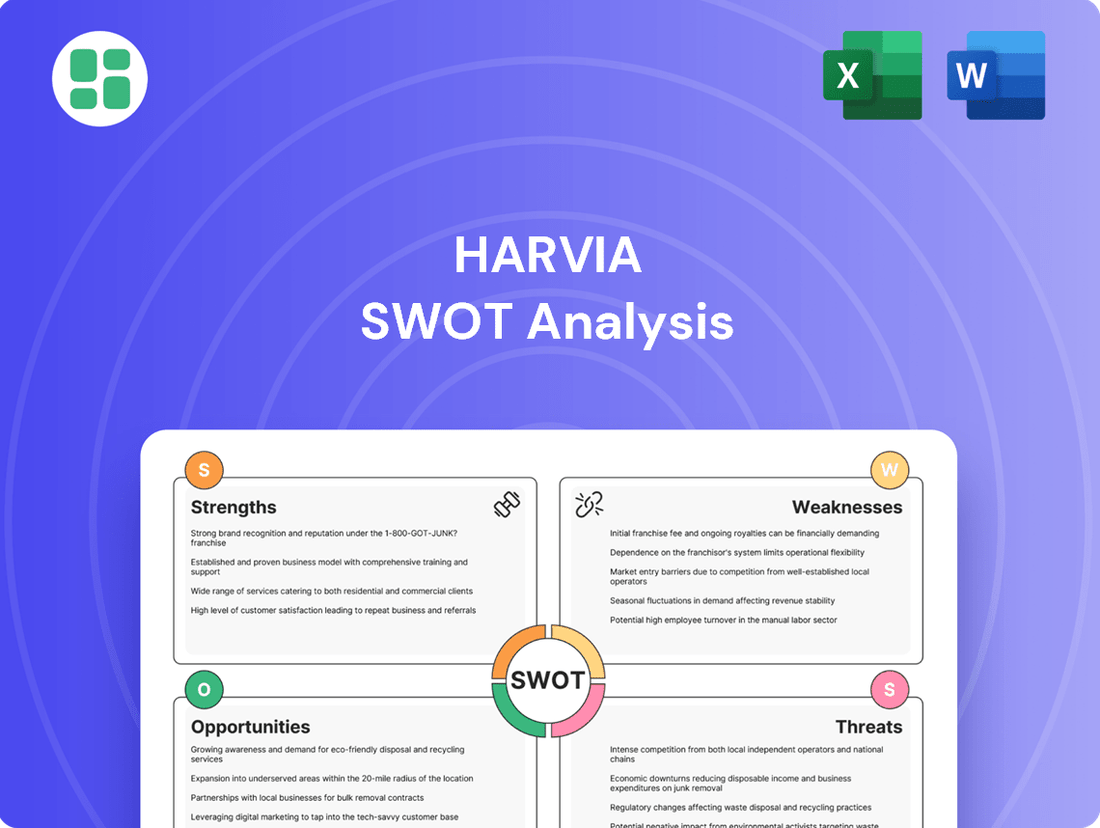

Harvia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

Harvia's strong brand reputation and commitment to innovation present significant strengths, but understanding potential market shifts and competitive pressures is crucial. Our full SWOT analysis dives deep into these dynamics, offering actionable insights into their opportunities and threats.

Want the full story behind Harvia's market position, including detailed strategic takeaways and financial context? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Harvia is a recognized global leader in the sauna and spa sector, a position solidified by its impressive revenue figures and widespread international presence. The company's products reach customers in roughly 90 countries, underscoring its extensive market penetration.

This leading market position is a significant strength, enabling Harvia to shape industry trends and establish benchmarks for quality and innovation. It translates into a powerful competitive edge, allowing the company to leverage its scale and brand recognition effectively.

Harvia boasts a remarkably comprehensive product portfolio, encompassing everything from sauna heaters and steam generators to complete sauna rooms and an array of accessories. This extensive offering allows them to cater to a broad customer base, serving both individual homeowners and commercial enterprises with diverse wellness needs.

The company's strength is further amplified by its portfolio of highly respected brands, including Harvia, EOS, Almost Heaven Saunas, ThermaSol, and Kirami. These well-established names resonate with consumers globally, providing Harvia with significant brand equity and the ability to effectively address the varied demands of the international sauna market.

Harvia has showcased impressive financial strength, with its revenue climbing by 16.4% to EUR 175.2 million in 2024. This robust growth was coupled with a sustained adjusted operating profit margin above 20%, demonstrating the company's ability to translate sales into solid profitability.

The company successfully met its long-term financial objectives in 2024, a testament to its efficient cost control and streamlined operations. Even when faced with fluctuating market demands, Harvia managed to maintain its financial targets, highlighting its operational resilience and effective management strategies.

Strategic Acquisitions and Organic Growth Initiatives

Harvia's growth strategy is a dual-pronged approach, focusing on both building from within and acquiring external capabilities. This balanced strategy aims to solidify its market presence and expand its product and service portfolio. The ThermaSol acquisition in July 2024 is a prime example, significantly bolstering Harvia's footprint in North America and enhancing its expertise in steam and digital wellness solutions.

The company consistently evaluates and pursues mergers and acquisition (M&A) opportunities. These strategic moves are designed not only to consolidate its position within the fragmented sauna and spa industry but also to augment its existing offerings. Harvia's commitment to this strategy is evident in its ongoing efforts to identify and integrate synergistic businesses, driving both revenue growth and market share expansion.

- Strategic Acquisitions: The acquisition of ThermaSol in July 2024 is a key example, strengthening Harvia's position in the North American market and expanding its digital and steam capabilities.

- Organic Growth Focus: Harvia complements its M&A activity with a strong emphasis on organic growth, developing new products and expanding existing market penetration.

- Industry Consolidation: The company actively seeks M&A opportunities to consolidate the fragmented sauna and spa market, aiming to achieve economies of scale and enhance its competitive advantage.

Commitment to Innovation and Sustainability

Harvia's unwavering commitment to innovation is a significant strength, as demonstrated by its proactive product development. The company launched a solar-powered electric sauna in 2024, showcasing its forward-thinking approach to renewable energy integration. Furthermore, Harvia is collaborating with Toyota on a hydrogen sauna concept, a project announced in June 2025, highlighting its dedication to exploring cutting-edge technologies.

This focus on innovation is intrinsically linked to Harvia's strong emphasis on sustainability. The company is actively implementing energy-efficient production methods across its operations. This dedication to reducing its environmental footprint directly addresses the increasing consumer demand for eco-friendly products and services in the global market.

- Innovation in Action: Launch of solar-powered electric sauna (2024) and co-development of hydrogen sauna concept with Toyota (June 2025).

- Sustainability Focus: Implementation of energy-efficient production methods to minimize environmental impact.

- Market Alignment: Meeting growing consumer preference for sustainable and eco-conscious products.

Harvia's market leadership in the sauna and spa sector is a core strength, evidenced by its global reach across approximately 90 countries. This extensive penetration allows the company to effectively leverage its brand recognition and scale, setting industry standards for quality and innovation. The company's robust financial performance, with a 16.4% revenue increase to EUR 175.2 million in 2024 and sustained adjusted operating profit margins exceeding 20%, underscores its operational efficiency and financial resilience.

The company's comprehensive product portfolio, featuring respected brands like Harvia, EOS, and Kirami, caters to a wide customer base. This breadth is further enhanced by a dual growth strategy combining organic development with strategic acquisitions, such as the July 2024 ThermaSol purchase, which bolstered its North American presence and digital wellness offerings.

Innovation is a key differentiator, demonstrated by the 2024 launch of a solar-powered electric sauna and the June 2025 collaboration with Toyota on a hydrogen sauna concept. This forward-thinking approach, coupled with a strong commitment to sustainability through energy-efficient production, aligns with growing consumer demand for eco-friendly solutions.

| Metric | 2024 Data | Significance |

|---|---|---|

| Revenue Growth | 16.4% | Demonstrates strong market demand and effective sales strategies. |

| Adjusted Operating Profit Margin | >20% | Indicates efficient cost management and strong profitability. |

| Countries of Operation | ~90 | Highlights extensive global market penetration and brand reach. |

| ThermaSol Acquisition | July 2024 | Strengthened North American presence and digital/steam capabilities. |

| Hydrogen Sauna Concept | June 2025 | Showcases commitment to cutting-edge, sustainable technology. |

What is included in the product

Offers a full breakdown of Harvia’s strategic business environment, examining its internal capabilities and external market dynamics.

Offers a clear framework to identify and address potential market disruptions, turning threats into actionable strategies.

Weaknesses

Harvia's performance shows a clear divide by region. While North America and the APAC & MEA regions are experiencing robust growth, other areas are struggling. This unevenness presents a significant challenge.

Specifically, parts of Europe, especially Northern Europe and Finland, are facing tough market conditions. The construction and housing sectors are seeing reduced activity, and consumer confidence is low in these key markets. This directly impacts Harvia's sales, demonstrating a clear weakness in its market penetration in these specific geographies.

Harvia's financial health is susceptible to shifts in the global economy. For instance, in the second quarter of 2025, North America experienced a noticeable dip in consumer confidence, directly impacting demand for discretionary goods like those Harvia offers. This macroeconomic vulnerability can translate into slower sales growth and potentially reduced profitability.

Harvia faced significant operational cost pressures in Q2 2025, with employee expenses and other operating costs rising. A notable one-off inventory adjustment further weighed on profitability, causing operating profit margins to dip below expectations.

These cost increases, particularly in personnel and general operations, created headwinds, impacting the company's ability to consistently achieve its targeted adjusted operating profit margin, despite an otherwise robust profitability picture.

Exposure to Currency Fluctuations

Harvia's financial performance is susceptible to currency exchange rate volatility. For instance, a weakening U.S. dollar could negatively impact sales and profitability, especially in crucial markets such as North America. This currency exposure introduces a financial risk that can distort reported earnings, even if the company's core operations remain strong.

- Currency Risk: Harvia faces risks from fluctuating exchange rates impacting its international sales and costs.

- Impact on Profitability: Adverse currency movements can reduce the value of foreign earnings when translated back into Harvia's reporting currency.

- Market Sensitivity: Key growth regions like North America, where sales are often denominated in U.S. dollars, present significant exposure.

Reliance on Construction and Housing Market

Harvia's revenue is closely tied to the construction and housing market, particularly in its core regions like Finland. A slowdown in new home builds or renovations, often seen during periods of economic uncertainty, directly translates to fewer sales for Harvia's products. For instance, during Q1 2024, while Harvia reported overall resilience, the company noted that the fluctuating demand in new construction projects in some European markets presented a challenge.

This reliance means that a dip in consumer confidence or a rise in interest rates, which typically cools housing markets, can significantly impact Harvia's growth trajectory. In 2023, for example, the company experienced a noticeable slowdown in its Finnish market, which is heavily influenced by residential construction activity, impacting its sales volumes in that segment.

The vulnerability to these cyclical industries poses a key weakness:

- Sensitivity to Housing Market Cycles: Harvia's sales performance is directly correlated with the health of the construction and housing sectors.

- Impact of Economic Downturns: Weak consumer confidence and reduced disposable income in affected regions can lead to decreased demand for saunas and wellness products.

- Geographic Concentration Risk: A significant portion of Harvia's business is concentrated in markets where construction activity is a primary driver of sales.

- Projected Slowdown in New Builds: Forecasts for 2024 and 2025 in several European countries indicate a moderation in new residential construction, which could dampen Harvia's sales growth in those areas.

Harvia's reliance on the construction and housing markets creates a significant vulnerability. For instance, a slowdown in new residential construction, projected for several European countries through 2025, directly impacts Harvia's sales volumes. This cyclical dependence means that economic downturns and reduced consumer confidence, as seen with a dip in confidence in North America during Q2 2025, can disproportionately affect Harvia's revenue streams.

Furthermore, the company faces operational cost pressures. In Q2 2025, rising employee and operating expenses, coupled with a one-off inventory adjustment, led to lower-than-expected operating profit margins. This sensitivity to cost inflation and operational inefficiencies poses a challenge to maintaining profitability, especially when combined with market-specific headwinds.

Geographic concentration risk is also a concern, with a notable divide in performance across regions. While North America and APAC & MEA show strength, Northern Europe and Finland are experiencing weaker market conditions due to reduced construction activity and low consumer confidence, directly impacting sales in these key areas.

Currency exchange rate volatility adds another layer of risk, as a weakening U.S. dollar could negatively impact sales and profitability in crucial markets like North America.

Preview Before You Purchase

Harvia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Harvia SWOT analysis, so you know exactly what you're getting. Purchase now to unlock the complete, in-depth report.

Opportunities

The intensifying global emphasis on health, wellness, and personal care is fueling a significant rise in demand for sauna and spa experiences. This trend is evident in both public wellness centers and private homes, indicating a broad market appeal for Harvia's offerings. Consumers are increasingly investing in solutions that promote stress relief, detoxification, and general well-being.

Harvia sees substantial growth opportunities in North America and the APAC & MEA regions, fueled by a rising global appreciation for sauna wellness. These markets represent a chance to expand beyond its European stronghold.

By focusing strategic efforts and investments in these high-potential areas, Harvia can significantly boost its revenue and gain deeper market share. This geographic expansion is key to its future growth trajectory.

The increasing consumer focus on health and wellness is driving a significant rise in home sauna installations. This trend, amplified by the desire for personal convenience and privacy, presents a substantial growth avenue for Harvia. For instance, the global home spa market was valued at approximately $12.5 billion in 2023 and is projected to grow, indicating strong consumer interest in at-home wellness solutions.

Advancements in Smart and Sustainable Technologies

Technological advancements are reshaping the sauna and wellness industry, with smart and sustainable solutions becoming increasingly important. Innovations such as intelligent sauna systems, intuitive digital controls, and highly energy-efficient heating elements are driving market trends. Harvia's commitment to research and development is evident in its forward-thinking product lines, including pioneering solar-powered and hydrogen saunas.

These innovations directly address the growing demand from consumers who are both technologically adept and deeply concerned about environmental impact. Harvia's strategic investments in R&D position the company to capitalize on this shift. For instance, the development of advanced heating technologies not only enhances user experience through precise temperature control but also significantly reduces energy consumption, a key factor for eco-conscious buyers.

The market for smart home technology, which includes connected wellness devices, is experiencing robust growth. By 2025, the global smart home market is projected to reach over $150 billion, indicating a substantial opportunity for companies offering integrated, intelligent solutions. Harvia's focus on smart sauna systems aligns perfectly with this expanding market, offering consumers enhanced convenience and personalized wellness experiences.

Harvia's proactive approach to sustainability, exemplified by its exploration of renewable energy sources for saunas, is a significant competitive advantage. This focus on eco-friendly materials and energy-efficient designs appeals to a broad customer base increasingly prioritizing environmental responsibility in their purchasing decisions. The company's R&D efforts are geared towards creating products that offer both superior performance and a reduced ecological footprint, tapping into a critical market differentiator.

- Smart Sauna Systems: Harvia is developing and marketing connected sauna experiences, offering remote control and personalized settings via mobile applications.

- Energy Efficiency: The company is investing in next-generation heating elements designed to minimize energy consumption, aligning with global sustainability goals.

- Renewable Energy Integration: Harvia is exploring and implementing solutions like solar-powered and hydrogen-based heating for saunas, catering to environmentally conscious consumers.

- Digital Controls: Advanced digital control panels provide users with precise temperature management, pre-set programs, and enhanced safety features.

Strategic Industry Consolidation through M&A

Harvia is actively pursuing strategic mergers and acquisitions (M&A) to consolidate its position within the sauna and spa sector. This approach is designed to broaden its product portfolio, incorporating areas like infrared and steam technology, and to fortify its presence in crucial geographical markets.

The company's inorganic growth strategy is a key enabler for swift market share gains and the achievement of operational synergies. For instance, in 2023, Harvia completed the acquisition of the U.S.-based sauna and steam company, Amerec, a move that significantly enhanced its North American market reach and product diversity.

- Expanding Product Range: M&A allows Harvia to quickly integrate complementary technologies such as infrared and steam, offering customers a more comprehensive wellness experience.

- Geographic Market Penetration: Acquisitions are strategically targeted to bolster Harvia's footprint in high-growth regions, increasing brand visibility and sales channels.

- Synergy Realization: Consolidation offers opportunities for cost efficiencies through shared resources, optimized supply chains, and combined R&D efforts.

- Market Leadership: By actively acquiring competitors and complementary businesses, Harvia aims to solidify its status as a leading global player in the wellness industry.

Harvia is well-positioned to capitalize on the growing demand for smart and sustainable wellness solutions. Its investments in R&D for energy-efficient heaters and smart controls, like those found in its connected sauna systems, directly address consumer interest in both technology and environmental consciousness. The company's commitment to exploring renewable energy sources, such as solar and hydrogen, further solidifies its appeal to an eco-aware market.

Strategic acquisitions are a key growth lever for Harvia, allowing it to quickly expand its product offerings and geographic reach. The acquisition of Amerec in 2023, for example, significantly boosted its presence in North America and broadened its product portfolio to include steam technology. This M&A strategy aims to consolidate its market position and achieve operational synergies, enhancing its competitive edge.

The global wellness market continues to expand, with consumers increasingly prioritizing personal health and home-based relaxation. This trend creates a fertile ground for Harvia's sauna and spa products, especially as more individuals invest in creating at-home wellness sanctuaries. The company's focus on innovation and sustainability aligns perfectly with these evolving consumer preferences.

| Opportunity Area | Description | Example/Data Point |

|---|---|---|

| Smart & Connected Wellness | Leveraging technology for enhanced user experience and remote control. | Global smart home market projected to exceed $150 billion by 2025. |

| Geographic Expansion | Increasing presence in high-growth regions like North America and APAC. | Acquisition of Amerec in 2023 strengthened North American market position. |

| Sustainability & Eco-Friendly Solutions | Developing energy-efficient products and exploring renewable energy sources. | Focus on solar-powered and hydrogen saunas to attract environmentally conscious consumers. |

| Product Portfolio Diversification | Expanding into complementary areas like infrared and steam through M&A. | Acquisitions enable integration of new technologies for a comprehensive wellness offering. |

Threats

Global economic uncertainties, including persistent inflation and rising interest rates, significantly threaten Harvia's sales. For instance, the Eurozone experienced inflation rates averaging 5.3% in 2023, and projections for 2024 suggest a continued but moderating trend. This economic climate directly impacts consumer confidence, leading to a potential reduction in discretionary spending on premium products like saunas and spa equipment, which are often considered luxury or non-essential purchases.

A notable decrease in consumer confidence, as seen in various economic indicators, poses a direct threat to Harvia's revenue streams. In early 2024, consumer sentiment indices in key markets like Germany and Sweden showed signs of stagnation or slight decline compared to previous periods. This erosion of confidence can translate into delayed or canceled purchases of Harvia's offerings, particularly impacting sales volumes in regions where consumers are more cautious about their spending on non-essential goods.

The sauna and spa market is indeed a crowded space, with many companies competing for customer attention. This intense competition, especially in established regions, can lead to price wars and squeezed profit margins for players like Harvia. For instance, in 2023, the global wellness market, which includes saunas and spas, was valued at over $5.6 trillion, indicating significant consumer interest but also a highly contested landscape.

New companies are also frequently entering the market, attracted by its growth potential. This influx of new competitors can further intensify pricing pressures and necessitate continuous innovation to maintain market share. Harvia must remain vigilant against both established rivals and agile newcomers who might disrupt existing market dynamics.

Rising energy costs present a dual threat to Harvia. Increased operational expenses for manufacturing, particularly for energy-intensive processes, could squeeze profit margins. Furthermore, higher energy bills for consumers might dampen demand for discretionary purchases like saunas and related wellness products, impacting sales volumes.

Supply chain vulnerabilities remain a significant concern. Disruptions, whether from geopolitical events or logistical bottlenecks, can lead to production delays and increased input costs for materials like wood, heating elements, and electronics. For instance, the global supply chain challenges experienced throughout 2022 and into 2023 have shown how quickly material availability and pricing can fluctuate, directly affecting Harvia's ability to meet demand and maintain profitability.

Regulatory and Environmental Compliance Burdens

Harvia faces increasing pressure from evolving regulatory landscapes, especially concerning environmental standards and product safety. For instance, stricter emissions regulations for wood-burning saunas, a core product line, could necessitate significant redesign and investment. As of early 2024, many European Union member states are reviewing or have already implemented more stringent emission limits for solid fuel burning appliances, potentially impacting Harvia's existing product portfolio and requiring adaptation.

Adapting to these new requirements, such as potential future mandates on energy efficiency or material sourcing, demands continuous investment in research and development. This can directly affect the cost of product development and, consequently, the final price of Harvia's offerings. For example, the EU’s Ecodesign directive continues to evolve, pushing manufacturers towards more sustainable and lower-emission products, a trend that will likely intensify through 2025.

- Stricter emissions standards: Potential for increased R&D costs and product redesign for wood-burning heaters.

- Environmental compliance: Need for ongoing investment to meet evolving standards like the EU's Ecodesign directive.

- Product safety regulations: Adapting to new safety requirements could impact manufacturing processes and material choices.

Brand Dilution from Imitations or Lower-Quality Alternatives

Harvia's reputation as a premium brand in the sauna and wellness industry is vulnerable. The market is seeing an influx of imitations and lower-cost alternatives, particularly from regions with lower manufacturing expenses. This influx can confuse consumers and dilute the perception of Harvia's superior quality and craftsmanship.

These cheaper alternatives, while not matching Harvia's standards, can still capture market share by appealing to price-sensitive consumers. For instance, while Harvia's premium sauna models might range from $5,000 to $20,000+, some basic infrared sauna kits can be found for under $1,000. This significant price disparity creates a competitive challenge.

- Brand Erosion: Lower-quality imitations can undermine the perceived value of Harvia's high-end products.

- Price Competition: Harvia may be forced into price adjustments to remain competitive, potentially impacting profit margins.

- Market Share Loss: Competitors offering similar functionality at lower price points could attract a segment of Harvia's potential customer base.

- Consumer Confusion: The proliferation of varied products can make it difficult for consumers to distinguish between genuine Harvia quality and inferior alternatives.

The increasing prevalence of imitations and lower-cost alternatives poses a significant threat to Harvia's premium brand positioning. These products, often originating from regions with lower manufacturing costs, can confuse consumers and dilute the perceived value of Harvia's quality and craftsmanship. This intense price competition, exemplified by basic sauna kits available for under $1,000 compared to Harvia's premium models, could force price adjustments and impact profit margins.

Harvia's market share is also at risk from competitors offering similar functionality at substantially lower price points. This dynamic can attract price-sensitive consumers, potentially leading to a loss of customers who might otherwise opt for Harvia's superior offerings. The proliferation of varied products makes it challenging for consumers to discern genuine Harvia quality from inferior alternatives.

| Threat Category | Description | Potential Impact | Example/Data Point |

|---|---|---|---|

| Brand Erosion | Influx of imitations and lower-cost alternatives | Dilution of perceived value, consumer confusion | Basic sauna kits priced under $1,000 vs. Harvia's premium models ($5,000-$20,000+) |

| Price Competition | Competitors offering similar functionality at lower prices | Pressure on profit margins, potential price adjustments | N/A (ongoing market dynamic) |

| Market Share Loss | Attracting price-sensitive consumers | Loss of potential customers to cheaper alternatives | N/A (ongoing market dynamic) |

SWOT Analysis Data Sources

This Harvia SWOT analysis is built upon comprehensive data from financial reports, extensive market research, and insights from industry experts to provide a robust and actionable strategic overview.