Hana Financial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hana Financial Group Bundle

Hana Financial Group operates in a dynamic financial services landscape, where the bargaining power of buyers, the intensity of rivalry, and the threat of substitutes significantly shape its competitive environment. Understanding these forces is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Hana Financial Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hana Financial Group's reliance on advanced technology for its digital transformation, particularly in areas like cloud computing and AI, grants significant bargaining power to its tech suppliers. Partnerships with major players like Google, AWS, and Microsoft for initiatives such as 'Hana Digital Power On' highlight this dependency. These specialized and often indispensable technological offerings, coupled with high switching costs for migrating platforms, mean these suppliers hold considerable sway.

Suppliers offering high-quality data and analytics wield significant bargaining power. Their specialized datasets, crucial for risk assessment and tailored financial products, are difficult for firms like Hana Financial Group to replicate. This reliance enhances supplier leverage.

Hana Financial Group's partnership with SK Group to build an advanced credit rating model, integrating telecom and financial data, underscores the value of these unique data sources. The proprietary nature and accuracy of such information directly impact Hana's strategic decisions and operational efficiency, amplifying the suppliers' influence.

The demand for highly skilled professionals in fields like AI, blockchain, and digital finance grants substantial bargaining power to suppliers of human capital, such as recruitment firms and universities. Hana Financial Group's commitment to talent development, exemplified by initiatives like 'Hana Digital Power On,' highlights the market's scarcity of these specialized skills.

The intense need for experts to spearhead digital transformation and manage intricate financial technologies makes attracting and retaining such talent both critical and expensive. For instance, in 2024, the average salary for a senior AI engineer in South Korea could exceed ₩100 million annually, demonstrating the high cost of securing specialized digital talent.

Wholesale Funding and Interbank Market Access

Hana Financial Group, despite its size, relies on wholesale funding and interbank markets. This dependence gives significant power to institutional lenders and investors who supply this capital. For instance, in 2023, South Korea's corporate bond market saw robust issuance, with total issuance reaching approximately 175 trillion Korean Won (KRW), indicating generally favorable conditions. However, any shift towards tighter liquidity or heightened risk perception can quickly escalate funding costs for Hana Financial Group.

The group's need for stable and varied funding sources means that large institutional capital providers can wield influence. This influence is often exercised through the pricing of loans and the terms of capital provision. In 2024, the Bank of Korea's policy rate remained a key factor influencing overall borrowing costs across the financial system, impacting the group's funding expenses.

- Wholesale Funding Reliance: Hana Financial Group's access to capital is partly through wholesale markets, where institutional investors are key suppliers.

- Interbank Market Dynamics: Activity in the interbank lending market directly impacts the group's short-term liquidity and associated costs.

- Bond Market Conditions: Favorable issuance conditions in South Korea's bond market, like those seen in 2023, can lower funding costs, but this can reverse quickly.

- Supplier Influence: Large institutional capital providers can exert bargaining power through pricing and terms, especially during periods of market stress.

Infrastructure and Real Estate Providers

For a financial conglomerate like Hana Financial Group with an extensive network of bank branches and corporate offices, suppliers of real estate, utilities, and physical security services hold a notable degree of bargaining power. The need for prime locations, especially in major urban centers, can concentrate this power. For instance, in 2024, commercial real estate prices in Seoul, a key market for Hana, continued to see upward pressure, potentially increasing lease costs.

While many of these services are often considered commoditized, specific requirements for large-scale infrastructure or unique geographical needs can foster dependencies on particular suppliers. The logistical challenges and costs associated with relocating or switching providers for a vast physical footprint are significant, granting these suppliers moderate leverage. Long-term lease agreements and service contracts further solidify this influence, making abrupt changes difficult and costly for Hana.

- Real Estate: Hana Financial Group's physical presence, including its headquarters and numerous branches, necessitates significant real estate holdings. In 2024, the average commercial rent in Seoul's Gangnam district, a prime business area, remained high, reflecting strong demand and limited supply.

- Utilities: Consistent and reliable utility services are critical for financial operations. While utility providers are often regulated, their essential nature and the scale of Hana's consumption give them a baseline level of bargaining power.

- Physical Security: Protecting assets and customer data requires robust physical security. Specialized security firms, particularly those with proven track records and advanced technological capabilities, can command higher prices due to the critical nature of their services.

Suppliers of specialized technology, critical data, and essential human capital possess significant bargaining power over Hana Financial Group. This is due to high switching costs, the unique nature of their offerings, and the scarcity of expertise in areas like AI and digital finance. For instance, in 2024, the average salary for a senior AI engineer in South Korea exceeded ₩100 million annually, highlighting the premium for specialized digital talent.

Hana Financial Group's reliance on wholesale funding and interbank markets also grants considerable influence to institutional lenders and investors. Market conditions, such as liquidity levels and risk perceptions, directly impact borrowing costs. In 2023, South Korea's corporate bond market saw robust issuance totaling approximately 175 trillion KRW, indicating generally favorable conditions that can reduce funding expenses for Hana.

The bargaining power of suppliers is further amplified by Hana's extensive physical footprint, which requires real estate, utilities, and security services. Prime locations, like Seoul's Gangnam district, command high commercial rents, as seen in 2024, increasing operational costs. The essential nature of these services and the logistical challenges of switching providers solidify supplier leverage.

| Supplier Category | Hana Financial Group's Reliance | Supplier Bargaining Power Factors | 2024 Data/Context |

|---|---|---|---|

| Technology Providers (Cloud, AI) | Crucial for digital transformation (e.g., Hana Digital Power On) | Specialized offerings, high switching costs | High demand for AI talent, impacting costs |

| Data & Analytics Providers | Essential for risk assessment, product development | Proprietary data, difficult to replicate | Partnerships like SK Group for credit models |

| Human Capital Suppliers (Recruiters, Universities) | Need for AI, blockchain, digital finance experts | Scarcity of specialized skills | Senior AI engineer salaries exceeding ₩100 million annually |

| Wholesale Funding & Interbank Markets | Access to capital for operations | Market liquidity, risk perception, institutional investor terms | South Korea's corporate bond issuance reached ~175 trillion KRW in 2023 |

| Real Estate, Utilities, Physical Security | Extensive branch network and corporate offices | Prime locations, essential services, logistical switching costs | Commercial rents in Seoul's Gangnam district remained high in 2024 |

What is included in the product

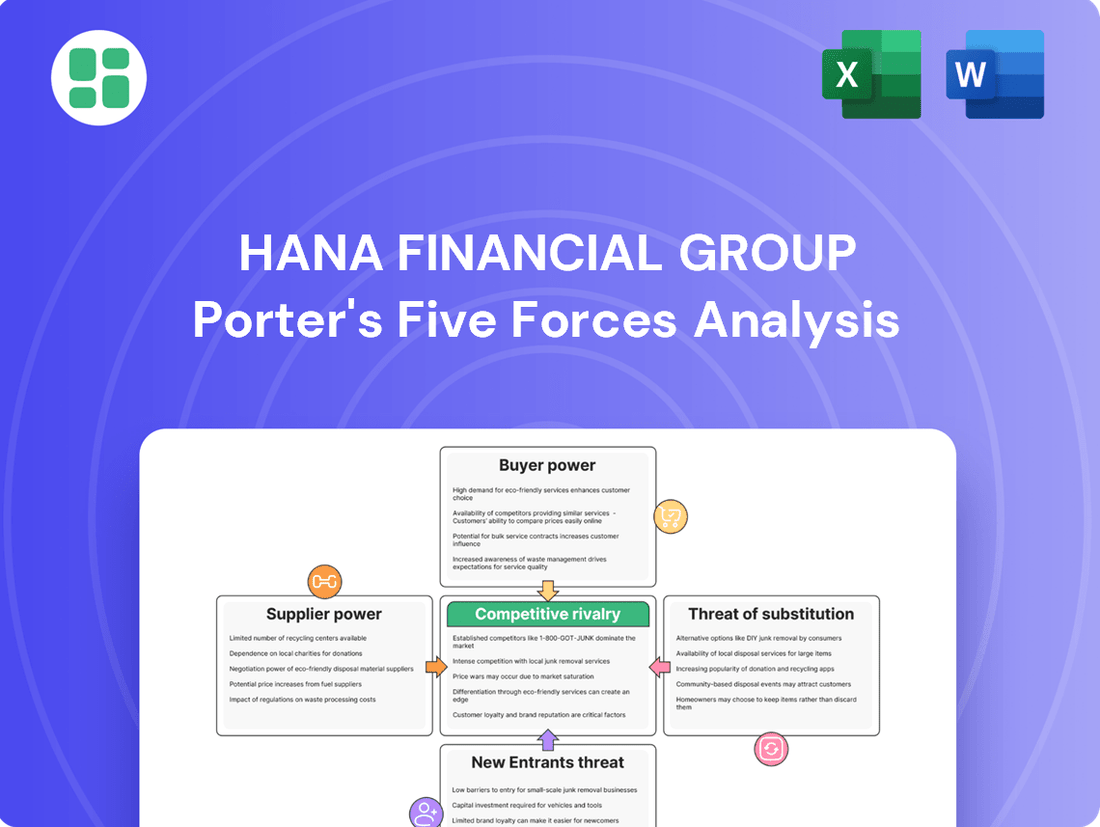

This Porter's Five Forces analysis for Hana Financial Group examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes within the financial services industry.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, allowing Hana Financial Group to proactively address industry pressures.

Customers Bargaining Power

Customers in South Korea experience low switching costs for fundamental banking and payment services. This is largely due to the widespread adoption of digital banking and mobile payment solutions, making it simple to move funds or establish new accounts with various institutions. In 2023, South Korea saw a significant increase in mobile banking transactions, with the Bank of Korea reporting a 15% year-on-year rise, highlighting the ease with which customers can engage with multiple providers.

Customers, especially individuals and small businesses, are highly attuned to interest rates on loans and deposits, as well as fees associated with financial services. In 2024, South Korea's benchmark interest rate saw fluctuations, directly impacting customer choices for banking products. This sensitivity means Hana Financial Group must remain competitive on pricing to retain and attract clients who can easily switch to institutions offering better terms.

Customers today have a much wider range of financial choices than ever before, moving beyond just traditional banks. They can now invest directly in stock markets, use peer-to-peer lending platforms, and explore various fintech innovations. This growing availability of alternatives, especially for managing money and borrowing, means customers aren't as reliant on single large financial institutions.

For Hana Financial Group, this translates to increased bargaining power for its customers. When customers can easily find similar or even better services elsewhere, they are less likely to accept less favorable terms or pricing from Hana. For instance, the global fintech market was valued at over $11.2 trillion in 2023 and is projected to grow significantly, indicating a strong and expanding competitive landscape.

To counter this, Hana Financial Group needs to consistently improve its offerings. This means not only providing competitive rates and fees but also innovating with new products and services that cater to evolving customer needs and preferences. Staying ahead requires a deep understanding of these diverse alternatives and a commitment to offering superior value and a seamless customer experience.

Information Transparency and Digital Comparison Tools

The digital revolution has dramatically shifted the balance of power towards customers in the financial sector. Information transparency, fueled by readily available data and sophisticated comparison tools, allows consumers to effortlessly evaluate everything from interest rates on loans to the fees associated with investment accounts. This ease of access empowers individuals to make more informed choices, directly impacting how financial institutions like Hana Financial Group must compete on price and service. For instance, in 2024, the proliferation of fintech platforms offering side-by-side comparisons of banking products meant that a significant portion of consumers actively used these tools before making a decision, forcing providers to offer more competitive terms.

Online comparison platforms and digital advisory services act as powerful equalizers, diminishing the traditional information asymmetry that once favored financial institutions. Customers can now meticulously research and contrast offerings from various providers, identifying the most beneficial deals. This heightened awareness and accessibility mean that customers are less likely to accept suboptimal terms, as they can swiftly identify and switch to providers offering superior value. This trend is evident in the increasing adoption rates of comparison websites for mortgages and savings accounts, with data from late 2023 and early 2024 indicating a substantial percentage of banking customers utilizing these resources.

- In 2024, approximately 60% of consumers surveyed indicated they used online comparison tools before selecting a new bank account or loan product.

- Digital advisory platforms have seen a 25% year-over-year growth in user engagement for financial product research as of mid-2024.

- The ability to easily compare fees and interest rates directly influences customer loyalty, with price sensitivity remaining a key driver for switching providers.

Institutional and Corporate Client Leverage

Large corporations and institutional clients wield considerable influence over Hana Financial Group. Their substantial transaction volumes and intricate financial requirements mean they can negotiate for better terms, including preferential interest rates and tailored service packages. This leverage is particularly pronounced in areas like investment banking and asset management, where the loss of a major client can significantly impact revenue streams.

Hana Financial Group must remain agile in meeting the sophisticated demands of these key players. For instance, in 2024, the financial services sector saw increased competition for large corporate accounts, with many institutions offering customized solutions to retain and attract this segment. Hana's ability to provide bespoke financial engineering and dedicated relationship management is paramount to mitigating this customer bargaining power.

- Significant Transaction Volumes: Institutional clients often manage billions in assets, making their business highly valuable.

- Demand for Bespoke Solutions: These clients require specialized financial products and services that go beyond standard offerings.

- Price Sensitivity: Even large clients are sensitive to rates and fees, especially in competitive markets.

- Switching Costs: While high for some services, the potential for better deals can incentivize clients to explore alternatives.

Customers in South Korea exhibit significant bargaining power due to low switching costs and a heightened awareness of available financial alternatives. This is amplified by the increasing transparency in pricing and service offerings, driven by digital comparison tools and a competitive fintech landscape. As a result, financial institutions like Hana Financial Group must continuously offer compelling value propositions to retain and attract clients.

The digital transformation has empowered customers, making it easier than ever to compare financial products and switch providers. This trend is evident in the growing use of online comparison platforms, with data from early 2024 indicating that a substantial percentage of consumers actively use these tools before making decisions. Consequently, price sensitivity remains a critical factor influencing customer loyalty.

Institutional clients, due to their large transaction volumes and demand for specialized services, also possess considerable bargaining power. They can negotiate for preferential terms, making it essential for Hana Financial Group to provide customized solutions and superior relationship management to secure and maintain these valuable relationships.

| Customer Segment | Bargaining Power Drivers | Impact on Hana Financial Group |

|---|---|---|

| Individual & Small Business Customers | Low switching costs, price sensitivity, access to comparison tools | Need for competitive pricing, superior customer experience, and innovative products. |

| Institutional & Corporate Clients | High transaction volumes, demand for bespoke solutions, potential for large-scale switching | Requirement for tailored financial engineering, dedicated relationship management, and customized service packages. |

Preview Before You Purchase

Hana Financial Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Hana Financial Group meticulously details the competitive landscape, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the financial services industry. This in-depth examination provides actionable insights into the strategic positioning and future outlook of Hana Financial Group.

Rivalry Among Competitors

Hana Financial Group faces formidable competition from major domestic banks like KB Financial Group, Shinhan Financial Group, and Woori Financial Group. This intense rivalry is evident across all their core operations, including banking, investment banking, asset management, and insurance. In 2023, these top three financial groups collectively held over 70% of the total banking assets in South Korea, underscoring the concentrated nature of the market and the significant competitive pressure Hana Financial Group navigates.

The competitive rivalry within the South Korean financial sector is intense, driven by an aggressive digital transformation race. Major financial groups, including Hana Financial Group, are channeling significant investments into artificial intelligence (AI) and fintech to secure a competitive advantage. For instance, Hana Financial Group's commitment is evident in initiatives like its 'My Branch' virtual service and strategic AI partnerships, reflecting a broader industry trend.

This digital arms race means rivals are continuously launching innovative digital platforms, advanced mobile applications, and AI-powered services. This dynamic environment compels all players to innovate at a rapid pace, ensuring they remain at the forefront of technological advancements and customer experience. The sector saw a substantial increase in digital banking adoption in 2023, with mobile banking transactions reaching record highs, underscoring the urgency of these digital investments.

Competitive rivalry in the financial sector, including for Hana Financial Group, is intensifying as firms move beyond traditional banking. They are actively expanding into a wide array of financial products, offering specialized services for diverse customer groups. For instance, Hana Financial Group's strategic push into non-banking mergers and acquisitions, alongside tailored offerings like 'Hana The Next' designed for senior citizens, highlights this trend of diversifying revenue streams and targeting specific market niches.

This broad diversification means that competitors are not just vying for deposits and loans but also for market share in areas like wealth management, insurance, and digital financial services. Many rivals are implementing comparable strategies, resulting in a complex and often overlapping product landscape. This intense competition compels companies to continuously innovate and differentiate their offerings to attract and retain customers across various financial needs.

Impact of Economic Conditions and Regulatory Environment

The competitive rivalry within South Korea's financial sector is significantly shaped by the prevailing economic conditions. For instance, in 2023, South Korea's economic growth was projected to be around 1.4%, a slowdown from previous years, impacting loan demand and potentially increasing non-performing loans. Fluctuations in interest rates, such as the Bank of Korea's base rate adjustments, directly affect lending margins and the cost of capital for all players, intensifying competition on pricing and product offerings.

Regulatory shifts also play a crucial role in defining the competitive landscape for Hana Financial Group and its rivals. For example, initiatives aimed at promoting financial inclusion might lower barriers to entry for new fintech firms, while stricter capital requirements, like Basel III implementation, can necessitate consolidation or strategic adjustments to maintain competitiveness. These external forces can either exacerbate existing rivalries or create new competitive dynamics, forcing established institutions to adapt their strategies.

The interplay of economic and regulatory factors creates a challenging environment for financial institutions. Consider these points:

- Economic Slowdown: South Korea's GDP growth, which was around 1.1% in 2023, directly impacts consumer and corporate spending, influencing demand for financial services and increasing the risk of loan defaults.

- Interest Rate Volatility: The Bank of Korea's monetary policy decisions, including interest rate hikes to combat inflation, can squeeze net interest margins for banks and alter the attractiveness of different financial products.

- Regulatory Landscape: Evolving regulations, such as those concerning digital finance or consumer protection, can create compliance burdens and necessitate investment in new technologies, thereby influencing competitive positioning.

- Non-Performing Loans: An increase in non-performing loans, a concern highlighted in financial sector reports throughout 2023 and early 2024, forces banks to allocate more resources to provisioning and collections, diverting capital from growth initiatives and intensifying competition for healthier loan portfolios.

Focus on Shareholder Value and ESG Initiatives

The competitive landscape for financial groups like Hana Financial Group is increasingly defined by a dual focus on delivering strong shareholder returns and demonstrating robust ESG performance. In 2024, Hana Financial Group reported record profits, underscoring its ability to generate value for its investors, further bolstered by its commitment to share buyback programs. This emphasis on shareholder value is not unique; rivals are actively engaging in similar strategies.

This intense competition extends to ESG initiatives, which have become a critical differentiator. Many financial institutions are now implementing comprehensive 'value-up' programs and publishing detailed sustainability reports. This signals a strategic shift where environmental, social, and governance factors are as crucial as traditional financial metrics in attracting both capital and customers.

- Shareholder Value Focus: Hana Financial Group's record profits in 2024 and ongoing share buyback plans highlight a direct effort to enhance shareholder returns.

- ESG as a Competitive Arena: Financial groups are increasingly judged on their Environmental, Social, and Governance performance, making it a key battleground for investor and customer loyalty.

- Industry-Wide Trend: Competitors are also adopting 'value-up' programs and sustainability reporting, mirroring Hana Financial Group's strategic direction in prioritizing ESG.

Hana Financial Group operates in a highly competitive South Korean market, facing strong rivals like KB Financial Group, Shinhan Financial Group, and Woori Financial Group, which collectively held over 70% of banking assets in 2023. This rivalry is amplified by a digital transformation race, with all major players investing heavily in AI and fintech, as evidenced by Hana Financial Group's 'My Branch' virtual service and AI partnerships. The intensity of competition is further fueled by a broad diversification of offerings beyond traditional banking into wealth management, insurance, and digital services, forcing constant innovation to capture market share across various financial needs.

| Competitor | Market Share (Banking Assets, 2023 est.) | Key Digital Initiative Example |

|---|---|---|

| KB Financial Group | ~25% | KB Star Banking App Enhancements |

| Shinhan Financial Group | ~23% | SOL (Shinhan Online) Platform Integration |

| Woori Financial Group | ~22% | Digital Transformation Acceleration Program |

| Hana Financial Group | ~18% | 'My Branch' Virtual Service, AI Partnerships |

SSubstitutes Threaten

The rapid expansion of fintech platforms in South Korea, bolstered by supportive government policies, poses a substantial threat of substitution for Hana Financial Group. For instance, Toss, a leading fintech player, has captured significant market share by offering a broad suite of financial services, from peer-to-peer payments to investment products, directly challenging conventional banking offerings. In 2023, Toss reported over 20 million cumulative users, demonstrating its strong appeal and reach.

Furthermore, the increasing prevalence of digital wallets and contactless payment solutions is diminishing the necessity for traditional banking channels for everyday transactions. This shift, driven by convenience and user experience, means customers can increasingly bypass traditional banks for many of their financial needs, impacting transaction volumes and customer loyalty.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat by offering alternative funding channels. These platforms often cater to individuals and small businesses overlooked by traditional banking, providing more accessible and flexible loan terms. For instance, the global P2P lending market was valued at approximately $54.6 billion in 2023 and is projected to grow substantially, directly impacting Hana Financial Group's core lending business.

The rise of direct investment in capital markets presents a significant threat to Hana Financial Group. Increased financial literacy and the proliferation of user-friendly online brokerage platforms, such as Robinhood and Charles Schwab, empower individuals and institutions to bypass traditional intermediaries. This trend is particularly evident in 2024, with a notable surge in retail investor participation in stock markets.

Younger demographics, in particular, are increasingly opting for direct engagement with foreign equities and emerging virtual assets, further diminishing reliance on established financial institutions for certain investment activities. For instance, global fintech adoption rates continue to climb, with a significant portion of this growth attributed to direct investment tools.

Big Tech Companies Entering Financial Services

Big Tech companies like Naver and Kakao are a significant threat of substitutes for Hana Financial Group. These tech giants, boasting vast user bases and advanced data analytics, are increasingly offering financial services such as payments, lending, and investment advice. For instance, Naver Pay, launched in 2015, had processed over 100 trillion KRW in transactions by early 2024, directly competing with Hana Bank's payment services.

Their ability to integrate financial solutions seamlessly into their existing ecosystems presents a formidable challenge. By leveraging established customer relationships, they can offer bundled services that are highly convenient for users, potentially drawing customers away from traditional financial institutions. This integration model is a key differentiator, allowing them to capture market share rapidly.

While Hana Financial Group collaborates with some of these platforms, the independent financial service offerings from Naver and Kakao represent a direct substitutional threat. These tech companies' agility and customer-centric digital strategies can disrupt traditional banking models, forcing established players to innovate at an accelerated pace to remain competitive.

Key aspects of this threat include:

- User Base Leverage: Naver and Kakao have millions of active users, providing a ready-made customer base for their financial products.

- Data Analytics Capabilities: Their extensive data allows for personalized financial offerings and more accurate risk assessment, potentially outperforming traditional methods.

- Seamless Integration: Financial services are embedded within popular platforms, offering unparalleled convenience and reducing the need for separate banking apps.

- Competitive Pricing: Tech companies often enter markets with aggressive pricing strategies or fee structures, attracting price-sensitive consumers.

Internal Corporate Finance Capabilities

Large corporations increasingly possess the financial acumen and resources to develop sophisticated internal finance departments. This capability can directly substitute for many services traditionally offered by investment banks and corporate banking divisions, such as treasury management, capital raising, and complex risk management. For instance, by 2024, many Fortune 500 companies have dedicated treasury teams managing billions in cash and investments, reducing their need for external treasury services.

The internalization of these functions allows well-resourced multinational corporations to maintain greater control and potentially reduce costs associated with external financial advisory. This trend is evident as companies invest heavily in financial technology and talent to build out their in-house expertise.

- Internal Treasury Management: Companies like Apple manage vast cash reserves internally, reducing reliance on external treasury services.

- In-house Capital Raising: Large corporations often bypass external advisors for debt issuance, directly accessing capital markets.

- Risk Management Sophistication: Internal teams now handle complex hedging strategies, substituting for external risk management consultants.

The threat of substitutes for Hana Financial Group is significant, driven by agile fintech platforms and Big Tech companies encroaching on traditional banking services. These substitutes offer convenience, competitive pricing, and integrated user experiences, compelling Hana to continually innovate. For example, Naver Pay's transaction volume exceeding 100 trillion KRW by early 2024 directly challenges Hana Bank's payment services.

Fintech platforms like Toss, with over 20 million users in 2023, provide a wide array of financial products, from payments to investments, directly competing with Hana's offerings. Similarly, the growth of P2P lending, a market valued at approximately $54.6 billion in 2023, offers alternative funding channels that bypass traditional banking. The increasing trend of direct investment in capital markets, particularly among younger demographics, further diminishes reliance on established financial institutions.

Large corporations are also increasingly substituting external financial services with in-house capabilities, particularly in treasury management and capital raising. This trend reduces the demand for corporate banking services, forcing institutions like Hana to adapt their value propositions.

Entrants Threaten

South Korea's government is actively fostering fintech, significantly reducing traditional barriers to entry. Initiatives like regulatory sandboxes and direct investment in startups by bodies such as the Financial Services Commission (FSC) create a more welcoming environment for new financial service providers. For instance, the FSC's push for an open interbank payment network, operational since 2023, simplifies integration for digital finance newcomers.

The rise of internet-only and digital banks presents a significant threat of new entrants for established financial groups like Hana Financial Group. These digital-first entities, unburdened by extensive physical branch networks, can operate with substantially lower overheads. For instance, by mid-2024, several neobanks globally reported achieving profitability with minimal physical footprints, showcasing their cost-efficiency advantage.

These agile newcomers often target underserved or digitally-savvy customer segments with innovative, user-friendly products and highly competitive pricing. Their ability to quickly adapt to market changes and leverage technology for streamlined customer onboarding and service delivery directly challenges the traditional operating models of legacy institutions. This digital disruption can erode market share if established players are slow to modernize their own offerings.

New technologies like AI and blockchain are significantly lowering barriers to entry in financial services. These innovations reduce the reliance on extensive physical branches and large workforces, making it cheaper for new players to offer services. For instance, robo-advisors powered by AI can manage portfolios with minimal human oversight, and blockchain can streamline asset management processes, requiring less upfront capital compared to traditional banking models.

Startups are capitalizing on this by launching innovative products with lower overheads. Consider the rise of digital-only banks and payment platforms that operate entirely online, bypassing the substantial costs associated with brick-and-mortar operations. This trend is evident globally, with fintechs attracting significant venture capital funding in 2024, indicating a strong influx of new, tech-enabled competitors.

Hana Financial Group recognizes this threat and is proactively investing in these advanced technologies. Their strategic focus includes developing AI-driven customer service solutions and exploring blockchain applications for enhanced security and efficiency in transactions. This forward-looking approach aims to not only mitigate the threat of new entrants but also to leverage these advancements for competitive advantage.

Niche Market Entry and Specialization

New entrants can indeed sidestep direct confrontation with established giants like Hana Financial Group by concentrating on specific, underserved segments of the financial market. Think about specialized digital lenders or wealth management applications designed for particular age groups or income brackets. These entities can gain a foothold without immediately needing the extensive regulatory approvals required for a full banking license.

This strategy of 'unbundling' financial services allows for a more gradual and less capital-intensive entry into the broader financial landscape. For example, by focusing solely on a niche, a new player might attract a dedicated customer base and build expertise before considering expansion. In 2024, the digital lending sector, particularly for small businesses and specific consumer needs, saw significant growth, with fintechs often leading the charge in these specialized areas.

- Focus on Underserved Niches: New entrants can target specific customer segments or product offerings overlooked by larger institutions.

- Incremental Market Entry: Specialization allows for a phased approach, building expertise and customer loyalty before broader expansion.

- Fintech Innovation: Digital platforms and specialized apps are increasingly unbundling traditional financial services, creating new entry points.

- Regulatory Advantages: Focusing on specific services can sometimes bypass the stringent licensing requirements of full-service banking.

Brand and Trust Establishment

While technological barriers to entry in financial services are decreasing, the significant challenge for new players lies in building brand trust and navigating stringent regulatory landscapes. Financial services are inherently built on trust, a commodity that new entrants must painstakingly cultivate over time. For instance, in 2024, the global financial services sector continued to emphasize cybersecurity and data privacy, making regulatory compliance a paramount concern for any new participant. This trust deficit can be a substantial deterrent, even with innovative offerings.

However, the landscape is evolving. New entrants can leverage innovative customer acquisition strategies and superior digital user experiences to bridge the trust gap more rapidly. By 2024, fintech companies were increasingly demonstrating the ability to attract customers with user-friendly platforms and personalized services, sometimes outperforming established institutions in customer satisfaction metrics. This allows them to gain market share swiftly, despite not having decades of brand recognition.

- Brand Trust: A critical barrier, as financial services depend heavily on customer confidence, which takes years to build.

- Regulatory Hurdles: New entrants must comply with complex and evolving financial regulations, adding significant cost and time.

- Digital Innovation: Fintechs can accelerate trust-building through advanced technology and seamless user experiences.

- Market Share Acquisition: Despite trust challenges, innovative approaches allow new players to quickly capture market share.

The threat of new entrants for Hana Financial Group is amplified by government support for fintech and the rise of digital-only banks. These new players, unburdened by legacy systems and physical infrastructure, can operate with lower costs and offer innovative, user-friendly products. For example, by mid-2024, several neobanks globally demonstrated profitability with minimal physical footprints, highlighting their cost advantage.

New technologies like AI and blockchain are further reducing entry barriers, enabling startups to offer services with less capital. Robo-advisors, for instance, manage portfolios with minimal human oversight, and blockchain streamlines processes. This allows agile newcomers to target specific market niches, such as digital lending for small businesses, which saw significant growth in 2024.

While technological barriers are falling, building brand trust and navigating complex regulations remain significant challenges for new entrants. However, innovative customer acquisition strategies and superior digital experiences, as seen with fintechs outperforming established players in customer satisfaction by 2024, can help bridge this gap and rapidly capture market share.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hana Financial Group leverages comprehensive data from financial statements, investor relations reports, and industry-specific market research to assess competitive intensity.

We incorporate insights from regulatory filings, economic databases, and competitor disclosures to thoroughly evaluate the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.