Hansen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansen Bundle

Hansen's competitive landscape is shaped by critical forces, from the bargaining power of buyers to the threat of new entrants. Understanding these dynamics is crucial for strategic success.

The complete report reveals the real forces shaping Hansen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hansen Technologies sources essential components from a wide array of technology suppliers, encompassing cloud infrastructure, hardware, and specialized software. The bargaining power of these suppliers can significantly impact Hansen's operational costs.

If a small number of suppliers dominate the market for critical inputs, their leverage grows, potentially driving up prices for Hansen. For instance, in 2024, the global semiconductor shortage highlighted how concentrated supply chains for essential chips could lead to substantial cost increases and production delays for technology firms.

However, the IT sector's generally diverse supplier landscape tends to moderate this risk for Hansen. The availability of multiple vendors for most technological needs provides Hansen with options and helps prevent any single supplier from exerting undue influence.

Hansen Porter's proprietary software for billing, customer care, and data management forms the bedrock of its operations, making these core inputs highly unique. This uniqueness inherently limits the bargaining power of suppliers for these specific components, as direct substitutes are scarce.

However, Hansen's reliance on third-party software libraries, operating systems, or AI components, such as its investment in Dial AI, introduces potential supplier leverage. The more specialized or patented these external inputs are, the greater the supplier's ability to influence pricing and terms, directly impacting Hansen's costs and operational flexibility.

For Hansen, the bargaining power of suppliers is significantly influenced by switching costs. Changing core technology providers or cloud platforms can be a complex and expensive undertaking for a software firm. This often involves intricate data migration, re-integrating systems, and substantial employee retraining, all of which add to the financial burden and operational disruption.

These high switching costs inherently bolster the bargaining power of Hansen's current suppliers. When it’s difficult and costly to move to an alternative, suppliers can often command more favorable terms. Hansen's established, long-standing partnerships, such as its relationship with VMO2, suggest a degree of customer stickiness that further strengthens the supplier's position.

Threat of Forward Integration by Suppliers

Suppliers of essential software or cloud infrastructure might leverage their position to move into direct competition by offering their own billing or customer management services. This threat is particularly relevant for foundational technology providers.

While less probable for highly specialized billing solutions, broader enterprise software giants, such as Oracle, which already competes with Hansen Porter in certain market segments, could expand their service portfolios. This expansion would inherently boost their bargaining power.

- Increased Competition: Forward integration by suppliers can introduce new competitive pressures, potentially impacting Hansen Porter's market share and pricing power.

- Supplier Leverage: When suppliers can credibly threaten to enter a company's market, they gain significant leverage in price negotiations and contract terms.

- Strategic Response: Companies like Hansen Porter must monitor supplier capabilities and market trends to anticipate and strategically respond to potential forward integration threats.

Importance of Hansen to Supplier

Hansen Technologies' significance to its suppliers plays a crucial role in determining their bargaining power. If Hansen represents a substantial portion of a supplier's overall revenue, that supplier has less leverage. Such a supplier would be highly motivated to maintain the relationship, potentially accepting less favorable terms to secure Hansen's business. For instance, if a specialized software provider derives 20% of its annual income from Hansen, they are likely to be accommodating.

Conversely, for larger, more diversified technology companies that supply Hansen, the situation is different. Hansen might constitute a relatively small fraction of their total sales. In these scenarios, the supplier holds greater bargaining power. They are less dependent on Hansen's business and can therefore dictate terms more assertively, knowing that losing Hansen as a client would have a minimal impact on their operations. For example, a cloud services provider that counts Hansen as one client among thousands would have considerably more leverage.

This dynamic can be illustrated by considering the financial scale. If a supplier's annual revenue is $50 million and Hansen accounts for $10 million of that, Hansen's importance is 20%. However, if a supplier's revenue is $1 billion and Hansen represents $5 million, Hansen's importance is only 0.5%. This disparity directly impacts the supplier's willingness to negotiate prices or terms.

- Supplier Dependence: The percentage of a supplier's revenue generated from Hansen directly influences their bargaining power.

- Market Diversification: Suppliers with a broad customer base have more leverage with Hansen compared to those heavily reliant on Hansen's business.

- Client Size Impact: For large tech conglomerates, Hansen may represent a minor client, amplifying the supplier's negotiating strength.

- Revenue Contribution: A supplier earning 20% of its income from Hansen has less power than one earning 0.5% from the same client.

The bargaining power of suppliers for Hansen Technologies is a key factor in its cost structure. High switching costs for critical inputs like proprietary software or cloud infrastructure significantly strengthen supplier leverage. For example, the complexity and expense of migrating data and retraining staff for a new cloud provider can make switching prohibitive, allowing existing providers to dictate terms.

Suppliers who are vital to Hansen's operations, such as those providing specialized AI components like Dial AI, can exert considerable influence. This is especially true if these components are unique or patented, limiting Hansen's alternatives. The threat of forward integration, where suppliers might offer competing services, also increases their power, as seen with broader enterprise software giants like Oracle.

Hansen's reliance on a diverse IT supplier landscape generally moderates supplier power. However, the concentration in certain areas, like the 2024 semiconductor shortage, demonstrated how limited options for essential components can lead to significant cost increases and production delays. The relative size of Hansen as a customer also plays a role; a supplier heavily dependent on Hansen's business will have less power than one for whom Hansen is a small client.

What is included in the product

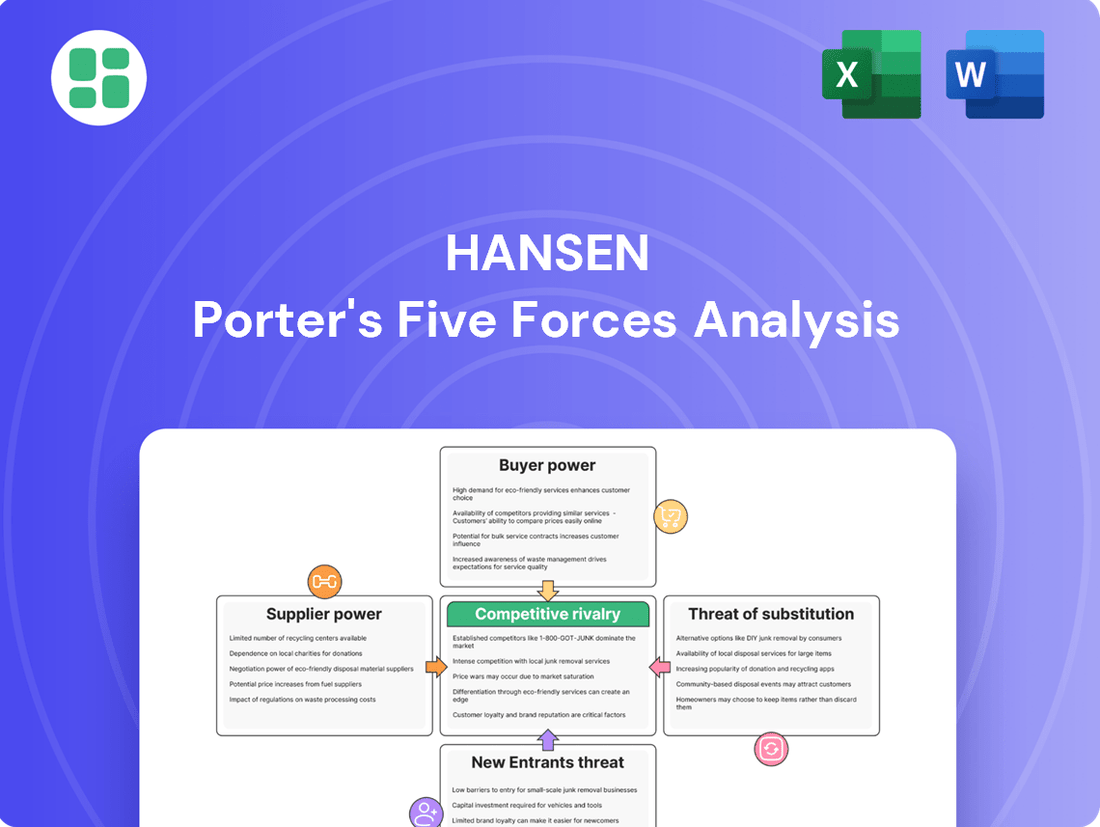

Hansen Porter's Five Forces Analysis dissects the competitive intensity and profitability of Hansen's industry by examining buyer power, supplier power, threat of new entrants, threat of substitutes, and existing rivalry.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Hansen Porter's customer base is highly concentrated within specific sectors like energy, water, telecommunications, and pay-TV. This concentration means a few large enterprise clients represent a significant portion of the company's revenue. For instance, in fiscal year 2024, while no single customer exceeded 8% of revenue, the collective impact of these major clients is substantial, granting them considerable leverage.

This significant customer concentration directly translates into increased bargaining power for these large enterprises. They can exert pressure on pricing, contract terms, and service levels due to their substantial contribution to Hansen Porter's overall business. The recent renewals of major contracts with clients like VMO2 and MultiChoice Group underscore the critical importance of retaining these key relationships and the influence these clients wield.

Hansen's software is integral to its clients' essential functions like billing and customer relationship management. The significant expense and intricate nature of migrating these fundamental systems create substantial customer retention, thereby diminishing their leverage.

For instance, a typical enterprise might spend upwards of $1 million and dedicate 12-18 months to fully transition from one core operational software to another, factoring in data migration, retraining, and system integration. This high barrier to switching directly translates to reduced customer bargaining power for Hansen, as the effort and cost involved in finding and implementing an alternative are prohibitive.

Customer information asymmetry can tip the scales in their favor, but Hansen Porter seems to be managing this. If customers lack insight into Hansen's true costs or the full range of available alternatives, their ability to negotiate effectively is diminished. However, large enterprise clients, a key segment for Hansen, typically perform rigorous due diligence, which helps level the informational playing field.

Hansen's inclusion in Gartner Market Guides, such as the 2023 Gartner Market Guide for Identity Proofing and Corroboration, indicates a degree of transparency. This recognition implies that Hansen's offerings are subject to competitive analysis and benchmarking, which can further reduce information asymmetry for sophisticated buyers.

Price Sensitivity of Customers

Even with high switching costs, customers in sectors like utilities and telecommunications are feeling the squeeze to cut expenses. This heightened price sensitivity could lead to more demanding negotiations for Hansen, especially if these customers experience revenue dips or face stricter regulations. For instance, if a major telecom client's revenue falls by 5% year-over-year, they might push harder for a 10% discount on Hansen's software licenses during renewal.

Hansen's own financial outlook for FY25 indicates a robust second half, largely driven by the scheduled collection of license fees and significant system upgrade projects. This suggests that while customers may be price-sensitive, the value proposition of Hansen's offerings, particularly for upgrades, remains strong enough to command favorable terms, at least in the near term.

The bargaining power of customers is influenced by several factors:

- Price Sensitivity: Customers are more likely to exert pressure if they can easily find cheaper alternatives or if their own profitability is declining.

- Switching Costs: High switching costs (e.g., data migration, retraining) generally reduce customer bargaining power.

- Information Availability: When customers have access to detailed information about pricing and alternatives, their bargaining power increases.

- Threat of Backward Integration: If customers can realistically develop similar solutions in-house, they gain leverage.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large utility or telecom firms, is a key consideration for Hansen. These entities possess the financial clout to develop their own billing and customer care systems. However, the highly specialized nature and intricate complexity of these platforms, coupled with the significant ongoing maintenance and upgrade costs, make this a prohibitively expensive and rare strategic move for most. For instance, developing a robust, secure, and compliant billing system can easily run into tens or even hundreds of millions of dollars in initial investment and ongoing operational expenses, significantly diluting the potential cost savings.

This complexity means that for Hansen's core, sophisticated offerings, the actual risk of a major customer bringing such a critical function in-house remains relatively low. While smaller, less complex functions might be considered for insourcing, the specialized expertise and continuous innovation required for Hansen's advanced solutions act as a substantial barrier. This is particularly true in regulated industries where compliance and security are paramount, adding further layers of difficulty and cost to any potential backward integration effort.

Consider the ongoing investment in cybersecurity alone. In 2024, the average cost of a data breach for companies in the utilities sector was reported to be around $5.5 million, a figure that underscores the substantial investment needed to protect sensitive customer data. For a large utility to replicate Hansen's established, secure infrastructure would require a massive capital outlay and specialized talent acquisition, making it an economically unviable proposition for most.

- High Development Costs: Building a custom billing system can cost millions, often exceeding $50 million for large-scale operations.

- Specialized Expertise Required: Companies need to hire and retain highly skilled software engineers, data scientists, and cybersecurity professionals.

- Ongoing Maintenance & Updates: Continuous investment in system upgrades, security patches, and regulatory compliance is essential.

- Risk of System Failure: A poorly developed in-house system could lead to billing errors, customer dissatisfaction, and significant financial penalties.

Hansen Porter's customers, particularly large enterprises in sectors like telecommunications and utilities, wield significant bargaining power due to their concentrated revenue contribution. While switching costs are high, exceeding $1 million and 12-18 months for migration, customers' increasing price sensitivity, driven by economic pressures, can lead to tougher negotiations. The threat of backward integration, though mitigated by the immense complexity and cost of replicating Hansen's specialized systems (estimated at tens of millions for development and ongoing cybersecurity, with data breaches costing utilities around $5.5 million in 2024), remains a factor in their leverage.

| Customer Bargaining Power Factor | Impact on Hansen Porter | Supporting Data/Context |

|---|---|---|

| Customer Concentration | High leverage for major clients | No single customer exceeded 8% of FY24 revenue, but major clients' collective impact is substantial. |

| Switching Costs | Reduces leverage | Migration costs $1M+, takes 12-18 months. |

| Price Sensitivity | Increases leverage | Customers in utilities/telecom face pressure to cut expenses. |

| Threat of Backward Integration | Low to moderate leverage | Development costs $50M+, requires specialized expertise; cybersecurity costs are high. |

Preview Before You Purchase

Hansen Porter's Five Forces Analysis

This preview showcases the complete Hansen Porter's Five Forces Analysis, offering a detailed examination of competitive forces within an industry. The document you see here is precisely the same professionally formatted analysis you'll receive instantly after purchase, ensuring no surprises or missing sections. You can confidently use this preview as an accurate representation of the final deliverable, ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

Hansen Technologies operates within a competitive arena populated by numerous established entities. Key rivals such as Oracle and Landis+Gyr are significant players, particularly in the utility billing and meter data management sectors, areas where Hansen also focuses. This dynamic means Hansen faces competition from both highly specialized firms and broader software solution providers.

Despite the crowded market, Hansen is acknowledged as a 'Major Player' within its specific niche. For instance, in the 2023 fiscal year, Landis+Gyr reported revenues of approximately $1.7 billion, showcasing the scale of some of its competitors. Oracle, a much larger conglomerate, has a significant presence in enterprise software, including utility solutions, with revenues exceeding $50 billion annually.

The utility billing software market is anticipated to expand at a compound annual growth rate of 7.2% between 2025 and 2033. This steady growth indicates a healthy demand for these services.

In parallel, the enterprise data management market is forecast to see a more robust growth of 11.8% CAGR from 2025 to 2032. Such significant expansion in a related field suggests opportunities for synergy and increased competition.

This moderate to high growth across these sectors is a magnet for new entrants and fuels a more aggressive competitive landscape among established companies. All players will be striving to capture a larger piece of these expanding markets.

Hansen Porter stands out by offering specialized, modular solutions delivered through flexible Software as a Service (SaaS), on-premise, or cloud options. This approach allows them to cater to specific industry needs, a key differentiator in a crowded market.

Innovation is central to Hansen's strategy, with a strong focus on emerging areas like sustainable energy supply chains, the Internet of Things (IoT), and advanced connected services. This forward-looking product development ensures their offerings remain relevant and competitive.

Further bolstering its distinctiveness, Hansen recently injected significant capital into AI-powered customer engagement solutions. This investment aims to create more personalized and efficient customer interactions, setting them apart from competitors who may rely on more traditional service models.

High Fixed Costs and Storage Capacity

The need for substantial investment in developing and maintaining sophisticated billing and customer management software creates high fixed costs for players in this sector. These costs, encompassing research and development as well as essential infrastructure, mean companies are motivated to maximize their operational capacity. This often translates into intensified competition and aggressive pricing strategies as firms strive to secure and retain contracts.

Hansen, for instance, demonstrates this commitment by dedicating over 400,000 hours annually to research and development, underscoring the significant upfront investment required to stay competitive. This continuous innovation is crucial for maintaining a leading edge in a market where technology evolves rapidly.

- High R&D Investment: Hansen Porter allocates more than 400,000 hours each year to research and development, highlighting the substantial fixed costs associated with software innovation.

- Capacity Utilization Pressure: Companies with significant fixed costs are driven to operate at or near full capacity, which can lead to price wars to fill available resources.

- Competitive Pricing: The pressure to utilize capacity often results in aggressive pricing tactics as businesses compete for market share and revenue.

Exit Barriers

High exit barriers can trap even struggling competitors in the market, intensifying rivalry. These barriers, like specialized assets, long-term commitments, and valuable intellectual property, make it difficult and costly for firms to leave. This means companies might continue competing even when profits are minimal, simply because exiting is too prohibitive.

Hansen's own business model features elements that contribute to these exit barriers. For instance, their involvement in long-term contracts, such as the five-year agreement with Virgin Media O2, locks them into ongoing relationships. This creates a situation where exiting such contracts prematurely could incur significant penalties or loss of future revenue, thus keeping Hansen and its competitors engaged in the market.

- Specialized Assets: Investments in unique machinery or technology that have limited resale value.

- Long-Term Contracts: Agreements with customers or suppliers that extend for many years, making early termination costly.

- Intellectual Property: Patents, proprietary software, or unique processes that are difficult to divest or license to others.

- Emotional Attachment: In some cases, founders or management may have a strong emotional connection to their business, hindering a rational exit.

Competitive rivalry is intense in the utility billing and meter data management sectors, with major players like Oracle and Landis+Gyr posing significant challenges to Hansen Technologies. The market is characterized by high R&D investment, with Hansen alone dedicating over 400,000 hours annually to innovation, driving up fixed costs and encouraging aggressive pricing to ensure capacity utilization.

High exit barriers, including specialized assets and long-term contracts like Hansen's five-year deal with Virgin Media O2, further intensify this rivalry by keeping firms engaged even when profitability is low. The utility billing software market is projected to grow at a 7.2% CAGR from 2025-2033, while enterprise data management is expected to expand even faster at 11.8% CAGR from 2025-2032, fueling competition as companies vie for market share.

| Competitor | Approximate 2023 Revenue | Key Market Focus |

|---|---|---|

| Landis+Gyr | $1.7 billion | Utility Billing, Meter Data Management |

| Oracle | >$50 billion | Enterprise Software, Utility Solutions |

SSubstitutes Threaten

Customers might bypass Hansen Porter's specialized utility billing software by adopting more generic enterprise resource planning (ERP) systems that include billing functionalities. These ERP solutions, while not as niche, offer a broader suite of business management tools and could be a viable substitute for some clients.

Another significant threat comes from the possibility of clients developing their own in-house billing solutions. This approach, particularly attractive to larger organizations with extensive IT resources, allows for complete customization and integration with existing systems, potentially negating the need for third-party software.

The utility billing software market itself acknowledges the existence of 'build-your-own solutions,' indicating a recognized alternative pathway for businesses. This flexibility in deployment models means that Hansen Porter faces competition not just from direct software rivals but also from the option of self-sufficiency.

For smaller clients or those with complex, long-standing legacy systems, these alternative solutions can be particularly appealing. The cost-effectiveness and perceived control offered by generic ERPs or custom builds present a tangible threat to Hansen Porter's market share.

Generic software alternatives often present a tempting lower upfront cost but frequently fall short on the specialized functionality, scalability, and crucial regulatory compliance that Hansen Porter's industry-specific solutions provide. This performance gap, impacting efficiency and accuracy, typically justifies the premium for Hansen's dedicated offerings.

The crucial difference lies in how Hansen's software acts as an essential ingredient in customers' commercial business models, directly contributing to their revenue generation and operational success, a value proposition often absent in broader, less tailored substitutes.

Customers are very unlikely to switch away from Hansen's billing and customer care systems, even though other options exist. This is because the costs and risks involved in switching are quite high, making it a difficult decision. For instance, the potential for operational disruptions and the complex process of moving data often deter customers from exploring alternatives.

Hansen's exceptional customer retention rate of approximately 98% in 2024 underscores this loyalty. This high retention signifies that the value and reliability of Hansen's mission-critical systems outweigh the perceived advantages of potential substitutes for the vast majority of their client base.

Emergence of New Technologies

The emergence of new technologies presents a significant threat of substitutes for Hansen Porter. Disruptive innovations, such as advanced AI-driven platforms or blockchain-based billing systems, could offer more efficient or cost-effective alternatives to Hansen's current service offerings. For instance, AI could automate many of the analytical and advisory functions that Hansen currently provides, potentially reducing the need for human expertise.

Hansen is actively working to mitigate this threat. The company is making strategic investments in AI solutions, exemplified by its development of Dial AI. This proactive approach aims to integrate cutting-edge technology into its own operations, thereby transforming potential substitutes into competitive advantages or internal tools. By embracing these advancements, Hansen seeks to remain at the forefront of technological change.

- AI-Driven Platforms: These can automate complex data analysis and client interaction, potentially replacing traditional consulting roles.

- Blockchain-Based Systems: Could offer more secure, transparent, and efficient transaction processing, impacting financial services segments.

- Hansen's AI Investment: Dial AI represents a direct effort to leverage artificial intelligence for enhanced service delivery and operational efficiency.

- Spatial Web Interoperability: Exploring this technology positions Hansen to adapt to future digital environments and integrate new forms of data and interaction.

Regulatory and Compliance Requirements

The threat of substitutes for specialized utility billing software like Hansen Porter's is significantly mitigated by stringent regulatory and compliance requirements. Industries such as energy, water, and telecommunications operate under a complex web of regulations, necessitating software with built-in capabilities for accurate billing and robust data management to ensure adherence to these rules. Generic software solutions often lack the specific functionalities required to navigate these intricate compliance landscapes, making specialized providers a more secure and reliable choice for utility companies.

The utility billing software market is experiencing considerable growth, driven in large part by the continuous evolution of regulatory frameworks. For instance, in 2024, many regions saw updated data privacy laws and new environmental reporting mandates that directly impact billing and customer data handling. Companies that fail to comply face substantial fines and reputational damage. This dynamic regulatory environment makes it difficult for general-purpose software to keep pace, reinforcing the preference for specialized solutions.

- Regulatory Complexity: Energy, water, and telecom sectors face unique, often sector-specific, compliance mandates.

- Data Management Demands: Specialized software is crucial for meeting stringent data accuracy, security, and reporting requirements.

- Market Growth Drivers: Evolving regulations in 2024, including data privacy and environmental reporting, are key catalysts for the utility billing software market.

- Risk Mitigation: Generic substitutes often fail to meet these specific demands, increasing the risk of non-compliance and penalties for utility providers.

The threat of substitutes for Hansen Porter's specialized utility billing software is relatively low due to high switching costs and the mission-critical nature of their services. While generic ERPs or in-house solutions exist, they often lack the industry-specific functionality, regulatory compliance, and scalability that Hansen provides, making them less attractive alternatives. Hansen's exceptional 98% customer retention in 2024 highlights the stickiness of their offerings.

New technologies, such as AI and blockchain, present a more dynamic substitute threat, but Hansen is proactively addressing this through investments like Dial AI. The complex regulatory environment in the utility sector further solidifies the need for specialized software, as generic options struggle to meet compliance demands, a critical factor in 2024 market dynamics.

| Substitute Type | Key Characteristics | Hansen's Advantage | Market Penetration (Estimated) | Impact on Hansen |

|---|---|---|---|---|

| Generic ERPs | Broader functionality, lower upfront cost | Specialized features, regulatory compliance | Moderate for non-utility sectors | Low to Moderate |

| In-house Solutions | Full customization, integration | Faster deployment, ongoing support | Low to Moderate (larger enterprises) | Low |

| Emerging Tech (AI/Blockchain) | Automation, enhanced security/efficiency | Integrated AI (Dial AI), spatial web exploration | Nascent but growing | Low to Moderate (requires adaptation) |

Entrants Threaten

Entering the specialized enterprise software market, particularly for utilities and communications, demands significant upfront capital. Developing robust solutions for billing, customer care, and data management necessitates extensive research and development, alongside building out the necessary infrastructure and establishing a strong sales and marketing presence. This high cost of entry acts as a formidable barrier for potential new competitors.

Established players like Hansen, founded in 1971, benefit significantly from economies of scale in development, sales, and customer support. This allows them to spread costs over a larger output, leading to lower per-unit costs. New entrants would find it incredibly difficult and expensive to replicate these cost efficiencies in the short to medium term.

Furthermore, Hansen's decades of experience, serving over 550 customers in more than 80 countries, have cultivated deep industry expertise and established operational best practices. This accumulated knowledge is a formidable barrier, as new companies would struggle to acquire similar insights and build robust processes quickly, placing them at a distinct competitive disadvantage from the outset.

Hansen has cultivated a formidable brand, evidenced by its long-standing relationships with key global clients, resulting in exceptional loyalty and retention. For instance, in 2023, Hansen reported a client retention rate exceeding 95% for its top-tier service packages.

New competitors face a steep uphill battle in carving out a distinct market position. The industry's emphasis on proven performance and unwavering reliability makes it difficult for newcomers to establish the trust Hansen enjoys.

Access to Distribution Channels

Gaining access to the large enterprise customers Hansen serves necessitates robust sales networks, established industry partnerships, and a proven history of successful project implementations. Newcomers would encounter substantial obstacles in building these critical distribution channels and earning trust within Hansen's specialized market segments.

Hansen's recognized position in the 2025 Gartner Market Guide for CSP Customer Management underscores the difficulty for new entrants to replicate the established relationships and market penetration required to reach these key clients. This deep integration into the customer lifecycle represents a significant barrier.

- Established Sales Networks: Hansen benefits from years of investment in building a direct sales force with deep industry knowledge and existing relationships with major enterprises.

- Industry Partnerships: Crucial alliances with technology providers and consulting firms create integrated solutions and preferred vendor status, which new entrants would struggle to replicate quickly.

- Credibility and Track Record: A history of successful, complex deployments with large enterprises provides a significant trust factor that new competitors would need to earn over extended periods.

Regulatory Hurdles and Compliance Complexity

The energy, water, and telecom sectors are heavily regulated, imposing significant compliance burdens on new entrants. These regulations cover critical areas such as billing accuracy, data privacy, and customer service management. For instance, in 2024, the global data privacy software market was valued at approximately $2.5 billion, highlighting the substantial investment required to meet these standards.

Navigating these intricate regulatory frameworks demands substantial resources and expertise. New companies must ensure their billing and customer management solutions adhere to a complex web of legal requirements and industry-specific standards, significantly increasing the cost and difficulty of market entry.

The utility billing software market, in particular, sees regulatory compliance as a primary driver for adoption and innovation. Companies that can effectively manage these compliance challenges often gain a competitive advantage.

- High Compliance Costs: New entrants face substantial upfront investment to meet stringent regulatory requirements in utilities.

- Data Privacy Mandates: Regulations like GDPR and CCPA necessitate robust data protection measures, increasing operational complexity.

- Industry-Specific Standards: Utilities must comply with unique billing and service delivery regulations, creating specialized barriers.

- Evolving Regulatory Landscape: Keeping pace with changing regulations requires continuous adaptation and investment.

The threat of new entrants into Hansen Porter's specialized enterprise software market is considerably low. High capital requirements for development and market penetration, coupled with significant economies of scale enjoyed by incumbents, create substantial barriers. Furthermore, Hansen's established brand, deep industry expertise, and robust sales networks, built over decades, make it exceptionally challenging for newcomers to gain traction and trust.

The regulatory environment in sectors like utilities and communications also acts as a significant deterrent. New entrants must invest heavily in understanding and complying with complex data privacy mandates and industry-specific standards, a burden that established players like Hansen have already managed. For instance, the global data privacy software market was valued at approximately $2.5 billion in 2024, indicating the scale of investment needed for compliance.

| Barrier Type | Description | Impact on New Entrants | Hansen's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, infrastructure, sales, and marketing. | Significant hurdle for new players. | Ability to spread costs over a large customer base. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants struggle to match cost efficiencies. | Decades of operational optimization. |

| Brand and Reputation | Established trust and customer loyalty. | Difficult to build credibility quickly. | Over 95% client retention in 2023 for top-tier services. |

| Regulatory Compliance | Meeting stringent data privacy and industry-specific standards. | Adds substantial cost and complexity. | Expertise in navigating complex legal frameworks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive understanding of competitive forces.