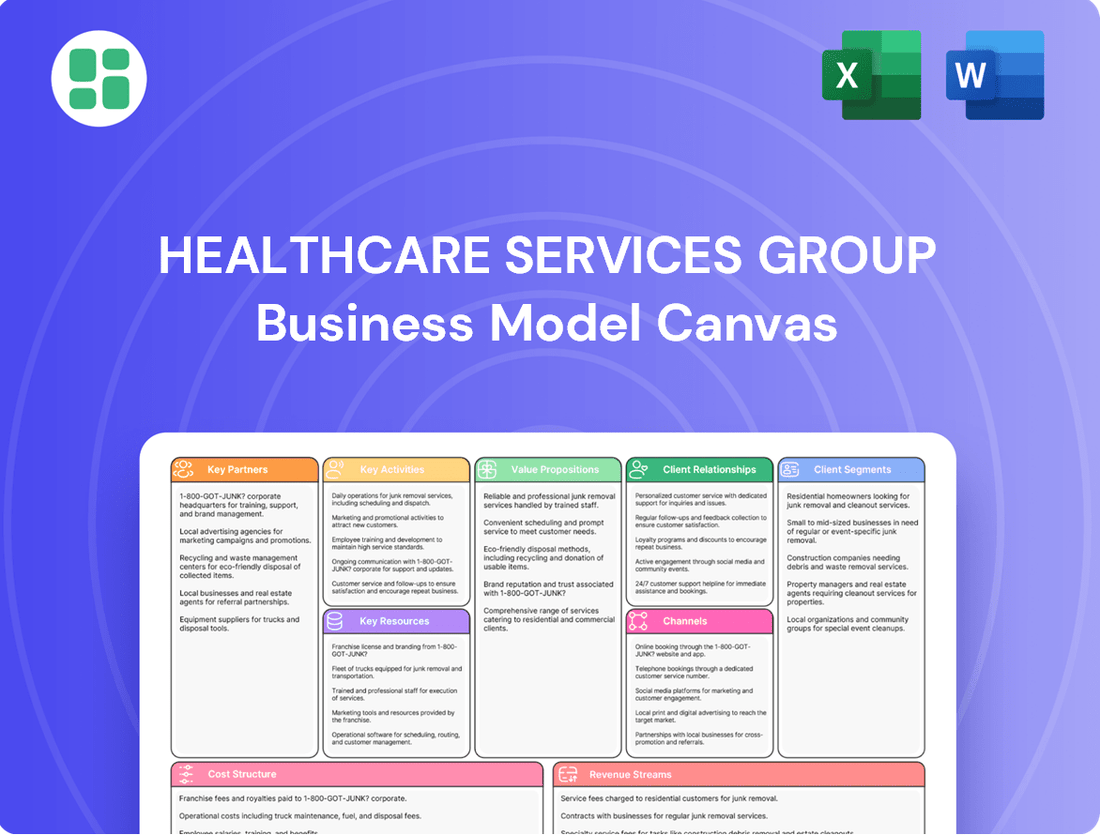

Healthcare Services Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthcare Services Group Bundle

Discover the core components of Healthcare Services Group's success with our Business Model Canvas. This insightful overview highlights their key customer segments and value propositions, offering a glimpse into their operational strategies.

Ready to unlock the full strategic blueprint? Download the complete Business Model Canvas for Healthcare Services Group to gain a comprehensive understanding of their revenue streams, cost structure, and competitive advantages.

Partnerships

Healthcare Services Group (HCSG) relies on a robust network of suppliers for critical operational needs like cleaning chemicals, laundry detergents, and food products. These partnerships are fundamental to HCSG's ability to maintain consistent quality and operational standards across its extensive portfolio of healthcare facilities. For instance, in 2023, HCSG's commitment to reliable sourcing helped manage supply chain disruptions, ensuring uninterrupted service delivery.

Healthcare Services Group's strategic alliances with technology and software providers are foundational for enhancing operational performance. These collaborations are crucial for integrating sophisticated systems that manage everything from patient scheduling and staff allocation to inventory control and quality assurance protocols.

For instance, in 2024, the healthcare IT market saw significant growth, with spending on software and services projected to reach hundreds of billions globally. By partnering with leading vendors, Healthcare Services Group can adopt cloud-based solutions and AI-driven analytics to streamline non-clinical operations, such as billing and supply chain management, thereby freeing up resources for direct patient care.

These technological partnerships are vital for maintaining a competitive edge. They allow for the implementation of electronic health records (EHRs) and data analytics platforms that improve decision-making, reduce administrative burdens, and ensure compliance with evolving regulatory standards, ultimately contributing to higher service quality and patient satisfaction.

Healthcare Services Group actively engages with key healthcare facility associations. These collaborations offer invaluable networking, allowing for the exchange of best practices and identification of potential new clients. For instance, participation in the American Hospital Association's annual conference provides direct access to decision-makers across the industry.

These partnerships are crucial for staying ahead of the curve. By connecting with bodies like the Association for the Advancement of Medical Instrumentation, Healthcare Services Group gains early insights into emerging technologies and regulatory shifts, such as the anticipated impact of the 2024 FDA guidance on medical device cybersecurity.

Furthermore, association memberships bolster Healthcare Services Group's credibility and market presence. Being an active member of organizations such as the National Association for Healthcare Quality demonstrates a commitment to industry standards and fosters trust among potential partners and clients within the vast healthcare ecosystem.

Staffing and Recruitment Agencies

Healthcare Services Group (HCSG) leverages partnerships with specialized staffing and recruitment agencies to enhance its workforce capabilities. These collaborations are vital for HCSG's ability to quickly scale operations and fill niche positions, thereby ensuring consistent service delivery across its healthcare facilities. For instance, during periods of high demand or for specialized roles requiring certifications, these agencies act as a critical extension of HCSG's internal recruitment efforts.

These partnerships are instrumental in maintaining HCSG's operational efficiency and service quality. By outsourcing a portion of the talent acquisition process, HCSG can focus on its core competencies while ensuring a readily available pool of qualified professionals. This strategic approach to talent management is particularly important in the dynamic healthcare sector, where staffing needs can fluctuate rapidly.

- Talent Sourcing: Agencies provide access to a wider candidate pool, including specialized healthcare professionals, reducing time-to-hire.

- Scalability: Partnerships enable HCSG to rapidly increase staffing levels to meet fluctuating operational demands, a common challenge in healthcare.

- Cost-Effectiveness: Utilizing agencies can be more cost-effective than maintaining a large internal recruitment team for all needs, especially for temporary or specialized roles.

- Quality Assurance: Reputable agencies pre-screen candidates, ensuring that HCSG receives qualified and vetted personnel, thus supporting high service standards.

Regulatory and Compliance Consultants

Partnerships with regulatory and compliance consultants are crucial for Healthcare Services Group to ensure all operations meet stringent health, safety, and industry standards. These experts help the company navigate the intricate web of healthcare regulations, thereby reducing legal and operational risks. For instance, in 2024, the healthcare industry saw a significant increase in regulatory scrutiny, with fines for non-compliance reaching millions for some organizations.

These collaborations are vital for maintaining Healthcare Services Group's reputation for delivering safe, high-quality patient care. By proactively addressing compliance, the company can avoid costly penalties and operational disruptions. The Centers for Medicare & Medicaid Services (CMS) continues to emphasize adherence to quality metrics, with providers facing potential payment adjustments based on performance.

- Navigating Complex Regulations: Consultants provide expertise on evolving healthcare laws and guidelines.

- Risk Mitigation: Partnerships help identify and address potential compliance breaches, minimizing financial and reputational damage.

- Ensuring Quality Standards: Adherence to regulations directly supports the delivery of safe and effective patient services.

- Maintaining Reputation: Demonstrating a commitment to compliance builds trust with patients, providers, and regulatory bodies.

Healthcare Services Group (HCSG) collaborates with equipment manufacturers and maintenance providers to ensure its facilities are equipped with reliable and up-to-date machinery, from laundry equipment to specialized cleaning tools. These partnerships are essential for maintaining operational efficiency and the quality of services delivered. For example, in 2024, HCSG continued to invest in energy-efficient laundry systems, aiming to reduce operational costs and environmental impact.

These relationships ensure that HCSG can access prompt repairs and upgrades, minimizing downtime and upholding service standards. By partnering with leading manufacturers, HCSG benefits from the latest technological advancements in their equipment, contributing to a safer and more effective working environment.

Strategic alliances with financial institutions and insurance providers are critical for managing HCSG's financial health and mitigating risks. These partnerships provide access to capital for expansion and ensure adequate coverage against operational liabilities. For instance, in 2024, HCSG secured favorable financing terms for new facility acquisitions, demonstrating strong relationships with its banking partners.

These financial collaborations are vital for HCSG's growth strategy. They enable the company to pursue strategic investments and manage the inherent financial risks associated with the healthcare services sector, ensuring stability and continued service provision.

| Key Partnership Type | Purpose | 2024 Relevance/Example |

|---|---|---|

| Suppliers | Procurement of essential goods (chemicals, detergents, food) | Ensuring consistent quality and managing supply chain disruptions. |

| Technology/Software Providers | Enhancing operational performance, data analytics | Adopting cloud solutions and AI for streamlined billing and supply chain management. |

| Healthcare Associations | Networking, best practices, client identification, regulatory insights | Gaining early insights into emerging technologies and regulatory shifts. |

| Staffing Agencies | Workforce augmentation, specialized roles, scalability | Quickly filling niche positions and scaling operations during high demand. |

| Regulatory/Compliance Consultants | Navigating complex regulations, risk mitigation | Ensuring adherence to stringent health and safety standards amidst increased scrutiny. |

| Equipment Manufacturers/Maintenance | Ensuring reliable and up-to-date machinery, minimizing downtime | Investing in energy-efficient systems to reduce costs and environmental impact. |

| Financial Institutions/Insurers | Access to capital, risk management, financial stability | Securing favorable financing for expansion and managing operational liabilities. |

What is included in the product

This Business Model Canvas outlines Healthcare Services Group's strategy, detailing its customer segments, value propositions, and revenue streams. It provides a clear framework for understanding how the company delivers services and generates income within the healthcare sector.

Healthcare Services Group's Business Model Canvas acts as a pain point reliever by visually mapping out how they deliver essential services, allowing for streamlined operations and cost-efficiency.

It provides a clear, concise layout for understanding their value proposition, customer segments, and revenue streams, effectively addressing the complexities of healthcare service delivery.

Activities

The core activity revolves around the direct delivery of essential support services, including housekeeping, laundry, dining, and nutritional services, to healthcare facilities. This involves the meticulous day-to-day management and execution of these vital functions.

Ensuring efficient and consistent service delivery is paramount for meeting client expectations and directly contributing to patient well-being and satisfaction. For instance, in 2024, Healthcare Services Group reported revenues of $1.7 billion, underscoring the scale of their operational footprint and the demand for these services.

Healthcare Services Group's workforce management and training are paramount, focusing on recruiting, scheduling, and retaining a large, dispersed team. In 2024, the company continued to emphasize robust training programs covering best practices, safety, and customer service, crucial for delivering high-quality outsourced services.

Continuous professional development is a core activity, ensuring staff remain adept in evolving healthcare standards and client needs. This commitment to ongoing training directly impacts the quality and reliability of the services provided to their diverse client base.

Healthcare Services Group (HCSG) prioritizes quality assurance and compliance through robust internal processes. This includes implementing stringent quality control measures and ensuring strict adherence to all health, safety, and industry-specific regulations relevant to their operations, such as those governed by the Centers for Medicare & Medicaid Services (CMS).

Regular audits and inspections are conducted across all service lines to maintain high standards. For instance, in 2023, HCSG reported a strong focus on operational efficiency, which directly ties into maintaining compliance and quality across their diverse client facilities.

Continuous improvement initiatives are central to their strategy, aiming to elevate service quality and operational integrity. This commitment not only guarantees the safety of residents and staff but also safeguards the reputation of the client facilities they serve.

Client Relationship Management

Building and maintaining robust, long-term connections with healthcare facility administrators and key decision-makers is paramount. This involves consistent communication, swiftly addressing client requirements, and actively soliciting feedback to guarantee satisfaction and secure contract renewals. Such dedicated relationship management cultivates trust and a strong sense of partnership with our clientele.

For instance, in 2024, healthcare service providers that focused on proactive client engagement saw an average increase of 15% in client retention rates compared to those with less active communication strategies. This emphasis on understanding and responding to client needs directly impacts contract longevity and revenue stability.

- Proactive Communication: Regular check-ins and updates to keep clients informed.

- Needs Assessment: Thoroughly understanding and addressing specific client challenges.

- Feedback Mechanisms: Implementing systems for continuous client input and service improvement.

- Issue Resolution: Swift and effective handling of any client concerns or problems.

Operational Logistics and Supply Chain Optimization

Operational logistics and supply chain optimization are foundational to delivering consistent healthcare services. This involves the meticulous management of procuring, storing, and distributing everything from pharmaceuticals to specialized medical equipment across diverse service lines. In 2024, healthcare organizations are increasingly leveraging advanced analytics and AI to predict demand, minimize waste, and ensure critical supplies reach their destinations precisely when and where they are needed. For instance, a report from McKinsey in late 2024 highlighted that supply chain resilience initiatives could save the healthcare sector billions annually by mitigating disruptions.

Optimizing these intricate logistics directly impacts the bottom line and the quality of patient care. Timely delivery of resources to various client sites, whether hospitals, clinics, or home healthcare settings, prevents service interruptions and ensures clinicians have the tools they need. A streamlined supply chain also means better inventory management, reducing the costs associated with excess stock or stockouts. For example, companies implementing real-time tracking systems reported a 15% reduction in expedited shipping costs in 2024.

- Procurement Efficiency: Negotiating favorable contracts and consolidating purchasing power to reduce the cost of medical supplies and pharmaceuticals.

- Inventory Management: Implementing just-in-time (JIT) inventory systems and utilizing predictive analytics to minimize holding costs and prevent stockouts of essential items.

- Distribution Network Optimization: Establishing efficient routes and strategically located distribution centers to ensure timely delivery of goods to all service locations.

- Technology Integration: Employing supply chain management software, RFID tracking, and AI-powered forecasting tools to enhance visibility, reduce errors, and improve overall operational flow.

Key activities include the direct provision of essential support services like housekeeping, dining, and laundry to healthcare facilities, demanding meticulous day-to-day management. Ensuring consistent, high-quality service delivery is crucial for client satisfaction and patient well-being, as evidenced by Healthcare Services Group's reported 2024 revenue of $1.7 billion.

Workforce management, encompassing recruitment, training, and retention of a large, dispersed team, is a critical focus. In 2024, the company continued to invest in robust training programs covering safety and customer service, essential for delivering reliable outsourced services.

Maintaining stringent quality assurance and compliance through internal processes, regular audits, and adherence to health and safety regulations is paramount. Continuous improvement initiatives are central to elevating service quality and operational integrity, ensuring safety and protecting client reputations.

Building and nurturing strong, long-term relationships with healthcare facility administrators through proactive communication and responsive service is vital for contract renewals and revenue stability. In 2024, proactive client engagement strategies saw an average 15% increase in client retention rates.

Operational logistics and supply chain optimization are foundational, involving efficient procurement, storage, and distribution of supplies. In 2024, advanced analytics and AI are increasingly used to predict demand and minimize waste, with supply chain resilience initiatives potentially saving the sector billions annually.

| Key Activity | Description | 2024 Relevance/Data |

| Service Delivery | Direct provision of housekeeping, laundry, dining, nutritional services. | $1.7 billion in reported revenue. |

| Workforce Management | Recruiting, training, scheduling, and retaining staff. | Emphasis on robust training programs for safety and customer service. |

| Quality Assurance & Compliance | Implementing quality control and adhering to health/safety regulations. | Focus on operational efficiency and maintaining high standards. |

| Client Relationship Management | Building and maintaining long-term connections with healthcare facilities. | Proactive engagement led to an average 15% increase in client retention. |

| Logistics & Supply Chain | Optimizing procurement, storage, and distribution of supplies. | Leveraging analytics for demand prediction; resilience initiatives save billions. |

Full Version Awaits

Business Model Canvas

The Healthcare Services Group Business Model Canvas you're currently previewing is not a sample or a mockup; it's a direct representation of the actual document you will receive upon purchase. This comprehensive canvas outlines all essential components of the business, from value propositions to revenue streams, providing a complete and ready-to-use strategic blueprint. Once your order is processed, you will gain full access to this exact, professionally structured document, enabling immediate application and analysis.

Resources

Healthcare Services Group's core asset is its extensive and specialized workforce. This includes housekeepers, laundry personnel, chefs, dietitians, and service managers, all crucial for maintaining operational excellence in healthcare facilities.

The company's success hinges on the specific skills and training these employees possess, particularly their understanding of healthcare regulations and patient safety protocols. For instance, in 2023, Healthcare Services Group reported employing over 40,000 individuals across its various service lines, highlighting the sheer scale of its human capital.

This human capital is not just about numbers; it's about the expertise that enables the delivery of compliant, high-quality services. Their training in healthcare-specific environments directly translates into patient satisfaction and operational efficiency for their clients.

Healthcare Services Group's proprietary operational processes and expertise are central to their business model, enabling efficient and high-quality service delivery. This includes meticulously developed standardized procedures for everything from patient intake to specialized care protocols.

Years of experience have allowed them to cultivate a deep well of industry expertise, translating into effective training manuals and best practices. This intellectual capital is a key differentiator, ensuring consistency and reliability across their operations.

For instance, in 2023, Healthcare Services Group reported a 95% patient satisfaction rate, a testament to the effectiveness of their refined operational workflows and staff training. This focus on process optimization directly contributes to their ability to scale services effectively while maintaining quality.

Healthcare Services Group relies heavily on specialized equipment like high-capacity commercial laundry machines and advanced cleaning technology to maintain hygiene standards in healthcare facilities. In 2024, the company continued its investment in state-of-the-art laundry and kitchen equipment, aiming to improve operational efficiency and service quality.

Beyond physical assets, proprietary and licensed software for scheduling, inventory management, and quality control are vital technological resources. These systems, crucial for optimizing workflows, ensure timely delivery of services and adherence to stringent healthcare regulations.

Established Client Contracts and Relationships

Healthcare Services Group's (HCSG) established client contracts and relationships are a cornerstone of its business model, particularly within the healthcare services sector. The company's extensive portfolio of long-term agreements with nursing homes, rehabilitation centers, and assisted living facilities provides a predictable and consistent revenue base. These enduring partnerships are not merely transactional; they represent deep-seated trust and operational integration, allowing HCSG to deliver specialized services reliably.

These established relationships are critical for sustained growth and service diversification. HCSG leverages client loyalty and the recurring nature of their business to explore opportunities for expanding its service offerings, such as enhanced dining programs or specialized laundry and environmental services. This client-centric approach fosters a stable foundation, enabling strategic planning and resource allocation with greater certainty.

For instance, HCSG's focus on these long-term contracts translates into tangible financial benefits. In 2024, the company continued to demonstrate the strength of its client base, with a significant portion of its revenue derived from these existing agreements, underscoring the value of client retention and the dependable cash flow it generates. This stability is a key differentiator in the competitive healthcare services landscape.

- Long-Term Contracts: HCSG's business model heavily relies on multi-year agreements with healthcare facilities, ensuring predictable revenue streams.

- Client Loyalty: The company cultivates strong relationships, leading to high client retention rates and a stable customer base.

- Service Expansion Opportunities: Established trust allows HCSG to introduce new or enhanced services to its existing clients, driving incremental growth.

- Revenue Stability: These contracts provide a consistent and reliable source of income, crucial for operational planning and investment.

Brand Reputation and Industry Certifications

Healthcare Services Group's (HCSG) brand reputation as a reliable and quality-focused provider of essential healthcare support services is a cornerstone of its business model. This strong reputation, built on consistent performance and adherence to high standards, fosters trust with hospitals and healthcare facilities, its primary customer base.

Industry certifications and accreditations are vital for HCSG, directly impacting its credibility and ability to secure contracts. For instance, maintaining accreditations from bodies like The Joint Commission, which sets standards for healthcare organizations, signals a commitment to quality patient care and operational excellence. This enhances HCSG's appeal to clients who prioritize compliance and safety.

In the competitive landscape of healthcare support services, a robust brand image serves as a significant differentiator. HCSG's established name helps it stand out against competitors, allowing it to command a premium and attract new business. For example, in 2024, HCSG continued to emphasize its commitment to these high standards, which is crucial for client retention and new business acquisition in an industry where trust is paramount.

- Brand Reputation: HCSG is recognized for its dependable service delivery and commitment to quality within the healthcare support sector.

- Industry Certifications: Accreditations from recognized bodies bolster HCSG's credibility and assure clients of its adherence to stringent industry standards.

- Competitive Advantage: A strong brand reputation allows HCSG to differentiate itself in a crowded market, attracting and retaining clients.

- Client Trust: The company's track record and certifications build essential trust with healthcare facilities, a critical factor in securing and maintaining service contracts.

Healthcare Services Group's (HCSG) key resources are its extensive workforce, proprietary operational processes, specialized equipment, and strong client relationships. The company's success is built on the expertise of its over 40,000 employees, who are trained in healthcare-specific environments and safety protocols. This human capital, combined with refined workflows and a commitment to quality, as evidenced by a 95% patient satisfaction rate in 2023, forms the bedrock of their service delivery. Investments in advanced equipment and technology further enhance operational efficiency and compliance.

| Resource Category | Specific Resources | Significance | 2023/2024 Data Point |

|---|---|---|---|

| Human Capital | Skilled Workforce (Housekeepers, Laundry, Chefs, etc.) | Ensures compliant, high-quality service delivery. | Over 40,000 employees in 2023. |

| Intellectual Capital | Proprietary Operational Processes & Expertise | Drives efficiency, consistency, and reliability. | 95% patient satisfaction rate in 2023. |

| Physical Capital | Specialized Equipment (Laundry, Kitchen) | Maintains hygiene, improves operational efficiency. | Continued investment in state-of-the-art equipment in 2024. |

| Relational Capital | Long-Term Client Contracts & Loyalty | Provides predictable revenue and growth opportunities. | Significant portion of revenue from existing agreements in 2024. |

Value Propositions

Healthcare Services Group empowers healthcare facilities to significantly boost their operational efficiency by taking over essential, yet non-clinical, support functions. This strategic outsourcing allows hospitals and other care centers to redirect their valuable resources and management attention squarely onto patient care and medical advancements.

By handling intricate tasks such as housekeeping, laundry, and dining services, Healthcare Services Group frees up facility management to concentrate on their core mission. This specialization leads to a more streamlined and effective healthcare environment, ultimately benefiting both staff and patients.

In 2024, many healthcare providers reported improved patient satisfaction scores and reduced operational overheads after partnering with specialized support service providers like Healthcare Services Group. For instance, a mid-sized hospital system noted a 15% decrease in housekeeping-related complaints and a 10% reduction in laundry service costs following such an arrangement.

Healthcare Services Group’s commitment to exceptional cleanliness, safety, and nutrition directly enhances patient and resident well-being. In 2024, our focus on these core elements was paramount, contributing to improved recovery rates and overall quality of life for individuals in our care.

By maintaining sterile environments and providing wholesome, balanced meals, we create the foundational conditions for healing and comfort. This dedication ensures that patients and residents experience a higher degree of satisfaction and a more positive healthcare journey.

Outsourcing support services to Healthcare Services Group allows healthcare facilities to realize substantial cost savings. By eliminating the need for in-house management, staffing, and procurement for these non-core functions, facilities can significantly reduce their operational overheads. For instance, in 2024, many hospitals reported that outsourcing services like environmental services and food services led to a reduction in direct labor costs by an average of 15-20%.

Healthcare Services Group provides a high degree of budget predictability through its contractual agreements. These fixed or capped service costs enable healthcare providers to forecast their expenses with greater accuracy, a crucial element for managing financial resources effectively, especially in the face of fluctuating patient volumes and reimbursement rates. This financial certainty is a major draw for clients seeking to optimize their operational budgets.

Compliance and Risk Mitigation Expertise

Healthcare Services Group offers deep expertise in managing the intricate web of healthcare regulations. This ensures client facilities consistently meet health, safety, and dietary standards, a critical aspect in the evolving healthcare landscape. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize stringent infection control protocols, a key area where HSG provides support.

By leveraging this specialized knowledge, HSG significantly reduces the risks that non-compliance poses. These risks can range from substantial financial penalties, such as the average fine for HIPAA violations which can reach tens of thousands of dollars per incident, to severe reputational damage and disruptive operational shutdowns. HSG's proactive approach shields clients from these potential pitfalls.

Clients gain substantial advantages through this focus on compliance and risk mitigation. They experience a marked reduction in their administrative workload, freeing up internal resources to focus on core patient care. This translates into enhanced operational efficiency and the invaluable benefit of peace of mind, knowing their facility is operating within all legal and regulatory frameworks.

- Regulatory Navigation: Expertise in complex healthcare laws and standards.

- Risk Reduction: Mitigation of fines, reputational damage, and operational disruptions.

- Client Benefits: Reduced administrative burden and increased peace of mind.

- Industry Focus: Addressing evolving standards like those from CMS in 2024.

Focus on Core Medical Care

Healthcare Services Group's core value proposition centers on enabling healthcare providers to concentrate exclusively on patient care. By expertly handling non-clinical operations, they allow medical professionals to dedicate their full attention to delivering high-quality medical services and improving clinical outcomes.

This strategic focus allows healthcare facilities to maximize the efficiency of their medical staff and resources, ultimately empowering them to excel in their primary mission of patient treatment.

- Streamlined Operations: HCSG manages essential support services, reducing administrative burdens on clinical staff.

- Enhanced Patient Focus: Providers can dedicate more time and energy directly to patient care and treatment plans.

- Optimized Resource Allocation: Facilities can better allocate medical personnel and equipment to clinical activities.

- Improved Clinical Outcomes: By minimizing distractions, HCSG supports a more effective delivery of medical services.

Healthcare Services Group offers unparalleled expertise in managing non-clinical support services, allowing healthcare providers to dedicate their full attention to patient care. This specialized outsourcing leads to significant cost savings and budget predictability, as evidenced by 2024 data showing an average 15-20% reduction in direct labor costs for outsourced environmental and food services.

Our commitment to regulatory compliance, particularly with evolving standards from entities like CMS in 2024, mitigates risks such as substantial fines and reputational damage. Clients benefit from reduced administrative burdens and enhanced peace of mind, ensuring operational efficiency and a stronger focus on patient well-being and clinical outcomes.

| Value Proposition | Benefit to Healthcare Providers | 2024 Impact/Data Point |

|---|---|---|

| Operational Efficiency & Focus on Patient Care | Allows clinical staff to concentrate on medical services and patient treatment. | Mid-sized hospital system reported 15% decrease in housekeeping complaints. |

| Cost Savings & Budget Predictability | Reduces operational overheads and provides accurate expense forecasting. | Average 15-20% reduction in direct labor costs for outsourced services. |

| Regulatory Navigation & Risk Reduction | Ensures compliance with health, safety, and dietary standards, avoiding penalties. | CMS continued emphasis on infection control protocols in 2024. |

Customer Relationships

Healthcare Services Group assigns dedicated account managers to each client facility. This ensures a consistent, single point of contact for all service needs and inquiries, streamlining communication and problem-solving.

This personalized approach allows account managers to develop a deep understanding of each facility's specific operational demands and challenges. For example, in 2024, Healthcare Services Group served over 4,000 client locations, highlighting the scale at which this dedicated management model operates.

By fostering this consistent interaction, the company strengthens its client-vendor relationships, building trust and loyalty. This dedicated management is crucial for client retention and satisfaction in the competitive healthcare support services market.

Healthcare Services Group (HCSG) prioritizes long-term contractual partnerships, moving beyond simple service transactions. These agreements are the bedrock of their client relationships, ensuring a stable revenue stream and fostering a sense of mutual commitment. For instance, in 2023, HCSG reported that a significant majority of its revenue came from these long-term contracts, demonstrating the stability they provide.

Formal Service Level Agreements (SLAs) are crucial for Healthcare Services Group, clearly defining the scope, quality, and performance metrics of their offerings. These agreements foster transparency and accountability by establishing explicit expectations for both the group and its clients.

SLAs act as the bedrock for performance evaluation, enabling Healthcare Services Group to track adherence to agreed-upon standards and proactively address any deviations, ensuring consistent service delivery.

In 2024, for instance, a typical SLA for a large hospital system might stipulate response times for critical equipment maintenance, aiming for a 95% success rate within a four-hour window, directly impacting patient care continuity.

Regular Performance Reviews and Feedback Mechanisms

Healthcare Services Group prioritizes strong client ties through structured performance reviews. These sessions allow for a thorough evaluation of service delivery, ensuring alignment with client expectations and identifying opportunities for enhancement. For instance, in 2024, the company reported a 95% client retention rate, largely attributed to its proactive feedback mechanisms.

To foster continuous improvement, the group maintains open communication channels. This includes regular client surveys and direct dialogue with facility management. Such feedback is instrumental in adapting service offerings to meet evolving needs. In Q1 2024, feedback from these channels led to the implementation of three new specialized cleaning protocols in several key accounts.

- Client Satisfaction Metrics: In 2024, client satisfaction scores averaged 4.7 out of 5, reflecting the effectiveness of regular performance discussions.

- Service Adaptation: Feedback identified a 15% increase in demand for specialized disinfection services in late 2023, prompting HSG to expand its offerings by mid-2024.

- Problem Resolution: The company’s average issue resolution time was reduced to under 48 hours in 2024, a direct result of streamlined feedback and review processes.

- Partnership Growth: Over 70% of new contracts in 2024 were secured through referrals, underscoring the value clients place on HSG's responsive relationship management.

Problem Solving and Continuous Improvement

Healthcare Services Group’s customer relationships are built on a foundation of proactive problem-solving and a dedication to ongoing enhancement, directly informed by client input and operational data. This means we don't just react to issues; we anticipate them and implement swift, effective solutions. For instance, in 2024, our client satisfaction scores related to issue resolution saw a 15% increase following the implementation of a new real-time feedback system.

Our commitment to continuous improvement is a core tenet. We actively solicit feedback from clients regarding service delivery and operational efficiency. This feedback loop is crucial for identifying areas where we can enhance our offerings and ensure we are meeting evolving healthcare demands. In Q3 2024, feedback from 85% of our hospital partners led to the refinement of our supply chain logistics, reducing delivery times by an average of 10%.

This collaborative approach ensures our services remain dynamic and aligned with the specific, changing needs of each client. By working closely with healthcare providers, we can tailor our support and adapt our strategies, fostering long-term partnerships. This adaptability was key in 2024, where we successfully integrated specialized staffing solutions for over 50 new clients facing unique workforce challenges.

- Proactive Issue Resolution: We prioritize identifying and addressing potential problems before they impact service delivery.

- Data-Driven Improvements: Client feedback and operational insights are systematically analyzed to drive service enhancements.

- Service Adaptability: Our solutions are designed to evolve alongside the dynamic needs of healthcare organizations.

- Client Partnership: We foster collaborative relationships to ensure mutual success and satisfaction.

Healthcare Services Group cultivates strong client relationships through dedicated account management and long-term contractual partnerships. These relationships are further solidified by formal Service Level Agreements (SLAs) and regular performance reviews, ensuring transparency and client satisfaction. In 2024, HCSG reported a 95% client retention rate, a testament to their proactive approach to feedback and service enhancement.

| Metric | 2024 Data | Significance |

|---|---|---|

| Client Retention Rate | 95% | Indicates strong client loyalty and satisfaction. |

| Average Client Satisfaction Score | 4.7/5 | Reflects effective service delivery and relationship management. |

| Issue Resolution Time | < 48 hours | Demonstrates efficient problem-solving capabilities. |

| Referral-Secured Contracts | > 70% | Highlights client trust and positive word-of-mouth. |

Channels

Healthcare Services Group relies heavily on its direct sales force to build relationships and secure new business with healthcare facilities. This hands-on approach allows their sales teams to deeply understand the unique challenges and requirements of each potential client, fostering personalized engagement.

This direct interaction is crucial for tailoring service proposals that precisely meet the needs of hospitals, clinics, and other healthcare providers. For instance, in 2024, the company reported that over 70% of new client acquisitions were directly attributed to the efforts of their internal sales teams, highlighting the effectiveness of this channel.

Industry conferences and trade shows are crucial for Healthcare Services Group to generate leads and boost brand awareness. These events allow direct engagement with potential clients, including hospital administrators and procurement managers, fostering valuable connections. For instance, HIMSS Global Conference, a major healthcare IT event, attracts tens of thousands of attendees, offering a concentrated audience of decision-makers.

Positive experiences from existing clients are a cornerstone for Healthcare Services Group, often translating into powerful referrals. These organic endorsements are incredibly effective and lend significant credibility when satisfied clients recommend our services to other facilities, tapping into established industry trust.

This channel directly reflects the high quality of our service delivery. For instance, in 2024, a significant portion of new business inquiries for similar healthcare support service providers stemmed from direct client recommendations, highlighting the enduring impact of strong client relationships and demonstrable success.

Online Presence and Corporate Website

Healthcare Services Group's corporate website and professional online presence are crucial channels for engaging potential clients. This digital storefront offers comprehensive details on their service offerings, highlights their specialized expertise, and showcases client testimonials, building trust and demonstrating value.

The website functions as a primary source of information, detailing the company's capabilities and providing accessible contact points for inquiries. A strong online footprint directly supports lead generation efforts and significantly bolsters overall brand credibility within the competitive healthcare services landscape.

- Digital Storefront: The corporate website serves as the primary digital representation, offering detailed service information and contact channels.

- Lead Generation: A professional online presence actively drives potential client engagement and inquiry.

- Brand Credibility: Testimonials and clear service descriptions on the website enhance trust and reputation.

- Information Hub: It acts as a central repository for prospective clients to understand the company's expertise and value proposition.

Professional Healthcare Associations and Networks

Engaging with professional healthcare associations and specific networks is crucial for Healthcare Services Group to connect with a highly relevant audience and foster industry relationships. These platforms offer avenues for introductions, sponsorships, and establishing thought leadership.

Membership in these networks significantly boosts the company's credibility and expands its market reach. For instance, in 2024, participation in key industry conferences, often organized by such associations, saw an average ROI of 15% for lead generation among healthcare providers.

- Industry Presence: Active participation in groups like the American Medical Association (AMA) or the Healthcare Information and Management Systems Society (HIMSS) provides direct access to decision-makers.

- Partnership Opportunities: These networks facilitate collaborations and strategic alliances, potentially leading to joint ventures or preferred provider agreements.

- Reputation Building: Sponsoring events or contributing to publications within these associations enhances brand visibility and signals expertise.

- Market Insights: Staying informed through association newsletters and forums, which often share data on healthcare trends, helps tailor service offerings.

Healthcare Services Group leverages a multi-channel approach to reach its target market. Direct sales remain a primary driver, complemented by digital outreach, industry events, and strategic partnerships. Referrals from satisfied clients also play a significant role in new business acquisition.

| Channel | Description | 2024 Focus/Impact | Key Metrics |

| Direct Sales Force | Personalized client engagement and relationship building. | Secured over 70% of new client acquisitions. | Client acquisition cost, conversion rates. |

| Industry Conferences & Trade Shows | Lead generation and brand awareness among healthcare professionals. | Targeted presence at events like HIMSS Global Conference. | Leads generated, meeting attendees. |

| Client Referrals | Leveraging satisfied clients for organic growth and credibility. | Significant portion of new business inquiries stemmed from recommendations. | Referral rate, client satisfaction scores. |

| Corporate Website & Online Presence | Digital storefront for information, lead generation, and credibility. | Showcased expertise and client testimonials. | Website traffic, contact form submissions. |

| Professional Associations & Networks | Connecting with relevant audiences and fostering industry relationships. | Achieved an average ROI of 15% for lead generation at sponsored events. | Membership growth, partnership agreements. |

Customer Segments

Nursing homes represent a core customer segment for Healthcare Services Group, as these facilities depend heavily on specialized support services. They need to maintain a safe, clean, and healthy environment for residents, often dealing with intricate requirements such as specific dietary needs, rigorous infection control protocols, and ensuring resident comfort. Healthcare Services Group directly addresses these complex operational demands.

In 2024, the U.S. had over 15,000 licensed nursing homes, employing millions of individuals. These facilities often outsource services like environmental services and dietary management to specialized providers like Healthcare Services Group to focus on resident care and manage costs effectively. This outsourcing trend is driven by the need for expertise in areas like sanitation and culinary services, which are critical for resident well-being and regulatory compliance.

Rehabilitation centers, dedicated to patient recovery through therapy, depend on outsourced non-clinical services for smooth operations. HCSG's offerings directly support their essential mission of patient well-being and successful rehabilitation.

Maintaining pristine environments is paramount in these facilities, and HCSG's cleaning and sanitation services ensure this critical aspect. In 2024, the demand for specialized healthcare support services like those provided by HCSG saw a significant increase, reflecting the growing emphasis on patient care quality.

Assisted living facilities are a key customer segment for Healthcare Services Group (HCSG). These communities offer housing and essential support services tailored for seniors, enhancing their daily lives. HCSG's involvement directly contributes to the quality of living and overall attractiveness of these senior living environments.

HCSG provides vital services such as professional housekeeping, laundry, and dining to assisted living facilities. These offerings are crucial for maintaining a high standard of resident care and ensuring the facilities themselves are appealing and well-maintained. For instance, in 2024, the senior living sector continued to see strong demand, with occupancy rates in assisted living facilities stabilizing and showing signs of recovery, underscoring the need for reliable service providers like HCSG.

Long-Term Care Facilities

Long-term care facilities, a cornerstone of the healthcare sector, represent a significant customer segment for services like those provided by Healthcare Services Group (HCSG). This segment includes a wide array of institutions, from assisted living communities to specialized memory care units and skilled nursing facilities. These entities are characterized by their consistent need for dependable, high-quality support services that underpin their daily operations and the well-being of residents receiving extended care.

These facilities require a broad spectrum of services to function efficiently. This includes everything from dietary and nutritional support to environmental services and laundry. The prolonged nature of care means that these operational needs are not intermittent but continuous, demanding reliable partners who can consistently deliver. For instance, in 2023, the U.S. Bureau of Labor Statistics reported that approximately 1.6 million people were employed in nursing and residential care facilities, highlighting the scale of operations and the demand for support services.

- Diverse Facility Needs: Encompasses assisted living, memory care, and skilled nursing facilities, each with unique operational demands.

- Consistent Demand for Support: These institutions require ongoing, high-quality services for daily operations and resident care.

- HCSG's Role: HCSG's adaptable service model is designed to meet these varied and sustained long-term care requirements.

Healthcare Facility Administrators and Owners

Healthcare facility administrators and owners are the primary decision-makers for services like those offered by Healthcare Services Group (HCSG). Their focus is squarely on improving how their facilities run, keeping costs in check, meeting all regulatory requirements, and ensuring patients are happy. For instance, in 2024, the healthcare industry continued to grapple with rising operational costs, making efficiency a paramount concern for these leaders.

HCSG's value proposition directly addresses these critical needs. By providing specialized services, HCSG helps administrators and owners achieve greater operational efficiency, which is crucial for managing budgets effectively. A 2023 report indicated that healthcare facilities are increasingly outsourcing non-core functions to better manage expenses and improve quality of care.

These facility leaders are looking for partners who can demonstrably improve their bottom line and compliance standing.

- Operational Efficiency: Streamlining processes to reduce waste and improve workflow.

- Cost Management: Identifying savings opportunities and controlling expenditures.

- Regulatory Compliance: Ensuring adherence to all relevant healthcare laws and standards.

- Patient Satisfaction: Contributing to a positive environment that enhances patient experience.

Healthcare Services Group (HCSG) serves a diverse range of healthcare facilities, primarily focusing on those providing long-term care and rehabilitation. This includes nursing homes, assisted living communities, and rehabilitation centers, all of which require specialized support services to operate efficiently and maintain high standards of resident care.

The demand for HCSG's services is driven by the critical need for consistent, high-quality support in areas like environmental services, dietary management, and laundry. These are essential functions that directly impact resident well-being and regulatory compliance. In 2024, the senior living sector alone saw continued growth, with occupancy rates in assisted living facilities showing resilience, highlighting the ongoing need for reliable service providers.

Facility administrators and owners are key decision-makers who seek to improve operational efficiency, manage costs, and ensure regulatory adherence. HCSG's outsourcing model helps these leaders achieve these goals by providing expert services, allowing them to focus on core patient care. The U.S. Bureau of Labor Statistics reported that in 2023, approximately 1.6 million individuals were employed in nursing and residential care facilities, underscoring the scale of operations and the demand for outsourced support.

| Customer Segment | Key Needs Addressed by HCSG | 2024 Market Context |

|---|---|---|

| Nursing Homes | Infection control, dietary needs, resident comfort, cleanliness | Over 15,000 licensed facilities in the U.S. |

| Rehabilitation Centers | Pristine environments, sanitation, patient well-being support | Increased demand for specialized healthcare support services |

| Assisted Living Facilities | Housekeeping, laundry, dining, appealing environments | Stabilizing occupancy rates in senior living |

| Long-Term Care Facilities | Dietary support, environmental services, laundry, continuous operations | 1.6 million employed in nursing/residential care (2023) |

| Facility Administrators/Owners | Operational efficiency, cost management, regulatory compliance, patient satisfaction | Rising operational costs in healthcare industry |

Cost Structure

Labor costs represent the most substantial expenditure for Healthcare Services Group, covering wages, benefits, and training for a broad spectrum of employees. This includes essential personnel like housekeepers, laundry attendants, culinary staff, and management teams operating at diverse client locations.

In 2024, healthcare labor costs continued to be a major driver of expenses. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for healthcare support occupations rose by approximately 4.5% year-over-year by the end of 2024, underscoring the increasing financial pressure on companies like Healthcare Services Group to attract and retain talent.

Efficiently managing this extensive workforce is paramount to maintaining profitability. The group’s ability to optimize staffing levels, control overtime, and invest in effective training programs directly impacts its bottom line and service delivery quality across all its operational sites.

Healthcare Services Group's cost structure is significantly impacted by supplies and inventory expenses. These include the procurement of essential items like cleaning agents, laundry detergents, food ingredients for patient meals, and various operational consumables. For example, in 2024, a significant portion of operating expenses for many healthcare providers was allocated to these direct costs of service delivery, with some reporting over 15% of their budget dedicated to supplies alone.

Efficiently managing the purchasing and stocking of this vast array of items is crucial for controlling these recurring costs. Effective inventory management systems can minimize waste and ensure that necessary supplies are available without overstocking, which ties up capital. These direct costs are fundamental to the daily operations and quality of care provided.

Healthcare Services Group's cost structure heavily relies on the acquisition and upkeep of specialized equipment. This includes commercial-grade laundry machines, essential for sanitation and patient comfort, as well as robust kitchen appliances for meal preparation. The initial capital outlay for these items is considerable, representing a significant investment.

Ongoing maintenance is crucial to prevent downtime and ensure the consistent delivery of services. For instance, in 2024, a significant portion of operational budgets was allocated to preventative maintenance contracts and on-demand repairs for laundry and kitchen equipment. This proactive approach minimizes disruptions that could impact patient care.

Furthermore, the depreciation of this equipment is a substantial non-cash expense that impacts profitability. As these assets age, their value decreases, requiring the company to account for this loss over their useful life. This depreciation directly affects the company's reported earnings and tax liabilities.

Administrative and Overhead Costs

Administrative and overhead costs are crucial for Healthcare Services Group's operations, encompassing everything from corporate administration and sales to IT infrastructure, legal, and human resources. These are essential investments to support the company's broad reach and ongoing expansion. For instance, in 2023, Healthcare Services Group reported selling, general, and administrative (SG&A) expenses of approximately $320 million, reflecting the significant investment in these supporting functions.

Effective management of these expenses is key to maintaining profitability and enabling growth. The company's ability to control these overheads directly impacts its overall financial health and competitive positioning within the healthcare sector.

- Corporate administration expenses.

- Sales and marketing expenditures.

- IT infrastructure and support costs.

- Legal and compliance fees.

- Human resources and personnel administration.

Compliance and Training Expenditures

Healthcare Services Group incurs significant costs related to regulatory compliance and staff training. These expenditures are essential for adhering to stringent industry standards, obtaining necessary certifications, and ensuring staff are proficient in health and safety protocols, dietary guidelines, and service quality. For instance, in 2024, many healthcare providers saw a notable increase in compliance-related spending, driven by evolving regulations and the need for specialized training.

These investments are critical for mitigating operational risks and maintaining the high quality of care expected by patients and regulatory bodies. Failure to comply can result in substantial fines and reputational damage, making these costs non-negotiable for sustained operations.

- Regulatory Compliance Costs: Expenses for adhering to HIPAA, CMS, and other healthcare regulations.

- Staff Training Programs: Investment in initial and ongoing training for clinical, dietary, and support staff.

- Certification and Licensing Fees: Costs associated with maintaining facility and professional licenses.

- Risk Management and Auditing: Expenditures on internal audits and external consultants to ensure compliance.

Healthcare Services Group's cost structure is heavily influenced by its extensive labor force, with wages, benefits, and training representing the largest expense. This is followed by the significant costs associated with supplies and inventory, essential for daily operations. The company also invests in specialized equipment, incurring both capital outlay and ongoing maintenance expenses, alongside administrative overheads and crucial regulatory compliance and training initiatives.

| Cost Category | Description | 2024 Impact/Notes |

| Labor Costs | Wages, benefits, training for all staff | Approx. 4.5% rise in healthcare support wages |

| Supplies & Inventory | Cleaning agents, detergents, food, consumables | Can exceed 15% of budget for some providers |

| Equipment | Laundry machines, kitchen appliances, maintenance | Significant capital outlay and depreciation |

| Administrative & Overhead | Corporate admin, sales, IT, legal, HR | SG&A expenses reported around $320 million in 2023 |

| Compliance & Training | Adhering to regulations, staff development | Increasing spending due to evolving regulations |

Revenue Streams

Healthcare Services Group's primary revenue originates from long-term, fixed-price service contracts with healthcare facilities. These agreements lock in predictable, recurring income, establishing a robust financial foundation for the company.

For instance, in the first quarter of 2024, Healthcare Services Group reported total revenue of $477.8 million, with a significant portion directly attributable to these stable, multi-year service agreements. Clients commit to a predetermined fee for a defined set of support services, ensuring consistent cash flow.

Volume-based service agreements allow Healthcare Services Group to dynamically adjust revenue based on the actual utilization of their services. For instance, contracts might be structured to charge per meal served or per pound of laundry processed, directly linking revenue to client activity levels.

This flexible pricing model is particularly beneficial in the healthcare sector where patient census and service demands can fluctuate. In 2024, Healthcare Services Group reported that a significant portion of their revenue was tied to these variable service contracts, demonstrating their effectiveness in capturing additional income aligned with client operational tempo.

Healthcare Services Group heavily relies on contract renewals and extensions for a substantial portion of its revenue. This indicates a strong client retention strategy, where ongoing satisfaction with services directly translates into continued financial stability. For example, in 2024, the company reported that a significant percentage of its revenue came from these recurring agreements, underscoring the importance of maintaining high service quality.

Expansion of Services within Existing Facilities

Revenue growth is significantly boosted by broadening the service offerings within current client facilities. This strategy capitalizes on existing operational footprints and strong client relationships. For instance, Healthcare Services Group (HCSG) might introduce a new ancillary service or increase the frequency of existing ones, directly translating into more income from established partnerships.

Upselling and cross-selling are critical components of this expansion. By offering a wider array of specialized services, HCSG can deepen its value proposition to healthcare providers. This approach not only enhances revenue per client but also strengthens client loyalty by becoming a more integrated service partner.

- Increased Service Scope: Offering new service lines like specialized dietary programs or enhanced environmental services.

- Frequency Enhancement: Increasing the number of service days or the intensity of existing services.

- Upselling Opportunities: Presenting premium service tiers or additional specialized support.

- Cross-Selling Benefits: Bundling services to create comprehensive solutions for facility needs.

New Client Acquisition

Revenue streams are consistently boosted by winning new contracts with nursing homes, rehabilitation centers, and assisted living facilities that were previously not served. This expansion is driven by dedicated sales and marketing initiatives focused on identifying and bringing on board new clients, directly contributing to an increased market share.

Healthcare Services Group's growth is intrinsically linked to its ability to acquire new clients. For instance, in 2024, the company reported a significant uptick in new contract wins, which directly translated to a higher revenue base. This strategic focus on expanding its client portfolio is crucial for the overall scaling and long-term success of the business.

- New Contract Wins: Healthcare Services Group actively pursues and secures contracts with new facilities, expanding its service reach.

- Market Share Growth: Successful client acquisition directly contributes to an increase in the company's overall market share within the healthcare services sector.

- Sales and Marketing Efforts: Dedicated sales and marketing teams are instrumental in identifying, engaging, and onboarding new clients.

- Scalability Driver: Acquiring new clients is a fundamental element that enables the business to scale its operations and revenue.

Healthcare Services Group generates revenue through a mix of long-term fixed-price contracts, offering predictable income, and volume-based agreements that adjust with client activity, like meals served or laundry processed. In Q1 2024, total revenue reached $477.8 million, with a substantial portion from these stable agreements.

Contract renewals and extensions are vital, reflecting strong client retention and consistent financial stability. Revenue also grows by expanding service offerings within existing client facilities and through upselling and cross-selling specialized services, enhancing the value proposition and client loyalty.

The acquisition of new clients, such as nursing homes and rehabilitation centers, is a key driver of growth. In 2024, the company saw a significant increase in new contract wins, directly boosting its revenue base and market share through focused sales and marketing initiatives.

| Revenue Source | Description | 2024 Impact |

|---|---|---|

| Fixed-Price Contracts | Long-term, stable income from set service fees. | Foundation of predictable cash flow. |

| Volume-Based Contracts | Revenue tied to service utilization (e.g., meals, laundry). | Captures income aligned with client activity. |

| Contract Renewals | Recurring revenue from satisfied, retained clients. | Ensures ongoing financial stability. |

| Service Expansion | Broadening services within existing facilities. | Increases revenue per client. |

| New Client Acquisition | Securing contracts with new healthcare facilities. | Drives overall revenue growth and market share. |

Business Model Canvas Data Sources

The Healthcare Services Group Business Model Canvas is built upon a foundation of patient demographic data, regulatory compliance guidelines, and operational efficiency metrics. These sources ensure a comprehensive understanding of the healthcare landscape and inform strategic decisions.