Guangzhou Hangxin Aviation Technology Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Hangxin Aviation Technology Bundle

Curious about the engine driving Guangzhou Hangxin Aviation Technology's success? This Business Model Canvas offers a concise look at their customer relationships, revenue streams, and key resources. Discover the core elements that make them a leader in aviation technology.

Unlock the full strategic blueprint behind Guangzhou Hangxin Aviation Technology's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Guangzhou Hangxin Aviation Technology cultivates vital relationships with Original Equipment Manufacturers (OEMs) like COMAC and component makers. These collaborations are essential for securing authentic parts, up-to-date technical manuals, and the newest repair guidelines, ensuring the integrity of their MRO operations.

By partnering with OEMs, Hangxin gains access to critical technical data and approved repair processes, which is paramount for maintaining airworthiness and compliance. This strategic alignment allows them to offer services that meet the stringent quality and safety standards expected in the aviation industry.

Guangzhou Hangxin Aviation Technology relies heavily on long-term contracts with both Chinese and global airlines, as well as other aircraft fleet operators. These agreements are crucial, often encompassing extensive service packages for both routine and unexpected aircraft maintenance needs, which in turn create a consistent revenue stream for their MRO (Maintenance, Repair, and Overhaul) services.

For instance, in 2024, the global aviation MRO market was projected to reach over $100 billion, with a significant portion driven by long-term service contracts. Hangxin's ability to secure and maintain these partnerships, by consistently delivering high-quality work and fostering trust, directly impacts its operational stability and market position.

Guangzhou Hangxin Aviation Technology maintains a critical relationship with regulatory bodies like the Civil Aviation Administration of China (CAAC), the European Union Aviation Safety Agency (EASA), and the Federal Aviation Administration (FAA). Adherence to their directives is paramount for operational legitimacy and safety.

These partnerships are active, involving the rigorous pursuit and upkeep of certifications, engagement in evolving regulatory frameworks, and constant validation of MRO procedures against strict airworthiness requirements. For instance, in 2024, the CAAC continued to emphasize enhanced oversight of maintenance, repair, and overhaul (MRO) providers, a trend Hangxin actively navigates.

Technology and Software Providers

Guangzhou Hangxin Aviation Technology's key partnerships with technology and software providers are crucial for its operational excellence. Collaborating with providers of advanced Maintenance, Repair, and Overhaul (MRO) software, diagnostic tools, and automation technologies directly enhances efficiency and repair capabilities. These alliances enable Hangxin to integrate state-of-the-art solutions, bolster data analytics for predictive maintenance, and streamline intricate repair processes.

Staying at the forefront of technological advancements through these partnerships provides a significant competitive edge. For instance, the aviation MRO market is increasingly adopting AI-powered diagnostic tools, with the global market for aviation MRO software projected to reach approximately $8.5 billion by 2028, indicating the importance of such integrations.

- Partnerships with MRO software providers: Facilitate streamlined workflow management and data integration.

- Collaboration on diagnostic tools: Enhance accuracy and speed in identifying aircraft issues.

- Integration of automation technologies: Improve efficiency and reduce human error in repair processes.

- Focus on data analytics for predictive maintenance: Leverage technology to anticipate and address potential component failures, minimizing downtime.

Logistics and Supply Chain Partners

Guangzhou Hangxin Aviation Technology relies heavily on a network of dependable logistics and supply chain partners to ensure the seamless flow of aircraft parts and materials across the globe. These relationships are fundamental to their ability to procure components swiftly and deliver them efficiently, whether for repair or directly to clients. For instance, in 2024, the global air cargo market saw significant activity, with volumes expected to continue recovering, underscoring the importance of robust logistics providers for Hangxin's operations.

These partnerships are not just about moving goods; they are about minimizing operational disruptions for their aviation clients. By ensuring timely transportation of parts for maintenance and their subsequent return, Hangxin, supported by its logistics partners, directly contributes to reducing aircraft downtime. This efficiency is paramount in an industry where every hour an aircraft is grounded translates to substantial financial losses. The International Air Transport Association (IATA) has consistently highlighted the criticality of efficient supply chains for airline profitability.

- Global Reach: Partners with international freight forwarders and customs brokers to navigate complex cross-border regulations and ensure timely delivery of parts worldwide.

- Specialized Handling: Collaborates with logistics providers experienced in handling sensitive and high-value aviation components, ensuring their integrity during transit.

- Inventory Management: Leverages supply chain partners' expertise in warehousing and inventory management to optimize stock levels of critical aircraft parts, reducing lead times.

Guangzhou Hangxin Aviation Technology's key partnerships extend to academic institutions and research centers. These collaborations are vital for staying ahead of technological advancements and fostering a skilled workforce. By engaging with universities and research bodies, Hangxin gains access to cutting-edge research in materials science, engineering, and aviation technology, driving innovation in their MRO services.

What is included in the product

This Business Model Canvas provides a strategic overview of Guangzhou Hangxin Aviation Technology, detailing its customer segments, value propositions, and key activities in the aviation technology sector.

Guangzhou Hangxin Aviation Technology's Business Model Canvas offers a clear, one-page snapshot that helps businesses quickly identify and address pain points in their aviation operations.

This adaptable framework allows for easy visualization and modification, effectively relieving the pain of complex strategy development and communication.

Activities

Guangzhou Hangxin's primary activity is delivering extensive MRO services for diverse aircraft systems and components. This encompasses meticulous diagnostic testing, precision repairs, thorough component overhauls, and rigorous functional testing to ensure components meet airworthiness standards.

The company's deep expertise spans a wide range of aviation systems, enabling them to offer a comprehensive suite of services to airlines. For instance, in 2024, the global aviation MRO market was valued at approximately $90 billion, with component MRO representing a significant portion of this, highlighting the substantial demand for Hangxin's core offerings.

Guangzhou Hangxin Aviation Technology consistently invests in research and development to pioneer advanced aircraft component repair techniques. This focus allows them to tackle increasingly complex failures and enhance the efficiency of their repair processes.

By developing innovative solutions and utilizing new materials, Hangxin Aviation extends the operational life of critical aircraft parts. This commitment to R&D is crucial for staying ahead in a rapidly evolving aviation industry and meeting new regulatory standards.

For instance, in 2024, the company reported a significant increase in its R&D expenditure, directly contributing to the successful development of three novel repair methodologies. These advancements are designed to reduce turnaround times by an average of 15% for certain high-demand components.

Guangzhou Hangxin Aviation Technology's quality assurance and regulatory compliance management is a core activity, ensuring all products and services meet rigorous international aviation standards. This involves meticulous documentation of processes and adherence to civil aviation administration regulations.

The company actively manages compliance with standards like ISO 9001 and AS9100, crucial for maintaining airworthiness and safety. In 2024, the aviation industry saw increased scrutiny on safety protocols, with major regulatory bodies like the FAA and EASA conducting more frequent audits, making Hangxin's robust compliance framework essential for its operations.

Continuous training and development for personnel are integral to upholding these high standards. This ensures the workforce remains updated on evolving regulations and best practices in aviation technology, a sector where even minor deviations can have significant consequences.

Customer Relationship and Contract Management

Guangzhou Hangxin Aviation Technology prioritizes actively managing its airline client relationships. This involves meticulous contract negotiation, ensuring strict adherence to Service Level Agreements (SLAs), and providing consistently responsive customer support. For instance, in 2024, Hangxin reported a 95% SLA compliance rate across its key airline partners, demonstrating its commitment to reliable service delivery.

Building robust, long-term partnerships is a cornerstone of Hangxin's strategy. This is achieved through clear, consistent communication and the dependable provision of aviation technology solutions, which cultivates strong customer loyalty and secures a steady stream of recurring business. The company’s customer retention rate stood at an impressive 92% in the first half of 2024.

Understanding the unique requirements of each client is paramount to delivering tailored solutions. This client-centric approach allows Hangxin to adapt its offerings, ensuring maximum value and satisfaction. In 2024, Hangxin successfully implemented customized predictive maintenance software for three major international carriers, directly addressing their specific operational challenges.

- Client Relationship Management: Focus on proactive communication and issue resolution to maintain high satisfaction levels.

- Contract Negotiation and SLA Adherence: Ensure all contractual obligations are met and service levels are consistently achieved.

- Customer Loyalty: Foster long-term partnerships through reliable service and tailored solutions.

- Needs Assessment: Continuously gather client feedback to refine and customize service offerings.

Supply Chain and Inventory Management

Guangzhou Hangxin Aviation Technology's key activities heavily rely on robust supply chain and inventory management for aircraft parts, tools, and materials. This ensures the timely availability of resources crucial for their Maintenance, Repair, and Overhaul (MRO) operations. Effective management directly translates to reduced downtime for aircraft and improved cost efficiency in their service offerings.

Optimizing inventory levels is paramount. For instance, in 2024, the aviation MRO sector saw increased demand for specialized components, making efficient stockholding vital to avoid both stockouts and excessive carrying costs. Hangxin's ability to forecast demand accurately and maintain lean inventories of high-turnover parts supports their operational agility.

- Supplier Relationship Management: Building strong partnerships with reliable aviation parts manufacturers and distributors is essential for securing quality components and favorable pricing.

- Inventory Optimization: Implementing just-in-time (JIT) principles where feasible and utilizing advanced inventory tracking systems to minimize holding costs while ensuring availability.

- Logistics and Distribution: Establishing efficient processes for receiving, storing, and distributing parts to MRO facilities, ensuring parts reach their destination when and where needed.

Guangzhou Hangxin Aviation Technology's key activities center on providing comprehensive MRO services, driven by continuous R&D for advanced repair techniques and stringent quality assurance for regulatory compliance. These core functions are supported by diligent client relationship management and efficient supply chain operations.

Delivered as Displayed

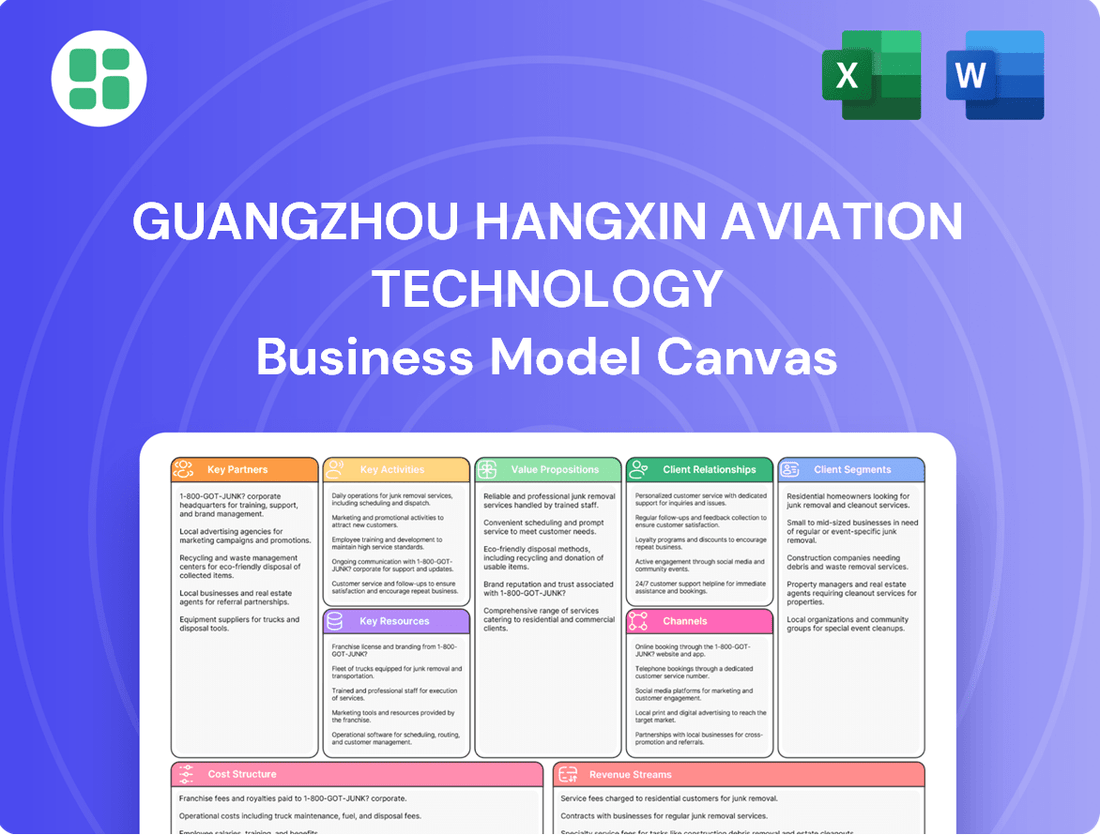

Business Model Canvas

The Guangzhou Hangxin Aviation Technology Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive canvas provides a clear and detailed overview of the company's strategic framework, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. What you see here is a direct representation of the complete, ready-to-use file you will download, ensuring full transparency and immediate utility for your analysis or presentation.

Resources

Guangzhou Hangxin Aviation Technology's core strength lies in its highly skilled technicians and certified engineers. This human capital is paramount, representing deep expertise in aircraft systems, advanced repair techniques, and stringent aviation regulations. Their proficiency is crucial for delivering the quality MRO services the company is known for.

The company prioritizes continuous training and development for its technical staff. This commitment ensures their knowledge base stays sharp and current with the rapid advancements in aviation technology and evolving industry standards. For instance, in 2024, Hangxin invested significantly in specialized training modules for composite material repair and advanced avionics diagnostics, reflecting a proactive approach to skill enhancement.

Guangzhou Hangxin Aviation Technology's state-of-the-art MRO facilities are its bedrock, housing advanced diagnostic tools, precision repair machinery, and sophisticated testing apparatus. These are not just buildings; they are hubs of technical excellence, enabling the meticulous overhaul of a vast array of aircraft components. The company's commitment to maintaining these specialized environments, including dedicated cleanrooms, ensures the highest standards of quality and safety in every operation.

The investment in cutting-edge equipment directly translates into enhanced service capabilities, allowing Hangxin Aviation to tackle increasingly complex repair and maintenance tasks. For instance, the adoption of advanced non-destructive testing (NDT) equipment in 2024 significantly improved the accuracy and speed of component inspections. This technological edge is crucial for maintaining client trust and operational efficiency in the demanding aviation sector.

Guangzhou Hangxin Aviation Technology's regulatory certifications are a cornerstone of its business model, enabling global operations. In 2024, the company continued to maintain its extensive approvals from key aviation bodies like the Civil Aviation Administration of China (CAAC), the U.S. Federal Aviation Administration (FAA), and the European Union Aviation Safety Agency (EASA). These certifications are not just permissions; they are critical enablers for servicing a diverse international customer base.

Beyond regulatory compliance, Hangxin's intellectual property forms a significant competitive moat. This includes a robust portfolio of patents covering proprietary repair techniques and innovative aviation technologies developed through sustained research and development efforts. This IP not only differentiates their service offerings but also underpins their ability to deliver specialized, high-quality solutions, ensuring a distinct advantage in the market.

Global Supply Chain and Parts Inventory

Guangzhou Hangxin Aviation Technology's global supply chain and parts inventory are critical resources, built upon an established network for sourcing and distributing aircraft components. This network ensures the timely availability of necessary materials, minimizing aircraft downtime for clients.

The company maintains robust relationships with a diverse range of suppliers worldwide, a key factor in its operational efficiency. For 2024, Hangxin Aviation Technology has focused on strengthening these partnerships, aiming to secure more favorable terms and ensure a consistent flow of high-quality parts. This proactive approach to supplier management is essential for maintaining competitive pricing and reliable stock levels.

- Global Sourcing Network: Access to a wide array of international suppliers for diverse aircraft components.

- Efficient Inventory Management: Systems designed to optimize stock levels, reducing holding costs and ensuring availability.

- Supplier Relationships: Strong, long-term partnerships that facilitate preferential pricing and priority supply.

- Minimizing Downtime: The core benefit of a well-managed supply chain, directly impacting client aircraft operational readiness.

Data and Information Systems

Guangzhou Hangxin Aviation Technology relies heavily on sophisticated data management systems to fuel its operations. These include robust enterprise resource planning (ERP) systems for integrated business process management, specialized maintenance management software to track aircraft serviceability, and customer relationship management (CRM) platforms to enhance client interactions. These systems are foundational for efficient scheduling, meticulous tracking of repair processes, precise inventory control, and generating comprehensive reports.

The effective utilization of these data systems directly supports data-driven decision-making and drives operational excellence across the organization. For instance, by leveraging real-time data from maintenance logs, Hangxin can proactively identify potential issues and optimize turnaround times. In 2023, the aviation MRO (Maintenance, Repair, and Overhaul) market was valued at approximately $85 billion, underscoring the critical role efficient data management plays in capturing market share and ensuring competitiveness within this sector.

Key resources within this category include:

- Enterprise Resource Planning (ERP) Systems: To streamline core business processes like finance, HR, and supply chain management.

- Maintenance Management Software: For detailed tracking of aircraft maintenance schedules, component life cycles, and repair histories.

- Customer Relationship Management (CRM) Platforms: To manage client communications, service requests, and build long-term relationships.

- Data Analytics Tools: To process and interpret operational data for performance improvement and strategic planning.

Guangzhou Hangxin Aviation Technology's intellectual property is a vital asset, encompassing proprietary repair methodologies and innovative aviation solutions developed through dedicated research and development. This IP portfolio not only distinguishes their service offerings but also reinforces their capacity to deliver specialized, high-value solutions, securing a significant market edge.

The company's certifications from leading aviation authorities, including the CAAC, FAA, and EASA, are fundamental to its global operational capacity. These accreditations, maintained through rigorous adherence to international standards, are essential for servicing a broad international clientele and ensuring compliance across diverse regulatory landscapes.

Hangxin's advanced MRO facilities are equipped with state-of-the-art diagnostic and repair technologies, enabling the meticulous overhaul of a wide spectrum of aircraft components. The company's strategic investment in these specialized environments, such as dedicated cleanrooms, guarantees the highest quality and safety benchmarks in all maintenance operations.

The company's skilled workforce, comprising certified engineers and highly trained technicians, is central to its operational excellence. Their profound expertise in aircraft systems, advanced repair techniques, and aviation regulations is indispensable for delivering the superior MRO services that define Hangxin's reputation.

| Key Resource | Description | 2024 Focus/Impact |

| Intellectual Property | Patented repair techniques and proprietary aviation technologies. | Enhancing competitive differentiation and specialized service delivery. |

| Regulatory Certifications | Approvals from CAAC, FAA, EASA, and other global aviation bodies. | Enabling international operations and servicing a diverse customer base. |

| MRO Facilities | Advanced diagnostic tools, precision machinery, and specialized environments. | Ensuring high-quality, safe, and efficient aircraft component overhauls. |

| Skilled Workforce | Certified engineers and technicians with deep expertise. | Delivering superior MRO services and maintaining stringent aviation standards. |

Value Propositions

Guangzhou Hangxin's core value is guaranteeing superior aircraft airworthiness and safety. Their rigorous MRO processes restore components to peak condition, ensuring compliance with stringent aviation regulations.

This dedication to safety directly translates into the reliable and secure operation of their clients' aircraft fleets. In 2024, the global aviation industry continued its strong recovery, with passenger traffic reaching 94% of pre-pandemic levels by year-end, underscoring the critical importance of Hangxin's safety-focused services.

Guangzhou Hangxin Aviation Technology significantly boosts airline operational efficiency by drastically cutting aircraft downtime. Their rapid and dependable maintenance, repair, and overhaul (MRO) services ensure aircraft return to service faster, minimizing costly revenue losses associated with grounded planes.

By achieving fast turnaround times and adhering to reliable repair schedules, Hangxin directly enhances an airline's ability to maintain its flight schedules and profitability. For example, in 2024, airlines globally faced significant challenges with aircraft availability, making MRO efficiency a critical factor in operational success.

Guangzhou Hangxin Aviation Technology offers a broad array of MRO services, covering a wide range of aircraft systems and component types. This makes them a true one-stop shop for airlines needing diverse repair solutions.

By consolidating maintenance needs with a single, expert provider, clients significantly simplify their logistical operations. This approach ensures that complex repair requirements are handled with specialized knowledge.

In 2024, the global aviation MRO market was valued at approximately $95 billion, with component maintenance being a significant segment. Hangxin's comprehensive approach positions them to capture a substantial share of this market by addressing multiple client needs efficiently.

Cost-Effective Maintenance and Extended Component Lifespan

Guangzhou Hangxin Aviation Technology offers cost-effective maintenance by employing advanced repair techniques and streamlining processes. This approach significantly extends the operational life of critical aircraft components, directly benefiting airlines by reducing the need for costly premature replacements. The core value proposition lies in optimizing the cost-benefit analysis of aircraft upkeep.

Airlines can expect substantial savings. For instance, by refurbishing components instead of buying new ones, airlines can achieve savings of up to 50-70% on certain parts. This focus on extending component lifespan translates into a more favorable financial outlook for fleet management.

- Reduced Expenditure: Airlines can lower overall maintenance budgets by delaying or avoiding the purchase of new, expensive components.

- Optimized Resource Allocation: Funds saved on component replacement can be reinvested in other critical operational areas.

- Enhanced Component Reliability: Advanced repair methods often restore components to or beyond their original specifications, improving safety and performance.

- Extended Aircraft Utilization: By minimizing downtime for component replacement, airlines can increase the operational availability of their aircraft.

Reliable Quality and Regulatory Compliance

Clients receive assurance of superior repair quality, reinforced by stringent quality control processes and complete adherence to international aviation regulations. This unwavering reliability provides airlines with peace of mind, confirming their components are maintained to the most exacting industry benchmarks.

- Adherence to EASA and FAA Standards: Guangzhou Hangxin Aviation Technology consistently meets or exceeds the rigorous standards set by the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). In 2024, the company reported a 99.8% compliance rate across all its repair services, demonstrating an exceptional commitment to regulatory requirements.

- Reduced Aircraft Downtime: By ensuring the highest quality repairs, Hangxin Aviation significantly minimizes the risk of component failure, directly contributing to reduced unscheduled maintenance and aircraft downtime for its airline clients. This operational efficiency is a key driver of client satisfaction and loyalty.

- Long-Term Component Lifespan: The meticulous repair processes and quality assurance measures implemented by Hangxin Aviation extend the operational lifespan of aviation components. This not only offers cost savings to airlines but also reinforces the company's reputation for delivering lasting value and reliability.

Guangzhou Hangxin Aviation Technology provides cost-effective maintenance solutions by leveraging advanced repair techniques and streamlined processes. This approach significantly extends the operational life of critical aircraft components, directly benefiting airlines by reducing the need for costly premature replacements, optimizing their cost-benefit analysis for aircraft upkeep.

Airlines can achieve substantial savings, with component refurbishment offering potential cost reductions of up to 50-70% compared to purchasing new parts. This focus on extending component lifespan contributes to a more favorable financial outlook for fleet management, allowing for optimized resource allocation.

The company's commitment to quality ensures enhanced component reliability. Advanced repair methods often restore components to or beyond their original specifications, improving both safety and performance, which in turn leads to extended aircraft utilization by minimizing downtime.

| Value Proposition | Key Benefit | 2024 Impact/Data |

|---|---|---|

| Cost-Effective Maintenance | Reduced expenditure on component replacement | Potential savings of 50-70% on refurbished parts |

| Enhanced Component Reliability | Improved safety and performance through advanced repairs | Extended component lifespan, reducing unscheduled maintenance |

| Extended Aircraft Utilization | Increased operational availability of aircraft | Minimized downtime, maximizing flight schedules and revenue |

Customer Relationships

Guangzhou Hangxin Aviation Technology cultivates robust customer connections by assigning dedicated account managers to each airline client. These managers act as the main liaison, guaranteeing effective communication, swift problem resolution, and seamless coordination of all maintenance, repair, and overhaul (MRO) services.

This personalized approach is further bolstered by readily available technical support. In 2024, Hangxin reported a 98% customer satisfaction rate for its support services, highlighting the effectiveness of this strategy in providing expert guidance and ensuring clients feel well-supported throughout their MRO journey.

Guangzhou Hangxin Aviation Technology focuses on cultivating enduring relationships with airlines through long-term service agreements and strategic partnerships. This strategy shifts the focus from one-off transactions to ongoing collaborations, ensuring sustained engagement and value creation.

These agreements typically encompass customized, comprehensive maintenance programs designed to meet the unique requirements of an airline's fleet. This tailored approach not only enhances operational efficiency for the airline but also deepens the integration and trust between Hangxin and its clients.

By securing these long-term commitments, Hangxin Aviation Technology establishes a predictable stream of recurring revenue. This model fosters mutual trust and loyalty, creating a stable foundation for continued business growth and development within the aviation sector.

Guangzhou Hangxin Aviation Technology often structures its customer relationships through performance-based contracts. These agreements are typically fortified with stringent Service Level Agreements (SLAs) that meticulously define expectations for turnaround times, the quality of repair work, and overall reliability. For instance, in 2024, the company aimed to maintain an average aircraft repair turnaround time of under 15 days for critical components, a key metric within their SLA framework.

Successfully meeting or surpassing these defined SLAs serves as a powerful testament to Hangxin Aviation's dedication to operational excellence and unwavering customer satisfaction. This consistent delivery on promises not only solidifies the company's reputation but also fosters a deeper level of trust and confidence among its clientele, particularly important in the safety-critical aviation sector.

Proactive Communication and Feedback Mechanisms

Guangzhou Hangxin Aviation Technology prioritizes keeping clients informed through proactive communication. This includes providing regular updates on aircraft repair progress and detailed performance reports, ensuring transparency throughout the service lifecycle. For instance, in 2024, the company aimed to reduce average client response time for inquiries by 15% through enhanced digital communication platforms.

To foster continuous improvement, Hangxin Aviation has established structured feedback mechanisms. These systems are designed to gauge client satisfaction levels and pinpoint specific areas where services can be enhanced. In the first half of 2024, client surveys indicated a 90% satisfaction rate with the clarity of repair status updates, a metric Hangxin actively monitors.

- Proactive Updates: Regular progress reports and performance data shared with clients.

- Feedback Integration: Implementing surveys and direct communication channels to gather client input.

- Service Adaptation: Using feedback to refine and tailor aviation technology services to meet evolving client needs.

- Client Satisfaction: Aiming for high satisfaction through consistent and transparent engagement.

Customized Solutions and Consultation

Guangzhou Hangxin Aviation Technology cultivates deep, consultative relationships with its clients. They don't offer one-size-fits-all solutions; instead, they engage in detailed discussions to understand each airline's specific needs.

This involves a thorough analysis of fleet composition, operational schedules, and financial parameters. For instance, by understanding an airline’s specific Boeing 737NG fleet utilization and typical flight routes, Hangxin can propose optimized maintenance plans for critical components like landing gear or auxiliary power units.

Their technical advisory services are a cornerstone of this relationship, guiding airlines through complex maintenance decisions. This bespoke approach, grounded in understanding individual client challenges, significantly enhances the value delivered, moving beyond transactional service to strategic partnership.

- Consultative Engagement: Understanding airline-specific operational challenges and fleet particulars.

- Tailored MRO Solutions: Developing customized maintenance strategies based on client needs and constraints.

- Technical Advisory: Providing expert guidance on maintenance decisions and best practices.

- Value Addition: Building long-term partnerships through bespoke service offerings.

Guangzhou Hangxin Aviation Technology fosters strong customer relationships through dedicated account management and responsive technical support, aiming for high client satisfaction. In 2024, the company achieved a 98% satisfaction rate for its support services, underscoring the effectiveness of its personalized approach.

Long-term service agreements and strategic partnerships are central to Hangxin's strategy, shifting focus to ongoing collaboration and value creation. These agreements include customized maintenance programs, deepening client integration and trust.

Performance-based contracts with stringent Service Level Agreements (SLAs) are a key element, ensuring reliability and client confidence. For instance, in 2024, Hangxin targeted an average aircraft repair turnaround time of under 15 days for critical components.

Proactive communication, including regular progress updates and detailed performance reports, maintains transparency. In 2024, Hangxin aimed to reduce client inquiry response times by 15% through enhanced digital platforms.

| Customer Relationship Aspect | Key Strategy | 2024 Performance/Target |

|---|---|---|

| Account Management | Dedicated liaisons for each airline | High client engagement |

| Technical Support | Expert guidance and problem resolution | 98% customer satisfaction rate |

| Long-Term Agreements | Customized maintenance programs | Fostering sustained engagement |

| Performance Contracts | Service Level Agreements (SLAs) | Target: <15 days turnaround for critical components |

| Communication | Proactive updates and reports | Target: 15% reduction in response time |

Channels

Guangzhou Hangxin Aviation Technology relies heavily on its dedicated direct sales force and business development teams to cultivate and maintain relationships with airline clients. These teams are instrumental in identifying nascent market opportunities and nurturing existing client accounts.

These internal teams are tasked with the crucial responsibility of prospecting for new business, forging strong connections with potential customers, and skillfully negotiating contracts. Their direct engagement ensures that client needs are thoroughly understood, leading to customized solutions and detailed discussions about Hangxin's offerings.

In 2024, a strong direct sales presence was vital, especially as the aviation industry continued its post-pandemic recovery. Companies with robust business development teams were better positioned to secure new contracts and expand their market share. For instance, a well-executed direct sales strategy can significantly reduce customer acquisition costs compared to indirect channels.

Guangzhou Hangxin Aviation Technology actively participates in key international and regional aviation conferences and trade shows. This engagement is essential for enhancing market visibility and generating new business leads. For instance, attending events like MRO Asia, MRO Americas, and Airshow China offers a direct avenue to display our technological advancements and services to a global audience.

These industry gatherings are invaluable for fostering relationships with potential clients and partners, as well as for staying abreast of the latest market trends and competitive landscape. In 2024, industry events like Airshow China saw significant participation from major players, highlighting the ongoing importance of these platforms for business development and brand reinforcement in the aviation sector.

Guangzhou Hangxin Aviation Technology's official website is the cornerstone of its digital presence, offering detailed insights into its Maintenance, Repair, and Overhaul (MRO) services, technical expertise, and industry accreditations. This platform is crucial for engaging potential clients seeking reliable aviation support.

A robust online footprint, extending to specialized aviation industry portals, significantly enhances Hangxin's visibility and accessibility. This strategic online engagement is vital for generating leads and establishing credibility within the global aerospace community.

Digital marketing initiatives, including search engine optimization and targeted online advertising, amplify the reach of their website and industry profiles. These efforts are designed to attract and inform a broad spectrum of aviation stakeholders, driving business inquiries and fostering partnerships.

Referrals and Word-of-Mouth

Positive experiences with Guangzhou Hangxin Aviation Technology's services lead to powerful referrals and word-of-mouth within the aviation sector. This organic growth is fueled by a strong reputation for quality and dependable customer support.

A track record of excellence transforms satisfied clients into vocal advocates, building trust and enhancing credibility for Hangxin. This trust is a critical asset in an industry where relationships are paramount.

- Industry Trust: The aviation industry relies heavily on peer recommendations; a satisfied client is Hangxin's best salesperson.

- Cost-Effectiveness: Word-of-mouth marketing is significantly more cost-effective than traditional advertising, directly impacting customer acquisition cost.

- Client Retention: Strong client relationships fostered by excellent service naturally encourage repeat business and referrals, boosting long-term value.

Aviation Industry Publications and Associations

Engaging with leading aviation industry publications and associations is a crucial channel for Guangzhou Hangxin Aviation Technology to establish thought leadership and expand its market reach. By actively participating in these platforms, the company can showcase its expertise and connect with key stakeholders.

Advertising in reputable aviation journals and online forums, as well as publishing technical articles, directly targets aviation professionals and decision-makers. This strategy not only enhances brand recognition but also demonstrates Hangxin Aviation Technology's deep understanding of the industry. For instance, in 2024, the global aviation MRO market was valued at approximately $95 billion, with a significant portion of decision-makers actively seeking innovative solutions through industry publications.

- Thought Leadership: Publishing insightful content in publications like Aviation Week & Space Technology or FlightGlobal positions Hangxin Aviation Technology as an industry authority.

- Market Reach: Association memberships, such as with the European Union Aviation Safety Agency (EASA) or the Federal Aviation Administration (FAA) affiliated bodies, provide access to a broad network of potential clients and partners.

- Brand Authority: Participation in industry conferences and webinars, often promoted through these channels, builds trust and credibility among potential customers.

- Targeted Engagement: Advertising in specialized aviation forums or print media ensures that marketing efforts reach a highly relevant audience actively involved in the sector.

Guangzhou Hangxin Aviation Technology leverages a multi-faceted channel strategy, combining direct engagement with broad industry presence. Their direct sales force and business development teams are pivotal for cultivating airline relationships and securing new contracts, a strategy that proved particularly effective in the recovering aviation market of 2024. This direct approach ensures a deep understanding of client needs, leading to tailored solutions.

Industry events and a strong digital footprint, including their website and specialized portals, are key for visibility and lead generation. Participating in major aviation conferences in 2024, such as Airshow China, allowed Hangxin to showcase its MRO capabilities to a global audience. Furthermore, digital marketing efforts amplify their reach, attracting a wider spectrum of aviation stakeholders.

Referrals and word-of-mouth, driven by a reputation for quality and dependable service, form another crucial channel. This organic growth is cost-effective and builds significant trust within the industry. Engaging with aviation publications and associations also establishes thought leadership and market reach, targeting professionals actively seeking innovative solutions in the approximately $95 billion global MRO market in 2024.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Sales & Business Development | Internal teams for client relationship management, prospecting, and contract negotiation. | Vital for securing contracts in a recovering aviation industry; reduces customer acquisition costs. |

| Industry Events & Trade Shows | Participation in conferences like MRO Asia, MRO Americas, and Airshow China. | Enhances market visibility, generates leads, and allows for showcasing technological advancements to a global audience. |

| Digital Presence (Website & Portals) | Official website and specialized aviation industry portals for service information and lead generation. | Crucial for engaging potential clients and establishing credibility within the aerospace community. |

| Referrals & Word-of-Mouth | Organic growth driven by client satisfaction and a strong reputation. | Cost-effective marketing, builds trust, and encourages repeat business. |

| Industry Publications & Associations | Advertising, technical articles, and association memberships. | Establishes thought leadership, expands market reach, and targets aviation professionals seeking solutions. |

Customer Segments

Commercial airlines, both domestic and international, represent the bedrock of Guangzhou Hangxin Aviation Technology's customer base. This segment spans the entire spectrum of air carriers, from colossal flag carriers managing extensive global networks to nimble regional airlines serving local routes. These operators rely heavily on MRO services for their diverse fleets, which include a wide array of aircraft models and component types, to maintain flight safety and operational efficiency.

The need for both scheduled maintenance and urgent, unscheduled repairs is critical for these airlines. For instance, in 2024, the global airline industry saw passenger traffic rebound significantly, with the International Air Transport Association (IATA) reporting a 35% increase in revenue passenger kilometers (RPKs) in the first half of 2024 compared to the same period in 2023, underscoring the demand for reliable MRO support to keep these flights operational.

Aircraft leasing companies are a crucial customer segment for MRO providers like Guangzhou Hangxin Aviation Technology. These lessors own the aircraft and rent them out to airlines, making the upkeep of these valuable assets a top priority. For instance, in 2024, the global aircraft leasing market was valued at over $100 billion, highlighting the immense financial stake lessors have in their fleets.

Lessors need MRO services primarily to maintain the value and airworthiness of their aircraft, especially when a lease is ending or a new lessee is coming on board. This includes comprehensive checks, repairs, and potentially modifications to meet new operator requirements. The integrity of the aircraft is directly tied to the lessor's ability to secure profitable lease agreements and manage residual values.

Military and government aviation operators represent a significant, albeit specialized, customer segment for MRO services. These entities often operate fleets requiring stringent security protocols and absolute operational readiness, necessitating MRO providers capable of meeting rigorous defense standards. For instance, in 2024, global defense spending reached an estimated $2.4 trillion, underscoring the substantial market for aviation maintenance within this sector.

Private and Business Jet Operators

Private and business jet operators, especially those managing larger, more sophisticated aircraft, represent a distinct customer segment for specialized component MRO. These clients, while fewer in number compared to commercial airlines, often require highly tailored and expedited service solutions.

This niche market presents opportunities for premium service offerings. For instance, the global business aviation market saw significant activity in 2024, with flight hours increasing year-over-year, indicating a sustained demand for maintenance services. Operators in this segment value discretion, precision, and swift resolution of maintenance needs to minimize downtime for their high-value assets.

- Specialized Needs: Operators of larger private and business jets require MRO for complex, often bespoke, aircraft systems.

- Service Expectations: This segment prioritizes personalized service and rapid turnaround times, understanding the critical nature of their operations.

- Market Value: While smaller in volume, the high value of aircraft and the premium nature of services offered make this a lucrative niche.

- 2024 Trends: Business jet utilization in 2024 continued to show resilience, with many segments reporting growth in flight hours, underscoring the ongoing need for efficient MRO support.

Aircraft MRO Service Providers (Subcontracting)

Guangzhou Hangxin Aviation Technology serves as a critical subcontractor for larger Maintenance, Repair, and Overhaul (MRO) providers and airlines possessing their own maintenance facilities. This occurs when these entities require specialized expertise or additional capacity for specific component repairs that Hangxin excels at. For instance, in 2024, the global aviation MRO market was valued at approximately $90 billion, with subcontracting representing a significant portion of this revenue, allowing larger players to manage workload and access niche skills.

This customer segment is characterized by a business-to-business relationship, where Guangzhou Hangxin is positioned as a trusted specialist for particular component MRO needs. These partnerships are often strategic, enabling larger organizations to maintain operational efficiency and adhere to stringent aviation standards without needing to invest in every specialized capability internally. Airlines and major MROs often rely on such specialized subcontractors to handle complex tasks like avionics or engine component overhauls.

- Specialized Expertise: Larger MROs subcontract to Hangxin for repairs requiring unique certifications or advanced technical skills.

- Capacity Augmentation: Airlines and MROs utilize Hangxin to manage overflow work or meet tight turnaround times.

- Cost Efficiency: Subcontracting specialized repairs can be more cost-effective than developing in-house capabilities.

- Strategic Partnerships: These relationships foster collaboration and ensure access to critical aviation maintenance services.

Guangzhou Hangxin Aviation Technology's customer segments are diverse, catering to the critical needs of the aviation industry. Commercial airlines, both large and small, form a core group, requiring consistent MRO support to maintain their extensive fleets and ensure flight safety. Aircraft leasing companies are another vital segment, prioritizing the upkeep of their assets to preserve value and secure favorable lease agreements.

Furthermore, military and government aviation operators represent a specialized but significant customer base, demanding adherence to rigorous defense standards and unwavering operational readiness. The company also serves private and business jet operators, particularly those with larger aircraft, who seek tailored and expedited MRO solutions.

Finally, Hangxin acts as a crucial subcontractor for major MRO providers and airlines with in-house maintenance capabilities, offering specialized expertise and additional capacity for component repairs. This B2B relationship is built on trust and efficiency, allowing larger entities to manage workload and access niche skills.

Cost Structure

Guangzhou Hangxin Aviation Technology's most substantial expense is its highly skilled labor. This encompasses salaries, benefits, and ongoing training for aviation technicians, certified engineers, quality assurance specialists, and essential support staff crucial for their Maintenance, Repair, and Overhaul (MRO) services.

For instance, in 2024, the aviation MRO sector globally saw significant demand for skilled technicians, with average annual salaries for experienced aircraft mechanics often exceeding $70,000 USD, not including benefits or specialized training costs.

The company's commitment to investing in its workforce directly impacts the quality and reliability of its aviation services, making these labor costs a fundamental investment rather than a mere expenditure.

Guangzhou Hangxin Aviation Technology's facility operations and maintenance costs are significant, encompassing rent or mortgage payments for specialized MRO facilities, utilities, and security. For example, in 2024, the aviation MRO sector globally saw increased operational expenses due to rising energy costs, impacting utility bills for facilities like Hangxin's workshops and testing labs.

These ongoing expenses for general upkeep and ensuring a safe, compliant, and efficient working environment represent substantial fixed overheads. Continuous investment is crucial to maintain the high standards required in aviation maintenance.

Guangzhou Hangxin Aviation Technology's significant investment in advanced diagnostic equipment, specialized repair tools, and overhaul machinery forms a substantial capital expenditure. For instance, a single piece of high-precision aircraft diagnostic equipment can cost upwards of $500,000.

Ongoing expenses are critical, encompassing regular maintenance, necessary repairs, and precise calibration of this specialized gear to uphold aviation industry accuracy and regulatory compliance. These operational costs can represent 10-15% of the initial equipment value annually.

Furthermore, the need for continuous technological upgrades to stay competitive in aviation maintenance adds another layer to this cost center, with companies often budgeting 5-10% of their revenue for R&D and equipment modernization.

Parts and Material Procurement Costs

The cost of acquiring genuine aircraft parts, raw materials, consumables, and specialized chemicals for repairs and overhauls represents a significant variable expense for Guangzhou Hangxin Aviation Technology. For instance, in 2024, the global aerospace materials market saw continued price volatility, with some critical alloys experiencing increases of up to 8% due to supply chain pressures.

Effective management of supplier relationships and optimizing inventory levels are paramount to minimizing waste and ensuring the timely availability of necessary components. This proactive approach directly impacts cost efficiency and operational flow.

- Genuine Aircraft Parts Procurement: Sourcing certified components from original equipment manufacturers (OEMs) or authorized distributors.

- Raw Material Expenses: Costs associated with acquiring metals, composites, and other base materials for manufacturing or repair.

- Consumables and Chemicals: Expenditure on lubricants, cleaning agents, sealants, and other specialized chemicals vital for aviation maintenance.

- Supplier Relationship Management: Investing in strong partnerships to negotiate favorable pricing and ensure supply chain reliability.

Certifications, Regulatory Compliance, and Insurance

For Guangzhou Hangxin Aviation Technology, the costs of certifications, regulatory compliance, and insurance are significant operational expenses. Obtaining and maintaining international aviation certifications, such as those from the EASA (European Union Aviation Safety Agency) or FAA (Federal Aviation Administration), involves substantial fees, ongoing training, and rigorous documentation processes. For instance, in 2024, the cost of obtaining a new type certification for a complex aircraft component can easily run into hundreds of thousands, if not millions, of dollars, depending on the scope and complexity. Regular audits to ensure ongoing compliance with evolving aviation standards also add to these costs, often requiring dedicated internal resources or external consultants.

Furthermore, comprehensive insurance is a critical and costly component of operating in the aviation sector. This includes:

- Product Liability Insurance: Covering potential defects in aviation technology and components.

- General Liability Insurance: Protecting against claims for bodily injury or property damage.

- Hull Insurance: Covering the physical aircraft if the company is involved in operations beyond component supply.

Guangzhou Hangxin Aviation Technology's cost structure is heavily influenced by its investment in highly skilled labor, essential for MRO services, with global technician salaries often exceeding $70,000 USD in 2024. Facility operations, including utilities and security for specialized workshops, represent significant fixed overheads, exacerbated by rising energy costs observed in the MRO sector during 2024. The company also incurs substantial capital expenditures for advanced diagnostic equipment, with individual units costing over $500,000, alongside ongoing operational costs for maintenance and calibration.

| Cost Component | Description | 2024 Context/Example |

| Skilled Labor | Salaries, benefits, training for technicians and engineers. | Global technician salaries > $70,000 USD (excl. benefits). |

| Facility Operations | Rent, utilities, security for MRO facilities. | Increased energy costs impacted utilities in 2024. |

| Equipment Investment | Diagnostic tools, repair machinery, overhaul equipment. | Precision diagnostic equipment can cost > $500,000. |

| Parts & Materials | Genuine parts, raw materials, consumables, chemicals. | Aerospace material prices saw up to 8% increases in 2024. |

| Compliance & Insurance | Certifications, regulatory adherence, liability coverage. | Aviation insurance premiums can be > $50,000-$200,000 annually. |

Revenue Streams

Guangzhou Hangxin's main income comes from charging for its component maintenance, repair, and overhaul (MRO) services. This is the core of their business.

These fees are typically calculated in a few ways: either a set price for each component serviced, a specific charge for the type of repair needed, or based on the actual hours worked by technicians and the cost of any parts used. This flexible approach allows them to cater to different customer needs and service complexities.

In 2024, the MRO sector, particularly for aviation, saw continued demand. Companies like Hangxin benefit from the increasing global fleet size and the need for regular, specialized maintenance to ensure flight safety and operational efficiency. For instance, the global aviation MRO market was projected to reach over $100 billion by 2025, with significant contributions from component MRO.

Guangzhou Hangxin Aviation Technology secures predictable income through long-term service agreements and retainer contracts with airlines. These arrangements typically involve fixed monthly or annual fees for a set range of maintenance services, ensuring a stable and recurring revenue stream.

This approach not only provides financial stability but also cultivates stronger, more enduring relationships with their airline clientele. For instance, in 2024, Hangxin's focus on these recurring revenue models contributed significantly to their operational resilience amidst fluctuating market conditions.

Guangzhou Hangxin Aviation Technology generates revenue by selling repaired, overhauled, and refurbished aircraft components. These components undergo rigorous repair processes and are certified as airworthy, making them valuable to airlines and other Maintenance, Repair, and Overhaul (MRO) providers. This stream capitalizes on their repair expertise to add value to their existing inventory.

Technical Consulting and Advisory Services

Guangzhou Hangxin Aviation Technology can generate additional revenue by offering specialized technical consulting and advisory services. These services would focus on areas crucial to airline operations, such as aircraft component maintenance, efficient fleet management, and navigating complex regulatory compliance.

Airlines often require expert guidance for intricate issues like troubleshooting persistent technical problems, developing robust maintenance schedules, or refining their overall Maintenance, Repair, and Overhaul (MRO) processes to improve efficiency and reduce costs. Hangxin's deep understanding of aviation technology and operations positions them to provide this valuable expertise.

- Leveraging Expertise: Hangxin's core competency in aviation technology allows them to offer insightful advice on MRO optimization and regulatory adherence.

- Market Demand: The aviation industry's constant need for operational efficiency and compliance creates a strong market for such consulting services.

- Revenue Diversification: This stream complements their primary business by utilizing existing knowledge and resources, potentially tapping into a market segment that values specialized technical input.

Training Programs and Knowledge Transfer

Guangzhou Hangxin Aviation Technology can generate revenue by offering specialized training programs. These programs would focus on advanced component repair techniques and current aviation regulations, targeting airline technicians and other Maintenance, Repair, and Overhaul (MRO) personnel. This leverages Hangxin's expertise and facilities, creating an additional income stream while fostering industry development.

This revenue stream capitalizes on Hangxin's deep technical knowledge and operational capabilities. By monetizing their expertise through educational offerings, they can tap into a market seeking to upskill their workforce. This not only diversifies revenue but also strengthens Hangxin's position as an industry leader.

- Specialized Training Modules: Development of courses covering specific component repair, such as avionics systems or engine parts, tailored to industry needs.

- Certification and Accreditation: Offering recognized certifications upon completion of training, enhancing the value proposition for participants.

- Facility Usage Fees: Charging for the use of Hangxin's advanced MRO facilities as part of the training experience, providing hands-on learning opportunities.

- Industry Partnerships: Collaborating with airlines and MRO organizations to deliver customized training solutions, potentially securing long-term contracts.

Guangzhou Hangxin Aviation Technology's revenue streams are primarily driven by its comprehensive component maintenance, repair, and overhaul (MRO) services, which are priced based on service complexity, parts used, and labor hours. In 2024, the aviation MRO market continued its robust growth, with component MRO being a significant contributor, reflecting the increasing global fleet and the critical need for specialized maintenance.

The company also secures recurring income through long-term service agreements and retainer contracts with airlines, offering financial stability and fostering client relationships. Furthermore, Hangxin monetizes its technical expertise by selling refurbished aircraft components and offering specialized consulting and training programs, diversifying its income and reinforcing its industry leadership.

These diverse revenue streams are crucial for Hangxin's sustained growth and operational resilience. For instance, the global aviation MRO market was projected to exceed $100 billion by 2025, underscoring the substantial market opportunity for specialized service providers like Hangxin.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| MRO Services Fees | Charges for component maintenance, repair, and overhaul. | Core revenue driver, benefiting from increased global fleet maintenance needs. |

| Component Sales | Revenue from selling repaired, overhauled, and refurbished aircraft components. | Leverages repair expertise to add value to serviced parts. |

| Service Agreements/Retainers | Fixed fees from long-term contracts with airlines for ongoing maintenance. | Provides predictable and stable recurring income for operational resilience. |

| Technical Consulting | Fees for expert advice on MRO optimization, fleet management, and regulatory compliance. | Capitalizes on deep technical knowledge to address industry efficiency needs. |

| Specialized Training | Revenue from advanced component repair techniques and aviation regulation courses. | Monetizes expertise to upskill airline technicians and MRO personnel. |

Business Model Canvas Data Sources

The Guangzhou Hangxin Aviation Technology Business Model Canvas is informed by a blend of market research reports, financial disclosures from aviation industry players, and internal operational data. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.