Huabao International Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huabao International Holdings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Huabao International Holdings's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to inform your strategic decisions. Don't get left behind; download the full version now to gain a competitive edge and understand the complete landscape.

Political factors

The Chinese government's stringent oversight of the tobacco sector, a core area for Huabao International Holdings, significantly shapes its operational landscape. For instance, in 2023, China's State Tobacco Monopoly Administration continued to enforce policies that directly influence production volumes and sales channels, impacting Huabao's ability to source and distribute tobacco raw materials.

Shifts in state-owned enterprise reforms or alterations to tobacco monopoly administration can directly affect Huabao's market entry and operational boundaries. These regulatory frameworks often prescribe production quotas, distribution networks, and pricing strategies, presenting both constraints and potential avenues for growth within Huabao's tobacco raw materials division.

International trade policies and potential shifts in tariffs, particularly between China and key global players, could significantly impact Huabao's supply chain for raw materials and its prospects for international market expansion. For instance, changes in import duties on flavor and fragrance components directly affect production expenses and necessitate adjustments to pricing strategies.

While Huabao's strong presence in the Chinese domestic market offers a degree of insulation, it does not entirely negate the risks associated with evolving global trade dynamics. For example, in 2023, China's trade surplus with the US widened, highlighting ongoing trade tensions that could influence future tariff impositions.

China's commitment to enhancing food and beverage safety is evident in its tightening regulatory landscape. For Huabao International Holdings, a key player in supplying flavors and fragrances, this translates to a constant need to adapt to stricter rules on ingredients, additives, and manufacturing. For instance, in 2023, China implemented revised regulations for food additives, demanding more rigorous testing and documentation for all substances used.

Failure to adhere to these evolving standards carries significant risks for Huabao. Penalties can range from hefty fines to outright bans on products, directly impacting sales. Beyond financial repercussions, non-compliance can severely damage brand reputation, eroding consumer trust and leading to a substantial loss of market share in the competitive Chinese food and beverage industry.

Industrial Policy and Support

Government industrial policies, particularly those aimed at fostering domestic innovation and supporting high-tech industries, present a significant opportunity for Huabao International Holdings. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes technological self-reliance and innovation-driven development, which can translate into tangible benefits for companies like Huabao operating within advanced materials and consumer goods sectors.

Specific incentives such as R&D subsidies, tax credits for innovation, or preferential access to funding for developing novel flavor and fragrance technologies could substantially accelerate Huabao's growth trajectory. These governmental supports can reduce the financial burden of research and development, thereby enhancing the company's competitive edge. For example, in 2023, China's Ministry of Science and Technology announced increased funding for key research areas, potentially benefiting companies investing in advanced chemical synthesis and biotechnology relevant to the fragrance industry.

- Government focus on innovation: China's 14th Five-Year Plan prioritizes technological advancement, creating a favorable environment for R&D-intensive companies.

- Potential financial benefits: Subsidies and tax incentives for R&D in new flavor and fragrance technologies can lower operational costs and boost innovation.

- Strategic alignment: Understanding and actively leveraging these industrial policies are critical for Huabao's long-term strategic planning and market positioning.

Political Stability and Geopolitical Tensions

China's political stability remains a cornerstone for businesses like Huabao International Holdings. While generally stable, shifts in policy or leadership transitions can introduce uncertainty. For instance, the 2022 leadership reshuffle, while largely anticipated, underscored the importance of monitoring internal political dynamics.

Geopolitical tensions, particularly those involving major global powers and China, directly impact international trade and investment flows. Increased trade friction or sanctions could affect Huabao's access to raw materials or its ability to export finished goods. The ongoing trade disputes, which saw tariffs imposed by various nations in recent years, highlight this vulnerability.

- China's GDP growth forecast for 2024 is around 5%, indicating a relatively stable economic environment, though geopolitical factors could influence this.

- Global supply chain disruptions, partly fueled by geopolitical events in 2023 and early 2024, have added complexity and cost to international operations.

- Consumer confidence in China, while generally robust, can be sensitive to both domestic policy changes and external geopolitical developments.

China's political landscape significantly influences Huabao International Holdings, particularly its tobacco and flavor/fragrance segments. Government oversight of the tobacco industry, including production quotas and distribution, directly impacts operations, as seen in 2023 policy enforcement by the State Tobacco Monopoly Administration.

Government support for innovation, as outlined in China's 14th Five-Year Plan, offers opportunities for Huabao through R&D subsidies and tax credits, potentially boosting its development of new flavor and fragrance technologies. For instance, increased funding for key research areas by the Ministry of Science and Technology in 2023 could benefit Huabao's advanced chemical synthesis efforts.

Geopolitical tensions and international trade policies, including tariffs and trade disputes that intensified in recent years, pose risks to Huabao's supply chain and export capabilities. While China's GDP growth forecast for 2024 is around 5%, global supply chain disruptions and geopolitical events in late 2023 and early 2024 add complexity and cost to international operations.

| Factor | Impact on Huabao | 2023/2024 Relevance |

|---|---|---|

| Tobacco Regulation | Shapes production, sales, and distribution channels. | Continued enforcement of policies by State Tobacco Monopoly Administration. |

| Innovation Policy | Provides opportunities for R&D investment via subsidies and tax credits. | 14th Five-Year Plan emphasis on tech self-reliance; increased M.O.S.T. funding in 2023. |

| Geopolitical Tensions | Affects supply chain access and export markets due to trade friction and tariffs. | Ongoing trade disputes and global supply chain disruptions impacting operations. |

What is included in the product

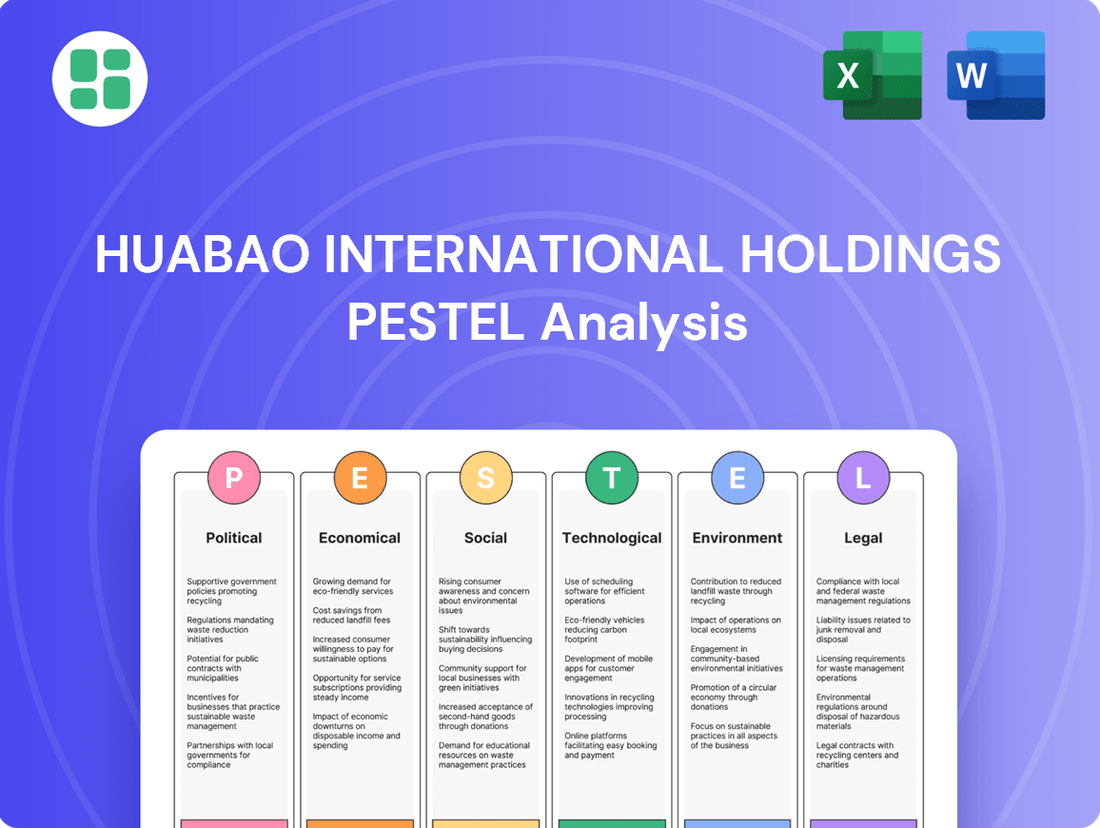

This PESTLE analysis of Huabao International Holdings examines the impact of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides a comprehensive overview of the macro-environmental landscape, highlighting key trends and potential implications for the company's future growth and sustainability.

A PESTLE analysis for Huabao International Holdings offers a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic planning meetings.

This analysis serves as a pain point reliever by visually segmenting external risks and opportunities by PESTEL categories, allowing for quick interpretation and informed decision-making.

Economic factors

China's economic growth rate is a significant driver for Huabao International Holdings. A strong GDP expansion directly correlates with increased consumer purchasing power, boosting demand for food, beverages, and household items that rely on Huabao's flavors and fragrances. For instance, China's GDP grew by 5.2% in 2023, indicating a healthy consumer market.

Conversely, any economic deceleration in China poses a risk to Huabao. A slower economy can dampen consumer sentiment and lead to reduced spending on non-essential goods, directly impacting Huabao's sales volumes. Projections for China's GDP growth in 2024 hover around 4.5% to 5%, suggesting continued but potentially moderating growth.

Rising inflation in 2024 and early 2025 directly impacts Huabao International Holdings by increasing the cost of essential inputs like raw materials, energy, and labor. For instance, global energy prices saw significant volatility, with Brent crude oil futures trading around $80-$90 per barrel in late 2024, a key factor for manufacturing and logistics costs. This necessitates robust procurement strategies and careful price adjustments to maintain healthy profit margins.

Effective management of these escalating costs is critical for Huabao. The company must closely monitor global commodity markets, such as those for key flavor and fragrance ingredients, which can experience sharp price swings. For example, the price of vanillin, a common ingredient, can fluctuate based on agricultural yields and global demand, directly affecting production expenses and requiring agile financial planning.

Changes in how much consumers are spending and how much money they have left after taxes, known as disposable income, directly influence the demand for the ingredients Huabao International Holdings supplies. For example, if Chinese consumers are feeling confident and have more disposable income, they are likely to buy more packaged foods and beverages, which in turn increases demand for Huabao's flavorings and ingredients.

As a business-to-business supplier, Huabao's performance is closely linked to the overall health of the consumer goods market in China. When the Chinese economy is strong and consumer spending is robust, companies that use Huabao's products see increased sales, leading to higher orders for Huabao.

The expansion of China's middle class, which saw its disposable income grow significantly, is a positive indicator for Huabao. In 2023, China's per capita disposable income reached over 39,000 yuan, a rise that typically translates to greater spending on consumer products, benefiting ingredient suppliers like Huabao.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a nuanced challenge for Huabao International Holdings. While the company's core operations are anchored in China, its potential reliance on imported specialized raw materials means that shifts in the Chinese Yuan (RMB) against currencies like the US Dollar or Euro can directly influence procurement costs. For instance, a stronger RMB could make imported inputs cheaper, while a weaker RMB would increase these expenses.

Furthermore, any foreign currency-denominated assets or liabilities Huabao may hold, perhaps from international investments or financing, are subject to valuation changes due to exchange rate volatility. Managing this currency risk is a critical component of maintaining financial stability and predictable earnings. As of early 2024, the RMB experienced periods of weakness against the US Dollar, underscoring the ongoing need for robust currency hedging strategies.

- Import Cost Impact: A 1% depreciation of the RMB against the USD could increase the cost of USD-denominated raw material imports by approximately 1%.

- Foreign Asset Valuation: Fluctuations can alter the book value of any overseas investments Huabao holds.

- Transaction Value: International sales or payments denominated in foreign currencies will yield different RMB amounts based on prevailing exchange rates.

- Hedging Necessity: Effective financial management necessitates strategies to mitigate potential losses arising from adverse currency movements.

Competition and Market Pricing

The Chinese market for flavors, fragrances, and tobacco raw materials is highly competitive. Huabao International Holdings faces pressure from both established domestic companies and international brands. This intense rivalry can significantly impact pricing strategies and market share, potentially leading to price wars that erode profit margins.

For instance, the flavors and fragrances market in China was valued at approximately $10.5 billion in 2023 and is projected to grow, but this growth attracts numerous players. Companies like Givaudan and Firmenich, alongside domestic giants, are vying for dominance. This necessitates continuous innovation and cost management for Huabao to maintain its competitive edge.

To navigate this challenging environment, Huabao must focus on:

- Product Differentiation: Developing unique flavor profiles and high-quality fragrance ingredients that stand out from competitors.

- Cost Efficiency: Streamlining production processes and supply chain management to offer competitive pricing without sacrificing quality.

- Strategic Partnerships: Collaborating with key clients or suppliers to strengthen market position and secure long-term contracts.

China's economic trajectory significantly shapes Huabao International Holdings' prospects. A robust GDP growth, like the 5.2% recorded in 2023, fuels consumer spending, directly benefiting demand for Huabao's flavor and fragrance ingredients. Projections for 2024 suggest continued, albeit potentially moderating, growth around 4.5%-5%, indicating an ongoing positive, yet watchful, environment for the company.

Rising inflation in 2024 and early 2025 presents a direct cost challenge for Huabao, increasing expenses for raw materials and energy. For example, global energy prices, with Brent crude around $80-$90 per barrel in late 2024, impact manufacturing and logistics. This necessitates agile procurement and pricing strategies to maintain profitability amidst input cost volatility.

Fluctuations in the Chinese Yuan (RMB) against major currencies like the US Dollar also affect Huabao. A weaker RMB, as seen in early 2024, can increase the cost of imported raw materials, impacting procurement expenses. Managing these currency risks through hedging is crucial for financial stability and predictable earnings.

| Economic Factor | Impact on Huabao International Holdings | Supporting Data (2023-2025 Projections) |

| GDP Growth | Drives consumer spending and demand for ingredients. | China GDP grew 5.2% in 2023; projected 4.5%-5% for 2024. |

| Inflation | Increases input costs (raw materials, energy). | Global energy prices volatile; Brent crude ~$80-$90/barrel (late 2024). |

| Disposable Income | Boosts demand for consumer goods using Huabao's products. | China per capita disposable income >39,000 yuan in 2023. |

| Currency Exchange Rates | Affects cost of imported raw materials and foreign assets. | RMB showed periods of weakness against USD in early 2024. |

Preview the Actual Deliverable

Huabao International Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Huabao International Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

Sociological factors

Chinese consumers are increasingly prioritizing health, driving a significant demand for natural, healthy, and functional food and beverage options. This societal shift is a direct opportunity for Huabao International Holdings to innovate its product offerings, focusing on natural flavors and healthier ingredient solutions to meet this growing market preference.

For instance, by 2024, the health and wellness food market in China was projected to reach over $180 billion, with functional ingredients seeing particularly strong growth. Huabao's ability to adapt its research and development to align with this trend, potentially reducing reliance on artificial additives where consumer demand dictates, will be crucial for its continued success and market relevance.

Public health initiatives and growing awareness of smoking's detrimental effects in China are projected to reduce tobacco consumption. This trend presents a significant challenge for Huabao International Holdings' tobacco raw materials division, prompting a strategic need for diversification or innovation in less harmful tobacco alternatives. The company must remain attuned to shifts in societal views on tobacco use.

Urbanization continues to reshape how people eat. As more people move to cities, there's a growing demand for convenient food options and flavors that suit busy lifestyles. This trend directly impacts companies like Huabao International, which need to adapt their flavor profiles to match evolving consumer tastes.

Changing dietary preferences are also a major driver. For example, the increasing popularity of plant-based diets or specific health-conscious food trends can significantly alter the demand for certain ingredients and flavorings. In 2024, the global plant-based food market was projected to reach over $70 billion, highlighting the substantial shift in consumer choices that fragrance and flavor companies must address.

Demographic Shifts

China's demographic landscape is undergoing significant transformations, notably an aging population and fluctuating birth rates, which directly impact consumer demand for various product categories. For Huabao International Holdings, this means understanding how different age cohorts, with their unique preferences for flavors and fragrances, will shape market needs. For instance, an increasing elderly population might drive demand for specific health-oriented or calming scents, while younger demographics could favor more innovative and vibrant fragrance profiles.

The declining birth rate in China, a trend that has been observed for several years, presents a challenge and an opportunity for Huabao. With fewer young children, the demand for certain baby-related products might soften, but it also signals a potential shift in household spending towards other areas. By 2024, China's population growth rate was projected to be very low, underscoring the need for companies like Huabao to adapt their strategies to a maturing consumer base. This demographic analysis is crucial for forecasting future market trends and identifying new avenues for growth.

- Aging Population: China's population is aging rapidly, with the proportion of citizens aged 65 and over expected to continue rising significantly through 2025. This demographic shift influences purchasing power and preferences, potentially increasing demand for products catering to older consumers' needs and tastes in flavors and fragrances.

- Declining Birth Rate: China's birth rate has been on a downward trend, impacting the size of younger consumer segments. This necessitates a strategic focus on product development and marketing that appeals to a broader age range or targets specific evolving consumer behaviors.

- Urbanization and Income: While not strictly demographic, the ongoing urbanization trend and rising disposable incomes in China create concentrated markets with greater spending capacity. Huabao can leverage this by tailoring premium flavor and fragrance offerings to urban consumers.

Brand Perception and Ethical Consumerism

Consumer sentiment towards ethical practices is a growing force, impacting ingredient suppliers like Huabao International Holdings. A significant portion of consumers, particularly in developed markets, actively seek out brands demonstrating strong corporate social responsibility. For instance, a 2024 survey indicated that over 60% of global consumers are willing to pay more for products from companies committed to sustainability and ethical sourcing.

This heightened awareness directly influences Huabao's customer base, which includes major food and beverage manufacturers. If Huabao's suppliers face scrutiny over issues like unsustainable palm oil sourcing or poor labor conditions, it can damage the reputation of Huabao's clients, creating a ripple effect. By 2025, it's projected that over 70% of B2B purchasing decisions will incorporate sustainability and ethical compliance as key criteria.

Huabao's commitment to transparency in its supply chain and adherence to stringent product safety standards is therefore crucial. Companies that proactively address these concerns often find it translates into enhanced brand loyalty and a competitive edge. In 2024, brands with demonstrable ethical sourcing policies saw an average 5% higher customer retention rate compared to their less transparent counterparts.

- Growing Consumer Demand: Over 60% of global consumers in 2024 were willing to pay a premium for ethically sourced products.

- B2B Purchasing Criteria: Projections for 2025 suggest over 70% of B2B buying decisions will factor in sustainability and ethical compliance.

- Brand Loyalty Impact: Companies with transparent ethical sourcing policies in 2024 experienced a 5% increase in customer retention.

- Reputational Risk: Negative press regarding labor practices or product safety in Huabao's supply chain can directly impact its clients' brand perception.

China's aging population and declining birth rate are reshaping consumer markets. An increasing elderly demographic, projected to constitute a larger percentage of the population through 2025, influences demand for specific flavor and fragrance profiles, potentially favoring calming or health-oriented options. Conversely, a lower birth rate necessitates strategies that appeal to a broader consumer base, moving beyond solely youth-centric products.

Urbanization and rising incomes continue to concentrate purchasing power in cities, creating opportunities for premium and specialized flavor and fragrance offerings. This trend, coupled with evolving dietary preferences such as the growing interest in plant-based options, demands adaptability from companies like Huabao International. The global plant-based food market's substantial growth, exceeding $70 billion by 2024, underscores the need to align product development with these shifts.

| Sociological Factor | Impact on Huabao International | Supporting Data (2024/2025) |

|---|---|---|

| Aging Population | Increased demand for products catering to older consumers' preferences in flavors and fragrances. | Proportion of citizens aged 65+ expected to rise significantly through 2025. |

| Declining Birth Rate | Need to adapt product strategy to appeal to a broader age range, not just younger demographics. | China's population growth rate projected to be very low by 2024. |

| Urbanization & Income Growth | Opportunity to tailor premium flavor and fragrance offerings to urban consumers with higher spending capacity. | Concentrated markets in cities with greater disposable income. |

| Health & Wellness Trend | Growing demand for natural, healthy, and functional food and beverage options. | China's health and wellness food market projected to exceed $180 billion by 2024. |

| Dietary Preferences (e.g., Plant-Based) | Shift in demand for specific ingredients and flavorings; need to innovate for evolving tastes. | Global plant-based food market projected to exceed $70 billion by 2024. |

Technological factors

Continuous advancements in chemical synthesis, biotechnology, and extraction techniques are enabling the creation of novel and more complex flavors and fragrances. For instance, in 2024, the global flavor and fragrance market was valued at approximately USD 30 billion, with synthetic ingredients playing a significant role in cost-effective production and unique scent profiles.

Huabao International Holdings must actively invest in research and development to integrate these cutting-edge technologies. This strategic focus is crucial for maintaining its competitive edge and consistently offering innovative products that meet evolving consumer demands, particularly for natural and clean-label solutions.

Huabao International Holdings is increasingly leveraging automation and smart manufacturing to bolster its production capabilities. The integration of AI and IoT in their facilities is designed to significantly boost efficiency and cut operational expenses. For instance, in 2023, the company reported a 7% increase in production output attributed to upgraded automated systems in key manufacturing plants.

These smart manufacturing techniques are crucial for optimizing production schedules and improving resource management. By adopting predictive maintenance, Huabao aims to minimize downtime and ensure a consistent flow of goods. This technological adoption is a cornerstone for achieving operational excellence and maintaining a competitive edge in the market.

Huabao International Holdings can significantly enhance its competitive edge by leveraging advanced data analytics. This technology allows for the identification of subtle shifts in consumer tastes and emerging market trends within the dynamic flavors and fragrances industry. For instance, by analyzing vast datasets from sales, customer reviews, and social media sentiment, Huabao can pinpoint unmet needs and potential new product avenues.

The insights gleaned from data analytics are crucial for refining research and development initiatives and optimizing marketing campaigns. In 2024, companies that effectively utilized data to understand consumer behavior saw an average increase of 15% in product launch success rates. This data-driven approach empowers Huabao to develop more precisely targeted products, thereby increasing the likelihood of market acceptance and commercial success.

Intellectual Property and R&D Capabilities

Huabao International Holdings' commitment to robust research and development is a cornerstone of its competitive advantage. The company actively invests in creating and protecting its unique flavor and fragrance formulations, securing a substantial portfolio of intellectual property. This focus on innovation is crucial for maintaining its edge in a specialized market, ensuring a steady stream of new products and deterring rivals from easily copying its creations.

In 2023, Huabao's R&D expenditure reached approximately HKD 150 million, a testament to its dedication to technological advancement. This investment underpins its ability to develop proprietary formulas and patents, which are vital for market differentiation and long-term growth. The company's strong IP position acts as a significant barrier to entry for competitors.

- R&D Investment: Huabao's R&D spending in 2023 was around HKD 150 million.

- Intellectual Property: The company holds a significant number of patents and proprietary formulas for its flavor and fragrance products.

- Innovation Pipeline: Continuous R&D ensures a consistent flow of new and improved products.

- Competitive Moat: Strong IP protects market share and prevents easy replication by competitors.

E-commerce and Digital Sales Channels

The increasing digitalization of procurement and supply chain management presents a significant technological factor for Huabao International Holdings. Even as a primarily B2B entity, the way its clients source materials and manage their supply chains is evolving. This means Huabao needs to consider how these digital shifts will affect its interactions and service delivery to its business partners.

The growth of B2B e-commerce platforms and digital marketplaces offers opportunities to streamline Huabao's ordering and distribution processes. Adapting sales and customer relationship management strategies to leverage these digital channels could lead to greater efficiency and improved client engagement. For example, by 2024, global B2B e-commerce sales were projected to reach over $35 trillion, highlighting the scale of this digital transformation.

Digital transformation can significantly enhance market reach for companies like Huabao. By adopting and optimizing digital sales channels, the company can potentially access new client segments and geographical markets more effectively than through traditional methods alone. This digital shift is not just about selling; it's about rethinking how business relationships are managed in an increasingly online world.

Key considerations for Huabao regarding e-commerce and digital sales channels include:

- Platform Integration: Exploring integration with major B2B e-commerce platforms to simplify transactions.

- Digital Marketing: Enhancing online presence and digital marketing efforts to attract new clients.

- Data Analytics: Utilizing data from digital interactions to better understand client needs and market trends.

- Supply Chain Visibility: Leveraging digital tools to provide clients with greater visibility into their orders and Huabao's supply chain.

Technological advancements are reshaping the flavor and fragrance industry, driving innovation and efficiency for companies like Huabao International Holdings. The company's strategic investments in R&D, particularly in chemical synthesis and biotechnology, are crucial for developing novel products. In 2024, the global flavor and fragrance market, valued around USD 30 billion, sees synthetic ingredients playing a key role in cost-effectiveness and unique scent profiles.

Huabao is also embracing automation and smart manufacturing, integrating AI and IoT to boost production efficiency and reduce costs. For instance, a 7% increase in production output in 2023 was attributed to upgraded automated systems. This focus on smart manufacturing optimizes production and resource management, minimizing downtime and ensuring consistent product flow.

Furthermore, Huabao leverages advanced data analytics to understand consumer tastes and market trends, enhancing its product development and marketing strategies. Companies effectively using data saw a 15% increase in product launch success rates in 2024. Huabao's R&D expenditure in 2023 was approximately HKD 150 million, underscoring its commitment to innovation and intellectual property protection, which creates a competitive moat.

The digitalization of procurement and supply chain management, including B2B e-commerce platforms, offers opportunities for Huabao to streamline operations and expand market reach. With global B2B e-commerce sales projected to exceed $35 trillion by 2024, adapting to these digital channels is vital for client engagement and efficiency.

| Technological Factor | Description | Impact on Huabao | Key Data/Trends (2023-2025) |

| Advancements in Synthesis & Biotechnology | Development of new flavor/fragrance compounds. | Enables product innovation, caters to demand for natural/clean-label. | Global F&F market ~USD 30 billion (2024); synthetic ingredients crucial. |

| Automation & Smart Manufacturing | AI, IoT integration in production. | Increases efficiency, reduces costs, optimizes resource management. | 7% production output increase (2023) from automation. |

| Data Analytics | Analyzing consumer behavior and market trends. | Refines R&D, optimizes marketing, improves product launch success. | 15% increase in product launch success for data-driven companies (2024). |

| Digitalization & E-commerce | Online procurement, B2B platforms. | Streamlines supply chain, expands market reach, enhances client engagement. | Global B2B e-commerce sales >$35 trillion (projected 2024). |

| R&D Investment & IP | Developing proprietary formulas and patents. | Maintains competitive edge, deters competitors, ensures long-term growth. | Huabao R&D spend ~HKD 150 million (2023). |

Legal factors

Huabao International Holdings operates in a heavily regulated sector, particularly concerning food additives. Navigating these complex rules is crucial for their flavor and fragrance business.

Compliance with national and international standards for safety, purity, and labeling of food ingredients is non-negotiable. For instance, the European Union's Regulation (EC) No 1334/2008 on flavourings sets strict guidelines that companies like Huabao must adhere to. Failure to comply can lead to product recalls and significant financial penalties.

Changes in approved additive lists or usage restrictions directly influence product development and market access. For example, if a commonly used flavoring agent is delisted or its permitted concentration is lowered, Huabao would need to reformulate its products, potentially impacting sales and requiring investment in new research and development.

Huabao International Holdings operates within a highly regulated tobacco sector, facing stringent legal frameworks governing product composition, marketing, and the sale of raw materials. These regulations, which can include limitations on specific ingredients and processing techniques, necessitate meticulous compliance to avoid penalties and preserve operating licenses.

Intellectual property (IP) protection is paramount for Huabao International Holdings, safeguarding its proprietary flavor formulas, fragrance compounds, and advanced manufacturing techniques. China's evolving IP legal framework, with a reported 40% increase in patent applications in 2023 according to the China National Intellectual Property Administration (CNIPA), offers a more robust environment for IP enforcement. However, the company must remain vigilant against potential infringement by competitors and ensure its own innovations do not violate existing patents or trademarks, a common challenge in rapidly developing markets.

Environmental Protection Laws

Huabao International Holdings' manufacturing processes are under the purview of environmental protection laws that govern emissions, waste disposal, and water consumption. Adherence to these regulations, which includes securing required permits and meeting pollution control benchmarks, is critical for the company's operations.

Stricter environmental legislation, potentially enacted in response to evolving climate concerns, could compel Huabao to invest in advanced pollution abatement technologies or modify its manufacturing workflows. For instance, China's Ministry of Ecology and Environment has been progressively tightening emission standards, with new regulations for industrial wastewater discharge coming into effect in 2024, potentially impacting companies like Huabao if their operations exceed these new limits.

- Emissions Control: Huabao must manage air and water emissions to comply with national and local environmental standards.

- Waste Management: Proper disposal and treatment of industrial waste are mandated, with increasing scrutiny on hazardous materials.

- Water Usage: Regulations on water abstraction and discharge quality affect manufacturing operations, particularly in water-scarce regions.

- Regulatory Changes: Anticipating and adapting to evolving environmental laws is key to avoiding penalties and operational disruptions.

Labor Laws and Employment Regulations

As a major employer in China, Huabao International Holdings is subject to stringent labor laws. These regulations cover crucial aspects like minimum wages, maximum working hours, and mandatory employee benefits, all designed to ensure fair treatment and safe working conditions. For instance, China's Labor Contract Law mandates clear terms for employment and outlines procedures for termination, impacting how companies manage their workforce.

Compliance with these labor laws is paramount for Huabao to maintain a productive and stable workforce. It helps prevent costly labor disputes and upholds the company's image as a responsible corporate citizen. In 2023, China saw an increase in labor arbitration cases, highlighting the importance of meticulous adherence to employment regulations to avoid legal entanglements and potential financial penalties.

Changes in labor legislation directly influence operational costs. For example, recent adjustments to social insurance contribution rates or mandated increases in minimum wages can lead to higher personnel expenses. These legislative shifts require companies like Huabao to regularly reassess their cost structures and adapt their financial planning accordingly to remain competitive.

Key aspects of China's labor laws impacting Huabao include:

- Wage Regulations: Adherence to national and regional minimum wage standards.

- Working Hours: Compliance with limits on daily and weekly working hours, including overtime regulations.

- Workplace Safety: Ensuring a safe and healthy working environment as per national standards.

- Employee Benefits: Provision of statutory benefits such as social insurance and housing provident funds.

Huabao International Holdings is subject to a complex web of legal and regulatory requirements across its diverse business segments. In its flavor and fragrance division, adherence to food additive regulations, such as the EU's Regulation (EC) No 1334/2008, is critical for market access and avoiding penalties. The tobacco sector faces stringent laws on product composition and marketing, necessitating meticulous compliance for operational continuity.

Intellectual property rights are vital, with China's evolving IP framework, evidenced by a reported 40% increase in patent applications in 2023, offering greater protection but requiring constant vigilance against infringement. Environmental laws governing emissions, waste, and water usage are also paramount; for instance, new industrial wastewater discharge standards implemented in 2024 by China's Ministry of Ecology and Environment could impact operations if not met.

Labor laws, including China's Labor Contract Law, dictate terms of employment, working hours, and benefits, with labor arbitration cases increasing in 2023, underscoring the need for strict adherence to prevent disputes and maintain a positive corporate image. Changes in these laws, such as adjustments to social insurance contributions or minimum wage hikes, directly affect operational costs and require proactive financial planning.

| Legal Factor | Impact on Huabao | Relevant Data/Regulation |

| Food Additive Regulations | Market access, product formulation, compliance costs | EU Regulation (EC) No 1334/2008 |

| Tobacco Sector Regulations | Product composition, marketing, licensing | National and local tobacco control laws |

| Intellectual Property Law | Protection of formulas, risk of infringement | China's IP framework, 40% rise in patent applications (2023) |

| Environmental Laws | Operational permits, pollution control investment | China's new industrial wastewater discharge standards (2024) |

| Labor Laws | Workforce management, labor costs, dispute risk | China's Labor Contract Law, increased labor arbitration cases (2023) |

Environmental factors

Growing consumer and regulatory demand for sustainable practices is prompting companies like Huabao International Holdings to scrutinize their raw material sourcing. This pressure means Huabao must evaluate and potentially improve how it acquires its ingredients, focusing on ethical and environmentally sound methods.

By prioritizing ethically and sustainably sourced ingredients, Huabao can differentiate itself. Minimizing its environmental impact and actively supporting biodiversity not only aligns with global trends but can also translate into a significant competitive edge in the market.

A key aspect of this involves actively engaging with suppliers to understand and influence their environmental footprint. For instance, as of early 2024, many food and beverage companies are setting targets to have 100% of their key raw materials sustainably sourced by 2030, a trend Huabao will likely need to align with.

Huabao International Holdings' manufacturing operations inevitably produce waste and emissions, necessitating a strong focus on environmental stewardship. The company is actively implementing comprehensive waste management strategies, which include enhanced recycling programs and ensuring the responsible disposal of all byproducts. Investing in advanced pollution control technologies is a key priority to significantly reduce its environmental impact.

Adhering to increasingly stringent environmental regulations is paramount for Huabao. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize stricter enforcement of air and water pollution standards, with significant penalties for non-compliance. Failure to meet these evolving standards could lead to substantial fines and damage to Huabao's corporate reputation.

Water scarcity is a growing concern, and for a company like Huabao International Holdings, which relies on manufacturing processes, this presents a significant environmental factor. Regions where Huabao operates might face increasing water stress, potentially impacting production continuity and costs. For instance, by 2025, it's projected that over two-thirds of the world's population could face water shortages, a statistic that underscores the urgency for businesses to address their water dependencies.

To mitigate these risks, Huabao International Holdings must prioritize efficient water usage and implement robust recycling initiatives. Responsible water discharge practices are also crucial, not only for environmental compliance but also for maintaining a positive corporate image. Companies are increasingly being evaluated on their water stewardship, with investors and consumers alike paying closer attention to their environmental footprint.

Assessing Huabao's overall water footprint is a necessary step in developing effective sustainable water management strategies. This involves understanding water consumption across all operational stages, from raw material sourcing to finished product manufacturing. Proactive strategies, such as investing in water-saving technologies or exploring alternative water sources, will be key to ensuring long-term operational resilience in the face of evolving environmental challenges.

Climate Change and Carbon Footprint

Growing global concerns over climate change are increasingly pushing companies like Huabao International Holdings to actively reduce their carbon footprint. This translates into potential pressure from various stakeholders, including regulators, investors, and consumers, to embrace more energy-efficient operations, transition to renewable energy sources, and transparently report greenhouse gas emissions.

These environmental shifts can directly impact Huabao's operational costs and strategic investment decisions. For instance, the International Energy Agency reported in 2024 that global renewable energy capacity additions reached a record high, indicating a strong market trend towards cleaner energy. Companies that fail to adapt may face increased compliance costs or reduced market access.

- Regulatory Pressure: Governments worldwide are implementing stricter emissions standards, potentially affecting manufacturing and supply chain processes.

- Investor Expectations: Environmental, Social, and Governance (ESG) investing continues to grow, with investors favoring companies demonstrating strong climate action. For example, a significant portion of global assets under management are now guided by ESG principles.

- Consumer Demand: Consumers are increasingly choosing products and services from environmentally conscious brands, influencing purchasing decisions and brand loyalty.

- Operational Efficiency: Investing in energy-efficient technologies can lead to long-term cost savings, even with initial capital outlay.

Consumer Demand for Eco-Friendly Products

Consumers are increasingly seeking out products that are both eco-friendly and natural, and this trend is significantly impacting the ingredients sector. Huabao International Holdings has a prime opportunity to capitalize on this by developing and marketing flavors and fragrances that are sourced sustainably or manufactured with a reduced environmental footprint. This strategic focus can unlock new market segments and bolster the company's brand reputation among environmentally aware customers.

For instance, the global market for natural flavors and fragrances was valued at approximately USD 16.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% through 2030. This growth is largely driven by consumer preference for clean-label products and a desire for ingredients perceived as healthier and more sustainable.

- Growing Demand: Consumer preference for eco-friendly and natural ingredients is a significant market driver.

- Market Opportunity: Huabao can develop sustainable flavor and fragrance solutions.

- Brand Enhancement: Meeting this demand can improve brand image and attract environmentally conscious clients.

- Market Size: The global natural flavors and fragrances market was valued around USD 16.5 billion in 2023, indicating substantial growth potential.

Environmental factors significantly influence Huabao International Holdings, particularly concerning raw material sourcing and operational impact. Growing consumer and regulatory demand for sustainability is pushing companies to adopt ethical and environmentally sound ingredient acquisition. This trend, exemplified by many food and beverage companies aiming for 100% sustainably sourced key raw materials by 2030, pressures Huabao to align its practices.

Huabao must also manage its manufacturing waste and emissions, investing in advanced pollution control and waste management strategies. Stricter environmental regulations, like China's continued emphasis on air and water pollution standards in 2024, mean non-compliance can result in substantial fines and reputational damage. Water scarcity is another critical concern, with projections indicating widespread water shortages by 2025, necessitating efficient water usage and recycling initiatives.

The company faces pressure to reduce its carbon footprint, driven by climate change concerns and stakeholder expectations for energy efficiency and renewable energy adoption. For instance, record renewable energy capacity additions in 2024 highlight a strong market shift. These environmental shifts directly impact operational costs and strategic investments, favoring companies that adapt to cleaner energy trends.

Consumer preference for eco-friendly and natural ingredients presents a significant market opportunity for Huabao. The global natural flavors and fragrances market, valued at approximately USD 16.5 billion in 2023 and projected to grow at a CAGR of 6.5% through 2030, underscores this demand. Developing sustainable flavor and fragrance solutions can enhance brand image and attract environmentally conscious clients.

| Environmental Factor | Impact on Huabao | Supporting Data/Trend |

| Sustainability Demand | Pressure for ethical sourcing, potential competitive edge | Aim for 100% sustainable raw materials by 2030 (industry trend) |

| Emissions & Waste | Need for pollution control, waste management | Stricter regulations in China (2024) |

| Water Scarcity | Risk to production, need for water efficiency | Global water shortages projected by 2025 |

| Climate Change & Energy | Pressure to reduce carbon footprint, adopt renewables | Record renewable energy capacity additions (2024) |

| Consumer Preference | Opportunity in natural/eco-friendly products | Natural flavors/fragrances market: USD 16.5B (2023), 6.5% CAGR |

PESTLE Analysis Data Sources

Our PESTLE analysis for Huabao International Holdings is meticulously constructed using data from reputable financial news outlets, official company filings, and market research reports. We integrate insights from economic indicators, regulatory updates, and industry-specific trends to provide a comprehensive overview.