HDFC Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HDFC Bank Bundle

HDFC Bank navigates a competitive landscape shaped by moderate buyer power and intense rivalry among established players. The threat of new entrants is somewhat mitigated by regulatory hurdles and capital requirements, but the digital banking revolution introduces new challengers.

The full analysis reveals the strength and intensity of each market force affecting HDFC Bank, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

HDFC Bank's extensive and granular deposit base, especially its low-cost Current Account Savings Account (CASA) deposits, significantly limits the bargaining power of individual depositors. In the fiscal year 2023-24, HDFC Bank's CASA ratio stood at a robust 42.7%, demonstrating its strength in attracting stable, low-cost funding.

While the Indian banking sector faces considerable competition for deposits, HDFC Bank leverages its strong brand reputation and widespread branch network to attract and retain customer funds effectively. This allows the bank to maintain a competitive edge without engaging in aggressive rate hikes.

The bank's strategic focus remains on growing its granular, high-quality deposit base. By prioritizing customer relationships and service, HDFC Bank aims to avoid costly rate wars, thereby preserving its profitability and competitive positioning in the market.

HDFC Bank's increasing reliance on digital platforms and advanced technologies like AI places it in a position of dependence on technology and software vendors. The bank's significant scale of operations and the presence of numerous vendors generally allow it to negotiate favorable terms, mitigating supplier power.

In 2023, the Indian banking sector saw substantial investment in digital transformation, with HDFC Bank actively participating. For instance, the bank has been a leader in adopting cloud computing and AI-driven analytics, requiring robust partnerships with tech providers. While specific vendor contract details are proprietary, the competitive landscape for enterprise software and cloud services in India, with players like TCS, Infosys, and global giants, provides HDFC Bank with leverage.

Furthermore, HDFC Bank actively pursues strategic partnerships with fintech companies to co-create innovative solutions. This approach not only fosters innovation but also serves to reduce direct reliance on any single traditional software vendor, thereby further diffusing supplier power.

The demand for skilled banking professionals, particularly in specialized areas like digital transformation and risk management, remains robust. This heightened demand translates into significant bargaining power for these employees, a trend reflected in the high attrition rates observed across the private banking sector in 2024.

HDFC Bank actively mitigates this supplier power by offering competitive remuneration packages and comprehensive career development pathways. Furthermore, fostering a supportive and engaging work environment is a key strategy to attract and retain its valuable talent pool.

Regulatory Bodies (e.g., RBI)

Regulatory bodies, such as the Reserve Bank of India (RBI), wield considerable power over HDFC Bank by setting capital requirements, operational guidelines, and compliance mandates. These regulations directly influence the bank's strategic decisions and operational costs, effectively acting as a powerful force shaping the banking landscape.

The RBI's influence is evident in its periodic pronouncements on prudential norms and risk management frameworks. For instance, the RBI’s directives on asset quality reviews and provisioning norms can significantly impact a bank's profitability and capital adequacy ratios. In 2023, the RBI's focus on strengthening the cybersecurity framework for banks underscored its role in dictating operational standards.

- RBI’s Capital Adequacy Norms: Mandates like the Basel III framework require banks to maintain specific capital to risk-weighted assets ratios, influencing lending capacity.

- Prudential Guidelines: RBI’s directives on loan classification, provisioning for bad loans, and income recognition directly impact a bank's financial health and reporting.

- Monetary Policy Stance: Changes in the repo rate and reserve requirements by the RBI affect the cost of funds and lending rates, influencing HDFC Bank's net interest margins.

- Compliance and Reporting: Stringent reporting requirements and adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) norms add to operational overheads and strategic constraints.

Interbank Market and Financial Institutions

HDFC Bank's reliance on the interbank market for short-term liquidity and wholesale funding is a key consideration. While the bank benefits from diverse funding avenues and robust financial standing, which mitigates its susceptibility to interbank market volatility, this market remains a factor.

The recent merger with HDFC Ltd. has influenced HDFC Bank's credit-deposit ratio, prompting a strategic shift towards deposit-led expansion. This focus on attracting retail deposits can indirectly lessen dependence on the interbank market for funding needs.

- Interbank Market Reliance: HDFC Bank uses the interbank market for short-term liquidity and wholesale funding.

- Funding Diversification: The bank’s access to varied funding sources and strong financial health limit its vulnerability to interbank market shifts.

- Post-Merger Strategy: The HDFC Ltd. merger led HDFC Bank to prioritize deposit growth, impacting its credit-deposit ratio and reducing reliance on wholesale funding.

HDFC Bank's reliance on technology and software vendors presents a moderate supplier power dynamic. The bank's significant scale and active pursuit of digital transformation, including AI and cloud adoption, necessitate strong relationships with tech providers. In 2023, the Indian banking sector saw substantial investment in digital solutions, and HDFC Bank's engagement with a competitive market of vendors, including major IT service firms, allows for negotiation of favorable terms.

The bank mitigates supplier power by fostering strategic partnerships with fintech companies, which diversifies its technology sourcing and reduces dependence on any single vendor. This approach ensures access to innovative solutions while maintaining leverage in negotiations.

The bargaining power of HDFC Bank's employees, particularly those with specialized skills in areas like digital banking and risk management, is notable. High attrition rates in the private banking sector during 2024 underscore this trend, indicating a strong demand for talent. HDFC Bank addresses this by offering competitive compensation and robust career development opportunities to retain its workforce.

| Supplier Type | Bargaining Power Influence | Mitigation Strategies |

|---|---|---|

| Technology & Software Vendors | Moderate | Leverages competitive vendor landscape, fosters fintech partnerships. |

| Skilled Employees | High | Offers competitive remuneration, career development, and positive work environment. |

What is included in the product

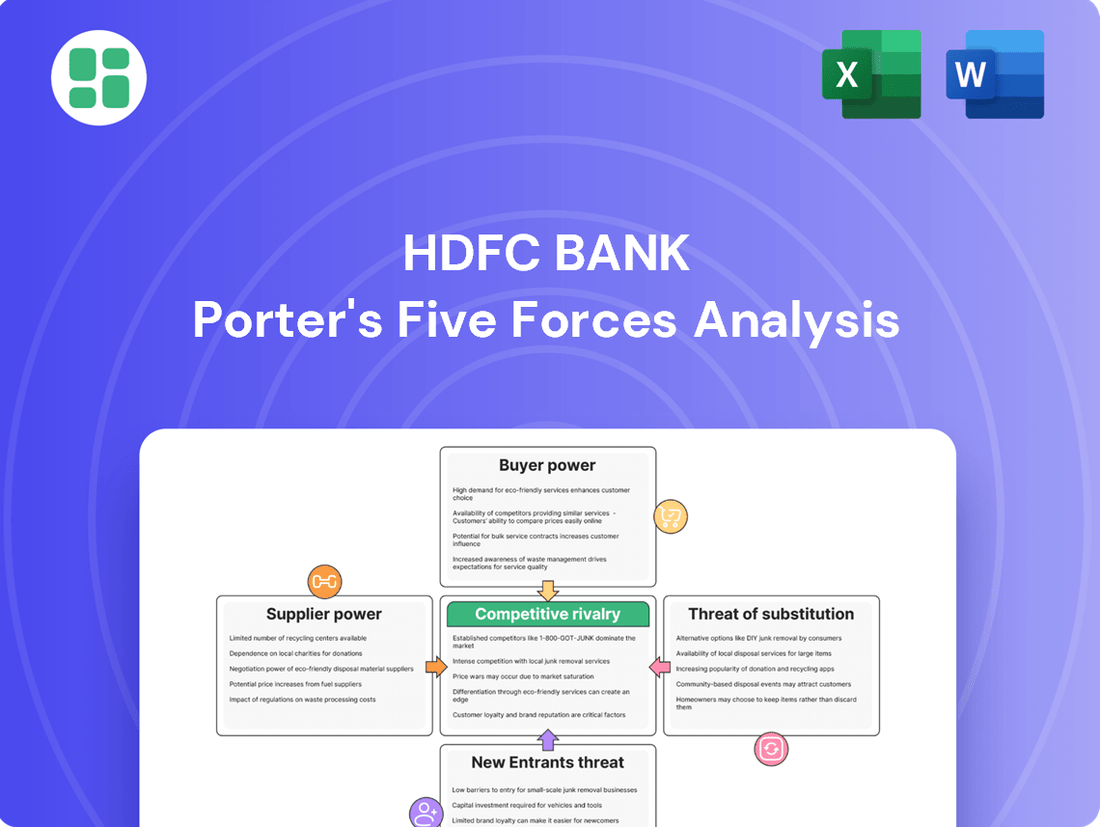

This Porter's Five Forces analysis for HDFC Bank examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes within the Indian banking sector.

Instantly identify and address competitive pressures with a dynamic Porter's Five Forces model for HDFC Bank, allowing for proactive strategy adjustments.

Customers Bargaining Power

HDFC Bank’s diverse customer base, encompassing retail individuals, small and medium-sized enterprises (SMEs), and large corporations, significantly dilutes the bargaining power of any single customer segment. This wide reach, serving over 9.7 crore customers as of early 2024, spreads risk and limits the impact of individual customer demands.

The bank’s extensive branch network, a key differentiator, further solidifies its customer relationships and reduces the ability of customers to easily switch to competitors. This broad accessibility, including a strategic focus on semi-urban and rural areas, enhances customer acquisition and retention, thereby moderating customer bargaining power.

For complex banking services like loans or wealth management, customers face substantial time and effort when switching banks, leading to high switching costs. This friction is a key factor in HDFC Bank's ability to retain clients, as demonstrated by its strong customer loyalty metrics. For instance, in FY23, HDFC Bank reported a retail deposit growth of 17.3%, indicating a sticky customer base.

The rise of digital platforms and financial aggregators has significantly boosted customer power by increasing price transparency. Customers can now easily compare offerings from various banks, leading to greater scrutiny of pricing and service quality. This digital empowerment allows them to make more informed choices, putting pressure on banks to remain competitive.

Indian banks are at the forefront of this digital revolution, enhancing customer relationships through integrated ecosystem services and superior user experiences. This digital transformation, as seen with HDFC Bank's extensive digital offerings, allows for greater customer engagement and loyalty. However, this heightened transparency, especially for standardized banking products, can indeed squeeze profit margins.

Customer Loyalty and Brand Reputation

HDFC Bank enjoys significant customer loyalty and a robust brand reputation, cultivated through years of reliable service and strong financial performance. This established trust often shields the bank from intense price competition, as customers are less likely to switch based solely on minor price differences.

The bank's proactive approach to customer satisfaction, exemplified by initiatives like 'Shift Right' which aims to enhance digital customer journeys, further solidifies this loyalty. By prioritizing customer experience, HDFC Bank effectively reduces the bargaining power of price-sensitive customers.

- Brand Equity: HDFC Bank's strong brand reputation translates into a significant competitive advantage, reducing customer sensitivity to price changes.

- Customer Loyalty: Decades of consistent service and performance have fostered deep customer loyalty, making switching less appealing for many.

- Customer-Centric Initiatives: Programs like 'Shift Right' demonstrate a commitment to customer experience, further strengthening the bank's relationship with its clientele and mitigating customer bargaining power.

Regulatory Protection for Consumers

Regulatory bodies, such as the Reserve Bank of India (RBI), actively safeguard consumer interests through various measures. These include enforcing fair lending practices, establishing robust grievance redressal mechanisms, and implementing stringent data privacy norms. These regulatory frameworks directly empower bank customers.

By ensuring banks maintain specific service quality and transparency standards, these regulations indirectly amplify customer bargaining power. For instance, the RBI's directives on transparent pricing of financial products and services mean customers have a clearer understanding of costs, allowing them to compare and negotiate more effectively.

The RBI's focus on customer protection, evident in its various circulars and guidelines throughout 2024, means customers are better equipped to challenge unfair practices. This increased awareness and the availability of recourse mechanisms strengthen their position when dealing with financial institutions like HDFC Bank.

Key consumer protection measures in 2024 include:

- Enhanced grievance redressal timelines: Banks are mandated to resolve customer complaints within specified periods.

- Data privacy and security mandates: Regulations ensure customer data is handled with utmost care and security.

- Fairness in product offerings: Guidelines promote transparency in the features and charges of banking products.

- Digital transaction protection: Rules are in place to secure online banking and prevent unauthorized transactions.

While HDFC Bank's extensive customer base and strong brand equity generally moderate customer bargaining power, the increasing digital transparency and regulatory focus on consumer protection are significant counterbalances. Customers can readily compare offerings, and RBI mandates ensure they are better informed and protected, potentially increasing their leverage, especially for standardized products.

| Factor | Impact on HDFC Bank | Customer Bargaining Power |

|---|---|---|

| Digital Transparency | Increases price comparison ease | Higher |

| Regulatory Protection (RBI) | Ensures fair practices, grievance redressal | Higher |

| Switching Costs | High for complex services | Lower |

| Brand Loyalty | Strong, reduces price sensitivity | Lower |

Preview the Actual Deliverable

HDFC Bank Porter's Five Forces Analysis

This preview showcases the comprehensive HDFC Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the Indian banking sector. The document you see here is precisely what you will receive instantly after completing your purchase, offering an in-depth examination of industry rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. This is the complete, ready-to-use analysis file, ensuring you get exactly what you're previewing for your strategic decision-making.

Rivalry Among Competitors

The Indian banking landscape is intensely competitive, featuring formidable public sector banks like State Bank of India (SBI) and major private players such as ICICI Bank, Axis Bank, and Kotak Mahindra Bank. HDFC Bank, as India's largest private sector bank by assets, holds a substantial market share, making this rivalry a constant factor.

HDFC Bank's position as the second-largest bank overall, with a significant share in both advances and deposits, underscores the intense competition it faces. This dynamic environment demands that HDFC Bank consistently innovate and maintain competitive pricing strategies to retain its market standing.

Competitors are aggressively investing in digital transformation, offering advanced mobile banking, online services, and fintech integrations. This digital arms race forces HDFC Bank to continuously innovate and enhance its digital offerings to retain and attract tech-savvy customers.

Indian banks are making remarkable progress in digital transformation, with nine banks recognized as 'Digital Champions' in Deloitte's 2024 Digital Banking Maturity (DBM) report, highlighting the intense competitive landscape HDFC Bank navigates.

The 2023 merger of HDFC Ltd. with HDFC Bank has reshaped India's banking sector, creating a behemoth that leads in most asset classes and ranks as the nation's second-largest bank. This consolidation intensifies rivalry, as the combined entity now wields significant market power. For instance, by the end of Q3 FY24, HDFC Bank's total assets stood at INR 25.05 lakh crore, a substantial increase post-merger.

While the merger strengthens HDFC Bank, it also introduces temporary vulnerabilities. Competitors may seek to exploit the period of adjustment, particularly concerning loan growth, which saw a slight deceleration immediately following the integration. Furthermore, the need to optimize the credit-deposit ratio presents an opening for rivals to attract customers with more favorable deposit rates or lending terms.

Product and Service Differentiation

HDFC Bank distinguishes itself by offering a wide array of banking products and services, extending beyond basic transactions to include wealth management and specialized solutions for both retail and corporate clients. This comprehensive approach aims to create holistic value for customers, fostering loyalty and reducing price sensitivity.

The bank actively differentiates through a superior customer experience, emphasizing personalized service and digital innovation. In 2024, HDFC Bank continued to invest heavily in its digital infrastructure, aiming to provide seamless and intuitive banking experiences across all touchpoints, which is a key driver of competitive advantage.

- Breadth of Offerings: HDFC Bank provides retail, wholesale, and treasury banking, plus wealth management.

- Customer Experience: Focus on personalized service and digital innovation to enhance customer satisfaction.

- Digital Investment: Significant capital allocation towards digital platforms in 2024 to streamline services.

Geographic Expansion and Market Penetration

Competitive rivalry intensifies as banks, including HDFC Bank, push for geographic expansion into Tier-2, Tier-3, and rural markets to capture untapped growth. This strategic move aims to broaden customer bases and diversify revenue streams beyond major urban centers.

HDFC Bank's extensive physical footprint is a significant differentiator. As of March 31, 2024, the bank operated 8,051 branches and 22,512 ATMs nationwide. Crucially, over half of its branches are situated in semi-urban and rural locations, directly addressing the penetration of these markets.

- Geographic Reach: HDFC Bank actively expands into Tier-2, Tier-3, and rural areas, mirroring industry trends.

- Branch Network: As of March 31, 2024, HDFC Bank maintained 8,051 branches and 22,512 ATMs.

- Rural Penetration: More than 50% of HDFC Bank's branches are located in semi-urban and rural areas.

- Competitive Advantage: This broad physical presence, augmented by robust digital offerings, forms a key competitive edge.

Competitive rivalry is a defining characteristic of the Indian banking sector, with HDFC Bank facing intense pressure from both public and private sector peers. The recent merger with HDFC Ltd. has created a larger entity, but rivals are actively innovating, particularly in digital banking, to capture market share. HDFC Bank's extensive branch network, with over 8,000 branches as of March 31, 2024, including a significant presence in rural areas, serves as a key differentiator in this highly contested environment.

| Competitor | Market Share (Approximate Deposits) | Key Competitive Strategy |

|---|---|---|

| State Bank of India (SBI) | ~23% | Extensive reach, government backing, digital initiatives |

| ICICI Bank | ~10% | Digital transformation, diverse product suite, strong retail presence |

| Axis Bank | ~7% | Digital innovation, focus on corporate banking, customer experience |

| Kotak Mahindra Bank | ~5% | Digital banking, wealth management, strong focus on customer acquisition |

SSubstitutes Threaten

Fintech companies, with their agile digital payment solutions, peer-to-peer lending platforms, and online investment tools, present a substantial threat of substitution for HDFC Bank. These entities often provide more convenient and cost-effective alternatives to traditional banking, directly impacting customer acquisition and retention.

India's digital payments sector has seen explosive growth, with the Unified Payments Interface (UPI) facilitating billions of transactions. In 2023 alone, UPI recorded over 117 billion transactions worth approximately $2.1 trillion, highlighting the strong consumer shift towards digital channels, a space where fintechs are particularly strong.

HDFC Bank recognizes this threat and is proactively addressing it through strategic fintech partnerships. By collaborating to co-create innovative solutions and bolster its digital capabilities, the bank aims to retain its market position and offer competitive digital services to its customer base.

Non-Banking Financial Companies (NBFCs) pose a significant threat of substitution for HDFC Bank, particularly in specialized lending areas like housing, vehicle finance, and microfinance, as well as wealth management services. Their focused approach allows them to cater to specific customer needs more effectively than a universal bank might.

The NBFC sector's competitive presence is underscored by its robust loan growth, which accelerated significantly in the 2023-24 fiscal year. This expansion demonstrates their increasing ability to capture market share from traditional banking services.

While HDFC Bank, with its broader product suite and established customer base, is relatively well-positioned, the agility and niche specialization of NBFCs offer a credible alternative for consumers seeking tailored financial solutions, thereby intensifying the competitive landscape.

Customers increasingly bypass traditional banks like HDFC Bank for savings and investments by directly accessing capital markets. Online platforms allow individuals to invest in mutual funds, stocks, and bonds, offering more control and potentially better returns than standard bank deposits. For instance, in 2024, the Indian mutual fund industry saw significant growth, with Assets Under Management (AUM) crossing INR 50 lakh crore, indicating a strong shift towards direct investment channels.

Government Savings Schemes and Post Office Services

Government savings schemes, such as the Public Provident Fund (PPF) and National Savings Certificates (NSC), along with post office savings accounts, present a significant threat of substitutes for traditional banking services. These government-backed options often provide competitive, risk-free returns, making them particularly appealing to conservative investors. For instance, in the fiscal year 2023-24, small savings schemes, which include many of these government offerings, saw a net collection of ₹3.40 lakh crore, indicating strong public preference.

The continued push for financial inclusion through initiatives like the Jan Dhan-Aadhaar-Mobile (JAM) trinity further bolsters the reach and accessibility of these government-sponsored financial products. This integration makes it easier for a wider population to access secure savings avenues, diverting potential deposits away from commercial banks. The robust performance of these schemes underscores their role as a viable alternative for individuals seeking safety and steady growth for their funds.

- Government-backed schemes offer secure, often attractive interest rates, competing directly with bank deposits.

- The JAM trinity facilitates wider access to these substitute savings avenues.

- Small savings schemes garnered ₹3.40 lakh crore in net collections during FY 2023-24, showcasing their popularity.

- Risk-averse individuals are particularly drawn to the safety and predictability of these government options.

Emerging Technologies (e.g., Blockchain, CBDC)

Emerging technologies like blockchain and Central Bank Digital Currencies (CBDCs) pose a significant threat of substitutes for traditional banking services. Blockchain offers enhanced security and efficiency for transactions, potentially bypassing intermediaries. For instance, in 2024, several countries continued to pilot CBDCs, exploring their potential for faster and cheaper cross-border payments, directly competing with existing remittance services offered by banks like HDFC.

These advancements could lead to entirely new financial ecosystems. Imagine decentralized finance (DeFi) platforms built on blockchain, offering lending, borrowing, and trading without traditional banks. While still developing, the potential for these platforms to capture market share from established players is a clear threat. By mid-2025, the global DeFi market capitalization was projected to reach trillions, indicating substantial growth and a growing alternative to conventional banking.

The threat is amplified as these technologies mature and gain wider adoption. Consumers and businesses might find these new digital alternatives more convenient, cost-effective, or transparent. HDFC Bank, like other traditional institutions, must innovate and integrate these technologies to remain competitive in a rapidly evolving financial landscape.

- Blockchain-based payment systems offer faster settlement times compared to traditional interbank transfers.

- CBDCs aim to provide a more efficient and potentially cheaper alternative for domestic and international payments.

- Decentralized Finance (DeFi) platforms are emerging as substitutes for traditional lending and borrowing services.

Fintech companies, government-backed savings schemes, and direct access to capital markets are key substitutes for HDFC Bank's traditional offerings. These alternatives often provide greater convenience, lower costs, or specific advantages like risk-free returns, drawing customers away from conventional banking services.

The digital payment surge, exemplified by UPI's over 117 billion transactions in 2023, highlights a significant shift towards fintech-driven solutions. Similarly, government small savings schemes saw net collections of ₹3.40 lakh crore in FY 2023-24, demonstrating strong customer preference for secure, government-backed options.

These substitutes are compelling because they cater to evolving consumer needs for speed, cost-effectiveness, and safety. HDFC Bank must continue to innovate and partner with fintechs to counter these threats and retain its customer base.

| Substitute Category | Key Offerings | Impact on HDFC Bank | Supporting Data (2023-2024) |

|---|---|---|---|

| Fintech Companies | Digital Payments (UPI), P2P Lending, Online Investments | Customer acquisition and retention challenges, pressure on fees | UPI transactions: 117 billion+ (2023) |

| Government Schemes | PPF, NSC, Post Office Savings | Diversion of deposits, competition on interest rates | Small Savings Schemes Net Collections: ₹3.40 lakh crore (FY 2023-24) |

| Capital Markets | Direct Investment in Stocks, Bonds, Mutual Funds | Reduced demand for bank deposits and wealth management | Mutual Fund AUM: Crossed INR 50 lakh crore (2024) |

Entrants Threaten

The threat of new entrants for HDFC Bank is significantly mitigated by high regulatory and capital barriers. The Reserve Bank of India (RBI) mandates stringent capital requirements, complex licensing procedures, and extensive regulatory compliance for any entity aspiring to become a universal bank.

These hurdles are substantial, as evidenced by AU Small Finance Bank receiving in-principle approval for its universal banking transition, the first such license granted in ten years. This scarcity of new universal banking licenses underscores the formidable entry barriers, effectively limiting the influx of new competitors into the market.

Established brand loyalty and the extensive network of incumbents like HDFC Bank pose a significant threat to new entrants. HDFC Bank has cultivated decades of trust, fostering deep customer relationships that are not easily replicated.

As of March 31, 2024, HDFC Bank operates an impressive network of over 9,455 branches and 21,139 ATMs across India. This vast physical presence and deeply ingrained brand reputation create a substantial barrier, making it incredibly challenging for new players to gain comparable market penetration and customer acceptance.

While digital banking can reduce some operational expenses, building a truly competitive digital infrastructure for a new entrant in the banking sector demands significant upfront capital. This investment is crucial for developing robust, secure, and scalable platforms that can rival established players like HDFC Bank.

Fintechs or new digital banks looking to offer comprehensive services must allocate substantial funds towards advanced technology development and stringent cybersecurity measures. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the immense cost associated with securing digital operations.

Customer Acquisition Challenges

New entrants face significant hurdles in attracting customers, as established banks like HDFC Bank already command a substantial and loyal customer base. This makes it difficult for newcomers to gain market share.

HDFC Bank's strategy of cross-selling, particularly amplified by its merger with HDFC Ltd., creates a more integrated offering. This deepens customer relationships and loyalty, presenting a formidable barrier for any new bank attempting to attract these customers.

- Customer Loyalty: HDFC Bank's extensive history and established trust contribute to high customer retention rates, making it challenging for new entrants to lure away existing clients.

- Cross-Selling Synergies: Post-merger, HDFC Bank can offer a wider array of products, from banking to housing finance, creating a stickier customer proposition that new entrants struggle to match.

- Digital Ecosystem: The bank's investment in digital platforms and services enhances customer experience, further solidifying its position and raising the bar for new competitors.

Consolidation in the Banking Sector

The Indian banking sector has seen significant consolidation, with mergers and acquisitions bolstering the market power of major institutions. For instance, the merger of HDFC Ltd. with HDFC Bank, finalized in July 2023, created a banking behemoth with a combined asset base exceeding $220 billion. This consolidation makes it increasingly challenging for new, smaller banks to enter the market and compete effectively against such scaled entities, thereby reinforcing the competitive advantage of established players like HDFC Bank.

This trend of consolidation effectively raises the barrier to entry for potential new competitors. Smaller, newly formed banks often struggle to match the extensive branch networks, technological infrastructure, and capital reserves of larger, merged entities. In 2024, the Reserve Bank of India's focus on strengthening the financial system further encourages such consolidation, making it even more difficult for nascent banks to gain a foothold and challenge incumbents.

- Increased Capital Requirements: Post-consolidation, the capital needed to establish a competitive banking operation has risen significantly.

- Economies of Scale: Larger, merged banks benefit from greater economies of scale in operations, technology, and marketing, which new entrants cannot easily replicate.

- Dominance of Established Brands: Established banks, like HDFC Bank, already possess strong brand recognition and customer loyalty, making it harder for new entrants to attract customers.

- Regulatory Hurdles: Navigating the complex regulatory landscape in India becomes a more substantial challenge for new entities compared to well-established players.

The threat of new entrants for HDFC Bank remains low due to significant regulatory hurdles, high capital requirements, and the established brand loyalty of incumbents. The Reserve Bank of India's stringent licensing and compliance rules create a formidable barrier, as demonstrated by the rarity of new universal banking licenses. For example, AU Small Finance Bank was the first to receive such approval in a decade as of 2023.

HDFC Bank's extensive network of over 9,455 branches and 21,139 ATMs as of March 31, 2024, coupled with its deep customer relationships, makes it incredibly difficult for new players to achieve comparable market penetration. The substantial investment required for digital infrastructure and cybersecurity, with the global cybersecurity market projected to exceed $300 billion in 2024, further deters new entrants.

The recent consolidation within the Indian banking sector, notably the HDFC Ltd. merger finalized in July 2023, has created a banking giant with assets over $220 billion. This increased scale provides incumbents like HDFC Bank with significant economies of scale and competitive advantages, raising the bar for any new entities seeking to enter the market.

| Factor | Impact on New Entrants | HDFC Bank's Position |

|---|---|---|

| Regulatory Barriers | High (Licensing, Capital Requirements) | Well-established compliance, strong capital base |

| Capital Requirements | Very High (Technology, Infrastructure) | Significant financial resources, post-merger strength |

| Brand Loyalty & Network | Challenging to replicate | Extensive network (9,455+ branches), decades of trust |

| Economies of Scale | Disadvantageous | Benefiting from recent merger, larger operational efficiencies |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for HDFC Bank is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We supplement this with insights from reputable industry research reports and macroeconomic data to provide a comprehensive view of the competitive landscape.