Harvia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

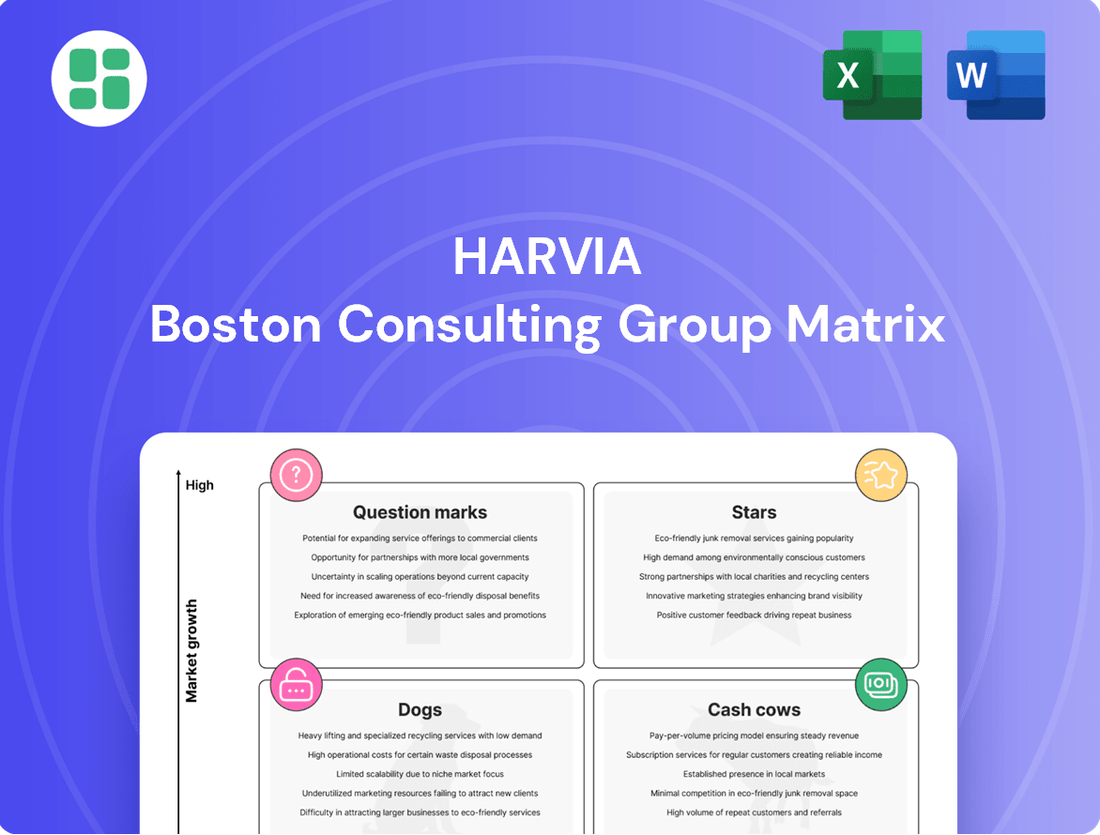

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See which products are poised for growth, which are generating steady income, and which may be underperforming.

Don't stop at the surface; dive into the full BCG Matrix to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development strategies. Purchase the complete report to transform this data into decisive business action.

Stars

North America represents a significant growth engine for Harvia, demonstrating robust performance. In the first quarter of 2025, this region accounted for over 80% of Harvia's total revenue growth. This impressive expansion is further underscored by an organic growth rate of nearly 40% recorded throughout 2024, signaling a dominant market share within a rapidly expanding geographical segment for sauna and spa offerings.

The strategic acquisition of ThermaSol in July 2024 significantly bolstered Harvia's footprint in this high-growth North American market. This move specifically strengthened Harvia's presence and capabilities in the steam solutions sector, a key component of the burgeoning spa and wellness industry in the region.

Harvia's Cilindro wood-burning heater, a 2024 launch, has immediately become a top seller, demonstrating robust first-quarter sales. This product exemplifies a strong market position within the premium sauna heater category, a segment experiencing growth due to consumer preference for sustainable and adaptable heating options.

Harvia's comprehensive sauna solutions are a shining star in the commercial segment, catering to demanding clients like hotels, fitness centers, and luxury resorts. This sector represents a substantial portion of the global sauna and spa market, with growth fueled by the booming wellness tourism trend.

The company's strength lies in its capacity to deliver customized, end-to-end sauna and spa experiences for professional settings. This strategic focus has secured Harvia a dominant market share within this high-value, expanding niche. Their established brand reputation among industry professionals further solidifies their star status.

Smart Sauna Systems and Digital Solutions

The integration of smart technology into sauna and spa experiences is a significant growth area, with global demand for these sophisticated systems on the rise. Harvia is strategically positioning itself to capitalize on this trend by enhancing its digital sales platforms, such as almostheaven.com, and investing in digital innovations, which may include advanced WiFi-controlled sauna features.

This focus on digital solutions and smart systems is crucial for capturing a substantial market share in this innovative and expanding segment. Harvia's efforts in this domain highlight a clear commitment to leadership in a high-growth opportunity within the sauna and spa industry.

- Smart Home Integration: The global smart home market, which includes connected wellness devices, was projected to reach over $138 billion in 2024, indicating a strong consumer appetite for integrated technology.

- Digital Sales Growth: Harvia's investment in digital channels aims to tap into the increasing preference for online purchasing of home wellness equipment.

- Product Innovation: The development of WiFi-controlled sauna features directly addresses consumer demand for convenience and remote management of their sauna experience.

Acquired Brands with Growth Potential (e.g., ThermaSol, Almost Heaven Saunas)

Harvia's strategic acquisitions, such as ThermaSol in July 2024, have significantly bolstered its sales and expanded its expertise in steam and digital offerings, particularly within the booming North American market.

Brands like Almost Heaven Saunas are also tapped for substantial growth, with recent enhancements to their online sales platforms.

These acquired businesses are now integrated into Harvia's robust brand ecosystem, poised for accelerated growth under the company's established market leadership.

- ThermaSol Acquisition (July 2024): Immediately boosted Harvia's sales and expanded its digital and steam capabilities in North America.

- Almost Heaven Saunas: Undergoing digital sales channel upgrades to unlock further growth potential.

- Portfolio Integration: Acquired brands are strategically positioned within Harvia's strong existing portfolio for synergistic growth.

- Market Leadership: Harvia's established market presence is expected to drive high growth for these newly integrated brands.

Harvia's "Stars" represent its highest-growth, high-market-share business units. These are characterized by strong demand and a leading competitive position. The North American market, with its nearly 40% organic growth in 2024, exemplifies this star status for Harvia.

The strategic acquisition of ThermaSol in July 2024 significantly contributed to this star performance, particularly in the steam solutions sector within North America. Harvia's premium wood-burning heaters, like the Cilindro launched in 2024, also quickly achieved star status due to strong sales and consumer preference.

The commercial sauna segment, serving hotels and resorts, is another key star for Harvia, driven by the wellness tourism trend. Furthermore, the integration of smart technology and digital sales platforms, such as Almost Heaven Saunas' online upgrades, positions Harvia for continued star performance in innovative and expanding markets.

| Business Unit/Product | Market Growth | Harvia's Market Share | Key Drivers |

|---|---|---|---|

| North America (Overall) | High (Nearly 40% organic growth in 2024) | Dominant | Expanding wellness industry, strategic acquisitions |

| Steam Solutions (e.g., ThermaSol) | High | Strong | Acquisition in July 2024, growing spa and wellness demand |

| Premium Wood-Burning Heaters (e.g., Cilindro) | Moderate to High | Leading | Product innovation, consumer preference for quality and sustainability |

| Commercial Sauna Solutions | High (Wellness tourism) | Dominant | Customized end-to-end solutions, established brand reputation |

| Smart Home/Digital Integration | Very High (Global smart home market over $138 billion in 2024) | Growing | Investment in digital platforms, WiFi-controlled features |

What is included in the product

The Harvia BCG Matrix analyzes product portfolio performance, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual representation of your product portfolio, simplifying strategic decision-making.

Cash Cows

Harvia's traditional electric sauna heaters are quintessential cash cows, representing a mature but robust segment of the global sauna market. As a leading manufacturer, Harvia likely commands a significant market share, benefiting from established brand loyalty and consistent demand from both new installations and replacement markets.

These heaters are the bedrock of Harvia's financial stability, generating substantial and predictable cash flows. Their profitability is sustained by ongoing replacement sales and a steady demand in established sauna cultures, requiring minimal incremental investment for growth.

In 2023, the global sauna and steam room market was valued at approximately USD 6.5 billion, with traditional electric heaters forming a substantial portion of this market. Harvia's strong position in this segment ensures these products continue to be a primary driver of the company's earnings.

Harvia's wide array of sauna components and accessories, such as stones, controllers, and benches, are crucial for keeping saunas in good condition and for improvements. These items hold a significant market share in a predictable replacement market, generating consistent, high-profit cash flow without needing much investment for growth. Their broad application across different sauna models ensures they are dependable sources of income.

Despite a slowdown in construction and housing activity across Northern Europe, especially in Finland, Harvia commands a significant and entrenched market position. This mature market, characterized by established brand loyalty and consistent replacement demand for its traditional offerings, serves as a reliable source of stable cash flow for the company, even with limited growth prospects.

Sauna Rooms (Standard Residential)

Standard residential sauna rooms are a cornerstone for Harvia, representing a mature market segment where the company holds a substantial market share. Despite potentially slower growth rates compared to emerging wellness trends, the consistent demand for these core products, coupled with Harvia's optimized production processes, translates into reliable profit margins and a steady stream of cash. This stability is a direct result of Harvia's deep-rooted expertise in the sauna industry.

These established offerings are crucial for funding innovation and expansion into newer, higher-growth areas. For instance, in 2023, Harvia reported a net sales increase of 12% to €231.3 million, with their Sauna business segment, which includes residential saunas, contributing significantly to this performance. This demonstrates the enduring financial strength of their core products.

- Market Position: Harvia commands a strong presence in the established residential sauna market.

- Financial Contribution: These products generate consistent cash flow due to stable demand and efficient operations.

- Strategic Importance: They act as cash cows, funding investment in new product development and market expansion.

- Performance Indicator: Harvia's Sauna business segment reported strong sales in 2023, underscoring the segment's financial health.

Aftermarket Sales and Spare Parts

Aftermarket sales and spare parts for sauna heaters and related equipment represent a significant Cash Cow for Harvia. This segment benefits from a stable, high-margin revenue stream, primarily fueled by the ongoing need for maintenance and repairs of Harvia's substantial global installed base. The predictable nature of these sales, requiring minimal new market development, underpins long-term revenue stability.

- Stable Demand: The installed base of Harvia products necessitates ongoing support, ensuring a consistent demand for spare parts and aftermarket services.

- High Margins: This segment typically commands higher profit margins compared to new product sales due to lower marketing and R&D costs.

- Predictable Cash Flow: Harvia's extensive global reach means a reliable and predictable inflow of cash from this mature business area.

- Customer Loyalty: Providing excellent aftermarket support fosters customer loyalty and can lead to repeat business for both parts and future product upgrades.

Harvia's traditional electric sauna heaters and associated components are prime examples of cash cows within the BCG matrix. These mature products benefit from established brand recognition and a consistent demand for replacements, requiring minimal new investment to maintain their market share and profitability.

The company's strong position in the global sauna market, valued at approximately USD 6.5 billion in 2023, ensures these core offerings continue to be a significant driver of earnings. Harvia's Sauna business segment, which includes these traditional products, demonstrated robust performance in 2023, with net sales increasing by 12% to €231.3 million, highlighting their enduring financial strength.

Aftermarket sales and spare parts also contribute significantly to this cash cow status, providing high-margin, predictable revenue streams from Harvia's extensive installed base. This segment is crucial for funding innovation and expansion into new growth areas.

| Product Category | BCG Status | Key Characteristics | 2023 Performance Indicator |

|---|---|---|---|

| Traditional Electric Sauna Heaters | Cash Cow | Mature market, high brand loyalty, consistent replacement demand | Strong contribution to Harvia's Sauna business segment sales |

| Sauna Components & Accessories | Cash Cow | Predictable replacement market, high-profit margins, broad application | Reliable source of income, supporting overall segment performance |

| Aftermarket Sales & Spare Parts | Cash Cow | Stable, high-margin revenue from installed base, low investment needs | Ensures long-term revenue stability and funds new ventures |

Full Transparency, Always

Harvia BCG Matrix

The BCG Matrix document you are previewing is the identical, fully formatted report you will receive immediately after your purchase. This means you'll get the complete, analysis-ready file without any watermarks or demo content, ready for immediate strategic application.

Dogs

Certain regions, including parts of Northern Europe such as Finland, have faced persistent challenges. This is largely due to subdued construction activity and a general dip in consumer confidence. For example, Finland's construction output saw a notable decline in early 2024 compared to the previous year.

Products aimed at these specific low-growth, low-demand areas, especially where Harvia holds a minor market share or observes falling sales, would fit into the Dogs category of the BCG matrix. These segments demand strategic attention to prevent them from becoming drains on resources.

Certain older or niche sauna heater models, like some early electric models with lower wattage or less precise temperature controls, might fall into the Dogs category. These have been largely replaced by more energy-efficient and technologically advanced units, leading to a diminished market share in a shrinking sub-segment of the sauna market.

These older heaters often struggle to break even or may even incur losses. This is due to a combination of low demand, which drives up production costs per unit, and their inability to compete with newer, more desirable features and better energy performance.

Products with high import dependencies in tariff-sensitive markets, like certain goods imported into the US facing tariffs, can become Dogs in Harvia's BCG Matrix. If these products have a low market share and their profitability is significantly eroded by import duties, they represent a weak position.

For example, if a product line relies on components imported from a country subject to a 25% tariff, and that product only holds a 2% market share, the tariff's impact can quickly turn a marginal profit into a loss. In 2024, such scenarios are critical to monitor as trade policies evolve.

These vulnerable products would struggle to generate positive cash flow. Their continued presence in Harvia's portfolio would likely be unsustainable, making them prime candidates for divestiture or a strategic decision to phase them out to conserve resources.

Low-End, Undifferentiated Accessories

Low-end, undifferentiated accessories, such as basic sauna buckets and ladles, often fall into this category. These items face fierce competition from many small manufacturers, leading to low brand loyalty among consumers. In 2024, the market for these basic accessories is estimated to be highly saturated, with growth projections remaining minimal, likely under 2% annually.

Products in this quadrant typically exhibit a low market share within the broader sauna accessory market. They operate in a highly commoditized segment where price is the primary differentiator. This results in thin profit margins, often in the single digits, and can lead to inventory being tied up without generating substantial returns for the company.

- Low Market Share: These accessories typically represent a small fraction of the overall accessory market.

- High Competition: Numerous small, often local, players compete aggressively on price.

- Low Brand Loyalty: Consumers are unlikely to show strong preference for specific brands in this segment.

- Low Profit Margins: Intense price competition squeezes profitability, often yielding single-digit margins.

Non-Strategic, Legacy Product Lines

Non-strategic, legacy product lines, those that no longer fit Harvia's focus on innovation, sustainability, and integrated solutions, would be categorized as Dogs in the BCG Matrix. These products often face declining market share and limited growth potential.

These legacy offerings can drain valuable resources, such as R&D and marketing budgets, without generating substantial returns or contributing to Harvia's long-term strategic objectives. For example, if Harvia's 2024 financial reports indicated a segment with declining revenue and negative profit margins, and this segment represented older, less technologically advanced sauna heaters, it would fit this description.

Harvia's strategic pivot towards smart sauna technology and energy-efficient solutions means that older product generations may become obsolete. Companies often divest or phase out such product lines to reallocate capital towards more promising ventures.

- Dwindling Market Share: Legacy products may see their market share erode as newer, more competitive alternatives emerge.

- Low Growth Prospects: Without significant innovation or market expansion, these lines offer minimal future growth potential.

- Resource Drain: Continued investment in non-strategic products diverts resources from areas with higher strategic value.

- Strategic Misalignment: These products often do not align with Harvia's stated goals of sustainability and comprehensive customer solutions.

Products in Harvia's "Dogs" category represent offerings with low market share in low-growth markets. These can include older sauna heater models, basic accessories facing intense competition, or product lines impacted by tariffs and declining consumer confidence, particularly in regions like Northern Europe. For instance, Finland's construction output saw a notable dip in early 2024, impacting demand for related products. These segments often struggle with profitability due to low sales volume and high competition, making them candidates for divestiture or phasing out to reallocate resources to more strategic areas.

| Harvia BCG Category | Market Growth | Market Share | Examples | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Older sauna heater models, basic accessories, tariff-affected imports | Divest, phase out, or minimize investment to conserve resources. |

Question Marks

Harvia is exploring hydrogen combustion for saunas, positioning this innovative technology in a nascent market segment with high growth potential. This venture into sustainability aligns with future trends, though the technology is currently unproven in widespread sauna applications.

As a new entrant, hydrogen combustion saunas have a negligible market share today. However, if successful and widely adopted, this segment could evolve into a Star within Harvia's portfolio, demanding significant investment in research, development, and consumer education to realize its potential.

The Kirami FinVision Sauna Zero, as the first solar-powered outdoor electric sauna, enters the market as a potential star. Its innovative, eco-friendly design taps into the booming sustainable wellness trend, a segment experiencing significant growth. While its current market share is understandably small due to its newness, the increasing consumer preference for green solutions suggests a strong trajectory for rapid expansion, necessitating focused marketing efforts to capture this emerging demand.

Harvia's advanced digital services and connectivity solutions, moving beyond basic remote control, represent a significant opportunity. Think AI-powered spa experiences or integrating biometric tracking into saunas. These are areas with high growth potential and currently low market penetration for Harvia.

These innovative offerings could attract a new, tech-savvy customer base. However, capturing this market requires substantial investment in research, development, and market penetration strategies to establish a strong foothold.

Expansion into New Geographic Markets (e.g., specific APAC regions beyond current focus)

Expanding into less developed APAC markets, such as Vietnam or Indonesia, for sauna and spa products would position these regions as Question Marks for Harvia. These markets exhibit high growth potential due to increasing disposable incomes and a growing interest in wellness, but Harvia currently holds a negligible market share. Significant investment in brand building, distribution networks, and understanding local consumer preferences would be necessary to transform these into Stars.

For example, while Japan and Australia are already showing strong growth and are likely considered Stars for Harvia, markets like Vietnam present a different scenario. Vietnam's wellness market is projected to grow significantly, with a CAGR of over 8% expected in the coming years, yet the adoption of sophisticated sauna and spa culture is still nascent. This presents a classic Question Mark situation where substantial capital expenditure is required to gain traction.

- High Growth Potential: Emerging economies in APAC, like Vietnam and Indonesia, are experiencing rising middle classes and increased health consciousness, creating a fertile ground for wellness products.

- Low Market Share: Harvia's current presence in these specific markets is minimal, meaning they start with a very low share of the potential demand.

- Significant Investment Required: To establish a foothold, Harvia would need to invest heavily in market research, product adaptation, marketing campaigns, and building robust distribution channels.

- Risk vs. Reward: While the potential rewards are high if successful, the initial investment carries a considerable risk due to unproven market acceptance and competitive landscapes.

Cold Plunges and Complementary Wellness Products

Harvia's strategic push to offer a complete sauna experience extends to complementary products like cold plunges. This diversification into new wellness categories, while potentially tapping into growing markets, positions these offerings as Question Marks within the BCG matrix. For instance, the global cold plunge market, while expanding rapidly, is still relatively fragmented with many emerging players.

These products, while promising, likely represent a small portion of Harvia's current revenue and require substantial investment to gain market share and potentially become Stars. The company's focus on the full sauna ecosystem, including accessories and related wellness items, aims to capture a larger share of the overall consumer spend on home spa and wellness. Harvia's 2023 annual report indicated a strong performance in its core sauna heating business, highlighting the need for strategic growth initiatives in newer segments.

- Market Expansion: Cold plunges and other complementary wellness products allow Harvia to enter potentially high-growth segments of the broader wellness industry.

- Investment Needs: As nascent product categories, these items likely require significant marketing and R&D investment to build brand awareness and market share.

- Strategic Fit: These products align with Harvia's overarching strategy of providing a comprehensive and integrated home spa and sauna experience for consumers.

- Growth Potential: While currently Question Marks, successful development and market penetration could see these products transition into Stars, driving future revenue growth for Harvia.

Harvia's expansion into less developed APAC markets, like Vietnam and Indonesia, positions these regions as Question Marks. These markets offer high growth potential due to rising incomes and wellness interest, but Harvia's current market share is negligible. Significant investment in brand building and distribution is crucial for success.

The cold plunge market, while expanding, is fragmented and requires substantial investment for Harvia to gain traction and potentially become a Star product. These complementary offerings align with Harvia's strategy for a comprehensive home spa experience, aiming to capture greater consumer spending in the wellness sector.

The global wellness market continues its upward trajectory. In 2023, the market was valued at approximately $5.6 trillion, with the home spa segment showing robust growth. Emerging markets in APAC are projected to contribute significantly to this expansion, with Vietnam's wellness market alone expected to grow at a CAGR exceeding 8% in the coming years.

| Category | Market Share | Growth Potential | Investment Needs | Strategic Importance |

| Undeveloped APAC Markets (e.g., Vietnam) | Negligible | High | High (Brand Building, Distribution) | Future Growth Driver |

| Cold Plunges & Complementary Wellness | Low (Fragmented) | High | High (R&D, Marketing) | Ecosystem Expansion |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive analysis, to accurately position each business unit.