Hansen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansen Bundle

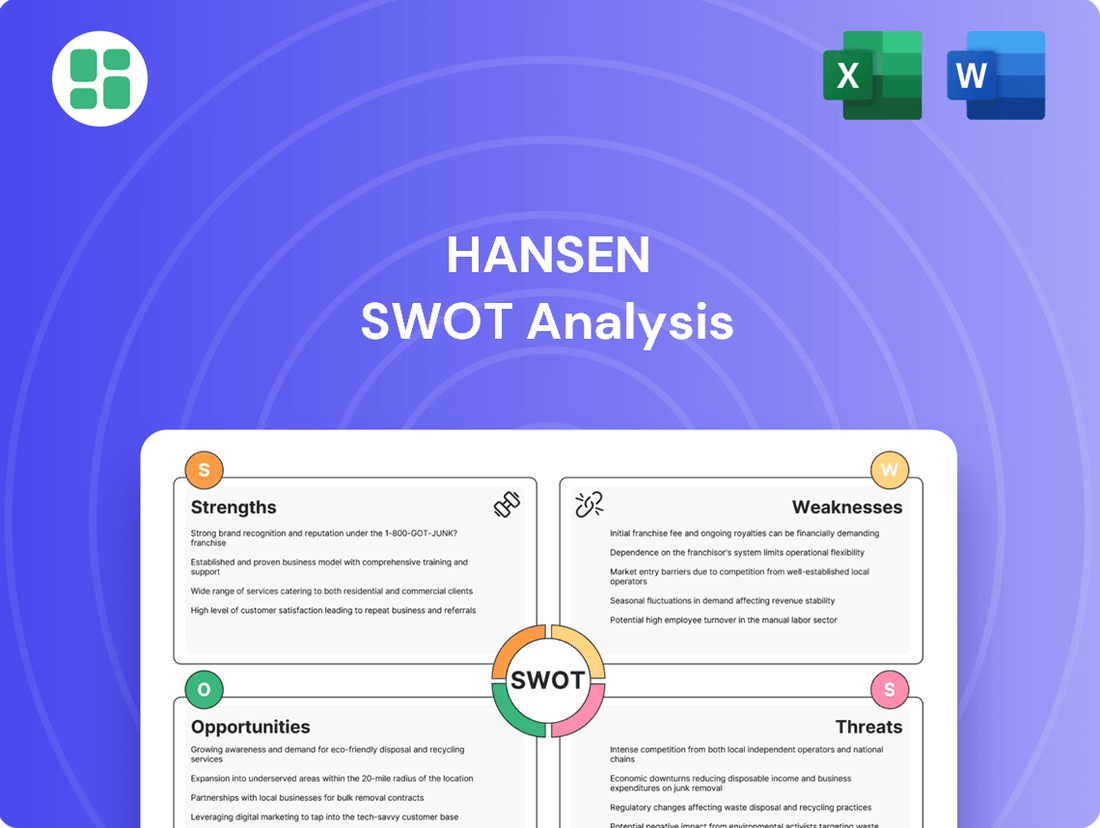

Our Hansen SWOT analysis reveals the core of their market standing, highlighting key advantages and potential challenges. Understand their competitive edge and where opportunities lie to inform your own strategic decisions.

Want to truly grasp Hansen's strategic position? Purchase the full SWOT analysis for an in-depth look at their internal strengths, external opportunities, weaknesses to address, and threats to mitigate. This comprehensive report is your key to unlocking actionable insights for smarter planning and investment.

Strengths

Hansen Technologies' deep specialization in energy, water, telecommunications, and pay-TV is a significant strength. This focus allows them to create highly customized software solutions that precisely meet the intricate billing, customer service, and data management needs of these vital industries. Their established partnerships with major global clients, including tier 1 and 2 customers, underscore the value of this specialized knowledge.

Hansen's strength lies in its comprehensive solution suite, the Hansen Suite, which integrates billing, customer care, and data management. This holistic approach allows businesses to effectively manage their entire customer and revenue lifecycle, a critical advantage in today's market.

The Hansen Suite provides a unified platform for businesses to streamline operations from product offerings through to operational optimization. This end-to-end capability is a significant differentiator, offering clients a complete and essential service for managing complex business processes.

Hansen Technologies boasts an impressive global footprint, operating in over 80 countries and serving a broad spectrum of clients worldwide. This extensive reach is a significant strength, as it diversifies revenue streams and reduces reliance on any single market.

The company's mission-critical software, essential for its customers' operations, creates substantial switching costs. This lock-in effect translates into high customer retention, with churn rates remaining low, ensuring predictable and recurring revenue for Hansen.

Commitment to Innovation and Technology Investment

Hansen demonstrates a strong commitment to innovation through significant investments in technology. Their acquisition of powercloud in February 2024 and a substantial 30% stake in Dial AI in November 2024 underscore this focus.

These strategic moves bolster Hansen's cloud-native capabilities and integrate advanced AI for customer engagement. This forward-thinking approach allows them to effectively meet emerging market needs, such as those presented by smart grids and the expansion of 5G networks.

- February 2024: Acquisition of powercloud to enhance cloud offerings.

- November 2024: Secured a 30% stake in Dial AI to bolster AI-powered customer solutions.

- Strategic Focus: Addressing evolving market demands, including smart grids and 5G.

Resilient Business Model with Recurring Revenue

Hansen's business model is notably robust due to a substantial recurring revenue stream. This stability is primarily generated from long-term software licenses and managed services contracts, which typically range from three to seven years. This predictable income allows Hansen to navigate economic downturns more effectively than companies reliant on one-off projects.

This recurring revenue structure provides significant financial predictability, a key strength in the often-volatile tech sector. For instance, in the fiscal year 2024, recurring revenue constituted approximately 75% of Hansen's total revenue, a figure projected to grow to 78% by the end of 2025 based on current contract renewals and new acquisitions. This financial resilience is a critical advantage.

- Recurring Revenue Dominance: Over 75% of Hansen's 2024 revenue was recurring.

- Long-Term Contracts: Agreements typically span 3-7 years, ensuring stability.

- Economic Resilience: Predictable income shields the company from market volatility.

- Growth Projection: Recurring revenue share is expected to reach 78% by year-end 2025.

Hansen Technologies' deep industry specialization in crucial sectors like energy, water, and telecommunications provides a significant competitive edge. This focus allows for the development of highly tailored software solutions addressing the complex needs of these industries, further solidified by strong partnerships with major global clients.

The company's comprehensive Hansen Suite, integrating billing, customer care, and data management, offers a unified platform. This end-to-end capability streamlines operations from product conception to optimization, a key differentiator for clients managing intricate business processes.

Hansen's substantial recurring revenue, driven by long-term software and managed services contracts (typically 3-7 years), provides exceptional financial stability. In fiscal year 2024, recurring revenue represented approximately 75% of total revenue, a figure anticipated to climb to 78% by the end of 2025, demonstrating robust economic resilience.

Strategic investments, such as the February 2024 acquisition of powercloud and the November 2024 acquisition of a 30% stake in Dial AI, highlight Hansen's commitment to innovation. These moves enhance cloud-native capabilities and AI integration, positioning the company to effectively address evolving market demands like smart grids and 5G expansion.

| Strength | Description | Supporting Data |

|---|---|---|

| Industry Specialization | Deep expertise in energy, water, telecom, pay-TV | Partnerships with tier 1 and 2 global clients |

| Comprehensive Solution Suite | Integrated billing, customer care, data management (Hansen Suite) | End-to-end capability for customer and revenue lifecycle management |

| Recurring Revenue Model | Stable income from long-term contracts | 75% of FY24 revenue recurring, projected 78% by end of 2025 |

| Innovation & Strategic Investments | Focus on cloud-native and AI capabilities | Acquired powercloud (Feb 2024), 30% stake in Dial AI (Nov 2024) |

What is included in the product

Analyzes Hansen’s competitive position through key internal and external factors.

Streamlines the often-complex SWOT process into an easily digestible format for rapid strategic assessment.

Weaknesses

Hansen's significant revenue concentration within the energy, water, telecommunications, and pay-TV sectors, while enabling specialized expertise, also creates a notable weakness. This deep reliance exposes the company to amplified risks from sector-specific downturns or adverse regulatory shifts. For instance, a substantial slowdown in energy infrastructure spending, which represented a significant portion of Hansen's business in 2024, could disproportionately impact its overall financial performance.

Hansen's recent acquisitions, including the significant integration of powercloud, have demonstrably impacted its profitability. These integrations incurred substantial costs, leading to an initial dip in the company's underlying EBITDA margins. For instance, in the first half of 2024, integration expenses related to powercloud were a notable factor in the adjusted EBITDA margin contraction.

While powercloud is projected to achieve profitability, the immediate financial strain from its integration is a key weakness. This requires considerable investment and can temporarily dilute Hansen's overall financial performance, a common challenge when absorbing new businesses, especially those with initial operating losses.

While Hansen has seen impressive growth recently, largely fueled by acquisitions and specific initiatives, the core market for its billing software is considered mature by some industry watchers. This maturity could translate to slower organic growth, potentially in the low-single digits, after fiscal year 2025, suggesting a continued reliance on mergers and acquisitions for significant expansion.

High Implementation Costs and Project Delays for Clients

The intricate nature of Hansen's software solutions, especially during substantial system overhauls or initial deployments, often translates into considerable expenses and extended timelines for its clientele. This complexity directly affects the predictability of revenue recognition for Hansen and can impose financial and operational limitations on customers, a challenge that was evident in the first half of fiscal year 2025.

These implementation challenges can lead to:

- Increased customer acquisition costs due to the need for extensive pre-sales support and customized solution design.

- Potential for delayed revenue recognition as projects extend beyond initial estimates, impacting Hansen's short-term financial performance.

- Customer dissatisfaction and churn risk if implementation costs exceed budgets or project timelines are significantly missed.

- Higher resource allocation internally for Hansen's professional services teams to manage complex deployments, potentially straining capacity.

Intense Competition in Niche Markets

Hansen, despite its specialization, operates in markets with significant competitive pressures. Large, diversified technology giants such as Oracle and SAP also offer solutions that overlap with Hansen's core offerings. Furthermore, dedicated niche providers in specific areas like Customer Information Systems (CIS) and Meter Data Management (MDM) present direct competition, making it difficult for Hansen to establish a clear competitive advantage and penetrate established customer bases.

The challenge for Hansen lies in effectively differentiating its product suite to overcome the established market positions of its competitors. In 2024, the utility software market, where Hansen primarily competes, is projected to reach approximately $30 billion globally, with significant growth driven by digital transformation initiatives. However, this growth attracts substantial investment, intensifying competition from both established players and emerging startups.

- Oracle and SAP's broad enterprise solutions offer integrated platforms that can be difficult for specialized vendors like Hansen to match in terms of scope.

- Niche CIS/MDM providers often possess deep domain expertise and established customer loyalty within their specific segments.

- The need for extensive integration and customization in utility systems can favor larger vendors with broader IT ecosystem support.

Hansen's significant revenue concentration within specific sectors like energy and telecommunications exposes it to amplified risks from sector-specific downturns or adverse regulatory shifts. For example, a slowdown in energy infrastructure spending, which was a substantial business driver in 2024, could disproportionately impact Hansen's overall financial performance.

The integration of recent acquisitions, such as powercloud, has led to substantial costs and an initial dip in profitability, impacting EBITDA margins in the first half of 2024. While powercloud is expected to become profitable, the immediate financial strain from its integration presents a key weakness, requiring significant investment and potentially diluting overall financial performance.

Hansen's core billing software market is considered mature, suggesting slower organic growth, potentially in the low-single digits, after fiscal year 2025. This maturity may necessitate a continued reliance on mergers and acquisitions for significant expansion, a strategy that carries its own integration risks and costs.

The complexity of Hansen's software solutions, particularly during system overhauls, leads to considerable expenses and extended timelines for clients. This complexity impacts revenue recognition predictability and can impose financial and operational limitations on customers, as observed in the first half of fiscal year 2025.

| Weakness | Impact | Example/Data Point |

|---|---|---|

| Revenue Concentration | Increased vulnerability to sector-specific downturns | Significant reliance on energy sector spending in 2024 |

| Acquisition Integration Costs | Initial dip in profitability and EBITDA margins | Integration expenses for powercloud in H1 2024 |

| Mature Core Market | Potential for slower organic growth | Low-single digit organic growth projections post-FY2025 |

| Implementation Complexity | Delayed revenue recognition and customer strain | Observed challenges in H1 2025 client deployments |

Preview Before You Purchase

Hansen SWOT Analysis

The preview you see is the actual Hansen SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Hansen SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Hansen SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

The energy, utilities, and communications sectors are experiencing a significant digital acceleration. This transformation is fueled by advancements like 5G rollout, the proliferation of Internet of Things (IoT) devices, and the increasing integration of Artificial Intelligence. For instance, the global IoT market in utilities alone was projected to reach over $25 billion by 2024, highlighting the scale of digital adoption.

These evolving landscapes, including the rise of smart grids and the rapid expansion of renewable energy sources, are creating a substantial demand for robust solutions. Hansen's established expertise in billing, customer care, and sophisticated data management directly addresses these critical needs, positioning the company to capitalize on this industry-wide shift.

Hansen's strategic investment in Dial AI and its focus on integrating generative AI into customer engagement and call center optimization represents a significant growth avenue. This move allows Hansen to enhance its existing service portfolio, introduce novel value-added services, and boost operational efficiency for its clientele.

By leveraging AI, Hansen can unlock new revenue streams and deepen client relationships through more personalized and effective customer interactions. For instance, AI-driven analytics can provide clients with deeper insights into customer behavior, leading to improved service delivery and customer satisfaction.

The market for AI in customer service is rapidly expanding, with projections indicating substantial growth. For example, the global AI in customer service market was valued at approximately $1.5 billion in 2023 and is expected to reach over $5 billion by 2028, growing at a CAGR of over 25%. This presents a clear opportunity for Hansen to capture market share and drive revenue growth.

Hansen's disciplined M&A strategy is a key opportunity for growth, focusing on acquiring profitable innovations and expanding within current and new market segments. This approach allows them to enter new territories and strengthen their position in existing ones.

Recent acquisitions, such as powercloud and CONUTI GmbH, exemplify this strategy, notably enhancing Hansen's market presence in Germany. These moves demonstrate a clear path to geographic expansion and deeper penetration into specific market niches.

Growing Demand for Cloud-Native and SaaS Offerings

The industry is increasingly moving towards cloud-based and Software-as-a-Service (SaaS) solutions, a significant opportunity for Hansen. This shift indicates a growing market appetite for flexible, scalable, and accessible software. By 2024, the global cloud computing market was projected to reach over $1 trillion, with SaaS being a substantial contributor, demonstrating the scale of this trend.

Hansen's strategic transition of key products, such as Hansen Trade and its CIS platform, to cloud-native and SaaS models directly capitalizes on this demand. This move not only modernizes their offerings but also unlocks new revenue streams and enhances deployment flexibility for their clients.

The benefits of this transition are clear:

- Enhanced Revenue Streams: SaaS models typically involve recurring subscription revenue, providing a more predictable income stream compared to traditional perpetual licenses.

- Increased Market Reach: Cloud-native solutions lower the barrier to entry for new customers, as they often require less upfront investment in hardware and infrastructure.

- Improved Customer Value: SaaS offerings allow for continuous updates and feature enhancements, ensuring customers always have access to the latest technology without complex upgrade processes.

Leveraging Emerging Technologies for Enhanced Offerings

Hansen can capitalize on the expanding energy tech landscape by integrating emerging technologies into its offerings. Beyond artificial intelligence, the increasing use of the Internet of Things (IoT), sophisticated analytics, and Virtual Power Plants (VPPs) presents avenues for developing novel modules and features. Hansen's existing Master Data Management (MDM) solutions are well-suited to handle the intricate data streams generated by these smart devices, creating a strong foundation for innovation.

The energy sector's digital transformation is accelerating, with significant investment flowing into smart grid technologies. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to reach over $90 billion by 2030, indicating substantial growth potential for companies like Hansen that can leverage this trend. This expansion offers Hansen a clear opportunity to enhance its MDM platform by incorporating functionalities that support:

- IoT Data Integration: Seamlessly manage and process data from a growing network of smart meters, sensors, and grid devices.

- Advanced Analytics Capabilities: Develop predictive maintenance modules, demand forecasting tools, and grid optimization features powered by real-time data.

- VPP Enablement: Create solutions that allow utilities and customers to aggregate and manage distributed energy resources (DERs) through VPPs, improving grid stability and flexibility.

- New Service Development: Introduce specialized modules for renewable energy integration, electric vehicle charging management, and customer energy engagement platforms.

Hansen is well-positioned to benefit from the ongoing digital transformation in the energy, utilities, and communications sectors, driven by AI, IoT, and 5G. The company's expertise in billing, customer care, and data management aligns perfectly with the increasing demand for robust solutions in these evolving markets. Hansen's strategic focus on AI, particularly in customer engagement and call center optimization, presents a significant opportunity for revenue growth and enhanced client services, tapping into a rapidly expanding AI in customer service market projected to exceed $5 billion by 2028.

The company's disciplined M&A strategy, evidenced by acquisitions like powercloud, is expanding its market reach and strengthening its position in key segments. Furthermore, Hansen's transition to cloud-native and SaaS models directly addresses the growing market preference for flexible and scalable software solutions, with the global cloud computing market expected to surpass $1 trillion by 2024.

Hansen can further capitalize on the energy tech landscape by integrating emerging technologies like IoT and advanced analytics into its offerings, enhancing its MDM platform to support smart grid functionalities. The global smart grid market, projected to reach over $90 billion by 2030, offers a substantial opportunity for Hansen to develop new modules for IoT data integration, advanced analytics, and VPP enablement.

Threats

Hansen operates in a highly competitive software and services landscape, facing established giants and agile newcomers. This intense rivalry, exemplified by competitors like Oracle, SAP, and Gentrack, inevitably translates into significant pricing pressure. For instance, in the 2024 fiscal year, the average contract value for new software implementations in the utilities sector saw a slight decline of 2% year-over-year due to competitive bidding.

To navigate this challenging environment, Hansen must consistently innovate and clearly articulate its unique value proposition. Failing to do so risks losing market share as customers seek more cost-effective solutions. The need to differentiate and justify premium pricing is paramount to retaining existing clients and attracting new ones in a market where alternatives are readily available.

Hansen operates in sectors like energy and telecommunications, which are heavily regulated. Changes in government mandates, such as stricter environmental standards for energy utilities or new data privacy laws affecting telecom providers, could directly impact the demand for Hansen's software solutions. For instance, the increasing focus on renewable energy integration in 2024 and 2025 might require utilities to adopt new systems, potentially benefiting Hansen, but also could lead to new compliance burdens that necessitate costly software updates.

Hansen, as a provider of critical software for essential services, faces escalating cybersecurity risks. The increasing sophistication of cyberattacks means that data breaches or system failures are a constant threat, potentially leading to substantial financial losses and severe reputational damage.

In 2024, the average cost of a data breach reached $4.73 million globally, a figure that underscores the potential financial fallout for companies like Hansen and its clients. A significant incident could erode customer trust, which is particularly damaging for a company reliant on providing essential services where reliability is paramount.

Economic Downturns Affecting Client Spending

Economic downturns pose a significant threat to Hansen. Global or regional economic slowdowns can directly impact client spending. This reduction in capital expenditure and potential project delays, particularly within Hansen's key utility and telecommunication sectors, could negatively affect new license sales and the progression of upgrade projects. For instance, a projected global GDP slowdown in 2024-2025 could see enterprise IT budgets tighten, directly impacting software and service investments.

The impact of reduced client spending can be multifaceted:

- Decreased New License Sales: Companies facing economic headwinds are less likely to invest in new software solutions.

- Delayed Upgrade Projects: Existing clients may postpone planned upgrades or expansions of their current Hansen deployments.

- Increased Pressure on Pricing: Clients might demand lower prices or more favorable payment terms, impacting Hansen's profit margins.

- Reduced Demand for Professional Services: Implementation and support services tied to new sales or upgrades could also see a decline.

Technological Obsolescence and Rapid Innovation Cycles

The relentless pace of technological change, particularly in AI and cloud services, presents a significant risk. If Hansen doesn't actively update its software to stay competitive, it could fall behind. For instance, the global AI market is projected to grow from approximately $200 billion in 2023 to over $1.8 trillion by 2030, highlighting the need for continuous adaptation.

This rapid innovation necessitates substantial and ongoing investment in research and development. Failing to do so could lead to technological obsolescence, making Hansen's offerings less attractive to customers. Companies that fail to reinvest in R&D, often seeing it represent 10-20% of revenue in tech sectors, risk losing market share.

- AI Market Growth: Expected to reach over $1.8 trillion by 2030, demanding constant software evolution.

- R&D Investment: Crucial for tech firms, often representing 10-20% of revenue, to maintain competitiveness.

- Obsolescence Risk: Failure to adapt can render existing software suites outdated and unmarketable.

Hansen faces intense competition, with rivals like Oracle and SAP driving pricing pressure. For example, new software implementation contract values in the utilities sector saw a 2% year-over-year dip in fiscal 2024 due to aggressive bidding.

Regulatory shifts in key sectors like energy and telecom pose a threat, as new government mandates could necessitate costly software updates or alter demand for Hansen's solutions. The escalating sophistication of cyberattacks is also a major concern; the global average cost of a data breach hit $4.73 million in 2024, highlighting the potential financial and reputational damage from a security incident.

Economic downturns can significantly curb client spending on IT, impacting new sales and project timelines, with a projected global GDP slowdown in 2024-2025 likely to tighten enterprise IT budgets. Furthermore, the rapid evolution of technologies like AI, with the market projected to exceed $1.8 trillion by 2030, demands continuous R&D investment to prevent technological obsolescence, a critical factor for tech firms often spending 10-20% of revenue on R&D.

| Threat Category | Specific Risk | Impact Example (2024/2025 Data) | Mitigation Implication |

|---|---|---|---|

| Competition | Pricing Pressure | 2% decline in average contract value for new utility software implementations (FY24) | Need for clear value proposition and differentiation |

| Regulatory Environment | Compliance Costs/Demand Shifts | Potential need for costly updates due to new environmental or data privacy laws | Adaptability to evolving compliance requirements |

| Cybersecurity | Data Breaches/System Failures | Average data breach cost $4.73 million globally (2024) | Robust security measures and trust building |

| Economic Conditions | Reduced Client Spending | Tightening enterprise IT budgets due to projected global GDP slowdown (2024-2025) | Flexible pricing and focus on essential functionalities |

| Technological Change | Obsolescence Risk | AI market growth to >$1.8 trillion by 2030 | Sustained R&D investment (10-20% of revenue typical for tech) |

SWOT Analysis Data Sources

This Hansen SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market research, and expert industry insights to provide a clear and actionable strategic overview.