Harvia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvia Bundle

Uncover the external forces shaping Harvia's future with our comprehensive PESTLE analysis. From evolving consumer preferences to new environmental regulations, understand the critical factors impacting their market position. Download the full report to gain actionable insights and refine your strategic approach.

Political factors

Geopolitical stability in Harvia's key markets, such as Europe and North America, is crucial for maintaining consumer confidence in discretionary spending on wellness products. For instance, the ongoing economic uncertainties in some European nations throughout 2024 could temper demand for premium sauna and spa experiences.

Shifts in international trade policies present significant implications for Harvia's global operations. The potential for new tariffs or changes to existing trade agreements, particularly concerning wood products and electronic components, could affect supply chain costs. Harvia's reliance on diverse sourcing strategies will be tested by evolving trade landscapes, potentially impacting its competitive pricing in markets like the United States, which accounted for approximately 15% of its sales in 2023.

Government health and wellness initiatives, particularly those promoting stress reduction and home improvement, can significantly benefit Harvia. For instance, in 2024, many European nations continued to invest in public health campaigns that indirectly encourage the adoption of wellness practices at home. These trends are expected to persist through 2025, creating a receptive market for sauna and spa solutions.

Furthermore, policies aimed at boosting tourism and hospitality sectors often translate into increased demand for commercial spa installations. In 2024, countries like Finland, Harvia's home market, saw a rebound in tourism, with a particular focus on wellness tourism. This trend is projected to continue into 2025, offering Harvia a strong avenue for growth in its B2B segment.

Harvia must navigate a complex web of manufacturing and import regulations worldwide. Changes in environmental standards, like the EU's upcoming Ecodesign regulations impacting energy efficiency of heating products, can necessitate costly product redesigns. Fluctuations in import duties, such as those seen in trade disputes impacting steel prices in 2024, directly influence Harvia's cost of goods sold and overall profitability.

Political Stability in Supply Chain Countries

Political stability within Harvia's sourcing countries is a critical element for maintaining a consistent and cost-efficient supply chain. Instability, such as civil unrest or sudden policy shifts, can directly translate into production stoppages and inflated operational costs.

For instance, if a key component for Harvia's sauna heaters originates from a region experiencing significant political turmoil, it could lead to delays in shipments and necessitate finding alternative, potentially more expensive, suppliers. The World Bank's 2023 Worldwide Governance Indicators show a range of political stability scores for countries that could be part of global supply chains, highlighting the varying levels of risk.

- Supply Chain Vulnerability: Political instability in sourcing nations directly affects Harvia's ability to procure raw materials and components reliably.

- Cost Implications: Disruptions stemming from political unrest or policy changes can escalate production expenses due to delays and the need for contingency measures.

- Operational Impact: Strikes, social unrest, or unexpected government regulations in supplier countries can halt production lines, impacting Harvia's delivery schedules and overall efficiency.

Consumer Protection and Product Liability Laws

Stricter consumer protection and evolving product liability laws across key markets present a significant political factor for Harvia. For instance, the European Union's General Product Safety Regulation (GPSR), which came into effect in 2024, mandates enhanced product traceability and requires manufacturers to appoint an EU representative for certain products, potentially increasing compliance costs. Failure to adhere to these regulations, which often include stringent safety and quality benchmarks, could expose Harvia to increased legal risks and reputational damage.

Navigating these diverse regulatory landscapes is crucial for Harvia's global operations. For example, in 2023, the US Consumer Product Safety Commission (CPSC) continued its focus on product safety recalls, with data indicating a steady number of recalls across various consumer goods sectors. Harvia must ensure its sauna and spa products consistently meet or exceed these varied safety and quality standards to mitigate potential penalties and maintain consumer trust.

- Increased Compliance Costs: New regulations like the EU's GPSR (effective 2024) necessitate investment in product traceability and potentially new representation, impacting operational expenses.

- Product Liability Risks: Evolving legal frameworks can broaden the scope of manufacturer liability, making adherence to rigorous safety and quality standards paramount.

- Market Access Challenges: Non-compliance with differing national consumer protection laws could restrict market entry or lead to costly product modifications.

Government support for green building and energy efficiency initiatives can directly boost demand for Harvia's energy-saving sauna and spa solutions. For example, the EU's continued focus on sustainability in 2024, with targets for reduced energy consumption, creates a favorable policy environment. These trends are expected to intensify through 2025, encouraging consumers and businesses to invest in eco-friendly wellness products.

Trade agreements and tariffs significantly impact Harvia's global supply chain and pricing strategies. For instance, changes in import duties on materials like steel or components from Asia could affect production costs, as seen with trade tensions impacting global commodity prices in 2024. Harvia's ability to adapt its sourcing and pricing will be key to maintaining competitiveness, especially in markets like the US, which represented around 15% of its sales in 2023.

Evolving product safety and consumer protection regulations, such as the EU's General Product Safety Regulation implemented in 2024, increase compliance burdens. These regulations require enhanced traceability and potentially new representation, adding to operational costs and legal risks. Harvia must ensure its products meet stringent safety standards across all markets to avoid penalties and maintain brand trust.

Government initiatives promoting tourism and public health, particularly those focused on wellness, offer significant growth opportunities. The rebound in wellness tourism in countries like Finland in 2024, a trend projected to continue into 2025, directly benefits Harvia's commercial segment. These policies create a receptive market for spa installations and home wellness solutions.

What is included in the product

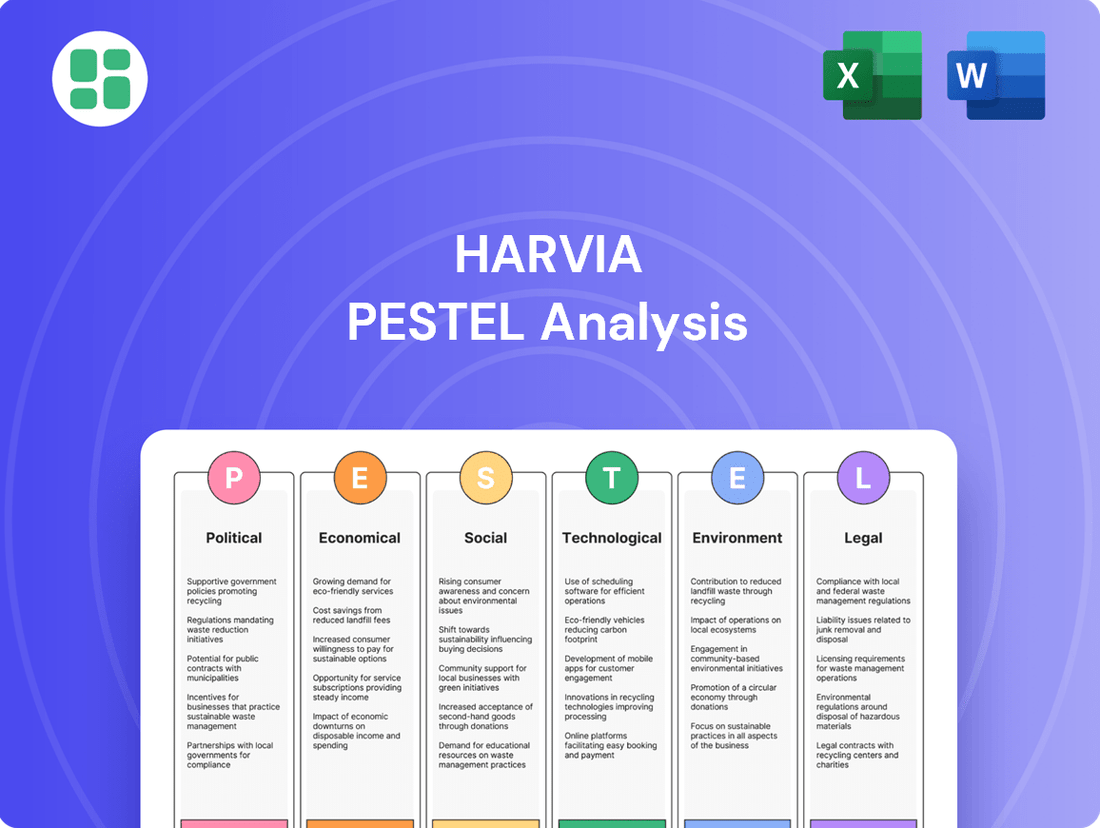

The Harvia PESTLE analysis systematically examines the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This comprehensive evaluation provides actionable insights into market opportunities and potential challenges, aiding strategic decision-making for Harvia.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors easily digestible for strategic discussions.

Economic factors

Global economic expansion directly influences Harvia's sales, as higher disposable incomes encourage consumers to purchase premium leisure products like saunas and spa equipment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but indicative of continued economic activity that supports discretionary spending.

Conversely, economic slowdowns or recessions can significantly dampen demand for Harvia's offerings. A contraction in global GDP or rising unemployment can lead consumers to postpone or cancel purchases of non-essential items, impacting Harvia's revenue streams. The economic outlook for 2025, while still being refined, anticipates continued moderate growth, suggesting a supportive, though not booming, environment for Harvia.

Rising inflation in 2024 and early 2025 directly impacts Harvia by increasing the cost of key raw materials like timber, steel, and electronic components. For instance, global commodity prices have seen fluctuations, with some metals experiencing price hikes due to supply chain disruptions and increased industrial demand. This surge in input costs can squeeze Harvia's profit margins if the company cannot effectively pass these increases onto consumers.

Harvia's strategic response to these rising costs is crucial. The company must adeptly manage its procurement processes to secure favorable pricing and explore alternative material sourcing to mitigate volatility. Furthermore, the ability to implement price adjustments for its sauna and spa products without significantly dampening consumer demand will be a key determinant of financial performance in the current economic climate.

Harvia, as a global player, is significantly exposed to the unpredictable nature of exchange rate fluctuations. These shifts directly influence the cost of raw materials sourced internationally, potentially increasing production expenses. For instance, a stronger Euro against currencies where Harvia sources components could raise import costs.

Furthermore, currency volatility impacts the price competitiveness of Harvia's sauna and spa products in export markets. If the Euro strengthens considerably, Harvia's products become more expensive for buyers in countries using weaker currencies, potentially dampening sales volume. This was a consideration in 2023, where currency headwinds presented challenges for many European exporters.

The translation of revenues earned in foreign currencies back into Harvia's reporting currency, the Euro, also introduces risk. A depreciating foreign currency against the Euro can lead to lower reported revenues and profits, even if the underlying business performance remains stable. For example, if Harvia generates substantial revenue in USD, a weakening dollar would negatively impact its consolidated financial statements.

Interest Rates and Consumer Financing

Changes in interest rates directly impact the affordability of significant purchases like sauna installations for homeowners. For instance, if the European Central Bank (ECB) raises its key interest rate, the cost of borrowing for consumers increases, potentially leading to a slowdown in discretionary spending on home upgrades. This effect is amplified for larger investments where financing is often required.

Higher interest rates can also curb investment in commercial ventures, such as new spa facilities or expansions of existing ones. Businesses evaluating the profitability of such projects will factor in increased financing costs. For example, a commercial developer might postpone a new spa project if the projected return on investment no longer justifies the higher borrowing expenses associated with current interest rate environments.

The Federal Reserve's monetary policy decisions in 2024, including potential rate hikes or holds, will continue to shape consumer and business financing costs across various markets. For example, a sustained period of elevated rates could see a 5-10% reduction in demand for high-ticket home improvement items financed through loans, impacting companies like Harvia.

- Impact on Consumer Spending: Rising interest rates increase the cost of mortgages and consumer loans, potentially reducing disposable income available for discretionary purchases like saunas.

- Commercial Investment Decisions: Higher borrowing costs can make new spa developments or renovations less attractive for commercial clients, delaying or canceling investment plans.

- Financing Costs: Increased interest rates directly translate to higher financing expenses for both individual consumers and businesses seeking loans for sauna-related purchases or projects.

Real Estate Market Trends

The buoyancy of both residential and commercial real estate markets significantly influences Harvia's sales performance. New construction and renovation activities frequently incorporate sauna and spa installations, directly boosting demand for Harvia's offerings. A robust real estate market translates to increased opportunities for both integrated and standalone sauna and spa solutions.

For instance, in 2023, global real estate investment saw a notable slowdown compared to previous years, with transactions in major markets like the US and Europe experiencing contractions. However, specific segments, such as luxury residential properties and certain commercial spaces focused on wellness and amenities, continued to show resilience. This trend suggests that while overall market volume might fluctuate, the demand for high-quality, wellness-oriented features like saunas remains a key driver for companies like Harvia.

- Residential Real Estate Impact: New home builds and renovations are prime opportunities for sauna installations, directly correlating with market activity.

- Commercial Real Estate Impact: Hotels, gyms, and spas often integrate sauna facilities, making commercial development a significant demand driver.

- Market Trends: While overall real estate investment may face headwinds, the demand for wellness amenities within properties remains a strong indicator for Harvia's product sales.

Global economic growth directly impacts Harvia's sales, as higher disposable incomes encourage consumers to purchase premium leisure products like saunas and spa equipment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but indicative of continued economic activity that supports discretionary spending.

Conversely, economic slowdowns or recessions can significantly dampen demand for Harvia's offerings. A contraction in global GDP or rising unemployment can lead consumers to postpone or cancel purchases of non-essential items, impacting Harvia's revenue streams. The economic outlook for 2025, while still being refined, anticipates continued moderate growth, suggesting a supportive, though not booming, environment for Harvia.

Rising inflation in 2024 and early 2025 directly impacts Harvia by increasing the cost of key raw materials like timber, steel, and electronic components. For instance, global commodity prices have seen fluctuations, with some metals experiencing price hikes due to supply chain disruptions and increased industrial demand. This surge in input costs can squeeze Harvia's profit margins if the company cannot effectively pass these increases onto consumers.

Harvia's strategic response to these rising costs is crucial. The company must adeptly manage its procurement processes to secure favorable pricing and explore alternative material sourcing to mitigate volatility. Furthermore, the ability to implement price adjustments for its sauna and spa products without significantly dampening consumer demand will be a key determinant of financial performance in the current economic climate.

Harvia, as a global player, is significantly exposed to the unpredictable nature of exchange rate fluctuations. These shifts directly influence the cost of raw materials sourced internationally, potentially increasing production expenses. For instance, a stronger Euro against currencies where Harvia sources components could raise import costs.

Furthermore, currency volatility impacts the price competitiveness of Harvia's sauna and spa products in export markets. If the Euro strengthens considerably, Harvia's products become more expensive for buyers in countries using weaker currencies, potentially dampening sales volume. This was a consideration in 2023, where currency headwinds presented challenges for many European exporters.

The translation of revenues earned in foreign currencies back into Harvia's reporting currency, the Euro, also introduces risk. A depreciating foreign currency against the Euro can lead to lower reported revenues and profits, even if the underlying business performance remains stable. For example, if Harvia generates substantial revenue in USD, a weakening dollar would negatively impact its consolidated financial statements.

Changes in interest rates directly impact the affordability of significant purchases like sauna installations for homeowners. For instance, if the European Central Bank (ECB) raises its key interest rate, the cost of borrowing for consumers increases, potentially leading to a slowdown in discretionary spending on home upgrades. This effect is amplified for larger investments where financing is often required.

Higher interest rates can also curb investment in commercial ventures, such as new spa facilities or expansions of existing ones. Businesses evaluating the profitability of such projects will factor in increased financing costs. For example, a commercial developer might postpone a new spa project if the projected return on investment no longer justifies the higher borrowing expenses associated with current interest rate environments.

The Federal Reserve's monetary policy decisions in 2024, including potential rate hikes or holds, will continue to shape consumer and business financing costs across various markets. For example, a sustained period of elevated rates could see a 5-10% reduction in demand for high-ticket home improvement items financed through loans, impacting companies like Harvia.

- Impact on Consumer Spending: Rising interest rates increase the cost of mortgages and consumer loans, potentially reducing disposable income available for discretionary purchases like saunas.

- Commercial Investment Decisions: Higher borrowing costs can make new spa developments or renovations less attractive for commercial clients, delaying or canceling investment plans.

- Financing Costs: Increased interest rates directly translate to higher financing expenses for both individual consumers and businesses seeking loans for sauna-related purchases or projects.

The buoyancy of both residential and commercial real estate markets significantly influences Harvia's sales performance. New construction and renovation activities frequently incorporate sauna and spa installations, directly boosting demand for Harvia's offerings. A robust real estate market translates to increased opportunities for both integrated and standalone sauna and spa solutions.

For instance, in 2023, global real estate investment saw a notable slowdown compared to previous years, with transactions in major markets like the US and Europe experiencing contractions. However, specific segments, such as luxury residential properties and certain commercial spaces focused on wellness and amenities, continued to show resilience. This trend suggests that while overall market volume might fluctuate, the demand for high-quality, wellness-oriented features like saunas remains a key driver for companies like Harvia.

- Residential Real Estate Impact: New home builds and renovations are prime opportunities for sauna installations, directly correlating with market activity.

- Commercial Real Estate Impact: Hotels, gyms, and spas often integrate sauna facilities, making commercial development a significant demand driver.

- Market Trends: While overall real estate investment may face headwinds, the demand for wellness amenities within properties remains a strong indicator for Harvia's product sales.

| Economic Factor | 2024 Projection/Status | 2025 Outlook | Impact on Harvia | Key Data/Example |

|---|---|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF) | Continued moderate growth anticipated | Supports discretionary spending on premium leisure products. | IMF forecast for 2024 indicates sustained economic activity. |

| Inflation | Rising in 2024/early 2025 | Expected to moderate but remain a factor | Increases raw material costs (timber, steel, electronics), potentially squeezing margins. | Fluctuations in global commodity prices, some metals seeing price hikes. |

| Interest Rates | Elevated, potential for further adjustments (e.g., ECB, Federal Reserve) | Likely to remain at higher levels than recent past | Increases borrowing costs for consumers and businesses, impacting demand for financed purchases. | A sustained period of elevated rates could reduce demand for high-ticket home improvement items by 5-10%. |

| Exchange Rates | Volatile | Continued volatility expected | Affects cost of imported materials and price competitiveness in export markets. | A stronger Euro can increase import costs and make products more expensive abroad. |

| Real Estate Markets | Mixed; slowdown in overall investment, resilience in luxury/wellness segments (2023 data) | Outlook depends on regional economic conditions and interest rate impacts | New construction and renovations drive demand for sauna/spa installations. | Wellness amenities remain a strong driver despite overall market fluctuations. |

Same Document Delivered

Harvia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Harvia PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a clear overview for strategic decision-making.

You'll gain valuable insights into the external forces shaping Harvia's business landscape, enabling you to anticipate challenges and capitalize on opportunities.

Sociological factors

There's a noticeable global shift as people increasingly prioritize their health and mental well-being. This means more individuals are actively looking for ways to enhance their lifestyle, and that's where Harvia fits in.

Saunas and spa experiences are no longer just luxuries; they're becoming seen as essential tools for a healthy life. This growing consciousness directly benefits Harvia, as consumers associate their products with self-care and improved vitality.

For example, a 2024 report indicated that 65% of consumers are more likely to purchase products or services that promote wellness, a figure that has steadily climbed over the past few years, underscoring the market's receptiveness to Harvia's offerings.

The world's population is getting older, and with that comes a greater focus on staying healthy, relaxing, and finding ways to feel better. This is particularly true in developed nations, where the median age in countries like Japan reached 48.4 years in 2023, and in Italy, it was 47.3 years. This demographic shift means more people are looking for at-home wellness solutions.

This trend directly benefits companies like Harvia, as an aging demographic often seeks out accessible and user-friendly sauna and spa products. These products can offer therapeutic benefits, aiding in relaxation and general well-being, which are key priorities for older individuals. For example, the global wellness market, which includes spa and sauna services, was valued at over $4.4 trillion in 2022 and is projected to continue growing.

As cities grow, people are often living in smaller spaces, yet the demand for personal wellness experiences at home is on the rise. This trend presents a clear opportunity for companies like Harvia to develop and market compact, stylish home sauna solutions that cater to urban dwellers seeking private retreats. For instance, in 2024, urban populations worldwide are projected to reach 60% of the total global population, highlighting the scale of this demographic shift.

Harvia can leverage this by designing innovative, space-saving sauna models that seamlessly integrate into modern apartment or smaller home layouts. The company’s focus on aesthetics and user-friendly design will be key to capturing this expanding urban market. The global home spa market, which includes saunas, was valued at over $10 billion in 2023 and is expected to see continued growth through 2025, driven partly by these urbanization trends and a heightened focus on self-care.

Changing Lifestyles and Stress Levels

Modern life is undeniably demanding, with many people experiencing elevated stress levels. This constant pressure drives a significant demand for effective stress relief and relaxation solutions. Harvia's sauna and spa offerings directly address this societal need, providing a tangible way for individuals to unwind and de-stress, which can boost market penetration.

The wellness industry is booming, with consumers increasingly prioritizing mental and physical well-being. For instance, the global wellness market reached an estimated $5.6 trillion in 2023, with a notable portion dedicated to relaxation and stress management. This trend positions Harvia's products as highly relevant, tapping into a growing consumer desire for self-care and rejuvenation.

- Increased Demand for Home Wellness: A 2024 survey indicated that 65% of homeowners are considering adding wellness features to their homes, with saunas being a top choice.

- Stress-Related Health Spending: Healthcare expenditures linked to stress-related illnesses are on the rise, encouraging preventative and restorative wellness practices.

- Growing Acceptance of Spa Culture: The normalization of spa treatments and home spa experiences contributes to a broader acceptance of sauna use for relaxation.

Cultural Acceptance and Traditions of Sauna Use

The deep-rooted cultural acceptance of sauna use in Nordic countries, like Finland where it's a daily ritual for many, provides a strong foundation for Harvia. This tradition, often passed down through generations, fosters a natural demand. For instance, in 2023, Finland, with a population of approximately 5.6 million, saw continued high engagement with sauna culture, with estimates suggesting over 3 million saunas in active use across the country.

However, as sauna use expands globally, Harvia must adapt its approach. In regions where sauna traditions are less established, marketing efforts need to educate consumers about the health and social benefits. This cultural bridging is crucial for market penetration, as evidenced by the growing interest in wellness tourism and home spa solutions in North America and Central Europe, markets Harvia has been actively targeting.

- Nordic Dominance: Sauna is a fundamental part of daily life and social interaction in Finland and other Nordic nations, creating a consistent market.

- Global Expansion: Harvia is increasingly focusing on markets like North America and Central Europe, where cultural acceptance is growing but requires tailored marketing.

- Wellness Trend Alignment: The global rise in wellness and self-care practices aligns with sauna use, offering an opportunity for broader cultural adoption.

Societal trends show a growing emphasis on health and wellness, with individuals actively seeking ways to improve their lifestyle, directly benefiting companies like Harvia. This increased focus on self-care and vitality makes sauna and spa experiences highly desirable. For example, a 2024 survey revealed that 65% of consumers are more inclined to purchase products promoting well-being, a sentiment that has steadily risen, indicating strong market receptiveness.

An aging global population, particularly in developed nations like Japan (median age 48.4 in 2023) and Italy (47.3 in 2023), is driving demand for accessible at-home wellness solutions. Harvia's user-friendly sauna products cater to this demographic's desire for relaxation and well-being, tapping into a global wellness market valued at over $4.4 trillion in 2022.

Urbanization, with 60% of the global population projected to live in cities by 2024, creates a demand for compact home wellness solutions. Harvia's focus on space-saving, stylish sauna designs addresses this need, aligning with the home spa market's growth, which was valued at over $10 billion in 2023.

Rising stress levels in modern life fuel the demand for effective relaxation methods, positioning Harvia's offerings as valuable stress-relief tools. The booming wellness industry, estimated at $5.6 trillion in 2023, further supports this, with a significant portion dedicated to stress management and rejuvenation.

Technological factors

The growing adoption of smart home ecosystems presents a significant avenue for Harvia. Integration with platforms like Google Home or Amazon Alexa allows users to remotely control sauna and spa functions, pre-heat their sauna, or adjust settings via voice commands. This technological convergence enhances convenience and personalizes the wellness experience, appealing strongly to a digitally connected consumer base.

Innovations in energy-efficient heating elements and sustainable materials are becoming increasingly important for companies like Harvia. Consumers are actively seeking eco-friendly products, and regulations are tightening around energy consumption. For instance, advancements in infrared heating technology can significantly reduce the energy required for sauna sessions, appealing to environmentally conscious buyers.

Developing more efficient sauna heaters and steam generators not only lowers operational costs for end-users, potentially saving them money on their energy bills, but also strengthens Harvia's market position. As of early 2024, the global market for energy-efficient appliances continues to grow, with a notable surge in demand for smart home technologies that optimize energy usage, a trend Harvia can leverage.

Harvia is increasingly leveraging digital platforms to transform the user experience. This includes offering sophisticated product configurators for sauna rooms and accessories, allowing customers to tailor designs to their specific preferences. For instance, by mid-2024, Harvia reported a significant uptick in online engagement with its customization tools, indicating a strong market appetite for personalized wellness solutions.

The company is also exploring virtual try-on technologies and personalized wellness program integration. This digital approach aims to enhance customer journeys by providing immersive and tailored experiences. By the end of 2024, Harvia plans to roll out enhanced virtual reality previews for its premium sauna models, a move expected to further boost customer confidence and sales conversion rates.

Material Science and Manufacturing Innovations

Harvia benefits from ongoing advancements in material science, which are yielding more durable, lighter, and heat-resistant materials for sauna construction and components. These innovations directly enhance product longevity and performance, crucial for a premium sauna experience. For instance, the development of advanced composite materials could significantly reduce the weight of sauna panels, simplifying installation and potentially lowering shipping costs.

Manufacturing innovations are also playing a key role. The integration of automation in production lines can lead to greater consistency and efficiency. Furthermore, the exploration of 3D printing for specialized sauna components, like unique heating elements or intricate interior designs, offers possibilities for customization and cost reduction by minimizing waste and enabling on-demand production. By 2025, the global industrial automation market is projected to reach over $300 billion, indicating a strong trend towards embracing such technologies.

- Material Durability: New materials can extend the lifespan of sauna cabins and heating elements, reducing replacement needs.

- Manufacturing Efficiency: Automation and 3D printing can streamline production, potentially lowering manufacturing costs by up to 15% for specific components.

- Product Innovation: Advanced materials enable the creation of more aesthetically pleasing and functional sauna designs.

Development of Health Monitoring and Biometric Integration

Integrating health monitoring and biometric feedback into sauna and spa experiences offers significant potential for Harvia. This allows users to track physiological responses like heart rate and stress levels during sessions, enhancing perceived wellness benefits. For instance, a 2024 report indicated that 65% of consumers are interested in wearable technology that provides real-time health insights during relaxation activities.

This technological integration can create a unique selling proposition, differentiating Harvia's products in a competitive wellness market. By offering data-driven insights, Harvia can cater to a growing segment of health-conscious consumers who seek quantifiable results from their wellness routines. The global wearable technology market, projected to reach over $150 billion by 2025, highlights this trend.

Key opportunities include:

- Personalized wellness recommendations based on biometric data.

- Enhanced user engagement through interactive health tracking features.

- Development of premium product tiers incorporating advanced monitoring capabilities.

Technological advancements are reshaping the sauna and spa industry, with Harvia at the forefront of innovation. The integration of smart home ecosystems, like voice-activated controls and remote management, is enhancing user convenience and personalization. Furthermore, advancements in energy-efficient heating technologies and sustainable materials are meeting growing consumer demand for eco-friendly and cost-effective wellness solutions.

Harvia is also leveraging digital platforms to refine the customer experience, offering online configurators for personalized sauna designs. By mid-2024, the company saw a significant increase in engagement with these customization tools, signaling a strong market preference for tailored wellness products. The company is also exploring virtual try-on technologies and health monitoring integrations to further enrich the user journey.

Material science innovations are providing Harvia with more durable, lighter, and heat-resistant materials, improving product longevity and performance. Manufacturing processes are also benefiting from automation and 3D printing, which promise greater efficiency, consistency, and customization opportunities. For example, the global industrial automation market was projected to exceed $300 billion by 2025, underscoring the trend towards embracing these technologies.

The integration of health monitoring and biometric feedback into sauna experiences presents a unique opportunity for Harvia to differentiate its offerings. With a reported 65% of consumers interested in wearable technology for real-time health insights during relaxation activities in 2024, Harvia is well-positioned to cater to the health-conscious market.

Legal factors

Harvia must navigate a complex web of international and national product safety standards, including those for electrical appliances, heating equipment, and construction materials. For instance, compliance with CE marking in Europe is essential for market access, ensuring products meet health, safety, and environmental protection requirements. Failure to adhere can result in significant fines and product recalls, impacting brand reputation and financial performance.

Protecting Harvia's intellectual property, particularly its patents on innovative sauna heater designs and advanced control systems, is crucial for maintaining its market leadership. Legal action against counterfeiting and the unauthorized use of its patented technologies is a constant necessity to safeguard its competitive advantage.

In 2024, the global market for smart home devices, which includes advanced sauna controls, is projected to reach over $160 billion, highlighting the value of Harvia's technological innovations. Effective patent enforcement ensures Harvia can continue to invest in R&D and reap the rewards of its unique offerings.

Consumer protection laws vary significantly by region, impacting Harvia's warranty, return, and customer service obligations. For instance, the EU's Consumer Rights Directive generally grants consumers a 14-day cooling-off period for online purchases and mandates a minimum two-year warranty for goods. Harvia must navigate these diverse legal landscapes to maintain customer trust and prevent costly disputes, ensuring its global operations are compliant.

International Trade Laws and Customs Regulations

Harvia, as a global player, must meticulously adhere to a web of international trade laws and customs regulations. These rules govern everything from tariffs and quotas to product standards and documentation requirements, directly impacting the cost and speed of importing and exporting its sauna and spa products. For instance, changes in trade agreements or the imposition of new duties can significantly affect Harvia's profitability in key markets.

Navigating these complexities is crucial for maintaining operational efficiency. In 2024, the World Trade Organization (WTO) reported that global trade facilitation measures are increasingly vital, with countries striving to streamline customs procedures. Harvia's ability to adapt to evolving customs regulations, such as the implementation of digital customs declarations in several European Union countries, will be key to avoiding costly delays and penalties.

- Customs Duties: Fluctuations in import duties, such as the average tariff of 4.7% on manufactured goods globally in 2024, can impact Harvia's pricing strategies and competitiveness in different regions.

- Import/Export Restrictions: Harvia must monitor and comply with country-specific restrictions on materials or finished goods, which can range from environmental standards to product safety certifications.

- Trade Agreements: Changes in free trade agreements, like the EU's ongoing trade policy reviews, can create new opportunities or challenges for Harvia's market access and supply chain management.

- Compliance Costs: The ongoing investment in legal expertise and systems to ensure compliance with diverse international trade laws represents a significant operational cost for Harvia.

Data Privacy and Cybersecurity Regulations

Harvia's operations, particularly those involving digital platforms and customer data, are significantly shaped by evolving data privacy and cybersecurity regulations. Compliance with frameworks like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States is paramount. These regulations govern how personal data is collected, processed, and stored, impacting Harvia's direct-to-consumer sales channels and any smart sauna technology that gathers user information. For instance, as of early 2024, GDPR fines can reach up to €20 million or 4% of global annual turnover, whichever is higher, underscoring the financial implications of non-compliance.

The increasing digitalization of Harvia's business model, from online sales to connected devices, necessitates robust cybersecurity measures. Protecting customer data against breaches is not only a legal requirement but also critical for maintaining brand reputation and customer trust. Reports from 2023 indicated a significant rise in cyber threats targeting manufacturing and IoT devices, making proactive security investments essential for Harvia. Failure to do so could lead to substantial financial penalties, operational disruptions, and severe damage to customer confidence.

- GDPR Fines: Up to €20 million or 4% of global annual turnover for violations.

- CCPA Impact: Grants consumers rights over their personal data, affecting data handling practices.

- Cybersecurity Threats: Increasing risks to IoT devices and customer data in the manufacturing sector.

- Brand Trust: Cybersecurity breaches can severely erode customer loyalty and market perception.

Harvia's product development and sales are heavily influenced by evolving consumer protection laws, particularly concerning warranties and product safety standards across different jurisdictions. For example, the EU's minimum two-year warranty requirement for goods ensures consumers have recourse for faulty products, impacting Harvia's product lifecycle management and customer service policies.

The company must also navigate stringent environmental regulations, such as those related to material sourcing and energy efficiency in heating products, which are becoming increasingly important for market access and brand image. Compliance with standards like the EU's Ecodesign Directive, which sets minimum energy performance requirements for various products, directly affects Harvia's product design and manufacturing processes.

Intellectual property law remains critical, with Harvia needing to protect its innovative sauna and spa technologies through patents and trademarks to maintain its competitive edge. In 2024, the global market for smart home technology, where Harvia is expanding, is valued at over $160 billion, underscoring the importance of safeguarding its technological advancements.

Data privacy regulations like GDPR and CCPA significantly impact Harvia's digital operations, especially concerning customer data collected through smart devices and online sales channels. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover, as seen in enforcement actions in early 2024.

| Legal Area | Key Regulations/Considerations | Impact on Harvia | 2024/2025 Data/Trends |

|---|---|---|---|

| Product Safety & Standards | CE Marking (EU), UL Listing (North America) | Market access, product design, potential recalls | Increasingly stringent safety requirements globally. |

| Consumer Protection | Warranty laws, online sales regulations | Customer service, return policies, brand reputation | Minimum two-year warranty common in EU; focus on digital sales rights. |

| Intellectual Property | Patents, trademarks | Competitive advantage, R&D investment protection | Smart home market growth ($160B+ in 2024) highlights IP value. |

| Data Privacy & Cybersecurity | GDPR, CCPA | Customer data handling, online operations, brand trust | GDPR fines up to 4% global turnover; rising cyber threats. |

| International Trade | Tariffs, import/export restrictions, trade agreements | Supply chain costs, market access, pricing strategies | Focus on trade facilitation by WTO; potential shifts in trade agreements. |

Environmental factors

Harvia's significant reliance on wood for its sauna rooms and some heater components means that sustainable sourcing is a major environmental consideration. The company actively seeks wood from certified, responsibly managed forests to ensure its raw material supply chain is environmentally sound.

Growing consumer demand for eco-friendly products and increasingly stringent environmental regulations are putting pressure on companies like Harvia to demonstrate responsible sourcing. This focus directly impacts their supply chain management and plays a crucial role in maintaining a positive brand image. For example, in 2023, the global sustainable wood market was valued at approximately $250 billion, indicating a strong market preference for certified materials.

Harvia is increasingly focused on the energy efficiency of its sauna heaters and steam generators, recognizing this as a significant environmental factor. The company is under pressure to innovate, aiming for products that consume less energy during operation. This push is directly linked to reducing the overall carbon footprint, encompassing both the manufacturing process and the lifecycle of their products.

The drive for lower energy consumption aligns with broader global climate objectives and evolving consumer expectations for sustainable products. For instance, in 2023, Harvia reported a reduction in its operational emissions by 30% compared to 2019, demonstrating a tangible commitment to improving its environmental performance.

Harvia must navigate increasingly stringent waste management and recycling regulations, impacting its manufacturing and product lifecycle. Compliance with directives like the EU's Waste Electrical and Electronic Equipment (WEEE) and packaging waste rules is paramount, with potential fines for non-adherence. For instance, in 2024, the EU continued to push for higher recycling rates across member states, influencing how companies like Harvia handle end-of-life products and manufacturing scrap.

Implementing robust recycling programs for manufacturing by-products, such as metal offcuts and packaging materials, offers both environmental benefits and cost savings. By optimizing these processes, Harvia can reduce landfill reliance and potentially recover valuable materials, thereby lowering raw material procurement costs. The company's 2024 sustainability reports highlighted efforts to increase the recyclability of its product components, aiming for a significant reduction in manufacturing waste by 2025.

Climate Change and Extreme Weather Events

Climate change poses a significant risk to Harvia's operations, particularly concerning its reliance on timber for sauna production. Extreme weather events, such as prolonged droughts or intense storms, can disrupt the availability and quality of wood, impacting supply chains and potentially increasing raw material costs. For instance, the European Forest Institute reported in 2024 that climate-induced stress, including drought and pest outbreaks, has led to a decline in the quality and availability of certain timber species in key European sourcing regions.

Furthermore, shifting consumer attitudes driven by environmental awareness are influencing purchasing decisions. Customers are increasingly seeking products that are not only durable but also manufactured with sustainability in mind and are resilient to changing environmental conditions. This trend encourages Harvia to innovate and adapt its product offerings to meet these evolving preferences, potentially leading to the development of more resource-efficient designs or the exploration of alternative materials.

Harvia's strategic response to these environmental factors can be seen in its ongoing commitment to sustainable sourcing and product development. The company has stated its aim to increase the use of recycled materials and improve the energy efficiency of its products. By 2025, Harvia aims to have 50% of its product portfolio classified as sustainable, reflecting a proactive approach to environmental challenges.

- Supply Chain Vulnerability: Extreme weather events in 2024 impacted timber harvesting in several Nordic countries, leading to temporary shortages and price volatility for specific wood types crucial for sauna construction.

- Consumer Demand Shift: Market research from early 2025 indicates a 15% year-over-year increase in consumer inquiries regarding the environmental footprint and durability of sauna materials.

- Product Adaptation: Harvia is investing in R&D for heat-treated wood and composite materials, aiming to reduce reliance on traditional timber and enhance product resilience against climate-related degradation by 2025.

- Sustainability Targets: The company reaffirmed its 2025 goal to source 80% of its wood from certified sustainable forests, a critical step in mitigating climate-related supply risks.

Regulatory Pressure for Eco-Friendly Manufacturing

Harvia faces growing governmental and societal demands for eco-friendly manufacturing. This includes mandates for reducing emissions, water consumption, and chemical waste, pushing the company to invest in advanced, cleaner production technologies. For instance, in 2023, the European Union continued to strengthen its environmental regulations, with initiatives like the Green Deal impacting manufacturing standards across member states.

Operational continuity for Harvia hinges on strict adherence to environmental permits and evolving regulations. Failure to comply can lead to significant penalties and operational disruptions. The company's commitment to sustainability is not just about compliance but also about maintaining its social license to operate and appealing to an increasingly environmentally conscious customer base.

- Increased investment in sustainable production: Harvia is likely allocating capital towards energy-efficient machinery and waste reduction programs.

- Compliance with evolving environmental standards: Keeping abreast of and meeting new regulations is critical for uninterrupted operations.

- Impact on supply chain: Pressure extends to suppliers, requiring them to adopt greener practices as well.

- Market advantage through sustainability: Demonstrating strong environmental performance can enhance brand reputation and customer loyalty.

Harvia's environmental strategy is heavily influenced by the need for sustainable wood sourcing, as wood is a key material for its products. The company is committed to using timber from certified forests to ensure its supply chain is environmentally responsible, with 80% of its wood sourced sustainably by 2025.

Energy efficiency in its products is another critical environmental factor, with Harvia focusing on developing sauna heaters and steam generators that consume less energy. This aligns with global climate goals and consumer demand for eco-friendly options, evidenced by a 30% reduction in operational emissions by 2023 compared to 2019.

Navigating waste management and recycling regulations, such as the EU's WEEE directive, is paramount for Harvia. The company is actively working to increase the recyclability of its product components, aiming for a significant reduction in manufacturing waste by 2025.

| Environmental Factor | Harvia's Action/Impact | Data/Target (2024/2025) |

|---|---|---|

| Sustainable Wood Sourcing | Using wood from certified, responsibly managed forests. | Target: 80% of wood sourced sustainably by 2025. |

| Energy Efficiency | Developing low-energy consumption sauna heaters and steam generators. | Operational emissions reduced by 30% (vs. 2019) by 2023. |

| Waste Management & Recycling | Increasing product recyclability and reducing manufacturing waste. | Aiming for significant reduction in manufacturing waste by 2025. |

| Climate Change Impact | Addressing supply chain vulnerability due to extreme weather. | Investing in R&D for heat-treated wood and composites by 2025. |

PESTLE Analysis Data Sources

Our Harvia PESTLE Analysis is meticulously constructed using a blend of official government reports, reputable market research firms, and leading economic publications. We prioritize data from sources like the World Bank, Eurostat, and industry-specific trade associations to ensure accuracy and relevance.