Han's Laser Technology Industry Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Han's Laser Technology Industry Group Bundle

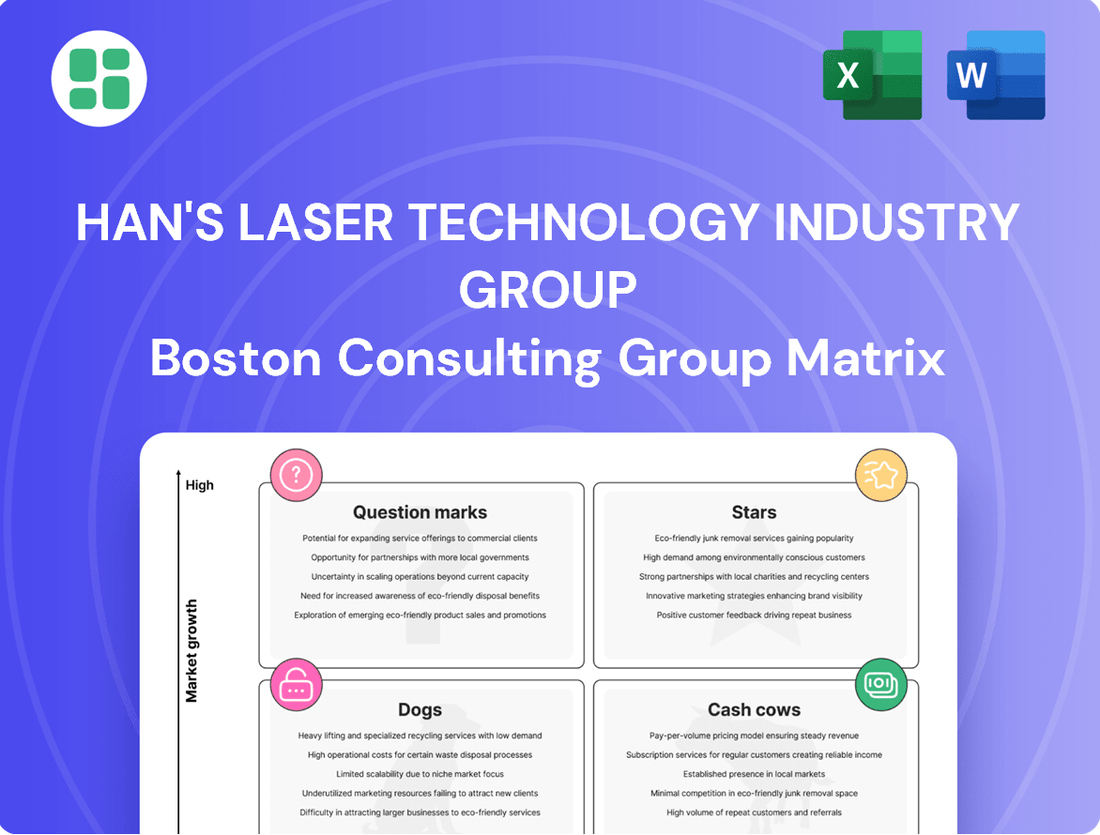

Han's Laser Technology Industry Group's BCG Matrix paints a compelling picture of its product portfolio, highlighting key areas of growth and stability. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic decision-making.

This glimpse into their market position is just the beginning. Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Han's Laser Technology Industry Group.

Stars

Han's Laser's High-Precision Five-Axis Laser Processing Equipment is a prime example of a star within the BCG Matrix, evidenced by its 2024 Ringier Technology Innovation Award. This recognition highlights its advanced capabilities and strong market reception.

This equipment leverages ultraviolet laser technology with five-axis linkage for intricate tasks like curved surface coating removal, crucial for the booming smartphone, VR/AR, and smart wearable industries. Its adoption in these high-growth consumer electronics and advanced manufacturing sectors points to a significant market share in an expanding market.

The HLW-5000/5000-G3 High-Power Ring Spot Fiber Laser, a product from Han's Laser Technology Industry Group, likely falls into the Stars category of the BCG Matrix. This designation is supported by its recent 2024 Ringier Technology Innovation Award and its 10kW ultra-high power with variable spot technology, positioning it at an international leading level.

The market for high-power fiber lasers is experiencing significant growth, driven by increasing adoption in cutting and welding applications across various industries. This trend, coupled with the HLW-5000/5000-G3's advanced features, suggests a strong competitive advantage in a high-growth market, aligning with the characteristics of a Star.

Han's Laser's New Energy and Photovoltaic Equipment segment is a burgeoning star. The company has substantially ramped up its investments in sectors like photovoltaics and power batteries. This strategic focus paid off, with the segment experiencing robust revenue growth. Specifically, the photovoltaic sector saw a 30.60% increase, while the power battery sector surged by an impressive 69.81% in 2022, demonstrating strong market traction even amidst industry headwinds.

The global demand for clean energy solutions and the accelerating adoption of electric vehicles create a highly favorable market environment. Han's Laser is strategically positioning itself within this high-growth arena. By offering specialized equipment and solutions tailored to these industries, the company is actively working to capture a larger share of this expanding market, solidifying its position as a key player.

Advanced Automation Solutions for Integrated Circuits & PCB

Han's Laser Technology Industry Group's advanced automation solutions for integrated circuits and PCBs are a cornerstone of their intelligent manufacturing portfolio. These offerings are critical for the sophisticated processes involved in high-end printed circuit board (PCB) production and the intricate fabrication of integrated circuits. The company's commitment to innovation in this space positions them well within a rapidly evolving technological landscape.

The PCB equipment segment, a key area for these automation solutions, demonstrated exceptional performance throughout 2024. This robust growth is a direct reflection of the high market share Han's Laser commands in a sector characterized by continuous technological advancement and substantial demand. This segment is pivotal for industries embracing Industry 4.0 principles and seeking to elevate their advanced manufacturing capabilities.

- Global Leadership: Han's Laser is recognized worldwide for its intelligent manufacturing equipment, particularly in automation for advanced PCB and IC production.

- 2024 PCB Segment Strength: The PCB equipment division experienced significant growth in 2024, underscoring its strong market position in a high-demand, technologically driven industry.

- Industry 4.0 Enablement: These automation solutions are essential for businesses transitioning to smart factories and adopting the latest manufacturing paradigms.

Laser Solutions for Automotive Lightweighting and EV Battery Production

Han's Laser is a significant player in the automotive sector, particularly with its laser solutions for lightweighting and electric vehicle (EV) battery production. The company's high-power laser welding and advanced processing capabilities are crucial for developing lighter vehicle bodies and streamlining EV battery manufacturing. This strategic focus aligns with the automotive industry's rapid growth and increasing demand for precision engineering.

The automotive market presents a substantial opportunity for Han's Laser, driven by the need for efficient and precise manufacturing processes. Key areas of demand include battery tray welding, where accuracy is paramount for safety and performance, and the development of intelligent assembly lines for EVs. These factors position Han's Laser favorably within this high-growth segment.

- Automotive Market Growth: The global automotive market is projected to reach over $3.5 trillion by 2025, with EVs representing a rapidly expanding segment.

- EV Battery Production Demand: The demand for advanced laser welding in EV battery pack assembly is expected to surge, supporting increased production volumes and improved battery performance.

- Lightweighting Trend: Lightweighting initiatives in vehicle design, crucial for improving fuel efficiency and EV range, rely heavily on advanced joining technologies like laser welding.

- Han's Laser's Role: Han's Laser's investment in R&D for high-power laser systems directly addresses these industry needs, offering solutions for complex welding and assembly challenges.

Han's Laser's High-Precision Five-Axis Laser Processing Equipment, recognized with a 2024 Ringier Technology Innovation Award, exemplifies a Star. Its application in high-growth sectors like smartphones and VR/AR, coupled with its advanced ultraviolet laser technology for intricate tasks, solidifies its strong market share in an expanding market.

The HLW-5000/5000-G3 High-Power Ring Spot Fiber Laser, also a 2024 Ringier Technology Innovation Award recipient, is another Star. Its 10kW ultra-high power and variable spot technology place it at an international leading level, catering to the growing demand for high-power fiber lasers in cutting and welding across diverse industries.

Han's Laser's New Energy and Photovoltaic Equipment segment, with a 30.60% revenue increase in photovoltaics and a 69.81% surge in power batteries in 2022, is a burgeoning Star. Strategic investments in these clean energy sectors capitalize on global demand for electric vehicles and renewable solutions.

Advanced automation solutions for integrated circuits and PCBs represent a Star for Han's Laser. The PCB equipment segment's robust growth in 2024 highlights the company's significant market share in a technologically advancing and high-demand sector crucial for Industry 4.0 adoption.

| Product/Segment | BCG Category | Key Growth Drivers | 2024 Recognition/Data |

|---|---|---|---|

| High-Precision Five-Axis Laser Processing Equipment | Star | Smartphone, VR/AR, Smart Wearables demand; advanced technology | 2024 Ringier Technology Innovation Award |

| HLW-5000/5000-G3 High-Power Fiber Laser | Star | Growth in industrial cutting/welding; EV manufacturing | 2024 Ringier Technology Innovation Award; 10kW ultra-high power |

| New Energy & Photovoltaic Equipment | Star | Clean energy demand; EV adoption; renewable energy growth | 30.60% PV revenue growth; 69.81% power battery revenue growth (2022) |

| IC & PCB Automation Solutions | Star | Industry 4.0 adoption; advanced PCB/IC manufacturing needs | Strong 2024 growth in PCB equipment segment |

What is included in the product

Han's Laser's BCG Matrix likely showcases its diverse product portfolio, identifying high-growth, high-share Stars and stable Cash Cows, while also pinpointing areas for strategic investment or divestment in Question Marks and Dogs.

The Han's Laser BCG Matrix offers a strategic roadmap, transforming market complexity into actionable insights by identifying Stars for growth and Cash Cows for sustained revenue.

Cash Cows

Han's Laser's traditional fiber laser marking machines are firmly positioned as Cash Cows within their BCG matrix. These machines are renowned for their high reliability and excellent beam quality, making them a staple in industrial applications.

The laser marking market, while mature, continues its upward trajectory. Projections indicate a steady compound annual growth rate (CAGR) exceeding 9.2% from 2024 through 2032, underscoring the sustained demand for these technologies.

Their broad adoption across diverse sectors such as electronics, automotive, and packaging ensures a consistent and predictable cash flow for Han's Laser. This strong market presence and ongoing demand solidify their status as a mature, high-performing product line.

Standard laser cutting machines for sheet metal represent a strong Cash Cow for Han's Laser. This segment of the market is mature, characterized by consistent demand and established competition, allowing Han's Laser to leverage its strong brand and technological expertise.

Han's Laser's fiber laser cutting machine tools have achieved national-level 'Manufacturing Industry Single Award Enterprise' status for three consecutive periods, from 2018 to 2026. This repeated recognition underscores the company's enduring market dominance and the high quality of its offerings in this mature product category.

These machines are reliable revenue generators, benefiting from Han's Laser's established market presence and customer loyalty. Consequently, they require minimal promotional investment to maintain their sales volume, contributing significantly to the company's overall profitability.

Han's Laser's General Laser Welding Equipment segment is a robust Cash Cow within its product portfolio. This division provides a broad spectrum of laser welding machines, essential for industries like mold manufacturing and IT product assembly. The company commands a substantial market share in this established industrial segment.

This foundational area of industrial laser equipment benefits from consistent demand, ensuring a steady and significant contribution to Han's Laser's overall cash flow. Despite not being a high-growth market, its established presence and loyal customer base solidify its position as a reliable revenue generator for the group.

Standard Laser Engraving Systems

Standard laser engraving systems from Han's Laser are a cornerstone of their business, fitting squarely into the Cash Cows quadrant of the BCG matrix. These systems are designed for a wide array of general industrial uses, serving a mature and stable market that demands reliable permanent marking and identification solutions.

The enduring demand for these engraving systems is a testament to their proven track record across numerous applications. This consistent market presence translates into predictable revenue streams and solid profitability for Han's Laser, making them a vital component of the company's financial stability.

- Market Position: These systems hold a significant share in a slow-growing, established market for industrial marking.

- Revenue Generation: They consistently generate substantial revenue with minimal investment required for maintenance or growth, contributing significantly to Han's Laser's overall profit margin.

- Profitability: As mature products, their operational costs are well-understood and optimized, leading to high and stable profit contributions.

- Strategic Role: The cash generated from these systems can be reinvested into other areas of Han's Laser's portfolio, such as Stars or Question Marks, fueling future growth initiatives.

After-Sales Services and Support for Established Equipment

Han's Laser Technology Industry Group's after-sales services and support for established equipment function as a significant Cash Cow. This segment leverages a substantial global installed base of mature products, including marking, cutting, and welding machines, to generate consistent, high-margin recurring revenue through services like machine installation and maintenance.

This mature service offering demands relatively low investment compared to the research and development of new products, contributing to its strong profitability. For instance, in 2023, Han's Laser reported a significant portion of its revenue derived from its established product lines and the associated service contracts, underscoring the stability of this income stream.

- Recurring Revenue: The installed base of mature laser equipment ensures a steady demand for maintenance, repairs, and upgrades.

- High Profit Margins: Service and support operations typically carry higher profit margins than new equipment sales due to lower incremental costs.

- Low Investment Needs: This segment requires minimal new capital expenditure, freeing up resources for other strategic initiatives.

- Customer Loyalty: Excellent after-sales support fosters strong customer relationships and repeat business, reinforcing its Cash Cow status.

Han's Laser's traditional fiber laser marking machines are firmly positioned as Cash Cows within their BCG matrix. These machines are renowned for their high reliability and excellent beam quality, making them a staple in industrial applications. The laser marking market, while mature, continues its upward trajectory, with projections indicating a steady compound annual growth rate (CAGR) exceeding 9.2% from 2024 through 2032, underscoring the sustained demand for these technologies.

Standard laser cutting machines for sheet metal represent a strong Cash Cow for Han's Laser. Han's Laser's fiber laser cutting machine tools have achieved national-level 'Manufacturing Industry Single Award Enterprise' status for three consecutive periods, from 2018 to 2026. These machines are reliable revenue generators, benefiting from Han's Laser's established market presence and customer loyalty, requiring minimal promotional investment to maintain sales volume.

Han's Laser's General Laser Welding Equipment segment is a robust Cash Cow within its product portfolio, commanding a substantial market share in this established industrial segment. This foundational area of industrial laser equipment benefits from consistent demand, ensuring a steady and significant contribution to Han's Laser's overall cash flow. Standard laser engraving systems also fit squarely into the Cash Cows quadrant, serving a mature and stable market that demands reliable permanent marking solutions.

Han's Laser Technology Industry Group's after-sales services and support for established equipment function as a significant Cash Cow. This segment leverages a substantial global installed base of mature products to generate consistent, high-margin recurring revenue. For instance, in 2023, Han's Laser reported a significant portion of its revenue derived from its established product lines and associated service contracts, underscoring the stability of this income stream.

| Product Segment | BCG Category | Market Growth | Market Share | Revenue Contribution |

|---|---|---|---|---|

| Fiber Laser Marking Machines | Cash Cow | Mature, steady (CAGR >9.2% 2024-2032) | High | Significant, predictable |

| Standard Laser Cutting Machines | Cash Cow | Mature, stable | High | Consistent, profitable |

| General Laser Welding Equipment | Cash Cow | Mature, consistent demand | Substantial | Steady, significant |

| Standard Laser Engraving Systems | Cash Cow | Mature, stable | Significant | Predictable, solid |

| After-Sales Services & Support | Cash Cow | Mature, recurring | High (based on installed base) | Consistent, high-margin |

Preview = Final Product

Han's Laser Technology Industry Group BCG Matrix

The preview you are currently viewing is the exact, unwatermarked Han's Laser Technology Industry Group BCG Matrix report you will receive upon purchase. This comprehensive analysis is fully formatted and ready for immediate strategic application, providing clear insights into the company's product portfolio.

Rest assured, the document you see is the final, professional-grade BCG Matrix report you'll download after completing your purchase. It contains no demo content or hidden alterations, offering a complete and actionable strategic overview of Han's Laser Technology Industry Group.

Dogs

Han's Laser's older generation CO2 laser drilling machines for HDI boards, primarily used in traditional 5G communication and industrial control, may represent a question mark or even a dog within the BCG matrix. While these machines cater to established, albeit slower-growing, sectors, the broader consumer electronics and PCB equipment markets saw significant declines in 2022, with revenue for Han's Laser's PCB equipment segment falling by 21.7% year-on-year to RMB 1.15 billion.

This performance suggests that the market for these older CO2 technologies, in applications not at the forefront of innovation, is likely experiencing low growth and potentially declining market share. The capital investment required to maintain or upgrade these product lines, without a corresponding high return due to market saturation or technological obsolescence, could classify them as cash traps, draining resources that could be better allocated to more promising areas.

Han's Laser's 'Laser Display Series' appears to be a product segment with limited recent public development or market recognition compared to their strong industrial laser offerings. While listed, there's a scarcity of data showcasing significant innovation or market leadership in this area, suggesting it might not be a primary growth driver.

Given the intense competition from established and emerging display technologies, this series could be positioned as a low-growth, low-market share product. Without substantial recent investment or market traction, it's plausible that the 'Laser Display Series' may only achieve break-even status, potentially representing a question mark or even a dog in the BCG matrix for Han's Laser.

Han's Laser's niche sub-surface engraving systems, while part of their diverse portfolio, are not as prominent as their core marking, cutting, and welding technologies. These specialized systems cater to very specific industrial needs, and their market adoption reflects this.

Given that these sub-surface engraving applications represent a smaller segment of the overall laser technology market, their growth trajectory might be slower. If advancements in this niche haven't spurred widespread adoption or opened up new significant markets, these systems could be categorized as a 'Dog' within the BCG matrix, indicating low market share and potentially limited growth prospects as of 2024 data.

Legacy Non-Metal Laser Processing Equipment with Limited Automation

Han's Yueming Laser's legacy non-metal laser processing equipment, particularly older models with limited automation, likely falls into the Dogs category of the BCG matrix. While Yueming Laser is a significant player in non-metal applications, these specific older units may face challenges in today's market.

These machines, lacking advanced integration into smart manufacturing or Industry 4.0 initiatives, could be experiencing declining market share. In 2023, the global laser processing equipment market saw continued growth, but segments with less automation are increasingly being outpaced by more sophisticated offerings.

- Market Position: These older, less automated systems likely hold a low market share in a segment that is either mature or facing rapid technological advancement.

- Growth Prospects: Future growth for these specific legacy products is expected to be minimal, as demand shifts towards smarter, more integrated solutions.

- Competitive Landscape: Competitors offering advanced automation and connectivity in non-metal laser processing are likely capturing market share from these older models.

Certain Specialized Laser Components with Diminishing Demand

Certain specialized laser components within Han's Laser Technology Industry Group's portfolio may be experiencing diminishing demand. These could include older generation laser generators or specific optical components that are being replaced by more advanced and efficient technologies. For instance, if a particular type of CO2 laser source, once a staple, is now being superseded by fiber lasers in many applications, its market share would naturally decline.

These components, characterized by a low market share within a shrinking market segment, would be categorized as Dogs in the BCG matrix. This implies that while they might still generate some revenue, their future growth prospects are limited, and they require careful management to avoid becoming a drain on resources. For example, in 2024, the global market for certain legacy laser processing systems saw a contraction, with demand shifting towards newer, more versatile laser sources.

- Diminishing Demand: Older or highly specialized laser components are being phased out due to technological advancements.

- Low Market Share: These components hold a small portion of the overall laser market.

- Shrinking Segment: The market for these specific components is contracting as newer technologies gain traction.

- Strategic Consideration: Han's Laser must evaluate the cost-effectiveness of continuing production or phasing out these Dog products.

Han's Laser's older generation CO2 laser drilling machines for HDI boards, serving traditional sectors, may be classified as Dogs. The company's PCB equipment segment saw a revenue decline of 21.7% in 2022, indicating a challenging market for these less innovative technologies.

The 'Laser Display Series' likely represents a Dog due to scarce public data on innovation and market leadership, suggesting low growth and market share in a competitive display technology landscape.

Specialized sub-surface engraving systems, catering to niche industrial needs, could also be Dogs if advancements haven't driven widespread adoption, indicating limited growth prospects as of 2024.

Legacy non-metal laser processing equipment from Han's Yueming Laser, lacking advanced automation, faces declining market share as the global market favors Industry 4.0 integrated solutions.

Certain specialized laser components, like older CO2 laser sources being replaced by fiber lasers, are also Dogs due to diminishing demand and a contracting market segment, as observed in 2024.

| Product Segment | BCG Category | Rationale | Relevant Data (2022/2023/2024) |

|---|---|---|---|

| Older CO2 Laser Drilling Machines (HDI) | Dog | Low growth market, declining segment revenue. | PCB equipment revenue down 21.7% in 2022. |

| Laser Display Series | Dog | Limited public development, low market recognition. | Scarcity of data on innovation and market leadership. |

| Sub-Surface Engraving Systems | Dog | Niche applications, potentially slow growth without significant adoption. | Market adoption reflects specific industrial needs; limited growth potential if not widely adopted. |

| Legacy Non-Metal Laser Processing Equipment (Yueming) | Dog | Lacks advanced automation, losing share to integrated solutions. | Global laser processing market favors smarter, integrated solutions. |

| Specialized Laser Components (Legacy) | Dog | Diminishing demand, shrinking market segment due to technological shifts. | 2024 saw contraction in legacy systems demand, shift to newer laser sources. |

Question Marks

Han's Laser's Sincerity Series Thin-Sheet Ultrafast Laser, a recipient of the 2025 Ringier Technology Innovation Award, showcases its cutting-edge capabilities. This recognition highlights the technology's significant innovative potential within the ultrafast laser market.

Ultrafast lasers represent a high-growth segment, enabling advanced precision micromachining for critical applications like semiconductors and delicate materials. This positions the Sincerity Series for substantial future development, capitalizing on the increasing demand for such specialized processing.

While currently a niche product with a potentially smaller market share due to its specialized nature, the Sincerity Series possesses considerable growth potential. Successful market penetration and adoption will be driven by continued investment and technological advancements, solidifying its position in the ultrafast laser landscape.

Han's Laser provides advanced 3D printing solutions, notably Selective Laser Melting (SLM) and Metal Powder Energy Deposition equipment. This laser-based additive manufacturing sector is experiencing robust growth, driven by demand in critical industries such as aerospace and healthcare. For instance, the global metal 3D printing market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating a compound annual growth rate (CAGR) exceeding 20%.

Within this dynamic, high-growth market, Han's Laser's position in the SLM segment is likely that of a developing player. While the overall market potential is substantial, the company's specific market share in this competitive niche may still be establishing itself. Significant investment is likely required to solidify its presence and capitalize on the burgeoning opportunities, aiming to transition from potential to market leadership.

Han's Laser is making significant strides in semiconductor packaging equipment, a sector demanding extreme precision. Their increased R&D investment in semiconductors and core devices, a trend amplified in 2024, signals a clear strategic pivot towards this high-growth arena.

The semiconductor industry, known for its relentless innovation and stringent quality requirements, presents a lucrative, albeit competitive, landscape. Han's Laser is actively positioning itself to capture a larger share of this market, aiming to leverage its advanced laser technologies for sophisticated packaging solutions.

While Han's Laser's current market share in this specialized, high-precision niche may still be developing, the potential for expansion is substantial. The company's commitment to this segment underscores its ambition to become a key player in enabling the next generation of semiconductor devices through cutting-edge equipment.

AI and IoT Integrated Laser Systems

The market for AI and IoT integrated laser systems is experiencing rapid expansion, driven by the broader Industry 4.0 revolution. This integration allows for enhanced automation, cloud connectivity, and AI-powered diagnostics, fundamentally transforming manufacturing processes. Han's Laser is strategically positioned to capitalize on this trend by focusing on digital transformation and building an intelligent manufacturing ecosystem.

While this segment represents a significant growth opportunity, the adoption of these advanced AI/IoT laser systems is still in its nascent stages. Han's Laser will likely need to make substantial investments to secure a strong market position. For instance, the global industrial laser market was valued at approximately $15.2 billion in 2023 and is projected to grow substantially, with the AI and IoT segment expected to be a key driver of this expansion.

- Market Driver: Industry 4.0 and the demand for smart manufacturing solutions are propelling the integration of AI and IoT into laser systems.

- Han's Laser Strategy: The company is actively pursuing digital industry transformation and aims to establish a comprehensive intelligent manufacturing ecosystem.

- Investment Needs: Capturing market share in this emerging sector will require significant upfront investment in research, development, and market penetration strategies.

- Growth Potential: The early adoption phase suggests high future growth potential, with early movers poised to benefit from market leadership.

Specialized Laser Solutions for Medical Devices

Specialized laser solutions for medical devices represent a promising area for Han's Laser Technology Industry Group, fitting into the Question Mark quadrant of the BCG Matrix. The global laser cutting market within the medical sector is expanding rapidly, with an anticipated 8% compound annual growth rate from 2025 to 2033, fueled by the increasing need for precision in manufacturing advanced medical equipment.

Han's Laser's technology is integral to the production of various medical devices, and its active participation in key industry gatherings like MDM EAST underscores its commitment to this sector. Despite the market's strong growth trajectory, Han's Laser's current market share in this highly specialized and regulated field may still be nascent. This positions it as a Question Mark, a business unit with high growth potential but currently a low market share, requiring strategic investment to capitalize on its opportunities.

- Market Growth: The medical laser cutting market is projected for an 8% CAGR from 2025-2033.

- Application: Han's Laser's equipment is used in the manufacturing of medical devices.

- Industry Presence: Active participation in events like MDM EAST demonstrates engagement.

- BCG Classification: High market growth potential with a potentially low current market share categorizes it as a Question Mark.

Han's Laser's specialized solutions for medical devices fall into the Question Mark category of the BCG Matrix. The medical laser cutting market is expected to grow at an 8% CAGR from 2025 to 2033, indicating significant potential. While Han's Laser's technology is applied in medical device manufacturing, its current market share in this specialized field is likely still developing, necessitating strategic investment to achieve market leadership.

| Product/Service | Market Growth Rate | Relative Market Share | BCG Quadrant |

| Specialized Medical Device Laser Solutions | High (8% CAGR 2025-2033) | Low (Developing) | Question Mark |

BCG Matrix Data Sources

Our Han's Laser BCG Matrix leverages comprehensive data from annual reports, market research, and industry expert analysis to accurately position each business unit.