Han's Laser Technology Industry Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Han's Laser Technology Industry Group Bundle

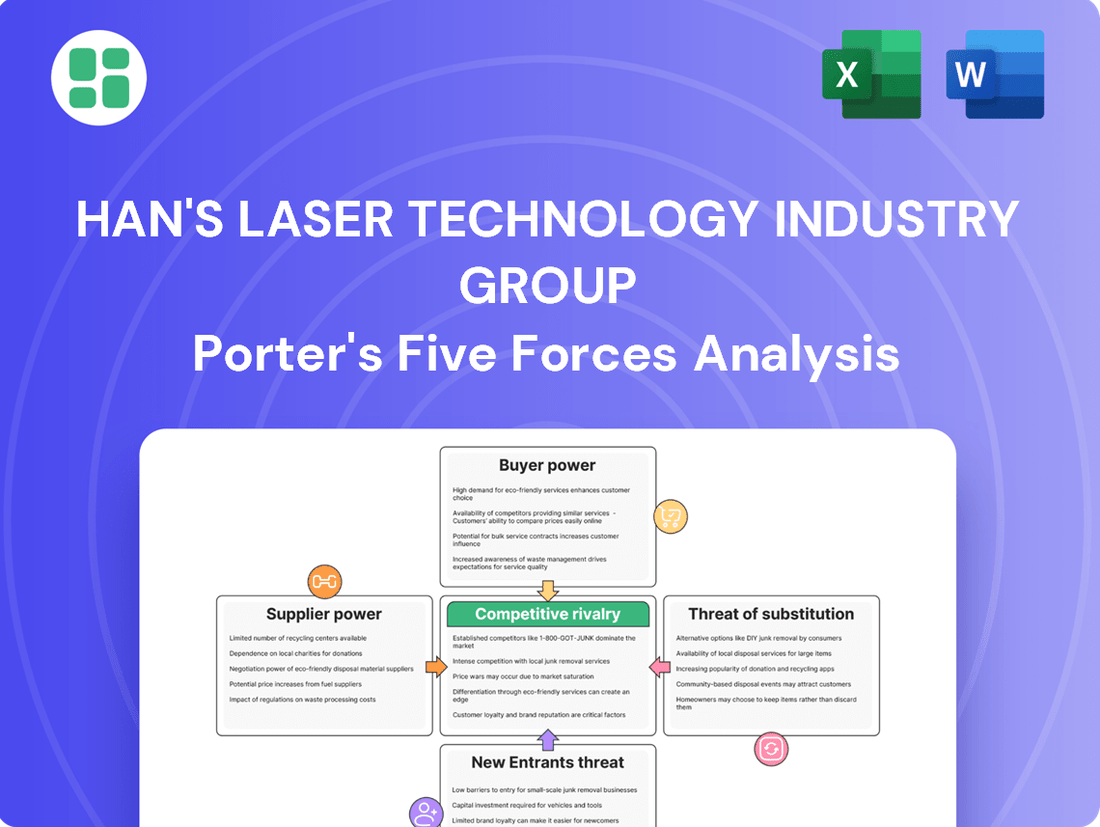

Han's Laser Technology Industry Group navigates a competitive landscape shaped by moderate buyer power and a growing threat of substitutes, while the intensity of rivalry is significant due to numerous players. Supplier power remains relatively low, but the threat of new entrants is a growing concern as the market expands.

The complete report reveals the real forces shaping Han's Laser Technology Industry Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The industrial laser equipment market depends on specialized components like high-power fiber lasers and advanced control systems. Suppliers of these critical parts, often possessing unique technological expertise, can exert considerable bargaining power. For instance, a significant portion of the global fiber laser market is dominated by a few key players, meaning Han's Laser may face limited alternatives when sourcing these essential inputs.

Switching suppliers for critical laser sources or advanced optical components presents significant hurdles for Han's Laser. These disruptions can manifest as substantial costs and operational downtime, directly impacting production efficiency and market responsiveness.

The process of changing suppliers isn't merely a transactional event. It often necessitates costly redesigns of existing equipment, extensive re-calibration of intricate production lines, and comprehensive retraining programs for skilled personnel. These factors collectively bolster the bargaining power of existing suppliers, especially when their components are deeply integrated into Han's Laser's product architecture.

For instance, in 2023, the semiconductor industry, a key supplier of laser diodes, experienced supply chain constraints that led to price increases. This situation highlights how reliance on specialized, high-performance components can amplify supplier leverage, forcing companies like Han's Laser to absorb higher costs or face production delays.

Suppliers offering unique or highly specialized laser components, like ultra-fast lasers or precision galvanometers, wield significant bargaining power. If these inputs are critical for Han's Laser's advanced product differentiation and alternative suppliers are scarce, these providers can dictate higher prices. The rapid pace of laser technology innovation often keeps specialized component manufacturers in a strong position.

Threat of Forward Integration by Suppliers

If key component suppliers possess the capability and motivation to integrate forward into producing industrial laser equipment, their bargaining power over Han's Laser Technology Industry Group would undoubtedly rise. This scenario could pressure Han's Laser into accepting less favorable terms to preempt direct competition from entities that currently supply their essential parts. For instance, a supplier of high-power laser diodes might consider establishing its own assembly lines for laser processing machines.

However, the significant technical expertise and intricate system integration required to manufacture sophisticated industrial laser equipment often present a substantial barrier to such forward integration attempts by suppliers. The complexity involved in ensuring seamless operation across various components, software, and user interfaces typically demands specialized knowledge and significant investment, which many component suppliers may lack or find prohibitive.

- Supplier Integration Risk: The potential for key component suppliers to move into manufacturing finished laser equipment.

- Impact on Han's Laser: Increased supplier leverage, potentially leading to less favorable contract terms for Han's Laser.

- Barrier to Integration: The high complexity of system integration and specialized knowledge required for industrial laser equipment manufacturing.

Importance of Han's Laser to Suppliers

Han's Laser's position as China's largest laser equipment supplier and a major global player translates into substantial purchasing power. In 2023, the company reported revenues of approximately RMB 16.1 billion (USD 2.2 billion), underscoring its significant demand for components.

This considerable volume of business makes Han's Laser a crucial client for many upstream component manufacturers. Consequently, these suppliers may find their bargaining power somewhat diminished, as a disruption in their business with Han's Laser could lead to a notable impact on their own revenue streams.

The sheer scale of Han's Laser's operations means they are often a primary customer for specialized component providers. This reliance can shift the negotiation balance, allowing Han's Laser to potentially secure more favorable terms on pricing and supply agreements.

- Significant Market Share: Han's Laser holds a leading position in the Chinese laser equipment market, a vital sector for industrial automation.

- Revenue Impact for Suppliers: Losing Han's Laser as a customer could represent a substantial percentage of a component supplier's total sales, creating a strong incentive to maintain a positive relationship.

- Negotiating Leverage: The company's consistent demand for high-quality components allows it to negotiate from a position of strength, influencing pricing and delivery schedules.

The bargaining power of suppliers to Han's Laser Technology Industry Group is influenced by the concentration of suppliers for critical components. For example, the market for high-power fiber lasers, a key input, is dominated by a few global players, granting them significant leverage. This reliance on a limited supplier base means Han's Laser has fewer alternatives when sourcing these essential, technologically advanced parts.

Switching suppliers for these specialized components can be prohibitively expensive and time-consuming for Han's Laser. The need for re-engineering, recalibration, and retraining creates substantial switching costs, reinforcing the bargaining power of incumbent suppliers. For instance, the semiconductor industry experienced supply chain disruptions in 2023, leading to price hikes for laser diodes, illustrating the impact of specialized component reliance.

Han's Laser’s substantial market presence, evidenced by its 2023 revenue of approximately RMB 16.1 billion (USD 2.2 billion), grants it considerable purchasing power. This scale makes Han's Laser a vital customer for many component suppliers, potentially mitigating their individual bargaining power. However, suppliers of highly differentiated or unique components, such as ultra-fast lasers, can still command strong terms due to scarcity and critical product integration.

| Factor | Impact on Han's Laser | Supporting Data/Example |

| Supplier Concentration (Fiber Lasers) | High supplier bargaining power | Dominance of a few global players in high-power fiber laser market |

| Switching Costs | High supplier bargaining power | Costs of re-engineering, recalibration, and retraining personnel |

| Component Specialization | High supplier bargaining power for unique components | Ultra-fast lasers, precision galvanometers critical for product differentiation |

| Han's Laser Purchasing Volume | Reduced supplier bargaining power | 2023 Revenue: RMB 16.1 billion (USD 2.2 billion) |

What is included in the product

This analysis evaluates the competitive intensity and profitability of the laser technology industry for Han's Laser, examining supplier power, buyer bargaining, threat of new entrants, substitutes, and rivalry.

A clear, one-sheet summary of Han's Laser's Porter's Five Forces—perfect for quickly identifying and addressing competitive pressures.

Instantly understand strategic pressure points within the laser technology industry, enabling proactive pain point relief for Han's Laser.

Customers Bargaining Power

Han's Laser Technology Industry Group serves a broad array of industries, including electronics, automotive, aerospace, and medical devices. This wide customer reach across various sectors helps to mitigate the bargaining power of any single customer. For instance, in 2023, revenue from the automotive sector represented a significant portion, but it was balanced by contributions from other growing segments.

Despite the diverse customer base, large-volume buyers, such as major automotive manufacturers or leading electronics corporations, can still wield considerable influence. Their substantial purchase volumes allow them to negotiate more favorable terms, impacting Han's Laser's pricing and margins. For example, a key automotive client's decision to consolidate suppliers could significantly shift the balance of power.

Switching industrial laser equipment suppliers presents significant hurdles for customers. Costs associated with retooling production lines, retraining skilled operators, and the potential for costly operational downtime can be substantial. For instance, a major automotive manufacturer integrating new laser welding systems might face millions in capital expenditure and weeks of disruption if switching mid-production.

Han's Laser Technology Industry Group, by offering integrated solutions and advanced automation capabilities, can foster a strong lock-in effect. This makes it more difficult for existing clients to transition to alternative providers. This reduced substitutability directly enhances Han's Laser's bargaining power within its established customer relationships.

Han's Laser's extensive product portfolio, encompassing laser marking, cutting, welding, and engraving systems, along with integrated automation, significantly reduces customer reliance on single-product suppliers. This broad offering makes it harder for customers to find comparable, all-in-one solutions elsewhere, thereby diminishing their bargaining leverage.

The company's focus on customized, high-precision, and efficient laser processing systems further strengthens its position. For instance, Han's Laser's advanced 3D laser cutting machines, which can handle complex geometries with remarkable accuracy, are not easily replicated by competitors, thereby insulating the company from direct price comparisons and limiting customer power.

Customer Price Sensitivity

Customer price sensitivity for laser equipment is a significant factor, especially when the machinery represents a substantial investment that directly influences a company's production costs and overall efficiency. In 2024, the global laser market, valued at approximately $17.5 billion, saw continued pressure on pricing for more standardized laser systems. While Han's Laser's technological edge offers clear advantages, buyers will naturally gravitate towards the most cost-effective solutions that meet their performance needs.

The competitive landscape within the laser technology industry means that pricing remains a critical decision-making criterion for purchasers. Buyers are constantly evaluating the total cost of ownership, including initial purchase price, operational expenses, and potential downtime. This makes Han's Laser's ability to offer compelling value propositions, balancing advanced features with competitive pricing, crucial for maintaining market share.

- Significant Capital Expenditure: Laser equipment often requires a substantial upfront investment, making price a primary concern for customers.

- Efficiency vs. Cost: While advanced technology boosts efficiency, customers will compare the cost savings against the initial outlay for equipment.

- Competitive Market: The presence of numerous suppliers ensures that pricing remains a key differentiator in customer purchasing decisions.

- Total Cost of Ownership: Buyers consider not just the purchase price but also ongoing operational and maintenance costs when evaluating laser solutions.

Customers' Threat of Backward Integration

The threat of Han's Laser's customers backward integrating into manufacturing their own industrial laser equipment is generally low. This is primarily due to the substantial capital outlay, sophisticated research and development capabilities, and highly specialized technical expertise needed to produce such advanced machinery. For instance, the global industrial laser market, valued at approximately $17.5 billion in 2023, requires significant investment in precision engineering and ongoing innovation.

This low likelihood of backward integration significantly diminishes the bargaining power of Han's Laser's customers.

- High Capital Investment: Establishing a manufacturing facility for industrial lasers demands hundreds of millions of dollars for specialized machinery, clean rooms, and testing equipment.

- R&D and Technical Expertise: Developing and maintaining cutting-edge laser technology requires a dedicated team of highly skilled engineers and scientists, a significant ongoing expense.

- Complexity of Manufacturing: The production process involves intricate optical alignments, advanced control systems, and rigorous quality assurance, making it a highly specialized field.

Customers' bargaining power is moderated by the high switching costs associated with laser equipment, including retooling and training, which can run into millions for large manufacturers. Han's Laser's integrated solutions and broad product portfolio also create customer lock-in, making it difficult for them to find comparable alternatives. While price sensitivity exists, especially in a competitive market valued at approximately $17.5 billion in 2023, Han's Laser's technological edge and customized offerings help mitigate direct price comparisons.

| Factor | Impact on Han's Laser | Customer Influence Level |

|---|---|---|

| Switching Costs | High (Retooling, Training) | Low to Moderate |

| Product Differentiation | High (Integrated Solutions, Customization) | Low |

| Price Sensitivity | Moderate (Market Value ~$17.5B in 2023) | Moderate |

| Backward Integration Threat | Very Low (High Capital & Expertise) | Very Low |

Preview the Actual Deliverable

Han's Laser Technology Industry Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of Han's Laser Technology Industry Group meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the laser technology sector.

Rivalry Among Competitors

The industrial laser equipment market is intensely competitive, featuring a mix of established global giants and a growing number of innovative new entrants. Prominent players like Coherent, IPG Photonics, TRUMPF, and Bystronic consistently vie for market share, alongside a significant surge of Chinese manufacturers, contributing to a moderately concentrated yet highly dynamic landscape.

Han's Laser Technology Industry Group navigates this crowded arena, where market concentration is tempered by the sheer volume and diversity of competitors. This intense rivalry, particularly within the burgeoning Chinese market, demands continuous innovation and strategic agility to maintain a competitive edge.

The global industrial laser systems market is set for substantial growth, with projected Compound Annual Growth Rates (CAGRs) between 6.82% and 13.8% from 2025 through 2034. This expansion is a double-edged sword for competitive rivalry; while a larger pie means more opportunity, it also ignites fiercer competition as companies vie for increasing market share.

Rapid technological advancements are a key driver of this growth and, consequently, a significant factor intensifying rivalry. Companies must constantly innovate to stay ahead, leading to a dynamic environment where cutting-edge solutions quickly become the standard, pushing competitors to invest heavily in research and development to maintain their edge.

Competitive rivalry in the laser technology sector is intense, largely fueled by a relentless pursuit of product differentiation and innovation. Companies are constantly striving to develop and offer cutting-edge laser technologies, such as high-precision fiber lasers and ultra-fast lasers, which are critical for advanced manufacturing processes.

Han's Laser actively competes by strategically expanding its diverse product portfolio. The company focuses on enhancing key performance metrics like beam quality, energy efficiency, and reducing operational maintenance costs. This commitment to improvement, alongside offering tailored, customized solutions to meet specific client needs, is central to its competitive strategy.

In 2023, Han's Laser reported significant investment in research and development, a crucial element for maintaining a competitive edge. This ongoing R&D effort is vital for staying ahead in a market where technological advancements directly translate into market share and profitability, with new product introductions often driving revenue growth.

Exit Barriers

The industrial laser equipment manufacturing sector demands massive upfront investment in research and development, sophisticated production plants, and highly trained personnel. These considerable fixed costs and unique assets erect substantial barriers to exiting the market.

Consequently, companies often choose to persist through periods of reduced profitability rather than divest, which in turn fuels ongoing and intense competition among existing players.

- High R&D Investment: Companies like Han's Laser Technology Industry Group invest heavily in developing next-generation laser solutions, with R&D expenses often representing a significant percentage of revenue. For instance, in 2023, many leading players reported R&D spending exceeding 10% of their annual sales.

- Specialized Assets: Manufacturing laser equipment requires highly specialized machinery and facilities, making it difficult and costly to repurpose or sell these assets if a company decides to exit.

- Skilled Workforce Dependency: The industry relies on a specialized workforce with expertise in optics, electronics, and software engineering. Disbanding such a team or retraining them for other industries incurs substantial costs.

- Brand and Reputation: Established brands have built trust and recognition over years, making it challenging for new entrants and difficult for exiting firms to recoup their investment in brand equity.

Market Share and Geographic Presence

Han's Laser holds a commanding position as China's largest laser equipment supplier and ranks as the third-largest globally. Its substantial footprint in the Asia-Pacific region, which accounts for a significant portion of the worldwide market, underscores its competitive strength. This strong regional presence, however, also places it in direct contention with other major international manufacturers aggressively pursuing market share across crucial areas such as laser cutting, welding, and marking applications.

The competitive rivalry within the laser equipment industry is intense, driven by a few key global players. For instance, in 2023, the global laser market was valued at approximately $16.1 billion, with significant growth projected. Han's Laser's substantial market share in China, a key manufacturing hub, provides a solid foundation. However, it faces robust competition from companies like Trumpf Group and IPG Photonics, which have established global distribution networks and strong technological innovation pipelines.

- Market Leadership: Han's Laser is China's premier laser equipment provider and globally the third-largest.

- Geographic Focus: The company has a dominant presence in the Asia-Pacific market, a critical region for laser technology adoption.

- Direct Competition: Han's Laser competes directly with major international players in key application segments like cutting, welding, and marking.

- Market Dynamics: The global laser market, valued at around $16.1 billion in 2023, is characterized by intense competition among established global brands.

Competitive rivalry in the industrial laser market is fierce, characterized by significant R&D investment and specialized assets that create high barriers to exit, compelling existing players to compete vigorously. Han's Laser, as China's largest supplier and third globally, faces intense competition from established giants like TRUMPF and IPG Photonics, particularly in key application areas. The global laser market, valued at approximately $16.1 billion in 2023, is dynamic, with rapid technological advancements fueling this competitive landscape.

| Key Competitor | 2023 Estimated Revenue (USD Billions) | Key Strengths |

| TRUMPF Group | ~5.0 | Global presence, broad product portfolio, strong R&D |

| IPG Photonics | ~1.6 | Pioneer in fiber lasers, vertical integration, high-power lasers |

| Han's Laser | ~2.5 (approximate, based on reported figures and market share) | Dominant in China, cost competitiveness, expanding global reach |

SSubstitutes Threaten

While laser processing is highly precise and efficient, traditional manufacturing methods like CNC machining, mechanical cutting, stamping, and conventional welding continue to be viable alternatives for many tasks. These established techniques can fulfill customer needs where extreme precision isn't paramount or where existing infrastructure favors them.

For companies with established CNC machining or stamping capabilities, the cost and learning curve associated with adopting new laser technologies can be a significant deterrent. In 2024, many manufacturers continue to rely on these methods, especially for high-volume, lower-margin components where the upfront investment in advanced laser systems might not offer a clear return.

While laser technology remains a leader, advancements in areas like ultra-high-pressure waterjet cutting and sophisticated plasma arc systems present a growing threat. These methods are increasingly capable of achieving finer tolerances and faster processing speeds for certain materials, potentially diverting market share from laser applications in sectors like automotive and aerospace manufacturing.

The high initial investment for industrial laser systems, which can range from tens of thousands to hundreds of thousands of dollars, presents a significant barrier for smaller enterprises or those with constrained budgets. This cost factor makes more traditional, less expensive methods, such as mechanical cutting or stamping, appealing alternatives. For instance, a small metal fabrication shop might find the upfront cost of a CNC laser cutter prohibitive compared to a plasma cutter, which can be acquired for a fraction of the price.

When the cost-benefit analysis leans towards non-laser alternatives for specific tasks, the threat of substitution intensifies. For applications where precision and speed are not paramount, or where material thickness is not a major concern, cheaper methods may suffice. For example, in some woodworking applications, traditional saws or routers can achieve acceptable results at a much lower capital outlay than a laser engraver.

Customer Awareness and Acceptance of Substitutes

Customer awareness and acceptance of alternatives significantly shape the threat of substitutes for laser processing. If customers readily see other technologies as equally effective, Han's Laser faces greater pressure. The industry, including Han's Laser, actively works to highlight laser technology's advantages, such as its unparalleled precision and efficiency, to counteract this threat.

The perceived value and performance differences between laser processing and alternatives are critical. For instance, while traditional mechanical cutting might be cheaper for some applications, it often lacks the fine detail and material integrity that lasers provide. This distinction is crucial for sectors like electronics manufacturing where precision is paramount.

- Customer perception of laser processing's superiority in precision and speed compared to alternatives like plasma cutting or waterjet cutting.

- Han's Laser's marketing efforts focus on demonstrating the cost-effectiveness and quality improvements offered by laser technology over the long term.

- The increasing adoption of laser systems in high-tech industries, such as semiconductor manufacturing and advanced automotive production, underscores customer acceptance of its capabilities.

- While mechanical processes might offer lower initial investment, the total cost of ownership, considering material waste and rework, often favors laser technology for complex tasks.

Limitations of Laser Technology

While industrial lasers offer broad applicability, they face limitations that can pave the way for substitutes. Certain materials may not respond optimally to laser processing, or alternative methods might yield superior results for specific outcomes. For instance, in applications requiring deep penetration or unique surface finishes on specific alloys, traditional machining or advanced chemical treatments could prove more effective or cost-efficient. This material compatibility issue is a key area where substitutes can gain traction.

These limitations create opportunities for substitute technologies, particularly in niche markets where laser processing isn't the ideal solution. For example, in the textile industry, while laser cutting is used, traditional die-cutting remains a viable and often preferred substitute for mass production of certain garments due to speed and cost-effectiveness. Similarly, for very delicate or heat-sensitive materials, alternative cutting or joining methods might be necessary to avoid damage. In 2024, the global industrial laser market was valued at approximately USD 16.5 billion, but the specific segments where laser limitations are most pronounced are where substitutes are most competitive.

- Material Incompatibility: Certain materials exhibit poor absorption of laser energy or undergo undesirable thermal effects, making them unsuitable for laser processing.

- Processing Depth Limitations: For applications requiring very deep cuts or welds, lasers may not be as efficient or cost-effective as alternative methods.

- Surface Finish Concerns: In some cases, laser processing can leave a heat-affected zone or rougher surface finish than desired, necessitating post-processing or the use of substitutes.

- Cost-Effectiveness in Niche Applications: For low-volume or highly specialized tasks, the initial investment and operational costs of laser systems can make substitutes more economically viable.

The threat of substitutes for laser processing remains significant, especially where cost and existing infrastructure favor traditional methods. While laser technology excels in precision, alternatives like CNC machining, waterjet cutting, and plasma arc systems continue to be viable, particularly for less demanding applications or where initial investment is a primary concern. For instance, in 2024, many manufacturers, especially smaller ones, still rely on these established techniques due to the substantial capital outlay required for advanced laser systems, which can easily run into hundreds of thousands of dollars.

The perceived value and performance differences are key battlegrounds; while mechanical processes might be cheaper initially, the total cost of ownership, factoring in material waste and rework, often favors lasers for complex tasks. However, limitations in material compatibility or processing depth can create openings for substitutes. For example, in the textile industry, traditional die-cutting remains a cost-effective alternative for mass production of certain garments, highlighting that laser technology isn't always the universally superior solution.

Customer awareness and acceptance play a crucial role, as a willingness to adopt alternatives can shift market dynamics. Han's Laser and its competitors actively work to showcase laser technology's long-term cost-effectiveness and quality advantages to counter this. The global industrial laser market was valued at approximately USD 16.5 billion in 2024, but the segments where laser limitations are most pronounced are precisely where substitutes are most competitive.

Key areas where substitutes pose a threat include material incompatibility, where certain materials absorb laser energy poorly or suffer undesirable thermal effects, and processing depth limitations for very deep cuts or welds. Additionally, concerns about surface finish, where lasers might leave a heat-affected zone, and the cost-effectiveness of substitutes in niche, low-volume applications, all contribute to the ongoing competitive landscape.

Entrants Threaten

The industrial laser equipment market demands significant capital for research and development, advanced manufacturing capabilities, and sophisticated machinery. For instance, establishing a state-of-the-art production facility can easily run into tens or even hundreds of millions of dollars, creating a formidable financial hurdle for aspiring competitors.

Building robust global distribution and service networks also necessitates considerable upfront investment, further deterring potential new entrants. Han's Laser's established infrastructure, a result of years of investment, represents a massive cost for any newcomer attempting to replicate its reach and operational scale.

The industrial laser sector thrives on cutting-edge, proprietary technology and ongoing research and development. Han's Laser, as a major player, benefits from substantial intellectual property and a wealth of accumulated expertise, creating a high barrier to entry for newcomers. For instance, Han's Laser's significant investment in R&D, often reflected in its substantial annual R&D expenditure, allows it to maintain a technological edge.

Existing giants in the laser industry, such as Han's Laser, leverage significant economies of scale. This means they can produce their laser equipment at a much lower cost per unit due to massive production volumes and bulk purchasing power. For example, in 2023, Han's Laser's revenue reached approximately RMB 14.7 billion, showcasing their substantial operational footprint.

New companies entering the market would find it incredibly difficult to match these cost advantages. Without the same scale in manufacturing, procurement, and distribution, they would face higher per-unit costs, immediately placing them at a competitive disadvantage in terms of pricing against established players.

Brand Loyalty and Established Relationships

Han's Laser Technology Industry Group benefits from significant brand loyalty and deeply entrenched relationships with a global clientele, particularly in demanding sectors like automotive and electronics. Newcomers must overcome the substantial hurdle of cultivating trust and replicating this established brand equity, where consistent performance and dependable after-sales support are non-negotiable. For instance, Han's Laser's consistent delivery of high-precision equipment, a factor in their strong client retention, makes it difficult for less proven entities to gain a foothold.

The threat of new entrants is somewhat mitigated by the difficulty in replicating Han's Laser's established client relationships and brand recognition. Building trust in a market where precision and reliability are critical takes considerable time and proven performance. For example, in 2023, Han's Laser reported a robust order backlog, indicating continued client confidence and preference for their established solutions.

- Brand Recognition: Han's Laser commands significant global brand recognition, built over years of delivering quality laser equipment.

- Client Relationships: Long-standing partnerships with major industry players across automotive, electronics, and aerospace sectors create high switching costs for customers.

- Trust and Reliability: The precision and reliability of Han's Laser's products are paramount, making it challenging for new entrants to build the necessary trust.

- After-Sales Service: A strong reputation for post-sales support and technical assistance further solidifies customer loyalty, posing a barrier to new competitors.

Regulatory Hurdles and Safety Standards

The industrial laser equipment sector faces significant regulatory barriers. New companies must invest heavily in research and development to meet stringent safety protocols, such as those outlined by the International Electrotechnical Commission (IEC) standards for laser safety. For instance, compliance with IEC 60825-1, which classifies lasers based on their potential hazards, requires rigorous testing and documentation, adding substantial upfront costs for any new entrant aiming to compete with established players like Han's Laser.

Navigating these complex regulatory landscapes, which often include country-specific certifications and environmental impact assessments, is a formidable challenge. The time and resources dedicated to achieving compliance can delay market entry and increase the overall cost of doing business. This creates a high barrier, particularly for smaller or less capitalized firms seeking to enter the advanced laser manufacturing market.

- Stringent Safety Regulations: Compliance with international standards like IEC 60825-1 is mandatory.

- Complex Compliance Processes: Navigating varied national and international certifications is time-consuming and costly.

- Increased Entry Costs: Regulatory adherence significantly raises the capital required for new market participants.

The threat of new entrants for Han's Laser Technology Industry Group is relatively low due to substantial capital requirements for R&D, manufacturing, and global distribution networks. Building brand recognition and customer loyalty in this sector also demands significant time and proven performance, creating high switching costs for existing clients.

The industry's reliance on proprietary technology and ongoing innovation, coupled with stringent regulatory compliance, further erects formidable barriers. For example, in 2023, Han's Laser's revenue of approximately RMB 14.7 billion underscores its scale advantage, making it difficult for newcomers to match its cost efficiencies.

Han's Laser's established client relationships, particularly in demanding sectors like automotive and electronics, and its strong after-sales service reputation also deter new players. The company's robust order backlog in 2023 further illustrates sustained client confidence, presenting a significant challenge for any emerging competitor.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Han's Laser Technology Industry Group is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings. This comprehensive data set allows for a robust assessment of competitive dynamics.