Halkbank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halkbank Bundle

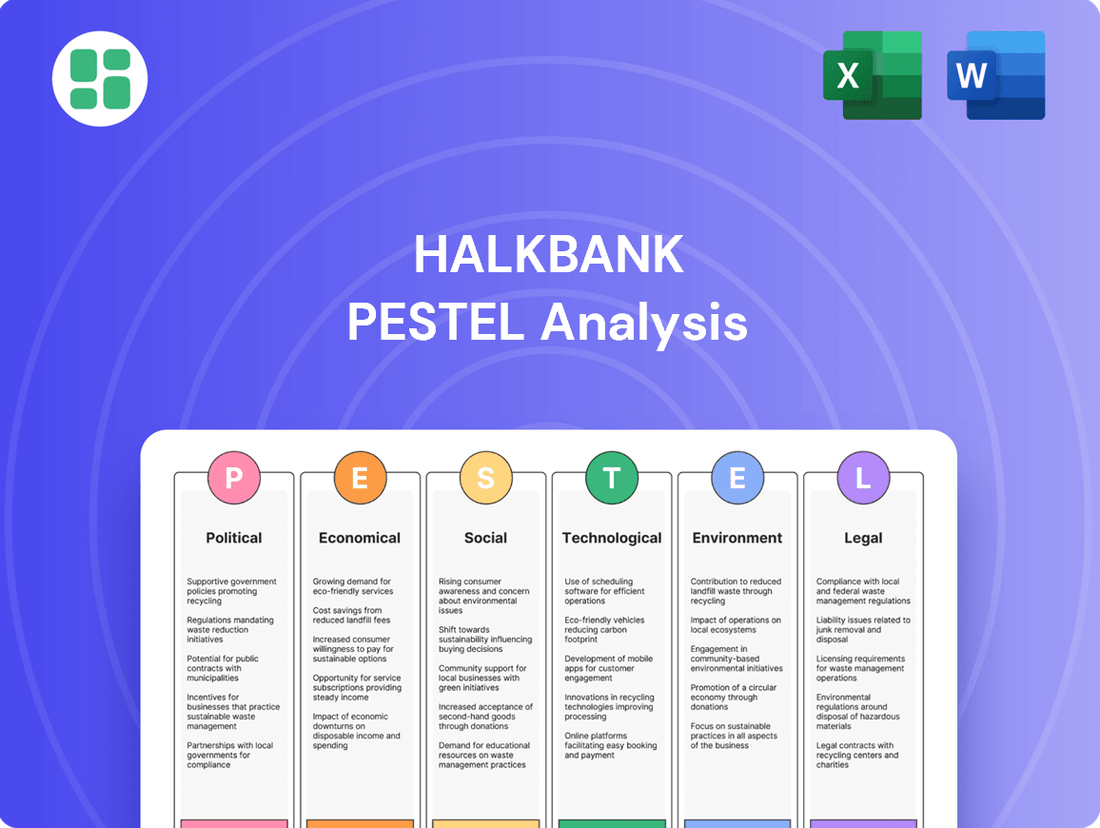

Understand how political shifts, economic volatility, and technological advancements are profoundly impacting Halkbank's operations and future growth. Our expertly crafted PESTLE analysis dives deep into these critical external factors, offering actionable intelligence. Gain a competitive edge by leveraging these insights to refine your strategy. Download the full version now and unlock a comprehensive understanding of Halkbank's external landscape.

Political factors

As a state-controlled entity, Halkbank's strategic direction and operational priorities are heavily shaped by the Turkish government. This government influence extends to its mandate to foster economic growth and support key industries, directly impacting its lending practices and the risks it undertakes.

For instance, in 2023, the Turkish government continued to emphasize support for small and medium-sized enterprises (SMEs) as a driver of employment and economic stability. This policy directive would likely translate into Halkbank offering favorable credit terms and tailored financial products to this sector, potentially influencing its loan portfolio composition.

Furthermore, government initiatives aimed at social development, such as promoting family businesses or specific demographic support, can also steer Halkbank's product development and marketing efforts. The bank's commitment to these government-aligned objectives is a critical political factor influencing its market positioning and overall business strategy.

Halkbank continues to navigate significant geopolitical risks, most notably its ongoing legal challenges in the United States concerning alleged sanctions evasion. The bank's appeal process in these high-profile cases is still underway, with potential outcomes carrying substantial financial penalties and reputational damage.

The broader international relations between Turkey and key global players directly influence Halkbank's operations. Strained diplomatic ties can impede its ability to conduct international banking services and engage in crucial trade finance activities, impacting its global reach and profitability.

The Turkish government's regulatory approach, overseen by the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT), significantly shapes Halkbank's operational landscape. While the CBRT has maintained a tightening monetary stance, aiming for price stability, political considerations can introduce volatility through changes in macroprudential policies and lending restrictions. These interventions directly impact Halkbank's ability to grow its loan portfolio and affect its overall profitability.

Government's Economic Policies

Halkbank's strategic direction is heavily influenced by the Turkish government's economic policies, particularly its ongoing efforts to curb inflation and bolster the stability of the Turkish Lira. For instance, the Central Bank of the Republic of Turkey (CBRT) maintained its policy rate at 45% as of its March 2024 meeting, signaling a commitment to price stability, which directly impacts Halkbank's lending and deposit rates.

The bank actively participates in implementing government-backed support packages designed for specific economic sectors, such as tradespeople and small to medium-sized enterprises (SMEs). This involvement underscores Halkbank's alignment with national economic objectives, aiming to stimulate growth and employment. In 2023, Turkey's GDP growth was reported at 4.5%, indicating a generally positive economic environment that supports such initiatives.

Furthermore, shifts in fiscal policy and updated economic growth forecasts by institutions like the International Monetary Fund (IMF) or the Turkish government itself directly shape Halkbank's operational targets and financial planning. For example, if the government announces new tax incentives or increased public spending, Halkbank would adjust its lending strategies and risk assessments accordingly to capitalize on or mitigate these changes.

- Inflation Control: Turkey's inflation rate, while elevated, has seen efforts to stabilize, with projections suggesting a gradual decrease in the coming years, impacting Halkbank's interest income and expense.

- Lira Stability: Government measures to stabilize the Turkish Lira are crucial for Halkbank's foreign exchange operations and its ability to manage international liabilities.

- Fiscal Policy Impact: Changes in government spending, taxation, and budget deficits directly influence the overall economic climate and, consequently, Halkbank's loan demand and asset quality.

- Support Packages: The effectiveness and scale of government support programs for businesses and individuals will determine the volume and risk profile of Halkbank's targeted lending activities.

Sanctions and International Legal Cases

The ongoing legal proceedings against Halkbank in the United States, stemming from allegations of evading Iran sanctions, remain a significant political and legal hurdle. Recent rulings have stripped the bank of sovereign immunity, paving the way for continued prosecution and potential severe financial penalties. This protracted legal battle directly impacts Halkbank's international standing and operational capacity.

The US Justice Department's pursuit of Halkbank highlights the extraterritorial reach of American sanctions enforcement. A conviction could lead to fines potentially reaching billions of dollars, impacting the bank's capital adequacy and profitability. This legal uncertainty also deters potential international partnerships and investments.

- US Sanctions Enforcement: The US Department of Justice has actively pursued cases against financial institutions accused of violating Iran sanctions, demonstrating a firm stance on international legal compliance.

- Sovereign Immunity Ruling: Court decisions denying sovereign immunity to Halkbank mean the bank can be prosecuted in US courts, increasing the risk of substantial financial penalties.

- Reputational Damage: The prolonged legal battle and associated allegations significantly damage Halkbank's global reputation, affecting customer trust and business relationships.

- Financial Penalties: Potential fines could range from hundreds of millions to billions of dollars, depending on the scale of the alleged violations, posing a considerable financial risk.

Halkbank's operations are intrinsically linked to the Turkish government's economic agenda and regulatory framework. The government's commitment to controlling inflation, as evidenced by the Central Bank's 45% policy rate in March 2024, directly influences Halkbank's interest income and lending strategies. The bank's role in implementing government-backed support for SMEs and tradespeople, aligning with Turkey's 4.5% GDP growth in 2023, further solidifies this connection.

The ongoing legal challenges in the United States concerning alleged sanctions evasion present a significant political risk. The denial of sovereign immunity in these cases opens Halkbank to substantial financial penalties, potentially in the billions of dollars, and severe reputational damage. This situation underscores the impact of international relations and US sanctions enforcement on the bank's global operations and financial stability.

| Political Factor | Description | Impact on Halkbank | Relevant Data/Context (2023-2024) |

|---|---|---|---|

| Government Economic Policy | Turkish government's focus on inflation control and economic growth. | Influences lending rates, credit availability, and support programs. | CBRT policy rate at 45% (March 2024); Turkey's GDP growth at 4.5% (2023). |

| US Sanctions Enforcement | US legal actions against Halkbank for alleged sanctions evasion. | Risk of massive fines, operational restrictions, and reputational damage. | Denial of sovereign immunity; potential fines in billions of dollars. |

| Regulatory Environment | Oversight by BRSA and CBRT, including monetary policy decisions. | Shapes lending practices, capital requirements, and profitability. | Tightening monetary stance by CBRT to combat inflation. |

What is included in the product

This Halkbank PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of the external forces shaping its strategic landscape.

This Halkbank PESTLE analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

Turkey's inflation remains a significant challenge, with the Central Bank of the Republic of Turkey (CBRT) actively pursuing a tight monetary policy to curb price increases. This environment directly impacts Halkbank, influencing its funding costs and the rates it can charge for loans, which in turn affects its net interest margins.

As of early 2024, Turkey's annual inflation rate hovered around 60%, prompting the CBRT to maintain its policy rate at 45%. This high-interest rate scenario presents both opportunities and risks for Halkbank's lending and deposit operations.

Projections suggest a potential gradual easing of policy rates towards the end of 2025. This anticipated shift could positively influence Halkbank's profitability by lowering its cost of funds and potentially stimulating credit growth, though the pace and extent of this decline remain key variables.

The Turkish Lira's persistent volatility presents a substantial economic hurdle for Halkbank. This fluctuation directly impacts the bank's balance sheet, particularly its holdings of assets and liabilities denominated in foreign currencies, and consequently, its overall financial health. For instance, in early 2024, the Turkish Lira experienced significant depreciation against major currencies like the US Dollar and Euro, widening the gap between foreign currency assets and liabilities for Turkish banks.

The Central Bank of the Republic of Turkey (CBRT) is actively pursuing strategies to bolster the Lira and mitigate exchange rate risks. A key initiative involves encouraging the de-dollarization of deposits, aiming to increase the proportion of Turkish Lira deposits within the banking system. This policy directly influences Halkbank's deposit base, as seen in the gradual shift towards Lira-denominated savings observed throughout 2023 and into early 2024, as the bank adapts to regulatory incentives.

Turkey's economic growth is projected to moderate in 2024 and 2025 as the country implements macroeconomic stabilization measures and maintains tighter financial conditions. This anticipated slowdown could temper loan demand from both individuals and businesses, potentially impacting Halkbank's ability to expand its loan book.

Despite this moderating growth, Halkbank's strategic emphasis on supporting Small and Medium-sized Enterprises (SMEs) and fostering overall economic development remains a key aspect of its operations. This focus aligns with national objectives for sustainable growth, even amidst a period of adjustment.

Monetary Policy of the Central Bank of Turkey

The Central Bank of the Republic of Turkey's (CBRT) monetary policy significantly impacts Halkbank's operations. Decisions on policy rates, such as the one-week repo rate, directly influence the cost of funding for the bank and the rates it can charge on loans. For instance, the CBRT maintained its policy rate at 45% through early 2024, a stance that affects Halkbank's net interest margin and overall profitability.

Macroprudential measures also play a crucial role. The CBRT's efforts to manage liquidity and enhance monetary transmission, like the gradual phasing out of FX-protected deposit schemes and adjustments to reserve requirements, directly shape Halkbank's lending capacity and deposit-gathering strategies. These measures aim to stabilize the financial system and can lead to shifts in deposit preferences and credit availability.

Key policy actions and their implications include:

- Policy Rate: The CBRT's benchmark rate, held at 45% in early 2024, dictates borrowing costs for banks like Halkbank.

- Reserve Requirements: Changes in reserve ratios affect the amount of funds Halkbank must hold, impacting its lending potential.

- FX-Protected Deposits: The CBRT's policy shifts away from these instruments influence Halkbank's deposit mix and foreign exchange exposure management.

- Liquidity Management: CBRT operations to manage overall market liquidity directly affect Halkbank's funding costs and availability.

Credit Risk and Non-Performing Loans (NPLs)

The Turkish banking sector, while generally robust, faces increasing challenges from non-performing loans (NPLs). This trend is particularly pronounced in retail areas such as consumer credit cards, directly impacting Halkbank's asset quality. For instance, as of the first quarter of 2024, the NPL ratio for the Turkish banking sector stood at 1.6%, a slight increase from the previous year, highlighting the growing concern.

Halkbank needs to proactively manage its credit risk exposure. Adapting to evolving regulatory frameworks, including potential adjustments to risk weights and lending caps, will be crucial for sustaining a healthy loan portfolio. The bank's strategy must incorporate rigorous credit assessment and proactive NPL management to mitigate these risks effectively.

- Accelerating NPLs: Retail segments, especially credit cards, are showing an upward trend in defaults.

- Asset Quality Impact: Rising NPLs directly threaten the quality of Halkbank's loan book.

- Regulatory Adaptation: The bank must adjust to new rules on risk weights and lending limits.

- Portfolio Health: Proactive credit risk management is key to maintaining a sound loan portfolio.

Turkey's economic landscape in 2024 and 2025 is characterized by a persistent battle against inflation, with the CBRT maintaining a tight monetary stance. This environment, marked by a policy rate of 45% in early 2024, directly influences Halkbank's funding costs and lending rates, impacting its net interest margins.

While projections suggest a potential easing of rates by late 2025, the Turkish Lira's volatility remains a significant economic challenge. The CBRT's de-dollarization efforts aim to stabilize the currency, influencing Halkbank's deposit base and foreign currency exposure management.

Economic growth is expected to moderate in 2024-2025 due to stabilization measures, potentially tempering loan demand. However, Halkbank's strategic focus on supporting SMEs and economic development aligns with national growth objectives amidst this adjustment period.

| Economic Factor | Key Data (Early 2024 / Projections) | Implication for Halkbank |

|---|---|---|

| Inflation Rate | Around 60% (annual) | Increases funding costs, impacts net interest margins. |

| CBRT Policy Rate | 45% | Dictates borrowing costs and influences lending rates. |

| Turkish Lira Volatility | Significant depreciation against USD/EUR | Affects foreign currency asset/liability balance, financial health. |

| Economic Growth Projection | Moderating in 2024-2025 | Potential tempering of loan demand. |

| Non-Performing Loans (NPLs) | 1.6% (sector average, Q1 2024) | Threatens asset quality, requires proactive risk management. |

Preview the Actual Deliverable

Halkbank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Halkbank PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. It's designed to offer actionable insights for strategic planning.

Sociological factors

Turkey's demographic landscape, characterized by a significant youth population and evolving family structures, directly shapes the demand for a wide array of financial products. As of early 2024, Turkey's median age remains relatively young, around 33 years, indicating a substantial segment of the population entering their prime earning and borrowing years. This youthful demographic, coupled with changing household needs, fuels the demand for accessible credit, savings products, and investment vehicles.

Halkbank strategically aligns its offerings with these societal shifts. Initiatives like supporting tradespeople, women, and youth entrepreneurship directly address identified demographic segments with specific financial needs. The bank's 'Halkbank is My Family' program, for instance, aims to foster financial inclusion by providing tailored support, recognizing the diverse financial realities within Turkish households.

Consumer behavior is increasingly shifting towards digital banking, with a significant portion of transactions now conducted online or via mobile apps. This trend, evident across many markets, requires banks like Halkbank to prioritize investment in robust technological infrastructure and intuitive user interfaces to meet evolving customer expectations for convenience and accessibility.

In 2024, a substantial percentage of banking customers, particularly younger demographics and small to medium-sized enterprises (SMEs), prefer digital channels for everyday banking needs. Halkbank's ability to offer seamless mobile banking solutions and digital onboarding processes directly impacts its competitiveness and its capacity to serve a broad customer base effectively.

Financial literacy is a key sociological factor influencing Halkbank's operations in Turkey. Improving these levels directly impacts consumer demand for complex financial instruments and encourages more responsible credit utilization. For instance, in 2023, the Turkish government reported that approximately 60% of the adult population had low financial literacy, highlighting a significant opportunity for growth.

Halkbank actively engages in initiatives to boost financial education. Their program, 'Three Coin Banks,' specifically targets children to instill early habits of saving and financial management. Such efforts are crucial for cultivating a future customer base that is more informed and adept at navigating financial products, potentially leading to increased engagement with Halkbank's offerings.

Public Trust in State-Owned Financial Institutions

Public trust in Halkbank, as a state-owned entity, is directly tied to the perceived stability of the Turkish government and its economic policies. Recent economic performance, including inflation rates and GDP growth, significantly shapes public confidence in state-backed financial institutions. For instance, while Turkey's GDP grew by an estimated 4.5% in 2024, persistent inflation remains a concern for depositors.

Halkbank's role in national development initiatives, such as supporting small and medium-sized enterprises (SMEs), can bolster its image and attract a broader customer base. Transparency in operations and a clear commitment to social welfare programs are vital for nurturing and maintaining this trust, especially in attracting and retaining deposits amidst economic fluctuations.

Key factors influencing public trust include:

- Government Stability: Perceptions of political stability directly impact confidence in state-owned banks.

- Economic Performance: Inflation and GDP growth figures influence deposit decisions.

- Social Welfare Contributions: Halkbank's involvement in national development and social programs can enhance its reputation.

Labor Market Trends and Talent Acquisition

The availability of skilled talent in Turkey's banking sector is a critical factor for Halkbank. In 2024, reports indicated a growing demand for digital banking expertise, with a significant portion of new hires needing skills in areas like data analytics and cybersecurity. This trend highlights the need for continuous investment in employee training and development to ensure Halkbank can attract and retain top talent in a competitive market.

Broader labor market dynamics in Turkey also influence Halkbank's human capital strategy. As of early 2025, the overall unemployment rate remained a key consideration, though specific sectors like technology and finance continued to experience shortages of highly specialized professionals. Adapting to these shifting workforce dynamics, including embracing remote work options and fostering a culture of lifelong learning, is essential for maintaining operational efficiency and driving innovation within the bank.

- Skilled Talent Demand: Growing need for digital banking skills, including data analytics and cybersecurity professionals, in the Turkish banking sector.

- Talent Acquisition Challenges: Competition for specialized IT and finance roles, potentially impacting Halkbank's ability to attract experienced candidates.

- Workforce Dynamics: Adaptability to changing work models and the importance of continuous learning for employee retention and innovation.

- Human Capital Investment: Strategic focus on training and development to bridge skill gaps and enhance employee capabilities.

Societal attitudes towards financial institutions and wealth management are evolving in Turkey, influencing customer engagement with banks like Halkbank. A growing emphasis on corporate social responsibility and ethical banking practices is becoming more prominent among consumers, particularly younger generations. This means Halkbank's commitment to community development and sustainable practices directly impacts its public perception and customer loyalty.

The bank's initiatives, such as supporting local economies and promoting financial inclusion, resonate with these changing societal values. For example, Halkbank's continued focus on financing SMEs, a sector employing a significant portion of Turkey's workforce, aligns with a societal desire for economic stability and growth.

Consumer trust in state-owned banks, like Halkbank, is closely linked to perceptions of economic stability and government policy. As of early 2025, while Turkey's economy showed resilience, ongoing inflation concerns continue to shape consumer confidence in financial institutions. Halkbank's transparent communication regarding its financial health and its role in supporting national economic objectives is crucial for maintaining and enhancing this trust.

Technological factors

Halkbank is actively embracing digital transformation, a crucial technological factor shaping its future. This involves a strong push towards mobile banking, with a reported 5.7 million active mobile banking users as of the first quarter of 2024, demonstrating a significant shift in customer interaction. The bank is investing heavily in digital payment systems and enhancing its online platforms to provide a seamless and efficient customer experience.

As financial services increasingly move online, Halkbank faces growing cybersecurity threats and the imperative to protect sensitive customer data. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

Robust cybersecurity measures and compliance with data privacy regulations, such as GDPR and similar local mandates, are critical. These are essential for maintaining customer trust and preventing substantial financial losses due to breaches.

The Turkish fintech sector is experiencing significant growth, with projections indicating a continued upward trend through 2024 and into 2025. This surge in fintech innovation directly impacts traditional institutions like Halkbank, presenting a dual challenge of increased competition and avenues for strategic partnerships. For instance, the digital payments market, a key area for fintech disruption, saw transaction volumes rise by an estimated 30% year-over-year in late 2023, a trend expected to accelerate.

To remain competitive, Halkbank must actively embrace digital transformation. This involves not only enhancing its existing digital offerings but also exploring collaborations with agile fintech firms to introduce novel services, particularly in areas like personalized investment platforms and seamless payment solutions. By the end of 2024, it's anticipated that over 60% of banking customers in Turkey will prefer digital channels for most transactions, underscoring the urgency for traditional banks to adapt.

Use of AI and Big Data Analytics

Halkbank's strategic adoption of artificial intelligence (AI) and big data analytics is pivotal for gaining deeper customer insights and tailoring financial offerings. This technological integration allows for more precise risk assessments and streamlined operational workflows, ultimately fostering more informed and efficient decision-making across the organization.

By leveraging AI and big data, Halkbank can anticipate market trends and customer needs with greater accuracy. For instance, advanced analytics can identify patterns in transaction data to detect fraudulent activities more effectively, thereby strengthening security measures. This proactive approach not only minimizes financial losses but also enhances customer trust and loyalty.

The bank's investment in these advanced technologies is expected to yield significant operational efficiencies. For example, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human resources for more complex tasks. By the end of 2024, it's projected that AI adoption in the banking sector will lead to a 20-30% reduction in operational costs for tasks that can be automated.

Key benefits include:

- Enhanced Customer Understanding: Analyzing vast datasets to personalize product recommendations and improve customer engagement.

- Improved Risk Management: Utilizing AI for more accurate credit scoring and fraud detection, potentially reducing non-performing loans by up to 15% in targeted portfolios.

- Operational Efficiency: Automating routine tasks and optimizing internal processes, leading to faster service delivery and cost savings.

- Data-Driven Decision Making: Empowering management with real-time insights for strategic planning and market responsiveness.

Infrastructure Development for Digital Services

The ongoing development of Turkey's digital infrastructure is paramount for Halkbank's ability to offer and expand its digital services. Reliable high-speed internet, widespread mobile network coverage, and secure data centers are essential building blocks for a thriving digital banking environment. As of early 2024, Turkey has seen significant investments in fiber optic networks, with the government aiming to increase fiber penetration significantly by 2025.

These advancements directly impact the user experience and operational efficiency of digital banking platforms. For instance, the expansion of 5G networks, which is progressing across major Turkish cities, will enable faster transaction processing and richer digital service offerings. Furthermore, the government's digital transformation initiatives, including efforts to enhance cybersecurity and data privacy, provide a more secure foundation for Halkbank's digital operations.

- Increased Fiber Optic Penetration: Turkey's target to expand fiber optic infrastructure by 2025 is key to supporting higher bandwidth demands for digital banking.

- Mobile Network Advancement: The rollout of 5G technology in urban centers is enhancing the speed and reliability of mobile banking services.

- Government Digitalization Push: Initiatives focused on cybersecurity and data protection bolster the trust and safety of Halkbank's digital offerings.

- Data Center Capacity Growth: Investments in modern, secure data centers are crucial for the scalability and resilience of digital banking operations.

Halkbank is heavily invested in digital transformation, evidenced by its 5.7 million active mobile banking users in Q1 2024 and significant investments in online platforms and digital payments. This focus is crucial as the Turkish fintech sector grows, projecting continued upward trends through 2024-2025, with digital payments transaction volumes up an estimated 30% year-over-year in late 2023.

The bank's strategic use of AI and big data analytics is enhancing customer insights and operational efficiency, with AI adoption in banking expected to reduce operational costs by 20-30% for automated tasks by year-end 2024. Furthermore, Turkey's expanding digital infrastructure, including fiber optic network growth and 5G rollout, is critical for supporting Halkbank's advanced digital service offerings.

| Technological Factor | Impact on Halkbank | Supporting Data/Trend |

|---|---|---|

| Digital Transformation | Enhanced customer engagement and operational efficiency | 5.7 million active mobile banking users (Q1 2024) |

| Fintech Growth | Increased competition and partnership opportunities | Digital payments market up ~30% YoY (late 2023) |

| AI & Big Data | Improved customer insights, risk management, and cost savings | AI adoption to reduce operational costs by 20-30% (2024 projection) |

| Digital Infrastructure | Enables advanced digital services and user experience | Turkey's fiber optic expansion and 5G rollout |

Legal factors

Halkbank operates under the strict oversight of Turkey's Banking Regulation and Supervision Agency (BRSA). This agency mandates adherence to robust capital adequacy ratios, with Turkish banks, including Halkbank, needing to maintain a minimum capital adequacy ratio of 12% as per Basel III standards, a figure that has remained consistent through 2024. The BRSA's purview covers everything from licensing and credit operations to corporate governance, ensuring the stability and integrity of the banking sector.

Non-compliance with BRSA regulations can lead to severe consequences for Halkbank. The agency possesses the power to levy substantial financial penalties, which can significantly impact profitability. For instance, in 2023, the BRSA imposed fines totaling hundreds of millions of Turkish Lira on various financial institutions for regulatory breaches, highlighting the financial risks associated with non-adherence.

Halkbank's operations are heavily influenced by anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. These laws are crucial for preventing illicit financial flows and are particularly relevant given the bank's historical legal entanglements concerning sanctions evasion.

Maintaining strong compliance with both national and international AML/CTF standards is paramount for Halkbank. This involves implementing rigorous internal controls and reporting systems to detect and deter financial crimes, thereby reducing legal and reputational exposure.

For instance, in 2023, global AML fines reached record highs, underscoring the increasing scrutiny on financial institutions. Halkbank's proactive approach to these regulations, including investments in advanced monitoring technologies, is essential to navigate this complex legal landscape and rebuild trust.

Halkbank operates under stringent consumer protection laws designed to shield its individual customers. These regulations mandate fair lending practices, ensuring transparent terms for deposit accounts and loans, and establishing clear dispute resolution processes. For instance, in 2024, Turkey's Banking Regulation and Supervision Agency (BRSA) continued to emphasize robust consumer rights frameworks, with reported customer complaints in the banking sector showing a slight decrease year-over-year, indicating ongoing efforts in compliance.

International Sanctions and Legal Frameworks

The international legal landscape, particularly concerning sanctions, presents a substantial challenge for Halkbank. The ongoing legal proceedings in the United States, stemming from allegations of evading sanctions against Iran, highlight the critical impact of these frameworks on the bank's global operations. This situation directly influences Halkbank's capacity to engage in international trade finance and other cross-border financial services, as compliance with diverse global sanctions regimes is paramount.

Key considerations include:

- Sanctions Compliance: Halkbank's adherence to sanctions imposed by major economic blocs, such as the US and the European Union, is crucial for maintaining access to international financial markets.

- Legal Proceedings Impact: The outcome of the US legal case could lead to significant fines, restrictions on operations, or reputational damage, affecting investor confidence and future business prospects.

- Regulatory Scrutiny: Increased scrutiny from international financial regulators necessitates robust compliance programs and transparent operational practices to mitigate legal and financial risks.

Data Privacy Regulations (e.g., KVKK in Turkey)

Halkbank, like all financial institutions, must navigate a complex landscape of data privacy regulations. In Turkey, the primary legislation governing this is the Law on the Protection of Personal Data (KVKK). This law mandates strict rules around how customer information is collected, processed, stored, and transferred. Failure to comply can result in significant penalties.

Adhering to KVKK is not just about avoiding fines; it's crucial for maintaining customer trust. In 2023, data breaches continued to be a major concern globally, and customers are increasingly aware of their digital privacy rights. For Halkbank, demonstrating robust data security and transparent data handling practices is paramount to safeguarding its reputation and customer loyalty.

- KVKK Compliance: Halkbank must align its operations with Turkey's Law on the Protection of Personal Data (KVKK).

- Data Handling: The bank is legally bound to manage customer data ethically, covering collection, processing, storage, and transfer.

- Customer Trust: Robust data security and privacy measures are essential for maintaining and building customer confidence.

- Legal Repercussions: Non-compliance with data privacy laws can lead to substantial legal penalties and reputational damage.

Halkbank operates under the stringent supervision of Turkey's Banking Regulation and Supervision Agency (BRSA), which enforces capital adequacy ratios, with Turkish banks maintaining a minimum of 12% as per Basel III standards through 2024. The bank is also bound by comprehensive anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, critical for preventing illicit financial flows and mitigating legal risks, especially in light of past sanctions evasion allegations. Furthermore, Halkbank must adhere to consumer protection laws ensuring fair lending and transparent practices, with the BRSA emphasizing these frameworks in 2024, leading to a reported decrease in customer complaints. The bank's international operations are significantly impacted by global sanctions regimes, with ongoing US legal proceedings highlighting the critical need for robust compliance to maintain access to international markets and investor confidence.

Environmental factors

Halkbank is actively integrating Environmental, Social, and Governance (ESG) factors into its lending and investment processes, reflecting a broader shift towards sustainable finance. This means the bank now evaluates the environmental and social footprint of the projects it supports, with a particular focus on industries such as energy and manufacturing.

In 2023, Halkbank reported a significant increase in its sustainability-linked loan portfolio, aiming to channel more capital towards environmentally friendly initiatives. For instance, the bank committed to increasing its financing for renewable energy projects by 15% by the end of 2025, a move that aligns with Turkey's national climate goals.

Halkbank acknowledges climate change as a major environmental risk, simultaneously viewing it as a significant avenue for green financing. This strategic positioning aligns with the growing global and Turkish emphasis on sustainable investments.

The bank is poised to actively finance projects focused on renewable energy sources and other climate change mitigation and adaptation efforts. This reflects a broader trend within the Turkish banking sector, where institutions are increasingly directing capital towards environmentally conscious initiatives.

For instance, Turkey's renewable energy capacity reached over 100 gigawatts by early 2024, with solar and wind power showing substantial growth, presenting direct funding opportunities for Halkbank. Such investments not only address environmental concerns but also tap into a rapidly expanding market segment.

Turkish regulators, including the Banking Regulation and Supervision Agency (BRSA), are actively promoting sustainable finance. Their 'Sustainable Banking Strategic Plan' mandates greater integration of environmental, social, and governance (ESG) factors into banking operations and disclosures, directly influencing institutions like Halkbank.

Reputational Risks Related to Environmental Impact

Halkbank, as a significant player in the financial sector, is susceptible to reputational damage stemming from its environmental impact and the environmental consequences of the projects it underwrites. Public perception and trust are directly tied to how the bank addresses its ecological footprint.

To mitigate these risks, Halkbank must actively showcase its dedication to environmental stewardship and provide clear, regular updates on its sustainability initiatives. This transparency is key to solidifying its public image.

In 2023, the Turkish banking sector, including institutions like Halkbank, faced increasing scrutiny regarding their role in financing environmentally impactful industries. For instance, global financial institutions committed to net-zero emissions by 2050 are increasingly divesting from or restricting financing for fossil fuel projects, setting a precedent that could influence customer and investor expectations in Turkey.

- Environmental Footprint: Halkbank's operational emissions and waste management practices directly influence its environmental reputation.

- Financed Emissions: The environmental impact of projects Halkbank finances, such as those in energy or infrastructure, carries significant reputational weight.

- Stakeholder Expectations: Investors, customers, and regulators are increasingly demanding demonstrable commitment to sustainability from financial institutions.

- Sustainability Reporting: Transparent and comprehensive reporting on environmental performance is crucial for building and maintaining trust.

Resource Efficiency and Operational Sustainability

Halkbank is increasingly focusing on resource efficiency within its own operations. This includes implementing measures to reduce energy consumption across its branches and data centers, a critical aspect of operational sustainability. For instance, in 2023, the bank reported a reduction in its overall carbon footprint, though specific figures for 2024 are still being finalized, the trend indicates a commitment to lowering environmental impact.

Waste management is another key environmental factor for Halkbank. The bank is exploring initiatives such as paperless banking solutions and enhanced recycling programs to minimize waste generation. These efforts are not only about compliance but also about fostering a culture of sustainability that resonates with environmentally conscious customers and stakeholders.

The bank's commitment to reducing its operational environmental footprint is evident in its ongoing efforts. While detailed 2024 data on specific programs like zero waste initiatives is pending, Halkbank's 2023 sustainability report highlighted progress in energy efficiency measures, contributing to its overall performance. This focus on internal sustainability is crucial for long-term resilience and brand reputation.

- Energy Efficiency: Ongoing implementation of energy-saving technologies in branches and offices.

- Waste Reduction: Expansion of paperless services and improved recycling protocols.

- Carbon Footprint: Continued efforts to monitor and decrease emissions from operational activities.

- Sustainability Reporting: Commitment to transparently reporting environmental performance metrics.

Halkbank is increasingly aligning its lending with Turkey's environmental goals, aiming to boost financing for renewable energy. By the close of 2025, the bank plans a 15% increase in funding for green initiatives, reflecting a national push towards sustainability. This strategy is supported by Turkey's growing renewable energy sector, which surpassed 100 gigawatts of capacity by early 2024, presenting significant investment opportunities.

Regulatory bodies like the BRSA are mandating greater ESG integration, pushing Halkbank to prioritize environmental factors in its operations and financing decisions. The bank is also focusing on reducing its own operational footprint through energy efficiency and waste management programs, with initial reports from 2023 indicating progress in lowering its carbon emissions.

| Environmental Focus Area | Halkbank's Commitment/Action | Relevant Data/Target |

|---|---|---|

| Renewable Energy Financing | Increasing capital allocation to green projects | 15% increase in financing for renewable energy by end of 2025 |

| Operational Efficiency | Reducing energy consumption and waste | Reported reduction in carbon footprint in 2023; ongoing zero waste initiatives |

| Market Opportunity | Leveraging Turkey's renewable energy growth | Turkey's renewable energy capacity exceeded 100 GW by early 2024 |

PESTLE Analysis Data Sources

Our Halkbank PESTLE Analysis is built on a robust foundation of data from official Turkish government sources, international financial institutions like the IMF and World Bank, and reputable industry and market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the bank.