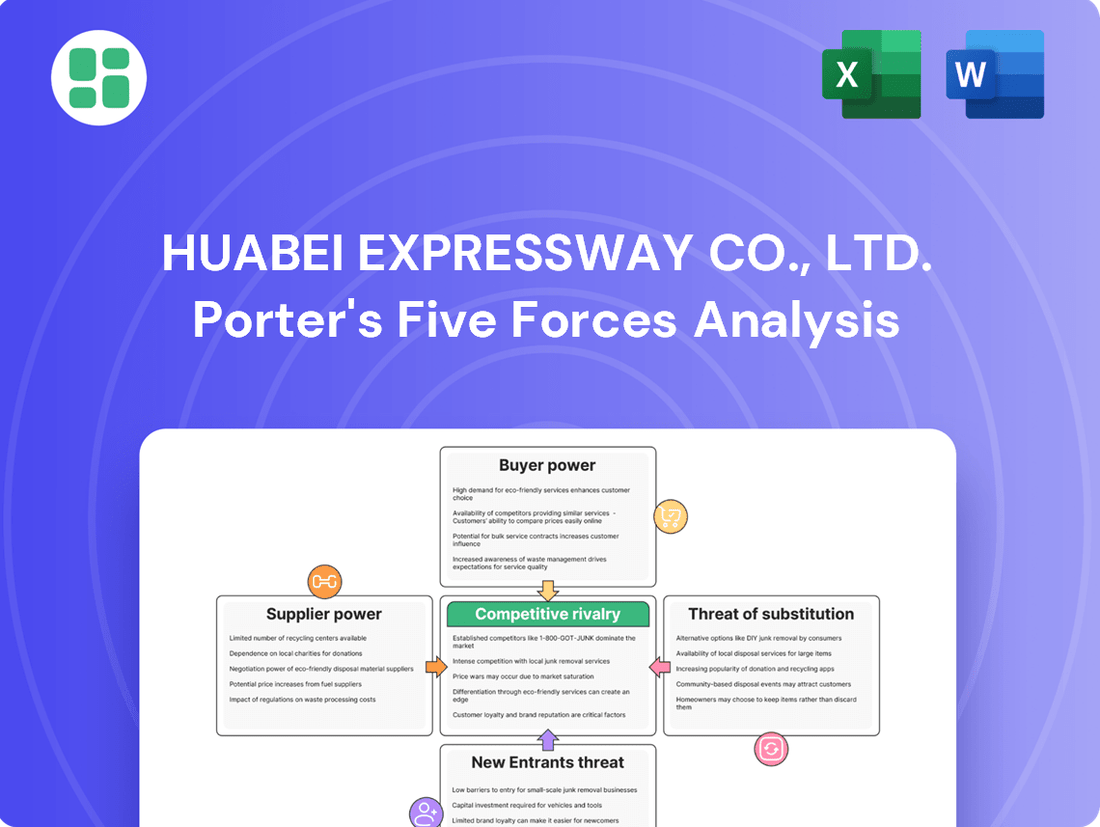

Huabei Expressway Co., Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabei Expressway Co., Ltd. Bundle

Huabei Expressway Co., Ltd. faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers impacting its profitability. The threat of new entrants is relatively low due to high capital requirements, while the threat of substitutes is also contained by the essential nature of its services.

The complete report reveals the real forces shaping Huabei Expressway Co., Ltd.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Huabei Expressway Co., Ltd. is significantly shaped by the concentration of specialized providers for essential inputs. This includes advanced electronic toll collection (ETC) systems, heavy-duty construction machinery, and premium road construction materials like asphalt and concrete. When a limited number of suppliers control these critical niches, they gain leverage to influence pricing and contract terms.

China's drive towards digitalizing its transportation network, aiming for 100% ETC adoption by 2025, underscores a growing dependence on these specialized technology suppliers. This trend amplifies the bargaining power of those few companies capable of delivering the necessary sophisticated ETC solutions, potentially impacting Huabei Expressway's operational costs.

Suppliers providing highly specialized or proprietary technology, like advanced traffic management software or unique bridge construction methods, hold significant bargaining power. For instance, providers of 5G-enabled C-V2X networks for connected vehicles or AI-powered traffic monitoring systems benefit from the distinctiveness of their solutions.

Huabei Expressway's reliance on these cutting-edge technologies to boost operational efficiency and enhance user experience directly translates into increased leverage for these suppliers. This is particularly true as the company aims to integrate smart infrastructure, a trend that saw significant investment in 2024 as China pushed forward with its digital infrastructure development.

The bargaining power of suppliers is significantly influenced by switching costs. For Huabei Expressway, these costs could involve the expense of re-tooling machinery for different asphalt types or retraining maintenance crews on new road surface technologies. Such transitions can be financially burdensome and time-consuming, making it difficult to switch providers without impacting operational efficiency.

For a company like Huabei Expressway, which manages extensive highway networks, the costs associated with switching suppliers for critical materials like concrete, steel, or specialized paving equipment can be substantial. These high switching costs mean Huabei Expressway might be locked into existing supplier relationships, giving those suppliers more leverage in price negotiations and contract terms.

In 2023, infrastructure projects globally saw material cost increases, with asphalt prices, for example, fluctuating based on crude oil markets. If Huabei Expressway relies on specific suppliers for these essential materials, the effort and expense to find and onboard new ones, potentially involving new quality certifications or contract renegotiations, can be considerable, thereby strengthening supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into toll road operations is a key consideration for Huabei Expressway Co., Ltd. If suppliers could directly operate expressways, their leverage would significantly increase.

However, this threat is largely mitigated due to the substantial capital investment, complex regulatory frameworks, and lengthy concession agreements inherent in China's expressway sector. For instance, the average concession period for expressways in China can extend for decades, making forward integration a daunting prospect for typical suppliers.

Furthermore, the Chinese government's significant role and direct involvement in managing and developing the toll road infrastructure network further curtails the feasibility of suppliers independently entering this market. This governmental oversight acts as a substantial barrier to entry for potential forward-integrating suppliers.

- High Capital Requirements: Building and operating expressways demand billions in investment, a significant barrier for most suppliers.

- Regulatory Hurdles: Navigating China's stringent regulations for infrastructure development and operation is a complex challenge.

- Long Concession Periods: The extended durations of operating rights mean suppliers would face a long wait to recoup substantial investments.

- Governmental Control: State-owned enterprises and direct government management dominate the sector, limiting private supplier entry.

Importance of Supplier's Input to Huabei's Cost Structure

The criticality of a supplier's input to Huabei Expressway's cost structure significantly influences supplier bargaining power. For instance, specialized materials for road construction and advanced technology for electronic toll collection systems represent substantial portions of Huabei's capital and operational expenditures. In 2024, the cost of asphalt and concrete, key components for highway maintenance and new construction, saw fluctuations influenced by global commodity prices, directly impacting Huabei's project budgets.

Suppliers of essential components, such as those providing the specialized machinery for asphalt paving or the integrated circuits for tolling systems, wield considerable influence. Their ability to dictate terms is amplified when these inputs are unique or difficult to substitute. For example, a single supplier dominating the market for a specific type of traffic sensor could command higher prices, affecting Huabei's operational efficiency and cost of service.

- Critical Inputs: Construction materials like asphalt and concrete, specialized labor for maintenance, and advanced toll collection technology are vital to Huabei's operations.

- Cost Impact: The pricing of these essential inputs directly affects Huabei's profitability and the overall cost of maintaining and expanding its expressway network.

- Market Dynamics: China's ongoing infrastructure development in 2024 suggests robust demand for these materials and services, potentially strengthening supplier negotiating positions.

- Technological Dependence: Reliance on proprietary technology for toll collection can give technology providers significant leverage over Huabei.

The bargaining power of suppliers for Huabei Expressway is moderate, primarily due to the availability of alternative suppliers for many raw materials like asphalt and concrete, though specialized technology providers for ETC systems and advanced traffic management solutions hold more sway. High switching costs for complex technological integrations and the critical nature of certain construction materials mean suppliers of these niche inputs can exert significant influence on pricing and terms.

China's continued investment in smart infrastructure, with a focus on advanced connectivity and data analytics for transportation networks, has increased the dependence on specialized technology suppliers. This trend, evident in 2024 infrastructure spending, allows providers of unique solutions, such as AI-driven traffic monitoring or 5G-enabled communication systems for vehicles, to command higher prices and favorable contract conditions.

The threat of supplier forward integration is minimal for Huabei Expressway. The immense capital requirements for expressway construction and operation, coupled with lengthy concession periods and stringent government regulations in China, create substantial barriers to entry for suppliers looking to enter the toll road operation market. Government oversight further solidifies this barrier.

| Factor | Impact on Huabei Expressway | Example Data/Trend (2024) |

| Supplier Concentration (Specialized Tech) | High Bargaining Power | Limited number of providers for advanced ETC and C-V2X systems. |

| Switching Costs (Technology) | High | Significant investment needed to reconfigure integrated tolling systems. |

| Availability of Alternatives (Materials) | Low to Moderate Bargaining Power | Multiple sources for asphalt and concrete, though quality variations exist. |

| Criticality of Input | Moderate to High Bargaining Power | Asphalt and concrete costs impacted global commodity prices in 2024, affecting project budgets. |

| Threat of Forward Integration | Very Low | Billions in capital, long concessions, and government control deter supplier entry into operations. |

What is included in the product

This analysis explores the competitive landscape of Huabei Expressway Co., Ltd., examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute services.

Huabei Expressway's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive pressures, acting as a vital pain point reliever for strategic planning.

This analysis allows for the customization of pressure levels based on new data or evolving market trends, offering a dynamic solution to address pain points in real-time.

Customers Bargaining Power

The primary customers for Huabei Expressway are the road users who pay tolls. While individual drivers might be sensitive to toll prices, especially if other routes are available, the fundamental role of expressways in facilitating efficient travel, particularly on a key corridor like the Beijing-Tianjin-Tanggu Expressway, somewhat dampens their collective bargaining power.

The government also plays a role by mandating a minimum 5% discount for Electronic Toll Collection (ETC) users. This requirement suggests a level of pricing influence or control exerted on expressway operators. For instance, in 2024, expressways across China saw continued adoption of ETC, with reports indicating that over 90% of transactions on major national expressways were conducted via ETC, highlighting the government's ability to shape pricing incentives.

The bargaining power of Huabei Expressway's customers is somewhat limited by the availability of alternative transportation. While other national highways exist, they often lack the controlled-access and speed of expressways, making them less attractive for time-sensitive travel.

For long-distance passenger journeys, high-speed rail offers a viable substitute, potentially diverting some traffic from expressways. However, for specific, high-demand corridors, such as the Beijing-Tianjin-Tanggu route, direct and equally efficient free alternatives are scarce, thus strengthening Huabei Expressway's position.

In 2024, China's high-speed rail network continued its expansion, with over 45,000 kilometers of high-speed rail lines in operation by the end of the year, providing a significant alternative for intercity travel.

Huabei Expressway's customer base is incredibly spread out, made up of millions of individual drivers and many logistics firms. This means no single customer or even a small group holds enough sway to demand lower tolls.

In 2023, the company's toll revenue reached about CNY 2.4 billion. The sheer volume of individual transactions and the diverse nature of its clientele, from daily commuters to large shipping companies, dilute the impact any one customer can have on pricing or service terms.

Information Availability and Switching Costs for Customers

Customers of Huabei Expressway Co., Ltd. generally have good access to information about toll rates and alternative routes available to them. This transparency empowers them to compare options before making a travel decision.

The switching costs for customers are quite low, especially for individual trips. For instance, choosing a different, potentially non-toll road for a single journey incurs minimal direct financial or time investment to switch.

While price is a factor, the convenience and time savings provided by expressways often hold more weight for travelers. This means that even if there are slight differences in toll fees, customers are less likely to switch routes solely based on minor price variations.

- Information Access: Customers can readily compare toll rates and alternative routes through various mapping and traffic applications.

- Low Switching Costs: The primary cost of switching is the potential for a longer or less convenient journey, not significant financial penalties.

- Value Proposition: Convenience and time savings are key drivers, often outweighing small toll differentials for the average commuter or traveler.

Other Revenue Streams and Customer Influence

Huabei Expressway Co., Ltd. diversifies its income beyond tolls through advertising, logistics, and vehicle repair. The bargaining power of advertising clients hinges on the exclusivity and reach of their chosen expressway locations. For instance, high-traffic interchanges offer premium visibility, potentially increasing client leverage if alternative premium advertising spots are scarce.

In the logistics and vehicle repair sectors, customer bargaining power is directly tied to the competitive intensity of these ancillary services. If numerous providers offer similar logistics or repair solutions along Huabei Expressway’s routes, customers gain more power to negotiate prices and terms. In 2023, the logistics sector saw a 5% increase in competition in some regions, potentially impacting pricing power for service providers like Huabei Expressway.

- Advertising Clients: Bargaining power is influenced by the uniqueness and audience reach of advertising spaces.

- Logistics Customers: Power is derived from the competitiveness of the logistics service market.

- Vehicle Repair Customers: Influence depends on the availability and pricing of alternative repair services.

- Revenue Diversification: While diversifying revenue streams, Huabei Expressway must manage customer power in each segment.

The bargaining power of Huabei Expressway's customers is generally low due to the essential nature of its services and the fragmented customer base. While individual users might be price-sensitive, the lack of readily available, equally efficient alternatives for key routes limits their ability to negotiate. The government's mandate for ETC discounts, however, represents a form of indirect customer influence on pricing structures.

| Customer Segment | Bargaining Power Factor | Impact on Huabei Expressway |

| Individual Road Users | Low due to essential service and limited alternatives | Minimal direct price negotiation power |

| Logistics Companies | Slightly higher if significant volume, but still limited by route necessity | Potential for volume discounts, but overall impact diluted by scale |

| Advertising Clients | Varies by location and reach; higher for premium spots | Negotiation on ad placement and rates |

Preview Before You Purchase

Huabei Expressway Co., Ltd. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Huabei Expressway Co., Ltd. Porter's Five Forces Analysis highlights intense rivalry among existing players and the significant threat of new entrants due to high capital requirements and regulatory hurdles. Bargaining power of buyers is moderate, influenced by alternative transportation options, while the bargaining power of suppliers is low, given the standardized nature of road construction materials and labor. The threat of substitutes is also considerable, as advancements in high-speed rail and air travel offer competitive alternatives for long-distance travel.

Rivalry Among Competitors

The Chinese toll road sector exhibits a fragmented competitive landscape, with many provincial and municipal entities operating distinct routes. For instance, in 2023, China's Ministry of Transport reported over 160,000 kilometers of expressways in operation, managed by numerous state-owned enterprises and local government bodies. This low concentration means Huabei Expressway Co., Ltd. faces a diverse set of players, though direct competition on identical routes is often mitigated by the concession-based nature of toll road development.

China's ongoing commitment to infrastructure development, particularly highways, fueled by substantial government investment and ambitious new project pipelines, signals a robustly expanding market. This growth environment is crucial for companies like Huabei Expressway.

The heavy and civil engineering construction sector, encompassing highways, streets, and bridges, reached an impressive $873.4 billion in 2024. Projections indicate a compound annual growth rate (CAGR) of 5.00% from 2024 to 2029, suggesting a healthy expansionary trend for the industry.

This expanding market dynamic can serve to temper the severity of price-based competition among established expressway operators. As demand increases and new opportunities arise, the pressure to undercut rivals on pricing may lessen, allowing for more stable revenue streams.

Toll road services, like those offered by Huabei Expressway, are inherently difficult to differentiate. The primary offering is simply passage, making the core product largely commoditized. While improvements in road quality or the addition of better service area amenities can offer some distinction, these are often incremental.

Technological advancements, such as the widespread adoption of Electronic Toll Collection (ETC) systems, are becoming a key differentiator. China's goal of 100% ETC adoption by 2025 means seamless, efficient passage is increasingly expected by users. This focus on technological integration aims to reduce friction and improve the overall user experience.

Despite these efforts, the actual cost for a user to switch between expressways, assuming alternative routes exist, remains very low. This lack of significant switching costs means competition naturally gravitates towards operational efficiency and user convenience, as companies vie to attract and retain traffic based on speed and ease of use.

High Fixed Costs and Exit Barriers

Huabei Expressway Co., Ltd., like many in the toll road sector, faces significant competitive rivalry driven by high fixed costs and substantial exit barriers. The construction and ongoing maintenance of expressways represent massive capital outlays, creating a high cost structure from the outset. For instance, major expressway projects often run into billions of dollars, and Huabei Expressway's 2023 annual report indicates substantial ongoing investment in infrastructure upkeep.

These high fixed costs, coupled with the long-term nature of concession agreements and the inherent immobility of expressway assets, create exceptionally high exit barriers. Companies are thus strongly incentivized to continue operating, even if profitability dips, simply to cover these fixed operational expenses. This can intensify price competition if traffic volumes falter or if new, potentially lower-cost transportation alternatives emerge, putting pressure on existing operators like Huabei Expressway.

- High Capital Intensity: The toll road industry requires enormous upfront investment for construction and continuous expenditure for maintenance, making it a capital-intensive business.

- Immobility of Assets: Expressway infrastructure cannot be easily relocated or repurposed, locking companies into long-term commitments.

- Operational Incentive: High fixed costs encourage continued operation even at low profitability to amortize these costs over time.

- Potential for Price Wars: A decline in traffic or the introduction of competitive alternatives can trigger aggressive pricing strategies among existing players.

Government Regulation and Influence

The Chinese government's substantial influence over the toll road sector significantly impacts competitive dynamics. Through regulatory frameworks and direct investment, Beijing shapes how companies like Huabei Expressway operate and compete.

This government intervention can create an uneven playing field, potentially favoring state-owned enterprises. For instance, the government's role in setting concession terms and tolling periods directly affects profitability and investment attractiveness. In 2024, discussions around extending concession periods for certain toll roads were underway, aiming to bolster industry profitability and encourage further private capital infusion into infrastructure development.

- Government as Regulator: Sets toll rates, safety standards, and environmental regulations impacting operational costs.

- Government as Investor: Direct investment in new projects can alter supply and demand dynamics.

- Concession Agreements: Terms, including duration and tolling rights, are government-determined and crucial for revenue projections.

- Policy Shifts: Changes in infrastructure spending or privatization policies can rapidly alter the competitive landscape.

Competitive rivalry in the Chinese toll road sector is characterized by a large number of operators, though direct route competition is often limited by concessions. The commoditized nature of toll road services means differentiation is challenging, with technological adoption like ETC becoming a key factor. However, low switching costs for users ensure that operational efficiency and convenience remain critical competitive advantages for companies like Huabei Expressway.

The intense competition stems from high fixed costs and significant exit barriers inherent in expressway infrastructure. Companies are compelled to operate continuously to amortize these substantial investments, which can lead to aggressive pricing if traffic volumes decline or new transportation options emerge.

Government influence is a major factor, with regulations and investment shaping the competitive landscape. This can create advantages for state-owned entities, as demonstrated by ongoing policy discussions in 2024 regarding concession period extensions to enhance industry profitability.

| Factor | Description | Impact on Huabei Expressway |

|---|---|---|

| Number of Competitors | Fragmented market with many provincial/municipal operators. | Requires focus on operational efficiency and user experience to attract traffic. |

| Product Differentiation | Services are largely commoditized; differentiation is incremental. | Emphasis on technological integration (e.g., ETC) and service quality is crucial. |

| Switching Costs | Low for users if alternative routes exist. | Intensifies competition based on convenience, speed, and pricing. |

| Exit Barriers | High due to capital intensity and immobility of assets. | Encourages continued operation, potentially leading to price competition. |

SSubstitutes Threaten

For passenger transport, high-speed rail, regional trains, and extensive bus networks in China present formidable substitutes to expressways, particularly for long-distance journeys and inter-city travel. China boasts the world's most extensive high-speed railway network, a significant draw for travelers seeking speed, cost-effectiveness, and convenience over traditional road travel.

In 2023, China's high-speed rail carried over 3.7 billion passenger trips, demonstrating its substantial reach and appeal as an alternative to expressway usage for a vast number of travelers.

While Huabei Expressway Co., Ltd. provides a premium travel experience, the existence of non-toll national and provincial highways presents a significant threat of substitutes. These alternative routes, though generally slower and potentially more congested due to urban passage, offer a cost-free option for drivers prioritizing savings over speed. By 2024, China's extensive national highway system spanned over 1.9 million kilometers, providing a vast network of these substitute options.

For very long distances, air travel presents a viable substitute for expressway usage, particularly for business travelers or individuals valuing time efficiency. However, its competitive edge diminishes significantly for shorter to medium distances where expressways excel in convenience. The added complexities of airport procedures and associated costs further limit air travel's appeal as a direct substitute for many expressway journeys.

Emerging Technologies and Mobility Solutions

The threat of substitutes for Huabei Expressway Co., Ltd. is evolving with technological advancements. Future substitutes could emerge in the form of highly efficient public transportation networks, such as hyperloop systems or advanced magnetic levitation trains, potentially reducing the reliance on private vehicles and toll roads. Autonomous vehicle fleets, especially if integrated with dedicated smart lanes, could offer a more seamless and perhaps cost-effective alternative for certain travel needs. For instance, by 2024, the global autonomous vehicle market is projected to reach substantial figures, indicating a growing potential for these technologies to disrupt traditional transport models.

Furthermore, a significant societal shift towards remote work and reduced business travel, accelerated by trends observed in 2024, directly impacts the demand for long-distance commuting and, consequently, expressway usage. The development of smart infrastructure and the widespread adoption of 5G technology are also paving the way for innovative mobility solutions. These could include integrated multimodal transport platforms that optimize travel routes and costs, potentially offering a more attractive alternative to solely relying on expressways.

- Technological Advancements: Emerging technologies like hyperloop and maglev trains present potential long-term substitutes for traditional expressway travel.

- Autonomous Vehicles: The growth of autonomous vehicle technology, with market projections indicating significant expansion by 2024, could lead to new mobility paradigms.

- Remote Work Trends: Increased adoption of remote work, a notable trend in 2024, directly reduces the need for daily commuting and business travel.

- Smart Infrastructure: 5G-enabled smart infrastructure and integrated transport platforms offer the potential for more efficient and competitive mobility alternatives.

Logistics and Freight Alternatives

The threat of substitutes for road freight, particularly for Huabei Expressway's logistics operations, is significant. Rail cargo and coastal shipping present viable alternatives, especially for transporting bulk commodities over long distances. For instance, in 2023, China's railway freight volume reached approximately 4.08 billion tons, demonstrating its substantial capacity and cost-effectiveness for certain goods compared to road transport. This means that while expressways provide crucial flexibility and direct delivery, they face competition from these more economical modes for specific freight needs.

These alternative transportation methods can directly impact Huabei Expressway's revenue streams within its logistics segment. When shippers can opt for rail or sea for their bulk or long-haul needs, the demand for expressway usage for those specific types of cargo decreases. This competitive pressure necessitates that Huabei Expressway continuously evaluate its pricing and service offerings to remain attractive against these substitutes.

- Rail Freight Capacity: China's railway freight volume exceeded 4 billion tons in 2023.

- Coastal Shipping Viability: Coastal shipping remains a cost-effective alternative for bulk goods along China's extensive coastline.

- Expressway Limitations: While offering door-to-door service, expressways can be less cost-efficient for very large or long-distance bulk shipments compared to rail or sea.

The threat of substitutes for Huabei Expressway Co., Ltd. is multifaceted, encompassing both passenger and freight transport. For passengers, the extensive and rapidly expanding high-speed rail network in China, which carried over 3.7 billion passenger trips in 2023, offers a swift and often cost-competitive alternative for inter-city travel. Additionally, the vast network of non-toll national and provincial highways, spanning over 1.9 million kilometers by 2024, provides a free, albeit slower, option for drivers. Air travel remains a substitute for very long distances, though its convenience diminishes for shorter trips.

In the freight sector, rail cargo and coastal shipping represent significant substitutes, particularly for bulk commodities. China's railway freight volume, which reached approximately 4.08 billion tons in 2023, highlights the cost-effectiveness of rail for large-scale, long-haul transport. These alternatives directly compete with expressway usage for logistics operations, impacting Huabei Expressway's revenue by offering more economical choices for certain types of cargo.

| Substitute Type | Key Characteristics | Impact on Huabei Expressway | Relevant Data (2023/2024) |

|---|---|---|---|

| High-Speed Rail | Speed, Convenience, Cost-Effectiveness for Inter-city | Reduces passenger traffic on expressways | 3.7 billion passenger trips (2023) |

| Non-Toll Highways | Free to use, Accessibility | Offers cost-saving alternative for drivers | 1.9 million km national highway network (2024) |

| Air Travel | Speed for Long Distances | Limited impact for short/medium distances, competes for long-haul business travel | N/A (specific to expressway competition) |

| Rail Freight | Cost-Effectiveness for Bulk/Long-Haul | Reduces freight volume on expressways for specific cargo | 4.08 billion tons freight volume (2023) |

| Coastal Shipping | Cost-Effectiveness for Bulk/Coastal | Competes for freight along China's coastline | N/A (specific to expressway competition) |

Entrants Threaten

The construction and operation of expressways demand enormous capital. Projects can easily run into billions of dollars, creating a significant hurdle for any new company wanting to enter the market. For instance, Huabei Expressway's primary asset, the Beijing-Tianjin-Tanggu Expressway, is itself a testament to this vast financial commitment.

This immense financial barrier means that only well-established corporations or those with substantial government support can even consider entering the expressway sector. It effectively deters smaller or less capitalized entities from attempting to compete with existing players like Huabei Expressway.

The threat of new entrants for Huabei Expressway Co., Ltd. is significantly mitigated by strict government regulation and the concession system. The Chinese government maintains tight control over the toll road sector, typically issuing long-term operating concessions, often ranging from 15 to 30 years with potential extensions. This established framework, coupled with the intricate requirements for permits, land acquisition, and environmental clearances, erects substantial entry barriers.

Furthermore, the toll road industry in China frequently operates under administrative monopolies, with provincial government-affiliated entities often holding dominant positions. This structure, inherited from past development models, makes it exceptionally challenging for independent or new companies to enter and compete effectively against these established, government-backed players.

Existing operators like Huabei Expressway Co., Ltd. benefit significantly from established economies of scale in construction, maintenance, and toll collection. For instance, in 2023, Huabei Expressway reported operating revenue of RMB 10.5 billion, showcasing the efficiency of its large-scale operations. This scale naturally leads to lower per-unit costs, a hurdle for any new entrant attempting to match their operational footprint.

Furthermore, Huabei Expressway possesses decades of invaluable experience in managing complex infrastructure projects and navigating China's intricate regulatory landscape. This accumulated expertise translates into smoother operations, better risk management, and more efficient capital deployment, advantages that are difficult and time-consuming for newcomers to replicate, thereby limiting the threat of new entrants.

Established Networks and Brand Recognition

Huabei Expressway Co., Ltd. enjoys a significant advantage due to its established network and strong brand recognition, particularly for key routes like the Beijing-Tianjin-Tanggu Expressway. This existing infrastructure and public trust present a formidable barrier to new entrants.

For any new competitor aiming to replicate Huabei Expressway's reach and user base, the journey would be exceptionally long and resource-intensive. The sheer scale of developing a comparable network and cultivating public confidence in China's competitive market is a monumental undertaking.

- Established Network: Huabei Expressway operates a significant portion of China's vital expressways, facilitating substantial traffic flow.

- Brand Recognition: The company's brand is synonymous with reliable and efficient travel on its core routes, fostering customer loyalty.

- High Entry Costs: New entrants would face immense capital expenditure for land acquisition, construction, and regulatory approvals, estimated in the billions of USD for comparable projects in China.

- Regulatory Hurdles: Navigating China's complex regulatory environment for infrastructure projects adds further time and cost, favoring incumbents with established relationships.

Access to Distribution Channels and Critical Resources

New entrants attempting to establish themselves in the expressway sector, such as Huabei Expressway Co., Ltd. operates within, would encounter significant hurdles in securing essential resources. This includes acquiring prime land for constructing new toll roads, a process often fraught with regulatory complexities and high acquisition costs.

Furthermore, gaining access to the existing national toll collection system presents another formidable barrier. Established players have integrated their operations, making it difficult for newcomers to join without substantial investment and strategic partnerships.

Incumbent companies like Huabei Expressway benefit from long-standing relationships with government bodies, which are crucial for route approvals and operational permits. They also maintain strong ties with suppliers for construction materials and maintenance services, often securing preferential terms that are unavailable to new entrants.

- Securing prime land for new routes

- Access to the national toll collection system

- Established government relationships

- Supplier agreements for construction and maintenance

The threat of new entrants for Huabei Expressway Co., Ltd. is low due to substantial capital requirements, with major projects costing billions of dollars. For example, the Beijing-Tianjin-Tanggu Expressway represents a significant financial commitment. This high cost naturally limits the pool of potential competitors to well-funded corporations or those with strong government backing.

Strict government regulations and the concession system further deter new companies. China's toll road sector is heavily regulated, with concessions often lasting 15 to 30 years. Navigating permits, land acquisition, and environmental approvals adds layers of complexity, making entry challenging. The prevalence of administrative monopolies held by government-affiliated entities also favors incumbents.

Huabei Expressway benefits from established economies of scale, with 2023 operating revenue reaching RMB 10.5 billion. This scale allows for lower per-unit costs, a significant barrier for newcomers. Decades of experience in managing infrastructure and regulatory navigation provide further advantages that are difficult for new entrants to replicate.

The company's established network and brand recognition, particularly on key routes, create a formidable barrier. Building a comparable network and public trust in China is a resource-intensive and time-consuming endeavor for any new competitor.

| Barrier Type | Description | Impact on New Entrants | Example for Huabei Expressway |

|---|---|---|---|

| Capital Requirements | Enormous initial investment for construction and land acquisition. | Very High | Projects costing billions of USD. |

| Government Regulation & Concessions | Strict licensing, permits, and long-term operating concessions. | High | Concessions often 15-30 years; complex approval processes. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | High | RMB 10.5 billion in 2023 operating revenue. |

| Established Network & Brand | Existing infrastructure and customer loyalty. | High | Strong recognition on key routes like Beijing-Tianjin-Tanggu Expressway. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huabei Expressway Co., Ltd. is built upon a foundation of publicly available financial statements, annual reports, and official company disclosures. We also integrate insights from reputable industry research reports and government statistics to provide a comprehensive view of the competitive landscape.