Huabao International Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabao International Holdings Bundle

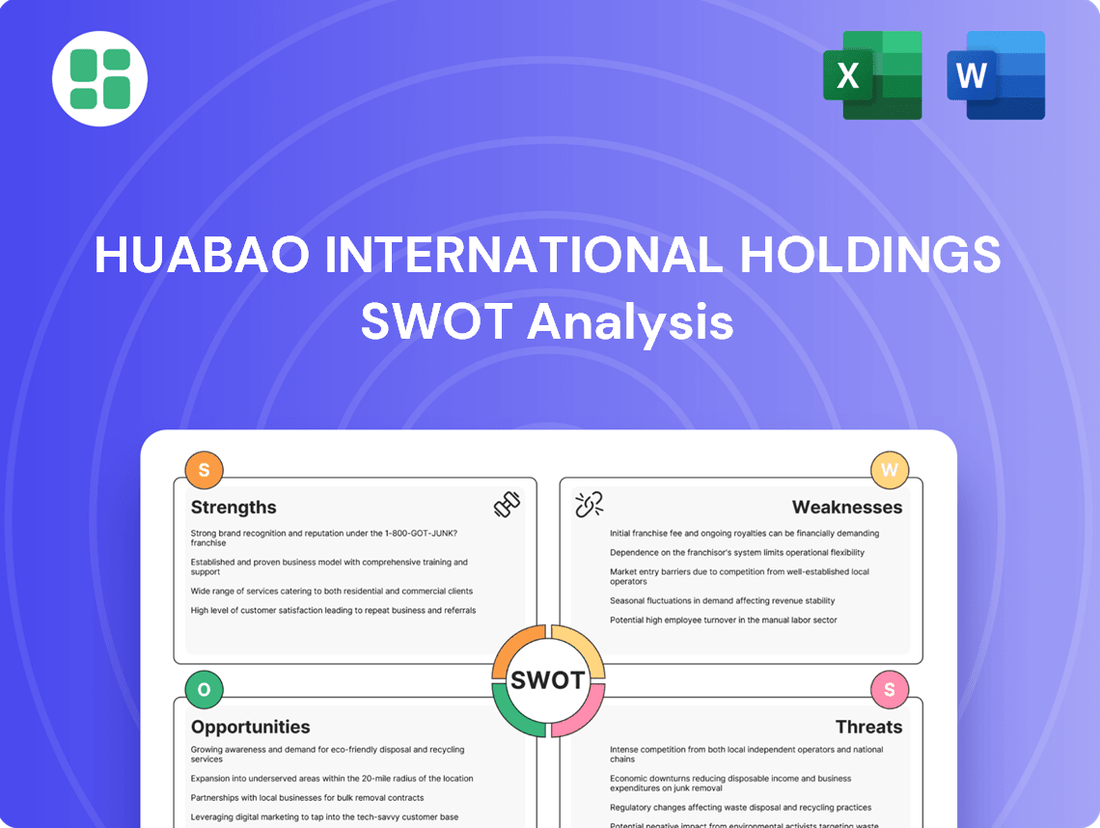

Huabao International Holdings demonstrates notable strengths in its established brand and diversified product portfolio, but faces potential threats from evolving market regulations and intense competition. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Huabao International Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Huabao International Holdings Limited is a dominant force in China's flavor, fragrance, and tobacco raw materials sectors. This strong market position is built on a broad product range catering to diverse consumer goods industries like food, beverages, and household items.

The company's diversified portfolio, extending across tobacco, food, beverages, and household products, significantly reduces its vulnerability to downturns in any single market. For instance, in the first half of 2024, Huabao International reported revenue of RMB 7.07 billion, with its tobacco ingredients segment contributing a substantial RMB 4.64 billion, showcasing its core strength while other segments like food and beverage flavors also showed growth.

Huabao International Holdings’ core strength is its unwavering dedication to the research, development, production, and sale of its specialized flavor and fragrance products. This robust R&D focus fuels continuous innovation in flavor technology, a vital element for staying ahead in a dynamic market and catering to shifting consumer tastes. For instance, their investment in R&D is a key driver for their strategic aim to expand into new product categories and geographic markets, as evidenced by their ongoing product development pipeline.

Huabao International Holdings showcased impressive financial resilience, with profit before tax doubling in the first half of 2025 compared to the prior year. This significant improvement was largely driven by the absence of substantial impairment losses recorded in 2024.

This strong recovery highlights the company's robust underlying operations and its ability to bounce back effectively from challenging periods, demonstrating a capacity for sustained profitability even after significant setbacks.

Established Domestic Market Presence

Huabao International Holdings benefits immensely from its established domestic market presence in China, a key driver of its strengths. This deep entrenchment in the vast Chinese market provides a robust foundation of consistent demand and well-developed distribution networks.

The company's long-standing operations have cultivated an intimate understanding of local market dynamics and evolving consumer preferences. This allows Huabao to adeptly tailor its product portfolios and marketing initiatives for maximum impact, a crucial edge in a competitive landscape.

Their sustained presence has fostered strong, enduring relationships with clients and achieved significant market penetration. For instance, as of the first half of 2024, Huabao reported a substantial portion of its revenue derived from its domestic operations, underscoring the significance of this established network.

- Deep understanding of Chinese consumer tastes and preferences.

- Extensive and efficient domestic distribution channels.

- Strong brand recognition and customer loyalty within China.

- Reduced reliance on international markets, mitigating geopolitical risks.

Strategic Focus on Growth Segments

Huabao International Holdings is strategically focusing on expanding its flavor technology to capture opportunities within the food and beverage flavors and fragrances sector. This clear development strategy aims to leverage existing expertise for growth in potentially higher-margin, less regulated markets.

The company's plans to accelerate the development of its aroma raw materials segment further underscore this growth-oriented approach. By concentrating on these areas, Huabao is positioning itself to capitalize on evolving consumer preferences and market dynamics.

For instance, the global flavors and fragrances market was valued at approximately USD 50 billion in 2023 and is projected to grow at a CAGR of around 5-6% through 2030, indicating a robust expansion trajectory that Huabao aims to tap into.

Key strengths in this area include:

- Enhanced Flavor Technology: Investment in R&D to improve flavor creation capabilities for the food and beverage industry.

- Aroma Raw Materials Expansion: Strategic push to develop and grow the aroma raw materials business.

- Focus on High-Growth Segments: Targeting markets with potentially higher growth rates and less stringent regulations compared to traditional tobacco flavorings.

Huabao International Holdings boasts a commanding presence in China's flavor, fragrance, and tobacco ingredient markets, underpinned by a diverse product range serving numerous consumer goods sectors. Its robust R&D investment fuels continuous innovation in flavor technology, essential for adapting to evolving consumer demands and expanding into new product categories.

The company's significant domestic market penetration in China provides a stable demand base and well-established distribution networks. This deep understanding of local tastes allows for effective product tailoring and marketing initiatives, fostering strong customer relationships and market share. For example, in the first half of 2024, domestic operations were a primary revenue driver.

Huabao's strategic focus on expanding its flavor technology for the food and beverage sector, alongside growth in aroma raw materials, positions it to capitalize on the expanding global flavors and fragrances market, which was valued at approximately USD 50 billion in 2023 and projected for robust growth.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Market Leadership in China | Dominant position in flavor, fragrance, and tobacco ingredients. | Strong revenue contribution from domestic operations in H1 2024. |

| R&D and Innovation | Commitment to developing advanced flavor technology. | Continuous investment in R&D pipeline for new product development. |

| Diversified Product Portfolio | Caters to food, beverage, and household product industries. | Reduces reliance on any single market segment, enhancing stability. |

| Financial Resilience | Demonstrated ability to improve profitability. | Profit before tax doubled in H1 2025 compared to H1 2024, aided by reduced impairment losses. |

What is included in the product

Analyzes Huabao International Holdings’s competitive position through key internal and external factors, detailing its strengths in product innovation and market reach alongside potential threats from regulatory changes and intense competition.

Offers a clear roadmap for navigating Huabao International Holdings' market challenges by highlighting actionable strategies derived from its SWOT analysis.

Weaknesses

Huabao International Holdings faced significant headwinds in 2024, recording substantial impairment losses. These write-downs, affecting goodwill, other assets, and investments in associates, directly impacted the company's profitability for the full year. This situation naturally sparks concerns regarding the accuracy of asset valuations and the operational health of specific business segments.

While the first half of 2025 indicated a recovery trend, the recurrence of such significant impairments in the previous year points to a potential weakness in Huabao's asset management strategies or its foresight into market dynamics. For instance, the company reported impairment losses of HK$793 million in its 2024 annual report, a figure that underscores the financial impact of these asset write-downs.

Huabao International Holdings' significant reliance on the tobacco sector, particularly for raw materials and flavors in vaping products, presents a considerable weakness. This segment is facing increasing regulatory pressure and public health initiatives in China and worldwide, which could hinder future growth and profitability.

For instance, the Chinese government has been tightening regulations on the e-cigarette industry, including product standards and sales channels, impacting companies like Huabao. Any shifts in government policy or a decline in consumer preference for tobacco-based products could severely affect a core revenue source for the company.

Huabao International Holdings is facing a significant hurdle with stagnant revenue growth, a key weakness. Despite a recent profit rebound, the company's top-line performance has shown little to no expansion in recent periods. This suggests that profit improvements might be driven more by effective cost management or the absence of one-off charges, rather than a genuine increase in sales volume. For sustained profitability and long-term success, Huabao needs to address this challenge by finding ways to consistently generate more revenue.

Valuation and Financial Transparency Concerns

Huabao International Holdings' significant impairment charges in 2024, amounting to RMB 1.05 billion (approximately USD 145 million) impacting its net profit, raise questions about its valuation practices. While the company reported a profit recovery in the first half of 2025, investors may demand greater clarity on the methodologies behind these financial fluctuations and assurances regarding the stability of its assets moving forward. This lack of transparency can erode investor confidence and lead to share price volatility.

The company's financial reporting, particularly concerning the volatility observed in 2024, could lead to increased scrutiny from investors and analysts. They will likely seek more detailed disclosures and robust explanations for the substantial impairment charges and subsequent recovery. This focus on financial transparency is crucial for maintaining investor trust and ensuring a stable market valuation.

- Valuation Scrutiny: The RMB 1.05 billion impairment charge in 2024 necessitates a deeper dive into Huabao's asset valuation models.

- Investor Confidence: Volatile financial swings can impact investor sentiment, potentially affecting share price stability.

- Reporting Transparency: A need for clearer explanations of financial performance drivers and future asset health is evident.

Exposure to China-Specific Economic and Regulatory Shifts

Huabao International Holdings' significant reliance on the Chinese market makes it particularly vulnerable to localized economic fluctuations and policy changes. For instance, a slowdown in China's GDP growth, which was projected to be around 5.0% for 2024 by various economic forecasts, could directly affect consumer purchasing power across Huabao's diverse product lines, from fragrances to food ingredients.

The company's operations are also subject to China's dynamic regulatory environment. Unexpected shifts in regulations, even those not directly related to tobacco, could create compliance challenges or alter market access for its various consumer goods. This concentration risk is a key weakness, as it means that events specific to China can disproportionately impact the company's overall performance.

- Geographic Concentration Risk: Over-reliance on the Chinese market amplifies exposure to China-specific economic downturns.

- Regulatory Sensitivity: Evolving Chinese regulations, beyond the tobacco sector, pose a potential threat to demand across product categories.

- Consumer Spending Volatility: Changes in Chinese consumer spending patterns, influenced by economic conditions, directly impact revenue streams.

- Systemic Risk: Adverse shifts in the Chinese economy or regulatory landscape represent a significant systemic risk for Huabao.

Huabao International Holdings' significant impairment charges in 2024, amounting to RMB 1.05 billion (approximately USD 145 million) impacting its net profit, raise questions about its valuation practices. While the company reported a profit recovery in the first half of 2025, investors may demand greater clarity on the methodologies behind these financial fluctuations and assurances regarding the stability of its assets moving forward. This lack of transparency can erode investor confidence and lead to share price volatility.

The company's financial reporting, particularly concerning the volatility observed in 2024, could lead to increased scrutiny from investors and analysts. They will likely seek more detailed disclosures and robust explanations for the substantial impairment charges and subsequent recovery. This focus on financial transparency is crucial for maintaining investor trust and ensuring a stable market valuation.

Huabao International Holdings' significant reliance on the Chinese market makes it particularly vulnerable to localized economic fluctuations and policy changes. For instance, a slowdown in China's GDP growth, which was projected to be around 5.0% for 2024 by various economic forecasts, could directly affect consumer purchasing power across Huabao's diverse product lines, from fragrances to food ingredients.

The company's operations are also subject to China's dynamic regulatory environment. Unexpected shifts in regulations, even those not directly related to tobacco, could create compliance challenges or alter market access for its various consumer goods. This concentration risk is a key weakness, as it means that events specific to China can disproportionately impact the company's overall performance.

| Weakness | Description | Impact | Supporting Data (2024/2025) |

| Valuation Scrutiny | Significant impairment charges raise questions about asset valuation models. | Erodes investor confidence, potential share price volatility. | RMB 1.05 billion impairment charge in 2024. |

| Revenue Stagnation | Little to no top-line expansion despite profit rebound. | Suggests profit growth driven by cost management, not sales. | Lack of specific revenue growth figures in recent reports highlights this. |

| Geographic Concentration | Over-reliance on the Chinese market. | Amplifies exposure to China-specific economic and regulatory risks. | China's projected 2024 GDP growth around 5.0% impacts consumer spending. |

| Regulatory Sensitivity | Exposure to evolving Chinese regulations across product categories. | Potential compliance challenges and altered market access. | Tightening regulations on e-cigarettes and other consumer goods in China. |

Full Version Awaits

Huabao International Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of Huabao International Holdings' internal Strengths and Weaknesses, as well as external Opportunities and Threats. This detailed report is designed to provide actionable insights for strategic decision-making.

Opportunities

Huabao International Holdings has a clear strategy to expand its flavors and fragrances operations into the food and beverage sector, a move that presents a substantial growth avenue. This industry, generally less regulated than tobacco, boasts a large and expanding consumer base, offering significant potential for Huabao to tap into new revenue streams.

By effectively leveraging its established flavor technology and robust R&D capabilities, Huabao can unlock considerable opportunities. In 2023, the global food and beverage market was valued at approximately $7.5 trillion, with the flavor and fragrance segment within it projected to grow steadily, indicating a fertile ground for Huabao's strategic expansion.

Huabao International is actively pushing to become a major player in the aroma raw materials sector, aiming for a top production position not just in Asia but worldwide. This strategic move is designed to broaden their product range and integrate them more deeply into global ingredient supply chains.

This expansion into aroma raw materials is a significant opportunity for Huabao. By developing this segment, they can diversify their revenue streams beyond their traditional fragrance and flavor offerings. The company's stated ambition to establish a leading production base in Asia and globally suggests a focus on scaling up production capacity and potentially acquiring key technologies or facilities.

For instance, in 2023, the global aroma chemicals market was valued at approximately USD 20 billion and is projected to grow at a CAGR of around 5% through 2030, indicating a robust and expanding market. Huabao's investment in this area could allow them to capture a larger share of this growing market, enhancing their international presence and competitive standing.

Huabao's robust research and development infrastructure presents a significant avenue for product innovation, extending beyond its established tobacco and current food and beverage offerings. This strategic expansion could involve creating novel flavors and fragrances tailored for rapidly growing consumer product sectors, such as personal care or home fragrances, and even niche industrial applications.

For instance, the global flavors and fragrances market was valued at approximately USD 63.5 billion in 2023 and is projected to reach USD 94.3 billion by 2030, indicating substantial growth potential. Huabao can leverage its R&D prowess to tap into these expanding markets, thereby fostering new revenue streams and driving sustained organic growth for the company.

Strategic Partnerships and Acquisitions

Huabao International Holdings can strategically leverage partnerships and acquisitions to fuel its expansion and diversification. By targeting smaller, innovative firms within the food, beverage, and aroma raw materials industries, Huabao can gain access to cutting-edge technologies, untapped markets, and established distribution channels. This proactive approach is crucial for enhancing its competitive edge and driving accelerated growth in a dynamic market environment.

For instance, in 2024, the global M&A market saw a notable increase in activity within the consumer staples sector, with companies actively seeking consolidation and innovation. Huabao could emulate this trend by identifying acquisition targets that complement its existing portfolio or offer entry into high-growth segments. This strategic move would not only broaden its product offerings but also strengthen its market presence.

- Accelerated Market Entry: Acquisitions provide immediate access to established customer bases and distribution networks, reducing the time-to-market for new products or services.

- Technology and Innovation Acquisition: Partnering with or acquiring innovative startups can inject new technologies and R&D capabilities, fostering product development and differentiation.

- Diversification of Revenue Streams: Expanding into new product categories or geographical markets through strategic moves can mitigate risks associated with over-reliance on a single segment.

- Synergistic Efficiencies: Integrating acquired businesses can lead to cost savings through economies of scale, shared resources, and optimized supply chains.

Leveraging E-commerce and Digital Channels

Huabao International can capitalize on China's growing digital economy by expanding its presence on e-commerce platforms. This digital shift offers a significant opportunity to broaden market reach and deepen customer engagement, especially for its consumer goods divisions. In 2023, China's online retail sales reached approximately 15.42 trillion yuan, demonstrating the immense potential of these channels.

Leveraging digital marketing strategies can enhance brand visibility and drive sales growth. This approach allows for more targeted campaigns and direct interaction with consumers, fostering loyalty and gathering valuable market insights. The food and household product segments, in particular, can benefit from the direct-to-consumer (DTC) model facilitated by e-commerce.

Key opportunities include:

- Expanding online sales channels: Partnering with major e-commerce players like Tmall and JD.com to increase product availability and reach a wider customer base.

- Enhancing digital marketing: Implementing data-driven marketing campaigns across social media, live streaming, and influencer collaborations to boost brand awareness and drive conversions.

- Improving customer experience: Utilizing digital tools for personalized recommendations, efficient customer service, and streamlined online purchasing processes.

- Data analytics for insights: Employing e-commerce data to understand consumer preferences, optimize product offerings, and refine sales strategies.

Huabao International Holdings is well-positioned to capitalize on the expanding global food and beverage market, which was valued at approximately $7.5 trillion in 2023. The company's expertise in flavors and fragrances offers a significant opportunity to tap into this vast consumer base, driving new revenue streams beyond its traditional tobacco operations.

The company also has a clear strategy to become a leader in aroma raw materials, a market valued at around USD 20 billion in 2023 and projected to grow. By investing in this segment, Huabao can diversify its offerings and integrate further into global supply chains, enhancing its international competitiveness.

Furthermore, Huabao's robust R&D capabilities present a chance to innovate in rapidly growing sectors like personal care and home fragrances, markets that collectively reached approximately USD 63.5 billion in 2023. Strategic partnerships and acquisitions are also key opportunities to gain access to new technologies and markets, as evidenced by the increased M&A activity in consumer staples in 2024.

Expanding its digital presence on e-commerce platforms in China, where online retail sales hit 15.42 trillion yuan in 2023, offers a direct path to broader market reach and enhanced customer engagement for its consumer goods. This digital push, coupled with data-driven marketing, can significantly boost brand visibility and sales.

Threats

Huabao faces a significant threat from intensifying regulatory scrutiny on tobacco and vaping products. Governments globally and domestically are cracking down, impacting Huabao's core business in tobacco raw materials and e-cigarette flavors. For instance, in 2023, China's National Health Commission continued to emphasize regulations on e-cigarettes, aiming to curb youth access and sales, a trend expected to persist through 2024 and 2025.

The flavors and fragrances industry is intensely competitive, featuring both global giants and nimble local companies. Huabao International Holdings must constantly innovate and ensure high product quality to keep pace. For instance, in 2023, the global F&F market was valued at approximately $60 billion, with growth driven by demand for natural ingredients and personalized scents.

This competitive pressure directly impacts Huabao, requiring them to balance innovation costs with pricing strategies. Failure to do so could lead to reduced profit margins or a decline in market share. Companies like Givaudan and Firmenich, major players in the sector, invest heavily in research and development, setting a high bar for all participants.

A significant economic slowdown in China presents a substantial threat to Huabao International Holdings. Should China's economy falter, consumer spending on discretionary items like those incorporating flavors and fragrances could see a sharp decline. For instance, reports in early 2024 indicated a moderation in China's GDP growth, with projections for the full year around 5%, a rate that, while positive, could still translate to reduced purchasing power for many consumers.

Raw Material Price Volatility and Supply Chain Disruptions

Huabao International Holdings, as a producer of flavors, fragrances, and related raw materials, faces significant risks from fluctuating raw material prices and potential supply chain disruptions. These external factors can directly impact production costs and overall profitability.

For instance, the global chemical industry, a key supplier for many of Huabao's raw materials, experienced notable price increases in late 2023 and early 2024 due to ongoing supply chain pressures and increased energy costs. This volatility makes it challenging for Huabao to maintain stable pricing for its own products.

- Geopolitical Instability: Events such as the ongoing conflicts in Eastern Europe and the Middle East can disrupt global trade routes and impact the availability and cost of key petrochemical-derived ingredients.

- Climate Change Impacts: Extreme weather events, like droughts or floods, can affect agricultural yields for natural fragrance and flavor components, leading to price spikes and shortages. For example, reports in early 2024 highlighted concerns about citrus oil availability due to adverse weather in key growing regions.

- Trade Policy Shifts: Changes in international trade agreements or the imposition of tariffs can increase the cost of imported raw materials, directly affecting Huabao's cost of goods sold.

Brand Image and Public Perception Risks

Huabao International Holdings operates in industries, like tobacco and vaping, that are increasingly scrutinized by the public and regulators. Negative sentiment surrounding these products can significantly damage its brand image, even impacting unrelated business ventures. For instance, increased societal aversion to vaping, as seen in some regions with stricter regulations or public health campaigns, could make it harder for Huabao to attract top talent or successfully penetrate markets focused on health and wellness.

The company's association with tobacco and vaping products presents a tangible threat to its overall public perception. Negative media coverage or shifts in consumer attitudes towards these goods can create a ripple effect, potentially deterring investment and hindering expansion into new, more socially acceptable sectors. This is particularly relevant as global health organizations continue to highlight the risks associated with smoking and vaping, potentially leading to further restrictions and negative public discourse.

To mitigate these risks, Huabao must proactively manage its brand narrative and address public concerns. While specific data on public perception shifts impacting Huabao directly is not readily available, broader industry trends indicate a growing demand for transparency and corporate responsibility. Failure to adapt could lead to reputational damage that is difficult and costly to repair, impacting stakeholder confidence and future growth opportunities.

Huabao is exposed to the significant threat of evolving regulations in the tobacco and vaping sectors, with governments worldwide tightening controls. This impacts its core business in tobacco raw materials and e-cigarette flavors, as seen with China's continued emphasis on e-cigarette regulations in 2023 and projected through 2024-2025 to limit youth access.

Intense competition in the flavors and fragrances market, with global and local players vying for market share, demands constant innovation and quality maintenance from Huabao. The global F&F market, valued around $60 billion in 2023, is driven by demand for natural ingredients, putting pressure on profit margins.

Economic downturns in China pose a risk, potentially reducing consumer spending on discretionary items that utilize flavors and fragrances. Early 2024 reports indicated a moderation in China's GDP growth, with projections around 5%, which could still dampen purchasing power.

Fluctuating raw material prices and supply chain disruptions are critical threats, directly affecting Huabao's production costs and profitability. The chemical industry, a key supplier, saw price increases in late 2023 and early 2024 due to supply chain pressures and energy costs.

| Threat Category | Specific Risk | Impact on Huabao | Example/Data Point |

| Regulatory Environment | Stricter tobacco and vaping regulations | Reduced demand for e-cigarette flavors, potential impact on tobacco materials business | China's ongoing e-cigarette regulations (2023-2025) |

| Market Competition | Intense competition in F&F | Pressure on pricing, need for continuous innovation | Global F&F market valued at ~$60 billion (2023) |

| Economic Conditions | Chinese economic slowdown | Decreased consumer spending on discretionary items | Moderated GDP growth projections for China (~5% in 2024) |

| Supply Chain & Costs | Raw material price volatility | Increased production costs, impact on profitability | Chemical industry price hikes (late 2023/early 2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, drawing from Huabao International Holdings' official financial reports, detailed market research, and expert industry analysis to provide a robust strategic overview.