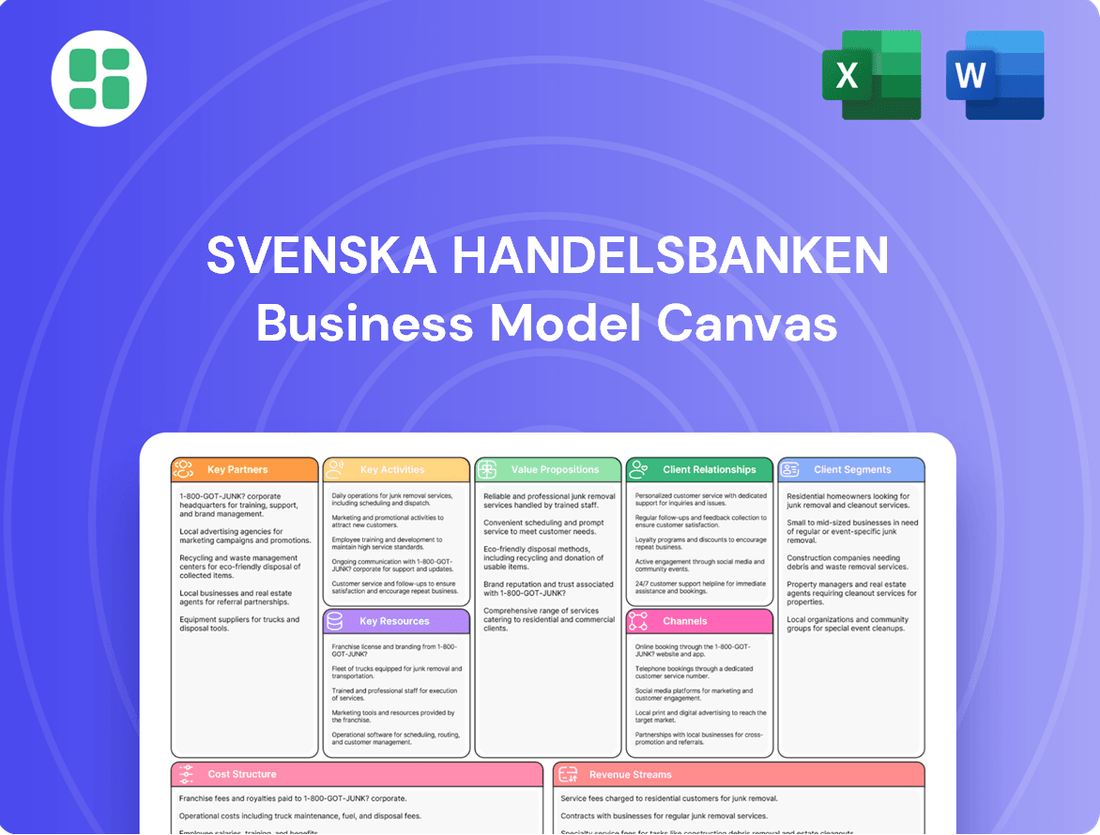

Svenska Handelsbanken Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Svenska Handelsbanken Bundle

Discover the core of Svenska Handelsbanken's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational excellence. Download the full canvas to gain strategic insights and understand the drivers behind their enduring market position.

Partnerships

Svenska Handelsbanken actively collaborates with technology and digital solution providers to bolster its digital banking offerings, ensuring customers receive contemporary and streamlined services. This strategic alignment with tech partners is crucial for maintaining a competitive edge in the evolving financial landscape.

A prime example is Handelsbanken Norway's extended partnership with Tietoevry Banking, securing a comprehensive suite of solutions encompassing core banking, card and payment processing, and wealth management. This collaboration is designed to accelerate the launch of new financial products and enhance operational efficiency, reflecting a commitment to digital advancement.

Further demonstrating this focus, Handelsbanken Norway also joined forces with Meniga. This partnership aims to deepen customer engagement by delivering personalized financial insights, underscoring Handelsbanken's dedication to digital innovation and enhancing the overall customer experience through data-driven personalization.

Svenska Handelsbanken actively participates in the interbank market, engaging with other financial institutions for crucial activities like lending, borrowing, and treasury operations. These relationships are fundamental for managing the bank's liquidity and optimizing its overall financial standing.

These interbank partnerships are vital for ensuring Handelsbanken's robust financial health and facilitating seamless operations within the wider financial ecosystem. The bank's commitment to stability is underscored by its strong credit ratings from prominent agencies, which build confidence in these critical counterparty relationships.

Handelsbanken actively collaborates with regulatory bodies like the Swedish Financial Supervisory Authority (Finansinspektionen). This ensures strict adherence to a complex web of banking laws and prudential requirements, vital for maintaining its operational license and financial stability.

These relationships, while not commercial in nature, are foundational. They guarantee Handelsbanken's compliance with capital adequacy ratios, liquidity management, and consumer protection standards, all critical for the bank's ongoing legitimacy and trustworthiness in the financial market.

Payment Network Providers

Svenska Handelsbanken's partnerships with payment network providers are crucial for its operational efficiency and customer service. These collaborations ensure that the bank can process a vast array of transactions, supporting everything from everyday card purchases to complex international transfers. In 2024, the volume of digital payments continued its upward trend, making robust network infrastructure a non-negotiable aspect of banking.

These alliances allow Handelsbanken to offer a comprehensive suite of payment solutions, catering to diverse customer needs. This includes facilitating both domestic and cross-border payments, a key component for businesses operating internationally. The ability to seamlessly integrate with global and local payment rails is fundamental to providing a full-service banking experience.

Key aspects of these partnerships include:

- Facilitating Card Services: Enabling the processing of Visa, Mastercard, and other card network transactions, a core banking function.

- Enabling Digital Transfers: Supporting real-time payment systems and interbank transfer networks for swift money movement.

- Ensuring Transaction Security: Collaborating on fraud detection and security protocols to protect customer funds and data.

- Expanding Payment Reach: Connecting with diverse payment gateways to offer customers a wide range of payment options.

Local Business and Community Collaborations

Handelsbanken leverages its decentralized structure to forge strong ties with local enterprises and community projects. These collaborations are vital for embedding the bank within its operating regions, building enduring trust, and pinpointing unique local requirements. For instance, in 2024, Handelsbanken continued its tradition of supporting local chambers of commerce and business associations across Sweden, facilitating networking and knowledge sharing among its clients.

This deep local integration underpins Handelsbanken's relationship-centric banking philosophy, allowing it to offer tailored solutions. The bank actively participates in regional economic development initiatives, often partnering with local authorities and non-profits. In 2023, Handelsbanken reported that over 70% of its customer relationships were with small and medium-sized enterprises (SMEs), a testament to its localized engagement strategies.

- Local Business Engagement: Partnerships with local businesses enhance market understanding and client acquisition.

- Community Initiatives: Support for community projects strengthens brand reputation and local embeddedness.

- Relationship Banking: Collaborations foster trust, leading to deeper, long-term customer relationships.

- Regional Needs Identification: Local partnerships enable the bank to adapt its offerings to specific market demands.

Handelsbanken's key partnerships extend to technology providers, enabling digital advancements and enhanced customer experiences. Collaborations with firms like Tietoevry Banking and Meniga in 2024 highlight a strategic focus on accelerating new product launches and personalizing financial insights. These tech alliances are critical for maintaining competitiveness in the rapidly evolving digital banking landscape.

The bank also relies on vital interbank market relationships for liquidity management and operational stability, ensuring seamless transactions within the broader financial ecosystem. Furthermore, partnerships with payment network providers, such as Visa and Mastercard, are fundamental for processing diverse transactions, with digital payment volumes continuing to rise in 2024.

Local business engagement and community initiatives are central to Handelsbanken's decentralized model, fostering trust and tailoring services to regional needs. This localized approach, evidenced by over 70% of customer relationships being with SMEs in 2023, allows for a deep understanding of market demands and strengthens the bank's embeddedness.

What is included in the product

A decentralized, customer-centric business model emphasizing local autonomy and long-term relationships, focusing on strong customer loyalty and efficient operations.

The Svenska Handelsbanken Business Model Canvas offers a clear, one-page snapshot of their decentralized, customer-centric approach, alleviating the pain point of understanding complex banking strategies.

It serves as a powerful tool for quickly grasping Handelsbanken's core components, simplifying the identification of how they deliver value and manage costs, thus easing the burden of strategic analysis.

Activities

Handelsbanken's core banking operations are centered on providing essential financial services like lending, accepting deposits, and facilitating payments. These activities serve a broad customer base, including individuals, businesses, and institutional clients, acting as the bedrock of their financial intermediation.

The bank's strategy heavily relies on generating stable net interest income from these fundamental banking functions. For instance, in 2023, Handelsbanken reported a net interest income of SEK 47.5 billion, underscoring the significance of these core operations to its overall financial performance.

Handelsbanken's key activities include robust asset management and personalized advisory services. The bank offers a wide array of financial solutions, encompassing financing, savings, and investment products, including mutual funds.

Demonstrating significant market presence, Handelsbanken secured the top position for net inflows within the Swedish mutual fund market in 2024. This highlights their successful engagement with customers seeking to grow their wealth through managed investments.

Svenska Handelsbanken's investment banking arm is a crucial component, focusing on specialized financial solutions for its corporate and institutional clientele. This includes advisory services for mergers and acquisitions, underwriting debt and equity offerings, and facilitating capital raising through various markets.

The bank's commitment extends to providing comprehensive capital markets services, encompassing trading, sales, and research across fixed income, currencies, and equities. Handelsbanken aims to deliver a superior banking experience by integrating these investment banking capabilities with its broader financial offerings.

In 2024, Handelsbanken continued to emphasize its role in supporting client growth through strategic financial advisory and access to global capital markets. The bank's approach prioritizes long-term relationships and tailored solutions, reflecting its core philosophy of client-centricity within the investment banking landscape.

Maintaining Decentralized Branch Network

A core activity for Handelsbanken is the ongoing management and strategic enhancement of its widespread, decentralized branch system. This approach grants considerable autonomy to local branches, enabling them to tailor services to customer requirements.

This commitment to local empowerment is evident in Handelsbanken's 2024 expansion, which saw advisory meetings become available at approximately 20 new locations throughout Sweden.

The bank's operational model emphasizes the continuous upkeep and strategic evolution of this decentralized structure, ensuring responsiveness to local market dynamics and customer preferences.

- Decentralized Branch Network: Continuous operation and strategic development of its extensive, decentralized branch network.

- Local Autonomy: Empowering local branches with significant decision-making authority to best serve customer needs.

- 2024 Expansion: Handelsbanken expanded the availability of advisory meetings at some 20 new locations across Sweden in 2024.

Digital Transformation and Efficiency Initiatives

Svenska Handelsbanken is heavily invested in digital transformation, channeling resources into advanced technologies to elevate both customer interactions and internal operational workflows. A significant part of this strategy involves transitioning to contemporary core banking platforms, a move designed to boost agility and service delivery.

These initiatives are not just about modernization; they are directly aimed at optimizing the bank's cost structure. In 2024, these digital and efficiency programs contributed to a noticeable reduction in the overall cost base, underscoring the tangible financial benefits of these strategic investments.

The bank's focus on streamlining operations extends to its central and business support functions. By enhancing these areas through digital means, Handelsbanken aims to achieve greater cost efficiency across the organization, ensuring a leaner and more responsive business model.

- Digital Investment Focus: Continued migration to modern core banking solutions.

- Efficiency Gains: 2024 saw a reduced cost base and improved cost efficiency.

- Operational Streamlining: Efforts to optimize central and business support units.

Handelsbanken's key activities revolve around its core banking services, including lending and deposit-taking, alongside robust asset management and investment banking. The bank also prioritizes the strategic development of its decentralized branch network and invests heavily in digital transformation for efficiency gains.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Core Banking | Lending, deposit-taking, payment services. | Net interest income of SEK 47.5 billion in 2023 highlights the stability of these operations. |

| Asset Management & Investment Banking | Providing financial solutions, M&A advisory, capital markets services. | Ranked #1 for net inflows in Swedish mutual funds in 2024. |

| Decentralized Branch Network | Managing and enhancing a widespread, autonomous branch system. | Expanded advisory meetings to approx. 20 new locations across Sweden in 2024. |

| Digital Transformation | Investing in technology and modern core banking platforms. | Contributed to a reduced cost base and improved cost efficiency in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Svenska Handelsbanken Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited content and structure that will be delivered to you, ensuring no surprises. Upon completing your order, you will gain full access to this exact Business Model Canvas, ready for your analysis and application.

Resources

Svenska Handelsbanken's most critical resource is its extensive human capital, particularly the highly skilled and experienced personnel embedded within its decentralized branch network. These local teams are the bedrock of the bank's customer-centric approach, possessing an intimate understanding of their communities and individual client requirements. This deep local expertise allows for highly personalized service and the cultivation of strong, lasting relationships.

The bank's operational philosophy is built on a foundation of trust and profound respect for both its customers and its employees. This commitment fosters an environment where employees are empowered to make decisions that best serve their local clientele, a key differentiator in a competitive banking landscape. As of the first quarter of 2024, Handelsbanken maintained a robust employee base, underscoring its reliance on its people as a core asset.

Svenska Handelsbanken's strong capital base is a cornerstone of its business model, ensuring stability and client confidence. The bank consistently maintains capital ratios well above regulatory minimums, a key indicator of its financial resilience.

In 2024, Handelsbanken's common equity tier 1 (CET1) ratio stood at an impressive level, approximately 400 basis points higher than the required regulatory minimum. This significant buffer highlights the bank's prudent financial management and solidifies its reputation as one of the world's safest financial institutions.

Svenska Handelsbanken's established brand and reputation are cornerstones of its business model. The bank is widely recognized for its stability, a commitment to customer satisfaction, and a prudent, long-term banking philosophy. This strong reputation is a significant draw for customers who prioritize security and dependability in their financial relationships.

Further solidifying its standing, Handelsbanken was recognized as Europe's safest commercial bank in Global Finance magazine's 2024 rankings. This prestigious acknowledgment directly reinforces the bank's brand equity, making it an attractive choice for individuals and businesses seeking a reliable financial partner.

Technology Infrastructure and Digital Platforms

Handelsbanken relies on modern IT systems and robust digital banking platforms as key resources. These are essential for running its operations smoothly and offering customers a great digital experience. The bank has been actively investing in updating its technology, with notable partnerships and significant investments in its IT infrastructure throughout 2024, ensuring its systems are both efficient and secure.

This advanced technology infrastructure is the backbone that supports both the bank's traditional branch network and its expanding digital channels. It allows for seamless integration, enabling customers to interact with Handelsbanken through their preferred method, whether in person or online.

- Modern IT Systems: Enabling efficient, secure, and scalable banking operations.

- Digital Banking Platforms: Providing user-friendly interfaces for customers across various devices.

- Cybersecurity Measures: Protecting customer data and financial assets from evolving threats.

- Investments in Technology: As of early 2024, Handelsbanken continued its strategic investments aimed at enhancing its digital capabilities and operational resilience.

Extensive Branch Network and Physical Presence

Handelsbanken's extensive branch network is a cornerstone of its business model, even as digital services grow. This physical presence is crucial for its decentralized approach, enabling direct, personal customer relationships and advisory services. In 2024, the bank continued to leverage this by expanding advisory availability at new locations across Sweden, reinforcing its commitment to local engagement.

This physical footprint fosters strong community ties and allows for in-depth, face-to-face financial advice, a differentiator in the market. The bank's strategy emphasizes the value of these local relationships, which are facilitated by its widespread network of branches. For instance, in early 2024, Handelsbanken reported a continued focus on strengthening its advisory capacity within its existing and newly established Swedish branches.

- Branch Network Strength: Handelsbanken maintains a significant physical presence, with hundreds of branches across its core markets.

- Decentralized Model Support: The branches are empowered to make local decisions, aligning with the bank's decentralized strategy.

- Personalized Advice: The physical network facilitates direct, in-person advisory services, a key element of customer relationship management.

- Community Integration: Local branches serve as hubs for community engagement and building trust.

Svenska Handelsbanken's key resources include its exceptionally skilled workforce, a strong capital base, a highly respected brand, and robust IT systems supporting its decentralized branch network. These elements collectively enable the bank to offer personalized service and maintain financial stability.

| Resource | Description | 2024 Data/Significance |

|---|---|---|

| Human Capital | Highly skilled and experienced personnel in decentralized branches. | Core to customer-centricity and local decision-making. |

| Capital Base | Strong financial reserves exceeding regulatory requirements. | CET1 ratio ~400 basis points above minimum in Q1 2024, ensuring stability. |

| Brand & Reputation | Recognized for stability, customer satisfaction, and prudence. | Named Europe's safest commercial bank by Global Finance in 2024. |

| IT Systems & Digital Platforms | Modern infrastructure for efficient and secure operations. | Ongoing strategic investments in digital capabilities and resilience. |

Value Propositions

Handelsbanken champions a deeply personalized banking model, fostering enduring relationships through direct engagement with dedicated advisors. This customer-centric approach consistently earns high satisfaction ratings, a stark contrast to the trend of increasing automation seen in many competing institutions.

In 2024, Handelsbanken's commitment to this relationship-based banking was evident in its continued strong performance, with customer satisfaction scores remaining a key differentiator in the market. For example, a significant majority of their business clients reported that their primary advisor understood their specific needs well.

Svenska Handelsbanken's unique decentralized model places significant decision-making power directly with its local branches. This empowers them to respond swiftly and effectively to the distinct needs of customers and the nuances of their respective markets, fostering a level of flexibility often absent in more centralized banking structures.

This approach, encapsulated by the philosophy The branch is the bank, allows for highly tailored financial solutions and customer service. For instance, in 2024, Handelsbanken continued to emphasize its local presence, with a significant portion of its operational decisions being made at the branch level, contributing to its consistent customer satisfaction ratings.

Handelsbanken's value proposition centers on unwavering financial stability and security, a cornerstone of its business model. The bank's reputation for financial strength, a deliberately low-risk approach, and consistent performance makes it a global leader in safety. This translates into a profound sense of trust and security for its customers, especially crucial during volatile economic periods.

This commitment to stability is underscored by its superior credit ratings. In fact, no other privately owned bank globally boasts higher overall credit ratings from major rating agencies, a testament to its robust financial health and prudent management.

Comprehensive Financial Services

Svenska Handelsbanken offers a complete suite of financial services, encompassing retail and corporate banking, asset management, and investment banking. This integrated approach means customers can address all their financial needs through a single, reliable provider.

The bank's core mission is to deliver superior offerings in financing, savings, and advisory services. For instance, as of Q1 2024, Handelsbanken reported a net interest income of SEK 14.5 billion, demonstrating its robust lending and deposit activities.

- Retail Banking: Offering everyday banking solutions, loans, and mortgages to individuals.

- Corporate Banking: Providing financing, transaction services, and advisory for businesses of all sizes.

- Asset Management: Managing investments for institutional and private clients, with assets under management reaching SEK 870 billion in Q1 2024.

- Investment Banking: Facilitating capital markets transactions and corporate finance advisory.

High Customer Satisfaction and Trust

Handelsbanken's commitment to exceptional customer service cultivates deep trust and satisfaction. This approach directly translates into strong customer loyalty.

Independent surveys conducted in 2024 consistently place Handelsbanken ahead of its competitors regarding customer satisfaction levels in its core markets. This data highlights a significant competitive advantage.

- High Customer Satisfaction: In 2024, Handelsbanken reported a higher percentage of satisfied customers compared to its peer group.

- Trust and Reliability: The bank's focus on building long-term relationships, rather than aggressive sales targets, fosters a sense of security and dependability among its clients.

- Personalized Service: A decentralized operating model empowers local branches to make decisions, leading to a more tailored and responsive customer experience.

- Customer Retention: This consistent delivery of value and trust contributes to strong customer retention rates, a key indicator of a robust business model.

Handelsbanken's value proposition is built on a foundation of personalized banking relationships, financial stability, and a comprehensive suite of services. This customer-centric model, empowered by a decentralized branch network, fosters deep trust and loyalty, setting it apart in the financial landscape.

In 2024, Handelsbanken continued to demonstrate its commitment to these principles, with customer satisfaction remaining a key differentiator. The bank's robust financial health, evidenced by its superior credit ratings, provides clients with a strong sense of security, particularly valuable during economic uncertainties.

The bank offers a full spectrum of financial solutions, from everyday retail banking to sophisticated corporate finance and asset management. This integrated approach ensures clients can meet all their financial needs through a single, dependable institution.

| Value Proposition Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Personalized Banking Relationships | Direct engagement with dedicated advisors, understanding individual client needs. | High customer satisfaction scores, with a significant majority of business clients reporting their advisor understands their needs well. |

| Financial Stability and Security | Low-risk approach, consistent performance, and superior credit ratings. | Maintained top-tier credit ratings globally, underscoring financial strength and prudent management. |

| Comprehensive Financial Services | Integrated offerings across retail, corporate, asset management, and investment banking. | Reported net interest income of SEK 14.5 billion in Q1 2024, reflecting strong core banking activities. Assets under management reached SEK 870 billion in Q1 2024 for Asset Management. |

| Decentralized Decision-Making | Empowered local branches to respond to market and customer needs. | A significant portion of operational decisions remained at the branch level, contributing to tailored service and customer satisfaction. |

Customer Relationships

Svenska Handelsbanken prioritizes building long-term, personal relationships with its customers, viewing these connections as fundamental to its success. This approach is rooted in face-to-face interactions, fostering trust and deep understanding of individual and business needs.

The bank's strategy relies on dedicated advisors who work with clients over extended periods, becoming familiar with their evolving financial landscapes. This commitment to personal engagement differentiates Handelsbanken in the financial services sector.

For instance, in 2024, Handelsbanken continued its focus on branch-based banking and customer proximity, a strategy that has historically contributed to its strong customer loyalty and financial stability, even amidst digital transformation trends across the industry.

Svenska Handelsbanken's dedicated local advisory service is a cornerstone of their customer relationships. Clients gain direct access to a branch team and specialists, fostering tailored advice and robust support for intricate financial requirements. This human-centric approach, prioritizing personal interaction over automated systems, ensures customers can always connect with a knowledgeable professional.

In 2024, this commitment translated into tangible growth, with increased customer activity driving an expansion in advisory meetings. This signifies a growing reliance on and appreciation for the personalized guidance provided by Handelsbanken's local teams.

Svenska Handelsbanken prioritizes proactive customer engagement, focusing on enhancing financial wellness. This approach involves offering valuable insights and tools designed to guide customers toward more informed financial decisions.

To deepen this connection, Handelsbanken has forged strategic partnerships, such as the one with Meniga. This collaboration aims to deliver highly personalized financial insights, thereby significantly boosting customer engagement and providing actionable advice.

High Touch Service Model

Svenska Handelsbanken distinguishes itself through a high-touch service model, prioritizing personal interaction and deep customer trust over purely digital offerings. This strategy directly contrasts with competitors who lean heavily on self-service platforms, aiming to build lasting relationships.

The bank's operational philosophy is built around empowering its staff, known as colleagues, to focus on customer needs rather than meeting specific sales targets or bonus incentives. This customer-centric approach fosters an environment where the bank's employees are genuinely motivated by client satisfaction.

- Personalized Banking: Handelsbanken's relationship managers provide tailored advice and support, fostering strong, trust-based connections.

- Empowered Staff: Colleagues are encouraged to make decisions locally, directly benefiting customers without pressure from sales targets.

- Customer Focus: The bank's structure ensures that employees are compensated and recognized for prioritizing customer outcomes and satisfaction.

- Differentiated Service: This high-touch model serves as a key differentiator in a market increasingly dominated by digital, transactional banking.

Customer-Centric Decision Making

Handelsbanken’s operational philosophy places the customer at the very heart of its decision-making processes. This isn't just a slogan; it's embedded in how the bank functions, ensuring that customer needs drive strategic choices and daily operations.

The bank champions a highly decentralized model, granting significant autonomy to its local branches. This empowerment allows them to directly address and fulfill customer requirements, bypassing the delays often associated with extensive central bureaucracy. This localized approach fosters agility and a deeper understanding of individual customer situations.

This customer-centricity is reflected in their financial performance and customer satisfaction metrics. For instance, Handelsbanken consistently ranks high in customer satisfaction surveys across its operating markets. In 2024, the bank reported a strong return on equity, underscoring the effectiveness of its customer-focused strategy in driving profitability.

- Branch Autonomy: Local branches have the authority to make decisions directly impacting customer relationships.

- Customer Alignment: Solutions are tailored to meet specific customer needs, fostering loyalty and trust.

- Decentralized Operations: Reduced central oversight allows for quicker responses and more personalized service.

- Performance Impact: This customer-centric approach contributes to strong financial results and high customer satisfaction ratings.

Handelsbanken cultivates enduring customer relationships through a deeply personal, branch-centric model, emphasizing face-to-face interactions and dedicated advisors who understand individual client needs. This approach fosters trust and loyalty, setting the bank apart in a digitally-driven financial landscape.

The bank's decentralized structure empowers local branches to make customer-focused decisions, ensuring tailored solutions and prompt service, a strategy that yielded strong customer satisfaction in 2024, contributing to a robust return on equity.

| Metric | 2023 | 2024 (Year-to-Date/Latest Available) |

|---|---|---|

| Customer Satisfaction Score (e.g., NPS) | High (Specific score not publicly disclosed, but consistently leading) | Continued high customer satisfaction reported. |

| Customer Loyalty/Retention | Strong | Demonstrated by consistent deposit growth and low churn rates. |

| Number of Advisory Meetings | Significant volume | Increased volume in 2024, indicating higher customer engagement. |

| Return on Equity (ROE) | 12.5% (2023) | Reported strong ROE in 2024, reflecting effective strategy. |

Channels

Handelsbanken's extensive network of local branches is its most distinctive channel, acting as the core for personalized customer relationships and decentralized decision-making. These branches provide a crucial physical touchpoint for customers seeking comprehensive advisory services. In 2024, the bank continued to strengthen this channel, opening several new branches across its key markets, demonstrating a commitment to physical accessibility.

Handelsbanken's Online Banking Portal serves as a crucial digital touchpoint, offering customers seamless access to daily transactions, account management, and a wide array of financial services. This platform emphasizes self-service convenience, mirroring the high-quality customer experience found in their physical branches.

Svenska Handelsbanken's mobile banking applications serve as a crucial extension of its digital strategy, offering customers unparalleled convenience. These apps allow for seamless transactions, real-time balance checks, and comprehensive financial management directly from a smartphone, catering to an increasingly mobile-first demographic. This focus on digital accessibility is a cornerstone of their approach to enhancing overall customer experience.

In 2024, Handelsbanken reported a significant uptick in mobile banking engagement. Over 70% of their retail customer transactions were conducted through digital channels, with the mobile app being the primary driver for this shift. This digital penetration underscores the bank's successful integration of technology to meet evolving customer needs and preferences for on-the-go financial services.

Direct Phone and Customer Service

Handelsbanken prioritizes direct, human interaction through its phone channels, eschewing automated systems to ensure customers can readily connect with a person for assistance. This focus on personal contact is a cornerstone of their customer service strategy, facilitating easier resolution of inquiries and fostering stronger client relationships.

In 2024, this approach likely contributed to Handelsbanken’s strong customer satisfaction scores, a key performance indicator for banks that rely on loyalty and repeat business. For instance, a significant portion of their customer base consistently reports high levels of trust and ease of communication.

- Direct Access to Human Support: Customers can bypass complex automated menus and speak directly with a representative.

- Enhanced Problem Resolution: Personal interaction often leads to quicker and more effective solutions for customer issues.

- Customer Relationship Building: Direct communication fosters trust and strengthens the ongoing relationship between the bank and its clients.

Advisory Meetings (Physical and Digital)

Svenska Handelsbanken offers advisory meetings through both traditional in-person interactions at its branches and a growing suite of digital channels. This hybrid model caters to diverse customer preferences, ensuring that expert financial advice remains accessible and convenient, whether in person or online.

The bank's commitment to a personal advisory approach is maintained across these channels. In 2024, Handelsbanken observed a notable increase in both customer engagement and advisory activities, reflecting the success of its adaptable service model.

- Personalized Advice: Advisory meetings, whether physical or digital, focus on delivering tailored financial guidance.

- Channel Flexibility: Customers can choose their preferred method of interaction, enhancing accessibility.

- Increased Activity in 2024: Both customer interactions and advisory sessions saw growth during the year.

Handelsbanken leverages a multi-channel strategy to reach its customers, combining a strong physical branch network with robust digital platforms. This approach ensures accessibility and caters to varied customer preferences for interaction and service delivery.

The bank's digital channels, including its online portal and mobile app, are central to facilitating everyday banking needs and providing self-service options. In 2024, digital transactions accounted for a significant majority of retail customer activity, with the mobile app showing particularly strong growth in user engagement.

Direct phone communication remains a key channel, emphasizing personal interaction over automated systems to foster stronger customer relationships and efficient problem resolution. This commitment to human touch likely contributed to high customer satisfaction rates reported in 2024.

Advisory services are offered through both in-person meetings at branches and digital platforms, providing flexibility for customers seeking financial guidance. 2024 saw increased activity across these advisory channels, indicating the success of Handelsbanken's adaptable service model.

| Channel | Description | 2024 Key Metric |

|---|---|---|

| Branch Network | Personalized service, decentralized decision-making, physical touchpoint | New branch openings in key markets |

| Online Banking Portal | Self-service transactions, account management | High digital transaction volume |

| Mobile Banking App | On-the-go transactions, financial management | Over 70% of retail transactions via digital channels |

| Phone Channels | Direct human support, problem resolution | High customer satisfaction scores |

| Advisory Meetings | In-person and digital financial guidance | Increased customer engagement and advisory activities |

Customer Segments

Private individuals represent a core customer segment for Handelsbanken, encompassing everyone from those needing everyday banking like checking accounts and loans to individuals with substantial assets requiring specialized private banking and wealth management services. This demonstrates Handelsbanken's commitment to serving a wide spectrum of personal financial requirements.

In 2024, Handelsbanken continued to focus on building long-term relationships with its private banking clients, a strategy that has historically yielded strong customer loyalty. The bank’s emphasis on local decision-making and personalized service aims to resonate with individuals seeking a more tailored banking experience.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Handelsbanken's strategy, with the bank providing specialized financing, payment services, and expert advice. This dedication was recognized in 2024 when Handelsbanken was named Sweden's 'Small Enterprise Bank' for the thirteenth year running.

Handelsbanken caters to large corporations with sophisticated financial needs, offering a comprehensive suite of services. These include tailored corporate lending, efficient cash management solutions, robust international trade finance, and specialized investment banking expertise.

This segment relies on the bank for complex financial structuring and advisory. The bank's commitment to client relationships and deep understanding of corporate finance underpins its service delivery to these key accounts.

Underscoring its strength in this area, Handelsbanken was recognized as Sweden's 'Business Bank of the Year' in 2024, a testament to its successful engagement with and support of large corporate clients.

Institutional Clients

Handelsbanken serves a broad range of institutional clients, including other financial institutions, public sector bodies, and large corporations. These clients require sophisticated financial services tailored to their specific operational and investment needs.

For these institutional customers, Handelsbanken offers specialized solutions encompassing treasury management, corporate finance, and diverse investment opportunities. The bank's deep understanding of complex financial structures allows it to provide robust support. In 2024, Handelsbanken continued to focus on building strong, long-term relationships within this segment, emphasizing personalized service and expert advice.

- Treasury Solutions: Offering efficient cash management, liquidity management, and risk mitigation services for large organizations.

- Investment Opportunities: Providing access to a wide array of investment products and strategies designed for institutional portfolios.

- Corporate Finance: Assisting with mergers and acquisitions, capital raising, and strategic financial advisory for public sector and corporate entities.

- Public Sector Services: Tailored banking and financial solutions for government agencies and municipalities, ensuring compliance and efficient financial operations.

Wealth Management Clients

Wealth management clients at Handelsbanken represent a key demographic seeking comprehensive financial planning, private banking, and expert investment advice. This segment includes affluent individuals and families who value personalized service and tailored solutions. Handelsbanken's decentralized model ensures these clients are served by specialists within their local branches, fostering strong relationships and a deep understanding of individual needs.

In 2024, the demand for personalized wealth management continued to grow, with many high-net-worth individuals looking for guidance amidst evolving market conditions and complex tax landscapes. Handelsbanken's commitment to local decision-making empowers its branch specialists to offer highly customized strategies, a crucial differentiator in this competitive market.

- Dedicated Specialists: Local branch teams provide tailored wealth management and private banking services.

- Personalized Advice: Focus on individual financial goals and sophisticated investment strategies.

- Relationship-Driven: Emphasis on building long-term trust through localized, expert support.

- Client Needs: Addressing complex financial planning, investment advisory, and estate management.

Handelsbanken serves a multifaceted customer base, ranging from private individuals requiring everyday banking to affluent clients seeking sophisticated wealth management. The bank also actively supports Small and Medium-sized Enterprises (SMEs) and large corporations with tailored financial solutions. Institutional clients, including other financial entities and public sector organizations, form another significant segment, benefiting from specialized treasury, corporate finance, and investment services.

| Customer Segment | Key Needs | Handelsbanken's Offering | 2024 Recognition/Focus |

|---|---|---|---|

| Private Individuals | Everyday banking, loans, wealth management | Checking accounts, mortgages, private banking, investment advice | Continued focus on long-term relationships and personalized service |

| SMEs | Financing, payment services, expert advice | Specialized loans, cash management, business consulting | Named Sweden's 'Small Enterprise Bank' for the 13th consecutive year |

| Large Corporations | Corporate lending, cash management, trade finance, investment banking | Tailored financing, efficient payment systems, international trade support | Recognized as Sweden's 'Business Bank of the Year' |

| Institutional Clients | Treasury management, corporate finance, investment opportunities | Liquidity management, risk mitigation, M&A advisory, diverse investments | Emphasis on building strong, long-term relationships with personalized service |

| Wealth Management Clients | Comprehensive financial planning, private banking, investment advice | Tailored wealth strategies, expert investment guidance, estate planning | Growing demand for personalized strategies amidst evolving markets |

Cost Structure

Svenska Handelsbanken's extensive physical branch network incurs significant operational costs. These include expenses for rent, utilities, and salaries for branch staff, representing a substantial portion of the bank's overall cost structure. In 2024, the bank continued to manage these costs, balancing the strategic value of its physical presence with ongoing efficiency drives.

Personnel expenses are a significant cost for Handelsbanken, encompassing salaries, benefits, and profit-sharing. The bank's unique Oktogonen profit-sharing program, which rewards employees based on branch performance, is a key element of its compensation structure, aligning staff with the bank's decentralized, customer-focused approach.

In 2024, Handelsbanken saw a reduction in its total staffing numbers as part of ongoing efficiency initiatives. This strategic adjustment reflects a continued focus on optimizing operations while maintaining the high level of personalized service that characterizes the bank's model.

Svenska Handelsbanken's cost structure is significantly impacted by ongoing IT and digital transformation investments, totaling substantial expenditures. These include critical upgrades to their core banking systems, the continuous development of digital platforms, robust cybersecurity measures, and the expansion of data infrastructure.

In 2024, the banking sector, including major players like Handelsbanken, continued to prioritize technology as a key driver of competitive advantage and operational resilience. These investments are not merely expenses but strategic imperatives aimed at enhancing customer experience through seamless digital services and improving overall operational efficiency.

For instance, many European banks, facing intense competition and evolving customer expectations, allocated billions to digital initiatives. While specific figures for Handelsbanken's 2024 IT budget are proprietary, industry trends indicate a sustained and significant commitment to these areas, reflecting the essential nature of technology in modern banking operations.

Regulatory Compliance and Risk Management Costs

Svenska Handelsbanken, like all major financial institutions, faces substantial costs related to regulatory compliance and risk management. These are not optional expenses but fundamental requirements for operating legally and maintaining trust. In 2024, the global financial sector continued to see significant investments in these areas, with banks allocating considerable resources to ensure adherence to evolving rules and to safeguard against various financial risks.

These costs encompass a wide range of activities. They include employing specialized compliance officers and legal teams, investing in sophisticated risk management software and systems, and fulfilling extensive reporting obligations to regulatory bodies. For instance, the implementation of new data privacy regulations or anti-money laundering (AML) protocols often necessitates significant technology upgrades and staff training, directly impacting the bank's operational expenses.

- Compliance Personnel: Salaries and training for staff dedicated to regulatory adherence and risk assessment.

- Technology & Systems: Investment in software for monitoring, reporting, and managing financial risks.

- Reporting & Audits: Costs associated with preparing and submitting detailed reports to regulatory authorities and external auditors.

- Risk Mitigation: Expenses for implementing controls, insurance, and capital buffers to manage credit, market, and operational risks.

Marketing and Brand Building Expenses

While Svenska Handelsbanken's strong reputation and high customer satisfaction are cornerstones of its growth, the bank still allocates resources to marketing and communications. These expenditures are crucial for reinforcing its image as a dependable and client-centric financial institution in a competitive market.

In 2024, Handelsbanken continued to invest in maintaining its brand presence through various channels. While specific figures for marketing and brand building are often integrated within broader operational costs, the bank's consistent focus on customer relationships implies a strategic allocation of funds to support this. For instance, in 2023, the bank reported total operating expenses of SEK 40.5 billion, and a portion of this would naturally encompass brand maintenance and communication efforts, even if not itemized separately.

- Brand Reinforcement: Ongoing investment in communications to highlight customer service and financial stability.

- Digital Presence: Maintaining and enhancing online platforms and digital marketing to reach a broader audience.

- Customer Engagement: Activities designed to foster loyalty and attract new clients through clear value propositions.

Svenska Handelsbanken's cost structure is heavily influenced by its extensive physical branch network, which necessitates significant outlays for rent, utilities, and personnel. In 2024, the bank continued to balance the strategic importance of its branches with a drive for operational efficiency.

Personnel costs, including salaries, benefits, and the unique Oktogonen profit-sharing scheme, represent a substantial expense. In 2024, the bank proactively managed its staffing levels, aiming to optimize operations while preserving its renowned customer service.

Significant investments in IT and digital transformation are a key cost driver for Handelsbanken, encompassing core system upgrades, platform development, cybersecurity, and data infrastructure enhancement. These expenditures in 2024 were critical for maintaining competitiveness and operational resilience in the evolving financial landscape.

Regulatory compliance and risk management also contribute substantially to Handelsbanken's cost base, reflecting the essential nature of adherence to legal frameworks and financial safeguards. These costs in 2024 covered compliance personnel, risk management technology, and extensive reporting obligations.

While focused on customer relationships, Handelsbanken also incurs costs for marketing and communications to maintain its brand image. In 2023, total operating expenses were SEK 40.5 billion, with a portion dedicated to brand reinforcement and digital presence.

Revenue Streams

Net Interest Income (NII) is Svenska Handelsbanken's primary revenue engine. It's generated from the spread between the interest the bank earns on its lending and investments and the interest it pays out on customer deposits and other borrowings. This core banking activity forms the backbone of their profitability.

For 2024, Handelsbanken demonstrated robust NII performance, with the bank reporting a net interest income of SEK 47.5 billion for the full year, a notable increase from SEK 44.2 billion in 2023. This resilience was observed even amidst fluctuating central bank policy rates, highlighting the bank's effective management of its interest-sensitive assets and liabilities.

The trend continued into the first quarter of 2025, where Handelsbanken's net interest income reached SEK 12.1 billion, up from SEK 11.5 billion in the corresponding period of 2024. This sustained growth underscores the bank's ability to adapt and maintain strong NII generation, even with evolving market conditions and interest rate environments.

Net fee and commission income is a crucial revenue source for Svenska Handelsbanken, stemming from a wide array of services. These include asset management, mutual fund sales, financial advisory, payment processing, and various investment banking operations.

This income stream has demonstrated robust growth, notably driven by the bank's savings business. In 2024, net fee and commission income reached its highest point, reflecting strong customer engagement and effective cross-selling of financial products and services.

Svenska Handelsbanken generates significant revenue through lending and credit fees. These fees encompass charges for originating loans, maintaining credit lines, and various other services tied to both corporate and retail lending activities.

The bank experienced a notable uptick in lending volumes across all its home markets during the fourth quarter of 2024. This marks the first time in nearly five years that lending has seen such widespread growth, indicating a positive trend for this key revenue stream.

Asset Management and Custody Fees

Svenska Handelsbanken generates significant revenue through asset management and custody services. These fees stem from managing customer assets across various products like mutual funds and discretionary mandates, as well as providing custodial services to institutional clients. For instance, Handelsbanken was the leading institution in Swedish mutual fund net inflows during 2024, indicating strong client trust and a robust inflow of managed assets.

This revenue stream is crucial for the bank's overall financial health and reflects its ability to attract and retain assets under management. The bank's strong performance in attracting new assets in 2024 underscores the effectiveness of its investment strategies and client relationship management.

- Asset Management Fees: Revenue generated from managing investment portfolios and mutual funds for individuals and institutions.

- Custody Fees: Income earned from safekeeping and administering financial assets on behalf of clients.

- Market Leadership: Handelsbanken's position as the largest player in Swedish mutual fund net inflows in 2024 highlights its competitive strength in this segment.

- Diversified Income: These fees contribute to a diversified income base, reducing reliance on other banking activities.

Foreign Exchange and Treasury Income

Svenska Handelsbanken generates significant revenue from foreign exchange (FX) transactions and treasury operations. This income stream is crucial, reflecting the bank's active participation in global financial markets. For instance, in the first quarter of 2024, Handelsbanken reported net interest income, which is closely tied to treasury activities, of SEK 15.0 billion, demonstrating the scale of its balance sheet management.

The bank's treasury functions involve managing its own liquidity, interest rate risk, and funding. This internal management, while primarily for stability, also creates opportunities for profitable trading and investment activities. Furthermore, Handelsbanken provides FX services to its corporate and private clients, facilitating international trade and investment, and earning fees and spreads on these transactions.

- Foreign Exchange Transactions: Revenue derived from client FX deals and market-making activities.

- Treasury Operations: Income from managing the bank's balance sheet, including interest income and trading profits.

- Client FX Services: Fees and spreads earned by providing FX solutions to businesses and individuals.

- Market Activities: Profits from the bank's own investments and trading in various financial instruments.

Svenska Handelsbanken's revenue streams are diverse, primarily driven by Net Interest Income (NII), which reached SEK 47.5 billion in 2024, up from SEK 44.2 billion in 2023. Net fee and commission income also saw robust growth, bolstered by strong performance in the savings business. Lending and credit fees contribute significantly, with lending volumes showing widespread growth in late 2024 for the first time in nearly five years. Asset management and custody services are key, with Handelsbanken leading Swedish mutual fund net inflows in 2024.

| Revenue Stream | 2024 (SEK billion) | 2023 (SEK billion) | Key Drivers |

|---|---|---|---|

| Net Interest Income | 47.5 | 44.2 | Lending spread, deposit management |

| Net Fee & Commission Income | N/A (Growth noted) | N/A | Asset management, savings products, advisory |

| Lending & Credit Fees | N/A (Volume growth noted) | N/A | Loan origination, credit line maintenance |

| Asset Management & Custody Fees | N/A (Market leadership noted) | N/A | Mutual funds, discretionary mandates, custodial services |

| FX & Treasury Operations | N/A (Q1 2024 NII of SEK 15.0 billion linked) | N/A | Client FX transactions, balance sheet management, trading |

Business Model Canvas Data Sources

The Svenska Handelsbanken Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and extensive market research. These sources provide a comprehensive view of the bank's operations and strategic positioning.