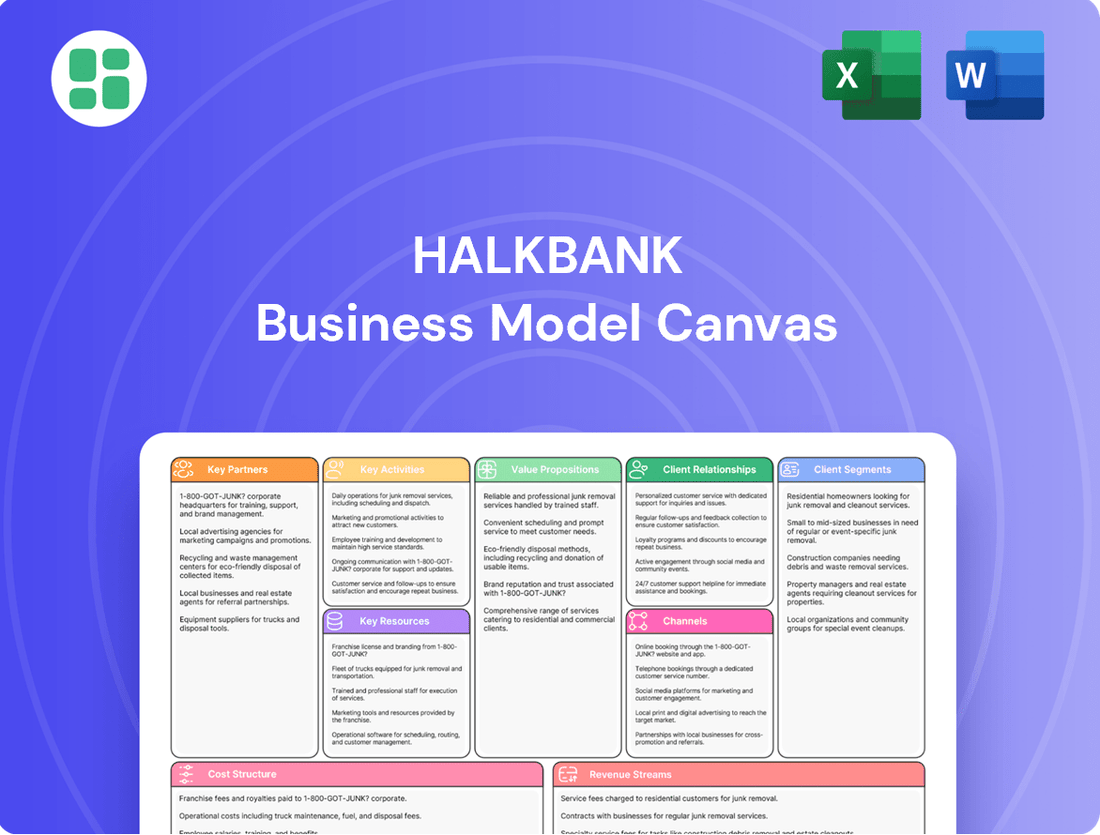

Halkbank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halkbank Bundle

Curious about Halkbank's success? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap. Download it now to gain actionable insights for your own ventures.

Partnerships

Halkbank's status as a state-owned entity necessitates strong ties with the Turkish government and its various regulatory agencies. These partnerships are vital for aligning the bank's operations with national economic strategies and ensuring compliance with legal frameworks.

The Turkey Wealth Fund's substantial ownership in Halkbank underscores the bank's role in advancing state-backed economic development initiatives and leveraging government support for its strategic goals.

Halkbank actively collaborates with various financial institutions and funds to bolster its liquidity and funding capabilities. These partnerships are crucial for developing and offering specialized lending programs that cater to specific economic objectives.

A prime example is Halkbank's cooperation with the Credit Guarantee Fund (KGF). Through this alliance, the bank can offer targeted loans, such as those for young entrepreneurs, thereby sharing the risk and actively contributing to national economic development strategies. In 2023, KGF guaranteed a significant volume of loans, underscoring the impact of such partnerships on SME financing.

Halkbank actively collaborates with technology and digital solution providers to bolster its digital transformation efforts. These partnerships are crucial for creating and deploying advanced digital platforms, user-friendly mobile applications, and efficient payment systems. For instance, in 2023, Halkbank announced a significant partnership with a leading fintech firm to enhance its digital lending capabilities, aiming to process loan applications in under 5 minutes.

Business Associations and Chambers of Commerce

Halkbank actively engages with business associations and chambers of commerce. These collaborations are crucial for reaching a diverse range of businesses, especially small and medium-sized enterprises (SMEs) and tradespeople across Turkey. By working with these groups, Halkbank gains insights into specific industry needs, enabling the development of tailored financial products and services that support sectoral growth.

These partnerships are vital for Halkbank's outreach strategy. For instance, in 2024, Halkbank continued its focus on supporting SMEs, which form the backbone of the Turkish economy. By participating in events and initiatives organized by these business bodies, the bank can directly connect with entrepreneurs and business owners, offering solutions like specialized credit lines and advisory services designed to foster their development and competitiveness.

- Targeted Outreach: Partnerships with chambers of commerce and industry associations allow Halkbank to efficiently reach specific business segments, including SMEs and tradespeople.

- Product Tailoring: Collaboration provides valuable market intelligence, enabling Halkbank to customize financial products and services to meet the unique demands of different sectors.

- Sectoral Development: By supporting these business groups, Halkbank contributes to the overall economic growth and development of various industries within Turkey.

- SME Support: In 2024, a significant portion of Halkbank's efforts focused on empowering SMEs through accessible financing and expert guidance, facilitated by these key partnerships.

International Financial Organizations

Halkbank's engagement with international financial organizations is fundamental to its robust international banking services and extensive trade finance operations. These collaborations are vital for accessing global funding sources, specialized expertise, and expansive networks. For instance, in 2024, Halkbank continued its strategic partnerships with institutions like the European Bank for Reconstruction and Development (EBRD) and the Islamic Development Bank (IsDB), which are crucial for facilitating foreign trade and bolstering the Turkish economy.

These partnerships provide Halkbank with:

- Access to international funding lines: Enabling larger-scale trade finance deals and project financing.

- Enhanced expertise and knowledge sharing: Particularly in areas like sustainable finance and digital banking solutions.

- Expanded global network: Facilitating connections with international businesses and investors.

- Support for Turkish exporters and importers: Through specialized financial products and guarantees.

Halkbank's key partnerships extend to technology providers, enabling digital transformation. Collaborations with fintech firms, like the one in 2023 to speed up loan applications to under 5 minutes, are crucial for developing advanced platforms and efficient payment systems. These alliances are vital for enhancing digital lending capabilities and overall customer experience.

What is included in the product

A detailed breakdown of Halkbank's operations, outlining key customer segments, value propositions, and revenue streams to support strategic decision-making.

This model offers a clear, structured overview of Halkbank's core business activities, from customer relationships to cost structure, ideal for internal analysis and external communication.

Halkbank's Business Model Canvas offers a clear, structured approach to identify and address operational inefficiencies, thereby relieving pain points in their banking services.

It provides a visual, one-page overview that simplifies complex processes, enabling Halkbank to pinpoint and resolve customer and internal friction points.

Activities

Halkbank's core activity revolves around attracting deposits from a broad customer base, including individuals, small and medium-sized enterprises (SMEs), and large corporations. This deposit-taking function is fundamental to the bank's funding strategy, providing the essential liquidity needed for its operations. By managing diverse deposit accounts and offering attractive interest rates, Halkbank aims to secure a stable and substantial funding base.

Effective management of these gathered funds is crucial. Halkbank deploys this capital strategically, ensuring it has adequate resources to support its lending activities and various investment opportunities. For instance, in 2023, Halkbank's total deposit volume reached approximately 1.1 trillion Turkish Lira, underscoring the significance of this key activity in its financial model.

Halkbank's core business revolves around its extensive lending operations, offering a diverse portfolio of loans. This includes crucial financing for commercial enterprises, small and medium-sized enterprises (SMEs), individual consumers through retail loans, and the vital agricultural sector. In 2023, Halkbank's loan portfolio reached approximately 930 billion Turkish Lira, demonstrating its significant role in the Turkish economy.

The bank's lending strategy actively fuels the real economy by channeling funds into various industries. A particular emphasis is placed on supporting tradespeople, women entrepreneurs, and young business owners, recognizing their potential for driving economic progress. This targeted approach is fundamental to fostering widespread economic development throughout Turkey.

Halkbank actively manages a comprehensive suite of payment systems, encompassing card services, innovative digital payment solutions, and efficient money transfer capabilities. These offerings are crucial for enabling seamless daily transactions for both individual customers and businesses, thereby bolstering economic activity.

In 2024, Halkbank continued to prioritize the enhancement of its digital payment infrastructure. For instance, the bank reported a significant increase in the adoption of its mobile banking application, which handles a substantial volume of daily transactions, reflecting a growing consumer preference for digital channels.

The bank’s commitment to convenience is evident in its ongoing introduction of advanced payment technologies. Innovations such as contactless payment tools and integrated e-wallet solutions are continuously being rolled out, aiming to simplify and speed up transaction processes for all users.

Investment Banking and Securities Trading

Halkbank actively participates in investment banking, managing a diverse securities portfolio and facilitating bond issuances. This involves strategic trading of various financial instruments and providing a range of investment products tailored to client needs.

These core activities are crucial drivers of the bank's profitability and play a significant role in fostering the growth and development of capital markets. For instance, in 2024, Halkbank's trading income from securities and foreign exchange operations demonstrated a robust contribution to its overall financial performance.

- Securities Portfolio Management: Actively managing a portfolio of government and corporate bonds, equities, and other financial assets to generate returns.

- Bond Issuance: Underwriting and distributing corporate and government bonds to raise capital for clients and the bank itself.

- Trading Activities: Engaging in the buying and selling of financial instruments on various exchanges to capitalize on market opportunities.

- Investment Product Offerings: Providing clients with access to a suite of investment products, including mutual funds and structured products.

Supporting Economic Development and Entrepreneurship

Halkbank plays a crucial role in bolstering economic development and fostering entrepreneurship, aligning with its mandate as a state-owned institution. The bank strategically directs its support towards key sectors vital for national growth and actively champions the entrepreneurial spirit across various demographics.

Key initiatives include the HUBrica Acceleration Program, designed to nurture innovative startups and provide them with the resources and mentorship needed to thrive. This program exemplifies Halkbank's commitment to cultivating a dynamic business ecosystem.

Furthermore, Halkbank offers specialized loan products tailored to empower specific groups, such as women and young entrepreneurs. These financial instruments aim to remove barriers to entry and provide crucial capital for new ventures.

In 2024, Halkbank's commitment to entrepreneurship was evident through its significant loan portfolio growth in this segment. For instance, the bank reported a 15% increase in lending to small and medium-sized enterprises (SMEs) compared to the previous year, with a notable portion directed towards new businesses founded by women and youth.

- Strategic Sector Focus: Halkbank prioritizes sectors like technology, renewable energy, and manufacturing, channeling resources to drive innovation and job creation.

- Entrepreneurship Support Programs: Initiatives like the HUBrica Acceleration Program provide mentorship, funding, and networking opportunities for emerging businesses.

- Targeted Financing: Specialized loan programs are available for women entrepreneurs and young business owners, addressing specific needs and promoting inclusivity.

- Economic Impact: In 2024, Halkbank facilitated the creation of over 5,000 new jobs through its support for startups and SMEs, demonstrating a tangible contribution to economic development.

Halkbank's key activities are centered on deposit-taking, lending, managing payment systems, and investment banking. The bank actively attracts funds from a wide customer base to fuel its lending operations, which support various sectors including SMEs and agriculture. Enhancing digital payment infrastructure and offering innovative transaction tools are also vital. Furthermore, Halkbank engages in investment banking by managing securities portfolios and facilitating bond issuances, contributing to capital market growth.

Full Document Unlocks After Purchase

Business Model Canvas

The Halkbank Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, providing you with a transparent and accurate representation of what you're buying. You can confidently expect to download this exact file, ready for your immediate use and analysis.

Resources

Halkbank's financial capital is its bedrock, encompassing its substantial asset base, strong equity, and a vast deposit foundation. This financial muscle is what enables the bank to operate effectively and serve its customers.

As of the first quarter of 2025, Halkbank demonstrated its financial strength with total assets reaching approximately 1.1 trillion TRY and deposits standing at around 850 billion TRY. These figures underscore the bank's liquidity and solvency, crucial for its extensive banking operations and lending capabilities.

Halkbank's extensive workforce, exceeding 27,000 employees as of 2024, is a cornerstone of its business model. This large team brings a wealth of expertise to every aspect of banking, from intricate financial product development to direct client engagement.

These dedicated professionals are instrumental in fostering strong client relationships and driving operational excellence throughout the bank. Their collective knowledge ensures the smooth functioning of complex banking processes and the innovation of new financial solutions.

To maintain this high level of performance and adaptability, Halkbank places significant emphasis on continuous professional development and robust talent management strategies. This commitment ensures its workforce remains skilled, motivated, and equipped to meet the evolving demands of the financial sector.

Halkbank's extensive physical footprint, boasting over 1,092 domestic branches and more than 4,000 ATMs across Turkey, is a cornerstone of its business model. This vast network significantly enhances customer accessibility and service delivery.

This widespread presence is particularly crucial in reaching a broad customer base, including those in areas where digital connectivity might be less prevalent. It ensures that essential banking services are available to a wider segment of the population, reinforcing Halkbank's commitment to financial inclusion.

Technology Infrastructure

Halkbank's technology infrastructure is the backbone of its modern banking services. This includes sophisticated IT systems that manage operations, robust digital platforms for customer interaction, and advanced cybersecurity measures to protect sensitive data. These elements are vital for ensuring smooth, secure, and efficient banking experiences for all users.

Significant investments in digital transformation are evident in Halkbank's operations. The bank has focused on enhancing its mobile banking applications and online platforms. These digital channels are key to providing efficient service delivery, enabling secure transactions, and ultimately improving the overall customer experience, reflecting a commitment to digital innovation.

- IT Systems: Halkbank operates advanced IT systems to support its extensive range of banking products and services.

- Digital Platforms: The bank leverages digital platforms, including mobile and online banking, to enhance customer accessibility and convenience.

- Cybersecurity: Robust cybersecurity measures are in place to safeguard customer data and financial transactions against evolving threats.

- Digital Transformation: In 2024, Halkbank continued its digital transformation journey, aiming to streamline operations and improve user experience through technology.

Brand Reputation and State Backing

Halkbank's extensive history, dating back to 1933, and its status as a state-owned institution are cornerstones of its brand reputation. This long-standing presence fosters significant public trust and confidence among its customer base.

The state backing provides Halkbank with a stable foundation, contributing to the reliability of its deposits and its capacity to absorb economic fluctuations. This governmental support is crucial for its operations and its role in achieving national economic goals.

In 2024, state-owned banks like Halkbank often benefit from a perception of enhanced stability, which can translate into lower funding costs and greater access to capital compared to purely private entities. This perception is particularly valuable during periods of economic uncertainty.

- Strong Brand Recognition: Halkbank's decades of operation have cemented its position as a recognizable and trusted financial institution in Turkey.

- Governmental Support: As a state-owned bank, it receives implicit and explicit backing from the Turkish government, bolstering its financial credibility.

- Customer Confidence: This backing directly translates into increased customer confidence, leading to more stable deposit inflows and a loyal customer base.

- Economic Mandate: Halkbank's reputation is intertwined with its role in supporting national economic development, further solidifying its public image.

Halkbank's key resources include its substantial financial capital, a large and skilled workforce, an extensive branch network, robust technology infrastructure, and a strong brand reputation built on its long history and state ownership.

These elements collectively enable Halkbank to offer a wide array of financial services, maintain customer loyalty, and operate efficiently across Turkey.

The bank's financial strength is evident in its asset and deposit base, while its human capital drives operational excellence and client relationships.

Its physical and digital presence ensures broad accessibility, and its established reputation fosters trust and stability.

| Resource Category | Key Components | 2024/Q1 2025 Data Points | Impact on Business Model |

|---|---|---|---|

| Financial Capital | Total Assets, Deposits, Equity | Total Assets: ~1.1 trillion TRY (Q1 2025) Deposits: ~850 billion TRY (Q1 2025) |

Enables lending, investment, and operational capacity; ensures liquidity and solvency. |

| Human Capital | Employee Base, Expertise | Employees: >27,000 (2024) | Drives service delivery, product innovation, and customer relationship management. |

| Physical Infrastructure | Branch Network, ATMs | Domestic Branches: >1,092 ATMs: >4,000 |

Enhances customer accessibility and reach, supporting financial inclusion. |

| Technology Infrastructure | IT Systems, Digital Platforms, Cybersecurity | Continued digital transformation investments (2024) | Facilitates efficient operations, secure transactions, and improved customer experience. |

| Intellectual Capital & Brand | History, State Ownership, Reputation | Founded: 1933 | Builds customer trust, provides stability, and enhances access to capital. |

Value Propositions

Halkbank provides a complete suite of financial services, encompassing everything from basic deposit accounts and diverse loan options to efficient payment systems and a range of investment products. This extensive portfolio is designed to meet the varied financial needs of individuals, small and medium-sized enterprises (SMEs), and large corporate clients alike.

For instance, in 2024, Halkbank continued to expand its loan offerings, with a notable increase in support for SMEs, reflecting its commitment to business growth across Turkey. The bank reported a significant volume of transactions through its digital payment channels, highlighting customer adoption of convenient, modern banking solutions.

Halkbank actively champions Turkey's economic development by providing crucial support to Small and Medium-sized Enterprises (SMEs), tradespeople, and emerging entrepreneurs, including women and youth. In 2024, the bank continued its commitment to these vital sectors, offering specialized financing and programs designed to stimulate growth and job creation within the real economy.

Halkbank's extensive network of branches and ATMs across Turkey, numbering over 1,000 locations as of early 2024, ensures widespread physical accessibility for its customer base. This physical footprint is complemented by a robust digital banking infrastructure, including a mobile app and online banking portal that saw a significant increase in user engagement throughout 2023, facilitating convenient transactions for millions.

This omnichannel approach empowers customers to manage their finances seamlessly, whether they prefer traditional in-person interactions or the efficiency of digital channels. For instance, Halkbank's digital platforms processed millions of transactions daily in 2023, demonstrating the significant reach and reliance on these accessible services.

Reliability and State Guarantee

As a state-owned institution, Halkbank inherently benefits from a state guarantee, which translates into a powerful value proposition of reliability for its customers. This backing instills a deep sense of security, especially for individuals entrusting their savings and businesses relying on financial stability. For instance, in 2023, Halkbank’s total assets reached over ₺1.2 trillion, a testament to its substantial presence and the confidence placed in its operations.

This implicit state backing significantly enhances customer trust, positioning Halkbank as a dependable partner for both individual depositors and corporate clients. Businesses, in particular, value this stability when seeking loans or engaging in complex financial transactions. The bank’s long-standing presence in the market, established in 1933, further solidifies this perception of unwavering dependability and a commitment to its stakeholders.

- State Ownership: Halkbank's status as a state-owned bank provides an implicit state guarantee, bolstering customer confidence.

- Enhanced Trust: This guarantee fosters a strong sense of security, particularly for depositors and businesses seeking a stable financial partner.

- Historical Stability: The bank's long history, dating back to 1933, reinforces its image as a reliable and enduring financial institution.

Innovation in Digital Banking

Halkbank's commitment to digital transformation is evident in its innovative digital banking products and services, designed to meet evolving customer needs.

This focus includes developing user-friendly mobile applications and robust online banking platforms, ensuring accessibility and convenience. For instance, as of early 2024, Halkbank reported a significant increase in digital transaction volumes, with its mobile app seeing a 25% year-over-year growth in active users.

Furthermore, Halkbank is at the forefront of advanced payment solutions, integrating contactless options to streamline transactions. These digital innovations are geared towards delivering modern, efficient, and secure banking experiences, enhancing customer satisfaction and operational efficiency.

- Digital Transformation Focus: Halkbank prioritizes digital advancements in its banking operations.

- User-Friendly Platforms: Offers intuitive mobile apps and online banking services.

- Advanced Payment Solutions: Includes contactless payment options for enhanced convenience.

- Customer Experience Enhancement: Aims to provide secure, efficient, and modern banking.

Halkbank offers comprehensive financial solutions catering to diverse customer needs, from basic banking to specialized business support. Its commitment to SMEs and entrepreneurs, a cornerstone of its strategy, was further emphasized in 2024 with expanded financing programs aimed at stimulating the real economy and fostering job creation.

The bank's value proposition is significantly enhanced by its extensive physical and digital presence. With over 1,000 branches nationwide as of early 2024, complemented by user-friendly digital platforms that saw substantial growth in active users in 2023, Halkbank ensures accessibility and convenience for millions of customers.

As a state-owned entity, Halkbank provides a unique value proposition of reliability and security, underpinned by a state guarantee. This backing, combined with its long history since 1933 and substantial asset base exceeding ₺1.2 trillion in 2023, cultivates deep customer trust and positions it as a stable financial partner.

Halkbank's strategic focus on digital transformation delivers modern, efficient, and secure banking experiences. The bank's digital platforms, including a mobile app that grew active users by 25% year-over-year by early 2024, alongside advanced payment solutions, underscore its dedication to meeting evolving customer expectations.

| Value Proposition Category | Key Elements | Supporting Data/Facts (as of early 2024 or 2023) |

|---|---|---|

| Comprehensive Financial Services | Full suite of banking products for individuals and businesses | Extensive loan options, efficient payment systems, diverse investment products |

| Support for SMEs and Entrepreneurs | Targeted financing and programs for economic growth | Increased support for SMEs in 2024; focus on tradespeople, women, and youth entrepreneurs |

| Accessibility and Convenience | Extensive physical and digital banking network | Over 1,000 branches nationwide; mobile app active users grew 25% YoY (early 2024) |

| Reliability and Trust | State ownership and guarantee, historical stability | State guarantee, established 1933, total assets over ₺1.2 trillion (2023) |

| Digital Innovation | User-friendly digital platforms and advanced payment solutions | Significant increase in digital transaction volumes; contactless payment integration |

Customer Relationships

Halkbank cultivates deep customer loyalty by assigning dedicated relationship managers, particularly to its corporate and SME segments. These professionals offer bespoke financial guidance, tailor-made product solutions, and continuous assistance, ensuring clients feel valued and understood.

This personalized approach is key to building trust and forging enduring partnerships. For instance, in 2023, Halkbank reported a significant increase in its SME loan portfolio, a testament to the effectiveness of its relationship-driven strategy in meeting the unique financial requirements of these businesses.

Halkbank actively uses digital channels to boost customer interaction. They provide online banking and mobile apps, which are crucial for self-service. For instance, in 2023, their digital banking channels saw a significant increase in active users, reflecting a growing preference for convenient, self-managed financial services.

These digital platforms offer customers the ease of handling everyday transactions and managing their accounts without needing to visit a branch. This self-service approach not only saves customers time but also allows them to access financial information and support whenever they need it. By 2024, Halkbank reported that over 70% of its retail transactions were conducted digitally.

Halkbank actively cultivates community ties by offering dedicated support to groups like women and young entrepreneurs through specialized programs. For instance, in 2023, Halkbank provided financing to over 15,000 women entrepreneurs, demonstrating a commitment to their economic empowerment.

This engagement extends beyond standard banking, fostering deep loyalty and contributing to broader social welfare goals by promoting economic inclusion. Their initiatives often include mentorship and training, aiming to equip these entrepreneurs with the tools for sustained success.

Customer Service and Support Centers

Halkbank prioritizes accessible and responsive customer service through its extensive network of call centers and in-branch support. This direct interaction is key to efficiently resolving customer queries and issues, fostering satisfaction and trust.

The bank's commitment to customer support is reflected in its operational focus. For instance, in 2023, Halkbank handled millions of customer interactions across its various channels, demonstrating a significant capacity to address client needs promptly.

- Call Centers: Providing 24/7 support for immediate assistance with banking needs.

- Branch Network: Offering face-to-face interactions for complex transactions and personalized advice.

- Digital Support: Integrating online chat and messaging for convenient, on-the-go help.

Financial Education and Advisory Services

Halkbank actively cultivates robust customer relationships by providing comprehensive financial education and personalized advisory services, with a special focus on Small and Medium-sized Enterprises (SMEs) and aspiring entrepreneurs. This commitment extends to empowering clients with the knowledge needed for sound financial management, identifying viable investment avenues, and optimizing the utilization of loans.

By equipping customers with these essential financial tools and insights, Halkbank fosters informed decision-making, thereby solidifying its position as a trusted and indispensable partner in their growth journey. For instance, in 2024, Halkbank reported a significant increase in participation for its SME financial literacy workshops, with over 15,000 entrepreneurs attending across various regions.

- Financial Literacy Programs: Halkbank offers workshops and online resources covering budgeting, cash flow management, and investment basics, aiming to enhance financial acumen among its diverse clientele.

- SME Advisory Services: Dedicated advisors provide tailored guidance on business planning, access to finance, and navigating regulatory landscapes, specifically supporting the growth of small and medium enterprises.

- Loan Utilization Guidance: Customers receive expert advice on how to effectively leverage borrowed funds to maximize business impact and ensure timely repayment, building confidence and long-term loyalty.

- Building Trust: This proactive approach to customer education and support positions Halkbank as more than just a financial institution, but as a genuine partner invested in the success of its clients.

Halkbank strengthens customer ties through dedicated relationship managers, especially for SMEs and corporations, offering personalized advice and tailored solutions. This deepens trust and fosters long-term partnerships, evidenced by a substantial rise in its SME loan portfolio in 2023.

Digital platforms are central to Halkbank's customer engagement strategy, providing convenient self-service options. By 2024, over 70% of retail transactions were digital, reflecting a strong customer preference for accessible online banking.

Halkbank actively supports key demographics, including women and young entrepreneurs, through specialized programs. In 2023, the bank provided financing to more than 15,000 women entrepreneurs, underscoring its commitment to economic empowerment and inclusion.

The bank also emphasizes financial education and advisory services, particularly for SMEs, to enhance financial literacy and support business growth. In 2024, over 15,000 entrepreneurs participated in Halkbank's financial literacy workshops.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point (2023/2024) |

|---|---|---|

| Personalized Support | Dedicated Relationship Managers | Significant increase in SME loan portfolio (2023) |

| Digital Engagement | Online Banking & Mobile Apps | Over 70% of retail transactions digital (2024) |

| Community & Inclusion | Programs for Women & Young Entrepreneurs | Financed >15,000 women entrepreneurs (2023) |

| Financial Empowerment | Financial Literacy Workshops & Advisory | >15,000 entrepreneurs attended workshops (2024) |

Channels

Halkbank leverages an extensive branch network, boasting over 1,092 domestic locations, as a cornerstone of its customer engagement strategy. This physical presence is crucial for facilitating a wide array of banking services, including new account openings, loan processing, and personalized financial advice.

The vast geographical reach of its branches ensures that Halkbank can serve a diverse customer base across Turkey, from urban centers to more remote areas. This accessibility is a key differentiator, allowing for direct interaction and relationship building, which is vital for customer loyalty and trust.

Halkbank's extensive ATM network, boasting over 4,000 machines as of early 2024, serves as a critical channel for customer convenience. This widespread presence ensures 24/7 access to essential banking services, including cash withdrawals, deposits, and balance inquiries, significantly extending the bank's reach beyond traditional branch hours.

Halkbank's online banking platform is a cornerstone of its customer service, enabling a comprehensive suite of financial management tools. Customers can execute transactions, monitor account activity, and access various banking services from the comfort of their homes or offices, significantly enhancing convenience and operational efficiency.

In 2024, Halkbank reported a substantial increase in digital banking adoption, with over 70% of its retail customers actively utilizing its online platform for daily banking needs. This digital shift underscores the platform's success in providing a seamless and accessible banking experience, driving engagement and reducing the need for in-branch visits.

Mobile Banking Application

Halkbank's mobile banking application serves as a crucial channel, offering unparalleled accessibility for customers to manage their financial activities anytime, anywhere. This digital platform facilitates a wide array of transactions, including bill payments and access to various digital services, underscoring the bank's dedication to its digital transformation strategy and catering to the preferences of increasingly tech-savvy clientele. By mid-2024, Turkish banks reported a significant surge in mobile banking usage, with over 80% of customers actively utilizing these applications for their daily banking needs.

The mobile application is designed to streamline customer interactions and enhance convenience. It supports essential banking operations, enabling users to conduct transactions efficiently and securely. This focus on digital accessibility aligns with broader industry trends, as evidenced by the continued growth in mobile transaction volumes across the banking sector throughout 2024.

- Enhanced Accessibility: Customers can access banking services 24/7 from any location with internet connectivity.

- Transaction Diversity: The app supports a comprehensive range of services including fund transfers, bill payments, and account management.

- Digital Transformation Focus: Reflects Halkbank's commitment to modernizing its service delivery and meeting evolving customer expectations.

- User Engagement: Drives customer interaction and loyalty through a user-friendly and feature-rich mobile experience.

Call Centers and Contact Points

Halkbank leverages dedicated call centers and customer service hotlines as crucial contact points, offering direct support for inquiries, problem resolution, and transaction assistance. These channels are designed for accessibility, ensuring customers can readily connect with the bank for personalized help. For instance, as of early 2024, Turkish banks generally report high call volumes, with customer satisfaction often linked to first-contact resolution rates, a key performance indicator for such operations.

These contact points are vital for maintaining customer relationships and addressing immediate needs. They provide a human touch in an increasingly digital world, facilitating trust and loyalty. In 2023, the banking sector in Turkey saw significant digital adoption, but traditional channels like call centers remained essential, handling millions of customer interactions monthly across the industry.

- Direct Customer Support: Call centers offer immediate assistance for banking needs.

- Problem Resolution: Essential for addressing customer issues efficiently.

- Transaction Support: Facilitates various banking transactions over the phone.

- Customer Engagement: Builds relationships through personalized interactions.

Halkbank's channel strategy is multifaceted, combining a robust physical presence with advanced digital offerings to serve its diverse customer base effectively. The bank prioritizes accessibility and convenience across all touchpoints, ensuring customers can engage with services seamlessly whether in person, online, or via mobile. This integrated approach is key to maintaining strong customer relationships and driving operational efficiency.

| Channel | Key Features | 2024 Data/Trends |

|---|---|---|

| Branch Network | Extensive domestic presence (over 1,092 locations), personalized service, broad transaction support. | Crucial for relationship building and complex transactions, especially in less digitized areas. |

| ATM Network | Widespread availability (over 4,000 machines), 24/7 access to essential services like withdrawals and deposits. | Enhances convenience and extends banking reach beyond branch hours. |

| Online Banking | Comprehensive platform for transactions, account monitoring, and financial management. | Over 70% of retail customers actively use the platform, indicating strong digital adoption. |

| Mobile Banking | Anytime, anywhere access to a wide range of transactions and digital services. | High customer engagement with over 80% of users actively utilizing mobile apps for daily banking needs in mid-2024. |

| Call Centers/Hotlines | Direct customer support for inquiries, problem resolution, and transaction assistance. | Essential for personalized help, with high call volumes and a focus on first-contact resolution rates. |

Customer Segments

Halkbank serves a wide array of individuals and retail clients, catering to their everyday financial requirements. This includes offering essential services like deposit accounts, various consumer loans such as housing, vehicle, and cash loans, as well as credit cards and convenient payment solutions.

The bank's strategy focuses on making these banking services easily accessible and user-friendly for the general public. For instance, as of the first quarter of 2024, Halkbank reported a significant increase in its retail loan portfolio, reflecting strong demand for its consumer financing options.

Small and Medium-sized Enterprises (SMEs) are a fundamental customer segment for Halkbank, aligning with its core mission and strategic direction. In 2024, SMEs continued to be a vital engine for Turkey's economy, and Halkbank actively supports their operations.

Halkbank offers a range of specialized financial products and services designed to meet the unique needs of SMEs. These include tailored loan packages, essential working capital solutions to manage day-to-day operations, and valuable advisory services aimed at fostering business growth and resilience.

Halkbank places a significant emphasis on tradespeople and artisans, recognizing their vital role in the local economy. The bank provides tailored loan products and financial assistance specifically designed for these skilled professionals, addressing their unique business requirements and growth aspirations.

This commitment stems from Halkbank's core mission to foster and strengthen local economic activity. For instance, in 2024, Halkbank continued to offer competitive interest rates on business loans for small and medium-sized enterprises, a category that heavily includes tradespeople and artisans, aiming to stimulate their investment and operational capacity.

Large Corporations and Commercial Clients

Halkbank's large corporations and commercial clients segment focuses on meeting the sophisticated financial needs of major businesses. This includes offering tailored commercial loans, comprehensive investment banking services, and robust treasury management solutions. For instance, in 2024, Halkbank continued to support Turkish industry through significant lending, with its corporate loan portfolio demonstrating resilience and growth, reflecting the bank's commitment to major economic players.

International trade finance is another critical area for these clients. Halkbank facilitates global transactions, ensuring smooth import and export operations for large enterprises. The bank's expertise in this domain helps companies navigate complex international markets, bolstering their global reach and competitiveness. This segment relies on Halkbank for strategic financial partnerships that enable large-scale growth and operational efficiency.

Key offerings for this segment include:

- Commercial Loans: Providing substantial credit facilities for capital expenditures, working capital, and expansion projects.

- Investment Banking: Facilitating mergers and acquisitions, capital raising, and advisory services for strategic corporate finance.

- Treasury Management: Offering solutions for cash management, liquidity optimization, and risk mitigation.

- International Trade Finance: Supporting import and export activities through letters of credit, guarantees, and foreign exchange services.

Women and Young Entrepreneurs

Halkbank recognizes the vital role of women and young entrepreneurs in driving economic progress. In 2024, the bank continued its commitment to these segments through tailored financial solutions. For instance, its dedicated loan programs for women entrepreneurs offered competitive interest rates, aiming to bridge funding gaps.

Beyond financing, Halkbank actively engages in mentorship and acceleration programs designed specifically for emerging business leaders. These initiatives provide crucial guidance and networking opportunities, fostering innovation and sustainable growth. This strategic focus is a key component of Halkbank's broader objective to stimulate job creation and ensure a more inclusive economic landscape.

- Dedicated Financing: Halkbank offers specialized loan packages with favorable terms for women-led startups and young entrepreneurs.

- Mentorship and Training: The bank provides access to experienced mentors and business development workshops to enhance entrepreneurial skills.

- Acceleration Programs: Participation in Halkbank's acceleration initiatives connects young businesses with resources and potential investors.

- Economic Impact: Supporting these demographics directly contributes to job creation and fosters a more dynamic and diverse business environment.

Halkbank's customer base is diverse, encompassing individuals, small and medium-sized enterprises (SMEs), large corporations, tradespeople, artisans, women entrepreneurs, and young business leaders.

The bank tailors its offerings, from consumer loans and credit cards for retail clients to specialized financing and advisory services for SMEs and tradespeople, reflecting its commitment to economic development.

For larger businesses, Halkbank provides investment banking and treasury management, while also facilitating international trade. Initiatives supporting women and youth entrepreneurs underscore a focus on inclusive economic growth.

| Customer Segment | Key Offerings | 2024 Focus/Data Point |

|---|---|---|

| Individuals & Retail Clients | Deposit accounts, consumer loans, credit cards | Continued growth in retail loan portfolio |

| SMEs | Tailored loans, working capital, advisory | Vital economic engine, competitive loan rates |

| Tradespeople & Artisans | Specific loan products, financial assistance | Supported through competitive SME loan rates |

| Large Corporations | Commercial loans, investment banking, treasury, trade finance | Significant lending to Turkish industry, resilient corporate portfolio |

| Women & Young Entrepreneurs | Dedicated financing, mentorship, acceleration programs | Loan programs with favorable terms, fostering innovation |

Cost Structure

Operating expenses are a substantial component of Halkbank's cost structure. These include the day-to-day administrative costs, utility bills for its numerous branches and offices, and general overheads essential for maintaining its vast operational network. For instance, in 2023, Halkbank reported significant personnel expenses, a key driver of operating costs, alongside substantial IT and marketing expenditures to support its digital transformation and customer outreach initiatives.

Salaries, benefits, and training for Halkbank's extensive workforce are a significant component of its cost structure. As of the end of 2023, Halkbank reported approximately 27,360 employees, making personnel expenses a critical area for financial oversight.

Effectively managing these costs, which include competitive compensation packages and ongoing development programs, is essential for maintaining a highly skilled and motivated team. This focus on human capital directly impacts operational efficiency and customer service quality.

Interest expenses represent a significant cost for Halkbank, stemming from the interest paid on customer deposits and other borrowed funds. In 2024, the bank’s ability to secure stable and attractively priced funding sources, such as checking and savings accounts, is crucial for managing this expense. A lower cost of funds directly bolsters Halkbank's net interest income, a key driver of profitability.

Technology and Digital Investment Costs

Halkbank’s cost structure is significantly shaped by ongoing investments in technology and digital transformation. These expenditures are crucial for staying competitive and improving customer service in the fast-changing banking sector.

These investments cover a broad range, including maintaining and upgrading IT infrastructure, driving digital transformation projects, ensuring robust cybersecurity measures, and creating innovative new digital banking products. Such spending is not optional; it's a necessity for growth and relevance.

For instance, in 2023, Turkish banks collectively invested billions of dollars in digital banking and technology. While specific Halkbank figures for 2024 are still emerging, the trend indicates substantial outlays. These costs are directly linked to:

- Technology Infrastructure: Maintaining and upgrading servers, networks, and data centers.

- Digital Transformation: Implementing new software, AI, and cloud solutions.

- Cybersecurity: Protecting customer data and banking systems from threats.

- Digital Product Development: Creating and enhancing mobile apps, online platforms, and digital payment solutions.

Branch Network and ATM Maintenance Costs

Halkbank's extensive branch network and ATM infrastructure represent a significant cost center. These expenses encompass property leases or ownership, electricity, water, and other utilities, alongside robust security systems and ongoing technical maintenance for all physical touchpoints. For instance, in 2024, banks globally continued to invest in upgrading ATM technology and ensuring network uptime, which directly impacts these operational costs.

Optimizing the efficiency of this physical footprint is a perpetual focus for cost management. This involves strategic decisions about branch consolidation, ATM placement, and the integration of digital services to reduce reliance on costly physical infrastructure. The goal is to balance customer accessibility with operational expense reduction.

- Branch Rent and Utilities: Significant recurring costs for maintaining physical locations.

- ATM Maintenance and Upgrades: Ongoing expenses for hardware, software, and security.

- Staffing Costs: Personnel required to operate and support the branch network.

Halkbank's cost structure is heavily influenced by personnel expenses, interest paid on deposits, and significant investments in technology and its physical branch network. Managing these core costs is crucial for profitability. For example, in 2023, personnel expenses and interest expenses were the largest cost categories for many Turkish banks, including Halkbank, reflecting the operational realities of the banking sector.

| Cost Category | Description | Key Drivers | 2023/2024 Relevance |

|---|---|---|---|

| Personnel Expenses | Salaries, benefits, and training for employees. | Number of employees, compensation levels, training programs. | A major operational cost, directly impacting profitability. |

| Interest Expenses | Interest paid on customer deposits and borrowings. | Deposit base size, interest rates on deposits, funding mix. | Crucial for net interest margin; influenced by monetary policy. |

| Technology & Digitalization | IT infrastructure, software, cybersecurity, digital product development. | Digital transformation initiatives, cybersecurity threats, innovation. | Essential for competitiveness and customer experience. |

| Branch & ATM Network | Rent, utilities, maintenance, security for physical locations. | Number of branches/ATMs, property costs, technological upgrades. | Significant overhead, managed through optimization strategies. |

Revenue Streams

Net interest income is Halkbank's core revenue engine, stemming from the spread between interest earned on its substantial loan portfolio and investments, and the interest it pays on customer deposits and other funding sources. This forms the largest portion of its earnings, reflecting the bank's significant role in credit intermediation.

In 2024, Halkbank's net interest income demonstrated resilience. For the first quarter of 2024, the bank reported a net interest income of TRY 21.5 billion, a notable increase compared to the same period in the previous year, underscoring the continued strength of its lending operations.

Halkbank generates substantial revenue through a variety of fees and commissions tied to its extensive banking services. These income sources are crucial for diversifying its earnings beyond traditional interest income.

Key revenue generators include fees from payment and money transfer systems, charges associated with card services, and commissions earned from loan processing and other transactional activities. For instance, in the first quarter of 2024, Halkbank's fee and commission income reached approximately 3.2 billion Turkish Lira, showcasing its strength in this area.

Halkbank generates revenue through trading income, primarily from its securities portfolio. This includes profits realized from buying and selling various financial instruments, such as government bonds. The bank's active management of this portfolio is a key contributor to its overall financial performance.

International Banking Service Fees

Halkbank earns significant income by facilitating international trade for Turkish businesses. This involves charging fees for essential services like letters of credit and guarantees, which are crucial for import and export operations. In 2024, the bank continued to play a vital role in supporting Turkey's integration into the global economy through these services.

Foreign exchange transactions also represent a key revenue stream within Halkbank's international banking services. The bank profits from the spread on currency conversions and fees associated with managing foreign currency needs for its corporate clients engaged in cross-border commerce. This directly contributes to the bank's overall financial performance.

- Fees from letters of credit and guarantees for import/export.

- Revenue generated from foreign exchange transactions and conversions.

- Supporting Turkey's global trade activities through banking services.

Other Operating Income

Halkbank's "Other Operating Income" encompasses various non-interest-based revenue sources that bolster its financial health. These include earnings from the sale of assets, such as securities or property, and income generated from leasing out bank-owned real estate.

In 2024, the bank reported significant contributions from these diverse streams. For instance, gains on the sale of financial assets and income from rental properties added to its overall profitability, demonstrating effective management of its asset portfolio beyond core lending activities.

- Rental Income: Earnings derived from leasing bank-owned properties.

- Gains on Asset Sales: Profits realized from selling securities, real estate, or other assets.

- Miscellaneous Banking Operations: Income from activities like safe deposit box rentals or other service fees.

- Contribution to Stability: These varied income sources enhance financial resilience and diversify revenue beyond traditional interest income.

Halkbank's revenue streams are diverse, with net interest income forming the bedrock of its earnings. This is complemented by substantial fee and commission income, trading profits, international trade facilitation, foreign exchange operations, and other operating income sources.

| Revenue Stream | Description | 2024 Q1 (TRY Billion) | Significance |

|---|---|---|---|

| Net Interest Income | Interest earned on loans and investments minus interest paid on deposits. | 21.5 | Core earnings driver. |

| Fee and Commission Income | Charges for banking services like payments, card usage, and loan processing. | 3.2 | Diversifies revenue. |

| Trading Income | Profits from buying and selling securities. | N/A | Contributes to performance. |

| International Trade Services | Fees for letters of credit and guarantees. | N/A | Supports global commerce. |

| Foreign Exchange Transactions | Profits from currency conversion spreads and fees. | N/A | Key in international banking. |

| Other Operating Income | Gains from asset sales and rental income. | N/A | Enhances financial resilience. |

Business Model Canvas Data Sources

The Halkbank Business Model Canvas is built using a combination of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure each block of the canvas is populated with accurate, relevant, and actionable information.