Svenska Handelsbanken Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Svenska Handelsbanken Bundle

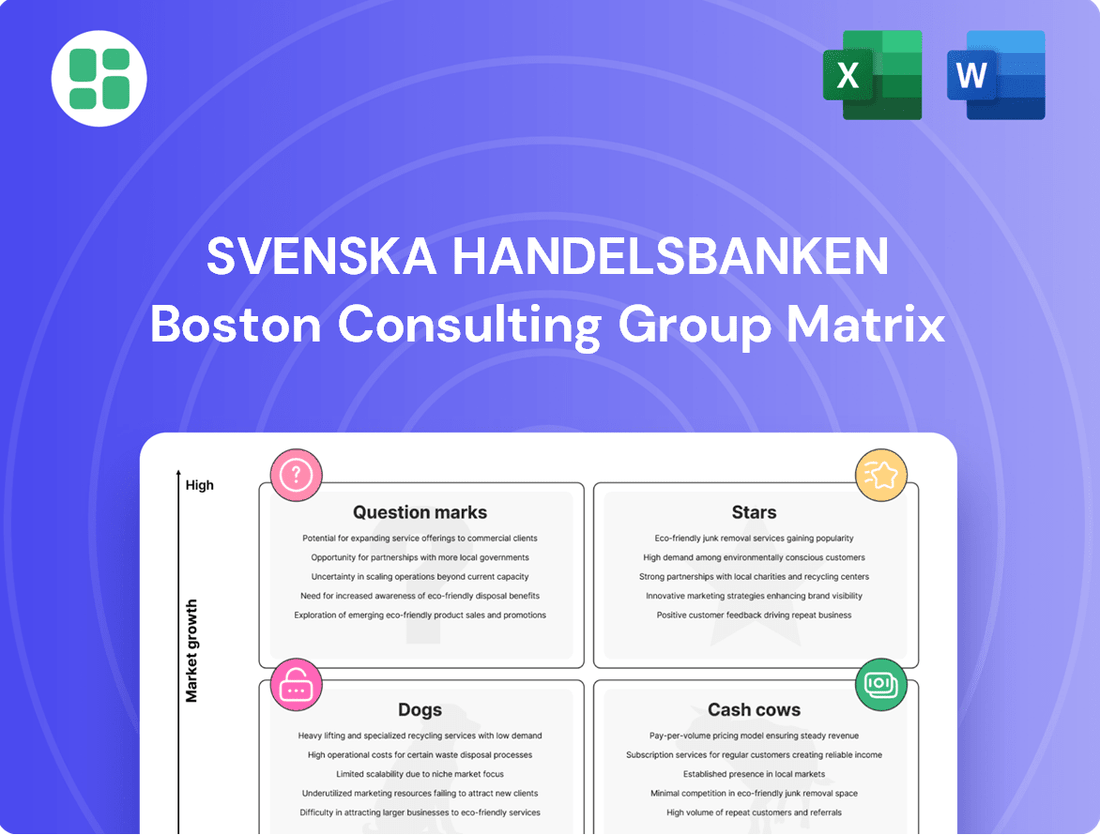

Curious about Svenska Handelsbanken's product portfolio performance? This preview hints at the strategic positioning of their offerings within the BCG Matrix. Understand which products are driving growth and which may require a closer look.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The savings and mutual funds business within Svenska Handelsbanken is a clear Star in the BCG matrix. The bank has seen robust growth and consistent net inflows in the Swedish mutual fund sector, solidifying its strong market position in an expanding area.

This segment is a major contributor to Handelsbanken's net fee and commission income, which hit a record high in 2024. The bank’s sustained success in increasing its market share within the savings business, a trend evident over many years, further reinforces its Star status.

Svenska Handelsbanken is strategically investing in digital advisory services, integrating AI to enhance human expertise. This allows for more insightful investment advice, contributing to a significant 40% surge in advisory meetings during 2024.

This AI-driven augmentation boosts both operational efficiency and the quality of customer engagement, a crucial advantage in today's fast-paced digital banking environment. The bank anticipates substantial growth as more customers embrace digital channels, making this blend of technology and personalized service a cornerstone of their expansion strategy.

Handelsbanken is bolstering its sustainable financing with green loans, targeting both individuals and businesses looking to fund energy-saving initiatives. This strategic move taps into the rapidly expanding sustainable finance market, positioning the bank to gain traction within an increasingly eco-aware customer base.

The bank's commitment is evident in its development of digital tools like Energikollen, which simplifies the process for customers to identify and finance energy-reducing measures. This focus on digital accessibility is crucial, as 2024 has seen a significant uptick in consumer and corporate demand for transparent and user-friendly sustainability solutions.

By embedding sustainability directly into its core offerings, Handelsbanken is not just offering financial products but also facilitating the transition to a greener economy. This approach allows the bank to capture market share while actively contributing to environmental goals, a key differentiator in today's financial landscape.

Small and Medium-sized Enterprise (SME) Banking

Svenska Handelsbanken's Small and Medium-sized Enterprise (SME) Banking unit is a clear Star in its BCG Matrix. The bank's repeated accolades, including being named Sweden's 'Business Bank of the Year' and 'Small Enterprise Bank' for the thirteenth consecutive year in 2024, underscore its dominant market position and exceptional customer satisfaction within this crucial segment.

This strong performance in SME banking signifies a leading market share, contributing significantly to Handelsbanken's overall growth. The segment is a key driver, fueled by increasing customer engagement and a rising demand for advisory services.

- Market Leadership: Recognized as Sweden's 'Business Bank of the Year' and 'Small Enterprise Bank' in 2024 for the thirteenth year running.

- Growth Driver: The SME segment is a significant contributor to the bank's growth through enhanced customer activity.

- Advisory Demand: High customer satisfaction translates into increased demand for the bank's advisory services within the SME sector.

- Customer Loyalty: Consistent awards suggest strong customer loyalty and a deep understanding of SME needs.

Norwegian Operations

Norwegian operations for Svenska Handelsbanken are a key component of its Nordic strategy. In the second quarter of 2025, the bank reported a notable improvement in profitability within Norway. This enhancement is reflected in a lower cost-to-income ratio and a stronger return on equity compared to the same period in the prior year.

With a substantial network of 38 branches across Norway, Handelsbanken holds a significant position in the Norwegian banking sector. This extensive presence underscores its considerable market share and provides a solid foundation for future expansion and customer engagement.

- Improved Profitability: Q2 2025 saw enhanced cost-to-income ratio and increased return on equity in Norway.

- Market Presence: Operates 38 branches, establishing it as one of Norway's larger banks.

- Growth Potential: Significant market share indicates strong opportunities for continued development.

The savings and mutual funds business is a clear Star for Svenska Handelsbanken, showing robust growth and consistent net inflows in the Swedish mutual fund sector. This segment contributed significantly to the bank's record net fee and commission income in 2024, further solidifying its strong market position in an expanding area.

Handelsbanken's SME Banking unit is also a Star, evidenced by its thirteenth consecutive win as Sweden's 'Business Bank of the Year' and 'Small Enterprise Bank' in 2024. This strong performance signifies a leading market share and drives growth through increased customer engagement and demand for advisory services.

The bank's Norwegian operations are emerging as a Star, with Q2 2025 reporting improved profitability, a lower cost-to-income ratio, and a stronger return on equity. With 38 branches, Handelsbanken has a substantial market presence and significant potential for continued development in Norway.

| Business Segment | BCG Category | Key Performance Indicators (2024/Q2 2025) |

|---|---|---|

| Savings & Mutual Funds | Star | Record net fee and commission income; robust growth and net inflows in Swedish mutual funds. |

| SME Banking | Star | Thirteenth consecutive 'Business Bank of the Year' award (2024); leading market share; increased customer engagement. |

| Norwegian Operations | Star | Improved profitability in Q2 2025; lower cost-to-income ratio; stronger return on equity; 38 branches. |

What is included in the product

This BCG Matrix overview for Svenska Handelsbanken provides strategic insights for each quadrant.

Svenska Handelsbanken's BCG Matrix provides a clear, one-page overview of each business unit's market position, easing strategic decision-making.

Cash Cows

Traditional Swedish Retail Banking is a cornerstone of Svenska Handelsbanken's business. As one of the nation's top four banks, it commands a significant portion of the credit market, particularly in mortgages and deposits. This segment is a reliable generator of substantial cash flow, benefiting from a deep-rooted customer base and robust brand loyalty, even within the slow-growing mature Swedish market.

In 2024, Handelsbanken continued to demonstrate the resilience of its retail banking operations. For instance, the bank reported a strong performance in its Swedish operations, with net interest income from the retail segment remaining a key contributor to overall profitability. This stability is a hallmark of a cash cow, providing the necessary funds to invest in other areas of the business.

Svenska Handelsbanken's core corporate lending in Sweden is a prime example of a Cash Cow within its BCG Matrix. This segment benefits from the bank's deeply entrenched position in both private and corporate banking within Sweden, a mature yet consistently profitable market.

The stable income and high profit margins are a direct result of Handelsbanken's renowned long-term customer relationships and its unique decentralized operating model. This allows for localized decision-making and a customer-centric approach, fostering loyalty and repeat business.

For 2024, Handelsbanken reported a net interest income of SEK 47.7 billion, with a significant portion attributable to its Swedish operations. The bank’s strong capital ratios, consistently above regulatory requirements, underscore the robustness and cash-generating ability of its core lending activities.

Svenska Handelsbanken's Private Banking and Wealth Management division functions as a classic Cash Cow within the BCG Matrix. The bank has been actively reinforcing its specialist teams in areas like Private Banking, signaling a strategic focus on catering to high-net-worth individuals and families.

These established wealth management services, while not experiencing rapid expansion, likely command a substantial market share among affluent clientele. This strong market position translates into consistent fee-based revenue, a key characteristic of a Cash Cow, contributing reliably to the bank's overall financial performance.

For instance, in 2024, Handelsbanken reported that its Wealth Management division continued to be a significant contributor to net interest income and commission income, with assets under management in this segment remaining robust, underscoring its stable, profit-generating nature.

Decentralized Branch Network and Relationship Model

Svenska Handelsbanken's decentralized branch network, a cornerstone of its strategy, empowers local branches to make decisions, fostering strong, long-term customer relationships. This model cultivates high customer satisfaction and loyalty, leading to stable business volumes and minimal customer attrition in established markets, thereby generating predictable cash flows.

This approach contributes to Handelsbanken's position as a Cash Cow within the BCG Matrix. The bank reported a solid financial performance in 2024, with its net interest income showing resilience. For instance, in the first quarter of 2024, Handelsbanken's net interest income remained robust, reflecting the consistent demand for its services and the effectiveness of its relationship-based model.

- Decentralized Decision-Making: Empowers local branches, driving efficiency and customer focus.

- Long-Term Relationships: Builds deep customer loyalty, ensuring stable revenue streams.

- Low Churn Rates: Mature markets benefit from consistent business volumes and predictable cash flow.

- 2024 Performance: Demonstrates continued strength in net interest income, validating the model's cash-generating ability.

Robust Capital and Liquidity Position

Svenska Handelsbanken's robust capital and liquidity position is a key strength, classifying it as a Cash Cow. The bank consistently demonstrates a Common Equity Tier 1 (CET1) ratio well above regulatory minimums. For instance, as of the first quarter of 2024, Handelsbanken reported a CET1 ratio of 20.1%, significantly exceeding the regulatory requirement.

This strong financial foundation allows Handelsbanken to operate with minimal funding and liquidity risk. High credit ratings from major agencies like Moody's (A1) and S&P (AA-) further validate its stability. This financial resilience enables the bank to efficiently generate and retain capital, supporting its ongoing operations and strategic initiatives.

- CET1 Ratio: 20.1% (Q1 2024), comfortably above regulatory needs.

- Credit Ratings: A1 (Moody's), AA- (S&P), indicating strong creditworthiness.

- Funding & Liquidity: Low risk profile due to robust capital base.

- Capital Generation: Efficiently generates and retains capital, fueling its Cash Cow status.

Svenska Handelsbanken's established Swedish mortgage market presence acts as a significant Cash Cow. The bank's deep penetration in this mature sector, characterized by stable demand and a loyal customer base, generates consistent and predictable cash flows. This stability is further bolstered by Handelsbanken's strong brand reputation and its decentralized model, which fosters enduring customer relationships.

The bank's performance in 2024 underscored this Cash Cow status, with its Swedish mortgage portfolio contributing substantially to net interest income. For instance, Handelsbanken's focus on long-term customer relationships in mortgages yielded a consistent revenue stream, allowing for reinvestment in growth areas.

This segment benefits from low operating costs relative to its revenue generation, a hallmark of a mature business with established infrastructure. The predictable nature of mortgage lending, combined with Handelsbanken's efficient operations, ensures it remains a reliable source of capital for the group.

Handelsbanken's commitment to customer service in its core markets, including mortgages, has resulted in low customer churn. This stability is vital for a Cash Cow, ensuring a consistent inflow of funds that can be deployed strategically across the organization.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Swedish Retail Banking | Cash Cow | Stable income, deep customer base, mature market | Key contributor to net interest income |

| Swedish Corporate Lending | Cash Cow | Long-term relationships, strong market position, predictable cash flow | Reliable revenue generator |

| Private Banking & Wealth Management | Cash Cow | Consistent fee-based revenue, affluent clientele, robust assets under management | Significant contributor to commission income |

| Mortgage Market Penetration | Cash Cow | Stable demand, loyal customers, low churn, efficient operations | Underpins net interest income stability |

Delivered as Shown

Svenska Handelsbanken BCG Matrix

The Svenska Handelsbanken BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means you get direct access to a comprehensive strategic analysis without any watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

In 2024, Svenska Handelsbanken divested the majority of its Finnish mortgage operations. This strategic move suggests that this particular business segment was likely a 'Dog' in the BCG matrix, characterized by low market share and limited growth potential.

Such an underperforming asset would have been consuming valuable resources without generating sufficient returns. The divestment allows Handelsbanken to reallocate capital and focus on more promising areas of its business.

Svenska Handelsbanken's strategic review likely identified certain legacy central functions as candidates for efficiency improvements, aligning with the BCG Matrix's focus on optimizing resource allocation. These functions, often supporting but not directly revenue-generating, can become bloated over time.

Initiatives aimed at central departments and business support units, including headcount reductions, signal a move to address potential inefficiencies. For instance, a 2024 report indicated a focus on streamlining back-office operations across the banking sector to reduce overhead costs.

This restructuring suggests that these legacy functions may have exhibited low productivity or high operational costs relative to their contribution, necessitating a re-evaluation for improved cost-effectiveness and alignment with the bank's overall strategic goals.

Within Svenska Handelsbanken's broader savings operations, certain niche investment products might be classified as underperformers. These are offerings that, despite potential initial promise, have struggled to capture meaningful market share or demonstrate robust sales figures. For instance, a specialized emerging markets bond fund launched in 2023 that saw only modest inflows, perhaps less than 0.5% of the total savings product portfolio by the end of 2024, would fall into this category.

Such products can become resource drains, requiring ongoing maintenance, marketing, and operational support without generating proportional revenue or contributing significantly to overall profitability. If a particular structured product, for example, has consistently underperformed its benchmark by over 2% annually since its inception and commands less than 0.1% of the bank's investment product assets, it exemplifies an underperforming niche.

Non-Core or Sub-scale International Ventures

Svenska Handelsbanken's non-core or sub-scale international ventures represent operations outside its primary markets that have not gained significant traction. These are typically characterized by limited market share and persistent underperformance, making them candidates for strategic reassessment.

For instance, if a specific European subsidiary consistently reported a return on equity below the group average, say 8% compared to a group average of 12% in 2024, it would exemplify this category. Such ventures might be considered for divestment if they do not offer a clear path to improved profitability or strategic alignment.

- Low Market Share: Ventures with less than 2% market share in their respective international segments.

- Sub-Par Profitability: Operations consistently yielding a return on equity significantly below Handelsbanken's target, such as under 7%.

- Strategic Misalignment: Businesses that do not contribute to the bank's core competencies or long-term growth objectives.

- Divestment Potential: These units are prime candidates for sale if restructuring or investment does not yield expected results.

Outdated Internal Processes Without Digital Transformation

Areas where manual, paper-intensive, or technologically outdated internal processes persist at Svenska Handelsbanken, despite broader digital advancements, could represent a significant Dogs category. These processes consume substantial operational resources and time without delivering proportionate gains in efficiency or customer value, evolving into costly inefficiencies.

For instance, if certain back-office functions still rely heavily on manual data entry or paper-based approvals, this directly impacts turnaround times and increases the risk of errors. Such inefficiencies can hinder the bank's ability to compete effectively in a rapidly digitizing financial landscape.

- Manual Loan Processing: Departments still requiring physical documentation and manual cross-referencing for loan applications.

- Paper-Based Account Opening: Processes that necessitate physical paperwork for new customer onboarding, slowing down customer acquisition.

- Outdated Reporting Systems: Legacy systems that require manual data extraction and consolidation for regulatory or internal reporting.

- Inefficient Branch Operations: Certain in-branch tasks that have not been fully digitized, leading to longer customer wait times.

Dogs within Svenska Handelsbanken's portfolio represent business segments or operations with low market share and low growth potential. These areas typically consume resources without generating significant returns, often due to outdated processes or a lack of competitive advantage. The bank's strategic actions, such as divesting its Finnish mortgage operations in 2024, highlight its approach to managing these underperforming assets.

Question Marks

Emerging digital payment solutions represent a potential 'Question Mark' for Handelsbanken. While current market share in these nascent areas might be low, the rapid evolution of fintech and consumer adoption signals significant growth opportunities. For instance, the global digital payments market was projected to reach over $15 trillion by 2024, indicating a vast untapped potential.

Investing in these areas, such as real-time payment networks or innovative cross-border payment platforms, requires substantial capital for development, infrastructure, and marketing to gain traction against established players and new entrants. Handelsbanken's strategic allocation of resources to these ventures will be crucial for their future success.

Svenska Handelsbanken's presence in the Netherlands, while showing growth in lending and asset management, faces profitability challenges. In the second quarter of 2025, the cost-to-income ratio and return on equity saw a decline, indicating that despite expanding services, operational efficiency needs significant improvement to capitalize on market potential and solidify its position.

Handelsbanken's pursuit of new fintech partnerships and deeper ecosystem integration aligns with a strategic move into potential high-growth areas. These collaborations could unlock innovative technologies and access new customer bases, mirroring the characteristics of a question mark in the BCG matrix. For instance, by partnering with a digital wealth management platform, Handelsbanken could tap into a growing segment of digitally-native investors, a market that is expanding rapidly.

The challenge lies in these ventures typically beginning with a low market share, necessitating significant strategic investment and careful nurturing to achieve success. Consider the burgeoning embedded finance sector; while offering substantial future revenue streams, initial market penetration for a bank integrating its services into non-financial platforms is often minimal. This requires a long-term vision and commitment to develop these nascent opportunities into robust offerings.

Specialized ESG Investment Funds

Specialized ESG investment funds, while fitting into a Star category due to the strong growth trend in sustainable finance, represent a potential question mark for Svenska Handelsbanken. These funds, often targeting specific environmental or social themes, aim for rapid expansion in a highly sought-after market segment. However, their success hinges on proving sustained market appeal and attracting substantial assets under management to justify their specialized nature.

The challenge lies in demonstrating long-term viability and differentiation within an increasingly crowded ESG landscape. For instance, while overall ESG assets under management continued to grow significantly in 2024, many newer, niche funds faced headwinds in capturing market share against established players. This necessitates a careful evaluation of their growth potential versus the resources required to establish and maintain their competitive edge.

- Market Saturation: The growing number of specialized ESG funds increases competition, making it harder for new entrants to stand out.

- Asset Gathering: Proving the ability to attract and retain significant assets under management is crucial for these funds' long-term viability.

- Performance Validation: Demonstrating consistent, competitive returns alongside their ESG mandate is key to investor confidence.

- Regulatory Scrutiny: Evolving ESG regulations could impact the operational and reporting requirements for these specialized funds.

Targeted Expansion into Adjacent Financial Services

Targeted expansion into adjacent financial services, like specialized insurance or lending for burgeoning sectors, would position these ventures as Stars within Handelsbanken's BCG Matrix. These areas, while having low initial market share, are earmarked for significant growth, necessitating focused investment to capture market share rapidly.

For instance, if Handelsbanken were to enter the InsurTech market, a sector projected to grow significantly, it would require substantial capital for technology development and customer acquisition. By 2024, the global InsurTech market was valued at over $10 billion, with projections indicating continued strong growth.

- Targeted Niche Focus: Expansion into areas like green financing or digital asset management would initially be considered Stars due to their high growth potential and nascent market share.

- Investment Strategy: Significant capital infusion would be required to build market presence and technological capabilities in these specialized fields.

- Growth Trajectory: The aim is to achieve rapid market penetration and establish a dominant position, mirroring the characteristics of a Star in the BCG framework.

- Potential for High Returns: Successful ventures in these high-growth adjacent services can yield substantial returns, further solidifying their Star status.

Emerging digital payment solutions represent a potential 'Question Mark' for Handelsbanken. While current market share in these nascent areas might be low, the rapid evolution of fintech and consumer adoption signals significant growth opportunities. For instance, the global digital payments market was projected to reach over $15 trillion by 2024, indicating a vast untapped potential.

Investing in these areas, such as real-time payment networks or innovative cross-border payment platforms, requires substantial capital for development, infrastructure, and marketing to gain traction against established players and new entrants. Handelsbanken's strategic allocation of resources to these ventures will be crucial for their future success.

The challenge lies in these ventures typically beginning with a low market share, necessitating significant strategic investment and careful nurturing to achieve success. Consider the burgeoning embedded finance sector; while offering substantial future revenue streams, initial market penetration for a bank integrating its services into non-financial platforms is often minimal. This requires a long-term vision and commitment to develop these nascent opportunities into robust offerings.

The success of these question marks hinges on Handelsbanken's ability to identify and invest in the right technologies and partnerships. For example, the bank's exploration of blockchain technology for cross-border payments, while currently a small niche, could evolve into a significant revenue stream if widely adopted. By 2024, the global blockchain in finance market was estimated to be worth billions, highlighting the potential upside.

BCG Matrix Data Sources

Our Svenska Handelsbanken BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.