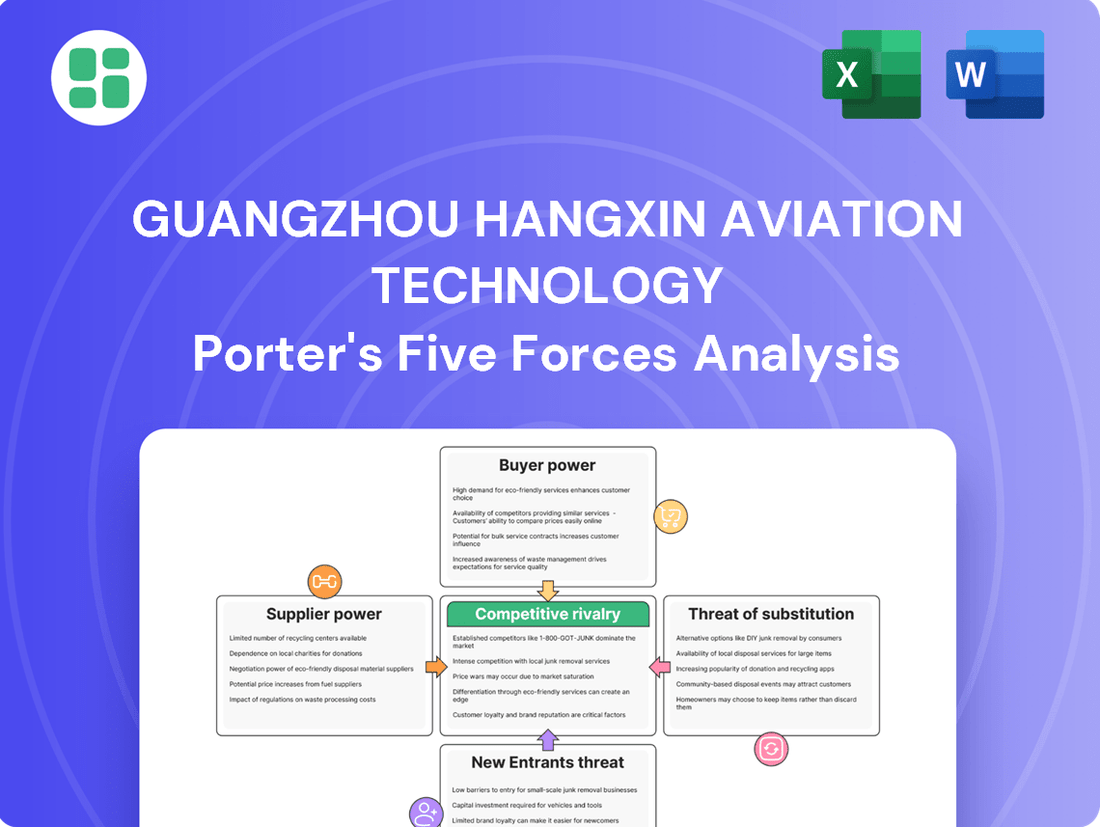

Guangzhou Hangxin Aviation Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou Hangxin Aviation Technology Bundle

Guangzhou Hangxin Aviation Technology navigates intense competition and significant buyer power within its sector. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for its strategic positioning.

The complete report reveals the real forces shaping Guangzhou Hangxin Aviation Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical aircraft components and specialized materials significantly impacts Guangzhou Hangxin Aviation Technology. A limited number of large suppliers, particularly for proprietary parts or advanced composite materials, can wield considerable bargaining power. For instance, the aerospace industry often relies on a handful of manufacturers for highly specialized engine components or avionics systems, making it difficult for MROs to switch providers without substantial cost and time implications. This situation is exacerbated by ongoing global supply chain disruptions, which, as reported in late 2023 and early 2024, have led to material shortages and increased lead times for many essential aerospace materials, further strengthening supplier leverage.

The uniqueness of inputs significantly shapes supplier bargaining power in the MRO sector. When aviation maintenance, repair, and overhaul (MRO) services rely on highly specialized or proprietary components and technologies, the suppliers of these critical inputs gain considerable leverage. This is particularly true for Guangzhou Hangxin Aviation Technology, given its authorized status with original equipment manufacturers (OEMs) like Boeing and Honeywell. These authorizations often imply a dependence on specific, sometimes unique, parts and approved repair procedures, granting OEMs and their designated suppliers a stronger position.

Guangzhou Hangxin Aviation Technology likely faces significant switching costs when changing suppliers for critical aviation components. These costs often include the expense and time required for re-certification of new parts and manufacturing processes, as well as potential re-tooling of production lines to accommodate different specifications. The aviation industry's stringent safety regulations mean that any new supplier's parts must undergo rigorous testing and approval, adding further complexity and expense, which directly bolsters supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Guangzhou Hangxin Aviation Technology. Original Equipment Manufacturers (OEMs), while primarily focused on aircraft production, are increasingly expanding their aftermarket services. This strategic shift allows them to directly compete in the Maintenance, Repair, and Overhaul (MRO) market, potentially capturing a larger share of the value chain and increasing their leverage over independent MRO providers like Hangxin.

For instance, in 2024, several major aircraft OEMs reported substantial growth in their MRO divisions, driven by a desire to monetize their existing customer relationships and proprietary technical knowledge. This trend suggests that suppliers are not just providing parts but are actively looking to become direct competitors, thereby diminishing the bargaining power of MRO companies that rely on their components.

- OEMs expanding aftermarket services: Many aircraft manufacturers are enhancing their MRO capabilities, moving beyond component supply to offering comprehensive maintenance solutions.

- Increased competition in MRO: This forward integration by suppliers directly intensifies competition within the MRO sector, potentially impacting pricing and market share for independent players.

- Leveraging proprietary knowledge: Suppliers can use their intimate knowledge of aircraft systems and components to offer specialized, high-value MRO services, creating a competitive advantage.

Importance of Guangzhou Hangxin to Suppliers

The significance of Guangzhou Hangxin Aviation Technology as a customer heavily influences its suppliers' bargaining power. If Hangxin constitutes a substantial portion of a supplier's revenue, the supplier is more likely to be accommodating to Hangxin's demands.

Conversely, if Hangxin is a minor client for its suppliers, those suppliers possess greater leverage. This is particularly relevant in the aerospace sector, where specialized components often come from a limited number of manufacturers.

For instance, in 2024, the global aerospace component manufacturing market saw continued consolidation. Companies that supply critical avionics or structural parts to multiple major players, including potentially Hangxin, might find themselves with less dependence on any single customer. This increases their ability to dictate terms, pricing, and delivery schedules.

- Customer Dependence: If Guangzhou Hangxin represents a small percentage of a supplier's total sales, that supplier has higher bargaining power.

- Supplier Concentration: In specialized aerospace sectors, a limited number of suppliers for critical components can shift power towards the supplier.

- Market Dynamics (2024): The ongoing consolidation in aerospace component manufacturing in 2024 suggests that many suppliers serve a broad customer base, potentially reducing their reliance on any one buyer like Hangxin.

The bargaining power of suppliers for Guangzhou Hangxin Aviation Technology is significantly shaped by the concentration within the aerospace component market. With many critical parts sourced from a limited number of specialized manufacturers, these suppliers often hold considerable sway. For example, in 2024, the market for advanced aerospace materials and complex engine components remained dominated by a few key global players, limiting Hangxin's options and increasing supplier leverage.

The reliance on unique or proprietary inputs further amplifies supplier power. When Hangxin, as an MRO provider, requires specific parts or technologies authorized by Original Equipment Manufacturers (OEMs), the suppliers of these items gain an advantage. This dependency is compounded by high switching costs, which include the extensive time and expense associated with re-certifying new parts and processes due to stringent aviation safety regulations.

| Factor | Impact on Guangzhou Hangxin Aviation Technology | Supporting Data/Trend (2024) |

|---|---|---|

| Supplier Concentration | High bargaining power for key component suppliers | Limited number of global manufacturers for specialized aerospace materials and engine parts. |

| Uniqueness of Inputs | Increased leverage for OEM-authorized parts suppliers | Dependence on proprietary components and approved repair procedures. |

| Switching Costs | High costs and time for changing suppliers | Rigorous re-certification and testing mandated by aviation safety standards. |

What is included in the product

This analysis meticulously examines Guangzhou Hangxin Aviation Technology's competitive environment, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Guangzhou Hangxin Aviation Technology's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying strategic pressure points.

Customers Bargaining Power

Customer concentration is a key factor in assessing bargaining power. If Guangzhou Hangxin Aviation Technology relies heavily on a few major airlines for its revenue, those large customers gain significant leverage. The airline industry is characterized by large, influential players, meaning even a moderate concentration of these major carriers as clients for Hangxin's aviation technology solutions would amplify their ability to negotiate favorable terms.

Airlines face significant hurdles when considering a switch in Maintenance, Repair, and Overhaul (MRO) service providers. Existing long-term contracts can lock them in, and the deep integration of MRO systems with an airline's operations means a change can be incredibly complex and disruptive. For instance, the need to obtain new certifications and approvals for a different provider's processes can be a lengthy and costly undertaking.

The highly specialized nature of aviation MRO services inherently contributes to higher switching costs. Airlines often invest heavily in training their staff to work with specific provider systems and procedures. This specialization means that simply moving to another MRO provider isn't like changing a supplier for generic parts; it requires a substantial re-education and re-tooling effort, thereby diminishing the bargaining power of individual airline customers.

Airlines, Guangzhou Hangxin's primary customer base, exhibit significant price sensitivity. This is driven by the constant need to control operational expenses, a critical factor in maintaining profitability. For instance, in 2024, airlines globally continued to grapple with fluctuating fuel costs and intense competition, making them actively seek MRO (Maintenance, Repair, and Overhaul) services that offer the best value for money.

Threat of Backward Integration by Customers

The threat of airlines performing Maintenance, Repair, and Overhaul (MRO) services in-house is a significant factor impacting Guangzhou Hangxin Aviation Technology. Many major airlines maintain their own MRO divisions, which can perform a substantial portion of their maintenance needs. This internal capability acts as a credible alternative for airlines, thereby limiting Hangxin's pricing power and bargaining leverage.

For instance, in 2024, several large carriers continued to invest in and expand their MRO capabilities. This trend is driven by a desire for greater control over operational costs, turnaround times, and quality assurance. The presence of these in-house MRO operations means that airlines can choose to bring work in-house if external providers like Hangxin become too expensive or if their own capacity allows.

- Airlines' In-House MRO Capacity: Many airlines operate their own dedicated MRO facilities, capable of handling routine checks, component repairs, and even heavier maintenance tasks.

- Cost Control and Efficiency: By performing MRO services internally, airlines aim to reduce outsourcing costs and improve operational efficiency, directly impacting their decision to use external providers.

- Strategic Importance of MRO: For some airlines, MRO is a core competency and a strategic advantage, further strengthening their ability to perform these services independently.

Availability of Substitute Services for Customers

The availability of substitute services significantly enhances the bargaining power of airlines in the aviation MRO (Maintenance, Repair, and Overhaul) market. With numerous independent MRO providers, original equipment manufacturer (OEM)-affiliated service centers, and other alternative solutions, airlines have a wide array of choices. This competitive landscape directly translates to increased leverage for customers, as they can readily switch to providers offering more favorable terms or pricing.

The MRO market is characterized by a substantial number of players, fostering a highly competitive environment. For instance, in 2024, the global aviation MRO market was valued at approximately $90 billion, with a significant portion attributed to independent MROs and OEM service networks. This sheer volume of service providers means airlines are not beholden to a single supplier, allowing them to negotiate terms more aggressively.

- High Supplier Fragmentation: The MRO industry includes a diverse range of providers, from large global players to smaller specialized shops, offering airlines numerous options.

- OEM vs. Independent MROs: Airlines can choose between services directly from aircraft manufacturers or from independent MROs, each potentially offering different cost structures and turnaround times.

- Technological Advancements: New technologies and innovative repair techniques can emerge from various MROs, providing airlines with better or more cost-effective solutions than traditional methods.

- Global Reach of MROs: Many MRO providers operate globally, meaning an airline can find comparable services regardless of its operational base, further reducing dependence on any single provider.

The bargaining power of customers, primarily airlines, is a significant force for Guangzhou Hangxin Aviation Technology. Airlines possess considerable leverage due to the availability of numerous MRO providers and their own in-house capabilities. This competition and the inherent switching costs for airlines mean they can negotiate terms effectively, impacting Hangxin's pricing and profitability.

In 2024, the global aviation MRO market, valued at approximately $90 billion, demonstrated intense competition among a fragmented supplier base. This environment allows airlines to readily compare offerings and secure favorable terms, as they are not reliant on any single provider. The strategic importance of cost control for airlines further amplifies their negotiating stance.

| Factor | Impact on Bargaining Power | Example for Airlines |

|---|---|---|

| Customer Concentration | High if few dominant airlines are clients | Reliance on a few major carriers for revenue |

| Switching Costs | Lowers bargaining power for providers | Complex system integration and certification needs |

| Price Sensitivity | Increases bargaining power | Constant need to control operational expenses |

| Threat of In-house MRO | Reduces provider pricing power | Airlines maintaining their own MRO divisions |

| Availability of Substitutes | Increases bargaining power | Numerous independent MROs and OEM service centers |

Full Version Awaits

Guangzhou Hangxin Aviation Technology Porter's Five Forces Analysis

This preview shows the exact Guangzhou Hangxin Aviation Technology Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the aviation technology sector. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This fully formatted document is ready for your immediate use, providing strategic clarity without any surprises.

Rivalry Among Competitors

The aviation Maintenance, Repair, and Overhaul (MRO) sector where Guangzhou Hangxin operates is quite crowded. There are numerous MRO service providers, ranging from massive global corporations to smaller, specialized domestic firms. This creates a highly competitive landscape for Hangxin.

Major international players like ST Engineering, Lufthansa Technik, and AAR Corp have a significant presence, often boasting extensive capabilities and global networks. These large competitors can leverage economies of scale and established relationships with major airlines, posing a substantial challenge.

Domestically, within China and the Asia-Pacific region, Hangxin also faces competition from other emerging MRO providers. For instance, companies like Haite High-Tech in China are also expanding their service offerings, directly vying for market share and contracts. The sheer number of these players, both large and small, intensifies rivalry.

The aviation Maintenance, Repair, and Overhaul (MRO) market is experiencing robust growth, projected to reach $100.4 billion by 2024. This expansion is largely driven by increasing global air travel demand and a growing fleet of aging aircraft requiring more maintenance. Such healthy expansion, however, can also fuel intense competition as it attracts new players and encourages existing ones to vie for market share.

Guangzhou Hangxin Aviation Technology's MRO services face a competitive landscape where differentiation can be challenging. While Hangxin offers specialized services and holds OEM authorizations, which provide a degree of distinction, the broader MRO market often sees competition driven by price due to the standardized nature of many repair and maintenance tasks.

Exit Barriers

Exit barriers in the aviation maintenance, repair, and overhaul (MRO) sector, including for Guangzhou Hangxin Aviation Technology, are substantial. These include the significant capital tied up in specialized facilities, advanced diagnostic equipment, and extensive spare parts inventory. For instance, a typical large MRO facility can represent hundreds of millions of dollars in investment.

These high fixed costs mean that once a company like Hangxin has committed to this infrastructure, exiting the market becomes financially punitive. Even during periods of reduced demand, these companies often continue operations to avoid the catastrophic losses associated with abandoning such assets. This can lead to prolonged periods of intense competition as firms fight to maintain market share and cover their overheads.

- High Capital Investment: MRO facilities require immense upfront investment in hangars, specialized tooling, and testing equipment, often running into tens or hundreds of millions of dollars.

- Specialized Workforce: The industry relies on highly skilled and certified technicians and engineers, whose training and retention represent a significant ongoing investment and a barrier to easy labor reallocation.

- Asset Specificity: Much of the equipment and facilities are purpose-built for aviation maintenance, making them difficult to repurpose or sell for alternative uses, thus increasing the cost of exit.

Fixed Costs

The aviation maintenance, repair, and overhaul (MRO) industry, which Guangzhou Hangxin Aviation Technology operates within, is characterized by substantial fixed costs. These include significant investments in specialized facilities, advanced tooling, and the rigorous certifications required by aviation authorities. For instance, establishing a certified MRO facility can easily run into tens of millions of dollars, with ongoing costs for skilled labor, which is a critical and often scarce resource.

These high fixed costs create a strong incentive for MRO providers to maintain high utilization rates across their operations. To achieve this, companies may engage in aggressive pricing strategies to secure contracts and keep their expensive infrastructure and personnel busy. This drive for volume can intensify competitive rivalry, as firms vie to capture market share and spread their fixed overheads over a larger revenue base.

- High Capital Investment: MRO operations require substantial upfront capital for hangars, specialized equipment, and regulatory compliance, often exceeding $50 million for a comprehensive facility.

- Skilled Labor Dependency: The need for highly trained and certified aircraft mechanics and technicians represents a significant ongoing fixed cost, as these professionals command premium salaries and benefits.

- Capacity Utilization Pressure: To offset high fixed costs, MRO providers are driven to operate at near-full capacity, leading to price competition and a focus on securing long-term contracts to ensure consistent demand.

The aviation MRO sector, where Guangzhou Hangxin operates, is intensely competitive, featuring numerous global and regional players. This crowding means Hangxin must constantly strive to win contracts against established giants and emerging local competitors, making market share gains challenging.

The market's growth, projected to reach $100.4 billion by 2024, attracts new entrants and intensifies efforts by existing firms to capture business. This dynamic fuels price competition, as providers aim to maximize the utilization of their substantial fixed assets and skilled workforces.

Differentiation is difficult, as many MRO services are standardized, leading to rivalry often centered on cost-effectiveness. Hangxin's OEM authorizations offer some distinction, but the overall environment pressures providers to be highly competitive on price to secure work and cover significant operational overheads.

The high exit barriers, stemming from massive capital investments in specialized facilities and equipment, compel existing MRO providers to remain operational even in challenging periods. This persistence intensifies competition as firms fight to maintain revenue streams and cover their considerable fixed costs, creating a sustained environment of rivalry.

| Competitor Type | Examples | Impact on Hangxin |

|---|---|---|

| Global MRO Giants | ST Engineering, Lufthansa Technik, AAR Corp | Leverage economies of scale, extensive networks, and established airline relationships, posing significant competitive pressure. |

| Emerging Regional Players | Haite High-Tech (China) | Directly compete for market share and contracts within specific geographic regions, increasing local rivalry. |

| Specialized Niche Providers | Firms focusing on specific aircraft types or component repairs | Compete for specialized contracts, potentially fragmenting market share and requiring Hangxin to maintain broad capabilities. |

SSubstitutes Threaten

The threat of substitutes for Guangzhou Hangxin Aviation Technology's MRO services is significant. Airlines can opt for component pooling agreements, where they share a pool of serviceable parts with other carriers, reducing their reliance on individual repair providers. In 2024, the used serviceable material (USM) market continued its robust growth, with many airlines increasingly turning to these pre-owned, certified parts as a cost-effective alternative to new or repaired components.

Original Equipment Manufacturers (OEMs) are increasingly offering lifetime maintenance contracts, presenting a significant threat of substitution for independent Maintenance, Repair, and Overhaul (MRO) providers like Guangzhou Hangxin Aviation Technology. These all-inclusive packages can be highly attractive to airlines, potentially drawing business away from third-party MRO services. For instance, in 2024, major aircraft OEMs continued to expand their service offerings, aiming to capture a larger share of the aftermarket revenue, which is projected to grow substantially in the coming years.

Delays in new aircraft deliveries, a persistent issue in recent years, actually bolster the demand for Maintenance, Repair, and Overhaul (MRO) services. For instance, Boeing faced significant production challenges throughout 2023 and into early 2024, leading to extended delivery timelines for airlines. This means airlines must keep their existing fleets flying longer, directly increasing the need for MRO to maintain operational readiness and safety.

The extended lifespan of older aircraft, driven by these delivery delays, translates into a higher volume of MRO work. Airlines are incentivized to invest more in maintaining their current aircraft rather than replacing them prematurely. However, a hypothetical future scenario where manufacturers like Boeing and Airbus rapidly accelerate new aircraft production and deliveries could eventually reduce the reliance on extensive MRO for aging fleets, potentially impacting demand for certain services.

In-house Maintenance Capabilities of Airlines

Airlines possessing robust in-house maintenance, repair, and overhaul (MRO) capabilities can significantly reduce their reliance on external providers. This internal capacity acts as a direct substitute for third-party MRO services, particularly for routine line maintenance and certain component repairs. For instance, major carriers often maintain extensive workshops and skilled personnel to handle a substantial portion of their fleet's upkeep.

The extent of these in-house capabilities varies. While some airlines outsource most heavy maintenance, many retain the ability to perform critical tasks themselves. This internal MRO capacity directly impacts the bargaining power of external MRO providers like Guangzhou Hangxin Aviation Technology, as airlines can choose to perform work internally if external pricing or service levels are unfavorable.

For example, in 2024, a significant percentage of major airlines worldwide maintained in-house line maintenance operations, handling tasks such as routine checks, minor defect rectifications, and component replacements. This internal capacity directly competes with the services offered by third-party MROs, thereby increasing the threat of substitutes.

- Internal MRO Capacity: Many large airlines maintain in-house capabilities for line maintenance and component repairs, acting as a direct substitute for external MRO providers.

- Reduced Outsourcing: Strong in-house MRO means airlines can perform maintenance themselves, lessening dependence on third-party MROs and influencing their pricing power.

- Competitive Pressure: The ability of airlines to conduct maintenance internally puts pressure on third-party MROs to offer competitive pricing and efficient service to secure contracts.

Technological Advancements in Aircraft Design

Technological advancements in aircraft design present a significant threat of substitutes for Guangzhou Hangxin Aviation Technology. Innovations leading to more durable aircraft components and extended maintenance intervals directly reduce the need for traditional MRO services. For instance, the increasing adoption of advanced composite materials in new aircraft models, like those seen in the Boeing 787 Dreamliner and Airbus A350 XWB, offers greater resistance to fatigue and corrosion, potentially lowering the frequency of required inspections and repairs.

While these advancements might reduce the overall volume of certain MRO tasks, they also foster the evolution of the industry. The rise of predictive maintenance technologies, utilizing sensors and data analytics to anticipate component failures, is a prime example. This shifts the MRO landscape from reactive repairs to proactive servicing, potentially creating new service opportunities for companies like Hangxin Aviation Technology that can adapt and invest in these sophisticated diagnostic capabilities.

The market for advanced aircraft materials is projected for substantial growth. For example, the global aerospace composites market was valued at approximately USD 15.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 8% through 2030. This trend underscores the increasing integration of materials that inherently require less frequent MRO intervention.

- Reduced Demand for Traditional Repairs: Advancements in aircraft materials and design, such as the use of composites, lead to longer service lives for components, decreasing the frequency of routine maintenance and repairs.

- Emergence of Predictive Maintenance: Technologies that predict component failure enable a shift from reactive to proactive MRO, potentially altering the service mix rather than eliminating the need for MRO altogether.

- Market Growth in Advanced Materials: The aerospace composites market, valued at around USD 15.5 billion in 2023, highlights the increasing adoption of materials that inherently reduce the demand for traditional MRO services.

Component pooling agreements and the growing market for used serviceable materials (USM) present viable alternatives to traditional MRO services. In 2024, the USM market continued its strong expansion, with airlines increasingly opting for these cost-effective, certified pre-owned parts over new or repaired ones.

Aircraft manufacturers are increasingly offering comprehensive lifetime maintenance contracts, which directly compete with independent MRO providers. By bundling services, OEMs aim to capture a larger share of the aftermarket. Major manufacturers continued to enhance their service portfolios in 2024, targeting substantial aftermarket revenue growth.

Airlines with strong in-house MRO capabilities can bypass external providers for routine maintenance and component work. This internal capacity acts as a direct substitute, especially for line maintenance. For example, major carriers in 2024 maintained extensive in-house operations for tasks like routine checks and minor repairs, directly impacting third-party MROs' market share.

Entrants Threaten

Establishing a Maintenance, Repair, and Overhaul (MRO) facility for aviation technology, like Guangzhou Hangxin Aviation Technology, demands immense capital. This includes building specialized hangars, acquiring sophisticated diagnostic and repair equipment, and stocking a vast inventory of spare parts. For instance, a new, state-of-the-art MRO facility can easily cost hundreds of millions of dollars to set up. This substantial financial hurdle significantly deters potential new entrants from entering the market, thereby protecting existing players.

The aviation maintenance, repair, and overhaul (MRO) sector faces significant barriers to entry due to stringent regulatory requirements. For instance, Guangzhou Hangxin Aviation Technology, like any MRO provider, must adhere to approvals from bodies such as the Civil Aviation Administration of China (CAAC), the Federal Aviation Administration (FAA) in the US, and the European Union Aviation Safety Agency (EASA).

Acquiring and maintaining these certifications is a rigorous, lengthy, and expensive undertaking. The process involves substantial investment in facilities, skilled personnel, and quality management systems, making it a formidable challenge for new players aiming to enter the market.

Newcomers face significant hurdles in building relationships with airlines, the primary customers for aviation technology. Guangzhou Hangxin, like other established firms, benefits from years of trust and proven performance, making it challenging for new entrants to secure initial contracts and gain a foothold in the market. This established customer loyalty and the difficulty in replicating existing supplier networks act as a substantial barrier.

Economies of Scale and Experience

Established players like Guangzhou Hangxin Aviation Technology benefit significantly from economies of scale. Their extensive operational history allows for optimized processes and supply chain efficiencies that are difficult for newcomers to replicate quickly. This accumulated experience translates into lower per-unit costs, making it challenging for new entrants to compete on price from the outset.

New entrants face substantial hurdles in matching the cost structures of incumbent MRO providers. For instance, in 2024, major MROs often operate with significantly lower overheads per aircraft serviced due to high utilization rates of specialized equipment and skilled labor. This scale advantage creates a substantial barrier, as new entrants would need considerable upfront investment to achieve comparable efficiency levels.

- Economies of Scale: Large MROs leverage bulk purchasing power for parts and materials, reducing acquisition costs compared to smaller, less frequent buyers.

- Experience Curve: Years of operation allow for refined maintenance procedures and troubleshooting, leading to faster turnaround times and reduced labor costs per task.

- Capital Investment: The high cost of specialized tooling, testing equipment, and certifications necessary for aviation maintenance deters many potential new entrants.

Proprietary Technology and Expertise

The threat of new entrants in the aircraft component MRO sector, particularly for companies like Guangzhou Hangxin Aviation Technology, is significantly mitigated by the substantial barriers associated with proprietary technology and deep expertise. Developing and maintaining the specialized repair techniques and technical know-how for complex aircraft components demands years of dedicated research, development, and hands-on experience. This investment in intellectual capital and advanced repair methodologies creates a formidable hurdle for newcomers aiming to compete in this highly technical field.

For instance, the intricate nature of repairing modern avionics or engine components often requires access to unique diagnostic equipment and proprietary software, which are costly to acquire and master. This technological moat, coupled with the need for highly skilled and certified technicians, means that new players must commit considerable financial resources and time to build comparable capabilities. In 2024, the average MRO provider invests millions in specialized tooling and training, underscoring the capital intensity of establishing a competitive presence.

- High R&D Investment: Aircraft component MRO demands continuous investment in research and development to keep pace with evolving aircraft technologies, often exceeding 10% of revenue for leading firms.

- Specialized Tooling and Equipment: The cost of acquiring and maintaining proprietary diagnostic tools and repair equipment for advanced aircraft systems can run into millions of dollars per facility.

- Skilled Workforce Requirements: Companies need highly trained and certified engineers and technicians, with specialized training programs taking several years and significant financial commitment.

- Intellectual Property Protection: Proprietary repair schemes and technical data are often protected by patents or trade secrets, limiting access for potential competitors.

The threat of new entrants for Guangzhou Hangxin Aviation Technology is notably low due to the immense capital required to establish a competitive MRO facility. Setting up a modern MRO operation, complete with specialized hangars and advanced equipment, can easily cost hundreds of millions of dollars, presenting a significant financial barrier.

Regulatory compliance further solidifies this barrier; MRO providers must obtain approvals from bodies like the CAAC, FAA, and EASA, a process that is both time-consuming and expensive, demanding substantial investment in infrastructure and quality systems. Established relationships with airlines, built on years of trust and performance, are also difficult for newcomers to replicate, creating a strong customer loyalty moat.

Economies of scale enjoyed by incumbents like Guangzhou Hangxin, stemming from optimized processes and bulk purchasing power, mean new entrants struggle to match cost efficiencies. In 2024, major MROs benefit from lower overheads per aircraft due to high equipment utilization, a level new entrants would need significant upfront investment to achieve.

Proprietary technology and deep expertise in repairing complex aircraft components also act as a substantial deterrent. Developing and mastering these specialized techniques requires years of R&D and hands-on experience, with leading firms in 2024 often investing over 10% of revenue in R&D to stay current with evolving aircraft technologies.

| Barrier Type | Description | Estimated Cost/Impact (Illustrative) |

|---|---|---|

| Capital Investment | Setting up specialized hangars, acquiring diagnostic and repair equipment, and stocking spare parts. | Hundreds of millions of dollars for a new facility. |

| Regulatory Approvals | Obtaining certifications from aviation authorities like CAAC, FAA, EASA. | Significant investment in facilities, personnel, and quality management systems. |

| Customer Relationships | Building trust and securing contracts with airlines. | Years of proven performance and established supplier networks are difficult to replicate. |

| Economies of Scale | Leveraging bulk purchasing and optimized operational processes. | Lower per-unit costs due to high utilization rates and efficient supply chains. |

| Technology & Expertise | Developing specialized repair techniques and mastering proprietary software/equipment. | Millions of dollars in specialized tooling and training; R&D investment often exceeds 10% of revenue. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Guangzhou Hangxin Aviation Technology is built upon a foundation of publicly available company filings, including annual reports and investor presentations. We also incorporate data from reputable industry research firms and aviation sector-specific market intelligence reports to provide a comprehensive view of the competitive landscape.