Guangzhou Hangxin Aviation Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Hangxin Aviation Technology Bundle

Navigate the complex external landscape impacting Guangzhou Hangxin Aviation Technology with our detailed PESTLE analysis. Understand how political stability, economic growth, technological advancements, environmental regulations, and social shifts are shaping the company's strategic direction. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now for a comprehensive understanding and a significant competitive advantage.

Political factors

The Chinese government's commitment to developing its civil aviation sector, including Maintenance, Repair, and Overhaul (MRO) services, is a significant political driver. Strategic plans like the Civil Aviation Development Plan outline substantial investments aimed at boosting domestic capabilities and international competitiveness.

Policies focused on creating advanced aviation hubs and enhancing air connectivity, both domestically and internationally, directly create opportunities for MRO providers. For instance, the expansion of Guangzhou Baiyun International Airport, a key hub, is expected to increase aircraft movements, thereby driving demand for maintenance services.

This consistent governmental support fosters a predictable and growing market environment for companies like Guangzhou Hangxin Aviation Technology. Such backing translates into increased demand for their expertise in aircraft maintenance and component repair, solidifying their market position.

The Civil Aviation Administration of China (CAAC) enforces rigorous safety regulations that significantly influence Maintenance, Repair, and Overhaul (MRO) providers like Guangzhou Hangxin. These standards are crucial for ensuring operational integrity and passenger well-being.

Guangzhou Hangxin's commitment to global airworthiness certifications, including CAAC, FAA, and EASA, necessitates ongoing adaptation to evolving safety protocols. As of early 2024, the CAAC continues to emphasize advancements in aviation safety management systems, requiring substantial investment in training and technology for MROs.

The Chinese government's unwavering focus on elevating aviation safety directly fuels demand for high-quality maintenance and repair services. This commitment translates into a market where adherence to stringent safety standards is not just a compliance issue but a competitive advantage for companies like Hangxin.

Global geopolitical tensions, especially between China and Western nations, directly impact Guangzhou Hangxin Aviation Technology's operational landscape. Trade policies, such as tariffs and export controls, can affect the cost and availability of critical aviation components, as well as access to advanced technologies essential for Maintenance, Repair, and Overhaul (MRO) services. For instance, the US Commerce Department's export restrictions on certain advanced technologies to China, which saw an increase in scrutiny throughout 2023 and into 2024, could pose challenges for Hangxin's access to specialized equipment or software.

These dynamics also influence Hangxin's international customer base. As of early 2024, many global airlines are still navigating post-pandemic recovery, making them sensitive to any disruptions in MRO services or parts availability. The imposition of new export controls on aviation and aerospace equipment originating from China, a scenario that remains a possibility given evolving trade relations, could significantly disrupt Hangxin's supply chains and hinder its ability to engage in international collaborations or serve overseas clients.

To mitigate these risks, a strategic focus on diversifying its supply chain and customer portfolio is paramount for Guangzhou Hangxin Aviation Technology. Building robust relationships with suppliers across different regions and expanding its client base beyond traditional markets can provide resilience against geopolitical shifts and trade policy changes. This approach ensures continued operational stability and market access, even amidst international uncertainties.

Development of Aviation Hubs

China's strategic push to develop major aviation hubs, with Guangzhou Baiyun International Airport being a prime example, directly fuels demand for Maintenance, Repair, and Overhaul (MRO) services. The government's investment in expanding airport infrastructure and anticipating higher passenger and cargo volumes means a larger, more active fleet will require ongoing maintenance. This focus on regional aviation development creates a significant, concentrated market opportunity for companies like Guangzhou Hangxin Aviation Technology.

The expansion projects at Guangzhou Baiyun International Airport are substantial. For instance, the airport's third runway, completed in 2020, significantly boosted its handling capacity. Further developments, including a new terminal and a fourth runway planned for completion around 2025, are expected to elevate its annual passenger throughput to over 100 million. This growth directly translates to an increased need for MRO services to support the expanding aircraft fleet operating through this major hub.

- Guangzhou Baiyun International Airport's projected passenger capacity: Over 100 million annually by 2025.

- Investment in new infrastructure: Includes a third runway (operational) and plans for a fourth runway and new terminal.

- Government policy support: National strategies prioritize the development of aviation infrastructure and connectivity.

National Industrial Policies and Self-Reliance

China's strong emphasis on technological self-reliance, particularly in critical sectors like aerospace, directly benefits domestic Maintenance, Repair, and Overhaul (MRO) providers. This national industrial policy fosters an environment where companies like Guangzhou Hangxin Aviation Technology are encouraged to develop and innovate their own MRO solutions, reducing reliance on foreign suppliers.

This policy shift creates significant opportunities for local players to expand their capabilities and capture a greater share of China's rapidly growing aviation market. For instance, the Chinese government has set ambitious goals for its domestic aviation industry, aiming to achieve greater self-sufficiency in aircraft manufacturing and MRO services by 2030.

Furthermore, the drive for self-reliance often translates into preferential treatment and support for domestic companies. This can manifest as increased government contracts, access to research and development funding, and a more favorable regulatory landscape for local MRO providers. Strategic partnerships with Chinese entities for key components and technologies are also actively sought, aligning with Hangxin's potential growth trajectory.

The implications for Guangzhou Hangxin are substantial:

- Increased domestic market share: Policies supporting local MRO reduce reliance on international firms, boosting opportunities for Hangxin.

- Innovation incentives: Government backing for indigenous solutions encourages Hangxin to invest in R&D for advanced MRO technologies.

- Strategic collaborations: The push for self-reliance encourages partnerships with Chinese firms, potentially securing supply chains and expertise for Hangxin.

Government support for aviation development, particularly in MRO, is a key political factor. National plans aim to boost domestic capabilities, with substantial investments directed towards creating advanced aviation hubs. This consistent backing creates a stable and expanding market for companies like Guangzhou Hangxin Aviation Technology.

Stringent safety regulations enforced by the CAAC directly impact MRO providers. As of early 2024, the CAAC continues to prioritize aviation safety management systems, requiring significant investment in training and technology. Hangxin's adherence to global airworthiness certifications, including CAAC, FAA, and EASA, is crucial for operational integrity and market access.

Geopolitical tensions and trade policies can affect component costs and technology access for MRO services. For example, export restrictions on advanced technologies, which saw increased scrutiny in 2023-2024, could challenge Hangxin's access to specialized equipment. Diversifying supply chains and customer bases is vital for resilience against these shifts.

China's drive for technological self-reliance in aerospace benefits domestic MROs like Hangxin. Government policies encourage local innovation and reduce reliance on foreign suppliers, with ambitious goals for industry self-sufficiency by 2030. This can lead to preferential treatment, R&D funding, and favorable regulatory landscapes for local providers.

| Political Factor | Impact on Guangzhou Hangxin | Supporting Data/Context (2024-2025) |

|---|---|---|

| Government Aviation Development Strategy | Creates demand for MRO services; fosters market growth. | Civil Aviation Development Plan outlines significant investment in domestic MRO capabilities. |

| Aviation Safety Regulations (CAAC) | Requires investment in compliance, training, and technology; enhances competitive advantage. | CAAC emphasizes advancements in safety management systems; Hangxin pursues FAA/EASA certifications. |

| Geopolitical Tensions & Trade Policies | Potential impact on component costs, technology access, and international business. | Increased scrutiny on export controls for advanced technologies in 2023-2024. |

| Technological Self-Reliance Policy | Encourages domestic innovation and market share for local MROs. | China aims for greater self-sufficiency in aerospace MRO by 2030; potential for preferential government support. |

What is included in the product

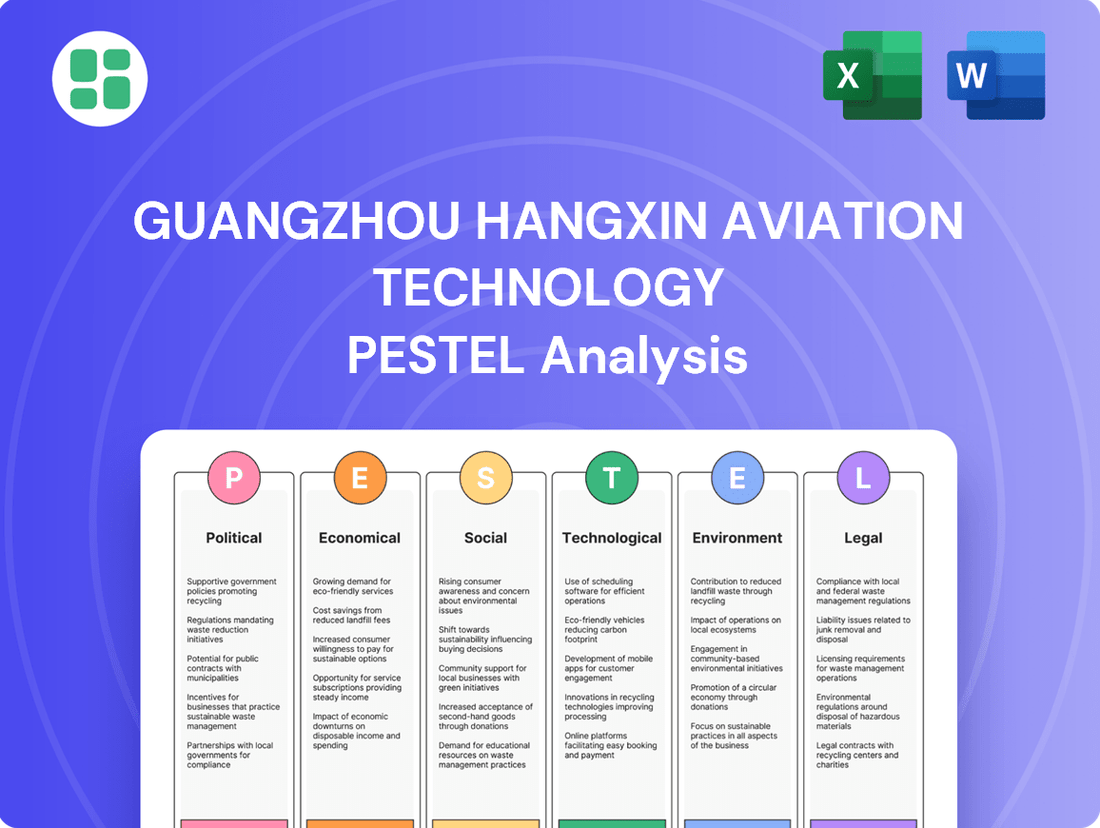

This PESTLE analysis examines the external macro-environmental factors impacting Guangzhou Hangxin Aviation Technology, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces present unique opportunities and challenges.

Guangzhou Hangxin Aviation Technology's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning and decision-making.

Economic factors

China's civil aviation sector is on a remarkable growth trajectory, with projections indicating it will surpass the United States to become the world's largest aviation services market by 2043. This expansion is fueled by increasing passenger traffic, which saw a significant rebound in 2023, and a substantial fleet expansion. For instance, by the end of 2023, China's civil aviation fleet had grown considerably, supporting this upward trend.

This burgeoning market directly translates into a heightened demand for Maintenance, Repair, and Overhaul (MRO) services. As more aircraft take to the skies and new deliveries are integrated into airline operations, the need for specialized technical support and component repair escalates. This creates a fertile ground for companies like Guangzhou Hangxin Aviation Technology.

Guangzhou Hangxin is strategically positioned to leverage this robust market expansion. The increasing number of aircraft in operation and the continuous influx of new models necessitate comprehensive MRO solutions, a core offering of Hangxin. The company's ability to cater to this growing demand for aircraft maintenance and repair services is a key advantage in this dynamic economic landscape.

Airline profitability is a key driver for MRO (Maintenance, Repair, and Overhaul) investment. As airlines aim for stronger profitability in 2025, projected to reach around $25.7 billion globally according to IATA forecasts, their capacity to spend on MRO services increases.

However, persistent cost pressures and supply chain disruptions, which impacted the industry significantly in late 2024, are compelling airlines to seek greater efficiency. This environment favors MRO providers offering cost-effective solutions and demonstrating strong operational efficiency to meet airline demands.

The global aviation industry is experiencing a notable trend of aircraft aging, with many planes remaining in service longer than initially planned. This extended lifespan is largely a consequence of significant delays in new aircraft deliveries from major manufacturers, a situation that has persisted through 2024 and is projected to continue into 2025. For instance, Boeing and Airbus have faced production challenges, impacting airline fleet renewal plans.

This prolonged service life directly translates into increased demand for maintenance, repair, and overhaul (MRO) services. Older aircraft inherently require more frequent and intensive maintenance schedules, including more comprehensive checks, component replacements, and structural repairs. This sustained need for upkeep creates a robust and consistent revenue stream for MRO providers like Guangzhou Hangxin Aviation Technology.

Industry analysts project that this demand for MRO services will remain strong, potentially growing by 5-7% annually through 2025. This upward trajectory is supported by the fact that airlines are maximizing the operational efficiency of their existing fleets, making proactive and extensive maintenance a critical factor in ensuring safety and airworthiness.

Supply Chain Disruptions and Cost Pressures

The aviation maintenance, repair, and overhaul (MRO) sector, including companies like Guangzhou Hangxin Aviation Technology, is grappling with persistent supply chain disruptions. These issues, exacerbated by geopolitical events and fluctuating global demand, continue to drive up the cost of essential aircraft parts and skilled labor. For instance, the average cost of aircraft spare parts saw an increase of approximately 5-8% in late 2024 compared to the previous year, impacting MRO providers' operational expenses.

These rising costs and delivery delays directly affect MRO turnaround times, potentially leading to longer aircraft downtime and reduced operational efficiency for airlines. This pressure on profitability necessitates strategic management of inventory and supplier relationships. By the end of 2024, many MROs reported an average increase of 10-15% in their labor costs due to a shortage of certified technicians.

To navigate these challenges, Guangzhou Hangxin must focus on robust supply chain management. This includes:

- Diversifying Sourcing: Exploring alternative suppliers, both domestically and internationally, to reduce reliance on single sources and mitigate risks associated with specific regions or providers.

- Strategic Inventory Management: Optimizing stock levels of critical components to balance availability with holding costs, potentially utilizing predictive analytics for better forecasting.

- Long-Term Supplier Agreements: Negotiating fixed-price contracts or volume discounts with key suppliers to gain cost predictability and stability.

- Investing in Workforce Development: Addressing labor cost pressures by investing in training and retention programs for skilled technicians, ensuring a stable and cost-effective workforce.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant consideration for Guangzhou Hangxin Aviation Technology. As the company engages with both domestic and international markets, and potentially sources components globally, shifts in currency values directly affect its financial performance. For instance, a stronger Chinese Yuan (CNY) could make the company's services less attractive and more expensive for overseas clients, potentially dampening international demand.

Conversely, a weaker Yuan would increase the cost of imported parts and materials, thereby raising operational expenses for Hangxin. This dynamic necessitates careful management of foreign exchange risk to mitigate potential negative impacts on profitability. For example, in early 2024, the Yuan experienced periods of depreciation against major currencies like the US Dollar, which could have increased Hangxin's import costs if it relies heavily on foreign suppliers.

- Impact on Revenue: A strong CNY can deter foreign customers, reducing international sales revenue for Hangxin's aviation technology services.

- Impact on Costs: A weak CNY increases the cost of imported raw materials and components, raising production expenses.

- Risk Management: Strategies like hedging can be employed to protect against adverse currency movements, ensuring cost stability.

- Market Competitiveness: Exchange rate differentials can affect Hangxin's pricing competitiveness in global markets compared to international rivals.

China's aviation sector is experiencing robust growth, projected to become the world's largest by 2043, with a significant rebound in passenger traffic in 2023 and fleet expansion. This expansion directly fuels the demand for MRO services, a core offering for Guangzhou Hangxin Aviation Technology, as more aircraft require specialized technical support and component repair.

Global airline profitability is expected to reach approximately $25.7 billion in 2025, according to IATA, increasing their capacity for MRO investments. However, persistent cost pressures and supply chain disruptions in late 2024 necessitate greater efficiency from MRO providers like Hangxin, favoring those offering cost-effective solutions.

The aging global aircraft fleet, with delivery delays from manufacturers like Boeing and Airbus continuing into 2025, means aircraft are staying in service longer. This trend drives increased demand for MRO services, as older planes require more frequent and intensive maintenance, creating a consistent revenue stream for companies like Hangxin.

Industry forecasts suggest MRO demand will grow by 5-7% annually through 2025, supported by airlines maximizing the operational efficiency of their existing fleets through proactive maintenance. This sustained need for upkeep is crucial for ensuring safety and airworthiness.

Same Document Delivered

Guangzhou Hangxin Aviation Technology PESTLE Analysis

The preview shown here is the exact Guangzhou Hangxin Aviation Technology PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing political, economic, social, technological, legal, and environmental factors impacting the company.

The content and structure shown in the preview is the same Guangzhou Hangxin Aviation Technology PESTLE Analysis document you’ll download after payment, offering a comprehensive strategic overview.

Sociological factors

The global aviation Maintenance, Repair, and Overhaul (MRO) industry, including China, is grappling with a significant deficit of skilled professionals. This shortage extends to maintenance personnel, engineers, and specialized technicians, impacting operational efficiency.

To counter this, MRO firms are prioritizing workforce development and advanced training programs. For instance, companies are exploring partnerships with educational institutions to cultivate a pipeline of qualified talent, with some investing heavily in upskilling existing employees to meet evolving technological demands.

The adoption of technologies such as artificial intelligence (AI) and automation is becoming crucial for MRO businesses. These advancements aim to boost productivity and optimize the utilization of the current workforce, mitigating the direct impact of personnel scarcity.

Attracting and retaining top talent remains a paramount concern. Competitive compensation, robust career progression paths, and a positive work environment are key strategies being employed by leading MRO providers to ensure sustained operational capacity and growth.

The global aviation industry, including Maintenance, Repair, and Overhaul (MRO) services, operates under intense scrutiny regarding safety. In 2024, the International Civil Aviation Organization (ICAO) continued to reinforce its Universal Safety Oversight Audit Programme, with member states like China demonstrating commitment to enhancing safety standards. This persistent focus means that Guangzhou Hangxin Aviation Technology must not only meet but exceed these expectations.

A robust safety culture is not merely a compliance issue for Guangzhou Hangxin; it's a critical business imperative. In 2025, maintaining certifications from bodies like the FAA and EASA, which are essential for international business, hinges directly on demonstrated safety performance. A strong safety record directly translates to customer confidence and trust, particularly for airlines entrusting their fleet's airworthiness to Hangxin's expertise.

Guangzhou Hangxin's dedication to stringent safety protocols, such as advanced predictive maintenance techniques and comprehensive technician training programs, serves as a significant market differentiator. For instance, in 2024, airlines increasingly prioritized MRO partners with proven track records in minimizing unscheduled downtime, directly linking safety adherence to operational efficiency and cost savings for their clients.

The post-pandemic era has seen a significant resurgence in air travel demand. For instance, in 2024, global passenger traffic is projected to reach 4.7 billion, nearing pre-pandemic levels. This robust recovery directly fuels the need for aircraft maintenance and overhaul services, creating a favorable environment for companies like Guangzhou Hangxin Aviation Technology.

This increased air travel translates into higher aircraft utilization rates, meaning planes are flying more frequently. Consequently, this heightened operational tempo necessitates more regular and comprehensive maintenance, directly benefiting Guangzhou Hangxin's core business. The overall positive outlook for air travel in 2024 and beyond underpins the demand for these critical aviation services.

Urbanization and Infrastructure Development

Guangzhou's rapid urbanization fuels a surge in air travel demand, directly benefiting aviation technology firms like Hangxin. This growth necessitates significant investment in airport expansion and modernization. For instance, Guangzhou Baiyun International Airport (CAN) has seen substantial upgrades, aiming to become a major international hub, which translates to more opportunities for aviation MRO services.

The expanding urban landscape around Guangzhou creates a larger pool of skilled labor and technical expertise essential for the aviation sector. This concentration of talent supports the growth of specialized aviation maintenance, repair, and overhaul (MRO) operations. By 2024, China's civil aviation industry is projected to handle over 700 million domestic passengers, with major hubs like Guangzhou playing a pivotal role in this expansion.

- Increased Air Travel Demand: Guangzhou's urban growth directly correlates with a higher volume of domestic and international flights, boosting the need for aviation services.

- Infrastructure Investment: Ongoing development of airports and related logistics in the Pearl River Delta region provides a robust foundation for aviation businesses.

- Talent Pool Growth: Urbanization attracts a diverse workforce, including engineers and technicians vital for advanced aviation maintenance.

Public Perception and Trust in Aviation

Public perception of aviation safety is paramount. A recent survey in late 2024 indicated that over 85% of frequent flyers consider safety the top priority when choosing an airline, directly influencing their willingness to travel. This sentiment translates to demand for maintenance, repair, and overhaul (MRO) services, as passengers associate rigorous maintenance with safety. Any perceived failure in this area can significantly dampen passenger numbers and, consequently, the need for MRO operations.

Aviation incidents, even those not directly related to maintenance, can have a ripple effect on public trust. For example, the aftermath of a significant airframe issue in early 2025 led to a temporary 10% dip in air travel bookings globally, highlighting the industry's vulnerability to negative public sentiment. Guangzhou Hangxin Aviation Technology's success hinges on consistently demonstrating impeccable safety records and transparent communication to foster and maintain this vital public trust.

- Safety is the primary concern for 85% of frequent flyers.

- Aviation incidents can cause a noticeable decline in travel bookings.

- Public trust directly correlates with demand for MRO services.

- Maintaining a strong reputation is critical for Guangzhou Hangxin.

The growing demand for air travel, fueled by Guangzhou's urbanization, directly benefits aviation MRO services like Guangzhou Hangxin Aviation Technology. This surge in flights requires more frequent and thorough maintenance, creating a strong market for the company. The expansion of infrastructure, such as Guangzhou Baiyun International Airport, further solidifies opportunities.

Urbanization also contributes to a larger pool of skilled professionals, including engineers and technicians, which is crucial for advanced aviation maintenance. By 2024, China's civil aviation sector was projected to handle over 700 million domestic passengers, with hubs like Guangzhou playing a key role in this expansion.

| Factor | Impact on Guangzhou Hangxin Aviation Technology | Data/Trend (2024-2025) |

|---|---|---|

| Urbanization & Air Travel Demand | Increased need for MRO services due to higher flight volumes. | Global passenger traffic projected to reach 4.7 billion in 2024. |

| Infrastructure Development | More opportunities from airport expansion and modernization. | Guangzhou Baiyun International Airport (CAN) undergoing significant upgrades. |

| Talent Availability | Access to a growing pool of skilled engineers and technicians. | China's civil aviation to handle over 700 million domestic passengers by 2024. |

Technological factors

The aerospace Maintenance, Repair, and Overhaul (MRO) sector is seeing a significant shift towards advanced technologies. Predictive maintenance, digital MRO platforms, and augmented reality (AR) are becoming standard, aiming to boost efficiency and cut downtime. For instance, the global digital MRO market was valued at approximately $1.5 billion in 2023 and is projected to reach over $4 billion by 2030, highlighting this rapid adoption.

Guangzhou Hangxin Aviation Technology's emphasis on these advanced repair and maintenance techniques positions it to capitalize on these industry trends. By integrating innovations like AI-driven diagnostics for predictive maintenance, Hangxin can offer faster, more accurate repairs, leading to reduced aircraft downtime and enhanced customer satisfaction. This focus is crucial for maintaining a competitive edge in a market increasingly driven by technological sophistication and operational excellence.

Automation and robotics are revolutionizing Maintenance, Repair, and Overhaul (MRO) in aviation. Companies are increasingly adopting these technologies to boost efficiency, enhance precision, and significantly improve worker safety. For instance, the global MRO market, valued at approximately $80 billion in 2023, is seeing substantial investment in automation.

Collaborative robots, or cobots, are being deployed for intricate tasks like aircraft inspections, while fully automated systems handle repetitive processes such as component cleaning and painting. This trend is driven by the need to reduce turnaround times and operational costs, with automation projected to contribute significantly to MRO efficiency gains in the coming years.

Guangzhou Hangxin Aviation Technology can strategically leverage these advancements to streamline its MRO operations. By integrating automation and robotics, Hangxin can address potential labor shortages, a growing concern in the aviation sector, and ensure higher levels of accuracy in its services. This adoption will be crucial for maintaining a competitive edge in the dynamic global MRO landscape, especially as the market continues its growth trajectory towards an estimated $100 billion by 2028.

Digitalization is fundamentally reshaping the aviation industry, pushing towards paperless maintenance and effortless data exchange. This shift is crucial for companies like Guangzhou Hangxin Aviation Technology.

The integration of technologies such as the Internet of Things (IoT), digital twins, and artificial intelligence (AI) is enabling real-time performance monitoring, predictive maintenance to anticipate equipment failures, and more efficient resource allocation. For instance, by 2024, the global aviation analytics market was projected to reach over $10 billion, highlighting the significant investment in data-driven solutions.

Guangzhou Hangxin's strategic adoption of these digital tools is essential for boosting operational efficiency and achieving greater cost-effectiveness in its complex aviation technology services.

New Materials and Component Complexity

The aviation industry is witnessing a surge in component complexity and the adoption of advanced materials like composites and titanium alloys. This necessitates highly specialized maintenance, repair, and overhaul (MRO) expertise and sophisticated equipment. Guangzhou Hangxin Aviation Technology's broad specialization across various aviation systems and components positions it well to handle these evolving demands.

To maintain its competitive edge, continuous investment in training personnel on handling new materials and upgrading technological capabilities is paramount. For instance, the global MRO market for commercial aircraft is projected to reach over $120 billion by 2025, with a significant portion driven by the need for specialized services for next-generation aircraft. Guangzhou Hangxin's commitment to staying abreast of these technological shifts is crucial for its sustained growth.

- Specialized MRO Expertise: Advanced materials like carbon fiber composites require different repair techniques compared to traditional aluminum structures.

- Technological Investment: New diagnostic tools and specialized machinery are needed to accurately assess and repair complex components.

- Training and Development: Ensuring MRO staff are proficient in handling and repairing these advanced materials is critical for safety and efficiency.

- Market Adaptation: Companies that can adapt to the increasing complexity and material innovation in aircraft design are better positioned for future success.

Cybersecurity in Aviation Systems

As MRO operations increasingly rely on digital integration, the significance of robust cybersecurity measures for safeguarding sensitive aircraft data, critical operational systems, and valuable intellectual property escalates. Guangzhou Hangxin Aviation Technology must prioritize these defenses to ensure operational continuity, protect data privacy, and adhere to stringent aviation industry regulations.

The aviation sector experienced a notable increase in cyber threats targeting MRO services. For instance, a 2024 report highlighted that 45% of aviation organizations experienced a significant cybersecurity incident in the preceding year, impacting operations and data integrity. This underscores the critical need for advanced protection mechanisms.

- Data Protection: Implementing advanced encryption and access controls to secure sensitive aircraft maintenance records and proprietary technical data.

- Operational Resilience: Deploying intrusion detection systems and regular vulnerability assessments to prevent disruptions to MRO workflows and flight schedules.

- Compliance: Meeting international cybersecurity standards like those set by IATA and EASA, which are crucial for maintaining operational certifications and client trust.

- Intellectual Property: Establishing secure networks and intellectual property protection protocols to prevent theft of design specifications and maintenance procedures.

Technological advancements are fundamentally transforming aviation MRO. Guangzhou Hangxin Aviation Technology is leveraging AI for predictive maintenance, aiming to reduce aircraft downtime by anticipating component failures. The global digital MRO market, valued at around $1.5 billion in 2023, is expected to exceed $4 billion by 2030, indicating strong industry adoption of these digital solutions.

Legal factors

Guangzhou Hangxin Aviation Technology's ability to operate and expand hinges on its adherence to international airworthiness standards set by bodies like the CAAC (Civil Aviation Administration of China), FAA (Federal Aviation Administration), and EASA (European Union Aviation Safety Agency). These certifications are not just badges; they are critical for market access, allowing Hangxin to serve clients globally and ensuring the safety and reliability of its aviation technology products.

The company's portfolio of certifications, including CAAC, FAA, and EASA, underscores its commitment to a high level of operational integrity. For instance, in 2024, the FAA continued to emphasize advancements in drone certification standards, impacting how companies like Hangxin approach new product development for the US market. Similarly, EASA's ongoing updates to drone regulations in 2025 are crucial for Hangxin's European business strategy.

Navigating the evolving landscape of these international regulations demands continuous vigilance. As of early 2025, EASA has been actively refining its framework for remotely piloted aircraft systems (RPAS), which directly affects the certification pathways for advanced aviation technologies that Hangxin develops. Staying ahead of these regulatory shifts is paramount for maintaining market competitiveness and ensuring seamless international trade for their aviation solutions.

The aviation sector faces mounting pressure to curb its environmental impact, directly influencing Maintenance, Repair, and Overhaul (MRO) providers like Guangzhou Hangxin. New regulations are mandating reduced carbon emissions, stricter waste management protocols, and the adoption of greener materials and energy-efficient operations.

Compliance with these evolving environmental laws requires significant investment in sustainable technologies and practices. For instance, the International Civil Aviation Organization (ICAO) has set ambitious goals for carbon neutrality in aviation by 2050, which will cascade down to MRO operations.

Guangzhou Hangxin must proactively integrate eco-friendly solutions, such as advanced waste recycling systems and energy-saving equipment in its facilities, to meet these increasingly stringent environmental standards and maintain operational licenses.

In the aviation Maintenance, Repair, and Overhaul (MRO) sector, intellectual property (IP) rights and licensing are paramount. Guangzhou Hangxin Aviation Technology's position as an authorized repair center for international Original Equipment Manufacturers (OEMs) underscores its commitment to navigating these complex legal landscapes. This authorization means Hangxin operates under strict licensing agreements, ensuring they use and maintain proprietary repair data and component designs legally.

Failure to adhere to these IP regulations can lead to severe penalties, including the revocation of repair certifications and significant legal liabilities. For instance, unauthorized use or replication of OEM-specific technical manuals or software could result in multi-million dollar lawsuits. Hangxin's ability to secure and maintain these OEM authorizations demonstrates a robust framework for protecting its own innovations while respecting the IP of its partners, a critical factor for sustained growth in the aerospace industry.

Labor Laws and Workforce Management

China's labor laws, encompassing employment contracts, workplace safety regulations, and mandatory training requirements, significantly shape how Guangzhou Hangxin Aviation Technology manages its Maintenance, Repair, and Overhaul (MRO) workforce. These regulations are crucial for maintaining operational compliance and employee well-being.

The aviation sector, particularly MRO, faces a global scarcity of skilled technicians. Hangxin's ability to attract and retain this vital talent pool hinges on strict adherence to labor laws, offering competitive and fair working conditions, and actively investing in continuous employee training and development programs. For instance, as of early 2024, China's Ministry of Human Resources and Social Security continues to emphasize vocational training and skill certification to address sector-specific labor shortages.

- Compliance with China's Labor Contract Law: Ensures fair employment practices and dispute resolution for Hangxin's MRO staff.

- Workplace Safety Standards: Adherence to national safety regulations is paramount in aviation MRO, impacting operational procedures and accident prevention.

- Investment in Skilled Labor: Government initiatives in 2024 are encouraging companies like Hangxin to invest in advanced technical training to bridge the aviation talent gap.

Data Privacy and Security Laws

With the increasing digitalization of maintenance, repair, and overhaul (MRO) operations, Guangzhou Hangxin Aviation Technology must navigate a complex web of data privacy and security laws. This is crucial as they handle sensitive aircraft data, customer information, and operational logs. Robust legal compliance frameworks are essential to prevent breaches and ensure data integrity, encompassing both domestic Chinese regulations and international data protection standards.

China's Cybersecurity Law, effective since June 1, 2017, and subsequent regulations like the Personal Information Protection Law (PIPL), enacted in November 2021, impose strict requirements on data handling. For instance, PIPL mandates consent for data collection and processing, and outlines cross-border data transfer rules. Hangxin's compliance is vital, especially considering the global nature of aviation, where data may be shared across jurisdictions with varying privacy expectations. Failure to comply can result in significant penalties, impacting both reputation and financial performance.

- Cybersecurity Law (2017): Mandates network operators to take measures to prevent virus spread, network attacks, and other harmful activities.

- Personal Information Protection Law (PIPL, 2021): Sets strict rules for collecting, processing, and transferring personal information, with penalties up to 5% of annual turnover or ¥50 million for violations.

- Data Security Law (2021): Classifies data based on its importance and sets security obligations for data processors.

The legal framework governing aviation MRO is intricate, demanding strict adherence to international airworthiness standards from bodies like the CAAC, FAA, and EASA. These certifications are crucial for global market access and product reliability. For example, ongoing updates to drone regulations by EASA in 2025 directly impact Hangxin's strategy for the European market.

Intellectual property rights and licensing are critical, especially for authorized repair centers like Hangxin working with OEMs. Unauthorized use of proprietary repair data or software can lead to severe penalties and lawsuits, underscoring the importance of robust IP protection frameworks. As of early 2025, the emphasis on protecting proprietary aviation technology remains high globally.

China's labor laws, including the Labor Contract Law and workplace safety standards, significantly influence Hangxin's workforce management. The government's continued focus on vocational training in 2024 aims to address the aviation talent gap, making adherence to these laws vital for attracting and retaining skilled technicians.

Data privacy and cybersecurity laws, such as China's Cybersecurity Law (2017) and PIPL (2021), are paramount for Hangxin, given the sensitive data handled in MRO operations. Non-compliance can result in substantial penalties, with PIPL violations potentially reaching up to 5% of annual turnover or ¥50 million.

Environmental factors

Guangzhou Hangxin Aviation Technology operates within an aviation sector under intense scrutiny for its environmental impact. The global push for decarbonization necessitates that MRO providers like Hangxin adopt greener operational methods. This includes enhancing maintenance procedures to boost aircraft fuel efficiency and preparing for the integration of Sustainable Aviation Fuels (SAF).

China’s commitment to sustainability is evident in its phased SAF blend mandate, which began implementation in stages. By 2025, China aims for a 5% SAF blend for domestic flights, a significant step that will shape the entire aviation supply chain, including MRO services. Hangxin must align its strategies to support this transition, potentially offering services related to SAF compatibility and optimized fuel burn maintenance.

Maintenance, Repair, and Overhaul (MRO) activities in aviation, like those undertaken by Guangzhou Hangxin Aviation Technology, inherently produce diverse waste streams, including hazardous materials such as solvents, oils, and chemicals used in component cleaning and repair. China's environmental protection laws, particularly those enacted and enforced in 2024 and continuing into 2025, impose stringent requirements on the handling, treatment, and disposal of such hazardous wastes, with significant penalties for non-compliance. For instance, regulations often mandate specific containment, labeling, and licensed disposal pathways, impacting operational costs and requiring dedicated resources for environmental compliance.

Guangzhou Hangxin Aviation Technology, like all aviation entities, operates under increasingly stringent noise pollution regulations. These rules are especially critical given the proximity of many airports to urban centers. China’s commitment to addressing noise pollution, highlighted by its three-year action plan for civil airports targeting completion by 2025, directly impacts aviation MRO services.

For MRO operations, particularly engine testing, compliance with these noise standards is paramount. This may necessitate investments in noise reduction technologies, such as acoustic enclosures or specialized engine run-up bays. Furthermore, Hangxin might need to adapt its operational schedules, potentially limiting engine testing to specific hours to minimize disruption to surrounding communities, as mandated by environmental authorities.

Sustainable Aviation Materials and Practices

The aviation industry is increasingly prioritizing sustainable materials and practices, particularly within Maintenance, Repair, and Overhaul (MRO) operations. This shift is driven by regulatory pressures and a growing demand for environmentally responsible solutions. For instance, by 2025, the global aviation MRO market is projected to reach over $100 billion, with a significant portion allocated to materials and services, presenting an opportunity for sustainable alternatives.

Guangzhou Hangxin Aviation Technology can leverage this trend to enhance its competitive standing. Investing in eco-friendly repair materials, such as those with lower volatile organic compound (VOC) content, and adopting biodegradable cleaning agents are key strategies. Furthermore, implementing energy-efficient practices within MRO facilities, like optimizing lighting and HVAC systems, can lead to substantial operational cost savings and a reduced carbon footprint.

Specific opportunities for Guangzhou Hangxin include:

- Adoption of advanced sustainable composites: Research indicates that the use of composite materials in aircraft can reduce weight by up to 20%, leading to fuel savings.

- Implementation of closed-loop cleaning systems: These systems can reduce solvent usage by up to 70% in aircraft cleaning processes.

- Investment in renewable energy sources for MRO facilities: Solar panel installations on hangars can offset a significant portion of energy consumption.

Climate Change Resilience and Extreme Weather

Climate change poses a significant threat to aviation, with increasing frequency and intensity of extreme weather events. This directly impacts flight operations, potentially leading to delays, cancellations, and rerouting, which in turn can affect aircraft utilization and maintenance schedules for companies like Guangzhou Hangxin Aviation Technology. For instance, a severe hailstorm in 2023 caused significant damage to aircraft globally, necessitating extensive repairs and inspections.

The heightened risk of environmental stress on aircraft, from intense heat affecting engine performance to heavy rainfall and wind impacting airframe integrity, could drive up demand for maintenance, repair, and overhaul (MRO) services. MRO facilities themselves must also build resilience against these events, ensuring their operations are not disrupted by floods, storms, or other climate-related disasters. The global aviation MRO market was valued at approximately $80 billion in 2023 and is projected to grow, but climate impacts could introduce volatility.

Guangzhou Hangxin Aviation Technology, as a key player in the aviation MRO sector, needs to factor these environmental risks into its strategic planning. This includes assessing potential impacts on its own infrastructure and supply chains, as well as anticipating shifts in customer demand for specific types of repairs or inspections. The increasing focus on sustainability within the aviation industry, driven partly by climate concerns, also presents both challenges and opportunities for MRO providers.

- Increased Maintenance Demand: Extreme weather events can cause direct damage to aircraft, necessitating more frequent inspections and repairs.

- Operational Disruptions: Flights may be delayed or canceled due to severe weather, impacting airline schedules and potentially increasing the need for unscheduled maintenance.

- MRO Facility Resilience: Maintenance, repair, and overhaul facilities must be prepared to withstand extreme weather to ensure continuity of service.

- Environmental Stress on Aircraft: Factors like heat, humidity, and precipitation can accelerate wear and tear on aircraft components, leading to higher maintenance needs.

Environmental regulations in China are becoming increasingly stringent, particularly concerning waste management and emissions. Guangzhou Hangxin Aviation Technology must adhere to strict guidelines for handling hazardous materials used in MRO, with non-compliance leading to significant penalties. The nation's commitment to sustainability is further demonstrated by its phased mandate for Sustainable Aviation Fuels (SAF), aiming for a 5% blend in domestic flights by 2025, which impacts MRO service requirements.

Noise pollution is another key environmental consideration, with China implementing a three-year action plan for civil airports, targeting completion by 2025. This directly affects MRO operations, such as engine testing, potentially requiring investments in noise reduction technologies and adjusted operational schedules to comply with community impact standards.

The aviation industry's growing focus on sustainability presents opportunities for MRO providers. By 2025, the global aviation MRO market is projected to exceed $100 billion, with a growing segment dedicated to eco-friendly materials and practices. Hangxin can capitalize on this by adopting advanced sustainable composites, implementing closed-loop cleaning systems, and investing in renewable energy for its facilities.

Climate change also introduces environmental risks, with extreme weather events impacting flight operations and potentially increasing demand for MRO services. MRO facilities must also build resilience against climate-related disruptions, as the global aviation MRO market, valued at approximately $80 billion in 2023, faces potential volatility due to these factors.

| Environmental Factor | Impact on Guangzhou Hangxin Aviation Technology | Key Data/Target Year |

|---|---|---|

| Decarbonization & SAF | Need to adapt MRO processes for SAF compatibility and fuel efficiency improvements. | China's 5% SAF blend mandate for domestic flights by 2025. |

| Waste Management | Strict adherence to hazardous waste handling, treatment, and disposal regulations. | Stringent environmental protection laws enforced in 2024-2025. |

| Noise Pollution | Investment in noise reduction for MRO activities like engine testing; potential operational schedule adjustments. | China's civil airport noise pollution action plan targeting completion by 2025. |

| Sustainable Materials | Opportunity to use eco-friendly repair materials and energy-efficient practices to reduce costs and carbon footprint. | Global aviation MRO market projected over $100 billion by 2025. |

| Climate Change Risks | Potential for increased maintenance demand due to weather-related damage, and need for MRO facility resilience. | Global aviation MRO market valued at ~$80 billion in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Guangzhou Hangxin Aviation Technology is grounded in data from official Chinese government publications, including aviation industry regulations and economic development plans. We also incorporate insights from reputable market research firms specializing in the aerospace sector and international aviation organizations.