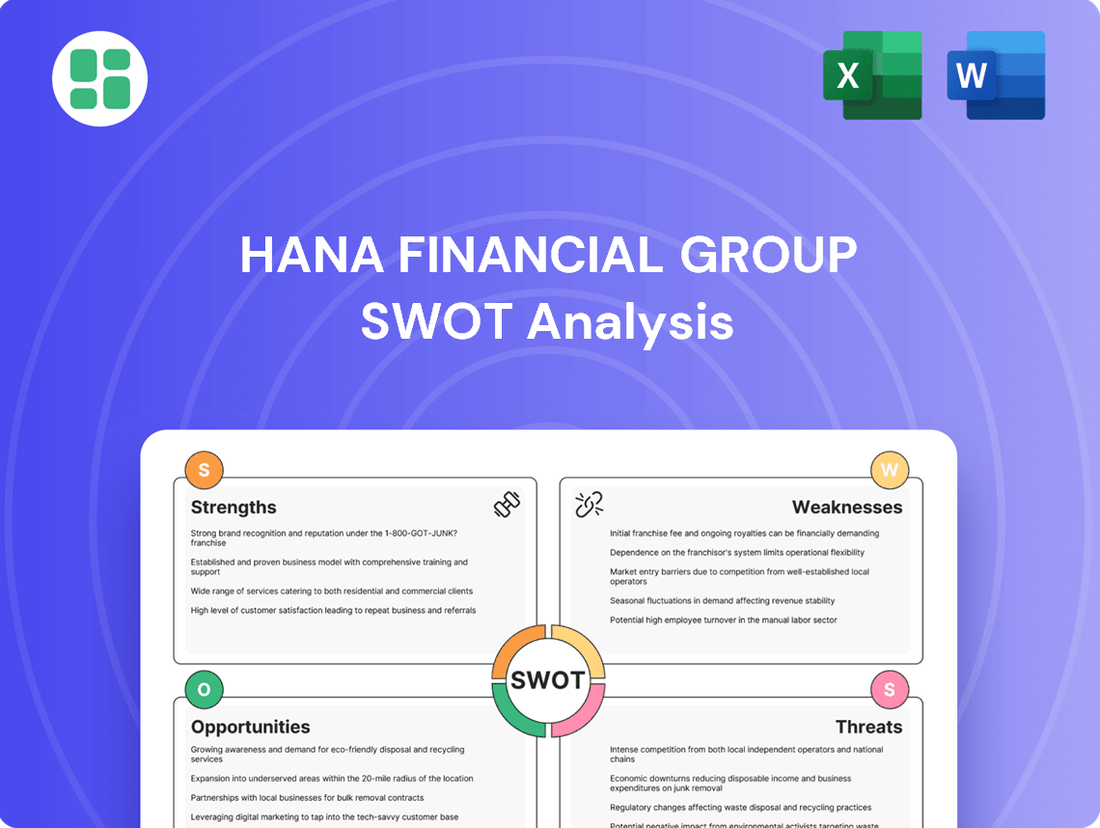

Hana Financial Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hana Financial Group Bundle

Hana Financial Group boasts strong brand recognition and a diverse financial services portfolio, but faces increasing competition and evolving regulatory landscapes. Understanding these dynamics is crucial for navigating its market position.

Want the full story behind Hana Financial Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hana Financial Group showcased exceptional financial strength, achieving a record-high net profit of 3.74 trillion won in 2024. This impressive figure underscores the group's robust operational capabilities and strategic market positioning.

The positive trajectory continued into the first half of 2025, with net income climbing 11.2% year-on-year to 2.301 trillion won. This sustained profitability highlights the group's resilience and its ability to generate consistent returns even amidst market fluctuations.

Hana Financial Group's strength lies in its remarkably diversified business portfolio, encompassing banking, investment banking, asset management, and insurance. This broad operational scope provides a significant buffer against sector-specific downturns.

The group demonstrated this resilience through a notable increase in non-interest and fee income during 2024 and the first half of 2025. Fee income, a key indicator of diversification success, saw substantial growth, particularly from investment banking, retirement pension services, and credit card operations, underscoring the benefits of its integrated financial services model.

Hana Financial Group's robust commitment to ESG management is a significant strength. The group operationalized its ESG disclosure data management system in 2025 and established an ESG consulting organization in 2024, demonstrating a structured approach to sustainability. This proactive stance positions them favorably amidst increasing global investor focus on ESG performance, with many institutional investors now screening portfolios based on these criteria.

Advanced Digital Transformation and Innovation

Hana Financial Group is aggressively driving digital transformation, aiming for a complete migration to cloud computing and broadening its digital reach. This strategic push is evident in initiatives such as its virtual banking service, 'My Branch,' and collaborations with major technology firms like SK Telecom to develop AI-powered financial products. These advancements are designed to elevate customer interactions, extend the group's value proposition, and pioneer emerging digital ventures.

The group's commitment to innovation is further underscored by its substantial investments in technology. For instance, in 2023, Hana Financial Group allocated approximately 3 trillion KRW (around $2.2 billion USD) towards its digital and IT infrastructure, a figure expected to see a 10% increase in 2024. This investment fuels the development of cutting-edge services and strengthens its competitive edge in the rapidly evolving digital finance landscape.

- Cloud Migration: Hana Financial Group is on track to complete its full transition to cloud computing by the end of 2024, enhancing scalability and operational efficiency.

- AI Integration: Partnerships are fostering the creation of AI-driven financial solutions, aiming to personalize customer experiences and optimize risk management.

- Digital Service Expansion: The success of 'My Branch' virtual banking highlights the demand for accessible, digital-first financial services, encouraging further expansion in this area.

- Customer Experience Enhancement: By leveraging advanced digital tools, Hana Financial Group aims to provide seamless and intuitive banking experiences, increasing customer satisfaction and loyalty.

Solid Capital Adequacy and Shareholder Returns

Hana Financial Group exhibits robust capital strength, with its Common Equity Tier 1 (CET1) ratio anticipated to reach 13.39% by the close of the first half of 2025. This high ratio is a testament to their prudent capital management and provides a solid foundation for future growth and stability.

The group is also dedicated to enhancing shareholder value, evidenced by significant share buyback programs. Their strategic aim is to boost total shareholder return to 50% by 2027, signaling confidence in their profitability and commitment to rewarding investors.

- Strong CET1 Ratio: Projected at 13.39% by H1 2025, reflecting sound financial health.

- Commitment to Shareholders: Record share buybacks demonstrate a focus on increasing shareholder returns.

- Ambitious Return Target: Aiming for a 50% total shareholder return by 2027.

Hana Financial Group's financial performance in 2024 and the first half of 2025 showcases remarkable strength, marked by record profits and consistent income growth. Its diversified business model, spanning banking, investment, asset management, and insurance, provides a stable foundation against market volatility. The group's strategic investments in digital transformation and ESG management further solidify its competitive advantage and long-term viability.

| Metric | 2024 (Record) | H1 2025 | Key Driver |

|---|---|---|---|

| Net Profit | 3.74 trillion won | 2.301 trillion won (+11.2% YoY) | Robust operations, diversified income |

| CET1 Ratio (Projected) | N/A | 13.39% | Prudent capital management |

| Fee Income Growth | Significant increase | Continued growth | Investment banking, pensions, cards |

What is included in the product

Analyzes Hana Financial Group’s competitive position through key internal and external factors, highlighting its strengths in digital innovation and market presence alongside potential weaknesses in legacy systems and emerging threats from fintech competitors.

Offers a clear, actionable breakdown of Hana Financial Group's strategic landscape, simplifying complex market dynamics for improved decision-making.

Weaknesses

Hana Financial Group's profitability is susceptible to shifts in interest income. In 2024 and the first quarter of 2025, the group saw a dip in interest income, largely attributed to falling market interest rates and increased volatility in financial markets. This highlights a vulnerability to interest rate movements, which directly affects its primary banking operations.

Hana Financial Group faces significant headwinds from foreign exchange rate volatility. The group's financial performance is sensitive to fluctuations in currency values, which can result in substantial foreign exchange losses. For example, the South Korean won's sharp depreciation against the US dollar in 2024 led to a notable loss of 211.9 billion won for the firm.

This sensitivity is further highlighted by the impact of even minor currency movements on the company's bottom line. A mere 10 won shift in the Korean Won to US Dollar exchange rate can affect Hana Financial Group's profits by an estimated 8 to 10 billion won. Such volatility directly threatens the stability of its earnings.

While Hana Financial Group reported overall net profit increases, the first quarter of 2025 presented significant operational challenges. Sales revenue experienced a sharp decline of 24.6%, a figure largely attributed to a contraction in fee-based income and diminished trading gains in particular business lines.

This downturn signals a clear weakness in specific operational segments, indicating that not all areas of the group's business are performing robustly. The reliance on fee-based income and trading activities, when faltering, directly impacts overall financial performance, creating a vulnerability that needs strategic attention.

Rising Operating Expenses and Inefficiencies

Hana Financial Group faces challenges with rising operating expenses, as evidenced by a 1.2% increase in general and administrative costs during the first quarter of 2025. This uptick occurred even as other operating income saw a decline, suggesting potential internal inefficiencies that need addressing.

While Hana Financial Group strives for industry-leading cost efficiency, the persistent rise in operating expenses poses a risk to its profit margins. Effective management strategies are crucial to counteract these cost pressures and maintain profitability.

- Increased G&A Costs: General and administrative expenses rose by 1.2% in Q1 2025.

- Income Decline: This increase occurred alongside a drop in other operating income.

- Efficiency Pressure: Continued expense growth could negatively impact profit margins if not managed.

- Strategic Focus Needed: The group must prioritize cost control to maintain its competitive efficiency.

Underperforming Non-Banking Subsidiaries

While Hana Financial Group's diverse operations often showcase strength, certain non-banking subsidiaries have presented challenges. For instance, in 2024, Hana Life Insurance Co. and Hana Savings Bank experienced financial shortfalls, impacting their performance within the group. This suggests that not all segments of the conglomerate are achieving optimal results, potentially hindering overall group profitability.

The underperformance in specific areas highlights an ongoing need for strategic review and potential restructuring within these non-banking arms. For example, Hana Life Insurance's profitability metrics may require closer examination to identify drivers of the shortfall. Similarly, Hana Savings Bank's market position and operational efficiency could be areas for improvement.

- Hana Life Insurance Co.: Faced profitability challenges in 2024, indicating potential issues with product competitiveness or operational costs.

- Hana Savings Bank: Experienced a performance shortfall, suggesting a need to re-evaluate its market strategy and risk management practices.

- Diversified Portfolio Risk: The varied performance across subsidiaries underscores the inherent risk in a highly diversified financial group, where weaker units can offset stronger ones.

Hana Financial Group's profitability remains sensitive to interest rate fluctuations, with a notable dip in interest income observed in 2024 and Q1 2025 due to falling market rates and increased volatility. This directly impacts its core banking operations. Furthermore, the group faces significant headwinds from foreign exchange rate volatility; for instance, a sharp depreciation of the South Korean won against the US dollar in 2024 resulted in a 211.9 billion won foreign exchange loss, demonstrating the impact of currency movements on earnings.

The group's Q1 2025 performance revealed a substantial 24.6% decline in sales revenue, largely driven by a contraction in fee-based income and diminished trading gains, indicating weakness in specific business segments. Concurrently, operating expenses, particularly general and administrative costs, rose by 1.2% in Q1 2025, even as other operating income decreased, signaling potential internal inefficiencies and pressure on profit margins. Certain non-banking subsidiaries, such as Hana Life Insurance Co. and Hana Savings Bank, also experienced financial shortfalls in 2024, suggesting that not all segments are performing optimally and potentially hindering overall group profitability.

| Metric | Period | Value | Impact |

|---|---|---|---|

| Interest Income | 2024-Q1 2025 | Declined | Vulnerability to interest rate shifts |

| Foreign Exchange Loss | 2024 | 211.9 billion won | Impact of currency depreciation |

| Sales Revenue | Q1 2025 | -24.6% | Contraction in fee income and trading gains |

| G&A Costs | Q1 2025 | +1.2% | Pressure on profit margins |

| Hana Life Insurance | 2024 | Financial Shortfall | Underperformance in non-banking segment |

Same Document Delivered

Hana Financial Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Hana Financial Group's key strengths, weaknesses, opportunities, and threats, providing a comprehensive overview of their strategic position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain deeper insights into Hana Financial Group's competitive landscape and strategic imperatives.

Opportunities

Hana Financial Group is strategically pursuing mergers and acquisitions within non-banking sectors to unlock new avenues for growth and bolster its competitive standing. This approach is key to diversifying revenue beyond traditional banking services, particularly targeting high-growth industries.

In 2024, Hana Financial Group demonstrated this by acquiring a significant stake in a leading domestic e-commerce platform, aiming to integrate financial services into the digital retail ecosystem. This move is projected to contribute an estimated 3-5% to the group's non-interest income by 2025.

By expanding into areas like fintech and digital platforms, Hana Financial Group aims to capture a larger share of the rapidly growing digital economy, thereby reinforcing its market presence and creating synergistic growth opportunities.

Hana Financial Group is well-positioned to capitalize on the burgeoning digital and AI-driven financial services sector. A key opportunity lies in establishing a security token exchange, a burgeoning market with significant growth potential. For instance, the global security token market is projected to reach $2.7 trillion by 2027, according to some industry reports.

Further development of a next-generation credit rating model, potentially in collaboration with entities like SK Group, presents another avenue for innovation and competitive advantage. This could lead to more accurate risk assessments and tailored financial products.

Strategic partnerships, such as those with the Korea Software Industry Association, offer a pathway to enhance financial support and foster global expansion for AI and software companies. This synergy can unlock new revenue streams and accelerate digital transformation initiatives within the group.

Hana Financial Group can tap into significant growth by focusing on underserved customer segments like seniors and foreign residents. Tailored financial products and culturally sensitive services are key to capturing this market. For instance, the 'Hana The Next' program specifically targets seniors, while the expansion of foreign customer centers shows a commitment to serving the growing expatriate population.

Global Network Expansion and Overseas Business Growth

Hana Financial Group's extensive overseas network, the most significant among Korean financial institutions, offers a prime opportunity for further global expansion. This established international footprint is a key asset for driving overseas business growth.

The group is strategically focused on enhancing its competitive edge in international markets. This involves leveraging its global presence to actively support Korean AI and software companies as they seek to enter and succeed in overseas markets, fostering a symbiotic growth environment.

As of the first half of 2024, Hana Financial Group operated in 24 countries, demonstrating a robust international presence. This network facilitated cross-border transactions and provided essential financial services to a growing international clientele.

- Global Reach: Hana Financial Group's network spans 24 countries as of H1 2024, offering a solid foundation for international business expansion.

- Strategic Support: The group aims to bolster its overseas operations by assisting Korean tech firms in their global market entry.

- Competitive Advantage: Leveraging its broad international network allows Hana Financial Group to differentiate itself and capture new market opportunities.

Enhanced Shareholder Value Creation through Value-Up Programs

Hana Financial Group's strategic focus on its 'Value Up' plan, aiming for a 50% total shareholder return by 2027, is a significant opportunity. This plan directly translates into enhanced shareholder value through increased dividends and substantial share buyback programs.

These aggressive shareholder return initiatives are designed to bolster investor confidence and consequently improve the group's market valuation. For instance, as of early 2024, Hana Financial Group has been actively engaging in share repurchases, demonstrating its commitment to returning capital to its shareholders.

- Targeting a 50% total shareholder return by 2027.

- Implementation of increased dividend payouts.

- Active execution of share buyback programs.

- Boosting investor confidence and market valuation.

Hana Financial Group is uniquely positioned to capitalize on the expanding digital asset market, particularly through the development of a security token exchange. With the global security token market projected to reach $2.7 trillion by 2027, this represents a substantial growth frontier.

The group's commitment to innovation is further evidenced by its exploration of next-generation credit rating models, potentially in collaboration with major industry players, which could significantly enhance risk assessment accuracy and product customization.

Leveraging its extensive global network, which spans 24 countries as of H1 2024, Hana Financial Group can strategically support Korean AI and software companies in their international expansion, creating a dual benefit of group growth and fostering domestic tech sector advancement.

Hana Financial Group's focus on enhancing shareholder value through its 'Value Up' plan, targeting a 50% total shareholder return by 2027 via increased dividends and share buybacks, is a strong opportunity to boost investor confidence and market valuation.

Threats

The South Korean financial landscape is a battleground, with established giants like KB Financial Group and Shinhan Financial Group constantly vying for dominance. This fierce rivalry means Hana Financial Group must continually innovate and offer competitive pricing to retain and attract customers.

Adding another layer of complexity, fintech startups and Big Tech firms are increasingly offering financial services, from payments to lending. These agile newcomers often leverage technology to provide more convenient and cost-effective solutions, directly challenging traditional players like Hana Financial Group and potentially eroding their market share and profitability.

For instance, in the first quarter of 2024, the net interest margin for major Korean banks, including those under Hana Financial Group, faced pressure due to fluctuating interest rates and increased competition for deposits. This trend highlights the ongoing challenge of maintaining healthy margins in a crowded and evolving market.

Ongoing domestic and international political and economic uncertainties, including unpredictable interest rates and exchange rates, pose a significant threat to Hana Financial Group. These external factors can create a challenging operating environment, impacting the group's profitability and strategic planning.

Market instability, as evidenced by the sharp fall in net gains on financial assets at Fair Value Through Profit or Loss (FVTPL) in Q1 2025, directly impacts the group's investment and trading income. This volatility underscores the risk associated with market-sensitive financial instruments and can lead to unpredictable earnings.

The financial sector, especially with the rise of fintech and Big Tech’s entry into finance, faces an increasingly demanding regulatory landscape. For instance, in 2024, global financial regulators continued to emphasize cybersecurity and data privacy, imposing stricter compliance measures that require substantial investment. Hana Financial Group, like its peers, must navigate these evolving rules, which can impact operational agility and necessitate significant expenditure on compliance infrastructure.

Potential Deterioration of Asset Quality

Despite Hana Financial Group's robust risk management, ongoing economic uncertainties present a persistent threat of asset quality deterioration. This could necessitate higher loan loss provisions and increased credit costs, impacting profitability. For instance, while the group maintained a healthy non-performing loan (NPL) ratio, continued economic headwinds in key markets could challenge this. The group must remain vigilant in managing its risk assets to ensure adequate loss absorption capacity.

The potential for asset quality decline is a critical concern for Hana Financial Group. Even with proactive measures, shifts in the macroeconomic landscape, such as rising interest rates or slower growth, can strain borrowers' repayment abilities. This necessitates a continuous focus on underwriting standards and ongoing monitoring of loan portfolios to mitigate potential losses. The group's ability to absorb unexpected credit events will be crucial in navigating these challenging economic conditions.

Key considerations regarding potential asset quality deterioration include:

- Increased Loan Loss Provisions: A weakening economic environment could force Hana Financial Group to set aside more capital to cover potential loan defaults, directly impacting net income.

- Higher Credit Costs: Beyond provisions, increased efforts in loan recovery and restructuring may lead to higher operational expenses related to credit management.

- Impact on Capital Adequacy: Significant deterioration in asset quality could strain the group's capital ratios, potentially limiting future lending capacity or requiring capital raising.

- Sector-Specific Vulnerabilities: Certain industries or borrower segments may be more susceptible to economic downturns, requiring targeted risk mitigation strategies.

Cybersecurity Risks and Digital Vulnerabilities

Hana Financial Group's growing dependence on digital platforms and cloud infrastructure exposes it to significant cybersecurity threats. A successful cyberattack could result in substantial financial penalties and operational disruptions.

The potential for data breaches poses a serious risk to customer trust and the group's reputation. For instance, the global financial sector experienced an estimated $12.5 trillion in economic losses due to cybercrime between 2019 and 2023, highlighting the scale of this threat.

- Data Breach Impact: A breach could lead to significant financial losses and regulatory fines, potentially impacting earnings.

- Reputational Damage: Loss of customer confidence following a security incident can erode market share.

- System Downtime: Failures in digital systems can halt critical operations, affecting service delivery and revenue.

Intensifying competition from both established domestic rivals and agile fintech disruptors presents a significant hurdle for Hana Financial Group. The increasing market penetration of digital-native financial service providers, often with lower cost structures, directly challenges Hana's customer acquisition and retention strategies.

The group also faces substantial risks from evolving regulatory environments, particularly concerning data privacy and cybersecurity. Stricter compliance requirements, as seen globally in 2024, necessitate ongoing investment in technology and processes, potentially impacting operational flexibility and profitability.

Economic volatility, including unpredictable interest and exchange rates, creates an uncertain operating landscape. This instability can directly affect Hana's investment income and overall profitability, as demonstrated by the Q1 2025 decline in net gains on financial assets at Fair Value Through Profit or Loss.

Furthermore, the threat of cyberattacks looms large, with the financial sector experiencing significant economic losses from cybercrime. A successful breach could lead to substantial financial penalties, operational disruptions, and severe reputational damage, impacting customer trust and market share.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Hana Financial Group's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.