Halewood International Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halewood International Ltd. Bundle

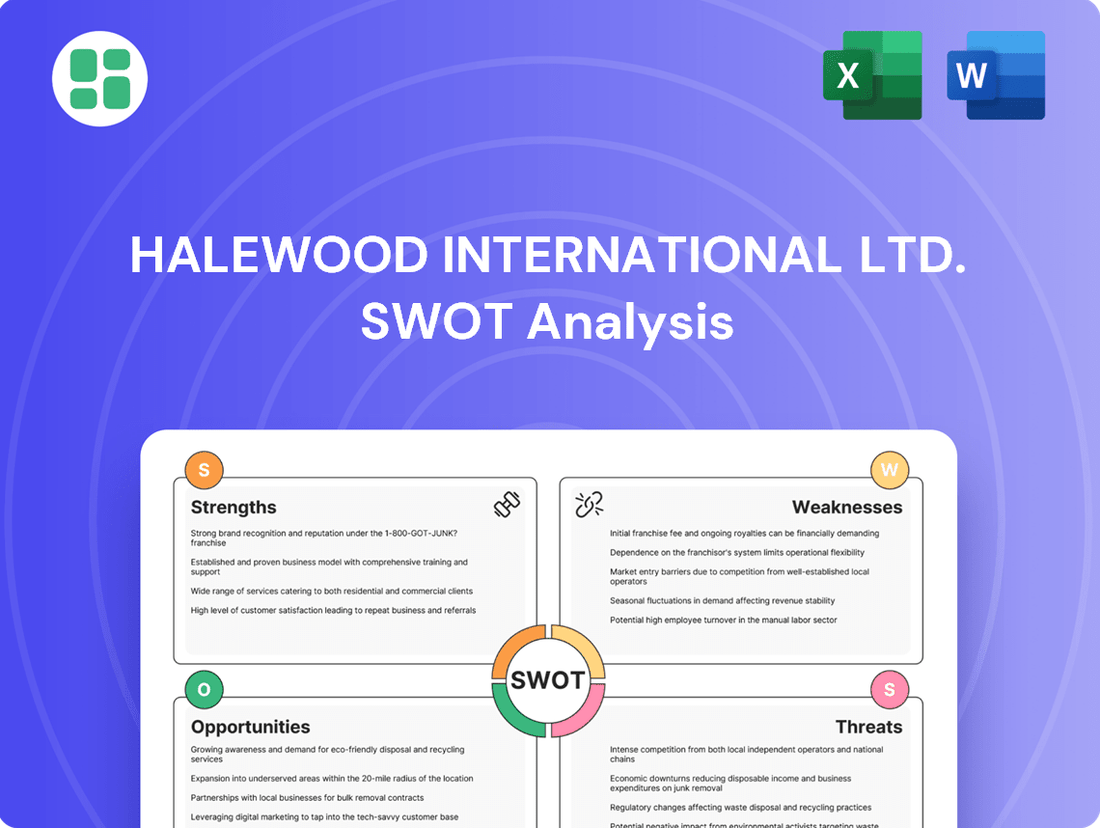

Halewood International Ltd. boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving consumer preferences. Our full SWOT analysis delves into these internal capabilities and external market dynamics, providing a comprehensive understanding of their strategic position.

Want the full story behind Halewood's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Halewood International Ltd. boasts a remarkably diverse alcoholic beverage portfolio, spanning spirits, wines, beers, and ready-to-drink (RTD) options. This broad offering, featuring well-known brands such as Whitley Neill Gin and Dead Man's Fingers Rum, effectively targets a wide array of consumer preferences and market niches, ensuring broad market penetration.

The company's commitment to quality is evident in its artisanal spirits, which have garnered an impressive tally of over 80 gold, double gold, and silver awards from esteemed industry competitions. This significant recognition highlights the superior craftsmanship and market desirability of Halewood's products, reinforcing their competitive advantage.

Halewood International Ltd. boasts a formidable end-to-end production and distribution network, encompassing manufacturing, wholesale, and retail operations. This integrated model ensures a consistent and high-quality supply chain for its diverse product portfolio.

The company's ownership of multiple distilleries across the UK, including the unique distinction of distilling whisky in Scotland, England, and Wales, underscores its commitment to controlling the entire production process. This vertical integration, a significant strength, allows for meticulous quality assurance and rapid adaptation to market demands.

As of late 2024, Halewood International continues to leverage this robust infrastructure to introduce new and innovative spirits, capitalizing on growing consumer interest in craft and locally produced beverages. Their ability to manage the journey from raw material to consumer is a key competitive advantage.

Halewood International has strategically invested in its global travel retail (GTR) presence, a move that has yielded impressive results. In the financial year ending June 2023, the company saw its GTR volumes double, demonstrating the effectiveness of this focused approach.

Looking ahead to 2024, Halewood has ambitious plans for international activation programs across key markets, including Europe, Australia, and South Africa. These initiatives are designed to prominently feature its core brands, further solidifying its position in the GTR sector and reaching a broad international audience.

Agile and Innovative Product Development

Halewood International Ltd. excels in agile and innovative product development, showcasing an entrepreneurial spirit that drives the creation of distinctive new products and flavors. This approach allows them to move beyond traditional offerings and capture market attention.

Their strategy prioritizes validating new flavors in domestic markets before venturing internationally, a measured approach that minimizes risk and maximizes the chances of success. For instance, Halewood has successfully launched a range of unique gin flavors, demonstrating their ability to tap into evolving consumer tastes and preferences.

- Entrepreneurial Spirit: Halewood consistently demonstrates an entrepreneurial and innovative approach to product creation, focusing on unique flavors that differentiate them in the market.

- Domestic Validation: The company's strategy of ensuring new flavors perform well domestically before international expansion mitigates risk and builds a strong foundation for growth.

- Consumer Adaptability: By introducing innovative products, such as distinctive gin varieties, Halewood effectively captures consumer interest and adapts to changing market demands.

Family-Owned Independence and Strategic Focus

As a family-owned, independent alcoholic beverage company, Halewood International Ltd. possesses a distinct advantage in maintaining flexibility in its strategic direction and decision-making processes. This autonomy allows for agile responses to evolving market dynamics, a crucial element in the competitive spirits industry. For example, in 2024, the company continued to emphasize its commitment to artisanal spirits, a testament to its focused strategy.

Despite undergoing financial restructuring, Halewood International has consistently reaffirmed its core objective: to concentrate on its own artisanal spirits. This dedication to its niche allows for a strong commitment to brand identity and product quality. Recent reports from late 2024 indicate a renewed investment in their craft distilling capabilities, underscoring this strategic focus.

- Strategic Agility: Family ownership facilitates quicker, independent decision-making, enabling faster adaptation to market shifts.

- Brand Identity: A clear focus on artisanal spirits reinforces a distinct brand image and appeals to a discerning consumer base.

- Product Development: Independence supports investment in unique product innovation and the development of craft spirits, a growing market segment.

- Long-Term Vision: Unburdened by short-term shareholder pressures, the company can pursue a more enduring, quality-focused strategy.

Halewood International's diverse product range, including popular brands like Whitley Neill Gin, effectively caters to varied consumer tastes and market segments, ensuring broad reach. The company's dedication to quality is underscored by over 80 industry awards for its artisanal spirits, validating their craftsmanship and market appeal.

A robust, integrated supply chain from production to retail, coupled with ownership of multiple UK distilleries, grants Halewood significant control over quality and responsiveness to market demands. The company's strategic investment in global travel retail has doubled volumes in the financial year ending June 2023, with plans for further international activation in 2024.

Halewood demonstrates agile product development, focusing on unique flavors and domestic market validation before international launches, as seen with their successful gin varieties. As a family-owned entity, they benefit from strategic flexibility and a long-term vision centered on artisanal spirits, with renewed investment in craft distilling capabilities noted in late 2024.

What is included in the product

Delivers a strategic overview of Halewood International Ltd.’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Streamlines the identification of Halewood International Ltd.'s strategic advantages and challenges, offering a clear roadmap to address operational inefficiencies.

Weaknesses

Halewood Artisanal Spirits has faced considerable financial headwinds. The company reported a significant operating loss of £20.9 million for the year ending July 2023. This trend continued with another operating loss of £18.8 million recorded for the year ending June 2024.

Net revenues have also experienced a notable downturn. This decline is partly attributed to a deliberate strategic shift aimed at exiting low-margin product lines. These figures highlight ongoing financial pressures and the critical need for the company to improve its profitability going forward.

Halewood International Ltd. faces a significant weakness in its vulnerability to changing consumer preferences for its core brands. This was evident in recent performance, where weak demand for established products like vodka and Crabbie's ginger beer contributed to sales declines.

The company's reliance on certain key products means a dip in their popularity directly impacts overall revenue. For instance, if vodka sales, a historically strong category, continue to falter, it poses a substantial risk to Halewood's financial health.

This situation underscores the ongoing challenge of keeping its entire product portfolio relevant in a market where consumer tastes evolve rapidly. Maintaining brand loyalty and adapting to new trends across diverse categories is crucial for sustained success.

Halewood International Ltd. faced significant operational disruptions, notably a cyber-attack during the crucial Christmas trading period of 2023. This incident severely impacted its supply chain, leading to a direct hit on sales and highlighting inherent operational vulnerabilities.

Such cybersecurity breaches can result in substantial financial losses and erode valuable customer trust, as seen with the disruption to Halewood's peak season. The company's ability to manage its intricate supply chains, particularly in the wake of production relocations, continues to present ongoing challenges.

Challenges within the Independent Brewing Sector

Halewood International Ltd., as a producer of craft beers, faces significant challenges inherent to the UK's independent brewing sector. This industry experienced a notable contraction, with approximately 100 breweries closing their doors in 2024, highlighting a difficult operating landscape.

The sector is grappling with several 'heavy headwinds'. These include increased taxation, which directly impacts profit margins, and rising operational costs, such as those for raw materials and energy. Furthermore, independent brewers often encounter restricted access to vital pub distribution channels, limiting their market reach and sales potential.

- Decline in UK Independent Breweries: Around 100 breweries ceased operations in 2024.

- Taxation Impact: Higher taxes place a direct financial burden on producers.

- Rising Operational Costs: Increased expenses for ingredients, utilities, and labor squeeze profitability.

- Distribution Challenges: Limited access to pub networks hinders market penetration.

These combined factors create an environment where sustained growth and consistent profitability are difficult to achieve for Halewood's beer segment, requiring strategic adaptation to navigate these industry-wide pressures.

Impact of Strategic Restructuring on International Footprint

Halewood International Ltd.'s strategic pivot, which saw a deliberate scaling back of international expansion and the termination of certain manufacturing partnerships, represents a significant weakness in its global footprint. This move, while intended to streamline operations and boost profitability, has inevitably led to a contraction of its market presence. For instance, by exiting agreements that previously extended its reach, the company might find itself with a diminished international market share compared to rivals who continue to aggressively pursue global growth opportunities.

This reduction in international activity could also impact brand visibility on a global scale. As competitors actively invest in new markets and strengthen their international brand recognition, Halewood's more restrained approach could result in a relative decline in its global brand awareness. This is particularly relevant in the competitive spirits industry, where consistent international presence is often key to building and maintaining a strong global brand identity.

The financial implications of this strategic shift also warrant consideration. While the aim is improved profitability, the immediate impact of ending agreements and reducing international operations could lead to short-term revenue dips or increased costs associated with the restructuring itself. For example, if Halewood previously relied on these international agreements for a significant portion of its revenue, their cessation could create a financial gap that needs to be effectively managed.

- Reduced Market Reach: Halewood's decision to scale back international expansion directly limits its access to new customer bases and emerging markets.

- Decreased Brand Visibility: Ending third-party and own-label manufacturing agreements can diminish global brand exposure and recognition relative to competitors.

- Potential Revenue Impact: The cessation of manufacturing agreements might lead to an immediate, albeit temporary, reduction in revenue streams that were previously generated from these international operations.

Halewood's reliance on a few key brands makes it vulnerable to shifts in consumer taste. Weak demand for established products like vodka and Crabbie's ginger beer contributed to sales declines, demonstrating how a dip in popularity for these historically strong categories poses a substantial risk to the company's financial health.

The company's operational vulnerabilities were starkly highlighted by a cyber-attack in late 2023, which disrupted its supply chain during a critical trading period, directly impacting sales and customer trust. Furthermore, Halewood's strategic decision to scale back international expansion and terminate manufacturing partnerships has contracted its global market presence and potentially diminished brand visibility relative to competitors.

| Weakness | Description | Impact |

| Brand Dependency | Vulnerability to changing consumer preferences for core brands like vodka and Crabbie's. | Directly impacts overall revenue and financial health due to reliance on specific product performance. |

| Operational Vulnerabilities | Impact of cyber-attacks (e.g., late 2023) disrupting supply chains and sales. | Leads to financial losses, erodes customer trust, and highlights systemic operational risks. |

| Reduced International Footprint | Scaling back international expansion and terminating manufacturing partnerships. | Contracts market presence, potentially decreases global brand awareness, and could lead to short-term revenue dips. |

Same Document Delivered

Halewood International Ltd. SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’ll gain a comprehensive understanding of Halewood International Ltd.'s Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is unlocked upon purchase.

Opportunities

The UK market for ready-to-drink (RTD) alcoholic beverages is expected to experience robust expansion, with a projected compound annual growth rate (CAGR) of approximately 6.959% between 2025 and 2035. This growth is fueled by evolving consumer preferences and convenience.

Concurrently, there's a noticeable and increasing consumer shift towards moderation in alcohol consumption and a greater emphasis on health-conscious decisions. This trend is directly boosting the demand for low and no-alcohol beverage options.

Halewood International Ltd. is well-positioned to leverage these market dynamics. The company can enhance its market presence by broadening its current RTD offerings and by actively developing innovative new products within the low and no-alcohol segments.

Consumers are increasingly drawn to premium and artisanal spirits, prioritizing unique flavors and elevated experiences. This growing preference for quality over quantity is a significant tailwind for companies like Halewood International. The global premium spirits market was valued at approximately $130 billion in 2023 and is projected to grow substantially, with artisanal segments showing particularly strong expansion.

Halewood is well-positioned to capitalize on this trend, boasting a portfolio of award-winning artisanal spirits and distilleries. Their dedication to quality and distinctive product development directly addresses this consumer demand. For instance, the craft spirits market, a key area of focus for Halewood, saw a year-over-year growth of nearly 10% in 2024 according to industry reports.

Halewood International Ltd. already boasts a significant global reach, distributing its brands across more than 75 countries, with established strongholds in Europe, the USA, Canada, and Australia. This extensive international presence, particularly its success in global travel retail, offers a solid springboard for further strategic expansion into new territories.

The company can capitalize on this existing infrastructure by deepening its market penetration in high-growth emerging economies. Simultaneously, leveraging the rapidly expanding e-commerce landscape presents a direct channel to reach a wider international consumer base, potentially bypassing traditional distribution hurdles.

Leveraging E-commerce and Direct-to-Consumer Sales

The alcoholic drinks sector has seen significant e-commerce expansion, amplified by recent global shifts. This digital avenue provides a direct and efficient way to connect with a broader consumer base. Halewood International can capitalize on this by strengthening its online infrastructure and direct-to-consumer (DTC) initiatives.

Investing in e-commerce allows Halewood to boost brand recognition, extend its market presence, and collect crucial consumer insights. The global e-commerce market for alcoholic beverages was valued at approximately $25 billion in 2023 and is projected to grow substantially. This digital transformation is key for driving both domestic and international sales.

- E-commerce Growth: The online sales channel for alcoholic beverages experienced a surge, with projections indicating continued strong growth through 2025.

- DTC Strategy: Implementing and enhancing direct-to-consumer sales models can increase profit margins and customer loyalty for Halewood.

- Data Collection: Online platforms offer invaluable opportunities to gather consumer purchasing habits and preferences, informing future product development and marketing.

- Market Reach: E-commerce breaks down geographical barriers, enabling Halewood to reach new customer segments domestically and internationally more effectively.

Strategic Acquisitions and Brand Partnerships

Halewood International Ltd. has a proven track record of strategic growth through acquisitions and partnerships. For instance, their investment in West Cork Distillers significantly enhanced their Irish whiskey offerings, a key growth area. Similarly, distribution agreements, such as the one for Krupnik vodka, have expanded their market reach.

Continuing this approach presents significant opportunities. By identifying and executing further targeted acquisitions or brand collaborations, Halewood can:

- Diversify Product Portfolio: Expand into new spirit categories or premium segments.

- Strengthen Market Position: Gain market share in key regions or product categories.

- Enhance Distribution Networks: Leverage new partners' established routes to market.

For example, in 2024, the global spirits market continued its upward trajectory, with premium and craft spirits showing particular strength. Halewood's strategic moves in 2023, like bolstering its craft gin range, position it well to capitalize on these trends through further partnerships or acquisitions in high-growth niches.

The UK ready-to-drink (RTD) alcoholic beverage market is poised for significant growth, with an estimated CAGR of nearly 7% between 2025 and 2035, driven by evolving consumer tastes and convenience. Halewood International can capitalize on this by expanding its RTD portfolio and innovating in the low and no-alcohol segments, aligning with the growing consumer preference for moderation and health-conscious choices.

The increasing consumer demand for premium and artisanal spirits presents a substantial opportunity, as this market segment was valued at approximately $130 billion in 2023 and continues to expand, with craft spirits showing nearly 10% year-over-year growth in 2024. Halewood's existing portfolio of award-winning artisanal spirits and distilleries is well-suited to meet this demand for unique flavors and elevated experiences.

Leveraging its global distribution network spanning over 75 countries, Halewood can deepen its penetration in high-growth emerging economies and utilize the expanding e-commerce landscape to reach new consumers. The alcoholic beverage e-commerce market, valued at around $25 billion in 2023, offers a direct channel to boost brand recognition and gather valuable consumer insights.

Halewood's history of successful strategic acquisitions and partnerships, such as its investment in West Cork Distillers, provides a strong foundation for further expansion. By pursuing targeted acquisitions or collaborations, the company can diversify its product offerings, strengthen its market position, and enhance its distribution networks, particularly in high-growth niches within the spirits market.

| Opportunity Area | Market Insight | Halewood's Position/Action |

|---|---|---|

| RTD & Low/No Alcohol Growth | UK RTD market CAGR ~6.96% (2025-2035) | Expand RTD offerings, develop low/no alcohol products. |

| Premium & Artisanal Spirits | Global premium spirits market ~$130B (2023); Craft spirits growth ~10% (2024) | Leverage award-winning artisanal portfolio, focus on quality. |

| E-commerce Expansion | Global alcoholic beverage e-commerce ~$25B (2023) | Strengthen online infrastructure, DTC initiatives for wider reach. |

| Strategic Acquisitions/Partnerships | Continued growth in premium/craft spirits | Target acquisitions/collaborations to diversify and strengthen market presence. |

Threats

Halewood International faces significant pressure from global giants like AB InBev and Diageo, companies with vastly greater financial muscle and established market dominance. These larger players can leverage economies of scale in production and distribution, alongside substantial marketing investments, to outmaneuver smaller competitors. For instance, major global brewers often control a significant portion of pub space and shelf placement through exclusive deals, limiting access for independent brands.

Halewood International, like many in the beverage industry, is grappling with significant inflationary pressures. Costs for essential inputs such as energy, raw materials, and logistics have surged, directly impacting operational overheads. This is further exacerbated by substantial alcohol tax increases in the UK, creating a challenging environment for maintaining profitability and competitive pricing.

These combined cost increases are squeezing profit margins across the sector. For instance, the Office for National Statistics reported that producer price inflation for alcoholic drinks was 7.2% in the year to April 2024, a notable increase from previous periods. This makes it difficult for companies like Halewood to absorb these rising costs without potentially deterring consumers through price hikes.

The financial health of UK alcohol producers is also a growing concern, with reports indicating rising rates of financial distress within the industry. This trend highlights the vulnerability of businesses to sustained cost pressures and tax burdens, posing a direct threat to Halewood's ability to manage its operational expenditures effectively and maintain its market position.

The UK alcohol industry faced its most significant alcohol tax increase in five decades in August 2023, with duty rates on spirits and beer rising substantially. This change directly impacts Halewood International's cost of goods and pricing strategies.

Potential new government policies, such as a Deposit Return Scheme, could introduce considerable upfront investment and ongoing operational expenses for producers like Halewood. For instance, similar schemes in other regions have required significant capital outlay for new machinery and logistics.

Furthermore, any tightening of alcohol marketing regulations or restrictions on consumption patterns could present a threat by limiting Halewood's ability to reach consumers and grow its market share, potentially impacting sales volumes for its diverse product portfolio.

Changing Consumer Habits Towards Alcohol Moderation

A significant shift towards health consciousness and mindful drinking, particularly among Gen Z and Millennials, is directly impacting alcohol consumption patterns. This trend is a notable threat to Halewood International Ltd. as consumers increasingly choose low-alcohol or no-alcohol options. For instance, the global low and no-alcohol market was valued at approximately $11 billion in 2023 and is projected to reach $25 billion by 2030, indicating a substantial and growing demand for alternatives.

This evolving consumer preference for moderation, often referred to as 'zebra striping' where individuals alternate alcoholic and non-alcoholic beverages, poses a direct risk to sales volumes for traditional, higher-alcohol content products. Halewood's portfolio, which includes established brands, may see a decline in demand if it doesn't adequately adapt to this growing market segment.

- Growing Health Consciousness: Consumers are prioritizing well-being, leading to reduced alcohol intake.

- Rise of Low/No-Alcohol Options: The market for these alternatives is expanding rapidly, projected to double by 2030.

- 'Zebra Striping' Trend: Consumers are actively alternating alcoholic and non-alcoholic drinks, impacting overall volume.

- Impact on Traditional Products: Halewood's high-ABV offerings may face reduced demand due to these changing habits.

Economic Downturn and Reduced Discretionary Spending

The persistent cost-of-living crisis and general economic instability are making consumers more mindful of their spending, particularly on non-essential items. This heightened price sensitivity directly impacts Halewood International's portfolio, especially its premium artisanal spirits, as consumers may opt for more budget-friendly alternatives.

For instance, in the UK, inflation remained elevated through much of 2024, with the Office for National Statistics reporting a Consumer Price Index (CPI) of 3.1% in April 2024, a slight decrease but still a significant factor for household budgets. This economic pressure can lead to a noticeable slowdown in the demand for higher-priced alcoholic beverages, directly affecting Halewood's sales volumes and revenue streams.

- Reduced Discretionary Income: Consumers have less disposable income for premium spirits due to rising costs of essentials like energy and food.

- Shift to Value Brands: A noticeable trend towards private label or lower-priced alcoholic beverages is expected to continue throughout 2024 and into 2025.

- Impact on Premium Sales: Halewood's focus on artisanal and premium products makes it particularly vulnerable to a downturn in discretionary spending.

- Overall Market Demand: Broader economic uncertainty can suppress overall consumer confidence, leading to a general decrease in spending across the entire alcoholic beverage market.

Halewood International faces intense competition from larger, well-funded global beverage corporations that benefit from significant economies of scale and extensive distribution networks. Furthermore, the company is navigating persistent inflationary pressures, with rising costs for raw materials, energy, and logistics impacting profitability. These challenges are compounded by substantial alcohol tax increases in the UK, creating a difficult environment for maintaining competitive pricing and healthy profit margins.

The evolving consumer preference for health and moderation, including the growing low/no-alcohol market, presents a significant threat to traditional alcohol sales volumes. Economic instability and the cost-of-living crisis further exacerbate this by reducing consumer discretionary spending, particularly impacting premium product segments. Potential new government regulations, such as Deposit Return Schemes, could also impose considerable upfront investment and ongoing operational costs.

| Threat Category | Specific Threat | Impact on Halewood | Supporting Data/Trend |

| Competitive Landscape | Dominance of Global Giants | Market share erosion, reduced pricing power | AB InBev, Diageo's vast financial and market resources |

| Economic Factors | Inflationary Pressures | Increased operational costs, squeezed profit margins | Producer price inflation for alcoholic drinks at 7.2% (April 2024) |

| Economic Factors | Cost of Living Crisis | Reduced discretionary spending, shift to value brands | UK CPI at 3.1% (April 2024) impacting household budgets |

| Regulatory/Policy | Alcohol Duty Increases | Higher cost of goods, pressure on pricing strategies | Significant duty rate increases in August 2023 |

| Consumer Trends | Health Consciousness & Low/No Alcohol | Decreased demand for traditional products, need for portfolio adaptation | Global low/no-alcohol market projected to reach $25 billion by 2030 (from $11 billion in 2023) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert commentary from industry professionals, ensuring a robust and data-driven assessment of Halewood International Ltd.