Healthcare Services Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

Navigate the complex external landscape impacting Healthcare Services Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are crucial for strategic decision-making. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Government healthcare spending and reimbursement policies are crucial for Healthcare Services Group (HCSG). Changes in how Medicare and Medicaid reimburse nursing homes, rehab centers, and assisted living facilities directly affect HCSG's clients' financial health and their capacity to engage outsourced services.

The Centers for Medicare & Medicaid Services (CMS) plays a significant role. For example, CMS's proposed Medicare reimbursement rate for skilled nursing facilities for fiscal year 2025 indicated an update to the Patient-Driven Payment Model (PDPM), aiming to better reflect the acuity of patients. This directly influences the budgets of HCSG's clients.

Furthermore, CMS's ongoing focus on quality and oversight in long-term care, evident in its 2024 and 2025 initiatives, can necessitate higher service standards from providers like HCSG, potentially impacting operational costs and service offerings.

Increased regulatory scrutiny on healthcare facilities, especially nursing homes, is a significant political factor. This focus on patient safety, quality of care, and cleanliness presents both hurdles and advantages for companies like HCSG. Stricter enforcement, while potentially raising compliance costs for clients, also emphasizes the importance of specialized outsourced services to meet these elevated expectations.

The Centers for Medicare & Medicaid Services (CMS) is set to introduce updated surveyor guidance in 2025. This guidance will specifically target areas such as infection control protocols and admission policies, reflecting a continued emphasis on operational excellence within healthcare settings. Such regulatory shifts directly impact how facilities operate and the services they require.

Government policies on minimum wage and labor laws directly influence Healthcare Services Group's operational costs. For instance, a potential federal minimum wage increase to $15 per hour, as discussed in 2024, would significantly impact the wages for their direct care and support staff, potentially increasing overall labor expenses.

Immigration policies also play a crucial role in the availability of healthcare workers. Stricter immigration controls could exacerbate the existing healthcare staffing shortages, making it harder for companies like Healthcare Services Group to recruit and retain essential personnel, especially given the projected demand for home health and personal care aides, which is expected to grow by 38% from 2022 to 2032.

The ongoing healthcare staffing crisis, with reports indicating millions of job openings in the sector throughout 2024 and 2025, underscores the importance of these labor and immigration factors. Healthcare Services Group's ability to navigate these policies and build a sustainable talent pipeline will be critical for its operational success and its capacity to serve clients effectively.

Public Health Initiatives and Preparedness

Government mandates for infection control, such as enhanced cleaning protocols and waste management, directly shape the operational demands on healthcare support services. These public health initiatives, particularly in light of ongoing pandemic preparedness, necessitate increased investment in specialized cleaning agents and staff training. For instance, the Centers for Disease Control and Prevention (CDC) continues to update guidance on environmental cleaning and disinfection in healthcare settings, impacting the types of disinfectants approved and the frequency of cleaning required.

The focus on preventing the spread of multidrug-resistant organisms (MDROs) and evolving COVID-19 immunization strategies in 2024-2025 significantly influences the scope and intensity of environmental services. This includes more rigorous disinfection of high-touch surfaces and specialized laundry procedures for contaminated linens. The U.S. Department of Health and Human Services (HHS) has allocated substantial funding towards public health infrastructure and emergency preparedness, with a portion directly supporting facility-level infection control measures.

- Increased Demand for Specialized Cleaning: Public health directives often require the use of EPA-approved disinfectants effective against a broader spectrum of pathogens, driving up costs for cleaning supplies.

- Enhanced Staff Training Requirements: Healthcare facilities must ensure housekeeping and laundry staff are proficient in new protocols, including proper personal protective equipment (PPE) usage and waste disposal, leading to higher training expenditures.

- Impact on Laundry Services: Regulations concerning the handling and laundering of potentially infectious textiles necessitate specialized equipment and processes, such as high-temperature washing and specific detergent formulations.

- Emergency Preparedness Funding: Government grants and funding initiatives aimed at bolstering healthcare system resilience against public health emergencies often include provisions for facility sanitation and preparedness, influencing operational budgets.

Healthcare Reform and Policy Shifts

Broader healthcare reforms and policy shifts significantly influence the healthcare services sector. For instance, potential changes to the Affordable Care Act (ACA) or the introduction of new long-term care funding models can dramatically alter market dynamics. These shifts might favor institutional care or, conversely, boost demand for home-based services, directly impacting Healthcare Services Group's client base and growth opportunities.

The 2024 US presidential election, for example, could usher in substantial policy changes. If a new administration prioritizes different healthcare approaches, it could lead to a re-evaluation of existing regulations and funding streams. This uncertainty necessitates strategic adaptation for companies like Healthcare Services Group.

- Federal Policy Impact: Changes to Medicare and Medicaid reimbursement rates, often debated during election cycles, directly affect revenue streams for many healthcare providers. For example, proposed cuts to Medicare Advantage payments in late 2023, though later revised, highlighted the sensitivity of the sector to federal budget decisions.

- State-Level Initiatives: States often implement their own healthcare reforms. California's efforts to expand Medi-Cal eligibility or Oregon's experiments with innovative care delivery models can create localized opportunities or challenges.

- Long-Term Care Funding: Discussions around expanding Medicaid’s role in home and community-based services, a trend gaining traction, could shift demand away from traditional nursing homes and toward in-home care providers. This transition is crucial for companies like Healthcare Services Group to monitor and potentially adapt their service offerings to.

Government policies significantly shape the healthcare landscape, directly impacting Healthcare Services Group (HCSG). Reimbursement rates from programs like Medicare and Medicaid, for instance, determine the financial capacity of HCSG's clients to utilize outsourced services. The Centers for Medicare & Medicaid Services (CMS) continues to refine payment models, such as the PDPM, aiming for better patient acuity reflection, which influences client budgets for 2025.

Regulatory scrutiny, particularly concerning patient safety and quality of care in nursing homes, presents both challenges and opportunities. Stricter enforcement by bodies like CMS, which is updating surveyor guidance in 2025 to focus on infection control, can elevate operational costs for clients but also highlight the value of specialized support services from HCSG.

Labor policies, including minimum wage discussions and immigration laws, critically affect HCSG's operational expenses and workforce availability. The projected 38% growth in demand for home health and personal care aides between 2022 and 2032, coupled with ongoing staffing shortages in the sector throughout 2024-2025, underscores the importance of navigating these political factors effectively.

Government mandates for infection control and environmental services, driven by public health initiatives and pandemic preparedness, necessitate advanced cleaning protocols and staff training. The CDC's ongoing guidance on environmental cleaning impacts the types of disinfectants and cleaning frequencies required, influencing the scope of services needed by healthcare facilities.

What is included in the product

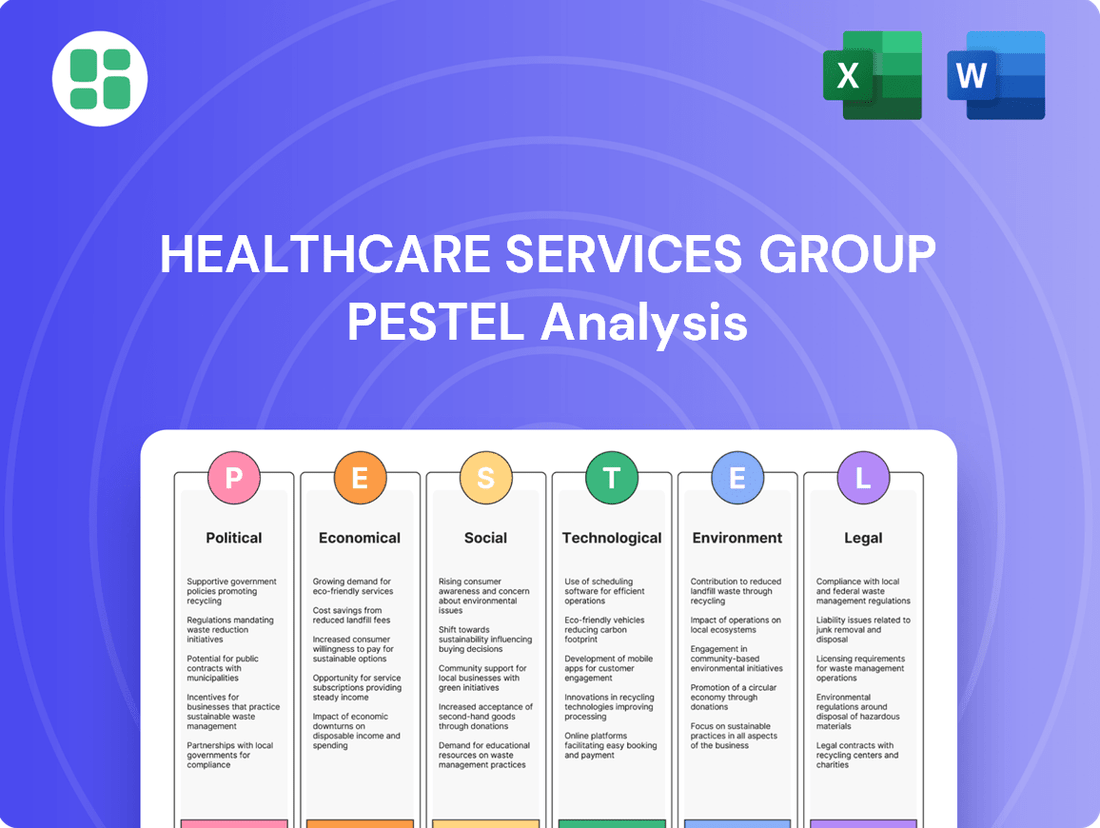

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Healthcare Services Group, providing actionable insights for strategic decision-making.

It offers a comprehensive understanding of the external landscape, enabling the identification of potential threats and opportunities to inform business strategy and foster growth.

This PESTLE analysis for Healthcare Services Group offers a clear, summarized version of external factors for easy referencing during strategic meetings and presentations.

It provides a concise version of the PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to identify key opportunities and threats.

Economic factors

National healthcare spending trends and the ongoing drive for cost containment significantly impact healthcare facilities' decisions to outsource non-clinical functions. As providers face pressure to operate more efficiently, outsourcing services like housekeeping, laundry, and dining becomes a more appealing strategy to manage expenses and focus on core clinical operations.

The global hospital outsourcing market is experiencing robust growth, with projections indicating a substantial increase in demand for external support services. For instance, the market was valued at over $200 billion in 2023 and is expected to reach over $350 billion by 2028, demonstrating a clear trend towards leveraging third-party providers for cost efficiency and operational improvements.

Labor costs are a significant driver for Healthcare Services Group, as its operations heavily rely on a skilled workforce. For instance, in 2024, average hourly wages for healthcare support occupations saw an increase, putting pressure on operating expenses. The availability of qualified personnel, particularly nurses and specialized medical staff, remains a persistent challenge, impacting service delivery and potentially leading to higher recruitment and retention costs.

Inflationary pressures are a significant concern for Healthcare Services Group, directly impacting the cost of essential operational inputs. For instance, rising prices for food and cleaning supplies, critical for maintaining hygiene and patient comfort, can erode profit margins. In 2024, the US Producer Price Index for healthcare services saw an increase, reflecting these rising input costs.

Supply chain disruptions further exacerbate these challenges. Delays in procuring necessary medical equipment or essential supplies can lead to higher procurement costs due to scarcity and increased shipping expenses. This can also translate into potential service delivery delays, impacting patient care and operational efficiency.

Effectively managing these escalating input costs is paramount for Healthcare Services Group's profitability. Strategies to mitigate inflation and supply chain volatility, such as diversifying suppliers and exploring bulk purchasing agreements, will be key to maintaining financial health.

Occupancy Rates of Client Facilities

The occupancy rates within client facilities are a critical economic indicator for Healthcare Services Group (HCSG). These rates directly reflect the demand for HCSG's essential services, such as housekeeping, laundry, and dining. When occupancy is high, it translates to more residents needing these services, thereby boosting HCSG's revenue potential.

Recent trends show a favorable outlook. For instance, data from the National Investment Center for Seniors Housing & Care (NIC) indicated that skilled nursing occupancy rates in the U.S. reached approximately 81.7% in the fourth quarter of 2023, a notable increase from earlier periods. Similarly, seniors housing occupancy also saw positive movement.

- Skilled Nursing Occupancy: Approximately 81.7% in Q4 2023 (NIC data).

- Seniors Housing Occupancy: Also trending upwards, indicating broader demand.

- Impact on HCSG: Higher occupancy directly correlates with increased service utilization and revenue for HCSG.

Interest Rates and Access to Capital

Interest rates significantly influence Healthcare Services Group's (HCSG) operational costs and investment capacity. For instance, the Federal Reserve's monetary policy adjustments, such as the federal funds rate, directly impact borrowing expenses for HCSG's capital-intensive projects like facility modernization. Higher rates in 2024 and projected into 2025 could increase the cost of debt, potentially slowing down expansion or upgrades.

Affordable capital is crucial for both HCSG's internal development and its clients' ability to maintain and enhance their facilities. When interest rates are low, as they were in earlier periods, clients are more likely to invest in their infrastructure, thereby increasing demand for HCSG's specialized services. Conversely, rising borrowing costs can constrain client budgets, potentially dampening demand for HCSG's offerings.

Broader economic conditions, reflected in interest rate environments, directly shape HCSG's financial trajectory. The company's ability to generate strong cash flow and maintain healthy profit margins is intrinsically linked to the cost of capital and the overall economic climate affecting its client base.

- The Federal Reserve maintained its target range for the federal funds rate between 5.25% and 5.50% through early 2024, reflecting a period of elevated borrowing costs compared to previous years.

- Analysts projected potential interest rate cuts in late 2024 or 2025, which could ease capital access for HCSG and its clients, though the timing and magnitude remain uncertain.

- HCSG's financial statements for 2023 and early 2024 indicated a focus on managing debt levels amidst a higher interest rate environment.

- Client investment in facility upgrades is often correlated with prevailing interest rates; lower rates historically spurred greater capital expenditure among healthcare providers.

The economic landscape significantly shapes Healthcare Services Group's (HCSG) operational environment, influencing everything from client demand to input costs. Factors like inflation, labor costs, and interest rates directly impact HCSG's profitability and strategic decisions.

Rising inflation, particularly in food and cleaning supplies, directly squeezes profit margins for HCSG. Simultaneously, increasing labor costs for essential healthcare support staff put further pressure on operating expenses. These combined pressures necessitate efficient cost management strategies for the company.

Occupancy rates within client facilities, such as skilled nursing and seniors housing, are a direct indicator of demand for HCSG's services. For example, skilled nursing occupancy rates hovered around 81.7% in late 2023, showing a positive trend that benefits HCSG's revenue potential.

Interest rates also play a crucial role, affecting HCSG's borrowing costs for capital expenditures and influencing clients' ability to invest in their facilities. Elevated interest rates, as seen through early 2024 with the federal funds rate between 5.25% and 5.50%, can increase debt expenses and potentially slow expansion or client upgrades.

| Economic Factor | 2023/2024 Data Point | Impact on HCSG |

|---|---|---|

| Skilled Nursing Occupancy | Approx. 81.7% (Q4 2023) | Increased service demand and revenue |

| Inflation (Healthcare Services PPI) | Increased in 2024 | Higher operating input costs (food, supplies) |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Increased borrowing costs, potential impact on client investment |

| Labor Costs (Healthcare Support) | Increasing hourly wages in 2024 | Higher operational expenses |

Preview the Actual Deliverable

Healthcare Services Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Healthcare Services Group will equip you with a deep understanding of the external factors influencing its operations. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape impacting the company.

Sociological factors

The United States is experiencing a significant demographic shift, with a growing proportion of its population entering older age brackets. This trend is a major catalyst for the long-term care sector, directly impacting companies like Healthcare Services Group (HCSG).

Projections indicate a continued rise in the number of Americans aged 65 and older. For instance, by 2030, this age group is expected to represent over 20% of the total U.S. population, a substantial increase from previous decades. This demographic expansion fuels an escalating demand for essential services such as nursing homes, assisted living facilities, and rehabilitation centers.

This phenomenon, often termed the 'silver tsunami,' translates into a greater need for the comprehensive support and specialized care that HCSG offers. The increasing prevalence of chronic conditions and the desire for aging in place with assistance further solidify the market's reliance on providers like HCSG.

Senior living residents and their families increasingly expect more than just basic care; they're looking for enriched lifestyles. This includes a significant shift in expectations for dining experiences, with a demand for higher quality, healthier options, and more engaging social atmospheres. For instance, a 2024 survey indicated that 70% of prospective senior living residents prioritize culinary offerings as a key factor in their decision-making process.

The trend leans heavily towards personalized nutrition plans and culinary experiences that mimic restaurant-quality dining. Residents and their families are actively seeking out communities that offer diverse menus, accommodate special dietary needs with flair, and foster a sense of community through shared meals. This evolving preference directly impacts service providers like HCSG, necessitating a proactive adaptation of their dining and nutritional services to meet these elevated standards and maintain client satisfaction in a competitive market.

The healthcare sector faces a critical challenge with an aging workforce, as a significant portion of direct care professionals, including Certified Nursing Assistants (CNAs), are nearing retirement age. This demographic shift, coupled with ongoing shortages of essential support staff, directly impacts the operational capacity of healthcare facilities.

These persistent labor shortages compel healthcare providers to increasingly outsource non-clinical functions, such as environmental services and dietary management, to specialized third-party companies like HCSG. For instance, the Bureau of Labor Statistics projected a 6% growth in healthcare support occupations between 2022 and 2032, indicating continued demand that outstrips supply.

HCSG's ability to effectively address these labor market dynamics is paramount to maintaining consistent and high-quality service delivery for its clients. Navigating the complexities of workforce availability and retention within the healthcare industry is a key strategic consideration for the company's continued success.

Health and Wellness Trends

The growing emphasis on holistic wellness and preventative care, particularly among the elderly, is reshaping healthcare service demands. This trend, often termed 'food as medicine,' directly influences the nutritional and dietary services offered by providers like HCSG. For instance, a significant portion of seniors are actively seeking diets that support specific health outcomes, driving demand for nutrient-dense and functional foods.

Facilities are responding by prioritizing personalized meal plans that cater to these evolving preferences. This requires HCSG's dining services to constantly innovate and adapt menus, moving beyond traditional offerings to incorporate ingredients known for their health benefits. This strategic shift aligns with broader initiatives aimed at enhancing resident well-being and promoting healthier aging.

- Holistic Wellness Focus: A 2024 AARP survey indicated that 70% of adults aged 50+ are interested in integrating wellness practices into their daily routines.

- Preventative Care Demand: The global preventative healthcare market is projected to reach $1.5 trillion by 2027, highlighting a strong consumer shift towards proactive health management.

- 'Food as Medicine' Adoption: Studies show a 25% increase in consumer spending on functional foods and dietary supplements between 2022 and 2024, reflecting growing trust in food's therapeutic potential.

Family Involvement and Decision-Making

Families are playing a much larger role in choosing and monitoring long-term care facilities. This means that the quality of everyday services like housekeeping, laundry, and dining is a major factor in their choices. For HCSG, a good reputation in these areas directly translates to more business.

The increasing emphasis on social dining and community engagement highlights a shift in resident expectations. These elements are becoming as important as clinical care for many families. For instance, a 2024 survey indicated that over 60% of adult children involved in selecting a senior living facility rated dining experience as a top three consideration.

- Family Influence: Over 70% of decisions regarding long-term care placement are influenced by family members.

- Service Perception: Facilities with highly-rated housekeeping and dining services see an average occupancy increase of 5-8% annually.

- Social Dining Trends: Reports from 2024 show a 15% rise in resident satisfaction scores for facilities prioritizing communal dining experiences.

The growing influence of family members in healthcare decisions, particularly for seniors, means that the quality of support services is under increased scrutiny. This heightened family involvement directly impacts how companies like HCSG are perceived and selected by consumers.

Families are increasingly prioritizing environments that offer not just care, but also a high quality of life, with dining and social engagement being key differentiators. For example, a 2024 survey revealed that 70% of adult children consider the dining experience a critical factor when choosing a senior living facility for their parents.

This trend necessitates that HCSG not only provide efficient operational support but also contribute to a positive living experience, aligning with family expectations for enriched lifestyles and community for their loved ones.

| Sociological Factor | Description | Impact on HCSG | Supporting Data (2024/2025) |

|---|---|---|---|

| Family Influence in Care Decisions | Adult children and other family members are increasingly involved in selecting and overseeing long-term care facilities. | HCSG must ensure high standards in non-clinical services to meet family expectations and secure contracts. | Over 70% of long-term care placement decisions are influenced by family members. |

| Demand for Enriched Lifestyles | Residents and their families expect more than basic care, prioritizing quality dining, social activities, and a sense of community. | HCSG's dining and environmental services need to support these lifestyle expectations to remain competitive. | 60% of adult children rate dining experience as a top three consideration in facility selection. |

| Holistic Wellness Expectations | There's a growing focus on overall well-being, including nutrition and healthy living, as integral to senior care. | HCSG's dietary services must adapt to 'food as medicine' trends and personalized nutritional plans. | 70% of adults aged 50+ are interested in integrating wellness practices into their routines. |

Technological factors

The integration of automation and robotics in facility management presents a significant technological factor for Healthcare Services Group. Automated cleaning equipment and smart laundry systems are already being deployed to boost operational efficiency and lessen dependence on manual labor. For instance, the global market for commercial robotic cleaning systems was projected to reach $1.5 billion in 2024, indicating a strong trend towards adoption.

While these advancements necessitate upfront capital, they promise substantial long-term cost reductions and a more consistent quality of service. Industry reports suggest that automation in healthcare facilities can reduce operational costs by up to 20% within five years of implementation. This efficiency gain is particularly crucial given the persistent challenges of staff shortages in the healthcare sector.

Artificial intelligence and automation are increasingly recognized as vital solutions for overcoming labor gaps and streamlining healthcare operations. A 2024 survey revealed that 75% of healthcare executives believe AI and automation are essential for improving patient care and operational resilience. By automating routine tasks, Healthcare Services Group can reallocate skilled staff to more critical patient-facing roles.

HCSG's operational efficiency is increasingly tied to its embrace of digital platforms for managing everything from inventory to service delivery and performance tracking. This digital transformation allows for real-time oversight, directly impacting how effectively they can manage resources and monitor service quality.

The strategic use of data analytics offers HCSG a powerful lens to refine its service offerings, identify areas for waste reduction, and gauge client satisfaction. By translating raw data into actionable insights, the company can make more informed, data-driven decisions, leading to optimized operations and potentially improved profitability. For instance, in 2024, companies across the healthcare support sector saw an average 15% improvement in operational efficiency by implementing advanced analytics for resource allocation.

Furthermore, the regulatory landscape is evolving, with enhanced digital tracking systems for waste management becoming a near-universal requirement. HCSG's investment in these digital solutions not only ensures compliance but also provides a more accurate and transparent view of their environmental impact and operational costs.

Advancements in nutritional software and personalized dining technologies are significantly reshaping how organizations like HCSG deliver dietary services. These innovations allow for highly tailored meal plans, directly addressing individual resident preferences, specific dietary restrictions, and evolving health objectives. This level of customization is becoming a key differentiator in resident satisfaction.

Artificial intelligence (AI) algorithms are at the forefront of this transformation, capable of analyzing complex nutritional needs and optimizing food inventory management. For instance, AI can predict demand based on resident data, reducing waste and ensuring the availability of necessary ingredients. This efficiency boost directly impacts operational costs and dining service quality.

By integrating these technologies, HCSG can expect a tangible enhancement in resident satisfaction, as dining experiences become more personalized and responsive. Furthermore, the operational efficiencies gained through AI-driven inventory and planning contribute to improved financial performance, with some reports suggesting potential waste reduction of up to 15% in food services through smart inventory systems.

Telehealth and Remote Monitoring's Indirect Impact

The growing adoption of telehealth and remote patient monitoring, while not a direct service offered by Healthcare Services Group (HCSG), presents an indirect opportunity. As healthcare facilities increasingly leverage these technologies for patient care, they may seek to outsource non-clinical support functions, such as environmental services and facilities management, to focus on their core clinical operations. This trend allows providers to enhance patient engagement and care delivery remotely, while relying on specialized partners like HCSG to maintain the physical infrastructure and cleanliness of their brick-and-mortar locations.

This shift could lead to a demand for HCSG's expertise in managing the physical aspects of healthcare environments, ensuring they remain safe, clean, and conducive to patient recovery, even as patient interactions move towards digital platforms. For instance, the projected growth in the telehealth market, estimated to reach over $370 billion globally by 2027 according to some industry forecasts, underscores the increasing reliance on technology in healthcare delivery. This expansion necessitates a robust support system for the physical facilities that remain integral to the healthcare ecosystem.

Consider the following implications:

- Increased Outsourcing Demand: Healthcare organizations may offload non-clinical tasks to concentrate on expanding telehealth capabilities.

- Focus on Core Competencies: Providers can dedicate resources to clinical innovation and patient care, relying on HCSG for facility management.

- Evolving Facility Needs: The physical healthcare environment may see shifts in usage patterns, requiring adaptable support services.

- Efficiency Gains: Outsourcing non-core functions can streamline operations and potentially reduce costs for healthcare providers.

Sustainability Technologies in Healthcare Buildings

The integration of sustainable technologies in healthcare buildings significantly impacts HCSG's environmental services. Advanced waste-capture systems, energy-efficient equipment, and water conservation methods are becoming standard, influencing operational practices and cost structures. For instance, the U.S. healthcare sector's energy consumption is substantial, with hospitals alone accounting for a significant portion of commercial building energy use, highlighting the potential for savings through efficiency upgrades.

The global push towards net-zero health facilities and carbon neutrality is a key technological driver. This necessitates greener cleaning practices and more sophisticated waste management solutions. By 2024, many healthcare systems are setting ambitious targets for emissions reduction, often requiring investments in new technologies and processes to achieve these goals.

- Energy Efficiency: Hospitals in the U.S. can reduce energy costs by 15-30% through retrofitting and adopting efficient HVAC and lighting systems.

- Waste Management: Innovations in medical waste treatment, such as plasma gasification, offer more sustainable alternatives to traditional incineration, reducing emissions.

- Water Conservation: Implementing low-flow fixtures and rainwater harvesting systems can decrease water usage in healthcare facilities by up to 20%.

- Net-Zero Goals: Many leading healthcare organizations have committed to achieving carbon neutrality by 2030 or 2040, driving demand for sustainable building technologies.

Technological advancements are reshaping healthcare services, with AI and automation at the forefront. In 2024, 75% of healthcare executives viewed AI and automation as crucial for enhancing patient care and operational resilience, aiming to fill labor gaps and streamline operations. These technologies are projected to reduce operational costs by up to 20% within five years, allowing skilled staff to focus on patient-facing roles.

Digital platforms are now integral for managing everything from inventory to service delivery, enabling real-time oversight and resource management. Data analytics further refines services and identifies waste; in 2024, companies using advanced analytics for resource allocation saw an average 15% improvement in operational efficiency. Moreover, evolving regulations mandate enhanced digital tracking for waste management, ensuring compliance and transparency.

Innovations in nutritional software and AI-driven dining technologies enable personalized meal plans and optimize food inventory. AI can reduce food waste by up to 15% through predictive demand analysis, directly impacting costs and service quality. The growth of telehealth, expected to exceed $370 billion globally by 2027, indirectly boosts demand for outsourced facility management as providers focus on remote patient care.

Legal factors

Healthcare Services Group navigates a complex web of federal and state regulations, with agencies like the Centers for Medicare & Medicaid Services (CMS) setting stringent guidelines. Compliance is non-negotiable, covering patient rights, infection control protocols, and the overall quality of care delivered in nursing homes and assisted living facilities. Failure to comply can result in significant penalties, impacting operational continuity and financial performance.

For 2025, CMS is rolling out updated regulations that place a heightened emphasis on quality improvement and increased oversight within the long-term care sector. These changes are designed to elevate patient safety and care standards, requiring providers like Healthcare Services Group to adapt their operational frameworks. For instance, new reporting requirements for staffing levels and resident outcomes are expected, aiming for greater transparency and accountability in care delivery.

Healthcare Services Group (HCSG) must navigate a complex web of labor laws. This includes adhering to federal and state minimum wage laws, which saw the U.S. federal minimum wage remain at $7.25 per hour in 2024, though many states and cities have higher rates. Compliance with overtime rules and Occupational Safety and Health Administration (OSHA) standards for workplace safety is paramount, especially given the inherent risks in healthcare settings.

Shifts in employment regulations pose significant challenges. For instance, proposed or enacted staffing ratio mandates in certain states could directly increase HCSG's labor costs by requiring more personnel per patient. The persistent healthcare staffing shortage, a critical issue throughout 2024 and projected into 2025, intensifies the pressure to comply with fair employment practices and competitive compensation to attract and retain staff.

Healthcare Services Group (HCSG) operates under a complex web of food safety and nutritional standards. Federal regulations like the Food Safety Modernization Act (FSMA) and state-specific health codes dictate everything from ingredient sourcing to sanitation protocols. For instance, HCSG's dining services must adhere to guidelines that prevent foodborne illnesses, a critical concern in healthcare settings where patient immune systems are often compromised. Failure to meet these standards can result in significant fines and operational disruptions.

The company's commitment to person-centered dining and nutritional planning directly addresses evolving regulatory expectations and patient needs. This focus ensures that meals are not only safe but also tailored to individual dietary requirements and preferences, often mandated by healthcare reimbursement models and patient satisfaction surveys. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize quality of life improvements, including dining experiences, for residents in skilled nursing facilities, directly impacting HCSG's service delivery and compliance efforts.

Environmental Regulations and Waste Management

Healthcare Services Group (HCSG) navigates a complex web of environmental regulations, particularly concerning waste management. This includes the stringent handling and disposal of medical waste and potentially hazardous materials generated within healthcare facilities.

Staying compliant with evolving Environmental Protection Agency (EPA) rules is paramount. For instance, the Hazardous Waste Generator Improvements Rule, implemented to streamline regulations, necessitates ongoing adaptation of HCSG’s operational protocols. Furthermore, the mandatory transition to an electronic manifest system (e-Manifest) by 2025 will require significant updates to tracking and reporting procedures for both HCSG and its clients, impacting efficiency and data accuracy.

- Compliance with EPA Hazardous Waste Generator Improvements Rule

- Mandatory adoption of e-Manifest system by 2025

- Impact on medical waste disposal protocols

- Need for updated client and HCSG compliance procedures

Contractual Obligations and Liability

The legal framework governing contracts with healthcare facilities is paramount for Healthcare Services Group, dictating the precise scope of services, performance benchmarks, and potential liabilities. Navigating these contractual risks, which include service level agreements and indemnification clauses, is essential for preventing legal conflicts and maintaining operational stability. For instance, the financial restructuring of major clients like Genesis HealthCare in 2024 underscores the critical nature of these contractual ties and the need for robust risk management within them.

Key contractual considerations for Healthcare Services Group include:

- Scope of Services Definition: Clearly outlining all services provided to prevent disputes over unmet expectations.

- Performance Metrics and Penalties: Establishing measurable standards for service delivery and associated consequences for non-compliance.

- Indemnification and Liability Clauses: Defining responsibilities and financial exposure in case of service failures or third-party claims.

- Termination and Dispute Resolution: Specifying procedures for ending contracts and resolving disagreements.

The legal landscape for Healthcare Services Group (HCSG) is heavily influenced by evolving healthcare policy and enforcement actions. New regulations from CMS, particularly those focusing on quality of care and staffing, will necessitate significant operational adjustments and compliance investments throughout 2025. Furthermore, the ongoing scrutiny of healthcare billing practices and patient protection laws means HCSG must maintain rigorous internal controls to avoid penalties and legal challenges. The increasing complexity of state-specific healthcare laws also adds another layer of compliance that HCSG must manage effectively.

Environmental factors

Healthcare facilities generate substantial volumes of waste, including both general and regulated medical waste, demanding sophisticated management systems. Healthcare Services Group's operations are integral to ensuring proper segregation and disposal, aligning with environmental stewardship goals. For instance, by 2024, many healthcare systems aim to divert over 50% of their non-hazardous waste from landfills through enhanced recycling programs.

The increasing focus on sustainability means that by 2025, regulatory bodies are likely to mandate more stringent protocols for medical waste segregation and place a greater emphasis on recycling initiatives for materials like plastics and paper products. This regulatory shift will directly impact how services like those provided by Healthcare Services Group are conducted, requiring investment in advanced sorting technologies and staff training.

Healthcare facilities, including those serviced by HCSG, have a significant environmental footprint, with energy and water consumption being major components. The demand for clean linens and sterile environments necessitates substantial use of these resources, particularly in laundry operations. For instance, a typical hospital laundry can consume thousands of gallons of water per day.

HCSG's strategic focus on energy-efficient laundry processes and water-saving cleaning methods directly addresses these concerns. By adopting advanced technologies, such as low-water-use washing machines or optimizing drying cycles, HCSG can help its clients achieve their sustainability targets. This not only reduces environmental impact but also leads to tangible cost savings for the healthcare providers.

The broader industry trend towards net-zero health facilities and reduced carbon footprints puts additional pressure on service providers like HCSG to innovate. As of 2024, many healthcare systems are setting ambitious goals for carbon reduction, making efficient resource management a key differentiator. HCSG's commitment to these principles positions it as a valuable partner in navigating this evolving landscape.

Healthcare facilities are increasingly demanding environmentally friendly cleaning products, sustainable food sourcing, and eco-friendly laundry detergents. This shift reflects a growing awareness of environmental impact within the industry, influencing procurement decisions and operational standards.

Healthcare Services Group can gain a competitive edge by prioritizing suppliers who demonstrate strong adherence to sustainable practices. This strategic focus on a greener supply chain not only reduces the company's environmental footprint but also resonates with the evolving preferences of clients, particularly within the senior living dining sector.

For instance, a 2024 survey indicated that over 70% of senior living operators consider sustainability a key factor when selecting service providers, highlighting the market's demand for environmentally conscious operations.

Climate Change and Extreme Weather Events

Climate change is directly impacting Healthcare Services Group (HCSG) and its clients. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, pose significant operational risks. These events can disrupt supply chains for essential medical supplies and affect staffing availability as employees may be unable to reach work. HCSG must ensure its facilities and those of its clients have resilient infrastructure to maintain uninterrupted service delivery during such crises.

The economic toll of extreme weather is substantial. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $145 billion in damages, according to NOAA. This highlights the financial strain such events can place on healthcare providers, potentially impacting their ability to invest in necessary upgrades or services.

Healthcare technology is emerging as a crucial element in building more resilient healthcare systems. Innovations in telehealth, remote patient monitoring, and data analytics can help maintain care continuity even when physical access to facilities is compromised. These technologies enable HCSG to adapt and continue providing vital services during and after extreme weather events.

- Operational Disruptions: Extreme weather can halt transportation, damage facilities, and impede staff access, directly impacting HCSG's ability to provide services.

- Supply Chain Vulnerability: Climate-related events can disrupt the production and delivery of critical medical supplies and equipment.

- Infrastructure Resilience: Investing in robust infrastructure is essential for HCSG to ensure continuous operations and patient care during adverse weather.

- Technological Adaptations: Healthcare technology offers solutions for maintaining service delivery and patient engagement when traditional methods are challenged by environmental factors.

Infection Control and Environmental Hygiene Standards

Environmental hygiene is paramount in healthcare, directly impacting infection control, particularly for vulnerable patient groups. HCSG’s cleaning and disinfection methods must align with rigorous environmental health standards, carefully weighing effectiveness against environmental sustainability. For instance, the CDC's 2024 guidance emphasizes updated protocols for preventing the spread of multidrug-resistant organisms (MDROs), requiring enhanced barrier precautions that HCSG must integrate.

Meeting these evolving standards involves continuous adaptation of cleaning agents and procedures. The global disinfectant market, valued at approximately $27.5 billion in 2023, is projected to grow, driven by increased awareness of hygiene and the emergence of new pathogens. HCSG's commitment to these standards is crucial for client trust and regulatory compliance.

- Adherence to CDC’s 2024 MDRO prevention guidelines

- Balancing disinfectant efficacy with ecological impact

- Continuous training on enhanced barrier precautions

- Meeting stringent environmental health standards for healthcare settings

The healthcare sector faces increasing pressure to minimize its environmental footprint, impacting waste management and resource consumption. By 2025, stricter regulations on medical waste segregation and recycling are anticipated, pushing companies like Healthcare Services Group (HCSG) to invest in advanced sorting technologies and staff training. HCSG's focus on energy-efficient laundry and water-saving techniques directly addresses the significant resource demands of healthcare facilities, aiming to reduce both environmental impact and operational costs.

The growing demand for sustainable practices influences procurement, with over 70% of senior living operators in 2024 considering sustainability when selecting service providers. This trend necessitates HCSG's prioritization of suppliers with strong environmental commitments, enhancing its competitive edge. Furthermore, the rising frequency of extreme weather events, which caused over $145 billion in damages across 28 U.S. disasters in 2023, highlights the need for resilient infrastructure and technological adaptations, like telehealth, to ensure service continuity.

| Environmental Factor | Impact on Healthcare Services Group | Key Data/Trends (2024-2025) | Strategic Response |

| Waste Management | Significant generation of regulated medical waste | Aim to divert over 50% of non-hazardous waste by 2024; anticipated stricter segregation/recycling mandates by 2025 | Investment in advanced sorting technologies and staff training |

| Resource Consumption | High water and energy usage in laundry operations | Typical hospital laundry uses thousands of gallons of water daily | Adoption of low-water-use machines and optimized drying cycles |

| Sustainability Demand | Client preference for eco-friendly services | Over 70% of senior living operators consider sustainability in provider selection (2024) | Prioritizing suppliers with strong sustainable practices |

| Climate Change & Extreme Weather | Operational risks from disruptions and supply chain issues | 28 U.S. billion-dollar weather disasters in 2023, totaling $145 billion in damages | Enhancing infrastructure resilience and leveraging healthcare technology for continuity |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Healthcare Services draws from a robust blend of official government health statistics, regulatory body updates, and leading industry market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.