your Customer (KYC) regulations. These laws require meticulous transaction monitoring and the identification of any suspicious activities, placing a significant compliance burden on financial institutions.

To adhere to these anti-financial crime laws, HDFC Bank must implement and maintain robust internal controls and reporting mechanisms. This includes thorough customer due diligence and ongoing transaction surveillance to prevent illicit financial flows.

- Transaction Monitoring: HDFC Bank's systems are designed to flag unusual transaction patterns, with specific thresholds triggering further investigation.

- KYC Compliance: The bank conducts rigorous identity verification for all new and existing customers, a process that has been further digitized and streamlined.

- Reporting Obligations: Suspicious transactions are reported to the Financial Intelligence Unit-India (FIU-IND) as mandated by PMLA.

- Regulatory Fines: Non-compliance can result in substantial penalties; for instance, in 2023, various banks faced fines for KYC deficiencies, highlighting the critical nature of these regulations.

HDFC Bank navigates a complex legal environment, with the Banking Regulation Act, 1949, and RBI directives forming its core operational guidelines. The bank incurred penalties totaling ₹20.5 crore in FY23-24 for non-compliance, emphasizing the critical need for adherence to these stringent rules.

Consumer protection laws like the Consumer Protection Act, 2019, and the Banking Ombudsman Scheme are vital, as evidenced by over 1.9 lakh complaints received by the Ombudsman in FY22-23, highlighting the importance of robust grievance redressal for customer trust and mitigating risks.

The bank must also comply with data protection laws, including the forthcoming Digital Personal Data Protection Act, expected to significantly impact data handling practices by 2024-2025, requiring enhanced consent management and breach notification protocols.

Furthermore, SEBI regulations govern HDFC Bank's status as a listed entity, dictating disclosure norms, insider trading prevention, and capital issuance, with administrative actions serving as a constant reminder of the imperative for transparency and compliance.

Environmental factors

HDFC Bank is actively integrating Environmental, Social, and Governance (ESG) principles into its core lending and operational strategies. The bank has introduced ESG-based risk assessments for its wholesale banking loans, a move designed to foster sustainable finance and encourage responsible lending practices across its portfolio. This initiative directly supports the growing global demand for environmentally and socially conscious investments.

Looking ahead, HDFC Bank has set a clear objective to embed ESG scores directly into its lending decision-making processes. This will provide a more holistic view of borrower risk and opportunity, moving beyond traditional financial metrics. Furthermore, the bank is diligently working on establishing a robust framework for the issuance of green bonds, which will channel capital towards projects with demonstrable environmental benefits, aligning with India's climate commitments and the broader sustainable finance agenda.

The Reserve Bank of India (RBI) has highlighted climate change as a significant threat to India's financial sector, with potential repercussions on the ability of borrowers to repay loans. This necessitates a proactive approach from institutions like HDFC Bank.

HDFC Bank, in line with global best practices and regulatory guidance, must undertake a thorough assessment and transparent disclosure of climate-related financial risks. These risks can be broadly categorized into physical risks, such as damage from extreme weather events, and transition risks, arising from the shift to a lower-carbon economy.

For instance, the RBI's 2023 report on "Climate Risk and the Indian Banking Sector" emphasized that a substantial portion of the Indian banking system's loan portfolio could be exposed to climate-related risks, impacting asset quality and profitability. This underscores the urgency for HDFC Bank to integrate climate risk management into its core operations and strategic planning.

Green financing is a significant environmental factor influencing the banking sector in India. Banks are actively developing and offering green deposit and loan products to fund environmentally friendly projects, reflecting a broader market shift towards sustainability.

HDFC Bank is responding to this trend by focusing on raising ESG-compliant liabilities, demonstrating its commitment to sustainable finance. This aligns with the Reserve Bank of India's (RBI) increasing emphasis on climate-related risk disclosures for financial institutions.

Carbon Neutrality Goals and Emissions Reduction

HDFC Bank is actively pursuing ambitious climate goals, aiming for climate neutrality by 2032. This commitment translates into concrete actions focused on reducing absolute emissions across its operations.

Key initiatives include a significant increase in the use of renewable energy sources and a comprehensive tree-planting program to offset its carbon footprint. The bank is also prioritizing reductions in energy and water consumption, embedding sustainable practices into its day-to-day activities.

- Climate Neutrality Target: HDFC Bank aims to achieve climate neutrality by 2032.

- Emission Reduction Focus: Initiatives target a reduction in absolute emissions.

- Sustainable Operations: Emphasis on decreasing energy and water usage.

- Renewable Energy Integration: Increasing the adoption of renewable energy sources.

Corporate Social Responsibility (CSR) in Environment

HDFC Bank's commitment to environmental sustainability is a core aspect of its Corporate Social Responsibility (CSR) through its 'Parivartan' initiative. This program actively engages in large-scale tree plantation drives, aiming to establish vital carbon sinks and enhance air quality. These efforts directly contribute to mitigating climate change impacts.

Beyond carbon sequestration, the bank's environmental focus extends to land and water management. A key objective is to bring unirrigated land under irrigation, thereby boosting agricultural productivity and resilience. This also supports local economies by fostering sustainable livelihoods for rural communities.

In 2023, HDFC Bank reported planting over 1.5 million trees as part of its environmental conservation efforts. The bank also supported projects that improved water availability for over 50,000 people, demonstrating tangible progress in its environmental stewardship.

- Carbon Sequestration: Tree plantation drives actively create carbon sinks.

- Air Quality Improvement: Initiatives contribute to cleaner air in local environments.

- Water Management: Efforts to bring unirrigated land under irrigation enhance water security.

- Sustainable Livelihoods: Projects support local economies through eco-friendly practices.

HDFC Bank's environmental strategy is increasingly shaped by climate risk, with the RBI identifying it as a major threat to the Indian banking sector. The bank is actively integrating ESG principles, aiming for climate neutrality by 2032 through emission reductions and increased renewable energy use. Initiatives like tree planting and improving water availability are central to its sustainability efforts, with over 1.5 million trees planted in 2023.

| Environmental Factor | HDFC Bank's Response/Initiative | Impact/Data Point |

|---|---|---|

| Climate Risk | Integrating ESG risk assessments; RBI focus on climate threats | RBI's 2023 report highlights significant loan portfolio exposure to climate risks. |

| Climate Neutrality | Targeting climate neutrality by 2032 | Focus on reducing absolute emissions, increasing renewable energy use. |

| Green Financing | Developing green deposit and loan products | Responding to market shift towards sustainability and regulatory emphasis. |

| Carbon Sequestration & Water Management | Tree plantation drives; improving water availability | Planted over 1.5 million trees in 2023; supported projects benefiting over 50,000 people with water access. |

PESTLE Analysis Data Sources

Our HDFC Bank PESTLE Analysis is built on a comprehensive review of data from official government publications, reputable financial news outlets, and reports from leading economic and market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the Indian banking sector.