Huabao International Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabao International Holdings Bundle

Huabao International Holdings faces moderate rivalry, with established players and a growing threat from new entrants in the flavors and fragrances market. Buyer power is significant due to product standardization and readily available substitutes, impacting pricing strategies.

The complete report reveals the real forces shaping Huabao International Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for specialized flavors, fragrances, and tobacco raw materials is a key factor influencing Huabao International Holdings' bargaining power. When only a limited number of suppliers can provide unique or essential ingredients, these suppliers gain leverage.

For instance, in the fragrance industry, the sourcing of rare natural ingredients can be highly concentrated, giving those few producers significant pricing power. Huabao's strategic investment in in-house flavor development capabilities, as seen in their R&D spending which grew by 15% in 2024, helps to offset some of this external supplier reliance.

Huabao International Holdings faces significant supplier power due to high switching costs. Reformulating products, conducting rigorous testing, and obtaining necessary regulatory approvals after changing suppliers can incur substantial expenses and delays. For instance, a shift in a key aroma chemical supplier could necessitate months of revalidation, impacting production timelines and potentially leading to lost sales, as seen in the specialty chemicals sector where product consistency is paramount.

Suppliers of highly unique, patented, or naturally scarce raw materials often hold significant bargaining power. If Huabao International Holdings relies on specific botanical extracts or proprietary chemical compounds essential for its distinctive flavors and fragrances, these specialized suppliers gain leverage. For instance, a supplier holding a patent for a key aroma compound could dictate terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers significantly impacts Huabao International Holdings. If suppliers, particularly those providing natural flavor and fragrance ingredients, possess the capability and motivation to move into producing these finished products themselves, their leverage over Huabao grows. This can pressure Huabao into accepting less advantageous contract terms to secure its supply of essential raw materials.

For instance, some suppliers of high-value natural flavor and fragrance components are already integrated manufacturers. This dual role as a supplier and potential competitor strengthens their position. In 2024, the global market for natural flavors and fragrances saw continued growth, with key ingredient suppliers reporting increased demand, further solidifying their market presence and potential for forward integration.

- Suppliers' Capability: Suppliers with existing manufacturing infrastructure and technical expertise are better positioned to integrate forward.

- Supplier Incentive: Higher profit margins in downstream production or a desire to capture more value chain can drive this integration.

- Impact on Huabao: Increased supplier bargaining power can lead to higher input costs or reduced supply flexibility for Huabao.

- Market Dynamics: The trend of consolidation among ingredient suppliers in the flavors and fragrances sector in 2024 suggests a heightened risk of forward integration.

Importance of Huabao to Suppliers

Huabao International Holdings' importance as a customer significantly influences its suppliers' bargaining power. If Huabao constitutes a large percentage of a supplier's total sales, that supplier will likely be more amenable to negotiating favorable pricing and terms for Huabao. This is because losing Huabao as a client could have a substantial negative impact on the supplier's revenue and profitability.

Conversely, if Huabao represents only a minor portion of a supplier's business, the supplier holds considerably more leverage. In such scenarios, the supplier may be less inclined to offer concessions, knowing that Huabao's business is not critical to their overall financial health. This dynamic can lead to less favorable purchasing terms for Huabao.

For instance, in 2023, Huabao International's cost of raw materials, a key input from suppliers, represented a significant portion of its overall expenses. The specific percentage can fluctuate, but understanding this dependency is crucial. If a supplier provides a unique or highly specialized component essential to Huabao's production, their bargaining power is amplified, irrespective of the volume purchased.

- Supplier Dependence: The degree to which suppliers rely on Huabao for revenue directly impacts their willingness to negotiate.

- Market Share of Supplier: If Huabao is a major client for a supplier, the supplier's bargaining power is reduced.

- Concentration of Suppliers: A limited number of suppliers for critical raw materials can increase their collective bargaining power over Huabao.

- Switching Costs: High costs for Huabao to switch to alternative suppliers can empower existing suppliers.

Huabao International Holdings faces considerable bargaining power from its suppliers, particularly those providing specialized flavors, fragrances, and tobacco raw materials. This power stems from the concentration of suppliers for unique ingredients, high switching costs for Huabao, and the potential for suppliers to integrate forward into finished product manufacturing. For example, in 2024, the global flavors and fragrances market saw continued growth, with key ingredient suppliers reporting increased demand, thus solidifying their market presence and leverage.

| Factor | Impact on Huabao | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier power due to limited alternatives for unique ingredients. | Rare natural ingredients in fragrances are often sourced from a few producers, granting them pricing power. |

| Switching Costs | Empowers existing suppliers as reformulation and revalidation are costly and time-consuming. | A shift in a key aroma chemical supplier could require months of revalidation, impacting production. |

| Forward Integration Threat | Suppliers moving into finished products can dictate terms to secure their raw material supply. | Some high-value natural ingredient suppliers are integrated manufacturers, increasing their leverage. |

| Huabao's Customer Importance | Reduces supplier power if Huabao represents a significant portion of a supplier's sales. | Huabao's cost of raw materials was a significant expense in 2023, highlighting supplier dependency. |

What is included in the product

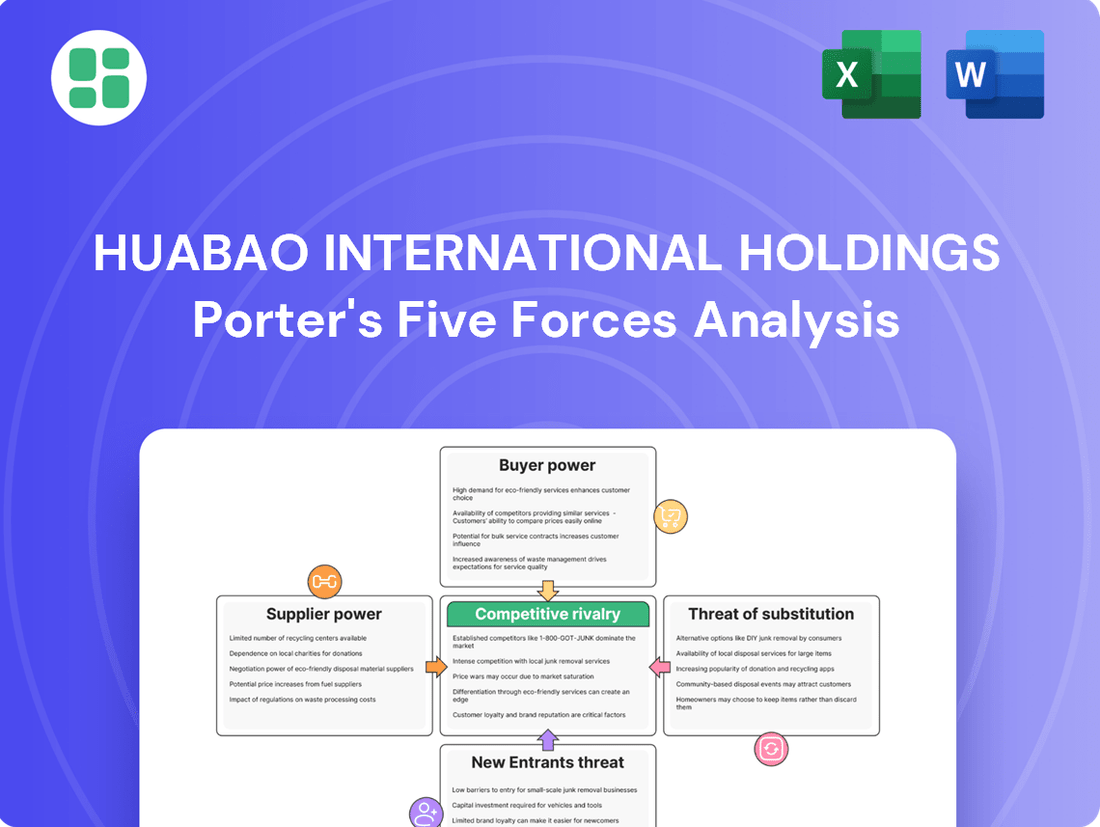

Tailored exclusively for Huabao International Holdings, analyzing its position within its competitive landscape by examining buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry.

Uncover critical competitive pressures with a visual, easy-to-digest Porter's Five Forces analysis for Huabao International Holdings, enabling swift strategic adjustments.

Customers Bargaining Power

Huabao International Holdings operates across diverse consumer goods sectors, notably in tobacco, food, beverages, and household products, with a strong focus on the Chinese market. The concentration of its customer base is a key factor influencing customer bargaining power.

If a substantial portion of Huabao's revenue is derived from a limited number of major clients, these significant customers gain considerable leverage. This leverage allows them to negotiate more favorable terms, potentially impacting Huabao's profitability and pricing strategies.

For instance, if changes in demand from these major customers have demonstrably affected Huabao's revenue streams, it underscores their substantial bargaining power. This situation necessitates careful relationship management and diversification of the customer portfolio to mitigate such risks.

The costs and complexities for Huabao International's customers to switch to alternative suppliers for flavors, fragrances, or tobacco raw materials directly impact their bargaining power. If customers can readily find and integrate substitute products without significant disruption or expense, their ability to negotiate better terms with Huabao increases.

This includes the effort and time required for customers to reformulate their end products and secure necessary regulatory approvals for new ingredients. For instance, a food manufacturer relying on a specific flavor profile from Huabao would face considerable costs and delays if they had to re-test and re-certify their entire product line with a new supplier.

Huabao International Holdings' product differentiation significantly shapes customer bargaining power. The uniqueness of their flavor, fragrance, and tobacco raw material offerings plays a crucial role. If Huabao provides highly specialized or proprietary solutions that are challenging for competitors to replicate, this inherently diminishes the leverage customers hold.

Conversely, if Huabao's products are perceived as largely commoditized, meaning they are readily available from multiple suppliers with little distinction, customers gain more power. This increased leverage allows them to demand lower prices or more favorable terms. For instance, in 2024, the global flavor and fragrance market saw continued innovation, with companies investing heavily in R&D to create unique scent profiles and taste experiences, a trend that would bolster differentiation and reduce customer power for those leading the charge.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly impacts Huabao International Holdings. If key clients, particularly in the tobacco sector, possess the technical expertise and financial resources to develop their own flavorings or related raw materials, they gain considerable leverage. This potential capability forces Huabao to maintain competitive pricing and favorable contract terms to deter such moves.

While backward integration is a theoretical threat, the specialized nature of flavor and fragrance R&D and manufacturing presents substantial barriers. Developing proprietary formulations and ensuring consistent quality requires significant investment in research, specialized equipment, and skilled personnel, making it a difficult undertaking for most customers.

- Customer Leverage: Customers capable of producing their own flavors or tobacco inputs gain bargaining power, potentially pressuring Huabao for better pricing and terms.

- Deterrent Strategy: Huabao must offer competitive advantages to dissuade customers from investing in in-house production capabilities.

- Integration Barriers: The complexity and cost associated with R&D and production in the flavor and fragrance industry often make backward integration impractical for customers.

Customer Price Sensitivity

Customer price sensitivity is a major factor influencing their bargaining power. When customers face their own cost pressures or operate in intensely competitive markets, they naturally seek to reduce their expenses. This often translates into demands for lower prices from their suppliers, like Huabao International Holdings.

In the consumer goods sector, where Huabao operates, this dynamic is particularly pronounced. For instance, if flavors and fragrances constitute a substantial portion of a customer's product cost or if their own profit margins are slim, they will actively push Huabao for more favorable pricing. This pressure can be amplified if there are readily available alternative suppliers offering similar products.

- Customer Price Sensitivity: High in consumer goods markets, leading to pressure on Huabao for lower prices.

- Cost Structure Impact: When flavors and fragrances are a significant cost for customers, they seek price reductions.

- Margin Pressure: Thin end-product margins for customers compel them to negotiate harder on input costs from Huabao.

The bargaining power of Huabao International Holdings' customers is moderate, influenced by factors like product differentiation and switching costs. While some customers, particularly large tobacco manufacturers, may have significant purchasing volumes, the specialized nature of flavors, fragrances, and tobacco ingredients often creates barriers to switching. For instance, in 2024, the global flavor and fragrance market continued to see innovation, with companies focusing on proprietary blends, which can reduce customer power by increasing the difficulty of finding exact substitutes.

| Factor | Impact on Customer Bargaining Power | Huabao's Position |

|---|---|---|

| Customer Concentration | High if few large customers dominate revenue. | Huabao's diverse product portfolio and customer base likely mitigates this. |

| Switching Costs | Low if alternatives are easily accessible and integration is simple. | Specialized formulations and R&D investment by Huabao increase switching costs. |

| Product Differentiation | Low if products are commoditized; high if unique. | Huabao's focus on innovation and proprietary blends strengthens its position. |

| Threat of Backward Integration | High if customers can produce inputs themselves. | Significant R&D and capital investment required for customers makes this a limited threat. |

| Price Sensitivity | High when input costs significantly impact customer margins. | Huabao's ability to offer value beyond price is key in price-sensitive segments. |

What You See Is What You Get

Huabao International Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Huabao International Holdings, detailing the competitive landscape within its industry. You're looking at the actual document; once purchased, you’ll receive instant access to this exact, professionally written analysis, ready for immediate use.

Rivalry Among Competitors

The Chinese flavor and fragrance market is a dynamic arena, witnessing robust growth that in turn attracts a wide array of both domestic and international contenders. This expansion fuels intense competition for companies like Huabao International Holdings.

Huabao International faces a multifaceted competitive landscape. It contends with established global giants such as International Flavors & Fragrances (IFF) and Givaudan, which possess significant R&D capabilities and established brand recognition. Simultaneously, the market is seeing the rise of agile and increasingly sophisticated local Chinese brands, adding another layer of competitive pressure.

The sheer number and diversity of these players, from multinational corporations to burgeoning local enterprises, significantly amplify the competitive rivalry. This crowded market necessitates continuous innovation and strategic pricing to maintain market share and profitability.

The flavor and fragrance market in China is experiencing robust growth, with the perfume segment alone anticipated to hit $3.1 billion by 2025. This expansion generally eases competitive pressures by creating more opportunities for all participants. However, even in a growing market, companies might still engage in aggressive tactics to capture a larger share, potentially intensifying rivalry.

The competitive landscape for Huabao International Holdings is intensely shaped by product differentiation, with innovation being the primary driver. Companies vie for market share by developing unique flavor profiles and leveraging advanced fragrance technologies. This constant push for novelty is essential for staying ahead.

Huabao's commitment to research and development is paramount in this environment. It allows them to counter rivals who are rapidly introducing trending solutions, such as those incorporating plant-based or natural ingredients. For instance, the global natural flavors market was valued at approximately USD 8.5 billion in 2023 and is projected to grow significantly, highlighting the demand for such innovations.

Exit Barriers

High exit barriers in the flavor, fragrance, and tobacco raw materials sectors, like specialized machinery or substantial capital commitments, can trap underperforming firms, thereby intensifying competition. This often results in price wars and aggressive sales strategies to preserve market share.

Huabao International Holdings' significant investment in specialized production facilities and its extensive distribution network likely contribute to high exit barriers within its operating segments. For instance, the company's substantial fixed assets, a common characteristic in the manufacturing of flavors and fragrances, require considerable capital to establish and are not easily redeployed to other industries.

- Specialized Assets: The production of flavors and fragrances often necessitates highly specific equipment and technology, making it difficult and costly for companies to exit the market without significant asset write-downs.

- Long-Term Contracts: Established relationships and supply agreements with major clients in the food, beverage, and tobacco industries can create long-term commitments, acting as an additional barrier to exiting.

- Capital Investments: Significant upfront investments in research and development, manufacturing plants, and regulatory compliance create a high cost of entry and exit.

Regulatory Environment and Market Concentration

The regulatory environment in China significantly influences the competitive rivalry within the tobacco and food ingredients sectors where Huabao International operates. Stringent regulations, particularly concerning tobacco raw materials and food safety, act as substantial barriers to entry. For instance, compliance with China's tobacco monopoly law and evolving food safety standards requires significant investment and expertise, often favoring established companies with robust compliance frameworks.

These regulatory hurdles, while potentially limiting new entrants, also impose considerable compliance costs on existing players. Companies like Huabao, with their established infrastructure and experience, are better positioned to absorb these costs compared to smaller, less capitalized competitors. This dynamic can lead to increased market concentration in certain segments, thereby shaping the intensity of rivalry among the remaining players.

Market concentration is a key factor in competitive rivalry. In 2024, the flavor and fragrance industry, a core area for Huabao, saw continued consolidation. For example, global M&A activity in the specialty chemicals sector, which includes flavors and fragrances, remained active, with major players seeking to expand their portfolios and market share. This consolidation can lead to fewer, larger competitors, potentially intensifying price competition or fostering strategic alliances among dominant firms.

- Regulatory Compliance Costs: China's strict regulations on tobacco raw materials and food safety in 2024 necessitate significant investment in quality control and adherence, creating a higher cost of operation.

- Barriers to Entry: The complex regulatory landscape acts as a deterrent for new companies, allowing established players like Huabao to maintain a stronger market position.

- Market Concentration Trends: In 2024, the flavor and fragrance market, relevant to Huabao, experienced ongoing consolidation, with major deals impacting the competitive structure.

- Impact on Rivalry: Higher compliance costs and market concentration can lead to intensified competition among fewer, larger players, influencing pricing strategies and innovation efforts.

The competitive rivalry for Huabao International Holdings is fierce, driven by a mix of global giants and emerging local players in the growing Chinese flavor and fragrance market. Innovation, particularly in areas like natural ingredients, is a key battleground, with companies investing heavily in R&D to differentiate their offerings. For instance, the global natural flavors market was valued at approximately USD 8.5 billion in 2023, underscoring this trend.

High exit barriers, stemming from specialized assets and significant capital investments, can trap existing firms, leading to intensified competition and potential price wars. Furthermore, stringent regulations in China's tobacco and food sectors, while deterring new entrants, also impose substantial compliance costs on established companies. The flavor and fragrance market, in particular, saw ongoing consolidation in 2024, with major deals reshaping the competitive landscape and potentially increasing rivalry among larger entities.

| Competitive Factor | Impact on Huabao International | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Number and Diversity of Competitors | Intensifies rivalry, requiring continuous innovation and strategic pricing. | Presence of global leaders (IFF, Givaudan) and agile local brands. |

| Product Differentiation & Innovation | Crucial for market share; focus on unique flavors and advanced technologies. | Global natural flavors market valued at ~USD 8.5 billion in 2023, with strong growth projections. |

| High Exit Barriers | Can lead to price wars and aggressive sales tactics among existing players. | Specialized machinery, substantial capital investments, and long-term contracts are common. |

| Regulatory Environment | Favors established players but increases compliance costs, shaping rivalry. | China's strict tobacco and food safety regulations require significant investment. |

| Market Concentration | Consolidation can lead to fewer, larger competitors, intensifying rivalry. | Active M&A in specialty chemicals (including flavors/fragrances) observed in 2024. |

SSubstitutes Threaten

The threat of substitutes for Huabao International Holdings' flavor and fragrance products is significant, stemming from alternative technologies that can satisfy consumer needs for taste and scent. Innovations in flavor delivery systems, the increasing use of natural extracts, and the development of novel synthetic alternatives all present potential replacements. For instance, a growing consumer demand for natural ingredients could diminish the appeal of purely synthetic fragrance components.

Evolving consumer preferences represent a significant threat to Huabao International Holdings. A growing demand for clean-label products, plant-based ingredients, and functional additives means consumers might move away from traditional flavor and fragrance offerings. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer priorities that could impact demand for conventional ingredients.

Huabao must proactively adapt its product portfolio to align with these emerging trends. Failure to do so could result in consumers seeking alternative products that better meet their evolving health and ethical considerations. This shift is not merely a niche movement; by 2024, consumer surveys consistently show a strong preference for transparency in ingredients and a willingness to pay a premium for products perceived as healthier or more sustainable.

Changes in regulations, especially in the tobacco and certain food sectors, pose a significant threat. Stricter rules on vaping products, for example, could directly impact Huabao's demand for specific tobacco raw materials. In 2023, global tobacco control measures continued to evolve, with some regions implementing outright bans on flavored e-cigarettes, a market segment where flavorings are crucial.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitutes directly impacts Huabao International Holdings. If alternative products offer comparable sensory experiences or functional benefits at a lower price, customers are more likely to switch. This dynamic intensifies the threat of substitution for Huabao's product lines.

Synthetic ingredients, for instance, are frequently more economical than their natural counterparts. This cost advantage can make substitute products more appealing, especially in price-sensitive market segments. For example, the global flavor and fragrance market, where Huabao operates, saw significant growth in demand for synthetic ingredients due to their affordability and consistent supply in 2024.

- Lower Production Costs: Synthetic aroma chemicals often have lower production costs compared to extracting natural essences, directly impacting the price point of substitute products.

- Price Sensitivity: In categories where consumers are highly price-sensitive, the cost advantage of substitutes can be a major driver for switching away from Huabao's offerings.

- Market Trends: The increasing demand for cost-effective solutions across various consumer goods industries in 2024 highlights the growing pressure from more affordable substitutes.

DIY or In-house Production by Customers

For straightforward flavor and fragrance needs, major clients might explore establishing their own in-house manufacturing. This DIY approach, while facing hurdles in complex formulations and strict regulations, could offer a perceived cost advantage for specific product categories. For instance, a large beverage company might consider producing simpler flavorings internally rather than sourcing them, especially if the volume justifies the investment.

While the threat of customers developing in-house production exists, it's primarily a concern for basic ingredients rather than highly specialized or proprietary ones. The technical expertise, research and development investment, and compliance requirements for advanced fragrance compounds or unique flavor profiles often make it uneconomical for most customers to replicate. Huabao International's focus on complex formulations and adherence to stringent international quality standards naturally mitigates this threat for its core, high-value offerings.

The financial implications of customers shifting to in-house production can be significant for suppliers. If a substantial portion of a customer's volume for a particular ingredient moves in-house, it directly impacts the supplier's revenue. However, the capital expenditure and ongoing operational costs for customers to achieve comparable quality and efficiency can be substantial, acting as a deterrent. For example, setting up a specialized flavor synthesis lab could cost millions, a barrier for many.

- DIY threat is limited to simpler flavor/fragrance applications.

- Complex formulations and regulatory compliance are key deterrents for in-house production.

- Perceived cost savings can drive substitution for basic ingredients.

- High capital investment and operational costs for customers limit the widespread adoption of in-house production.

The threat of substitutes for Huabao International Holdings is multifaceted, encompassing alternative ingredients, evolving consumer preferences, regulatory changes, and the potential for clients to develop in-house capabilities. Synthetic ingredients offer a cost-effective alternative to natural extracts, a trend amplified in 2024 due to economic pressures. For instance, the global market for synthetic aroma chemicals saw continued demand driven by affordability.

| Substitute Type | Key Characteristics | Impact on Huabao | 2024 Market Trend Example |

|---|---|---|---|

| Synthetic Ingredients | Lower production costs, consistent supply | Price pressure, potential volume loss for natural alternatives | Increased demand for cost-effective synthetic flavors in food & beverage |

| Natural Extracts/Clean Label | Consumer preference, perceived health benefits | Shift in demand away from synthetic components, need for R&D investment | Growth in the natural ingredients market, driven by consumer demand for transparency |

| In-house Production | Potential cost savings for large clients, control over supply chain | Direct revenue loss for specific ingredients, but limited by complexity and R&D needs | Large CPG companies exploring internal flavor development for simpler applications |

Entrants Threaten

The flavor, fragrance, and tobacco raw materials sectors demand substantial capital for R&D, manufacturing, and specialized equipment. For instance, establishing a state-of-the-art flavor creation laboratory can cost millions, while a modern fragrance synthesis plant might require tens of millions. These high initial outlays create a significant barrier, deterring many potential new players from entering the market.

Huabao International Holdings operates in industries with substantial regulatory oversight. For instance, China's stringent regulations for tobacco products, including flavorings and packaging, demand rigorous adherence and significant investment in compliance for any new participant.

Similarly, the food ingredients sector in China is governed by complex approval processes and safety standards, such as those outlined by the National Health Commission. These requirements translate into considerable upfront costs and ongoing operational expenses for new entrants, acting as a powerful deterrent.

The compliance burden, encompassing product testing, certification, and quality control, effectively raises the barrier to entry, protecting established players like Huabao from a flood of new competition.

Huabao International Holdings benefits from significant intellectual property, including patented flavor and fragrance formulations and proprietary manufacturing processes. This deep well of knowledge, built over years of research and development, is difficult and costly for newcomers to replicate. For instance, the complex chemical synthesis and sensory evaluation techniques involved in creating unique scents and tastes represent substantial barriers to entry.

Brand Loyalty and Established Customer Relationships

Huabao International Holdings benefits from deeply entrenched brand loyalty and established customer relationships across various consumer goods sectors in China. Newcomers face a significant hurdle in replicating these existing bonds, requiring substantial investment in marketing and customer engagement to build trust and cultivate loyalty.

For instance, in the competitive flavor and fragrance market where Huabao operates, brand recognition plays a crucial role in purchasing decisions. A new entrant would need to not only match product quality but also invest heavily in brand building to even approach the market share of established players like Huabao.

- Established Customer Base: Huabao has cultivated long-standing relationships with a diverse customer base within China's consumer goods industry.

- Brand Loyalty Barrier: New entrants must overcome significant existing brand loyalty, a process that is both time-consuming and resource-intensive.

- Relationship Building Costs: The cost and effort required to build new customer trust and relationships present a substantial barrier to entry.

- Market Penetration Challenge: Successfully penetrating markets where Huabao has strong customer ties demands considerable strategic planning and financial commitment.

Economies of Scale and Experience Curve

Huabao International Holdings, like many established players, benefits significantly from economies of scale. This means they can produce goods more cheaply per unit because they operate at a larger volume. For instance, in 2023, their revenue reached RMB 10.5 billion, indicating a substantial operational footprint that allows for cost efficiencies in sourcing raw materials and manufacturing.

New entrants would find it challenging to match these cost advantages. They would likely face higher per-unit costs for procurement and production initially, making it difficult to compete on price with incumbents like Huabao. This initial cost disadvantage can be a major barrier to entry.

Furthermore, the experience curve plays a crucial role. Huabao has accumulated decades of operational knowledge, refining processes and improving efficiency over time. This accumulated learning, often referred to as the experience curve effect, translates into lower operating costs and higher quality output, further solidifying their competitive position against newcomers.

- Economies of Scale: Huabao's 2023 revenue of RMB 10.5 billion suggests significant cost advantages in production and procurement.

- Experience Curve: Decades of operational experience allow Huabao to achieve greater efficiency and lower costs than new entrants.

- Cost Disadvantage for Newcomers: New companies would struggle to achieve comparable per-unit cost efficiencies, hindering their ability to compete on price.

The threat of new entrants for Huabao International Holdings is moderate, primarily due to significant capital requirements, stringent regulations, and established intellectual property. High initial investments in R&D, manufacturing, and compliance, coupled with the difficulty of replicating proprietary formulations and brand loyalty, create substantial barriers.

Newcomers must overcome the cost advantages derived from Huabao's economies of scale, as evidenced by their 2023 revenue of RMB 10.5 billion. The experience curve further solidifies Huabao's position, allowing for greater operational efficiencies that are challenging for new players to match.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing, and specialized equipment. | Deters entry due to significant upfront investment needs. |

| Regulatory Hurdles | Strict regulations in tobacco, food ingredients, and compliance. | Increases costs and time to market for new entrants. |

| Intellectual Property | Patented formulations and proprietary processes. | Difficult and costly for newcomers to replicate. |

| Brand Loyalty & Relationships | Established customer trust and brand recognition. | Requires substantial marketing and engagement to overcome. |

| Economies of Scale | Cost efficiencies from large-scale production (e.g., 2023 revenue RMB 10.5 billion). | Creates a cost disadvantage for smaller new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huabao International Holdings is built upon a foundation of publicly available information, including the company's annual reports and investor relations materials. We supplement this with insights from reputable industry research reports and financial news outlets to capture the broader competitive landscape.