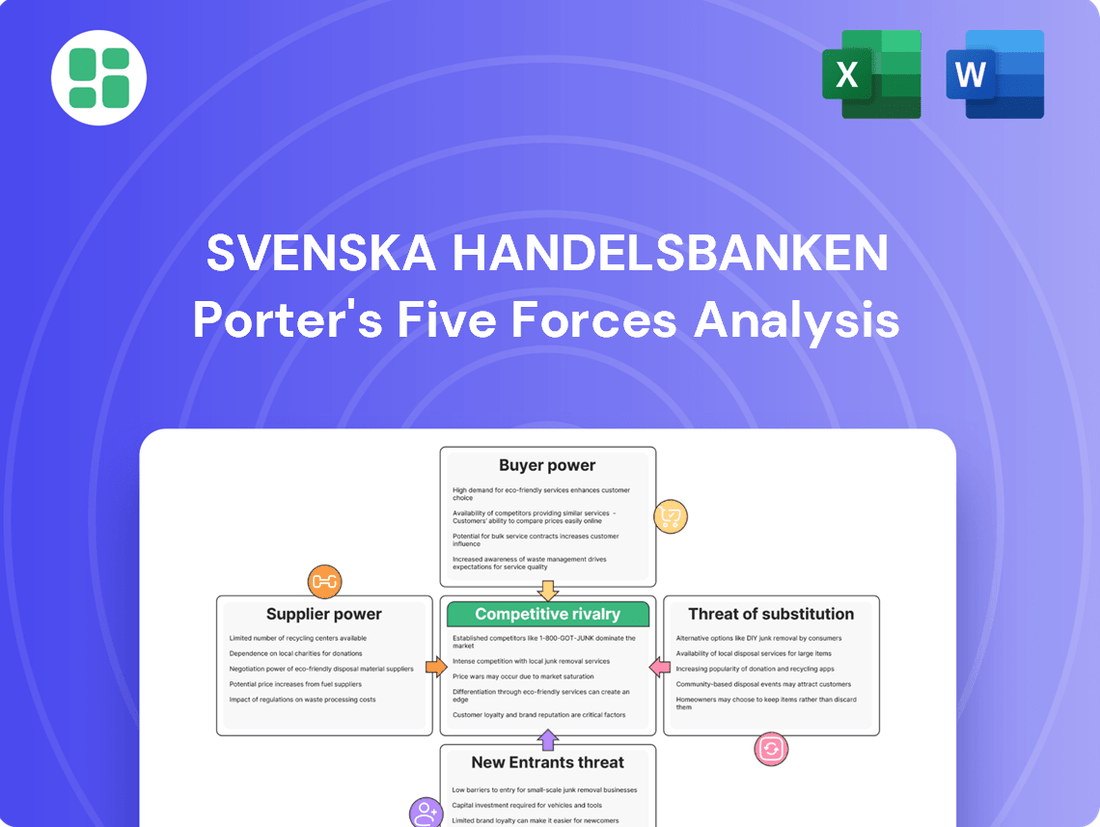

Svenska Handelsbanken Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Svenska Handelsbanken Bundle

Svenska Handelsbanken operates within a banking sector characterized by moderate threat of new entrants due to high capital requirements and regulatory hurdles, and intense rivalry among established players. Buyer power is significant, as customers can readily switch banks for better rates or services, impacting profitability. The full Porter's Five Forces analysis reveals the strength and intensity of each market force affecting Svenska Handelsbanken, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Svenska Handelsbanken's reliance on specialized technology and IT infrastructure providers is a significant factor in the bargaining power of suppliers. The bank, like its peers, depends on sophisticated software for online and mobile banking, alongside critical cybersecurity measures. The financial sector's rapid digital transformation, including the integration of AI, means these specialized vendors possess considerable leverage. Their services are not just beneficial but essential for maintaining a competitive edge and ensuring operational stability.

The continuous need for banks to invest in advanced risk management and cutting-edge technologies further amplifies the bargaining power of these IT and cybersecurity firms. For instance, global spending on cybersecurity solutions was projected to reach over $200 billion in 2024, highlighting the immense demand and the critical nature of these services. This dependence means providers can often command higher prices and dictate terms, as disruptions in these areas can have severe financial and reputational consequences for a bank like Handelsbanken.

Financial market infrastructure providers, such as payment networks and clearing houses, hold significant bargaining power over banks like Handelsbanken. These entities are essential for transaction processing and market integration, and their services are often non-substitutable. For instance, SWIFT, a global provider of secure financial messaging services, operates with a high degree of indispensability for international transactions.

Svenska Handelsbanken, like many in the financial sector, faces significant pressure from the bargaining power of suppliers, particularly concerning specialized IT talent. The ongoing digital transformation within banking necessitates a robust workforce skilled in areas like software development, data analytics, and cybersecurity. This demand, coupled with a noted shortage of such expertise in Sweden, allows these professionals and the firms that provide them, such as IT outsourcing companies, to negotiate higher salaries and service fees.

This dynamic directly impacts Handelsbanken's operational expenses. For instance, in 2023, the average salary for a senior software developer in Stockholm could range from SEK 60,000 to SEK 80,000 per month, a figure that has likely seen further upward pressure in early 2024 due to persistent demand. Consequently, the bank must contend with increased costs for acquiring and retaining the essential technological talent needed to maintain its competitive edge and drive innovation.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers hold substantial bargaining power within the banking sector due to the ever-increasing complexity and stringency of financial regulations. For instance, the implementation of new EU directives such as PSD3, PSR, and DORA by 2024 and 2025 necessitates significant investment and adaptation from institutions like Svenska Handelsbanken.

Firms specializing in Regulatory Technology (RegTech), legal counsel for financial compliance, and independent auditing services are crucial for banks to maintain their operational licenses and avoid penalties. The demand for these specialized services remains high, allowing providers to command premium pricing and dictate terms.

Handelsbanken's reliance on these external experts to navigate evolving requirements, including data protection and cybersecurity mandates under DORA, underscores the suppliers' leverage. Failure to comply can result in substantial fines; for example, GDPR violations can reach up to 4% of global annual turnover.

- Increased Regulatory Burden: Banks face a growing number of compliance requirements, driving demand for specialized services.

- High Switching Costs: Implementing new compliance systems and training staff can be costly and time-consuming, making it difficult for banks to switch providers.

- Limited Number of Expert Providers: The niche nature of regulatory compliance means there are fewer specialized firms, concentrating bargaining power.

- Essential Nature of Services: Compliance is not optional; it is a prerequisite for operating, giving service providers significant influence.

Real Estate and Branch Network Services

Despite the increasing trend towards digitalization, Svenska Handelsbanken continues to operate an extensive physical branch network, setting it apart from many purely digital banking competitors. This reliance on physical infrastructure means that suppliers providing real estate, maintenance, and security services for these branches hold a degree of bargaining power, particularly for prime locations. For instance, in 2024, the cost of commercial real estate in key European financial hubs remained robust, influencing lease and service agreements.

Handelsbanken's decentralized operational model, where local branches have significant autonomy, could potentially mitigate some of this supplier power. By allowing for localized negotiations with real estate and service providers, the bank might diffuse the collective bargaining strength of these suppliers across different regions. This approach can lead to more tailored agreements that reflect local market conditions rather than a uniform, centralized negotiation.

- Real Estate Costs: In 2024, prime office space rental costs in major Scandinavian cities, where Handelsbanken has a strong presence, saw an average increase of 3-5% year-over-year, impacting branch network operating expenses.

- Maintenance and Security Services: The demand for specialized banking security and advanced building maintenance services remained high, with service providers able to command competitive pricing due to the critical nature of these functions for financial institutions.

- Decentralized Negotiation Impact: While specific data on the financial impact of localized negotiations is proprietary, industry analysis suggests that decentralized procurement can lead to cost savings of up to 10% on services compared to centralized bulk purchasing, depending on market competition.

Suppliers of specialized IT and cybersecurity solutions wield significant bargaining power over Svenska Handelsbanken. This is driven by the essential nature of these services for digital operations and the high global spending on cybersecurity, projected to exceed $200 billion in 2024. Providers can thus influence pricing and terms due to the severe consequences of service disruptions.

Financial market infrastructure providers, like SWIFT, also possess strong leverage as their services are often non-substitutable for essential functions such as international transaction processing. Furthermore, the demand for skilled IT talent, particularly in areas like AI and data analytics, allows IT outsourcing firms and specialized professionals to negotiate higher fees, impacting Handelsbanken's operational costs, with senior developer salaries in Stockholm potentially ranging from SEK 60,000-80,000 monthly in 2023.

Regulatory and compliance service providers, including RegTech firms and legal counsel, hold substantial sway due to the increasing complexity of financial regulations, such as the upcoming EU directives DORA, PSD3, and PSR. The critical need for compliance to maintain operational licenses, coupled with potential GDPR fines up to 4% of global annual turnover, grants these providers significant influence over banks like Handelsbanken.

Suppliers of real estate, maintenance, and security services for Handelsbanken's physical branch network also possess bargaining power, especially for prime locations. Commercial real estate costs in key European financial hubs remained robust in 2024, with rental costs in major Scandinavian cities seeing an average increase of 3-5% year-over-year. While Handelsbanken's decentralized model may offer some negotiation flexibility, the essential nature of these services for operational continuity remains a key factor.

What is included in the product

This analysis unpacks the competitive forces impacting Svenska Handelsbanken, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Effortlessly identify and mitigate competitive threats by visualizing Handelsbanken's Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

Swedish banking customers demonstrate considerable mobility, with a notable percentage open to switching banks for different financial products. This ease of switching, often facilitated by low switching costs, directly enhances customer bargaining power.

In 2024, a significant portion of Swedish consumers, estimated to be around 30-40%, considered switching their primary bank within the year, reflecting this high mobility. This trend forces banks like Handelsbanken to remain competitive on pricing and service to retain their customer base.

Handelsbanken's strategic emphasis on building enduring customer relationships is a direct response to this inherent customer power. By fostering loyalty and providing personalized service, the bank aims to mitigate the impact of customers easily moving to competitors offering slightly better terms.

The proliferation of neobanks and fintech startups significantly amplifies customer bargaining power. These digital-first alternatives, often boasting lower overheads, can offer more attractive pricing and user experiences, directly challenging traditional players like Svenska Handelsbanken. For instance, by mid-2024, neobanks in Europe had captured a notable percentage of the retail banking market, forcing incumbents to innovate and compete on fees and service quality.

Customers, both individuals and businesses, are increasingly focused on price. This is particularly true in Sweden's competitive banking landscape, where digital platforms make it simple to compare interest rates, fees, and other charges. In 2024, this trend is amplified, with consumers actively seeking the best value for their money.

The expectation of low-cost financial services in Sweden directly reflects the significant bargaining power customers wield. Handelsbanken, like its peers, must acknowledge this customer demand for competitive pricing to maintain its market position.

Large Corporate and Institutional Clients

Large corporate and institutional clients wield considerable influence over banks like Svenska Handelsbanken. These sophisticated entities possess the financial muscle and expertise to negotiate favorable terms, often seeking customized solutions for their complex banking needs. Their ability to tap into capital markets directly or engage with a diverse range of financial institutions amplifies their bargaining power.

For Handelsbanken, which caters to a significant corporate and investment banking segment, this translates into pressure on pricing and service offerings. The sheer volume of business these clients represent means that banks must remain competitive to retain their custom. For instance, in 2023, major European banks saw their net interest margins squeezed, partly due to intense competition for large corporate deposits and lending mandates.

- Sophisticated Needs: Large clients require tailored financial products and services, from complex derivatives to syndicated loans, giving them leverage in negotiations.

- Direct Market Access: Their ability to access capital markets directly reduces their reliance on traditional bank financing, thereby increasing their bargaining power.

- Multiple Banking Relationships: Many large corporations maintain relationships with several banks, allowing them to play institutions against each other for better terms.

- Transaction Volume: The substantial transaction volumes associated with these clients make them highly valuable, compelling banks to offer competitive pricing and enhanced services.

Information Access and Financial Literacy

Customers today are far more informed than ever before, thanks to the explosion of online resources, comparison websites, and access to financial advisors. This heightened financial literacy significantly shifts the power dynamic, allowing consumers to readily compare offerings and demand better terms.

In 2024, for instance, the number of active users on personal finance websites and apps continued to climb, with many platforms offering detailed comparisons of banking services, interest rates, and fees. This easy access to information directly reduces information asymmetry between banks and their customers, forcing financial institutions to be more transparent and competitive.

- Informed Decisions: Customers leverage online tools to compare interest rates, fees, and service quality across multiple banks.

- Demand for Customization: Increased knowledge empowers customers to seek out products and services tailored to their specific financial needs.

- Price Sensitivity: readily available pricing information makes customers more sensitive to fees and less likely to accept unfavorable terms.

- Service Expectations: Well-informed customers expect higher levels of service and responsiveness from their banking providers.

The bargaining power of customers in the Swedish banking sector is substantial, driven by high customer mobility and a growing demand for competitive pricing. In 2024, an estimated 30-40% of Swedish consumers considered switching banks, underscoring the ease with which customers can move between institutions. This situation compels banks like Svenska Handelsbanken to focus on service quality and value to retain clients.

The rise of fintech and neobanks further empowers customers by introducing more competitive offerings and often lower fees, directly challenging traditional banks. These digital alternatives, which had captured a notable market share in Europe by mid-2024, force incumbents to innovate and be more transparent. Customers are increasingly informed, using online resources to compare rates and services, which heightens price sensitivity and service expectations.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Customer Mobility | High | 30-40% of Swedish consumers considered switching banks in 2024. |

| Competitive Landscape | Increased | Proliferation of neobanks and fintech startups offering lower fees. |

| Information Access | Enhanced | Growing use of personal finance websites for comparing banking services. |

| Price Sensitivity | High | Customers actively seeking best value due to easy comparison of rates and fees. |

Same Document Delivered

Svenska Handelsbanken Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Svenska Handelsbanken details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Svenska Handelsbanken faces significant competitive rivalry from other strong domestic and Nordic banks. Major players like Swedbank, Nordea, and SEB offer comparable full-service banking solutions, creating an intensely competitive landscape for customer acquisition and retention across all banking segments.

Smaller banks in Sweden have been steadily increasing their market share, especially in the crucial areas of credit and mortgage lending. This suggests a dynamic and increasingly competitive landscape for established institutions.

For instance, data from 2024 indicates that challenger banks and specialized financial institutions have successfully captured a growing portion of the Swedish banking market, putting pressure on larger players like Handelsbanken to adapt and maintain their customer base.

This upward trend in market share for smaller entities highlights their ability to innovate and attract customers, forcing incumbents to re-evaluate their strategies to remain competitive and defend their existing market positions.

Sweden's status as a premier fintech hub intensifies competitive rivalry. New entrants, often digital-first, are rapidly deploying innovative solutions that challenge traditional banking models. This dynamic forces established players like Handelsbanken to accelerate their own digital transformation, demanding substantial investment to remain competitive.

Mature Market with Slower Growth and Focus on Efficiency

The Nordic banking sector, including Svenska Handelsbanken's home markets, is characterized by its maturity, which translates to more subdued organic growth. This maturity naturally fuels a more intense competitive rivalry as established players vie for a larger slice of a relatively static customer base and market share.

In this environment, banks like Handelsbanken are compelled to sharpen their focus on operational efficiency to safeguard profitability. The pressure is on to reduce costs and explore new avenues for revenue generation, especially as traditional income sources, such as net interest income, face headwinds.

- Nordic Banking Maturity: The Nordic region's banking market is mature, leading to slower organic growth opportunities.

- Intensified Rivalry: This maturity fosters heightened competition among banks for existing customers and market share.

- Efficiency Focus: Banks are prioritizing cost efficiency to maintain profitability in a slower growth environment.

- Revenue Diversification: Exploration of alternative revenue streams is crucial due to pressures on net interest income.

Product Commoditization and Differentiated Service Models

Svenska Handelsbanken faces intensifying competitive rivalry as core banking products like mortgages and basic accounts become increasingly commoditized. This trend fuels price-based competition, putting pressure on traditional revenue streams. For instance, in 2024, the average mortgage interest rate across major European markets saw continued downward pressure, forcing banks to compete more on fees and service quality.

Handelsbanken's decentralized, relationship-driven model provides a key point of differentiation. This approach emphasizes local decision-making and strong customer relationships, which can foster loyalty. However, rivals are actively working to replicate or even surpass this with enhanced digital experiences, challenging the effectiveness of a purely branch-based service model in an increasingly digital-first world.

The challenge for Handelsbanken lies in maintaining its unique service proposition while competitors invest heavily in digital platforms. Many banks are enhancing their mobile apps and online banking services, offering seamless digital onboarding and personalized financial management tools. This digital arms race means Handelsbanken must continually innovate its service delivery to stay ahead of rivals who are rapidly evolving their customer engagement strategies.

- Commoditization Pressure: Core banking products like mortgages and savings accounts are increasingly viewed as interchangeable, leading to heightened price competition among financial institutions.

- Handelsbanken's Differentiator: The bank's decentralized, branch-focused, and relationship-driven approach aims to build customer loyalty through personalized service and local autonomy.

- Digital Competition: Competitors are rapidly improving their digital offerings, providing seamless online and mobile experiences that challenge the traditional branch-centric service model.

- Innovation Imperative: To counter rivals' digital advancements, Handelsbanken must continuously innovate its service delivery and integrate digital capabilities without sacrificing its core relationship values.

Svenska Handelsbanken operates in a highly competitive Nordic banking sector where established players like Swedbank, Nordea, and SEB offer similar services. This intense rivalry is further amplified by the market maturity in Sweden and other Nordic countries, leading to slower organic growth and a scramble for market share. The increasing presence of smaller banks and agile fintech challengers, particularly in the mortgage market, forces Handelsbanken to continually adapt its strategies and invest in digital transformation to maintain its competitive edge.

| Competitor | Market Share (approx. 2024) | Key Strengths | Handelsbanken's Challenge |

|---|---|---|---|

| Swedbank | ~20-25% (Sweden) | Strong retail presence, digital offerings | Maintaining relationship advantage against digital push |

| Nordea | ~15-20% (Nordics) | Large corporate client base, wealth management | Competing on scale and breadth of services |

| SEB | ~15-20% (Sweden) | Strong in corporate and investment banking, wealth management | Differentiating in a crowded market |

| Challenger Banks/Fintechs | Growing rapidly (esp. mortgages) | Agility, lower cost base, digital innovation | Adapting to new business models and customer expectations |

SSubstitutes Threaten

The rise of fintech and digital-only financial services presents a significant threat of substitutes for traditional banks like Svenska Handelsbanken. Companies offering specialized services, such as online payment platforms and robo-advisors, can directly compete with core banking products. These digital alternatives often attract customers with their convenience, lower fee structures, and tailored functionalities, chipping away at established market share.

By 2024, the global fintech market was projected to reach over $300 billion, demonstrating the substantial growth and adoption of these alternative financial solutions. For instance, digital wallets and peer-to-peer lending platforms are increasingly becoming viable substitutes for traditional savings accounts and loans, especially among younger demographics who prioritize digital experiences and cost-effectiveness.

Buy Now, Pay Later (BNPL) services, exemplified by Swedish giant Klarna, represent a significant threat of substitutes to traditional banking products like credit cards and consumer loans. These platforms directly target retail transactions, offering consumers a seemingly more accessible and often interest-free way to manage payments, bypassing conventional credit checks and processes. This directly siphons off transaction volume and customer relationships that would otherwise flow through traditional banking channels.

The appeal of BNPL lies in its convenience and perceived cost savings for consumers, especially for smaller, everyday purchases. In 2023, the global BNPL market was valued at approximately $137.5 billion and is projected to grow significantly, indicating a strong consumer preference shift. This growth directly challenges the market share of traditional lenders as consumers increasingly opt for these flexible, often immediate, payment solutions.

The rise of embedded finance presents a significant threat to traditional banks like Handelsbanken. Companies outside the financial sector are increasingly integrating financial services, such as point-of-sale financing or in-app payments, directly into their customer experiences. This trend allows consumers to access financial products and services without needing to engage with a traditional bank, potentially eroding customer loyalty and transaction volumes.

Direct Investment and Crowdfunding Platforms

Online brokerage and crowdfunding platforms present a significant threat of substitutes for Svenska Handelsbanken. These digital avenues allow individuals and businesses to bypass traditional banking intermediaries for savings, investments, and capital raising. For instance, the global crowdfunding market was projected to reach over $200 billion by 2024, offering a direct alternative to bank-managed investment products.

These platforms enable direct investment in various assets and businesses, diminishing the reliance on banks for financial intermediation and the associated fees. In 2023, retail investors increasingly utilized robo-advisors and direct investment apps, which often boast lower management costs compared to traditional bank offerings.

- Direct Access to Investments: Platforms like Robinhood and Kickstarter allow users to invest directly in stocks or fund projects, sidestepping bank advisory services.

- Lower Fee Structures: Many fintech investment platforms offer commission-free trading or lower management fees than traditional bank wealth management services.

- Capital Raising Alternatives: Crowdfunding sites provide businesses with an alternative to bank loans or equity financing, especially for startups and SMEs.

Cryptocurrencies and Blockchain-based Solutions

Emerging technologies like cryptocurrencies and blockchain-based financial solutions represent a growing threat of substitutes for traditional banking services. While not yet a widespread replacement for mainstream banking, these innovations offer alternative methods for transactions, lending, and asset management. For instance, by mid-2024, the total market capitalization of cryptocurrencies fluctuated significantly but remained in the trillions of dollars, indicating substantial user adoption and capital allocation away from traditional financial systems.

Decentralized finance (DeFi) platforms, in particular, are challenging established banking models by providing peer-to-peer lending and borrowing without intermediaries. By the end of 2023, the total value locked (TVL) in DeFi protocols reached over $50 billion, demonstrating a growing appetite for these alternative financial ecosystems. This trend suggests a potential long-term reduction in reliance on traditional banking infrastructure as these digital alternatives mature and gain broader acceptance.

- Cryptocurrency Market Cap: The global cryptocurrency market capitalization hovered around $2.5 trillion in early 2024, showcasing significant capital diversion from traditional finance.

- DeFi Total Value Locked (TVL): DeFi TVL exceeded $50 billion by the close of 2023, highlighting the increasing scale of decentralized financial activities.

- Blockchain Adoption: Major financial institutions are actively exploring blockchain technology for various applications, indicating a recognition of its potential to disrupt traditional banking.

The threat of substitutes for Svenska Handelsbanken is substantial, driven by the rapid evolution of financial technology and alternative service providers. These substitutes offer convenience, lower costs, and specialized functionalities that directly challenge traditional banking products.

Fintech companies, Buy Now Pay Later (BNPL) services like Klarna, embedded finance solutions, online investment platforms, and emerging digital currencies all represent viable alternatives for consumers and businesses. The increasing adoption of these digital solutions indicates a significant shift in customer behavior and preferences, forcing traditional banks to adapt or risk losing market share.

For example, the global fintech market's projected growth to over $300 billion by 2024, coupled with the BNPL market's valuation of approximately $137.5 billion in 2023, underscores the scale of these competitive threats. Furthermore, the cryptocurrency market capitalization hovering around $2.5 trillion in early 2024 highlights a substantial diversion of capital from traditional financial systems.

| Substitute Type | Key Offerings | Market Indicator (2023/2024 Data) | Impact on Traditional Banks |

|---|---|---|---|

| Fintech & Digital Banks | Online payments, robo-advisors, digital wallets | Global Fintech Market: Projected >$300 billion (2024) | Erosion of customer base for savings and loans |

| Buy Now, Pay Later (BNPL) | Point-of-sale financing, installment payments | Global BNPL Market: ~$137.5 billion (2023) | Loss of credit card and consumer loan volumes |

| Online Investment Platforms | Direct stock trading, crowdfunding, robo-advisory | Global Crowdfunding Market: Projected >$200 billion (2024) | Reduced demand for bank-managed investments and advisory fees |

| Cryptocurrencies & DeFi | Decentralized transactions, peer-to-peer lending | Crypto Market Cap: ~$2.5 trillion (early 2024); DeFi TVL: >$50 billion (end 2023) | Potential long-term disintermediation of core banking functions |

Entrants Threaten

The banking sector, including players like Svenska Handelsbanken, faces formidable regulatory and compliance challenges. Obtaining banking licenses is a rigorous process, often demanding significant capital reserves and adherence to strict operational standards. For instance, the Capital Requirements Regulation (CRR) mandates specific capital ratios that new entrants must meet, creating a substantial financial barrier.

Furthermore, ongoing compliance with evolving regulations such as Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) directives, alongside frameworks like the Digital Operational Resilience Act (DORA), adds considerable complexity and cost. These requirements necessitate robust IT infrastructure, skilled personnel, and continuous monitoring, effectively raising the bar for any new firm aspiring to enter the full-service banking market.

Establishing a bank like Svenska Handelsbanken requires vast amounts of capital. For instance, in 2024, regulatory capital requirements for major European banks, including those operating in Sweden, often mandate billions of euros in reserves to cover potential losses and ensure financial stability. This substantial financial hurdle makes it incredibly challenging for new entrants to even begin operations, let alone compete with established, well-capitalized institutions.

The banking sector, by its very nature, relies heavily on trust and a solid reputation, qualities that take many years, even decades, to build. Handelsbanken benefits immensely from its established brand and consistently high credit ratings, which act as significant barriers for newcomers. For instance, in 2023, Handelsbanken maintained an A+ rating from S&P, a testament to its stability.

New entrants face a considerable hurdle in replicating this level of customer confidence and trust, particularly when offering essential financial services where security and reliability are paramount. Without a proven track record, potential customers are less likely to entrust their finances to an unknown entity, giving established players like Handelsbanken a distinct advantage.

Complex IT Infrastructure and Cybersecurity Investments

The sheer cost and complexity of building and maintaining a robust IT infrastructure present a formidable hurdle for potential new entrants in the banking sector. Developing secure, scalable, and resilient systems capable of handling vast amounts of data and transactions, while adhering to stringent regulatory requirements, demands substantial upfront and ongoing investment. For instance, in 2024, global spending on financial services IT is projected to reach hundreds of billions of dollars, with a significant portion allocated to cybersecurity alone.

New players must also contend with the critical need for advanced cybersecurity measures. Protecting customer data and financial assets from increasingly sophisticated cyber threats is paramount, requiring continuous investment in cutting-edge security technologies, skilled personnel, and compliance frameworks. Failure to do so can result in catastrophic data breaches and severe reputational damage, making this a non-negotiable, yet prohibitively expensive, area for market entrants.

- High Capital Expenditure: Significant investment is needed for core banking systems, data centers, and network infrastructure.

- Cybersecurity Demands: Meeting regulatory standards like GDPR and implementing advanced threat detection and prevention systems are costly.

- Talent Acquisition: Attracting and retaining specialized IT and cybersecurity talent adds to operational expenses.

- Scalability and Resilience: Ensuring systems can handle growth and maintain uptime requires ongoing technology upgrades.

Challenges in Building Distribution Networks and Customer Loyalty

Even with digital banking reducing the need for extensive physical branches, new entrants face significant hurdles in building a comparable distribution network and cultivating deep customer loyalty. Svenska Handelsbanken's established decentralized model, emphasizing long-term customer relationships and local autonomy, fosters considerable customer stickiness.

This deep-rooted loyalty makes it difficult for new competitors to quickly gain substantial market share without significant investment in marketing and a clear differentiation in service offerings. For instance, in 2024, while many banks focused on digital expansion, Handelsbanken continued to leverage its branch network's local expertise, contributing to its strong customer retention rates which often exceed industry averages.

- Distribution Network Challenges: New entrants must invest heavily to replicate the reach and local presence that established banks like Handelsbanken have cultivated over decades.

- Customer Loyalty Barriers: Handelsbanken's relationship-centric approach creates a strong barrier to entry, as customers are less likely to switch for purely transactional benefits.

- Differentiation Imperative: To overcome these challenges, new entrants need to offer a compelling value proposition that clearly distinguishes them from incumbent players.

The threat of new entrants in the banking sector, impacting Svenska Handelsbanken, is significantly mitigated by high capital requirements and stringent regulatory hurdles. For instance, in 2024, European banking regulations mandate substantial capital reserves, often in the billions of euros, to ensure financial stability. This, combined with the extensive investments needed for robust IT infrastructure and cybersecurity, creates a formidable financial barrier for aspiring new banks.

Furthermore, the banking industry relies heavily on established trust and reputation, which take years to build. Handelsbanken's strong credit ratings, such as its A+ from S&P in 2023, and its deeply ingrained customer loyalty, cultivated through a relationship-centric approach, make it exceptionally difficult for new players to gain traction. New entrants must overcome these significant barriers by offering a clearly differentiated value proposition and substantial investment in building credibility.

| Barrier Type | Description | Illustrative Cost/Requirement (2024) | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Mandatory reserves to cover potential losses and ensure stability. | Billions of Euros for major European banks. | Prohibitive initial investment. |

| Regulatory Compliance | Adherence to AML, CTF, CRR, and DORA directives. | Significant ongoing investment in systems and personnel. | Increases operational complexity and cost. |

| Brand Reputation & Trust | Building customer confidence in financial security. | Years of consistent service and stability (e.g., S&P A+ rating in 2023). | Difficult to replicate; customers prefer established entities. |

| IT Infrastructure & Cybersecurity | Developing secure, scalable, and resilient systems. | Hundreds of billions of dollars globally in financial services IT, with substantial cybersecurity spend. | High upfront and continuous investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Svenska Handelsbanken leverages data from annual reports, financial statements, and industry-specific publications. We also incorporate insights from market research reports and economic databases to provide a comprehensive view of the competitive landscape.