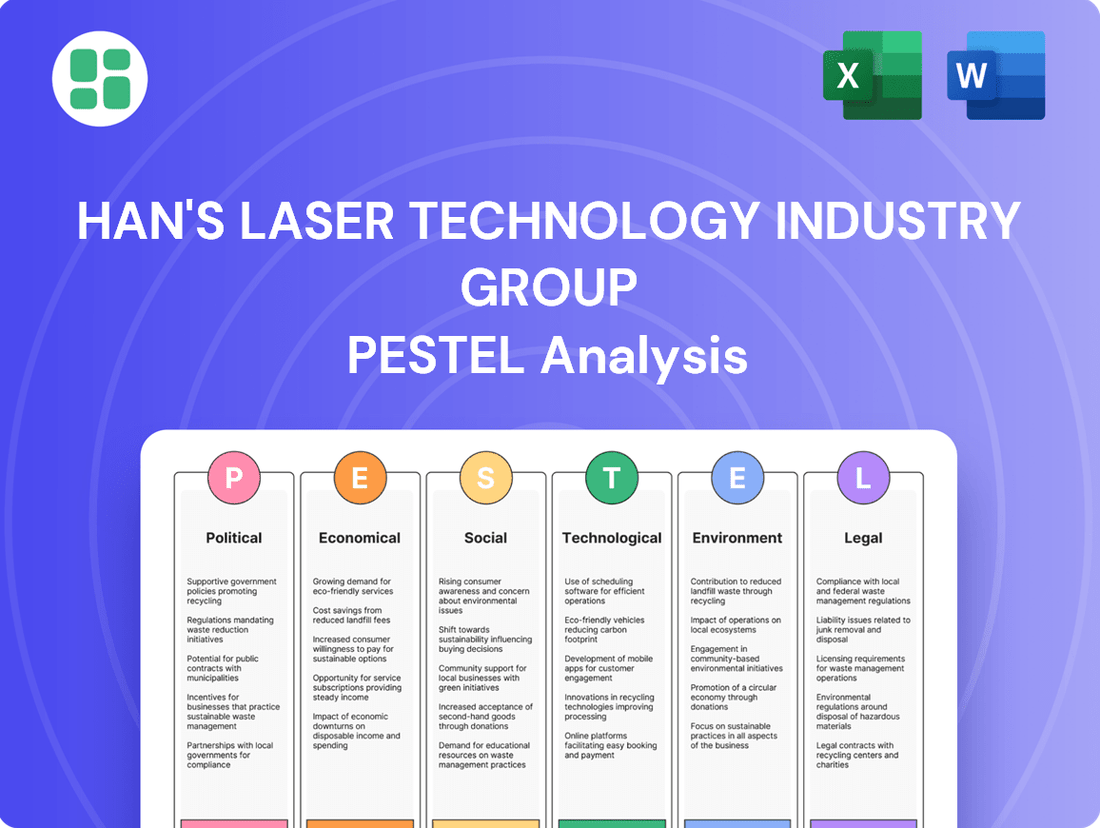

Han's Laser Technology Industry Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Han's Laser Technology Industry Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Han's Laser Technology Industry Group. Our comprehensive PESTLE analysis provides actionable insights into market dynamics and future opportunities. Download the full version now to gain a competitive edge and make informed strategic decisions.

Political factors

China's strategic push for 'new quality productive forces,' a key initiative from 2023 and a major focus in 2024, champions technological advancement and the modernization of its manufacturing base. This national directive is designed to elevate traditional industries into more intelligent, sustainable, and productive systems, creating a fertile ground for companies like Han's Laser to thrive with government backing and a supportive ecosystem.

The government's dedication to fostering advanced manufacturing and smart factories, backed by substantial infrastructure investments, directly stimulates demand for automated solutions. For instance, China's industrial robot installations saw a significant increase, reaching over 700,000 units in 2023, a trend expected to continue as the 'new quality productive forces' initiative gains momentum in 2024 and beyond, benefiting laser technology providers.

Geopolitical shifts, particularly ongoing trade tensions between the U.S. and China, directly affect Han's Laser's global operations. These conflicts can disrupt supply chains and limit access to critical technologies, forcing a strategic pivot towards greater self-reliance.

China's push for technological independence, epitomized by the "new quality productive forces" initiative, underscores the need for Han's Laser to bolster its domestic supply chains. This aligns with the increasing adoption of "Local for Local" strategies within China's industrial automation sector, a trend driven by these very geopolitical pressures.

China's industrial policies, particularly the ongoing emphasis on domestic automation under initiatives like Made in China 2025, directly support companies like Han's Laser. These policies encourage the adoption and development of Chinese-made robots and equipment, creating a favorable environment for Han's Laser's growth and market penetration in automation solutions.

The drive for localization, a key component of these industrial policies, means that Han's Laser, as a domestic leader, is well-positioned to capitalize on government incentives. This focus on local content also spurs increased competition, compelling both domestic and international automation providers to adapt their strategies, often by increasing their local manufacturing and R&D presence within China to stay competitive.

Intellectual Property Protection Enforcement

China's intensified focus on intellectual property (IP) protection in 2024, marked by robust enforcement and international standard alignment, creates a more secure landscape for innovation. This commitment is evidenced by efforts to speed up patent examinations and actively prosecute infringement cases, directly benefiting companies like Han's Laser. The growing number of valid invention patents held by Chinese enterprises further highlights this positive development.

Key aspects of China's IP protection enforcement include:

- Strengthened Enforcement: A significant increase in legal actions against IP infringement cases in 2024.

- Expedited Processes: Streamlined patent examination procedures to accelerate innovation cycles.

- International Alignment: Efforts to harmonize Chinese IP laws and practices with global benchmarks.

- Growth in Patents: A rise in the number of valid invention patents demonstrates increased R&D output and protection.

Regulatory Stability and Business Environment

The Chinese government's emphasis on high-quality development offers a stable foundation for advanced manufacturing like Han's Laser. However, the dynamic nature of Chinese economic policy means rapid shifts or stricter enforcement can still impact the market. For instance, in 2024, China continued its drive towards technological self-sufficiency, which could lead to both opportunities and regulatory adjustments for companies in the advanced equipment sector.

Han's Laser must remain vigilant, closely tracking evolving regulations to ensure full compliance and adapt its strategic planning. This is particularly crucial as China fine-tunes its industrial transformation objectives, aiming to upgrade its manufacturing capabilities. The nation's commitment to innovation, as evidenced by its significant R&D spending, which reached an estimated 2.64% of GDP in 2023, underscores the importance of staying ahead of policy curves.

- Regulatory Stability: The Chinese government's focus on upgrading its industrial base provides a generally supportive, though evolving, regulatory environment for high-tech manufacturers.

- Policy Agility: Businesses must be prepared for potential rapid policy changes or intensified enforcement actions that can influence market dynamics.

- Strategic Adaptation: Continuous monitoring of regulatory shifts is essential for Han's Laser to maintain compliance and adjust its business strategies effectively.

- Economic Transformation: China's ongoing economic restructuring and industrial upgrading initiatives create a landscape where proactive adaptation to new policies is paramount.

China's national strategy to develop 'new quality productive forces' heavily favors technological advancement and manufacturing modernization, directly benefiting Han's Laser. This directive, a major focus in 2024, aims to upgrade industries, creating a supportive ecosystem for companies in advanced automation. Geopolitical tensions, particularly US-China trade friction, necessitate a pivot towards domestic self-reliance and localized supply chains, a trend Han's Laser is well-positioned to leverage.

The government's commitment to fostering advanced manufacturing and smart factories, supported by significant infrastructure investment, directly fuels demand for automated solutions. China's industrial robot installations surpassed 700,000 units in 2023, with this growth expected to continue as the 'new quality productive forces' initiative gains traction in 2024 and beyond.

| Policy/Factor | Impact on Han's Laser | Supporting Data (2023/2024 Focus) |

|---|---|---|

| 'New Quality Productive Forces' Initiative | Government support for technological advancement and manufacturing upgrades. | China's R&D spending estimated at 2.64% of GDP in 2023. |

| Geopolitical Tensions (US-China) | Drives need for domestic self-reliance and localized supply chains. | Increased adoption of 'Local for Local' strategies in China's automation sector. |

| Industrial Policies (e.g., Made in China 2025) | Encourages adoption of Chinese-made automation equipment. | Favorable environment for Han's Laser's growth and market penetration. |

| Intellectual Property (IP) Protection | Creates a more secure landscape for innovation and R&D. | Strengthened enforcement and expedited patent examination processes in 2024. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Han's Laser Technology Industry Group, providing a comprehensive understanding of its operating landscape.

It offers actionable insights for strategic decision-making by highlighting key external influences and their potential ramifications for the company's future growth and stability.

Offers a clear, actionable PESTLE analysis of Han's Laser Technology Industry Group, transforming complex external factors into manageable insights to alleviate strategic planning pain points.

Provides a structured framework to identify and address potential external challenges and opportunities, thereby relieving the pressure of navigating an unpredictable global market for Han's Laser.

Economic factors

Han's Laser's performance is intrinsically linked to the economic vitality of its core sectors, such as electronics, automotive, and aerospace. While the global industrial lasers market anticipates robust expansion, China's broader automation market saw a contraction in 2024, attributed to subdued demand and supply-side disruptions.

Despite a reported net income rebound in 2024, Han's Laser experienced a revenue and net profit dip in 2023. This downturn stemmed from a sluggish consumer electronics sector and challenges within the printed circuit board (PCB) industry.

The industrial automation market in China, a crucial area for Han's Laser, is evolving with Industry 4.0, but it faced a slowdown in 2024. However, the sector is anticipated to see strong expansion ahead, supported by government backing for advanced manufacturing and increasing labor expenses that boost automation's appeal.

Government initiatives like the "Made in China 2025" strategy continue to prioritize high-tech manufacturing, directly benefiting companies like Han's Laser that provide smart factory solutions. This push is expected to drive significant investment in automation technologies throughout 2025 and beyond.

Rising labor costs in China, which saw average wages increase by approximately 7% in 2024 according to various reports, make the return on investment for automated systems increasingly attractive for manufacturers. This economic pressure is a key driver for the adoption of flexible manufacturing systems and advanced robotics.

Global supply chain disruptions, a persistent issue throughout 2023 and into 2024, have significantly impacted the industrial automation market. These disruptions, stemming from geopolitical tensions and lingering pandemic effects, have forced manufacturers to re-evaluate their inventory strategies, often leading to increased holding costs and production pressures. For Han's Laser, a global player, navigating these volatile conditions is crucial for maintaining stable production and competitive pricing in a market that saw average lead times for critical components extend by up to 20% in late 2023.

The strategic imperative for supply chain localization within China, driven by evolving geopolitical landscapes, presents both opportunities and challenges for Han's Laser. This trend aims to mitigate risks associated with international trade and ensure greater material availability. By fostering domestic supplier relationships, the company can potentially reduce transportation costs and lead times, thereby enhancing its cost management and overall operational efficiency in the dynamic Chinese market.

Investment in High-Tech Industries

Investment in China's high-tech industries is experiencing a significant upswing, with a notable year-on-year increase observed in 2024. This acceleration is largely fueled by the government's push for 'new quality productive forces,' directing substantial capital into critical sectors like advanced manufacturing and integrated circuits. These are precisely the areas where Han's Laser Technology Industry Group's advanced laser equipment and automation solutions are in high demand.

This robust investment environment translates into strong market opportunities for Han's Laser. For instance, in 2024, China's R&D spending as a percentage of GDP was projected to reach approximately 2.6%, a figure that underscores the nation's commitment to technological advancement. This commitment directly benefits companies like Han's Laser, which are integral to the supply chain for these burgeoning high-tech fields.

- Accelerated Growth: China's high-tech sector saw a significant year-on-year investment increase in 2024, driven by the 'new quality productive forces' initiative.

- Targeted Sectors: Capital is flowing into advanced manufacturing and integrated circuits, key markets for Han's Laser's offerings.

- Demand Driver: This investment surge creates a favorable demand environment for laser equipment and automation solutions.

- R&D Focus: China's commitment to R&D, with spending around 2.6% of GDP in 2024, supports the ecosystem Han's Laser operates within.

Currency Fluctuations and Export Competitiveness

Currency fluctuations significantly impact Han's Laser's export competitiveness. A stronger Chinese Yuan makes its products more expensive for international buyers, potentially reducing demand. Conversely, a weaker Yuan can boost export sales by making Han's Laser's offerings more attractive on the global market.

The Yuan's performance against major currencies like the US Dollar and Euro directly affects the cost of imported components and the final pricing of its laser equipment overseas. For instance, if the Yuan strengthens considerably, the cost of raw materials or specialized parts sourced internationally could rise, squeezing profit margins unless passed on to customers.

- Yuan Performance: As of late 2024, the Chinese Yuan has shown some volatility against the US Dollar, influenced by global economic trends and trade policies.

- Impact on Pricing: A 5% appreciation of the Yuan against the USD could effectively increase the cost of Han's Laser products by 5% for American buyers, assuming no other price adjustments.

- Component Costs: For components priced in USD, a stronger Yuan reduces the Yuan-denominated cost for Han's Laser, potentially improving margins if sales prices remain stable in foreign currency terms.

China's economic landscape in 2024 presented a mixed picture for Han's Laser. While the nation's commitment to technological advancement, evidenced by a projected 2.6% of GDP allocated to R&D in 2024, fuels demand for automation, the broader industrial automation market experienced a slowdown. This was partly due to subdued consumer electronics demand and supply chain disruptions that impacted lead times for critical components by up to 20% in late 2023.

Rising labor costs, estimated at a 7% increase in average wages in China during 2024, continue to make automation solutions like those offered by Han's Laser increasingly attractive. This economic pressure, coupled with government support for advanced manufacturing through initiatives like Made in China 2025, creates a strong long-term growth environment.

Currency fluctuations also play a significant role, with the Yuan's volatility in late 2024 impacting export competitiveness. A 5% appreciation of the Yuan against the USD, for example, could increase product costs for American buyers, while simultaneously reducing the Yuan-denominated cost of USD-priced components for Han's Laser.

| Economic Factor | 2023 Performance | 2024 Outlook/Data | Impact on Han's Laser |

|---|---|---|---|

| Industrial Automation Market (China) | Sluggish | Anticipated strong expansion, despite 2024 slowdown | Mixed; slowdown impacts immediate demand, but long-term growth drivers are positive. |

| Consumer Electronics Sector | Sluggish | Continued subdued demand | Reduced demand for laser processing equipment in this key sector. |

| Labor Costs (China) | Increasing | Approx. 7% annual increase | Increases attractiveness of automation solutions, driving demand. |

| R&D Spending (China) | Increasing | Projected ~2.6% of GDP | Supports ecosystem for high-tech manufacturing and laser technology. |

| Chinese Yuan (vs USD) | Volatile | Late 2024 volatility | Affects export pricing and imported component costs. |

Full Version Awaits

Han's Laser Technology Industry Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Han's Laser Technology Industry Group covers Political, Economic, Social, Technological, Legal, and Environmental factors crucial for understanding its market landscape. It provides actionable insights into the opportunities and threats influencing the company's strategic decisions.

Sociological factors

Rising labor costs in China are a major catalyst for automation adoption. For instance, average wages for manufacturing workers in China saw a notable increase, contributing to a more significant portion of production expenses. This economic pressure compels businesses to explore automated solutions to remain cost-competitive.

Simultaneously, potential labor shortages, especially in skilled manufacturing roles, further fuel the demand for automation. Companies are finding it increasingly difficult to secure a sufficient workforce, pushing them towards robotic and automated systems to ensure consistent production output and operational continuity.

Han's Laser Technology Industry Group is well-positioned to capitalize on this trend. Their advanced laser processing and integrated automation solutions directly address the need for efficiency and reliability in manufacturing environments facing these labor-related challenges.

The increasing sophistication of laser technology and automation means Han's Laser needs a workforce adept at operating, maintaining, and developing these advanced systems. This demand for specialized skills is a critical consideration.

While China's focus on industrial upgrading is a positive trend, the availability of human capital with cutting-edge technical expertise could present a bottleneck. For instance, reports from early 2024 indicated a growing gap in highly skilled manufacturing roles across various industries in China.

To mitigate this, Han's Laser might strategically invest in comprehensive internal training initiatives or forge partnerships with universities and vocational schools. This proactive approach would help secure a consistent pipeline of qualified talent, essential for sustaining the company's innovation and expansion objectives through 2025.

Societal acceptance of automation and AI is a significant driver for Han's Laser. China's government actively promotes smart manufacturing and Industry 4.0, fostering a positive environment for advanced technologies. This push has led to a cultural embrace of digitalization, making AI and data-centric solutions increasingly common in both daily life and industrial operations.

This receptiveness translates into a strong market demand for intelligent equipment like that offered by Han's Laser. For instance, the adoption of industrial robots in China surged by 20% in 2023, reaching over 900,000 units installed, signaling a clear societal and industrial inclination towards automation.

Consumer Preferences for High-Quality Products

The global and Chinese economies are increasingly emphasizing high-quality development, directly fueling consumer demand for superior products. This trend means consumers are less willing to compromise on quality, seeking out goods that are durable, efficient, and precisely manufactured. For instance, the automotive sector in China saw a significant push towards higher standards, with a growing segment of consumers prioritizing advanced features and build quality in their vehicle purchases during 2024.

Laser technology is at the forefront of enabling this shift. Its inherent precision and efficiency allow manufacturers to achieve tolerances and finishes that are simply not possible with traditional methods. This capability is crucial for producing everything from sophisticated electronics to high-performance components in industries like aerospace and medical devices. Han's Laser's advanced laser processing solutions are perfectly positioned to capitalize on this by providing the tools necessary for this enhanced production.

Han's Laser's ability to deliver cutting-edge laser processing directly addresses these evolving consumer preferences. By enabling manufacturers to create more precise, reliable, and aesthetically pleasing products, Han's Laser supports the production of goods that meet and exceed modern consumer expectations across a wide array of industries.

- Growing Demand for Precision: As consumer expectations for product longevity and performance rise, the demand for precision manufacturing techniques, like laser processing, escalates.

- Laser Technology's Role: Laser technology provides unparalleled accuracy and efficiency, crucial for meeting the stringent quality requirements of today's discerning consumers.

- Market Alignment: Han's Laser's offerings align with the global and Chinese focus on high-quality development, enabling businesses to produce superior goods that resonate with consumer preferences.

Urbanization and Industrial Concentration

China's ongoing urbanization, particularly in the Pearl River Delta and Yangtze River Delta regions, has created dense industrial clusters. These hubs, such as Shenzhen and Shanghai, concentrate manufacturing activities, offering Han's Laser Technology Industry Group proximity to a vast customer base and a readily available pool of skilled labor. For instance, by the end of 2023, China's urbanization rate reached approximately 66.16%, indicating continued migration to urban centers and the expansion of industrial zones.

This concentration of industries directly benefits suppliers of industrial equipment like Han's Laser. Proximity to these manufacturing hubs streamlines logistics, reduces transportation costs for both sales and service operations, and allows for more efficient supply chain management. The dense customer base within these zones also facilitates quicker adoption of new laser technologies and provides opportunities for localized technical support, crucial for maintaining a competitive edge.

- Urbanization Rate: China's urbanization rate stood at approximately 66.16% by the end of 2023.

- Industrial Hubs: Key manufacturing centers like the Pearl River Delta and Yangtze River Delta are focal points for industrial concentration.

- Efficiency Gains: Concentrated industrial zones enable Han's Laser to optimize sales, service, and supply chain operations.

- Market Access: Denser customer bases in urbanized industrial areas provide direct access to a significant market for laser equipment.

Societal shifts towards valuing higher quality products directly benefit Han's Laser. Consumers increasingly prioritize durability and precision, driving demand for advanced manufacturing. For example, the automotive sector in China saw a significant push towards higher standards in 2024, with consumers prioritizing advanced features and build quality.

Laser technology, with its inherent precision, is key to meeting these expectations. Han's Laser's solutions enable manufacturers to achieve superior finishes and tighter tolerances, aligning perfectly with consumer desires for better goods.

The increasing adoption of automation and AI, supported by government initiatives and growing cultural acceptance in China, creates a favorable market for intelligent equipment. China's industrial robot installations surged by 20% in 2023, exceeding 900,000 units, indicating a strong societal inclination towards automation.

China's urbanization, reaching about 66.16% by the end of 2023, has concentrated manufacturing in hubs like the Pearl River Delta. This proximity offers Han's Laser streamlined logistics and direct access to a large customer base, enhancing sales and service efficiency.

| Sociological Factor | Impact on Han's Laser | Supporting Data (2023-2024) |

|---|---|---|

| Rising Consumer Demand for Quality | Increased need for precision manufacturing | Automotive sector in China prioritizing advanced features and build quality (2024) |

| Societal Acceptance of Automation/AI | Growth in demand for intelligent equipment | Industrial robot installations in China surged 20% (2023) |

| Urbanization and Industrial Concentration | Proximity to customers and operational efficiencies | China's urbanization rate ~66.16% (end of 2023) |

Technological factors

Han's Laser Technology Industry Group is a major beneficiary of ongoing progress in laser technology. Developments like high-power picosecond lasers, ultrafast laser systems, and blue laser systems are directly boosting their capabilities. These advancements translate to better efficiency, increased power, greater precision, and improved dependability in their laser processing solutions.

These technological leaps are opening doors to novel applications and enhancing the processing of challenging materials, particularly those vital for the semiconductor and electric vehicle (EV) industries. For instance, the demand for advanced laser processing in semiconductor manufacturing, especially for wafer dicing and micro-machining, has seen significant growth, with the global market projected to reach billions by 2025.

Han's Laser's commitment to innovation in these fields has been recognized, with the company receiving accolades for its pioneering work. This focus on cutting-edge laser systems ensures they remain competitive and can meet the evolving demands of high-tech manufacturing sectors. Their investment in R&D for these areas is crucial for maintaining market leadership.

The integration of Artificial Intelligence (AI) and advanced automation is fundamentally reshaping industrial laser systems, boosting precision, efficiency, and adaptability. AI-powered systems allow for real-time optimization of parameters, predictive maintenance, enhanced quality control, and smarter management of materials and energy, leading to substantial improvements in production efficiency and cost reduction.

Han's Laser is actively embedding AI into its product offerings, which includes fully automated laser cutting equipment and sophisticated intelligent production management systems. This strategic move is crucial as the global market for industrial AI is projected to reach $37.3 billion by 2025, indicating a significant trend towards AI-driven manufacturing solutions.

The global shift towards smart manufacturing and Industry 4.0 is a significant technological driver for Han's Laser. This movement emphasizes integrating advanced technologies like AI, robotics, and the Internet of Things (IoT) to create more efficient and automated industrial operations.

Han's Laser is well-positioned to capitalize on this trend, being a leading provider of intelligent manufacturing solutions. Their commitment is evident in showcasing over 40 product innovations at key industry events specifically focused on smart manufacturing, demonstrating their proactive approach to adopting and developing these technologies.

Research and Development Investment

Han's Laser's commitment to continuous research and development investment is paramount for sustaining its competitive advantage and pioneering new technologies. The company's active development in areas such as high-power picosecond lasers and advanced chip packaging technologies underscores its dedication to innovation.

China's escalating investment in R&D, with enterprises playing a significant role in technological advancements, creates a fertile ground for Han's Laser's growth. For instance, China's R&D spending reached approximately 3.7% of its GDP in 2023, a figure expected to continue its upward trajectory, directly benefiting companies like Han's Laser.

- Han's Laser's focus on picosecond lasers aims to enhance precision and efficiency in manufacturing processes.

- Investment in chip packaging technologies positions the company to capitalize on the growing semiconductor industry.

- China's national strategy prioritizes technological self-reliance, encouraging substantial R&D funding for key industries like laser technology.

- In 2024, China's Ministry of Science and Technology announced plans to further boost R&D funding by 10% year-on-year, targeting areas critical for industrial upgrading.

New Application Areas and Material Processing

Technological advancements are continuously unlocking novel applications for laser processing. This is particularly evident in rapidly growing sectors such as electric vehicle (EV) battery production, the development of advanced materials, and the manufacturing of sophisticated medical devices. Laser welding and cutting are proving indispensable for achieving the high precision required in these cutting-edge fields.

Han's Laser Technology Industry Group is strategically positioned to benefit from this trend. By serving a diverse range of industries, the company is well-equipped to meet the escalating demand for advanced laser solutions in these burgeoning and expanding markets.

- EV Battery Manufacturing: Lasers are crucial for precise electrode cutting and battery pack assembly, a market projected to grow significantly. For instance, the global EV battery market was valued at approximately $50 billion in 2023 and is expected to reach over $200 billion by 2030.

- Advanced Materials: Lasers enable intricate processing of novel materials used in aerospace, automotive, and electronics, facilitating innovation and performance enhancements.

- Medical Devices: The medical sector increasingly relies on laser technology for minimally invasive surgical tools, diagnostics, and implant manufacturing, demanding exceptional accuracy.

Technological advancements are fundamental to Han's Laser's growth, particularly in high-power lasers and ultrafast systems. These innovations are critical for sectors like semiconductors and EVs, where precision is paramount. For example, the demand for laser processing in semiconductor wafer dicing is expected to see substantial market growth in the coming years.

The integration of AI and automation is transforming industrial laser systems, enhancing efficiency and precision. Han's Laser is actively incorporating AI into its automated cutting equipment and intelligent production systems, aligning with the projected growth of the industrial AI market, which is anticipated to reach tens of billions of dollars by 2025.

Han's Laser's investment in R&D, especially in areas like picosecond lasers and advanced chip packaging, is crucial for maintaining its competitive edge. China's increasing R&D spending, with enterprises driving technological progress, provides a supportive environment for companies like Han's Laser, with national R&D funding expected to see continued increases.

| Key Technology Area | Impact on Han's Laser | Market Relevance (2024-2025 Projections) |

| High-Power Picosecond Lasers | Enhanced precision and efficiency in material processing. | Growing demand in semiconductor and advanced manufacturing. |

| AI and Automation Integration | Improved system performance, predictive maintenance, and cost reduction. | Industrial AI market projected to reach significant figures by 2025. |

| Chip Packaging Technologies | Enabling advanced solutions for the booming semiconductor industry. | Critical for next-generation electronic devices. |

Legal factors

Han's Laser Technology Industry Group navigates a landscape where product safety and quality are paramount, particularly within regulated sectors such as medical devices and automotive manufacturing. Adherence to national and international standards, like ISO 9001 for quality management, is not merely a recommendation but a prerequisite for market entry and maintaining a strong brand image.

The company leverages advanced technologies, including AI-driven quality prediction and control systems, to enhance its laser blanking lines. This technological integration is vital for achieving high product pass rates, directly supporting compliance with these rigorous legal mandates and ensuring customer satisfaction.

Intellectual property (IP) laws and patents are critical for Han's Laser Technology Industry Group, a company built on technological innovation. China's commitment to strengthening IP protection, evidenced by increased enforcement and a focus on safeguarding advancements in sectors like advanced manufacturing, directly benefits Han's Laser. This robust legal framework is essential for protecting the company's proprietary technologies and maintaining its competitive edge in the market.

Han's Laser's market position is significantly bolstered by its portfolio of patents and technological achievements. For instance, its fully automatic laser cutting equipment represents a key innovation that differentiates it from competitors. As of early 2024, China's Supreme People's Court reported a substantial rise in IP infringement cases handled, underscoring the government's proactive stance on IP protection, which provides a secure environment for Han's Laser to invest in research and development.

Han's Laser Technology Industry Group, operating globally with advanced laser equipment, faces significant challenges in complying with stringent export control regulations. These rules, designed to prevent the proliferation of sensitive technologies, directly impact the company's ability to sell its high-tech products in various international markets. Failure to adhere can result in severe penalties, including hefty fines and restrictions on future trade, as seen with other Chinese tech firms navigating similar landscapes.

The complex web of international sanctions also presents a critical legal hurdle for Han's Laser. Sanctions imposed by countries like the United States and the European Union can restrict or prohibit business dealings with specific entities or nations, potentially disrupting supply chains and market access. For instance, in 2023, numerous companies faced scrutiny and trade limitations due to evolving geopolitical tensions, underscoring the need for rigorous due diligence and proactive compliance strategies for businesses like Han's Laser in the advanced manufacturing sector.

Labor Laws and Employment Regulations

Han's Laser Technology Industry Group, with its substantial workforce exceeding 16,000 individuals, operates under the stringent framework of China's labor laws and employment regulations. These laws dictate critical aspects of its human resource management, including minimum wage requirements, standards for working conditions, and provisions for social welfare and benefits. For instance, China's minimum wage standards vary by region, with major cities like Shanghai and Beijing setting higher benchmarks, directly impacting Han's Laser's payroll expenses depending on its operational locations.

Any shifts in these legal mandates, such as adjustments to social security contribution rates or stricter enforcement of working hour limits, can directly influence the company's operational costs and necessitate adaptive strategies in human resource management. Furthermore, the attractiveness and retention of a skilled workforce are significantly shaped by these regulations, as they set the baseline for employee compensation, benefits, and overall workplace fairness.

The company must remain vigilant regarding evolving labor legislation, including potential changes to contract laws or regulations on employee dismissals, to ensure compliance and mitigate legal risks. For example, updates to China's Labor Contract Law could affect how employment agreements are structured and terminated, potentially increasing administrative burdens.

- Compliance Costs: Adherence to China's Labor Contract Law and social insurance regulations directly impacts operational expenses.

- Talent Acquisition: Favorable labor regulations can enhance Han's Laser's ability to attract and retain skilled engineers and technicians.

- Workplace Standards: Regulations on working hours, safety, and health directly influence employee productivity and well-being.

- Legal Risk: Non-compliance with labor laws can lead to fines, lawsuits, and reputational damage.

Environmental Regulations and Compliance

Environmental regulations in China are tightening, directly affecting manufacturing. Han's Laser must ensure its production processes and equipment adhere to standards for energy use, emissions, and waste. For instance, China's commitment to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, as outlined in the 14th Five-Year Plan, necessitates significant investments in greener technologies and infrastructure upgrades for companies like Han's Laser.

This push for environmental sustainability means Han's Laser needs to focus on:

- Reducing carbon footprint: Implementing energy-efficient machinery and optimizing production workflows to lower energy consumption.

- Emission control: Investing in advanced filtration systems to manage air and water pollutants from manufacturing processes.

- Waste management: Developing robust recycling and disposal protocols for industrial waste, aligning with circular economy principles.

- Green technology adoption: Exploring and integrating renewable energy sources and environmentally friendly materials in its operations.

Legal factors significantly shape Han's Laser Technology Industry Group's operations, from product compliance to intellectual property protection. Stringent international export controls and sanctions, particularly those from the US and EU, directly impact market access for its advanced laser equipment. For example, evolving geopolitical tensions in 2023 highlighted the need for rigorous due diligence in navigating these complex trade restrictions.

Environmental factors

China's 14th Five-Year Plan, extending through 2025, prioritizes energy conservation and emissions reduction, impacting high-emitting sectors. This translates to stricter operational efficiency demands for manufacturing clients utilizing Han's Laser's equipment, as well as for Han's own production processes.

For instance, China aims to reduce energy intensity by 15% by 2025 compared to 2020 levels, a target that will pressure industries to adopt more efficient machinery and processes. Han's Laser's commitment to developing and deploying energy-efficient laser solutions can therefore be a key differentiator, offering clients both compliance with regulations and potential cost savings on electricity bills.

Environmental regulations are increasingly pushing industries towards waste reduction and better resource management. These rules are designed to make companies more efficient and less impactful on the planet. For example, in 2024, many regions saw stricter enforcement of landfill diversion targets, impacting manufacturing sectors.

Laser technology, like that developed by Han's Laser, is naturally aligned with these environmental goals. Its precision means less material is wasted during cutting and processing compared to older, less accurate methods. This inherent efficiency helps clients meet environmental standards more easily.

Han's Laser actively contributes to sustainability by developing software and hardware that optimize material usage. Their intelligent nesting algorithms, for instance, ensure that the maximum number of parts are cut from a single sheet of material. This focus on high-yield processes directly aids their customers in reducing scrap and complying with environmental mandates, a trend that continued to strengthen through early 2025.

China's commitment to environmental stewardship is a significant factor. The nation is actively expanding its emissions trading system, bringing more industries under its purview. This move, coupled with ambitious targets for peak carbon emissions by 2030 and carbon neutrality by 2060, will undoubtedly place greater pressure on manufacturing sectors. Companies like Han's Laser, and its clientele, will face increasing demands to integrate low-carbon technologies and actively reduce their environmental impact.

This evolving regulatory landscape directly influences market dynamics for industrial laser systems. As businesses prioritize sustainability, the demand for laser solutions that support eco-friendly manufacturing processes is on the rise. Han's Laser's ability to innovate and offer energy-efficient, low-emission laser technologies will be crucial for capitalizing on this growing segment of the market.

Green Manufacturing and Sustainability Trends

The global push for green manufacturing and corporate social responsibility significantly impacts Han's Laser Technology Industry Group. Customers worldwide increasingly prioritize suppliers with strong ESG (Environmental, Social, and Governance) credentials, driving demand for laser equipment that is both energy-efficient and environmentally sound.

This trend presents a clear opportunity for Han's Laser. By developing and promoting laser systems that reduce energy consumption and minimize waste, the company can cater to this growing market segment and secure a competitive edge. For instance, advancements in laser cutting and welding technologies that offer higher precision and lower power usage directly address these client needs.

- Growing demand for energy-efficient laser solutions: Many industries are setting ambitious energy reduction targets, making eco-friendly manufacturing equipment a key purchasing criterion.

- Increased scrutiny on supply chain sustainability: Han's Laser's clients are under pressure to demonstrate the sustainability of their entire value chain, influencing their choice of technology partners.

- Innovation in eco-friendly laser processes: Companies investing in R&D for greener laser applications, such as those reducing material waste or eliminating harmful chemicals, are likely to gain market share.

Compliance with Environmental Regulations

Han's Laser Technology Industry Group, like its customers, faces the challenge of adapting to China's tightening environmental regulations. The nation's commitment to combating air, water, and soil pollution, as evidenced by its amended Environmental Protection Law and various action plans, necessitates continuous adjustments in operational practices and technology adoption.

Failure to comply with these regulations can result in significant penalties, including substantial fines and even temporary or permanent operational suspensions. For instance, in 2023, numerous enterprises across various sectors faced penalties for environmental violations, underscoring the enforcement rigor.

To mitigate these risks and ensure sustained operations, Han's Laser must prioritize proactive engagement with local environmental authorities and strategically invest in technologies that meet or exceed current and anticipated compliance standards. This includes exploring cleaner production methods and waste management solutions.

- Stricter Enforcement: China's Ministry of Ecology and Environment reported a significant increase in environmental inspections and penalties in 2023 compared to previous years.

- Technological Investment: Companies are increasingly allocating capital towards advanced pollution control equipment and processes to meet discharge standards.

- Supply Chain Scrutiny: Customers are also scrutinizing their suppliers' environmental performance, making compliance a competitive advantage for Han's Laser.

- Focus on Key Pollutants: Regulations are increasingly targeting specific pollutants, requiring tailored solutions for emissions and waste streams.

China's ambitious environmental goals, including reducing energy intensity by 15% by 2025 and achieving carbon neutrality by 2060, directly impact manufacturing clients and Han's Laser's operations. The company's focus on energy-efficient laser technology, like intelligent nesting algorithms that minimize material waste, aligns with these directives and offers clients a competitive advantage in meeting stricter regulations.

The global emphasis on green manufacturing and corporate social responsibility means customers increasingly favor suppliers with strong ESG credentials. Han's Laser can capitalize on this by developing and promoting laser systems that reduce energy consumption and waste, addressing a growing market demand for eco-friendly solutions.

China's intensified environmental enforcement, with increased inspections and penalties in 2023, necessitates that Han's Laser and its clients invest in cleaner production methods and waste management. Proactive compliance and technological adaptation are crucial for sustained operations and avoiding significant fines.

| Environmental Target | Metric | Year |

| Energy Intensity Reduction | 15% | 2025 |

| Peak Carbon Emissions | Targeted | 2030 |

| Carbon Neutrality | Targeted | 2060 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Han's Laser Technology Industry Group is grounded in data from official government reports, reputable financial news outlets, and leading market research firms. We meticulously gather information on economic indicators, technological advancements, and regulatory changes to provide a comprehensive overview.