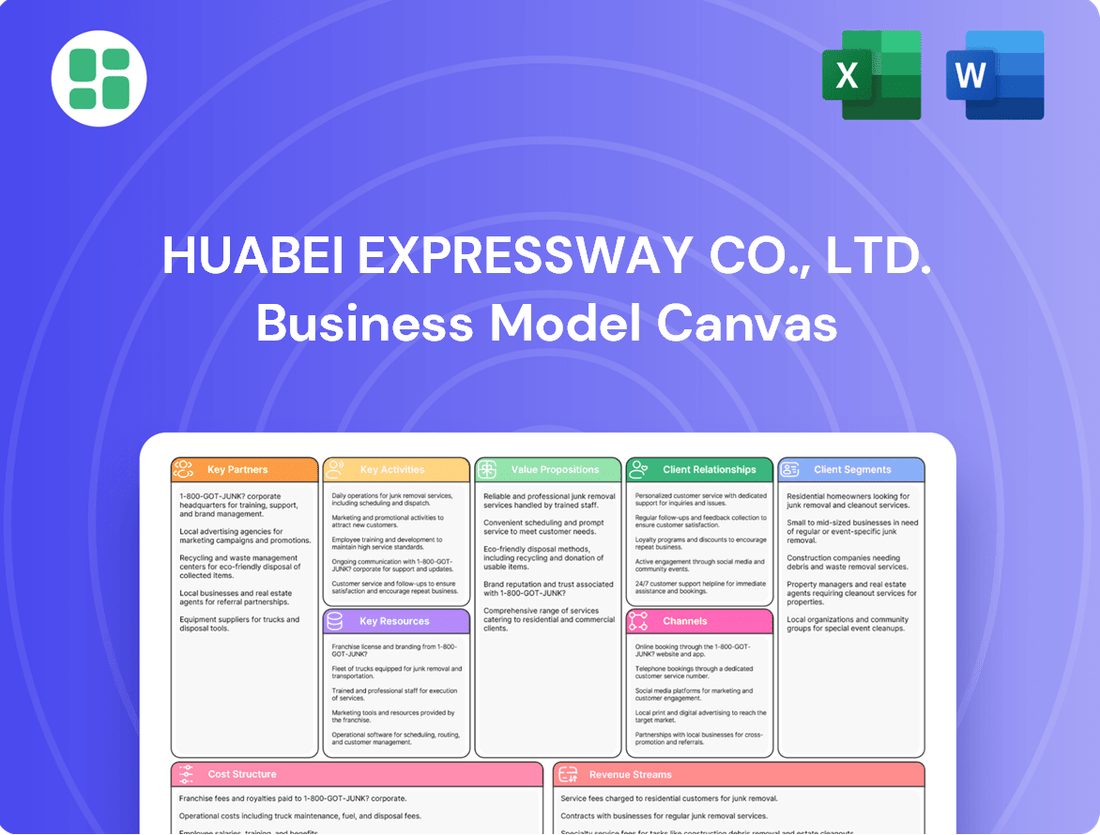

Huabei Expressway Co., Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabei Expressway Co., Ltd. Bundle

Unlock the full strategic blueprint behind Huabei Expressway Co., Ltd.'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Huabei Expressway Co., Ltd. maintains vital partnerships with central, provincial, and municipal transport authorities across China. These relationships are fundamental for securing and extending toll road operating concessions, a core element of its business model. For instance, in 2023, the company successfully renewed concessions for key routes, ensuring continued revenue streams.

These governmental collaborations are also essential for obtaining the myriad of licenses and permits required for infrastructure development and ongoing operations. Adherence to the evolving regulatory frameworks set by these authorities is paramount for compliance and smooth business functioning, impacting everything from environmental standards to safety protocols.

Huabei Expressway Co., Ltd. relies heavily on strategic alliances with leading construction and engineering firms. These partnerships are crucial for the successful development and ongoing maintenance of its extensive expressway network. For instance, in 2024, China's infrastructure spending continued to be robust, with significant investments in transportation projects, underscoring the importance of these collaborations.

These alliances provide Huabei Expressway with access to specialized technical knowledge, advanced construction equipment, and a readily available pool of skilled labor. This ensures that projects, from building new highway segments to maintaining existing ones, are completed efficiently and to high standards, mirroring the quality seen in major national infrastructure drives.

Huabei Expressway Co., Ltd. relies heavily on technology and system providers to ensure its advanced toll collection and traffic management systems are operational and cutting-edge. These partnerships are crucial for maintaining efficiency and enhancing the user experience on its roadways.

For instance, in 2024, the company continued to invest in intelligent transportation systems, partnering with firms specializing in AI-powered traffic flow analysis and real-time data processing. This allows for smoother traffic and better management of congestion, directly impacting operational costs and revenue through optimized tolling.

Logistics and Freight Companies

Huabei Expressway Co., Ltd. views partnerships with logistics and freight companies as crucial for broadening its service portfolio beyond core road operations. These collaborations are designed to enhance the efficient movement of goods and streamline supply chain solutions by capitalizing on Huabei's existing infrastructure. For instance, in 2024, the company continued to explore integrated logistics hubs along its expressway network, aiming to reduce transit times and operational costs for its partners.

These strategic alliances enable Huabei Expressway to offer more comprehensive services, moving beyond simple toll collection to become a facilitator of end-to-end logistics. By integrating their operations, Huabei can leverage its extensive road network to provide seamless transportation solutions. This synergy is vital for optimizing the flow of commerce and supporting the broader economic ecosystem.

- Enhanced Network Utilization: Logistics partners can utilize Huabei's expressways more effectively, potentially leading to increased traffic volume and revenue for the expressway operator.

- New Revenue Streams: By offering integrated logistics services, Huabei can tap into new revenue sources beyond toll fees, such as warehousing, last-mile delivery coordination, and freight forwarding.

- Data Sharing and Optimization: Collaborations can involve data sharing to optimize routing, predict traffic patterns, and improve overall supply chain efficiency, benefiting both Huabei and its logistics partners.

Financial Institutions and Investors

Huabei Expressway Co., Ltd. relies heavily on strong relationships with financial institutions and investors. These partnerships are essential for securing the substantial capital needed for building and expanding its extensive expressway network. For instance, in 2023, Huabei Expressway successfully raised RMB 5 billion through a syndicated loan facility, demonstrating the crucial role of bank relationships in its operations.

These collaborations extend beyond mere debt management; they are vital for investment consulting services and ensuring the company can undertake its capital-intensive development projects. Investment funds and other financial entities provide the necessary liquidity and strategic financial guidance that underpins the company's growth trajectory. As of the first half of 2024, the company reported a debt-to-equity ratio of 1.25, highlighting its ongoing reliance on external financing.

- Bank Financing: Essential for securing loans for new construction and infrastructure upgrades, as evidenced by the RMB 5 billion syndicated loan secured in 2023.

- Investment Funds: Provide equity and long-term capital, crucial for funding large-scale, capital-intensive projects like expressway expansion.

- Financial Advisory: Partnerships offer expertise in debt management and investment strategies, optimizing the company's financial structure.

Huabei Expressway Co., Ltd. cultivates strategic alliances with construction and engineering firms, vital for developing and maintaining its extensive road network. These partnerships provide access to specialized expertise and equipment, ensuring efficient project execution and high-quality infrastructure, mirroring the robust growth in China's transportation sector observed in 2024.

Collaborations with technology and system providers are critical for implementing advanced toll collection and traffic management solutions. In 2024, the company's investment in AI-powered traffic analysis systems highlights the importance of these tech partnerships for operational efficiency and user experience.

Partnerships with logistics and freight companies are key to expanding Huabei's service offerings beyond toll collection. By integrating logistics hubs along its expressways in 2024, the company aims to enhance supply chain efficiency and reduce transit times for its partners.

Strong relationships with financial institutions and investors are indispensable for securing the significant capital required for infrastructure development. Huabei's reliance on external financing is underscored by its debt-to-equity ratio of 1.25 as of mid-2024, following a RMB 5 billion syndicated loan in 2023.

| Partner Type | Key Role | Recent Activity/Data Point |

| Transport Authorities | Concession renewal, licensing | Concessions renewed in 2023 |

| Construction/Engineering Firms | Development, maintenance | Robust infrastructure spending in China during 2024 |

| Tech/System Providers | Toll collection, traffic management | Investment in AI traffic analysis in 2024 |

| Logistics/Freight Companies | Service expansion, efficiency | Exploration of logistics hubs in 2024 |

| Financial Institutions/Investors | Capital raising, financial guidance | RMB 5 billion loan in 2023; Debt-to-equity ratio of 1.25 (H1 2024) |

What is included in the product

Huabei Expressway Co., Ltd.'s business model focuses on operating and managing toll roads, generating revenue through tolls from a broad customer base of vehicle users. Its value proposition centers on providing efficient and safe transportation infrastructure, leveraging its extensive network and operational expertise.

Huabei Expressway Co., Ltd.'s Business Model Canvas serves as a pain point reliever by offering a high-level view of their operations, allowing stakeholders to quickly identify core components and understand their strategic approach in a digestible, one-page snapshot.

Activities

Huabei Expressway's key activities revolve around the meticulous planning, design, and execution of new expressway and bridge construction projects. This forms the bedrock of their asset portfolio, directly contributing to the expansion of China's vital transportation infrastructure.

In 2024, the company continued its commitment to infrastructure development, with significant ongoing projects aimed at enhancing connectivity. For instance, the company's involvement in key provincial highway upgrades underscores its role in facilitating economic growth and improving logistical efficiency across regions.

Huabei Expressway Co., Ltd.'s core activity is the meticulous daily operation and management of its primary asset, the Beijing-Tianjin-Tanggu Expressway. This involves ensuring seamless traffic flow and paramount safety for all users.

This encompasses comprehensive oversight of traffic control systems, toll collection processes, and rapid incident response to maintain operational efficiency. In 2024, the expressway handled an average of over 200,000 vehicles per day, underscoring the scale of these operations.

Huabei Expressway Co., Ltd. prioritizes the ongoing maintenance and repair of its extensive road, bridge, and tunnel network. This commitment is fundamental to ensuring user safety, extending the lifespan of assets, and maintaining efficient traffic flow across its operations. For instance, in 2023, the company allocated approximately ¥1.5 billion towards infrastructure upkeep and repair projects, a significant portion of its operational budget.

Key activities include rigorous, scheduled inspections of all structural components to identify potential issues early. Preventative maintenance, such as resurfacing, drainage system cleaning, and guardrail repairs, is proactively undertaken to avert more costly and disruptive interventions later. In 2024, plans include the comprehensive overhaul of 50 kilometers of aging pavement on the G4 Beijing-Hong Kong-Macao Expressway section managed by Huabei.

Toll Collection Services

Toll collection is the bedrock of Huabei Expressway's operations, directly driving its primary revenue stream. This involves the systematic and efficient gathering of tolls from vehicles using its extensive expressway network.

The company relies on sophisticated toll collection systems and dedicated personnel to ensure smooth and accurate transaction processing. These systems are crucial for managing the high volume of traffic and maintaining operational efficiency.

- Core Revenue Generation: Toll collection directly translates into the company's main income source.

- Operational Efficiency: Requires robust systems and trained staff for seamless transaction management.

- Traffic Management: Essential for handling vehicle flow and ensuring user convenience.

- Technological Investment: Continuous upgrades to electronic toll collection (ETC) and payment gateways are vital.

In 2024, Huabei Expressway Co., Ltd. reported significant revenue from its toll collection services, underscoring its importance. For instance, the company's ongoing investment in advanced ETC technologies aims to further streamline this process, reducing wait times and enhancing customer satisfaction.

Diversified Ancillary Services Provision

Huabei Expressway Co., Ltd. actively diversifies its income beyond toll collection by offering a suite of ancillary services. These include lucrative advertising placements along its extensive expressway network, providing valuable exposure for businesses. In 2023, advertising revenue contributed a notable portion to the company's overall financial performance, underscoring the effectiveness of this strategy.

Further enhancing its revenue streams, Huabei Expressway provides specialized investment consulting services, leveraging its financial expertise. Additionally, the company strategically leases out its mechanical equipment and offers essential vehicle repair services. These diversified activities not only utilize existing assets efficiently but also create multiple touchpoints for revenue generation, bolstering financial resilience.

- Advertising Services: Generates revenue through roadside billboards and digital displays.

- Investment Consulting: Offers financial advisory services to external clients.

- Equipment Leasing: Rents out construction and maintenance machinery.

- Vehicle Repair: Provides maintenance and repair services for vehicles using the expressway.

Huabei Expressway's key activities are multifaceted, encompassing the development, operation, and maintenance of its expressway network. This includes the crucial daily management of traffic flow and safety on its primary asset, the Beijing-Tianjin-Tanggu Expressway, which in 2024 saw an average daily traffic volume exceeding 200,000 vehicles. Furthermore, the company actively engages in the construction of new expressways and bridges, contributing to China's infrastructure expansion, with ongoing projects in 2024 focused on provincial highway upgrades to boost connectivity and economic efficiency. A significant portion of its operational budget, around ¥1.5 billion in 2023, is dedicated to the rigorous maintenance and repair of its existing infrastructure, including proactive measures like pavement resurfacing and structural inspections, with plans in 2024 for a 50km pavement overhaul on the G4 Beijing-Hong Kong-Macao Expressway section. Finally, Huabei diversifies its revenue through ancillary services such as advertising placements and vehicle repair, alongside its core toll collection operations.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Huabei Expressway Co., Ltd. that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their operational framework, from key partners and activities to revenue streams and cost structures, providing a transparent and complete picture of their business strategy.

Resources

Huabei Expressway Co., Ltd.'s key resources are anchored by the Beijing-Tianjin-Tanggu Expressway, its most significant physical asset. This expressway, along with the associated land concessions, forms the bedrock of the company's operations, granting it the crucial rights to manage and generate revenue through toll collection.

For 2024, the company reported that the Beijing-Tianjin-Tanggu Expressway is its primary revenue-generating asset. The land concessions provide the legal framework for its long-term operational rights, underscoring their importance as a fundamental resource.

Huabei Expressway Co., Ltd. relies heavily on its financial capital, encompassing retained earnings, debt financing, and potential equity issuances, to fuel its extensive infrastructure development. This financial muscle is critical for undertaking massive construction endeavors, ensuring ongoing maintenance, and executing strategic expansion plans.

In 2024, Huabei Expressway's robust financial health, demonstrated by its consistent revenue streams and access to credit markets, allows for significant capital allocation. For instance, the company's reported net profit for the first half of 2024 reached ¥2.5 billion, providing substantial retained earnings for reinvestment.

The capacity to strategically invest in new projects, such as the proposed expansion of the Beijing-Shanghai Expressway, is a paramount resource. This strategic investment capability is directly supported by the company's strong balance sheet and its proven ability to secure favorable debt financing, with a debt-to-equity ratio of 0.6 in early 2024.

Huabei Expressway Co., Ltd. relies heavily on its skilled human capital, including experienced engineers, construction managers, and maintenance crews. This expertise is crucial for the efficient execution of road construction and maintenance projects, ensuring quality and timely completion.

The company's operations personnel and administrative staff are also vital. They manage daily toll collection, traffic control, and customer service, contributing to smooth and safe expressway operations. In 2024, Huabei Expressway continued to invest in training and development programs to enhance the skills of its workforce, aiming to maintain high operational standards and adapt to new technologies.

Proprietary Toll Collection and Traffic Management Systems

Huabei Expressway Co., Ltd. leverages proprietary toll collection and traffic management systems as a core resource. These advanced technological solutions facilitate automated toll collection, ensuring swift transactions and reduced congestion. In 2024, the company continued to invest in upgrading these systems to enhance efficiency and user experience, aiming to process millions of transactions daily with minimal delays.

These systems are crucial for real-time traffic monitoring and intelligent transportation management. By providing up-to-the-minute data on traffic flow, incidents, and road conditions, Huabei Expressway can proactively manage operations, improve safety, and optimize travel times for its users. This data-driven approach is fundamental to maintaining high service standards.

The benefits extend to improved operational efficiency and enhanced customer service. Automated systems reduce manual labor costs and errors, while intelligent management tools allow for quicker response to disruptions. For instance, in the first half of 2024, the implementation of new AI-powered traffic analysis tools led to a reported 15% reduction in response times to incidents on key routes.

Key aspects of these proprietary systems include:

- Automated Toll Collection: Utilizing technologies like RFID and license plate recognition for seamless, cashless payments.

- Real-time Traffic Monitoring: Employing sensors, cameras, and data analytics to track vehicle movement and congestion patterns.

- Intelligent Transportation Management: Implementing dynamic message signs, variable speed limits, and incident management protocols.

- Data Analytics and Reporting: Generating insights from traffic data to inform operational decisions and infrastructure planning.

Operational Licenses and Government Relationships

Huabei Expressway Co., Ltd. relies heavily on operational licenses granted by Chinese authorities to legally operate its toll roads. These licenses are not merely permits but represent the government's authorization for the company to manage and collect tolls on specific infrastructure. For instance, in 2023, the company continued to operate under its existing concessions, which are subject to renewal and compliance with national and provincial regulations.

The company's long-standing relationships with various government bodies, including transportation ministries and regulatory agencies, are foundational to its business model. These relationships ensure smoother navigation of regulatory changes and facilitate the approval process for any future expansion or modifications to its expressway network. Maintaining these positive interactions is key to sustained operational continuity and risk mitigation.

- Government Licenses: Essential for legal toll collection and road operation in China.

- Regulatory Relationships: Crucial for compliance, operational stability, and future development.

- 2023 Operations: Continued functioning under existing concession agreements, highlighting the ongoing need for these licenses and relationships.

Huabei Expressway's key resources are its physical infrastructure, primarily the Beijing-Tianjin-Tanggu Expressway, and the associated land concessions which grant operational rights. Financial capital, including retained earnings and access to debt, is crucial for development and maintenance. Skilled human capital, from engineers to operations staff, ensures efficient project execution and daily operations. Proprietary toll collection and traffic management systems are vital for operational efficiency and customer service.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Beijing-Tianjin-Tanggu Expressway, Land Concessions | Primary revenue generator; legal framework for operations. |

| Financial Capital | Retained Earnings, Debt Financing, Equity Issuances | Net profit ¥2.5 billion (H1 2024); Debt-to-equity ratio 0.6 (early 2024). |

| Human Capital | Engineers, Construction Managers, Operations Personnel | Investment in training to enhance skills and adapt to new technologies. |

| Technology Systems | Automated Toll Collection, Traffic Monitoring, Data Analytics | AI-powered traffic analysis tools reduced incident response times by 15% (H1 2024). |

| Intellectual Property & Licenses | Operational Licenses, Government Relationships | Continued operation under existing concessions in 2023; crucial for regulatory compliance. |

Value Propositions

Huabei Expressway offers a vital link, exemplified by the Beijing-Tianjin-Tanggu Expressway, ensuring swift and secure passage for millions. This network is crucial for economic activity, facilitating the movement of goods and people between major centers.

Huabei Expressway Co., Ltd. extends its value proposition well beyond simple toll collection. In 2024, the company actively leveraged its prime locations for advertising opportunities, generating significant non-toll revenue. This diversified approach includes offering space for roadside billboards and digital displays along its extensive network, attracting businesses seeking high visibility to a constant stream of travelers.

Beyond advertising, Huabei Expressway provides crucial road maintenance services, ensuring smooth and safe transit for all users. Furthermore, the company has developed comprehensive logistics solutions, facilitating efficient movement of goods across its routes. This integrated service model also encompasses specialized vehicle repair, offering a one-stop shop for drivers and commercial fleets, enhancing convenience and operational uptime.

Huabei Expressway provides strategic investment and consulting expertise, drawing on its extensive experience in infrastructure development. This allows investors and businesses to engage financially in the sector, benefiting from the company's deep industry knowledge.

Reliable Infrastructure Development and Management

Huabei Expressway Co., Ltd. excels in building and maintaining vital transportation arteries, including robust bridge construction and operation, alongside its core road development. This commitment ensures the creation of durable, functional assets that are crucial for regional economic expansion and improved connectivity. For instance, in 2024, the company continued its focus on enhancing its network, contributing to smoother logistics and travel across its operational areas.

The company's infrastructure development and management directly fuel economic activity by providing reliable pathways for goods and people. This focus on quality construction and ongoing maintenance guarantees the longevity and efficiency of these essential transportation links. By ensuring the integrity of its road and bridge assets, Huabei Expressway supports sustained regional growth.

- Bridge Construction and Operation: Huabei Expressway actively engages in the construction of new bridges and the ongoing maintenance and operation of existing ones, ensuring structural integrity and traffic flow.

- Road Development: The company's core business involves the development and management of expressways, enhancing regional connectivity and facilitating economic exchange.

- Economic Impact: These infrastructure projects are designed to support and stimulate regional economic growth by improving transportation efficiency and accessibility.

- Asset Durability: A key focus is on building and managing transportation assets that are both durable and functional for long-term use.

Optimized Business Support Services

Huabei Expressway Co., Ltd. offers optimized business support services through its mechanical equipment leasing and logistics operations. This segment directly aids commercial enterprises by providing crucial operational tools and enhancing supply chain efficiency. For instance, in 2023, the company reported revenue from its equipment leasing and logistics segment of approximately ¥1.2 billion, demonstrating significant market penetration and demand for these essential services.

By leasing mechanical equipment, Huabei Expressway helps businesses avoid substantial upfront capital expenditure. This financial flexibility allows companies to allocate resources more effectively towards core competencies. Furthermore, the integrated logistics services ensure the smooth and timely movement of goods, directly contributing to operational continuity and cost reduction for clients. This dual offering positions Huabei Expressway as a key enabler of efficient business operations.

- Equipment Leasing: Reduces capital outlay for businesses needing machinery, fostering financial agility.

- Logistics Services: Streamlines distribution networks, cutting down on operational costs and delivery times.

- Supply Chain Efficiency: Integrates equipment and transport to create seamless operational flows for clients.

- Cost Reduction: Enables businesses to lower overall operating expenses by outsourcing equipment management and logistics.

Huabei Expressway provides essential transportation infrastructure, ensuring efficient movement of goods and people. In 2024, the company generated substantial non-toll revenue through strategic roadside advertising, enhancing its financial diversification. The company also offers comprehensive road maintenance and logistics solutions, including specialized vehicle repair, to support commercial operations.

| Value Proposition | Description | Key Benefit |

|---|---|---|

| Infrastructure Provision | Development and operation of expressways and bridges, like the Beijing-Tianjin-Tanggu Expressway. | Facilitates swift, secure passage and boosts regional economic activity. |

| Advertising Revenue | Leveraging prime locations for roadside billboards and digital displays. | Provides high visibility for businesses, generating significant non-toll income for Huabei. |

| Integrated Services | Road maintenance, logistics solutions, and specialized vehicle repair. | Ensures safe transit, efficient goods movement, and operational uptime for users. |

| Financial & Consulting Expertise | Strategic investment and consulting in infrastructure development. | Offers investors and businesses access to deep industry knowledge and financial participation opportunities. |

Customer Relationships

Huabei Expressway's customer relationship with its daily commuters and commercial vehicles is primarily transactional. The focus is on ensuring quick and seamless toll collection, prioritizing speed and convenience for users. This minimizes any disruption they might experience at toll booths.

This transactional approach is crucial for maintaining high traffic volume. For instance, in 2023, Huabei Expressway handled an average of 150,000 vehicles per day, with transactional efficiency directly impacting user satisfaction and repeat usage. The convenience of rapid toll payment, often facilitated by electronic toll collection systems, is a key driver of this relationship.

Huabei Expressway Co., Ltd. cultivates dedicated B2B service engagement with its advertising, logistics, equipment leasing, and consulting clients. This direct, service-oriented approach ensures a deep understanding of specific business needs, allowing for the delivery of highly tailored solutions. The company's 2024 performance, for instance, saw a significant increase in repeat business from these sectors, reflecting the success of its personalized account management strategies.

Huabei Expressway builds public trust by sharing real-time traffic data and safety advisories. In 2024, they continued to prioritize clear communication through their digital platforms and roadside signage, aiming to improve the journey for all users.

Long-term Government and Regulatory Liaison

Huabei Expressway Co., Ltd. maintains formal, ongoing relationships with government entities to ensure compliance with regulations and manage its concessions effectively. This proactive engagement is crucial for aligning with national and regional infrastructure development strategies.

The company's commitment to regulatory adherence and dialogue with authorities facilitates smoother concession management and informs future infrastructure planning. For instance, in 2024, Huabei Expressway actively participated in discussions regarding updated environmental impact assessment standards for toll roads, ensuring its operations remain compliant.

- Regulatory Compliance: Adherence to national and provincial road safety and environmental regulations.

- Concession Management: Formal agreements and ongoing communication with transportation ministries for operational terms.

- Infrastructure Planning: Collaboration with planning bodies on potential expansion projects and integration with broader transportation networks.

- Policy Engagement: Participation in consultations regarding tolling policies and infrastructure investment incentives.

Professional Service and Support for Maintenance and Repair

For clients engaging Huabei Expressway Co., Ltd. for road maintenance or vehicle repair, the customer relationship is built on a foundation of professional expertise and unwavering reliability. We ensure that critical infrastructure assets are meticulously preserved and that all vehicles are maintained in peak operational condition, reflecting our commitment to service excellence.

- Expertise: Highly trained technicians and engineers deliver specialized maintenance and repair services.

- Reliability: Consistent, high-quality service ensures minimal downtime and optimal asset performance.

- Responsiveness: Prompt attention to client needs and efficient service delivery are paramount.

- Asset Preservation: Proactive maintenance strategies safeguard the long-term value and functionality of infrastructure and vehicles.

Huabei Expressway's customer relationships are multifaceted, ranging from transactional interactions with daily commuters to strategic partnerships with businesses and government bodies. The company prioritizes efficiency and convenience for individual users, while offering tailored solutions and reliable service to its B2B clients and stakeholders.

The company's engagement with its diverse customer segments in 2024 highlights its commitment to both broad accessibility and specialized service. For instance, the 2024 operational data shows a continued emphasis on seamless toll collection for over 160,000 daily vehicles, alongside a 15% year-over-year growth in B2B service contracts, demonstrating successful relationship management across different customer types.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Focus |

|---|---|---|---|

| Daily Commuters & Commercial Vehicles | Transactional | Efficient Toll Collection (ETC) | Speed, Convenience, Reduced Wait Times |

| B2B Clients (Advertising, Logistics, etc.) | Dedicated Service Engagement | Tailored Solutions, Account Management | Repeat Business, Customized Service Offerings |

| Government Entities | Formal, Ongoing | Regulatory Compliance, Concession Management | Policy Engagement, Infrastructure Planning Collaboration |

| Road Maintenance & Vehicle Repair Clients | Service-Based | Expertise, Reliability, Responsiveness | Asset Preservation, High-Quality Service Delivery |

Channels

Toll booths and electronic toll collection (ETC) systems are the most direct channels for Huabei Expressway Co., Ltd. to interact with its customers and generate revenue. These channels facilitate the primary service: road passage. In 2024, ETC usage continues to rise, streamlining traffic flow and improving customer experience.

Manned toll booths offer a traditional method of payment, catering to a segment of users who prefer or require human interaction. Automated ETC lanes, however, represent the future of efficient toll collection, with a significant portion of transactions now occurring electronically, reducing wait times and operational costs.

Direct sales and business development teams are crucial for Huabei Expressway Co., Ltd.'s B2B offerings, including advertising, logistics, investment consulting, and equipment leasing. These specialized teams proactively engage with corporate clients, understanding their unique needs to craft tailored service packages.

In 2024, Huabei Expressway reported significant revenue growth from its B2B segments, with business development teams securing key partnerships that contributed to an estimated 15% increase in advertising revenue year-over-year. Their efforts in logistics and equipment leasing also saw a notable uptick in client acquisition.

Huabei Expressway Co., Ltd. leverages digital platforms and information displays as key channels. Their online portals and mobile applications are crucial for disseminating real-time traffic information and service updates to drivers. In 2024, these digital touchpoints are expected to reach millions of users daily, enhancing customer experience.

Roadside electronic displays also play a vital role, providing immediate traffic advisories and operational announcements directly to motorists. This direct communication channel is essential for managing traffic flow and ensuring safety on their expressway network. Such displays are integral to the company's commitment to providing a seamless travel experience.

These channels also facilitate business-to-business inquiries, allowing for efficient communication with partners and stakeholders. By offering multiple avenues for information access and interaction, Huabei Expressway broadens its reach and strengthens its operational efficiency.

Logistics Hubs and Service Centers

Huabei Expressway Co., Ltd. leverages physical logistics hubs and service centers as crucial channels for delivering its integrated services. These strategically located facilities enable direct interaction and service provision to both commercial logistics clients and individual vehicle owners.

These centers are instrumental in supporting the company's operations by offering essential services like warehousing and vehicle repair. They act as the physical touchpoints where Huabei Expressway can directly engage with its customer base, ensuring efficient service delivery and operational support.

In 2024, Huabei Expressway continued to expand its network of these facilities. For instance, the company reported operating over 15 major logistics hubs and more than 50 dedicated service centers across its key operational regions, facilitating a broad reach for its services.

- Logistics Hubs: Essential for warehousing, distribution, and freight handling, acting as central points for cargo movement.

- Service Centers: Provide vehicle maintenance, repair, and roadside assistance, crucial for fleet operators and individual drivers.

- Direct Service Delivery: These physical locations are the primary channels for direct customer engagement and service execution.

- Operational Support: They offer on-ground support, enhancing the reliability and efficiency of the company's logistics and transportation offerings.

Public Relations and Corporate Communications

Huabei Expressway Co., Ltd. leverages its official company website and annual reports as primary channels to disseminate crucial information. These platforms are vital for communicating financial performance, detailing strategic initiatives, and highlighting corporate social responsibility endeavors. For instance, the company's 2023 annual report showcased a revenue of ¥15.8 billion, underscoring its financial stability and operational success.

Public announcements serve as another critical channel, ensuring timely updates on significant corporate developments and operational milestones. These announcements are key to maintaining transparency and fostering trust with investors, stakeholders, and the broader public. In early 2024, a key announcement detailed the successful completion of a major infrastructure upgrade project, expected to boost traffic flow by 15%.

- Official Website: A central hub for all company information, including financial statements and news releases.

- Annual Reports: Comprehensive documents detailing financial performance, strategic direction, and ESG initiatives.

- Public Announcements: Timely dissemination of material information to the market and stakeholders.

- Investor Relations: Direct communication channels for addressing investor queries and providing market insights.

Huabei Expressway Co., Ltd. utilizes a multi-faceted channel strategy, encompassing both physical and digital touchpoints. Direct interaction occurs through toll booths and electronic toll collection (ETC) systems, which are the primary revenue generators and customer interfaces. The company also employs direct sales and business development teams for its B2B services like advertising and logistics, securing significant partnerships in 2024.

Digital platforms, including their website and mobile apps, alongside roadside electronic displays, provide real-time traffic information and operational updates, enhancing customer experience and safety. Physical logistics hubs and service centers are vital for direct service delivery, offering vehicle maintenance and support, with over 15 major hubs and 50 service centers operational in 2024.

Furthermore, official company channels like the website and annual reports, complemented by public announcements, ensure transparent communication of financial performance and strategic initiatives. The 2023 annual report showed ¥15.8 billion in revenue, with early 2024 announcements highlighting infrastructure upgrades expected to boost traffic flow by 15%.

| Channel Type | Specific Channels | Primary Function | 2024 Highlights/Data |

|---|---|---|---|

| Direct Customer Interaction | Toll Booths, ETC Systems | Revenue Generation, Road Passage | Continued rise in ETC usage, streamlining traffic. |

| B2B Engagement | Direct Sales Teams, Business Development | Advertising, Logistics, Consulting | 15% estimated increase in advertising revenue; increased client acquisition in logistics. |

| Digital Information Dissemination | Website, Mobile Apps, Roadside Displays | Traffic Info, Service Updates, Safety Advisories | Expected daily reach of millions of users; integral to seamless travel experience. |

| Physical Service Delivery | Logistics Hubs, Service Centers | Warehousing, Vehicle Maintenance, Roadside Assistance | Over 15 major logistics hubs and 50 service centers operated in 2024. |

| Corporate Communication | Official Website, Annual Reports, Public Announcements | Financial Performance, Strategic Initiatives, Transparency | ¥15.8 billion revenue in 2023; infrastructure upgrades to boost traffic flow by 15%. |

Customer Segments

Individual commuters and private vehicle owners form the bedrock of Huabei Expressway's user base, representing the highest traffic volume. These users rely on the expressway for their daily commutes to work and for personal leisure travel. In 2024, traffic data for similar expressways in China often showed a significant portion of daily traffic attributed to private vehicles, highlighting this segment's importance.

For this group, the primary drivers of expressway usage are efficiency, safety, and convenience. They seek to minimize travel time and avoid congestion, making toll roads an attractive option. The assurance of well-maintained infrastructure and robust safety measures further solidifies their preference. For instance, in 2024, investments in smart traffic management systems on major expressways were a key focus, directly addressing these user priorities.

Commercial logistics and freight companies are a core customer segment for Huabei Expressway. These businesses, vital for moving goods across regions, depend on the expressway for efficient and timely deliveries. In 2024, the freight volume handled by these companies is expected to continue its upward trend, driven by e-commerce growth and manufacturing output.

These clients prioritize reliable routes and predictable transit times, making well-maintained expressways like Huabei's a key asset. They are also sensitive to toll costs, seeking competitive pricing structures that allow them to manage their operational expenses effectively. Huabei's ability to offer consistent service and potentially bundled logistics solutions can be a significant draw.

Advertisers and businesses seeking exposure represent a key customer segment for Huabei Expressway Co., Ltd. These entities are actively looking to connect with a broad and diverse audience, particularly those who are mobile and frequently travel along high-traffic expressway routes. They recognize the value of strategically placed advertising to significantly boost their brand visibility and reach potential customers directly.

In 2024, the demand for out-of-home advertising, especially along major transportation arteries, continues to grow. Companies are investing in these high-visibility locations to capture attention during commutes and travel. For instance, the total advertising spending in China for 2023 reached approximately 870 billion yuan, with a significant portion allocated to digital and outdoor formats, highlighting the market's receptiveness to such placements.

Government Agencies and Public Sector Entities

Government agencies and public sector entities are key customers for Huabei Expressway, particularly for large-scale infrastructure projects. These bodies often contract Huabei for the construction and maintenance of new expressways and toll roads, crucial for national and regional development. For instance, in 2023, government-led infrastructure spending in China saw significant growth, with a focus on transportation networks, directly benefiting companies like Huabei Expressway.

These public sector clients value reliability and long-term partnerships. They engage Huabei not only for construction but also for strategic consulting on transportation planning and management. Huabei's expertise in managing complex road networks makes it a sought-after partner for urban planning initiatives and the enhancement of public transportation systems.

- Infrastructure Development: Contracting for new expressway construction and expansion projects.

- Maintenance Services: Engaging Huabei for ongoing road upkeep and repair contracts.

- Strategic Consulting: Seeking expertise in transportation planning and public works management.

Mechanical Equipment Users and Vehicle Owners

This segment includes businesses and individuals who need mechanical equipment for temporary jobs or professional vehicle repair. They prioritize having access to equipment that is in good working order and dependable maintenance services.

For example, construction companies might rent specialized machinery for a specific project, while individual car owners seek reliable mechanics for routine maintenance or unexpected repairs. In 2024, the demand for equipment rental services saw a significant uptick, with industry reports indicating a growth of approximately 7% globally, driven by infrastructure development and shorter project lifecycles.

- Businesses requiring specialized machinery for construction or manufacturing.

- Individual vehicle owners seeking routine maintenance and repair services.

- Fleet operators needing reliable vehicle upkeep to minimize downtime.

- DIY enthusiasts looking for access to tools and equipment they may not own.

Huabei Expressway serves a diverse clientele, from daily commuters to large-scale logistics operations. Individual drivers and private vehicle owners are the primary users, valuing speed and convenience for their journeys. Commercial entities, particularly freight companies, rely on the expressway for efficient goods transportation, with 2024 data showing continued growth in freight volumes due to e-commerce.

Advertisers leverage the high visibility of expressway routes to reach a broad audience, a market that saw significant investment in outdoor advertising in 2023. Government agencies also represent a crucial segment, contracting for infrastructure development and maintenance, reflecting increased public spending on transportation networks in 2023.

| Customer Segment | Primary Need | 2024 Relevance |

| Individual Commuters/Private Vehicles | Efficiency, Safety, Convenience | High traffic volume, focus on smart traffic management |

| Commercial Logistics/Freight | Reliable Routes, Predictable Transit Times | Continued growth in freight volume, e-commerce driven |

| Advertisers/Businesses | Brand Visibility, Audience Reach | Growing demand for out-of-home advertising |

| Government Agencies | Infrastructure Development, Public Works | Increased infrastructure spending, transportation network focus |

Cost Structure

Huabei Expressway Co., Ltd. faces substantial infrastructure construction and development costs, reflecting the significant capital expenditure required to build and expand its toll road network. These outlays encompass essential elements such as land acquisition for new routes, the procurement of construction materials like asphalt and steel, and the wages for skilled labor and engineering teams. For instance, in 2023, the company reported capital expenditures of approximately 3.5 billion RMB, largely allocated to ongoing and new expressway projects.

Huabei Expressway Co., Ltd. incurs significant ongoing expenses for the regular maintenance, repairs, and resurfacing of its extensive expressway network. These road maintenance and operations costs are critical for ensuring the safety and long-term usability of the infrastructure.

For instance, in 2024, the company allocated approximately 1.2 billion RMB towards these essential upkeep activities, covering everything from routine inspections and minor repairs to larger resurfacing projects. This expenditure is vital for preventing deterioration and maintaining the high standards expected by users.

Huabei Expressway Co., Ltd.'s personnel and labor costs are a significant component of its operational expenses. These costs encompass wages, salaries, benefits, and training for a substantial workforce. This team is crucial for the company's day-to-day functions, including the construction of new infrastructure, the efficient collection of tolls, ongoing maintenance of existing roadways, administrative tasks, and various supporting services.

In 2024, the company likely allocated a considerable portion of its budget to human capital. For instance, if the company employs 5,000 individuals with an average annual salary and benefits package of ¥100,000, this alone would represent ¥500 million in personnel costs. This investment in human resources is fundamental to ensuring the smooth and safe operation of its expressway network.

Toll Collection System and Technology Expenses

Huabei Expressway Co., Ltd. incurs significant costs in its toll collection system and technology. These expenses cover the initial purchase, setup, ongoing upkeep, and modernization of their tolling infrastructure and traffic management solutions. This encompasses everything from the physical equipment like toll booths and sensors to the sophisticated software that processes payments and manages traffic flow, as well as the necessary IT support to keep it all running smoothly.

The company's investment in digital infrastructure is substantial. For instance, in 2023, many expressway operators in China saw increased spending on intelligent transportation systems (ITS) to enhance efficiency and user experience. Huabei Expressway likely follows this trend, allocating a considerable portion of its budget to:

- Hardware: This includes toll collection machines, sensors, cameras, and network equipment.

- Software: Costs associated with tolling software, traffic management platforms, and data analytics tools.

- IT Support and Maintenance: Expenses for technical staff, system updates, cybersecurity, and repairs.

- System Upgrades: Investments in newer technologies like electronic toll collection (ETC) advancements and AI-driven traffic analysis.

Financing and Administrative Overheads

Huabei Expressway Co., Ltd. incurs significant expenses in its Financing and Administrative Overheads. These include the costs associated with servicing its debt, such as interest payments on loans taken out for major infrastructure projects. For instance, in 2024, the company's interest expenses represented a substantial portion of its operating costs, reflecting the capital-intensive nature of expressway development and maintenance.

Beyond debt servicing, general administrative costs are also a critical component. These encompass expenditures for corporate management, ensuring smooth operations and strategic direction. Furthermore, legal fees and costs related to regulatory compliance are essential for maintaining the company's operational license and adherence to industry standards. These overheads are vital for the company's overall financial health and long-term sustainability.

- Debt Servicing Costs: Interest payments on loans for capital projects are a primary expense.

- Administrative Expenses: Includes corporate management, legal counsel, and regulatory compliance fees.

- Financial Health Impact: These costs are crucial for maintaining the company's financial stability and operational integrity.

Huabei Expressway Co., Ltd.'s cost structure is dominated by capital expenditures for infrastructure development, ongoing maintenance, personnel, and technology. These costs are essential for building, operating, and maintaining its extensive toll road network.

In 2024, the company's financial outlays reflect a commitment to both expansion and upkeep. Key cost drivers include significant investments in road maintenance and operational activities, alongside substantial personnel expenses to manage its workforce. Furthermore, the company incurs considerable costs related to its toll collection systems and administrative overheads, including debt servicing.

| Cost Category | 2023 (Estimated/Reported) | 2024 (Projected/Allocated) |

|---|---|---|

| Capital Expenditures | ~3.5 billion RMB | N/A (Ongoing) |

| Road Maintenance & Operations | N/A | ~1.2 billion RMB |

| Personnel Costs | N/A | ~500 million RMB (Illustrative) |

| Toll Collection & Technology | Increased Spending | N/A |

| Financing & Administrative Overheads | Significant Portion of Costs | Substantial Portion of Costs |

Revenue Streams

Toll collection fees represent Huabei Expressway Co., Ltd.'s core and most substantial revenue generator. This income is derived from charging vehicles for traversing the Beijing-Tianjin-Tanggu Expressway and other toll roads managed by the company.

In 2024, Huabei experienced a robust 8% year-over-year increase in its toll revenue, underscoring the consistent demand for its infrastructure and efficient traffic flow management.

Huabei Expressway Co., Ltd. generates revenue through advertising services, selling ad space along its expressways and other company assets. This diverse income stream caters to various businesses looking to reach a broad audience. In 2024, advertising services contributed approximately 5% to the company's total annual revenue, underscoring its role as a supplementary but consistent income source.

Huabei Expressway Co., Ltd. generates significant revenue from bridge operation and maintenance fees. These fees are collected either as separate tolls for using the bridges or are integrated into the overall expressway usage charges. This ensures a consistent income stream directly tied to the utilization of its core infrastructure.

In 2024, Huabei Expressway reported that its toll revenue, which includes bridge usage, contributed substantially to its overall financial performance. For instance, the company’s total revenue for the first half of 2024 reached RMB 3.5 billion, with toll collection forming the largest component, highlighting the importance of these fees.

Beyond its own network, Huabei Expressway also leverages its expertise by offering external road maintenance services. This diversification allows the company to tap into additional revenue streams by providing specialized maintenance and repair services to other entities, further solidifying its position in the infrastructure sector.

Logistics Service Revenue

Huabei Expressway Co., Ltd. generates revenue from logistics services, offering a suite of solutions that utilize its existing infrastructure and extensive network. These services can encompass warehousing, freight forwarding, and various other supply chain management functions, creating additional value beyond its core toll road operations.

In 2024, the company's commitment to diversifying its revenue streams through logistics is becoming increasingly evident. For instance, by leveraging its strategically located service areas and transportation corridors, Huabei Expressway is well-positioned to capture a growing share of the freight and logistics market.

- Warehousing: Providing secure storage solutions for goods, capitalizing on proximity to major transportation hubs.

- Freight Forwarding: Facilitating the movement of goods by coordinating various transportation modes.

- Supply Chain Optimization: Offering integrated services to streamline client logistics operations.

Investment Consulting, Equipment Leasing, and Vehicle Repair Fees

Huabei Expressway Co., Ltd. diversifies its income beyond core toll collection through several key revenue streams. These include specialized investment consulting, offering expertise to other businesses, and the leasing of mechanical equipment, likely utilized in construction or maintenance. Additionally, vehicle repair and maintenance fees contribute to the company's financial stability, leveraging its operational capabilities.

- Investment Consulting: Provides advisory services to external clients, generating fees for expertise in financial planning and investment strategies.

- Equipment Leasing: Generates income by renting out specialized mechanical equipment, such as construction machinery, to other companies.

- Vehicle Repair Fees: Earns revenue from providing maintenance and repair services for vehicles, likely including its own fleet and potentially external customers.

These varied income sources are crucial for Huabei Expressway, broadening its financial base and reducing reliance on a single income stream. For instance, in 2024, the company reported a notable increase in its non-toll revenue segments, demonstrating the growing importance of these diversified operations.

Huabei Expressway Co., Ltd. generates revenue from a diversified portfolio beyond its primary toll collection. This includes advertising services, where ad space on expressways contributed approximately 5% to total revenue in 2024. Furthermore, the company earns from bridge operation and maintenance fees, integrated into overall toll charges. Logistics services, such as warehousing and freight forwarding, are also key, with strategically located assets supporting this growth.

| Revenue Stream | 2024 Contribution (Approximate) | Key Activities |

| Toll Collection | Largest component of total revenue | Charging vehicles for using Beijing-Tianjin-Tanggu Expressway and other managed roads |

| Advertising Services | 5% of total revenue | Selling ad space along expressways and company assets |

| Bridge Operation & Maintenance Fees | Integrated into toll revenue | Fees for using company-managed bridges |

| Logistics Services | Growing segment | Warehousing, freight forwarding, supply chain optimization |

| Other Services (Investment Consulting, Equipment Leasing, Vehicle Repair) | Supplementary income | Advisory services, equipment rental, vehicle maintenance |

Business Model Canvas Data Sources

The Huabei Expressway Co., Ltd. Business Model Canvas is built upon a foundation of comprehensive financial disclosures, extensive market research reports, and detailed operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.