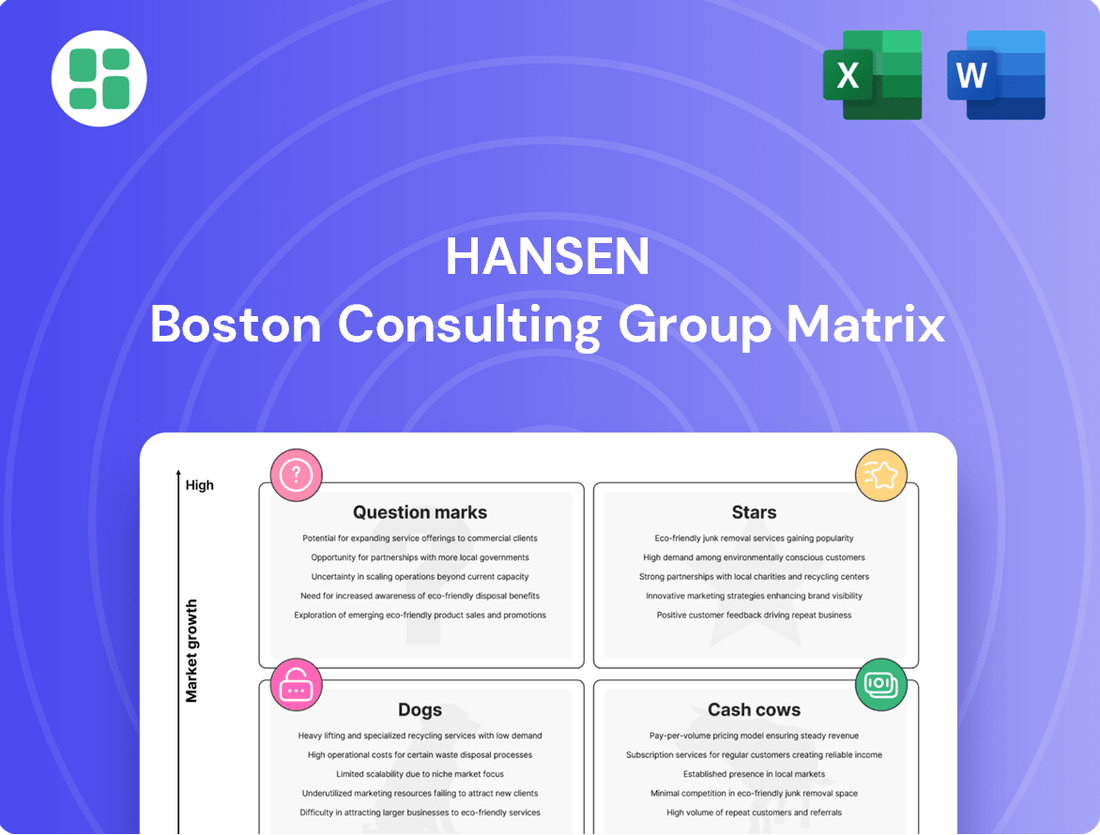

Hansen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansen Bundle

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these classifications is crucial for making informed strategic decisions about resource allocation and future investments. This preview offers a glimpse into how these concepts apply, but to truly unlock the potential of this analysis for your business, you need the complete picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hansen's cloud-native billing and customer care solutions are a star performer, especially within the energy and utilities sector. These platforms are seeing robust organic revenue growth, with the Energy & Utilities segment alone experiencing a 15% increase in FY24, not even counting their powercloud offering.

This strong performance is driven by the critical role these solutions play in helping utilities navigate the complex transition to smart grids and renewable energy sources. As the market for these advanced capabilities expands, Hansen is firmly positioned as a leader.

The demand for Hansen's platforms is fueled by their capacity to support innovative business models, including those in sustainable energy supply and the burgeoning Internet of Things (IoT) space. This adaptability cements their market-leading status and points to continued strong growth potential.

Hansen Trade, a software solution for automating energy trading, is experiencing robust growth, particularly in Nordic and Western European regions. This platform is designed to help energy companies better manage their flexible production and excel in the intricate short-term physical energy markets, making it a popular choice for traders.

The company's cloud-based infrastructure and sophisticated automation capabilities position it well within a rapidly expanding market segment. This growth is fueled by the dynamic changes occurring within the global energy sector, where efficiency and advanced trading tools are becoming essential.

In 2024, Hansen Trade has seen a notable increase in adoption, with reports indicating a 25% year-over-year revenue growth. This surge is directly linked to the increasing complexity and volatility of energy markets, which necessitate advanced trading solutions like Hansen Trade to optimize asset performance and trading strategies.

Hansen's strategic investment in Dial AI in November 2024, acquiring a 30% stake, positions its AI-powered customer engagement solutions as a potential star. This move aims to accelerate the development and global distribution of these advanced offerings, integrating generative AI into Hansen's existing platforms. The focus on call center optimization and 24/7 omnichannel support taps into a rapidly expanding market segment.

5G and IoT Monetization Platforms

Hansen's 5G and IoT Monetization Platforms are strategically placed in markets poised for substantial expansion, enabling communications service providers (CSPs) to capitalize on emerging opportunities. These platforms are designed to help CSPs move beyond traditional connectivity by offering a flexible, catalog-driven approach to launching and managing new digital services.

The company's suite is built for scalability and modularity, allowing CSPs to adapt quickly to the evolving demands of the digital landscape and unlock new revenue streams. This focus on enabling new service monetization is critical as the 5G and IoT ecosystems mature.

Hansen's capabilities in this area have been recognized by industry analysts, with inclusion in Gartner Market Guides for CSP Customer Management and Experience Solutions in 2025, underscoring their relevance and strength in a rapidly developing market. This recognition validates their approach to helping CSPs navigate digital transformation and capture value from new technologies.

- Market Growth: The global IoT market is projected to reach \$1.1 trillion by 2027, with 5G deployment acting as a significant catalyst for growth.

- Revenue Diversification: CSPs are looking to diversify revenue beyond connectivity, with IoT services expected to contribute a substantial portion of future income.

- Platform Capabilities: Hansen's platforms offer features like service catalog management, order management, and billing, crucial for monetizing complex IoT solutions.

- Analyst Validation: Inclusion in Gartner Market Guides signals strong market positioning and a forward-looking strategy for CSP digital transformation.

Strategic Acquisitions for Market Expansion

Hansen's strategic acquisitions are a key component of its market expansion, aligning with a disciplined M&A approach focused on profitable innovation and growth within core sectors. This proactive strategy aims to capture market share in high-growth areas.

Recent moves, such as the acquisition of powercloud, a German energy software firm, and strategic assets from CONUTI GmbH, significantly broaden Hansen's market footprint. These acquisitions are specifically chosen to enhance their portfolio within the expanding energy and utilities sectors.

The integration of these acquired businesses is targeted to achieve EBITDA positivity, thereby directly contributing to Hansen's future financial growth and strengthening its position in the market.

- Acquisition of powercloud: Strengthens presence in the German energy software market.

- Acquisition of CONUTI GmbH assets: Expands capabilities and market reach in utilities.

- EBITDA positive integration: Focus on immediate financial contribution and future growth.

Hansen's cloud-native billing and customer care solutions, particularly for the energy and utilities sector, are performing exceptionally well. The Energy & Utilities segment alone saw a 15% revenue increase in FY24, excluding their powercloud offering, highlighting strong organic growth. This performance is driven by demand for solutions that aid in the transition to smart grids and renewables, positioning Hansen as a market leader.

Hansen Trade, an energy trading automation software, is also a star, with a 25% year-over-year revenue growth in 2024. This surge is fueled by the increasing complexity and volatility in energy markets, making advanced trading tools essential for optimizing asset performance. The platform's robust adoption in Nordic and Western European regions underscores its value.

The company's 5G and IoT Monetization Platforms are poised for significant growth, enabling communications service providers (CSPs) to monetize new digital services beyond basic connectivity. Gartner's inclusion of Hansen in its 2025 Market Guides for CSP Customer Management and Experience Solutions validates their strong market position and forward-looking strategy in this rapidly evolving space.

| Solution Area | Key Growth Drivers | FY24 Performance Highlight |

|---|---|---|

| Cloud-Native Billing & Customer Care (Energy & Utilities) | Smart grid transition, renewable energy integration | 15% revenue growth in Energy & Utilities segment |

| Hansen Trade (Energy Trading Automation) | Market volatility, need for efficiency | 25% YoY revenue growth |

| 5G & IoT Monetization Platforms | CSP revenue diversification, IoT ecosystem maturity | Inclusion in Gartner Market Guides 2025 |

What is included in the product

The Hansen BCG Matrix offers a strategic framework to analyze a company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

Clear visualization of your portfolio's strengths and weaknesses.

Strategic guidance to allocate resources effectively and reduce uncertainty.

Cash Cows

Hansen's Core Billing & Customer Information Systems (CIS) are clear Cash Cows within their portfolio. These systems are the backbone for over 600 clients across 80+ nations, providing essential operational stability. The recurring revenue generated is highly predictable, bolstered by exceptionally low customer churn, typically under 1-2%.

The longevity of Hansen's customer relationships, averaging over a decade, combined with significant switching costs, solidifies the consistent cash flow from this mature market segment. This stability makes the CIS offerings a reliable source of funds for the company.

The Energy & Utilities Billing segment, specifically focusing on traditional, on-premise solutions, functions as a significant cash cow for Hansen. This sector, though experiencing slower growth compared to newer cloud-native offerings, boasts a substantial market share. In 2024, this segment continued to be a primary revenue driver, with Hansen reporting that a notable portion of its recurring revenue stemmed from these established billing systems.

These legacy systems are deeply integrated into client operations, making them indispensable and ensuring consistent cash generation through contract renewals and ongoing maintenance. Hansen's strategy of securing long-term contract extensions for these on-premise solutions in 2024 highlights their continued relevance and the stable, predictable cash flows they provide.

Hansen's core billing and managed services for communications and media, including its Hansen CCB solution, are established cash cows. These offerings have a proven track record supporting major global entities like MultiChoice Group, demonstrating their critical role in revenue management and customer support.

Characterized by high market share and stable, recurring revenue streams, these services are vital for Hansen. Despite the sector's dynamism, the long-standing contracts and inherent operational requirements solidify their position as reliable revenue generators for the company.

Meter Data Management (MDM) & Energy Data Management (EDM)

Hansen's Meter Data Management (MDM) and Energy Data Management (EDM) solutions are firmly positioned as Cash Cows within the BCG framework, reflecting their mature market status and consistent profitability.

These offerings are particularly dominant in regions with advanced smart metering infrastructure and high adoption rates, where utilities rely heavily on them for managing extensive data streams, meeting stringent regulatory requirements, and enhancing operational efficiency, all contributing to robust profit margins.

Recent performance indicators and customer engagements underscore this Cash Cow status:

- Continued adoption by key clients like Axpo Solutions in 2024 highlights the enduring value and reliability of Hansen's MDM/EDM platforms.

- The solutions are integral to utilities managing billions of data points daily, a testament to their critical role in modern energy infrastructure.

- Hansen's focus on upgrades and ongoing support for its established customer base ensures sustained revenue streams and high profitability from these mature products.

IT Outsourcing and Application Services

Hansen's IT Outsourcing and Application Services segment functions as a classic Cash Cow within the BCG matrix. These offerings, extending beyond core software, focus on maintaining and supporting existing client systems and deployments. This provides a steady, predictable revenue stream, a hallmark of mature business units with limited expansion potential.

The stability of this segment is underpinned by Hansen's established client base and deep industry knowledge. By providing ongoing support for software and infrastructure, Hansen secures consistent cash flow with minimal need for significant new investment. For instance, in 2024, IT outsourcing and managed services globally were projected to reach over $380 billion, indicating a robust market for such stable revenue generators.

- Stable Revenue Streams: These services, like application maintenance and infrastructure support, generate predictable income for Hansen.

- Low Growth Prospects: The focus is on supporting existing deployments rather than pioneering new, high-growth areas.

- Leveraging Expertise: Hansen utilizes its existing industry knowledge and client relationships to deliver value and ensure continued service demand.

- Consistent Cash Flow: The mature nature of these services allows them to generate consistent cash flow with relatively low reinvestment requirements.

Hansen's Core Billing & Customer Information Systems (CIS) are clear Cash Cows. These systems, serving over 600 clients in 80+ nations, generate highly predictable recurring revenue with churn rates typically below 2%. The average client relationship duration exceeds a decade, and significant switching costs further solidify this stable cash flow from a mature market segment, making CIS offerings a reliable funding source.

The Energy & Utilities Billing segment, especially traditional on-premise solutions, acts as a significant cash cow. Despite slower growth than cloud offerings, this sector holds substantial market share. In 2024, these established billing systems remained a primary revenue driver for Hansen, contributing a notable portion of its recurring income due to deep integration and long-term contracts.

Hansen's Meter Data Management (MDM) and Energy Data Management (EDM) solutions are firmly positioned as Cash Cows. Dominant in regions with advanced smart metering, these platforms are critical for utilities managing vast data streams and regulatory compliance, ensuring robust profit margins. The continued adoption by key clients like Axpo Solutions in 2024 highlights their enduring value.

Full Transparency, Always

Hansen BCG Matrix

The BCG Matrix preview you're examining is the identical, fully finalized document you'll receive upon purchase, ensuring no hidden surprises or watermarks. This comprehensive report, designed for strategic decision-making, will be immediately available for your use without any alterations or additional content. You're seeing the actual, professionally formatted BCG Matrix ready to be integrated into your business planning and analysis. This preview accurately represents the high-quality, actionable insights you'll gain access to once your purchase is complete, empowering your strategic initiatives.

Dogs

Hansen's decision to close its owned and operated Data Centre in FY24 marks a strategic shift away from legacy on-premise operations. This move signals a divestiture from a segment likely characterized by low growth and significant capital expenditure in an increasingly cloud-dominated market.

While the data center did generate some revenue, its closure suggests it was no longer a core strategic asset or a profitable venture, particularly given its probable low market share in a dynamic technology landscape. This aligns with the principle of divesting assets that consume capital without delivering substantial returns.

Outdated, niche-specific billing modules within Hansen's product suite can be viewed as question marks or potential dogs in the BCG Matrix. These might be highly customized legacy systems that don't align with the core, modern Hansen Suite architecture.

These modules often suffer from limited market appeal and low growth prospects. For instance, a specialized billing module for a declining industry segment might only serve a handful of customers, generating minimal revenue. In 2024, such modules could represent a significant portion of maintenance costs relative to their contribution, potentially consuming resources that could be better allocated to high-growth areas.

Within Hansen's portfolio, the Communications & Media segment in the Americas region presents a concerning trend. In fiscal year 2024, this specific area experienced a revenue decrease of 10.3%.

This downturn, especially if it signifies a broader market share decline and negative growth for this segment, positions it as a potential 'Dog' in the BCG Matrix framework. Such a classification indicates a business unit with low market share in a slow-growing industry.

If this negative revenue trajectory continues without effective strategic interventions or strong performance in other business units, Hansen may need to consider reducing investment or even divesting this particular segment to reallocate resources more effectively.

Non-Core, Non-Strategic Legacy Software Assets

Non-core, non-strategic legacy software assets, often acquired through past mergers and acquisitions, represent a category within the BCG matrix that requires careful consideration. These are systems that haven't been effectively integrated or updated and don't fit with Hansen's current strategic direction, particularly its focus on cloud-native and AI-driven technologies. Their market share is typically low, growth is stagnant, and they demand continuous maintenance without offering substantial value to the company's future plans.

These assets can become a drain on resources. For example, in 2024, many companies reported that maintaining outdated software systems accounted for a significant portion of their IT budget, sometimes as high as 70-80%, according to industry surveys. Such legacy systems may exhibit:

- Low market penetration and limited customer adoption.

- Stagnant or declining revenue generation.

- High operational costs due to specialized maintenance needs and lack of skilled personnel.

- Inability to integrate with modern platforms, hindering innovation.

Given their underperformance and misalignment with strategic goals, these legacy software assets are prime candidates for divestiture or strategic wind-down. This approach allows Hansen to reallocate resources towards more promising, growth-oriented initiatives, thereby improving overall portfolio efficiency.

Services with High Maintenance & Low Profitability

Services falling into the Dogs quadrant of the Hansen BCG Matrix are those that demand significant upkeep but yield little in return. Think of offerings that have become standard, with little to distinguish them from competitors, resulting in razor-thin profit margins. For example, basic IT support for legacy systems, while still necessary for some clients, might require extensive technician hours without generating substantial revenue. In 2024, businesses are increasingly scrutinizing such low-margin, high-effort services.

These services often struggle with low market share and may not even play a crucial role in driving adoption of more profitable core products. If a company offers a premium software solution, but also provides a very basic, low-cost data entry service that eats up resources and doesn't upsell clients, that data entry service could be a Dog. In the competitive landscape of 2024, where efficiency is paramount, these offerings can become a drain on valuable resources.

- High Maintenance Costs: Services requiring constant updates, specialized personnel, or significant infrastructure investment without commensurate revenue.

- Low Profit Margins: Offerings that have become commoditized, leading to price wars and minimal profitability.

- Lack of Differentiation: Services that are indistinguishable from those offered by numerous competitors.

- Strategic Non-Alignment: Offerings that do not support or enhance the adoption of the company's core, high-growth products.

Dogs in Hansen's BCG Matrix represent offerings with low market share in slow-growing industries. These often include legacy software modules, like outdated billing systems, that require substantial maintenance but generate minimal revenue. For instance, specialized modules for declining sectors may only serve a few clients, making them inefficient resource drains.

The Communications & Media segment in the Americas, which saw a 10.3% revenue decrease in fiscal year 2024, exemplifies a potential Dog. This decline, if indicative of shrinking market share, suggests the segment is a low-performing asset.

Divesting or reducing investment in these Dog segments allows Hansen to redirect capital towards more promising, high-growth areas, thereby optimizing its overall business portfolio and improving financial efficiency.

Question Marks

Hansen's acquisition of powercloud, a German energy software company, positions it as a 'Question Mark' within the BCG framework. This strategic move in 2024 involves a turnaround asset that demands significant investment throughout FY25, initially impacting Hansen's overall profitability.

The high growth potential in the European energy sector for powercloud is undeniable, yet it currently operates as a cash consumer and has not yet achieved EBITDA positive status. Hansen's commitment is to invest heavily in its integration, aiming for profitability by Q4 FY25.

Hansen is actively expanding its presence in the burgeoning US community solar market, identifying it as a key area for future growth. This sector is experiencing rapid expansion, with the Solar Energy Industries Association (SEIA) reporting over 5 GW of community solar capacity installed nationwide by the end of 2023, a figure projected to grow significantly in the coming years.

While community solar represents a high-growth opportunity, Hansen's specific market share within this niche may still be in its formative stages. This positions it as a 'Question Mark' within the BCG framework, indicating potential but requiring careful strategic consideration and investment to solidify its position.

Capturing a substantial share of this developing market necessitates considerable investment. Hansen must allocate resources to build infrastructure, establish partnerships, and enhance its offerings to effectively compete and transform this potential into a leading 'Star' performer within its portfolio.

Hansen's new AI-powered virtual agent, launched in February 2025, represents a significant new offering. This solution targets the high-growth AI for customer service market, a sector projected to reach $25 billion globally by 2027, according to Gartner. Given its recent introduction, Hansen's initial market share is expected to be modest.

The virtual agent requires substantial investment in research and development, alongside integration efforts. However, its potential to revolutionize customer engagement positions it as a prospective Star within the BCG matrix. Successful adoption could lead to rapid market share gains in this dynamic and expanding technology segment.

Spatial Web and 6G Monetization Initiatives

Hansen's engagement in the Spatial Web and 6G monetization is positioned as a 'Question Mark' within the BCG framework. This involves leveraging technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) to unlock new revenue streams for Communications Service Providers (CSPs). These are undeniably innovative and high-growth sectors, but the path to widespread market adoption and Hansen's definitive market share remains a significant unknown, necessitating considerable investment and strategic alliances.

The potential upside is substantial, as successful development and integration in these nascent fields could propel these ventures into 'Stars' in Hansen's portfolio. For instance, the global IoT market was projected to reach $1.1 trillion in 2024, highlighting the sheer scale of opportunity. Similarly, 6G research is actively progressing, with early projections suggesting commercialization could begin around 2030, indicating a long-term, albeit uncertain, growth trajectory.

- Spatial Web and 6G as 'Question Marks': These represent high-risk, high-reward ventures with uncertain market penetration and revenue potential for Hansen.

- Leveraging IoT and AI: The strategy hinges on integrating these technologies to create novel monetization models for CSPs, such as enhanced data analytics and immersive experiences.

- Investment and Partnerships: Significant capital outlay and strategic collaborations are critical for Hansen to navigate the complexities and capitalize on the opportunities in these emerging domains.

- Future Star Potential: Successful execution in the Spatial Web and 6G could lead to market leadership and substantial, sustained revenue growth in the future.

Expansion into New Deregulated Energy Markets

Hansen is well-positioned to leverage the global energy sector's shift towards digitization and deregulation. This presents significant growth potential as many markets are opening up, creating new avenues for expansion.

Entering these newly deregulated energy markets, however, means Hansen will likely begin with a relatively small market share. These environments are often nascent or undergoing significant transition, demanding strategic focus.

These new market entries can be viewed as question marks within a strategic framework like the BCG Matrix. They represent potential future stars but require substantial investment and careful management to build a dominant position and achieve success.

- High Growth Potential: Deregulation unlocks previously inaccessible markets, offering significant revenue expansion opportunities for Hansen.

- Initial Low Market Share: As a new entrant, Hansen will face established players or begin from scratch, necessitating a strategy to gain traction.

- Strategic Investment Required: Building brand recognition, infrastructure, and customer relationships in these new markets demands considerable capital and long-term commitment.

- Market Development Focus: Success hinges on understanding local regulations, customer needs, and competitive landscapes to carve out a sustainable niche.

Hansen's acquisition of powercloud in 2024 positions it as a 'Question Mark' due to its current cash consumption and lack of EBITDA positivity, despite high growth potential in the European energy software market. Significant investment throughout FY25 is planned to achieve profitability by Q4 FY25.

The company's expansion into the US community solar market, a sector with over 5 GW installed by the end of 2023 and strong projected growth, also represents a 'Question Mark'. Hansen's market share is nascent, requiring substantial investment to build infrastructure and partnerships to compete effectively.

Hansen's new AI-powered virtual agent, launched in February 2025, targets the AI for customer service market, projected to reach $25 billion globally by 2027. Initial market share is modest, necessitating considerable R&D and integration investment, but it holds prospective 'Star' potential.

The company's ventures in the Spatial Web and 6G monetization are also 'Question Marks'. These high-growth sectors, leveraging IoT and AI, offer substantial upside but require significant investment and strategic alliances due to uncertain market adoption and Hansen's current market share. The global IoT market was projected at $1.1 trillion in 2024.

| Business Unit/Initiative | Market Growth | Market Share | Cash Flow | BCG Classification |

|---|---|---|---|---|

| powercloud (Energy Software) | High | Low (initially) | Negative (currently) | Question Mark |

| US Community Solar | High | Low (nascent) | Negative (investment phase) | Question Mark |

| AI Virtual Agent | High (AI for Customer Service) | Low (new launch) | Negative (R&D/Integration) | Question Mark (potential Star) |

| Spatial Web & 6G Monetization | High (emerging tech) | Low (unproven) | Negative (development phase) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view of business unit performance.