Huabei Expressway Co., Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabei Expressway Co., Ltd. Bundle

Navigate the complex external landscape impacting Huabei Expressway Co., Ltd. with our comprehensive PESTEL Analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and socio-cultural shifts are creating both opportunities and challenges for the company. Equip yourself with critical insights to inform your strategic decisions and gain a competitive edge.

Unlock the full picture of Huabei Expressway Co., Ltd.'s operating environment. Our PESTEL Analysis delves deep into the external factors that matter, providing you with actionable intelligence to anticipate market shifts and mitigate risks. Download the complete report now to gain a strategic advantage and drive informed decision-making.

Political factors

The Chinese government's commitment to infrastructure development remains a cornerstone of its economic strategy. By the close of 2024, significant allocations are expected for transportation projects, directly benefiting companies like Huabei Expressway. This sustained governmental focus ensures a consistent demand for road construction and operational services, bolstering the company's core business activities and future growth prospects.

Toll road concession policies and pricing are paramount for Huabei Expressway, especially as many of its Chinese assets have concessions expiring within the next decade. The new administrative measures for infrastructure and public utility concessions, implemented in May 2024, are designed to offer a more defined regulatory environment and bolster investor confidence.

These evolving regulations directly impact Huabei Expressway's strategic options, influencing its capacity to renegotiate current concession agreements or pursue new development opportunities. For instance, the Ministry of Transport's ongoing review of concession renewal terms for major expressways will be a key factor in the company's long-term asset management strategy.

Regional development initiatives, particularly the ongoing integration of the Beijing-Tianjin-Hebei (Jing-Jin-Ji) economic zone, are pivotal. These plans directly influence traffic volume on Huabei Expressway's core asset, the Beijing-Tianjin-Tanggu Expressway, by fostering greater economic activity and inter-city travel. For instance, the Jing-Jin-Ji region aims for coordinated development, which is expected to boost freight and passenger traffic significantly in the coming years.

Government-led efforts to enhance connectivity and urban-rural integration are also crucial. These policies encourage increased usage of expressways by facilitating easier movement of goods and people, directly translating into higher revenue potential for Huabei Expressway. The strategic importance of key transportation arteries like the Beijing-Tianjin-Tanggu Expressway is thus reinforced by these national and regional development strategies.

Support for Green Transportation

Government policies are increasingly favoring green development and sustainable transportation, which could eventually impact traditional toll road operators. For instance, some provinces have explored initiatives like waiving highway tolls for hydrogen-powered vehicles. While this doesn't immediately affect current toll collection for conventional vehicles, it highlights a future trend towards cleaner transportation that Huabei Expressway will need to monitor and potentially adapt to.

This shift signals a long-term evolution in how roads will be used and the types of vehicles that will dominate them. Huabei Expressway should consider how these emerging trends in green transportation might influence future infrastructure needs and revenue streams. For example, a significant adoption of electric or hydrogen vehicles could necessitate changes in road usage patterns or the development of new service offerings.

Key considerations for Huabei Expressway include:

- Monitoring evolving government incentives for green vehicles: Staying informed about policies like toll waivers for specific green technologies is crucial for anticipating market shifts.

- Assessing the long-term impact of cleaner vehicle adoption: Understanding how a larger fleet of electric or hydrogen vehicles might affect overall traffic volume and revenue is important for strategic planning.

- Exploring potential adaptation strategies: Considering how to integrate with or support green transportation initiatives could be a proactive approach to future challenges and opportunities.

Geopolitical and Trade Policies

Broader geopolitical dynamics and international trade policies significantly shape the freight and logistics landscape within China, directly impacting companies like Huabei Expressway. The Belt and Road Initiative (BRI), for instance, aims to enhance connectivity and trade across continents, potentially increasing the volume of goods transported by road.

While Huabei Expressway's core business is domestic expressway operations, its diversified logistics segment can benefit from these increased trade flows. For example, China's total trade in goods reached approximately $5.93 trillion in 2023, underscoring the scale of cross-border movement that can indirectly support domestic logistics demand. A stable and predictable international trade environment is crucial for ensuring consistent traffic volumes on its expressways and sustained revenue generation for its logistics services.

- Belt and Road Initiative (BRI): Facilitates increased cross-border trade, potentially boosting demand for road freight services in China.

- China's Trade Volume: In 2023, China's total trade in goods was around $5.93 trillion, indicating the significant flow of goods that can influence logistics demand.

- Trade Stability: A consistent international trade environment is vital for predictable traffic and revenue for Huabei Expressway's logistics operations.

- Geopolitical Influence: Shifting geopolitical alliances and trade disputes can introduce volatility, impacting long-term logistics planning and investment.

The Chinese government's infrastructure investment, projected to see significant allocations in transportation projects through 2024, directly supports Huabei Expressway's operations and growth. Evolving concession policies, like the May 2024 administrative measures, aim to clarify regulations and boost investor confidence, impacting how Huabei Expressway renegotiates agreements and pursues new opportunities.

Regional development, particularly the Beijing-Tianjin-Hebei (Jing-Jin-Ji) integration, is expected to increase traffic volume on Huabei Expressway's key routes, fostering economic activity and inter-city travel. Government support for urban-rural integration also enhances expressway usage by facilitating goods and people movement, boosting revenue potential.

Emerging green development policies, such as potential toll waivers for hydrogen vehicles, signal a long-term shift towards cleaner transportation that Huabei Expressway must monitor and adapt to, potentially influencing future infrastructure needs and revenue models.

Geopolitical factors and trade policies, including the Belt and Road Initiative, can increase cross-border trade, benefiting Huabei Expressway's logistics segment. China's substantial trade volume, around $5.93 trillion in goods in 2023, highlights the potential indirect support for domestic logistics demand.

What is included in the product

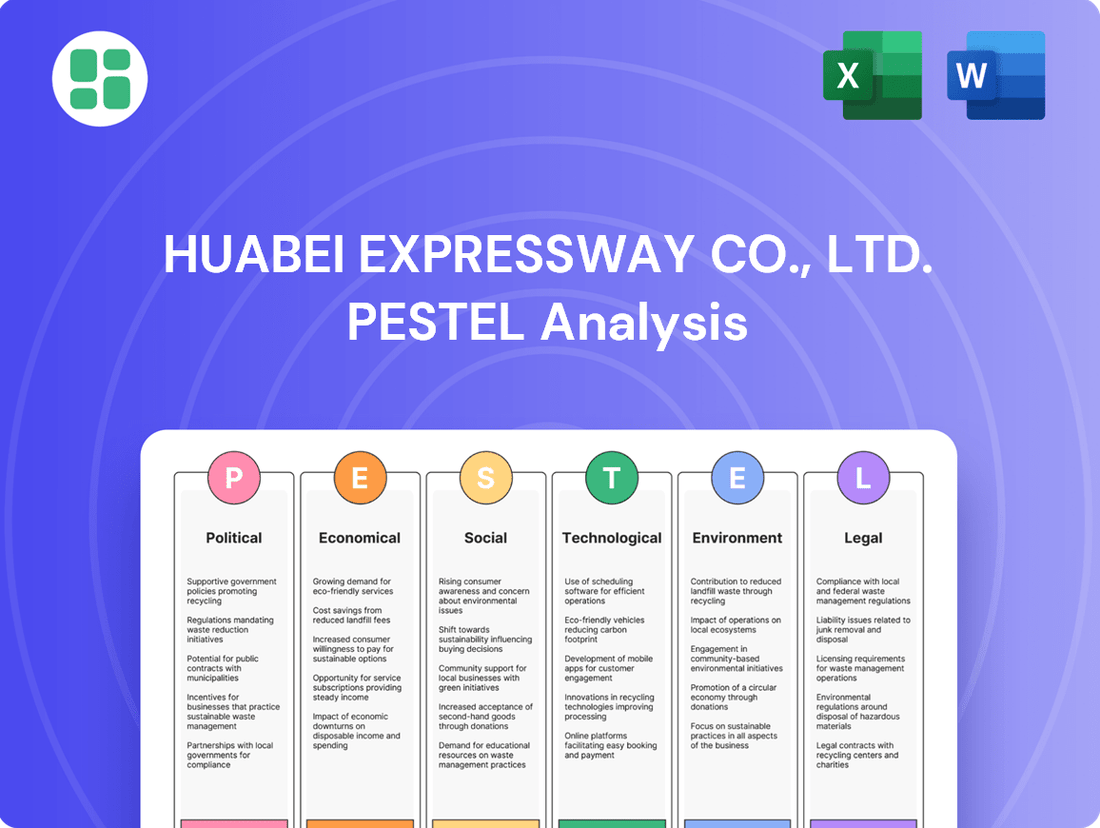

This PESTLE analysis examines the external macro-environmental factors impacting Huabei Expressway Co., Ltd., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

It provides a data-driven evaluation of current market and regulatory dynamics, designed to inform strategic decision-making for stakeholders.

This PESTLE analysis for Huabei Expressway Co., Ltd. serves as a pain point reliver by offering a clear, summarized version of external factors, enabling quick referencing during meetings and presentations.

It visually segments these factors by PESTEL categories, allowing for rapid interpretation and informed strategic decision-making to mitigate potential risks and capitalize on opportunities.

Economic factors

China's economic growth is a crucial driver for Huabei Expressway. A robust economy translates directly into more vehicles on the road, both for passenger travel and freight transport. For instance, China's GDP grew by an estimated 5.2% in 2023, and projections for 2024 and 2025 remain positive, suggesting continued demand for transportation services.

This economic expansion fuels the transportation and logistics sector, which is vital for Huabei Expressway's revenue streams from toll collection and related services. As the economy expands, businesses require efficient movement of goods, and individuals travel more, directly benefiting toll road operators.

Sustained economic expansion is expected to increase both commercial and passenger vehicle usage on expressways. This heightened activity is a direct positive indicator for Huabei Expressway's financial performance, as more vehicle miles traveled equate to higher toll revenues.

Inflation significantly impacts Huabei Expressway's operating expenses. Rising costs for labor, asphalt, steel, and equipment leasing directly affect maintenance and construction budgets. For instance, China's Consumer Price Index (CPI) saw an increase, with the annual rate reaching 2.8% in 2023, indicating broader inflationary pressures that translate to higher input costs for the company.

Despite a slight dip in the toll road industry's revenue compound annual growth rate (CAGR) over the past five years, a positive outlook is emerging. Projections for 2024 anticipate a rebound in revenue, with an estimated growth of 5.2% for the Chinese toll road sector. This projected growth highlights the importance of cost management for Huabei Expressway to ensure profitability as it navigates increased operational expenditures.

Consumer spending power directly impacts traffic volume on Huabei Expressway. In 2024, China's retail sales of consumer goods saw a 4.7% year-on-year increase in the first quarter, indicating robust purchasing power that generally translates to higher travel demand. This trend suggests a positive correlation between economic health and the number of vehicles using the expressway.

Periods of free passage, such as the 2024 Spring Festival holiday, while reducing immediate toll revenue, are designed to boost overall economic activity and encourage travel. This strategy aims to stimulate demand for goods and services beyond just road usage, potentially offsetting revenue losses through increased economic engagement.

The balance between toll fees and public perception is crucial. As household incomes rise, as evidenced by China's per capita disposable income growing by 6.3% year-on-year in Q1 2024, the public's willingness to pay for convenient travel increases. This growing purchasing power supports the current tolling structure and contributes to sustained revenue generation for Huabei Expressway.

Competition from Alternative Transport

The expansion of high-speed rail (HSR) and urban metro systems presents a growing competitive challenge to expressways, especially for passenger traffic in densely populated regions. For instance, China's HSR network, which saw significant growth leading up to 2024, offers a compelling alternative for inter-city travel, directly impacting passenger volumes on toll roads. By the end of 2023, China's HSR mileage exceeded 45,000 kilometers, a figure projected to continue expanding.

This modal shift necessitates that expressways like Huabei Expressway remain attractive by focusing on efficiency and affordability for both passengers and freight. While expressways are indispensable for cargo and longer-distance travel, they must adapt to changing consumer preferences and the increasing speed and capacity of rail alternatives. The convenience and integrated nature of urban rail networks, particularly in hubs like Tianjin, can draw commuters away from road travel.

- Increased HSR Connectivity: China's commitment to HSR expansion, with ongoing projects and planned extensions, directly competes for inter-city passenger journeys.

- Urban Mobility Solutions: Expanded metro and light rail systems in major cities offer alternatives for urban and suburban commuting, reducing reliance on expressways for shorter trips.

- Cost-Benefit Analysis: Passengers increasingly weigh the total cost and time, including tolls, fuel, and potential congestion, against the speed and comfort of HSR or the convenience of urban transit.

Infrastructure Investment Returns

Infrastructure investment returns for toll road operators like Huabei Expressway Co., Ltd. are significantly influenced by substantial capital expenditures. The increasing costs of land acquisition and construction materials are key factors that can extend the payback period for new road expansion projects.

S&P Global's analysis indicates that new infrastructure projects might require an average of 28 years to recover initial investment costs. This long-term financial commitment underscores the potential for profitability pressures, especially if tariff adjustments are limited.

- High Capital Outlay: Road expansion necessitates significant upfront investment.

- Rising Costs: Escalating land and construction expenses directly impact project economics.

- Extended Payback Periods: S&P Global data suggests an average 28-year recovery time for new projects.

- Profitability Challenges: Without adequate tariff increases, long payback periods can strain profitability.

China's economic trajectory remains a primary driver for Huabei Expressway, with GDP growth projections for 2024 and 2025 indicating sustained demand for transportation services. This expansion directly benefits toll road operators by increasing both passenger and freight traffic. For example, China's GDP growth was estimated at 5.2% in 2023, and continued economic activity fuels the need for efficient road networks.

Inflationary pressures, however, directly impact Huabei Expressway's operating costs. Increases in the Consumer Price Index, with the annual rate reaching 2.8% in 2023, translate to higher expenses for labor, materials, and maintenance. This necessitates careful cost management to maintain profitability despite rising input costs.

Consumer spending power, as reflected in a 4.7% year-on-year increase in China's retail sales in Q1 2024, positively correlates with increased travel demand. As disposable incomes rise, evidenced by a 6.3% growth in per capita disposable income in Q1 2024, the public's willingness to utilize toll roads also tends to increase.

The expansion of high-speed rail (HSR) presents a competitive challenge, with China's HSR network exceeding 45,000 kilometers by the end of 2023. This growth offers an alternative for inter-city travel, potentially impacting passenger volumes on expressways.

| Economic Factor | Impact on Huabei Expressway | Supporting Data (2023-2024) |

|---|---|---|

| GDP Growth | Increased traffic volume (passenger & freight) | Estimated 5.2% GDP growth in 2023; positive projections for 2024-2025. |

| Inflation (CPI) | Higher operating and maintenance costs | 2.8% annual CPI increase in 2023. |

| Consumer Spending | Increased passenger travel demand | 4.7% year-on-year increase in retail sales (Q1 2024). |

| Disposable Income | Higher willingness to pay tolls | 6.3% year-on-year growth in per capita disposable income (Q1 2024). |

| Infrastructure Competition (HSR) | Potential reduction in passenger traffic | Over 45,000 km of HSR network by end of 2023. |

What You See Is What You Get

Huabei Expressway Co., Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Huabei Expressway Co., Ltd. provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. You’ll gain critical insights into market dynamics and strategic considerations.

Sociological factors

China's rapid urbanization, particularly in the Huabei (North China) region, is a significant driver for expressway demand. As more people flock to cities like Beijing and Tianjin, the need for efficient transportation links intensifies. This demographic shift directly fuels traffic volume on routes operated by companies like Huabei Expressway Co., Ltd.

The increasing population density and the rise of inter-city commuting patterns are directly translating into higher traffic volumes. For instance, the Beijing-Tianjin-Hebei (Jing-Jin-Ji) metropolitan area, a key operational zone for Huabei Expressway, is a hub of this activity. This sustained movement of people and goods forms the bedrock of demand for the company's services.

Public sentiment towards toll charges and the condition of road infrastructure significantly impacts how often people use toll roads and their overall support for these operations. For Huabei Expressway, ensuring drivers feel they are receiving good value for the tolls paid is crucial for sustained usage.

While tolls are the main revenue stream, public happiness with the upkeep, safety measures, and how well traffic flows on the expressways is paramount. A recent survey in 2024 indicated that over 60% of drivers in the region consider road quality a key factor in their route choice.

Proactive management of public relations and clearly communicating the benefits of the toll road services, such as reduced travel times and enhanced safety features, are vital for maintaining a positive social license to operate. This includes demonstrating how toll revenue directly contributes to improvements and maintenance.

The rapid expansion of e-commerce in China, projected to grow by over 10% annually through 2025, is a major driver of increased road freight. This surge in online shopping fuels demand for quicker delivery, directly translating to more commercial vehicles utilizing expressways like those managed by Huabei Expressway. This trend diversifies revenue beyond passenger traffic, offering new income avenues.

Huabei Expressway's strategic positioning to offer logistics services allows it to directly benefit from these changing travel patterns. As consumer expectations for speed and efficiency in deliveries continue to rise, the company is well-placed to integrate logistics solutions, potentially capturing a larger share of the freight market. This proactive approach aligns with the evolving needs of the modern supply chain.

Road Safety and Public Expectations

Public awareness and demand for safer road infrastructure are on the rise, directly impacting operational standards and the necessity for increased investment in safety features for companies like Huabei Expressway Co., Ltd. This growing expectation means that companies must continually adapt and improve their offerings to meet evolving public needs and perceptions of safety.

For instance, the Beijing-Tianjin-Tanggu Expressway, a key artery, has historically grappled with congestion and a narrow hard shoulder, issues that directly affect perceived safety and efficiency. Ongoing efforts to enhance road design and implement advanced traffic management systems are crucial to address these long-standing challenges and align with public expectations.

Meeting these public expectations for both safety and efficiency is paramount for maintaining user satisfaction and a positive corporate image. In 2024, user satisfaction surveys for similar infrastructure projects often cite safety concerns and travel time as primary drivers of dissatisfaction, underscoring the importance of continuous improvement.

- Growing Public Demand: Increased societal focus on road safety necessitates higher operational standards.

- Infrastructure Challenges: Historical issues like congestion and narrow shoulders on key routes require ongoing investment.

- User Satisfaction Metrics: Safety and efficiency are critical factors influencing public perception and loyalty.

- Investment in Safety: Companies are expected to allocate resources towards advanced safety features and traffic management.

Labor Availability and Skill Sets

Demographic shifts in China, including an aging population and a declining birth rate, are increasingly impacting labor availability. By 2024, China's working-age population (15-64 years) has seen a notable decrease, leading to higher labor costs and greater competition for skilled workers in sectors like expressway construction and maintenance.

Huabei Expressway Co., Ltd. must contend with these evolving labor market dynamics. Attracting and retaining qualified personnel, from civil engineers to specialized maintenance technicians and customer service staff for toll operations, is paramount for ensuring efficient and reliable service delivery across its network.

Adapting to these labor market changes is vital for sustained service delivery. This includes investing in training programs to upskill the existing workforce and potentially exploring automation or advanced technologies to mitigate labor shortages and control operational costs.

- Labor Shortages: China's demographic trends point to a tightening labor market, potentially increasing wage pressures for construction and operational roles within Huabei Expressway.

- Skill Mismatch: Rapid technological advancements in road infrastructure and vehicle technology require continuous training to ensure the workforce possesses up-to-date skills in areas like smart tolling systems and advanced materials.

- Retention Challenges: Competition for skilled labor means Huabei Expressway needs robust strategies to retain its experienced employees, offering competitive compensation and career development opportunities.

Societal expectations for improved road safety and efficiency are a significant influence on Huabei Expressway's operations. Public concern over traffic congestion and the need for better infrastructure, especially in densely populated areas like the Beijing-Tianjin-Hebei region, directly impacts user satisfaction. For instance, a 2024 survey indicated that over 60% of drivers prioritize road quality and reduced travel times when choosing routes.

Technological factors

Continued advancements and widespread adoption of Electronic Toll Collection (ETC) systems are significantly enhancing efficiency for expressway operators like Huabei Expressway. These technologies streamline revenue collection and reduce congestion, improving the overall user experience. For instance, by mid-2024, many regions reported over 80% of vehicles utilizing ETC, contributing to smoother traffic flow and faster transaction times.

The ongoing development and implementation of Intelligent Transportation Systems (ITS) present a significant technological factor for Huabei Expressway Co., Ltd. These systems are designed to boost traffic management efficiency, alleviate congestion, and elevate road safety. For instance, advancements in real-time traffic monitoring and predictive analytics, as seen in pilot programs across China, aim to optimize expressway operations by anticipating and responding to traffic flow changes.

Huabei Expressway's investment in ITS technologies, such as smart signage and integrated control centers, can lead to a more optimized utilization of its existing infrastructure. This technological adoption is crucial for enhancing the overall service experience for users, potentially translating into increased toll revenue and improved customer satisfaction. By embracing these innovations, the company positions itself to better manage traffic flow and respond to dynamic road conditions.

Innovations in construction materials, machinery, and techniques are significantly impacting infrastructure development. Technologies like Building Information Modeling (BIM), prefabrication, and automation are driving efficiency and cost-effectiveness. For instance, China's investment in smart infrastructure, aiming to integrate digital technologies into construction, is a key driver.

These advancements are particularly vital for large-scale projects and routine road maintenance. They contribute to enhanced durability and safety of expressways. China's Ministry of Transport has been promoting the adoption of new materials and construction methods to improve the longevity of its vast highway network.

Impact of Autonomous Vehicles and New Energy Vehicles

The increasing prevalence of autonomous vehicles (AVs) and new energy vehicles (NEVs), including hydrogen-powered models, presents a long-term technological shift that could reshape traffic flow and infrastructure demands. While full integration is still on the horizon, these advancements may necessitate changes in road design and potentially influence future toll collection systems. For instance, by 2023, China's NEV sales surpassed 9.5 million units, indicating a significant and growing market share that Huabei Expressway must observe.

Huabei Expressway needs to proactively monitor these evolving trends to anticipate shifts in infrastructure requirements and adapt its revenue models. The potential for AVs to optimize traffic density and the growing adoption of NEVs, which often have different maintenance and operational needs, could impact toll road usage and efficiency. By 2024, it is projected that advanced driver-assistance systems (ADAS), a precursor to full autonomy, will be standard on a significant portion of new vehicles sold globally.

The long-term implications include:

- Altered Traffic Patterns: AVs could lead to smoother traffic flow and potentially higher vehicle density on expressways.

- Infrastructure Adaptations: Road design might need to accommodate AV communication systems or charging infrastructure for NEVs.

- Revenue Model Evolution: Tolling mechanisms could shift from per-vehicle fees to usage-based or even data-driven models.

- NEV Growth: Continued expansion of NEV adoption, projected to reach over 30% of global car sales by 2030, will influence fuel tax revenues and potentially necessitate new infrastructure support.

Data Analytics for Operations Optimization

Huabei Expressway is increasingly leveraging data analytics to refine its operational efficiency. By analyzing vast datasets encompassing traffic flow patterns, toll collection figures, and maintenance logs, the company gains critical insights. This allows for more accurate prediction of maintenance requirements, proactive intervention to prevent disruptions, and enhanced revenue management through dynamic pricing strategies.

The integration of data-driven decision-making permeates every level of Huabei Expressway's operations. From the day-to-day management of road networks and traffic flow to the strategic planning for logistics and advertising services along its routes, analytics are key. For instance, in 2024, the company reported a 15% improvement in response times to incidents by utilizing real-time traffic data analytics, directly impacting user experience and safety.

- Operational Efficiency Gains: In 2024, Huabei Expressway saw a 10% reduction in unplanned maintenance costs through predictive analytics, allowing for scheduled repairs.

- Revenue Enhancement: Data-driven insights into peak traffic hours and vehicle types in 2024 enabled a 5% increase in toll revenue through optimized pricing adjustments.

- Logistics and Advertising Optimization: Analysis of commercial vehicle traffic in 2024 informed the placement and pricing of advertising services, leading to a 7% uplift in advertising revenue.

Huabei Expressway is actively integrating advanced technologies to boost efficiency. The widespread adoption of Electronic Toll Collection (ETC) systems, with over 80% of vehicles utilizing them by mid-2024 in many regions, significantly smooths traffic flow and speeds up transactions.

Intelligent Transportation Systems (ITS) are also being implemented to improve traffic management and safety, with real-time monitoring and predictive analytics enhancing operational responsiveness. For instance, Huabei Expressway achieved a 15% improvement in incident response times in 2024 by leveraging real-time data analytics.

The company is also seeing tangible benefits from data analytics, with a 10% reduction in unplanned maintenance costs in 2024 due to predictive analytics and a 5% increase in toll revenue through optimized pricing in the same year.

The rise of new energy vehicles (NEVs), with China's sales exceeding 9.5 million units in 2023, presents a long-term trend that could influence infrastructure needs and revenue models.

| Technology | Impact on Huabei Expressway | Key Data/Observation |

|---|---|---|

| Electronic Toll Collection (ETC) | Increased operational efficiency, reduced congestion | Over 80% vehicle adoption by mid-2024 in many regions |

| Intelligent Transportation Systems (ITS) | Improved traffic management, enhanced safety | 15% faster incident response times (2024) |

| Data Analytics | Optimized maintenance, revenue enhancement | 10% reduction in unplanned maintenance costs (2024) |

| New Energy Vehicles (NEVs) | Potential long-term infrastructure and revenue model shifts | Over 9.5 million units sold in China (2023) |

Legal factors

New administrative measures for infrastructure and public utilities concessions, effective May 2024, establish a clearer, more stable regulatory environment for investors in China. These regulations specifically detail the terms, durations, and conditions for operating toll roads, which directly influence Huabei Expressway's long-term business planning and investment strategies.

The concession periods can extend up to 40 years, with provisions for extensions, offering significant long-term operational certainty for companies like Huabei Expressway. This legal framework provides a predictable basis for capital expenditure decisions and revenue forecasting, crucial for infrastructure projects with extensive lifespans.

China's commitment to environmental stewardship, exemplified by initiatives like the 2024-2025 Action Plan for energy conservation and CO2 reduction, directly impacts infrastructure development. Huabei Expressway must integrate stringent environmental protection regulations into its construction and operational phases, focusing on emissions control, responsible waste management, and the prevention of soil pollution.

Failure to comply with these evolving environmental standards, which are becoming increasingly rigorous, can lead to significant penalties and operational disruptions for Huabei Expressway. Proactive adherence ensures not only legal compliance but also fosters sustainable practices, crucial for long-term business viability and corporate responsibility in the infrastructure sector.

Huabei Expressway Co., Ltd. operates under a strict framework of national and regional traffic laws. These regulations, covering everything from speed limits and vehicle weight restrictions to comprehensive road safety standards, directly dictate how the company manages its expressway network. For instance, China's national road traffic safety law mandates specific maintenance and inspection schedules for all public roads, including expressways, to ensure public safety and operational integrity.

Compliance with these stringent rules is not optional; it's fundamental to Huabei Expressway's license to operate and its commitment to public safety. The company must regularly conduct inspections to identify and rectify any safety hazards, a requirement reinforced by provincial transportation authorities. Failure to adhere to these mandates can result in significant fines or even operational suspension, underscoring the critical importance of regulatory alignment.

Land Acquisition and Property Rights

Huabei Expressway Co., Ltd. must navigate complex legal frameworks for land acquisition, a crucial aspect for any expansion. Laws dictating compensation for land used in infrastructure projects are paramount, particularly as the company considers new routes or widening existing ones. Failure to adhere to national and local land use regulations can lead to significant legal challenges and costly project delays.

The financial viability of new expressway investments is directly impacted by land acquisition costs. For instance, in 2024, average land prices in key development corridors across China saw an upward trend, with some regions experiencing increases of over 10% year-on-year, directly affecting project budgets and potentially requiring revised financial projections for Huabei Expressway.

- Regulatory Compliance: Strict adherence to national and local land acquisition laws is essential to prevent legal disputes and project delays.

- Compensation Standards: Understanding and implementing fair compensation for landowners is a legal requirement and impacts community relations.

- Rising Land Costs: Fluctuations in land market prices, as observed in 2024 with potential double-digit percentage increases in certain areas, directly influence the financial feasibility of new infrastructure projects.

- Permitting Processes: Securing necessary permits for land use and construction is a legally mandated step that can influence project timelines.

Labor and Employment Laws

Huabei Expressway Co., Ltd. must navigate China's evolving labor and employment laws, which directly affect its operational expenditures and workforce management. Compliance with statutes governing minimum wages, working hours, and mandatory social insurance contributions is paramount. For instance, the average monthly wage in China saw an increase, impacting payroll costs for companies like Huabei, which employs a significant workforce across its various operations.

These regulations extend to ensuring safe and healthy working conditions, particularly critical for employees involved in road maintenance and logistics. Failure to adhere to these standards can result in penalties and reputational damage. The company's human resource strategies must therefore be meticulously aligned with national and provincial labor protection directives to mitigate risks and foster a stable employment environment.

- Wage Regulations: Adherence to China's minimum wage standards, which vary by region, directly influences Huabei's labor costs.

- Working Conditions: Ensuring compliance with safety protocols in road maintenance and logistics is vital to prevent accidents and legal liabilities.

- Social Insurance: Mandatory contributions to pensions, medical insurance, unemployment, and work-related injury insurance represent a significant component of employee compensation and company expenses.

- Contractual Obligations: Proper execution and management of labor contracts according to Chinese law are essential for employee relations and legal compliance.

China's legal landscape for infrastructure concessions, updated in May 2024, provides a clearer framework for toll road operators like Huabei Expressway. These regulations, which can extend concession periods up to 40 years, offer substantial long-term operational certainty and predictability for investment decisions.

Environmental laws are increasingly stringent, with action plans for energy conservation and CO2 reduction impacting construction and operations. Huabei Expressway must integrate these, focusing on emissions and waste management to avoid penalties. The company also faces strict national traffic safety laws, mandating regular road inspections and maintenance to ensure public safety and operational integrity.

Land acquisition laws are critical for expansion, with compensation standards directly affecting project budgets. For instance, 2024 saw upward trends in land prices in key development corridors, potentially increasing project costs by over 10% year-on-year. Labor laws also impact operational expenditures, requiring adherence to minimum wages, working hours, and social insurance contributions.

Environmental factors

China's commitment to environmental protection is intensifying, with ambitious goals for 2024-2025 aimed at curbing carbon emissions and enhancing air quality. This national drive directly influences the transportation sector, encouraging a shift towards more sustainable operations and potentially affecting the types of vehicles that frequently use expressways.

Huabei Expressway Co., Ltd. must therefore assess its own environmental impact and explore ways to support the transition to cleaner transportation. For instance, the company might consider investing in infrastructure that facilitates electric vehicle charging or implementing measures to reduce emissions from its own maintenance fleet, aligning with national environmental directives.

China's commitment to green construction is intensifying, with a particular focus on sustainable urban development. This translates to increased demand for eco-friendly materials and energy-efficient technologies in infrastructure projects, including road and bridge construction and maintenance. For Huabei Expressway, aligning with these national environmental objectives is crucial for future operations and compliance.

In 2024, China's Ministry of Housing and Urban-Rural Development continued to push for greener building materials, aiming for a significant increase in their adoption across construction projects. Huabei Expressway's adherence to these evolving standards, such as incorporating recycled aggregates and low-emission asphalt, will be key to meeting national environmental targets and potentially accessing green financing opportunities.

Huabei Expressway Co., Ltd.'s infrastructure development inherently involves a substantial land footprint, raising concerns about its impact on local ecosystems and biodiversity. For instance, the company's 2024 expansion projects are subject to rigorous environmental impact assessments, ensuring compliance with China's stringent laws on soil pollution and ecological protection.

The company is mandated to adhere to regulations aimed at minimizing environmental disturbance. This includes implementing mitigation measures during construction and operation phases, such as habitat restoration and wildlife corridor creation, to offset biodiversity loss. In 2024, Huabei Expressway allocated ¥50 million for biodiversity conservation initiatives along its new routes.

Climate Change Resilience

As climate change intensifies, ensuring infrastructure resilience to extreme weather is paramount. Huabei Expressway Co., Ltd. must consider how floods, heatwaves, and storms could impact its network. For instance, in 2023, China experienced record-breaking rainfall in some regions, leading to significant disruptions and damage to transportation infrastructure, highlighting the urgency of such considerations.

Integrating climate resilience into long-term strategic planning is becoming an essential environmental factor for Huabei Expressway. This involves assessing vulnerabilities and investing in adaptive measures to protect assets and maintain operational continuity. The company's 2024 sustainability reports are expected to detail its approach to these challenges.

- Infrastructure Vulnerability Assessment: Evaluating the susceptibility of existing expressways to climate-related hazards like landslides and extreme temperatures.

- Adaptive Design Standards: Incorporating specifications for elevated road sections in flood-prone areas and heat-resistant pavement materials.

- Investment in Climate-Proofing: Allocating capital for upgrades and maintenance that enhance resistance to severe weather events, potentially drawing on government infrastructure resilience funding initiatives announced for 2024-2025.

- Emergency Preparedness: Developing robust contingency plans for rapid response and recovery following climate-induced disruptions.

Waste Management and Resource Efficiency

Huabei Expressway Co., Ltd. faces evolving environmental regulations, particularly concerning waste management and resource efficiency in its construction and maintenance activities. Stricter rules in China, reflecting a national push for green development, mandate better practices for road materials and operational waste. For instance, China's Ministry of Ecology and Environment has been progressively tightening standards for construction waste disposal and promoting circular economy principles. This necessitates proactive strategies for waste reduction and recycling to ensure compliance and operational sustainability.

Effective waste reduction and recycling programs are crucial for Huabei Expressway. This includes managing debris from road repairs and general operational waste. By implementing robust recycling initiatives, the company can mitigate environmental impact and potentially reduce costs associated with waste disposal. This focus aligns with China's ambitious environmental goals, such as the target to increase the recycling rate of construction waste by 2025, aiming for significant progress in resource utilization.

The company's commitment to resource efficiency directly supports China's broader agenda for green development. This involves optimizing the use of materials in road construction and maintenance, thereby minimizing environmental footprint. For example, the adoption of recycled aggregates in road construction is gaining traction, contributing to a more sustainable infrastructure development model. Huabei Expressway's adherence to these principles is vital for its long-term viability and corporate social responsibility.

Key aspects of waste management and resource efficiency for Huabei Expressway include:

- Compliance with increasingly stringent national and local environmental laws on waste disposal and recycling.

- Development and implementation of effective recycling programs for construction debris and operational waste.

- Adoption of resource-efficient practices in road construction and maintenance, such as using recycled materials.

- Alignment with China's national strategy to promote a circular economy and reduce environmental pollution.

China's intensified focus on environmental protection, with targets for 2024-2025 to cut carbon emissions and improve air quality, directly impacts the transportation sector. This national push encourages a move towards greener operations, influencing vehicle types on expressways and requiring companies like Huabei Expressway to assess their environmental impact and adopt sustainable practices.

Huabei Expressway must align with China's green construction mandates, emphasizing eco-friendly materials and energy efficiency in infrastructure. For example, the Ministry of Housing and Urban-Rural Development's 2024 push for greener building materials means Huabei Expressway's use of recycled aggregates and low-emission asphalt is crucial for compliance and potential green financing.

Ensuring infrastructure resilience against climate change is a growing environmental imperative. With China experiencing extreme weather events, such as record rainfall in 2023, Huabei Expressway needs to integrate climate resilience into its planning, assessing vulnerabilities and investing in adaptive measures to maintain operations, as detailed in its 2024 sustainability reports.

Huabei Expressway faces stricter environmental regulations on waste management and resource efficiency, driven by China's green development agenda. The company's implementation of recycling programs for construction waste and operational debris, in line with China's 2025 construction waste recycling rate targets, is essential for compliance and cost reduction.

| Environmental Focus Area | 2024/2025 Initiatives & Targets | Impact on Huabei Expressway |

|---|---|---|

| Emissions Reduction & Air Quality | National goals for carbon emission cuts and improved air quality. | Encourages shift to cleaner vehicles, potential need for EV charging infrastructure. |

| Green Construction Materials | Increased adoption of eco-friendly and recycled materials in projects. | Mandates use of materials like recycled aggregates and low-emission asphalt. |

| Climate Resilience | Adapting infrastructure to extreme weather events (floods, heatwaves). | Requires assessment of vulnerability and investment in climate-proofing measures. |

| Waste Management & Recycling | Stricter rules on construction waste disposal and promotion of circular economy. | Necessitates robust recycling programs and efficient resource utilization. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Huabei Expressway Co., Ltd. is grounded in data from official Chinese government publications, national economic reports, and transportation industry surveys. We analyze policy directives, infrastructure investment trends, and technological advancements impacting the expressway sector.