Healthcare Services Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

Healthcare Services Group operates in a dynamic environment shaped by intense competition and evolving client needs. Understanding the forces of buyer power, supplier leverage, threat of new entrants, substitute services, and competitive rivalry is crucial for strategic success.

The complete report reveals the real forces shaping Healthcare Services Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Healthcare Services Group's (HCSG) suppliers is significantly shaped by how concentrated and specialized the supplier market is. When suppliers offer unique, hard-to-replicate products or services, their ability to dictate terms to HCSG naturally grows.

For instance, if a supplier provides a critical piece of medical equipment with few or no substitutes, HCSG has less room to negotiate pricing or contract terms. This was evident in the medical supply chain disruptions of 2020-2022, where specialized equipment suppliers held considerable sway.

Conversely, for more common or commoditized supplies, such as standard office supplies or basic cleaning agents, HCSG benefits from a broader supplier base, giving it greater leverage to secure favorable pricing and terms.

The bargaining power of suppliers for Healthcare Services Group (HCSG) is significantly influenced by the switching costs HCSG faces. If it's costly and disruptive for HCSG to change its food distributors, for example, those suppliers hold more sway over pricing and contract terms. These costs can include the effort and expense of finding and vetting new suppliers, integrating new ordering and delivery systems, and potentially retraining staff.

Healthcare Services Group (HCSG) plays a crucial role for many of its suppliers. If HCSG represents a substantial portion of a supplier's revenue, for example, if a cleaning supply vendor derives 30% of its sales from HCSG contracts, that supplier's leverage is significantly reduced. This dependence encourages suppliers to offer competitive pricing and favorable terms to secure HCSG's continued business.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for Healthcare Services Group (HCSG). If HCSG can readily source comparable cleaning supplies, food items, or laundry equipment from multiple vendors, it diminishes the leverage of any single supplier. This competitive sourcing environment is advantageous for HCSG.

For instance, in the janitorial supplies market, HCSG might find numerous providers offering biodegradable cleaning agents or specialized disinfectants. Similarly, the food service sector presents a wide array of distributors for fresh produce and processed goods. This abundance of alternatives means HCSG is not beholden to any one supplier for critical operational inputs.

- Reduced Supplier Dependence: HCSG's ability to switch suppliers easily for essential goods like cleaning chemicals or food products limits the pricing power of individual suppliers.

- Competitive Sourcing: A broad market for inputs, such as laundry equipment or specialized medical supplies, allows HCSG to negotiate favorable terms due to supplier competition.

- Operational Flexibility: The presence of readily available substitutes enhances HCSG's operational flexibility, preventing disruptions caused by a single supplier's issues.

Labor Market Dynamics

The labor market for essential non-clinical roles such as housekeepers, laundry staff, and food service workers significantly influences Healthcare Services Group's (HCSG) operational expenses, effectively positioning these workers as a key supplier group. Factors like the availability of qualified personnel, wage inflation trends, and the prevalence of unionization across various geographic locations directly shape HCSG's cost structure and, consequently, the bargaining power exerted by this labor segment.

For instance, during 2024, many regions experienced a notably tight labor market, leading to increased wage demands. Data from the Bureau of Labor Statistics indicated that average hourly earnings for food service and lodging workers saw a substantial increase year-over-year, putting upward pressure on HCSG's labor costs. This scarcity of available workers directly amplifies their negotiating leverage.

- Labor Availability: A shortage of available workers in non-clinical support roles strengthens their bargaining power.

- Wage Inflation: Rising wages, especially in service sectors, directly increase HCSG's operational costs.

- Unionization Rates: Higher unionization can lead to more formalized and potentially stronger collective bargaining for wages and benefits.

- Regional Variations: The impact of labor market dynamics varies significantly by geographic location, affecting HCSG's cost management in different markets.

The bargaining power of suppliers for Healthcare Services Group (HCSG) is generally moderate, influenced by several key factors. While HCSG operates in a sector with essential needs, the availability of multiple suppliers for many of its inputs, particularly for non-specialized goods and services, limits individual supplier leverage. However, the critical nature of some supplies and the potential costs associated with switching suppliers can grant certain vendors more influence.

For example, HCSG relies on a broad range of suppliers for cleaning chemicals, food products, and laundry services. The presence of numerous providers in these markets allows HCSG to negotiate competitive pricing. In 2024, the company likely benefited from a stable supply chain for many of these basic necessities, keeping supplier power in check. However, any disruption or concentration in specific niche supply areas, such as specialized medical-grade cleaning agents, could shift this balance.

| Factor | Impact on HCSG Supplier Bargaining Power | Example for HCSG |

|---|---|---|

| Supplier Concentration | High concentration increases power. | A single dominant supplier for a critical disinfectant could exert significant influence. |

| Switching Costs | High costs increase power. | If changing food distributors involves significant retraining and system integration, those suppliers gain leverage. |

| Availability of Substitutes | Many substitutes decrease power. | Numerous vendors for standard cleaning supplies allow HCSG to easily switch and negotiate. |

| Importance of Supplier to HCSG | High dependence decreases supplier power. | If a supplier relies heavily on HCSG for revenue, they are incentivized to offer better terms. |

What is included in the product

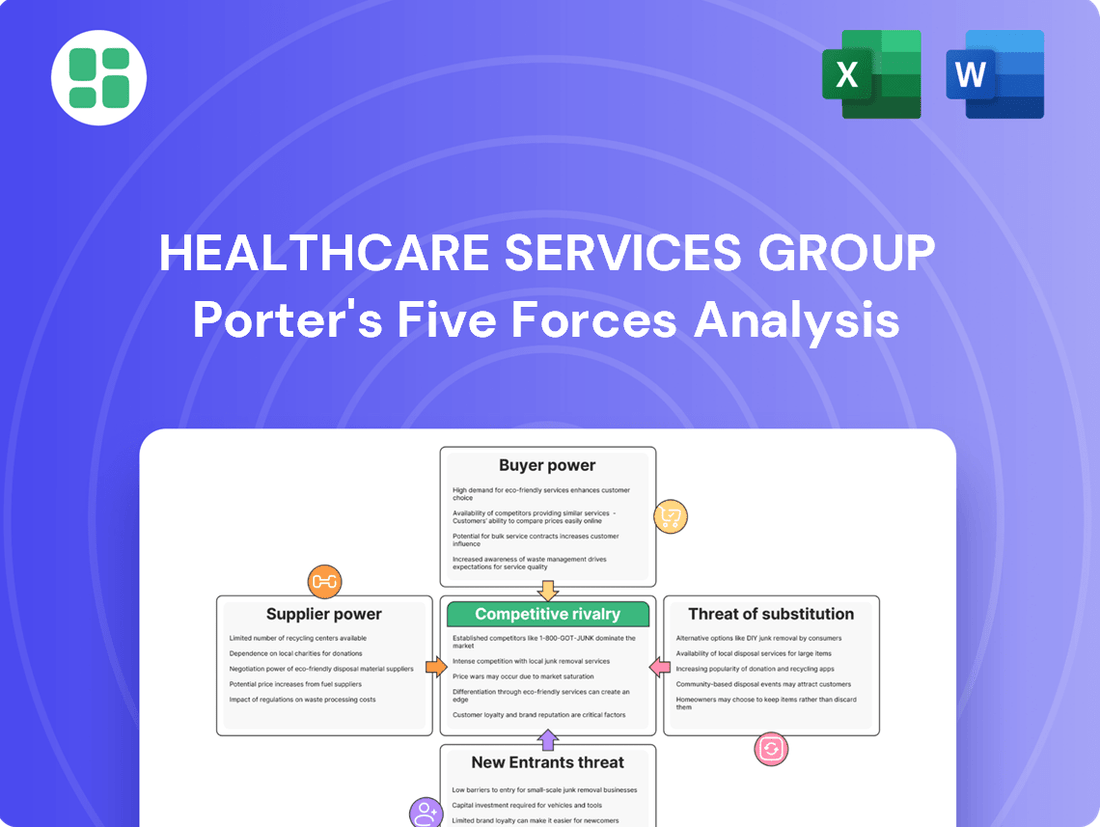

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Healthcare Services Group, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute services.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Healthcare Services Group.

Customers Bargaining Power

The bargaining power of Healthcare Services Group's customers, which include nursing homes, rehabilitation centers, and assisted living facilities, is substantial. This power stems from the potential for customer consolidation and the considerable value of the contracts they represent. For instance, large healthcare facility chains, by virtue of their scale, can effectively leverage their purchasing volume to negotiate more favorable pricing and service terms. While individual smaller facilities might possess less individual leverage, they still have the ability to solicit competitive bids from various service providers, including Healthcare Services Group, to secure advantageous arrangements.

Customer switching costs for healthcare facilities when changing outsourced service providers like Healthcare Services Group are generally considered moderate. While there's an initial effort involved in transitioning staff and integrating new operational processes, these disruptions are often manageable. For instance, a facility might spend a few weeks on onboarding a new housekeeping or dietary services team, ensuring service continuity.

The decision to switch often hinges on a cost-benefit analysis. If a competitor offers significantly lower prices or demonstrably higher service quality, the perceived benefits can easily outweigh the transition costs. For example, if a new provider can reduce housekeeping expenses by 10% while maintaining or improving cleanliness standards, the savings can quickly compensate for the temporary inconvenience of switching.

This dynamic empowers customers. In 2024, the competitive landscape for healthcare support services remained robust, with numerous providers vying for contracts. This competition intensifies the need for established players like Healthcare Services Group to offer compelling value propositions, as facilities can readily explore alternatives if current service levels or pricing become uncompetitive.

Healthcare facilities often operate with tight budgets, making them acutely aware of the costs associated with services, particularly for non-core functions. This financial pressure means they are very sensitive to price increases, giving them leverage when negotiating with providers like Healthcare Services Group (HCSG).

Because healthcare providers can easily compare pricing and service offerings from various companies, they have significant bargaining power. This ability to shop around allows them to push for more competitive rates and favorable contract terms from HCSG, directly impacting the company's revenue and profit margins.

Threat of Backward Integration (In-house Services)

Customers, particularly large healthcare systems or hospital networks, can wield significant bargaining power by threatening to bring services like housekeeping, laundry, and dining in-house. This potential for backward integration, while demanding substantial investment in personnel, training, and management, serves as a potent negotiating lever during contract discussions. For instance, a large hospital system might estimate the cost savings of managing its own laundry services to counter price increases from an external provider.

The viability of in-house operations hinges on factors such as the scale of the customer's facility and their existing infrastructure. A smaller clinic might find insourcing impractical due to limited resources, whereas a multi-building hospital campus could more readily absorb such functions. This threat is not always acted upon but remains a constant consideration for service providers aiming to maintain competitive pricing and service levels.

In 2024, the trend of healthcare organizations exploring insourcing for non-core services continued, driven by a desire for greater cost control and operational efficiency. While specific data on the percentage of healthcare facilities that have successfully insourced services like housekeeping or laundry is not readily available, anecdotal evidence suggests an increasing interest. For example, reports from industry surveys in late 2023 indicated that over 60% of hospital administrators were evaluating opportunities to bring ancillary services in-house to manage budget constraints.

- Customer Leverage: The option to insource services like housekeeping, laundry, and dining gives customers significant bargaining power.

- Investment Threshold: Bringing services in-house requires substantial investment in staff, training, and management, influencing its feasibility.

- Facility Size Matters: The practicality of backward integration often correlates with the size and existing infrastructure of the customer's facility.

- Negotiation Tool: The latent threat of insourcing provides customers with leverage during contract renewals and initial negotiations.

Service Differentiation and Quality Perception

While basic services like housekeeping can be seen as standard, Healthcare Services Group (HCSG) can mitigate customer bargaining power by emphasizing superior quality and efficiency. For instance, HCSG's focus on specialized dietary programs, which cater to specific patient needs, or their adherence to stringent regulatory compliance, can set them apart. This differentiation makes it harder for customers to simply switch based on price alone.

The perception of quality plays a crucial role. If healthcare facilities view HCSG's offerings as uniquely beneficial or more effective than competitors, their willingness to negotiate aggressively on price diminishes. This is particularly true in areas like infection control or specialized food services where a higher standard directly impacts patient outcomes and facility reputation.

- Service Differentiation: HCSG's ability to offer specialized programs, such as advanced dietary solutions or enhanced laundry services, can create a unique value proposition.

- Quality Perception: A strong reputation for efficiency and regulatory compliance can lead clients to view HCSG as a premium provider, reducing price sensitivity.

- Reduced Switching Incentives: When clients perceive HCSG's services as integral to their operational success or patient care quality, the cost and disruption of switching providers become more significant deterrents.

Healthcare Services Group's customers, primarily nursing homes and assisted living facilities, possess considerable bargaining power. This is amplified by the industry's competitive nature and the potential for customers to insource services, thereby reducing reliance on external providers like HCSG. In 2024, the pressure on healthcare budgets remained a key driver, making price sensitivity a significant factor in contract negotiations.

The ability for customers to switch providers is facilitated by moderate switching costs, especially when competitors offer substantial price advantages. For instance, a 10% reduction in housekeeping costs could easily offset the effort of transitioning to a new vendor. This dynamic forces HCSG to continually demonstrate value beyond mere cost savings.

Customers can also leverage their size and volume to negotiate better terms. Large healthcare chains, by consolidating their purchasing power, can demand more favorable pricing. This is further underscored by the fact that in 2024, many healthcare organizations were actively exploring insourcing options to gain greater control over costs and operations.

| Factor | Impact on HCSG | 2024 Context |

|---|---|---|

| Customer Consolidation | Increases buyer power, leading to price pressure | Continued trend of larger healthcare systems acquiring smaller ones |

| Switching Costs | Moderate, allowing for easier provider comparison | Facilities actively compare pricing and service offerings from multiple vendors |

| Threat of Insourcing | Significant leverage for customers | Growing interest in insourcing non-core services for cost control |

| Price Sensitivity | High due to tight healthcare budgets | HCSG must offer competitive pricing to retain contracts |

Preview Before You Purchase

Healthcare Services Group Porter's Five Forces Analysis

This preview shows the exact Healthcare Services Group Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis is ready for your strategic planning and decision-making.

Rivalry Among Competitors

The healthcare support services market is quite crowded, with a wide array of competitors ranging from national giants to smaller, specialized regional firms. This sheer number and variety mean that rivalry is often fierce, particularly for more standardized service offerings.

Companies like Healthcare Services Group (HCSG) face competition not only from other large, established national providers but also from numerous smaller, local businesses that may focus on specific services or geographic areas. For instance, in 2024, the market for outsourced environmental services in healthcare facilities saw continued growth, attracting new entrants alongside existing players.

Competition in this sector isn't solely driven by price; factors such as a company's reputation for quality, the range of services it can provide, and its ability to serve multiple locations are equally important. This multifaceted competition can put pressure on margins and necessitate continuous innovation and service improvement.

The growth rate of the healthcare services industry, especially for long-term care facilities, significantly shapes competitive rivalry. When the market expands quickly, companies can acquire new clients without directly impacting rivals' market share, which tends to soften competition.

Conversely, a slower growth environment forces companies into a more aggressive pursuit of existing contracts and customers. This dynamic can lead to price wars and increased competition as providers fight for a limited pool of business. For instance, the U.S. long-term care market, a key segment for many healthcare service providers, saw steady growth, but localized saturation can still intensify rivalry.

Healthcare Services Group (HCSG) faces intense competition where service differentiation is a key battleground. While core services like basic cleaning are often commoditized, HCSG's ability to offer unique value through specialized dietary programs or advanced sanitation techniques can significantly reduce direct rivalry. For instance, in 2024, the demand for enhanced infection control measures in healthcare facilities, a service HCSG can differentiate, has been a significant driver for providers able to demonstrate superior protocols.

The degree to which HCSG can carve out distinct offerings directly influences the intensity of competitive rivalry. Developing and marketing specialized dietary programs that cater to specific patient needs or implementing proprietary, advanced sanitation protocols can create a unique selling proposition. This differentiation allows HCSG to potentially command premium pricing, thereby lessening the pressure of direct price wars with competitors offering more standardized services.

Exit Barriers

Healthcare Services Group, like many in the healthcare services sector, faces significant exit barriers. These can include substantial investments in specialized equipment, such as large-scale laundry facilities or medical supply chains, which are difficult to repurpose or sell. The presence of these high fixed costs can trap companies in the market, even when returns are minimal.

These entrenched investments mean that firms may continue operating at reduced profitability to cover overheads, leading to prolonged overcapacity. This situation often fuels aggressive pricing tactics as companies strive to maintain market share and utilize their underemployed assets. For Healthcare Services Group, this dynamic can intensify competitive rivalry, as the cost of exiting the market outweighs the potential losses from continued operation.

- High Fixed Asset Investment: Companies in healthcare services often have significant capital tied up in specialized facilities and equipment, making divestment costly.

- Long-Term Contracts: Existing service agreements can bind companies to specific markets or clients, hindering a swift exit.

- Specialized Workforce: The need for skilled and specialized employees can create a barrier, as retraining or redeploying such talent is often challenging.

- Regulatory Hurdles: Exiting certain healthcare services may involve complex regulatory approvals, adding to the difficulty and cost of departure.

Cost Structure and Pricing Strategies

The cost structure of competitors significantly impacts competitive rivalry within the healthcare services sector. Companies that manage to lower their overheads or streamline operations can offer more aggressive pricing, directly challenging established players like HCSG. For instance, in 2024, many healthcare providers focused on optimizing staffing models and supply chain efficiencies to reduce operational costs.

Pricing strategies employed by rivals further intensify this rivalry. A shift from traditional cost-plus pricing to value-based pricing models means companies are increasingly judged on the outcomes and quality of care they provide, not just the services rendered. This can lead to price wars or a focus on differentiation through service quality.

- Competitor Cost Structures: Companies with lean operational models and efficient resource allocation can undercut rivals on price.

- Pricing Strategy Impact: The adoption of value-based pricing encourages competition based on quality and patient outcomes, not just cost.

- HCSG's Position: HCSG must continually assess its cost base and pricing to remain competitive against providers with potentially lower cost structures.

- Market Dynamics: The interplay between cost efficiency and pricing strategy dictates the intensity of rivalry in the healthcare services market.

Competitive rivalry in healthcare services, particularly for companies like Healthcare Services Group (HCSG), is intense due to a fragmented market and varying service offerings. In 2024, the demand for specialized services like advanced infection control and tailored dietary programs intensified competition, pushing providers to differentiate beyond basic offerings.

High exit barriers, such as significant investments in specialized equipment and long-term contracts, keep many firms operating even at low profitability. This can lead to prolonged overcapacity and aggressive pricing tactics as companies try to utilize their assets, thereby intensifying rivalry for established players like HCSG.

Competitor cost structures and pricing strategies are critical. In 2024, many healthcare providers focused on optimizing operations to reduce costs, enabling more aggressive pricing. The shift towards value-based pricing further fuels competition based on quality and patient outcomes, demanding continuous assessment of HCSG's cost base and service value.

| Factor | Impact on Rivalry | 2024 Trend Example |

|---|---|---|

| Market Fragmentation | High number of competitors leads to intense rivalry. | Continued growth in outsourced environmental services attracting new and existing players. |

| Service Differentiation | Ability to offer unique services reduces direct competition. | Increased demand for advanced infection control and specialized dietary programs. |

| Exit Barriers | High fixed costs and contracts trap firms, leading to overcapacity and price wars. | Companies continue operating with low profitability to cover overheads, intensifying competition. |

| Cost & Pricing Strategies | Lean operations and value-based pricing pressure margins. | Focus on operational efficiency and outcome-based service models. |

SSubstitutes Threaten

The most direct substitute for Healthcare Services Group's (HCSG) outsourced services is when healthcare facilities decide to manage these functions themselves. This move allows them to retain direct oversight of their staff and quality protocols. For instance, a large hospital system with significant in-house resources might find it more cost-effective to handle its environmental services or laundry operations internally, especially if they believe they can achieve better efficiency and control than an external provider.

Facilities may opt for in-house provision to maintain absolute control over their operational standards and staff management, aiming for greater customization and immediate responsiveness. This can also be driven by a perception of cost savings, particularly for organizations with substantial scale and established internal expertise. For HCSG, this represents a persistent competitive pressure, as clients always weigh the benefits of outsourcing against the potential advantages of internal management.

The threat of substitutes for Healthcare Services Group (HCSG) hinges on the perceived cost and quality of in-house versus outsourced services. If healthcare facilities find they can achieve comparable or superior quality at a lower price by handling services internally, the appeal of HCSG's offerings diminishes.

For instance, if a hospital can equip and staff its own laundry or environmental services for less than HCSG charges, and maintain the same or better standards, that hospital becomes a significant substitute. HCSG must therefore consistently prove its value proposition, highlighting efficiency gains, specialized expertise, and economies of scale that in-house operations might struggle to replicate.

In 2024, the trend towards greater operational efficiency and cost control within healthcare systems means that any facility considering in-house solutions will rigorously compare them against outsourced providers like HCSG. Demonstrating a clear return on investment and superior service delivery is crucial to counter this substitution threat.

Healthcare facilities' inclination to shift from outsourcing to in-house management of services hinges on their existing internal capabilities, the available management bandwidth, and their prior experiences with either model. For instance, a facility that has successfully managed services like laundry or food preparation internally in the past might more readily consider returning to that approach if current outsourcing arrangements become less favorable.

The perceived threat of substitution is directly influenced by these historical experiences. Facilities that have a track record of efficient in-house operations are less deterred by the idea of bringing outsourced services back in-house, thereby increasing the potential for substitution away from current providers.

Perceived Value of Specialization

Healthcare Services Group's (HCSG) specialized expertise in areas like food service and housekeeping, particularly concerning regulatory compliance and infection control, significantly diminishes the threat of substitutes. Many healthcare facilities find it more efficient and cost-effective to outsource these complex functions rather than develop the in-house capabilities themselves.

The perceived value of HCSG's specialization is further amplified by its ability to achieve economies of scale and implement efficient management practices. This allows them to offer services that are not only specialized but also competitively priced, making it harder for potential substitutes to match their value proposition. For instance, in 2023, HCSG reported revenue of $1.1 billion, demonstrating the scale of their operations and their established market presence.

- Specialized Expertise: HCSG's focus on non-clinical support services provides deep knowledge in areas like dietary management and environmental services, which are critical for healthcare operations but outside core medical functions.

- Economies of Scale: Operating across numerous facilities allows HCSG to leverage purchasing power and operational efficiencies, translating into cost savings for clients.

- Reduced Internal Burden: Healthcare providers can avoid the significant investment and complexity associated with managing specialized functions like regulatory compliance and infection prevention in-house.

- Market Presence: With a substantial revenue base, HCSG has demonstrated its ability to successfully serve a large number of clients, reinforcing the reliability and effectiveness of its specialized services.

Regulatory and Compliance Burdens

The increasing complexity of healthcare regulations, such as those related to patient privacy (HIPAA) and infection control standards, makes in-house management of these services a significant burden for many healthcare facilities. For instance, the Centers for Medicare & Medicaid Services (CMS) continuously updates its Conditions of Participation, requiring constant vigilance and specialized knowledge.

Healthcare Support Services Group (HCSG) offers specialized expertise in navigating these evolving regulatory landscapes, particularly in areas like environmental services and dining, which are directly impacted by health and safety mandates. This specialized knowledge reduces the perceived risk and cost associated with in-house management, thereby diminishing the attractiveness of substitutes.

- Regulatory Complexity: Facilities face increasing burdens from regulations like HIPAA and CMS Conditions of Participation.

- In-House Burden: Managing compliance in-house for services like food safety and infection control is costly and complex.

- HCSG's Value Proposition: HCSG provides specialized expertise to navigate these regulations, reducing facility risk.

- Reduced Substitute Attractiveness: HCSG's compliance proficiency makes outsourcing a more appealing option than in-house management.

The threat of substitutes for HCSG is moderate, primarily stemming from healthcare facilities' ability to manage non-clinical support services in-house. This option becomes more attractive if internal operations can achieve comparable quality at a lower cost or offer greater customization. For example, a large hospital system with existing infrastructure and management capacity might find it feasible to bring laundry or environmental services back in-house, especially if outsourcing costs rise or service levels decline.

However, HCSG's specialized expertise, particularly in regulatory compliance and infection control, significantly mitigates this threat. Many facilities lack the in-house knowledge and resources to effectively manage these complex areas, making outsourcing a more practical and less risky alternative. HCSG's scale also allows for cost efficiencies that are difficult for individual facilities to replicate internally.

In 2024, the ongoing pressure on healthcare providers to optimize costs while maintaining high standards of care means that the comparison between in-house and outsourced services will remain a critical decision point. HCSG's ability to demonstrate clear value through efficiency, specialized knowledge, and economies of scale is key to retaining clients and fending off substitution threats.

| Factor | HCSG's Position | Implication for Substitutes |

|---|---|---|

| In-house Management Viability | Moderate; depends on facility size and existing capabilities. | Facilities with scale and expertise may consider in-house options. |

| Specialized Expertise (Regulatory, Infection Control) | High; HCSG possesses deep knowledge. | Makes in-house management complex and costly for many facilities. |

| Economies of Scale | High; HCSG's large operational footprint. | Difficult for individual facilities to match cost efficiencies. |

| Cost-Benefit Analysis | HCSG must continually prove value against in-house costs. | Any perceived cost advantage for in-house operations increases substitution threat. |

Entrants Threaten

While starting basic healthcare support services might not demand massive upfront capital, scaling to rival incumbents like Healthcare Services Group (HCSG) presents a significant hurdle. HCSG, for instance, operates with substantial investments in specialized equipment, advanced technology platforms, and a considerable workforce, making it challenging for newcomers to match their operational capacity and efficiency.

Established players in healthcare services, like HCSG, often leverage significant economies of scale. This means they can negotiate better prices for supplies, optimize staffing across a larger network, and spread fixed costs over a greater volume of services, leading to lower per-unit costs. For instance, a large provider might secure bulk discounts on medical equipment or pharmaceuticals, a benefit a new, smaller entrant cannot immediately replicate.

The experience curve further solidifies this advantage. As companies like HCSG gain more experience in managing operations, patient care, and regulatory compliance, they become more efficient. This accumulated knowledge allows them to streamline processes, reduce waste, and improve service delivery, all contributing to a lower cost structure over time. New entrants face a steep learning curve, meaning their initial operational costs are likely to be higher as they build expertise and refine their systems.

This inherent cost disadvantage makes it challenging for new companies to enter the market and compete effectively on price. Without the scale and experience to match the established players’ efficiency, newcomers would struggle to offer competitive rates, hindering their ability to gain market share rapidly. For example, in 2024, the average operating margin for large healthcare service providers remained competitive, a testament to their efficiency gains, while smaller, newer entities often operate on thinner margins.

The healthcare industry's stringent regulatory environment presents a significant barrier to new entrants. Companies must navigate complex rules concerning sanitation, food safety, and healthcare-specific labor laws. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to enforce strict infection control standards, requiring substantial investment in training and infrastructure for any new service provider.

Developing the necessary expertise to ensure compliance with these multifaceted regulations demands considerable time and financial resources. This specialized knowledge is not easily replicated, effectively deterring many potential competitors. HCSG's established compliance infrastructure and deep understanding of these requirements offer a distinct competitive advantage in this landscape.

Access to Distribution Channels and Customer Relationships

New entrants face significant hurdles in accessing established distribution channels and cultivating crucial customer relationships within the healthcare services sector. Existing companies, like Healthcare Services Group (HCSG), have spent years building robust sales networks and fostering trust with key decision-makers in hospitals and other healthcare facilities. This incumbency advantage means new players must invest heavily in marketing and potentially offer lower prices to even get a foot in the door.

Consider the landscape in 2024: HCSG, for instance, reported revenues of $2.1 billion for fiscal year 2023, demonstrating their established market presence. Breaking into this market requires new entrants to not only match but often exceed the service quality and reliability that clients have come to expect from incumbents. Developing these relationships is a slow, deliberate process, often requiring extensive outreach and proof of consistent performance.

- Established Networks: Incumbents possess pre-existing relationships and contracts with a majority of healthcare facilities, making it difficult for new entrants to secure initial business.

- Brand Reputation: A strong brand reputation, built over years of reliable service, provides a significant barrier to entry, as clients are hesitant to switch to unproven providers.

- Sales Force Investment: New entrants need to invest substantially in building and training a sales force capable of navigating the complex healthcare procurement process and building rapport with facility management.

- Contractual Obligations: Long-term contracts held by existing providers limit the immediate opportunities for new companies to gain market share.

Brand Loyalty and Reputation

In the healthcare services sector, brand loyalty and reputation are incredibly powerful deterrents to new entrants. HCSG, for instance, has cultivated a strong reputation over its history, fostering trust and reliability among its clients. This established goodwill means potential new competitors face a significant hurdle in convincing customers to switch from a known and trusted provider.

Building this level of credibility and overcoming customer inertia requires substantial investment in marketing, service quality, and demonstrating a consistent track record. For example, in 2024, healthcare providers that invested heavily in patient satisfaction scores and clear communication often saw higher retention rates, indicating the importance of reputation.

- Reputation as a Barrier: Established players like HCSG benefit from years of building trust, making it difficult for newcomers to gain traction.

- Customer Reluctance: Clients in healthcare often prioritize reliability and proven quality, leading to a hesitancy to adopt new, unproven services.

- Investment in Credibility: New entrants must allocate significant resources to marketing and service development to overcome the established reputation of incumbents.

The threat of new entrants in the healthcare services sector, particularly for companies like Healthcare Services Group (HCSG), is significantly mitigated by substantial capital requirements and economies of scale. Newcomers must overcome high initial investments in specialized equipment and technology, a challenge exacerbated by HCSG's ability to leverage bulk purchasing power for supplies, leading to lower per-unit costs.

Furthermore, the steep learning curve and accumulated experience of incumbents like HCSG create an efficiency advantage that new entrants struggle to match. This cost disadvantage, coupled with stringent regulatory compliance, demanding significant investment in training and infrastructure, acts as a formidable barrier. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to enforce rigorous infection control standards, requiring substantial upfront investment for any new provider.

Established players also benefit from strong brand reputations and long-standing customer relationships, making it difficult for new companies to secure initial business. HCSG's reported fiscal year 2023 revenue of $2.1 billion underscores their established market presence, a testament to years of building trust and reliability, which new entrants must invest heavily to overcome.

| Barrier Type | Description | Impact on New Entrants | Example for HCSG (2024 Context) |

|---|---|---|---|

| Capital Requirements | High upfront investment in specialized equipment and technology. | Makes market entry financially prohibitive for smaller entities. | Need for advanced cleaning equipment, laundry facilities, and IT systems. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and operational efficiency. | New entrants cannot compete on price due to higher initial costs. | HCSG's ability to negotiate better pricing on cleaning supplies and linens. |

| Regulatory Compliance | Navigating complex healthcare regulations (e.g., infection control). | Requires significant investment in training, infrastructure, and expertise. | Adherence to CMS infection control standards, demanding specialized protocols and staff training. |

| Brand Reputation & Relationships | Established trust and long-term contracts with healthcare facilities. | Clients are hesitant to switch from proven providers to unproven ones. | HCSG's history of reliable service delivery fosters client loyalty, making it hard for new competitors to gain initial contracts. |

Porter's Five Forces Analysis Data Sources

Our Healthcare Services Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including financial reports from public healthcare providers, market research from reputable firms like IQVIA and Definitive Healthcare, and regulatory filings from government agencies such as CMS and FDA.