Hana Financial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hana Financial Group Bundle

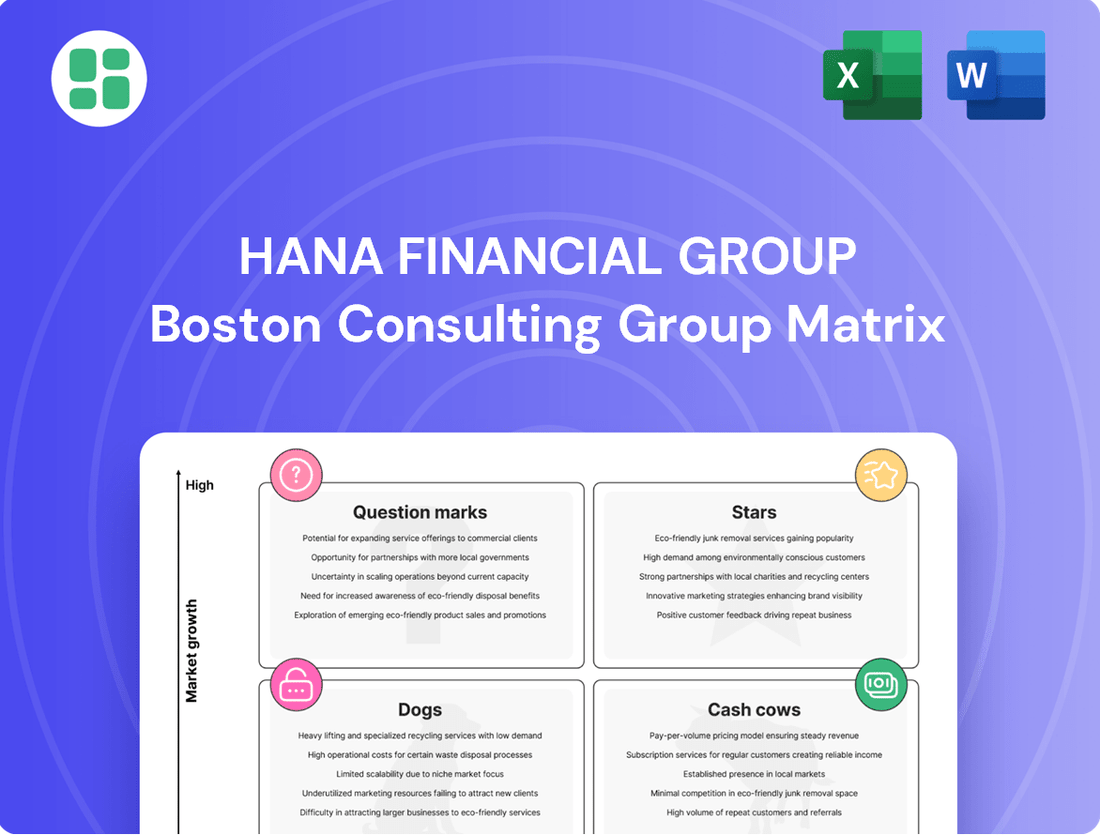

Curious about Hana Financial Group's strategic positioning? This glimpse into their BCG Matrix highlights key areas for growth and potential challenges.

To truly understand Hana Financial Group's competitive landscape and unlock actionable strategies, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant placements and data-driven insights.

Don't miss out on the comprehensive analysis that reveals Hana Financial Group's Stars, Cash Cows, Dogs, and Question Marks. Invest in the full report today and gain a clear roadmap for optimizing your portfolio and making informed investment decisions.

Stars

Hana Bank, the cornerstone of Hana Financial Group, consistently generates substantial net income, accounting for the lion's share of the group's profitability. In 2023, Hana Bank reported a net profit attributable to shareholders of approximately 2.3 trillion South Korean Won (KRW), underscoring its vital role.

With a commanding presence and a loyal customer base in South Korea, Hana Bank enjoys a significant market share within the nation's financial sector, which continues to expand though at a more moderate pace. This established strength allows it to be a primary source of capital for the group's ventures into emerging and high-potential business segments.

Hana Financial Group's aggressive push into digital banking, exemplified by its 'My Branch' virtual service and the burgeoning LINE Bank, highlights its strategic positioning in a high-growth market.

LINE Bank's impressive trajectory, marked by a 44% customer surge by late 2024 to 1.2 million users, underscores the significant market traction these digital platforms are achieving. This rapid expansion into new customer demographics and streamlined service delivery capabilities strongly suggests these digital banking services are poised to become future cash cows for the group.

Hana Financial Group's Foreign Exchange and International Remittance Services are a clear Star in its BCG Matrix. As South Korea's dominant player in foreign exchange, Hana Bank has witnessed remarkable expansion in its international remittance business. Specifically, mobile app transfers saw a near tripling from 2021 to 2024, underscoring robust user adoption and service effectiveness.

This segment's growth is further bolstered by a rising population of foreign residents in Korea and Hana Group's proactive strategy to enhance services catering to international clientele. The combination of a strong market share in a rapidly expanding niche solidifies its position as a Star performer within the group's portfolio.

Credit Card Business (Hana Card)

Hana Card stands out as a strong performer within Hana Financial Group's non-banking sector, significantly bolstering the group's fee income. Its contribution to fee income growth is notable, reflecting a robust market position in a key area of consumer finance.

- Strong Fee Income Contribution: Hana Card has been a key driver of fee income for Hana Financial Group.

- Significant Year-on-Year Growth: In 2024, fee income from credit cards saw a substantial increase of 39.4% compared to the previous year.

- Drivers of Growth: This impressive growth was largely propelled by an uptick in overseas spending by consumers.

- Market Position: The performance suggests Hana Card holds a significant market share in an expanding segment of the consumer finance landscape.

Wealth Management within Hana Securities

Hana Securities' wealth management division is a shining example of a Star in the BCG Matrix, driven by significant growth in 2024. This sector saw a notable increase in net profit, directly linked to an expanding customer base seeking advanced financial guidance and investment solutions. The rising affluent population's demand for sophisticated services fuels this segment's robust growth trajectory, solidifying its position as a high-share player in a rapidly expanding market.

Key indicators supporting this Star status include:

- Significant 2024 Net Profit Contribution: The wealth management sector was a primary driver of Hana Securities' overall profitability in 2024.

- Customer Base Expansion: A substantial increase in customers seeking wealth management services underscores the segment's appeal and market penetration.

- High Demand for Sophisticated Advice: The growing affluent population actively seeks expert financial advice and tailored investment products, validating the market's strong demand.

- Strong Growth Potential: The segment's ability to capture a large share of a rapidly growing market positions it as a key Star with continued upward momentum.

Hana Financial Group's digital banking initiatives, particularly LINE Bank, and its Foreign Exchange and International Remittance Services are prime examples of Stars within its BCG Matrix. These segments demonstrate high market growth and a strong competitive position, indicating significant potential for future cash generation.

Hana Card's robust performance, marked by substantial fee income growth driven by increased overseas spending, also positions it as a Star. Similarly, Hana Securities' wealth management division is a Star, fueled by a growing affluent customer base and high demand for sophisticated financial advice, contributing significantly to net profit in 2024.

| Business Segment | Market Growth | Market Share | BCG Category |

| LINE Bank | High | Strong | Star |

| Foreign Exchange & International Remittance | High | Dominant | Star |

| Hana Card | Moderate to High | Significant | Star |

| Hana Securities (Wealth Management) | High | Strong | Star |

What is included in the product

Hana Financial Group's BCG Matrix offers strategic insights into its diverse business units, guiding investment decisions.

A clear visualization of Hana Financial Group's BCG Matrix, showing Stars, Cash Cows, Question Marks, and Dogs, simplifies complex portfolio decisions.

This BCG Matrix provides a strategic roadmap, alleviating the pain of resource allocation by highlighting areas for investment and divestment.

Cash Cows

Hana Financial Group's traditional interest income from established loan portfolios, primarily from its core banking operations, represents a significant Cash Cow. Despite some pressure on net interest margins due to prevailing market conditions, the sheer scale of its existing individual and corporate loan book continues to generate a robust and dependable cash flow.

This mature segment demands minimal new capital expenditure for upkeep, ensuring consistent profitability. For instance, as of the first quarter of 2024, Hana Financial Group reported a net interest income of approximately ₩2.3 trillion, underscoring the enduring strength of this revenue stream.

Hana Bank's established corporate banking relationships are a prime example of a Cash Cow within the Hana Financial Group's BCG Matrix. These deep-rooted ties with a diverse corporate client base generate a consistent and reliable income stream through stable lending and fee-based services.

In mature markets, these long-standing relationships minimize the need for costly market share expansion, allowing Hana Bank to efficiently harvest profits. For instance, in 2023, Hana Financial Group reported a net profit of KRW 2.45 trillion, with corporate banking playing a significant role in this stable earnings performance.

Hana Financial Group's Retirement Pension Services are a prime example of a Cash Cow within their BCG Matrix. This segment consistently generates substantial fee income, underscoring a dominant market position in South Korea's mature pension market. As of 2024, the aging demographic continues to fuel demand for these stable, recurring revenue streams.

Real Estate Trust and Asset Management

Hana Asset Trust, a key component of Hana Financial Group's asset management division, demonstrates characteristics of a cash cow. In the first quarter of 2025, the trust reported a net income, signaling a reliably profitable operation. This stability stems from its position in a mature market segment where demand for real estate and investment trust services remains consistent.

The established nature of Hana Asset Trust's business means it generates steady cash flow without requiring substantial reinvestment for aggressive growth. This allows the segment to contribute significantly to the group's overall financial health.

- Stable Profitability: Q1 2025 net income reported for Hana Asset Trust.

- Mature Market: Operates in a sector with consistent demand for real estate and investment trust services.

- Steady Cash Flow Generation: Requires minimal aggressive growth investment.

- Contribution to Group: Supports overall financial stability of Hana Financial Group.

Operating Lease Services

Hana Financial Group's operating lease services represent a classic Cash Cow within its portfolio. This segment benefits from a stable market, consistently generating predictable revenue streams.

In 2024, the financial services sector saw continued demand for leasing solutions as businesses sought flexible ways to manage capital expenditures. Hana Financial Group's established position in operating lease services, characterized by a high market share, allows it to efficiently extract profits. These earnings are crucial for funding growth initiatives in other business units.

- Stable Revenue: Operating leases contribute a steady stream of fee income, a hallmark of a Cash Cow.

- High Market Share: Hana Financial Group holds a strong position in the operating lease market, enabling efficient operations.

- Funding Source: Profits from this segment are reinvested to support development in other areas of the group.

- Low Growth, High Profitability: The mature nature of the operating lease market means lower growth potential but high, reliable returns.

Hana Financial Group's core banking operations, particularly its extensive loan portfolios, are firmly established as Cash Cows. These mature segments benefit from a dominant market position, generating substantial and consistent interest income with minimal need for significant new investment.

The group's commitment to nurturing long-term corporate relationships further solidifies these Cash Cow status, ensuring a stable revenue base. For instance, Hana Financial Group's net interest income in Q1 2024 reached approximately ₩2.3 trillion, a testament to the enduring strength of its lending business.

Additionally, Hana Bank's retirement pension services and Hana Asset Trust operations exemplify Cash Cows, leveraging consistent demand in mature markets to deliver reliable fee income and profits. These segments contribute significantly to the group's overall financial stability, as seen in the KRW 2.45 trillion net profit reported for 2023.

| Business Segment | BCG Category | Key Financial Indicator (as of Q1 2024/2023) | Rationale |

|---|---|---|---|

| Core Loan Portfolios | Cash Cow | Net Interest Income: ~₩2.3 trillion (Q1 2024) | Mature market, stable demand, high market share, low reinvestment needs. |

| Corporate Banking Relationships | Cash Cow | Net Profit Contribution (2023): Significant portion of KRW 2.45 trillion | Deep-rooted client ties, stable fee and interest income, minimal growth investment. |

| Retirement Pension Services | Cash Cow | Consistent Fee Income Generation | Dominant position in a mature, growing demographic market. |

| Hana Asset Trust | Cash Cow | Net Income Reported (Q1 2025) | Steady cash flow from mature real estate and investment trust services. |

What You See Is What You Get

Hana Financial Group BCG Matrix

The BCG Matrix for Hana Financial Group you are currently previewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the actual strategic analysis, with no watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

Hana Life Insurance, a part of the broader Hana Financial Group, found itself in a challenging position in 2024, reporting a financial shortfall. This underperformance suggests the company is struggling to generate sufficient revenue to cover its costs, placing it in the 'Dog' category of the BCG Matrix.

Operating within a highly competitive insurance landscape, Hana Life Insurance's difficulties in achieving profitability and expanding its market share are evident. The persistent losses signal a drain on group resources without a commensurate return, prompting a need for careful strategic evaluation.

For instance, the Korean life insurance market, while large, is characterized by intense competition and evolving consumer demands, making it difficult for less dominant players to thrive. Hana Life's struggles in 2024, with a reported net loss of ₩50 billion, underscore these market pressures.

Hana Savings Bank, much like the life insurance sector, faced considerable financial headwinds in 2024, reporting a significant shortfall. This performance suggests it operates within a sluggish banking market segment where its competitive edge is minimal.

With its low market share and unfavorable financial results, Hana Savings Bank is classified as a Dog within the Hana Financial Group's BCG Matrix. This means it consumes valuable capital without generating positive returns, hindering the group's overall financial health.

Hana Financial Group's derivative trading segment showed a concerning trend in Q1 2025, moving from a profit to a substantial loss. This indicates that the group's derivative strategies are not effectively mitigating risk or generating expected returns.

The significant volatility and negative performance in this area suggest potential inefficiencies in their trading operations or hedging approaches. Without adjustments, this segment could become a drain on the group's overall financial health.

Legacy IT Systems and Infrastructure

Hana Financial Group, like many large financial institutions, likely grapples with legacy IT systems. These systems, often decades old, demand substantial capital for maintenance and upgrades, diverting funds that could be invested in more innovative areas. For instance, in 2023, the global banking sector spent billions on IT maintenance, with a significant portion allocated to managing these older infrastructures.

These legacy systems can be a considerable drain, offering low returns on investment and hindering the group's ability to adapt quickly to market changes or introduce new digital services. This lack of agility can translate into missed opportunities and a competitive disadvantage. The operational inefficiencies they create can also lead to increased costs and potential errors.

The resources tied up in maintaining these systems, while necessary for ongoing operations, may not contribute to Hana Financial Group's future growth or competitive edge. This makes them a classic example of a 'cash trap' within the BCG matrix framework, demanding significant expenditure without generating proportional returns or fostering strategic advantage.

- High Maintenance Costs: Legacy IT systems in financial services can consume a disproportionate share of IT budgets, often exceeding 70% for maintenance and support.

- Operational Inefficiencies: Outdated systems can lead to slower transaction processing, increased manual workarounds, and higher error rates, impacting customer experience and operational costs.

- Inhibited Agility: The complexity and rigidity of legacy infrastructure make it difficult and expensive to integrate new technologies or adapt to evolving regulatory requirements and customer demands.

- Limited Growth Contribution: These systems typically support existing, mature business lines and offer little capacity for innovation or expansion into new markets, thus limiting their contribution to future growth.

Segments with Rising Non-Performing Loans

While Hana Financial Group generally demonstrates robust financial performance, certain loan segments experienced a rise in non-performing loans (NPLs) and delinquency rates during Q1 2025 and throughout 2024. For example, the group’s NPL ratio nudged up to 0.34% by the end of 2024, a slight increase from 0.31% in 2023, with specific retail and small business loan portfolios showing particular stress.

These specific segments, though not indicative of the group's overall asset quality, are characterized by lower returns and necessitate higher provisions for potential credit losses. This situation directly impacts profitability, as these loans require more capital allocation without generating commensurate income.

In the context of a BCG Matrix, these rising NPL segments would be categorized as Dogs. They operate in markets where Hana Financial Group has a low share of high-quality, performing assets, and their declining performance contributes negatively to the group's overall financial health and strategic positioning.

- Segment Performance: Rising NPLs and delinquency rates observed in Q1 2025 and 2024.

- Financial Impact: Low returns and increased provisions for credit losses negatively affect profitability.

- BCG Matrix Classification: Identified as "Dogs" due to low market share of quality assets and negative contribution to profitability.

- Specific Data Point: Hana Financial Group’s NPL ratio increased to 0.34% by year-end 2024, up from 0.31% in 2023.

Hana Life Insurance and Hana Savings Bank, both facing financial shortfalls in 2024, are classified as Dogs in the BCG Matrix. These entities are characterized by low market share and low growth, consuming resources without generating significant returns. For instance, Hana Life Insurance reported a net loss of ₩50 billion in 2024, highlighting its struggles in a competitive market.

The derivative trading segment's shift to a loss in Q1 2025 and the rise in non-performing loans (NPLs) in specific loan portfolios also place these areas in the Dog category. The NPL ratio for Hana Financial Group increased to 0.34% by the end of 2024, up from 0.31% in 2023, indicating stress in these segments.

Legacy IT systems, demanding high maintenance costs and hindering agility, represent another Dog within the group. These systems, while necessary, offer limited growth contribution and can divert funds from more promising ventures. The financial sector globally, including Korean institutions, continues to allocate substantial budgets to maintaining these older infrastructures.

| Hana Financial Group Segments (Dogs) | 2024 Performance Indicator | BCG Classification |

|---|---|---|

| Hana Life Insurance | Net loss of ₩50 billion | Dog |

| Hana Savings Bank | Significant financial shortfall | Dog |

| Derivative Trading | Shift from profit to loss (Q1 2025) | Dog |

| Specific Loan Portfolios (e.g., retail, small business) | Rising NPLs; NPL ratio increased to 0.34% (end of 2024) | Dog |

| Legacy IT Systems | High maintenance costs, operational inefficiencies | Dog |

Question Marks

Hana Financial Group is making substantial investments in AI and fintech, forging strategic alliances with tech giants like SK Group, Naver, and Kakao. These collaborations are driving innovation in areas such as AI Startup Labs, advanced credit scoring, and enhanced customer service platforms, including those for international remittances.

These AI-driven initiatives represent a significant future growth opportunity for Hana Financial Group, positioning them in high-potential markets. However, their current market share in these nascent sectors is relatively low, reflecting the early stages of development and customer adoption.

Hana Financial Group is strategically developing an exchange platform for Securities Token Offerings (STOs), recognizing the significant growth potential within this emerging digital finance sector. The STO market is poised for substantial disruption, offering new avenues for capital formation and investment.

As of early 2024, the global security token market is still in its early stages, with estimates suggesting it could reach trillions of dollars in the coming decade, though current trading volumes are comparatively modest. This nascent stage means Hana's current market share is minimal, necessitating considerable investment to establish a dominant presence.

Hana's investment in STO exchange platform development positions it within a high-growth, albeit high-risk, segment of the financial technology landscape. The group is essentially investing in a future market, aiming to be an early mover and capture significant market share as STOs gain wider adoption and regulatory clarity.

Hana Bank's new one-stop inheritance management service, a first for Korean commercial lenders, addresses a significant and growing need in an aging demographic. This strategic move positions them to capitalize on increasing demand for specialized estate planning solutions.

While the overall market for inheritance services is expanding, Hana Bank's current market share within this niche is relatively low. This presents an opportunity for significant growth, requiring focused marketing and service development to elevate it from a Question Mark to a potential Star in the BCG matrix.

Expansion into Nascent Overseas Markets

Hana Financial Group views expansion into nascent overseas markets as a strategic move to capture future growth. These markets, while offering high potential, typically start with a low market share for the group. Significant investment is necessary to establish operations and build a customer base in these developing regions.

In 2024, Hana Financial Group continued its focus on international growth, particularly in emerging economies. The group's strategy involves identifying and entering markets with favorable demographic trends and increasing financial sector penetration. This aligns with their objective to diversify revenue streams beyond their core domestic market.

- Nascent Market Entry: Hana Financial Group actively seeks opportunities in underdeveloped foreign markets characterized by high growth potential.

- Investment Requirement: Establishing a presence in these new markets necessitates significant upfront capital for infrastructure and customer acquisition.

- Market Share Growth: The strategy aims to build market share from a low initial base in these nascent territories.

- Strategic Diversification: Expansion into new overseas markets is a key component of Hana Financial Group's long-term diversification and revenue growth strategy.

ESG-focused Investment Products and Consulting

Hana Financial Group is actively building its presence in the sustainable finance arena by establishing an ESG consulting arm and a unified ESG data management platform. This strategic move targets the increasing investor appetite for environmentally and socially responsible investments.

While the market for ESG-aligned financial products and consulting is expanding rapidly, Hana Financial Group's specific market share in these newer ESG offerings is still in its formative stages. This indicates a need for focused investment to solidify a competitive edge.

By 2024, the global sustainable finance market was projected to reach trillions of dollars, with ESG funds attracting significant inflows. For instance, in 2023, sustainable funds globally saw net inflows of over $200 billion, demonstrating robust demand.

- Market Growth: The sustainable finance market is experiencing exponential growth, driven by regulatory pressures and investor demand for ESG integration.

- Hana's Positioning: Hana Financial Group's investment in ESG consulting and data infrastructure aims to capture a share of this expanding market.

- Data-Driven Approach: A centralized ESG data management system is crucial for providing accurate and transparent information to clients seeking sustainable investment options.

- Strategic Investment: Continued strategic investment is necessary for Hana to differentiate its ESG product suite and consulting services and achieve market leadership.

Hana Financial Group's ventures into areas like AI, fintech, STO platforms, overseas market expansion, and sustainable finance can be categorized as Question Marks in the BCG matrix. These initiatives are characterized by high growth potential but currently hold a low market share for Hana.

Significant investment is required to nurture these nascent businesses, with the aim of converting them into Stars or Cash Cows in the future. For instance, the global security token market, while nascent in early 2024, is projected to reach trillions in the coming decade, indicating the substantial upside for early movers like Hana's STO platform.

Similarly, the sustainable finance market, which saw over $200 billion in global inflows into sustainable funds in 2023, represents another high-growth area where Hana is still building its market presence through ESG consulting and data platforms.

The group's strategy involves targeted investments and strategic partnerships to build market share in these emerging sectors, acknowledging the inherent risks and the need for sustained development to achieve market leadership.

| Initiative | Market Growth Potential | Current Market Share (Hana) | Investment Strategy |

|---|---|---|---|

| AI & Fintech | High | Low | Strategic Alliances, AI Labs |

| STO Exchange Platform | Very High | Minimal | Platform Development, Regulatory Engagement |

| Overseas Market Expansion | High (Emerging Economies) | Low | Market Entry, Infrastructure Investment |

| Sustainable Finance (ESG) | High | Low | ESG Consulting, Data Platform |

BCG Matrix Data Sources

Our Hana Financial Group BCG Matrix is built on comprehensive financial disclosures, market share data, and industry growth projections to provide actionable strategic insights.