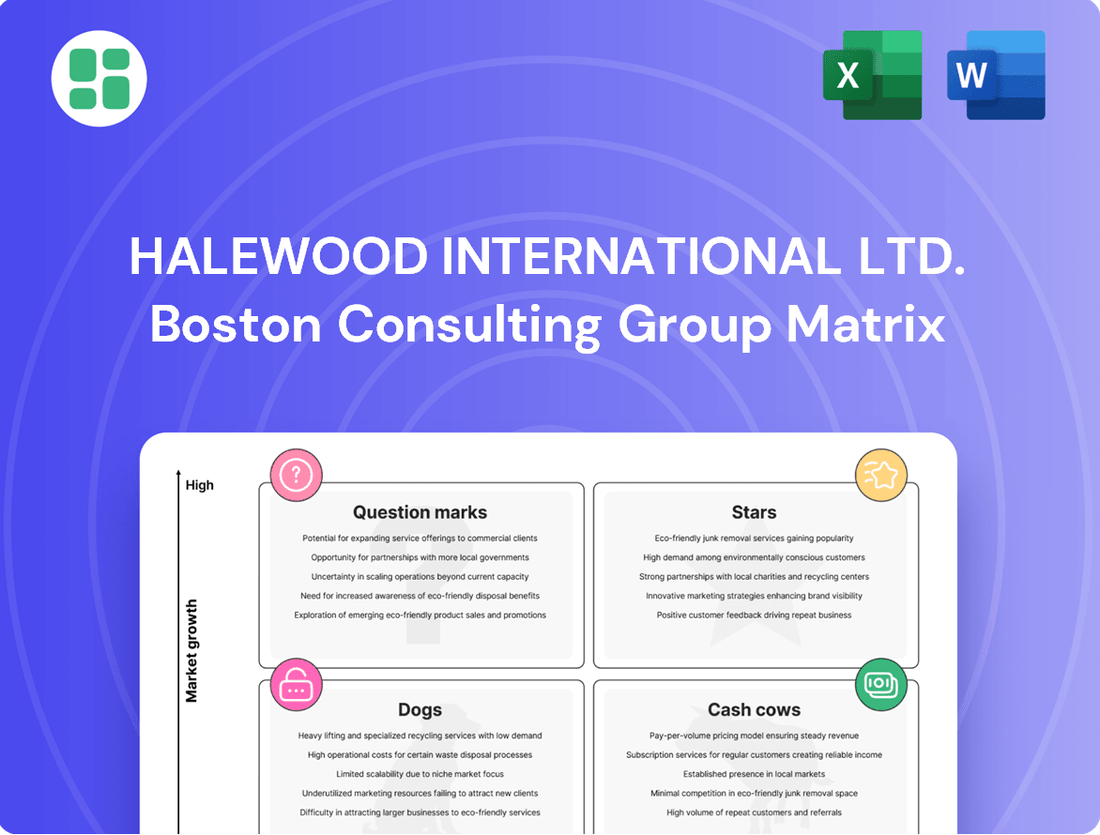

Halewood International Ltd. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halewood International Ltd. Bundle

Curious about Halewood International Ltd.'s product portfolio performance? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a strategic snapshot. Don't miss out on the critical insights needed to navigate their market position effectively.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a data-driven understanding of where to invest, divest, or nurture their brands for optimal growth and profitability.

This is your chance to gain a competitive edge. Secure the full BCG Matrix today and equip yourself with the strategic clarity to make informed decisions about Halewood International Ltd.'s future.

Stars

Dead Man's Fingers Rum is a shining example of a Star within Halewood International Ltd.'s portfolio. Its impressive net revenue growth of 31% in the financial year ending July 2023 underscores its position as a significant growth driver.

The rum market, especially for spiced and flavored varieties, is booming in the UK, with projections indicating a 5.1% compound annual growth rate between 2025 and 2030. This favorable market trend directly benefits Dead Man's Fingers.

Halewood's strategic investment in global travel retail activations for this brand further solidifies its Star status. This focus aims to capitalize on its already strong market share within a rapidly expanding segment.

Whitley Neill Premium Flavored Gins are a shining example of Halewood International's success, holding the coveted position of the UK's number one premium gin. Despite a general slowdown in the UK gin market, variants like Rhubarb & Ginger are exceptionally popular, demonstrating strong consumer appeal and a dominant presence in the premium category. This brand's continued innovation in new flavors, coupled with significant international expansion, solidifies its status as a star performer within Halewood's portfolio.

Aber Falls Single Malt Whisky is a strategic move by Halewood International Ltd. into the burgeoning whisky sector, positioning itself as a key player with its unique Welsh heritage. As one of only four distilleries in Wales and the first in North Wales for over 100 years, Aber Falls boasts significant differentiation.

Halewood is actively investing in global travel retail distribution for Aber Falls, signaling aggressive growth ambitions for this premium offering. The global whisky market, particularly the single malt segment, continues to see strong year-over-year growth, with the UK single malt whisky market alone valued at over £1.3 billion in 2023, presenting a fertile ground for Aber Falls to capture market share.

Halewood's Premium RTD Offerings

The Ready-to-Drink (RTD) cocktail market is a significant growth area, reaching £968 million in the UK in 2024. This segment is expected to expand at an impressive compound annual growth rate (CAGR) of 16.2% between 2024 and 2030, indicating strong consumer demand for convenient, high-quality pre-mixed beverages. Halewood is well-positioned to leverage this expansion with its premium RTD offerings.

Halewood's strategy focuses on meeting consumer demand for convenience without compromising on quality, a key driver in the burgeoning RTD market. While specific market share data for individual RTD brands within Halewood's portfolio isn't publicly detailed, the overall category's robust growth trajectory and Halewood's commitment to innovation suggest that its premium RTD lines have the potential to become significant revenue generators and market leaders.

- Market Growth: The UK RTD market was valued at £968 million in 2024.

- Projected CAGR: The market is forecasted to grow at 16.2% from 2024 to 2030.

- Consumer Trend: Increasing preference for convenience and premium quality in beverages.

- Halewood's Position: Strategic focus on premium RTDs to capture market share in a high-growth category.

Strategic International Gin & Rum Expansion

Halewood International Ltd. is strategically expanding its gin and rum portfolio, particularly within the high-growth global travel retail (GTR) sector. This focus is designed to elevate its core brands, Whitley Neill and Dead Man's Fingers, into true international stars.

- GTR Volume Growth: Halewood achieved a doubling of GTR volumes in the financial year ending June 2023, underscoring the success of its international expansion strategy.

- Brand Elevation: The aggressive investment in GTR channels aims to solidify Whitley Neill and Dead Man's Fingers as leading global brands.

- Consumer Engagement: Emphasis on 'liquid on lips' tasting activations is key to converting international travelers into repeat customers and building brand loyalty.

- Market Penetration: This initiative represents a significant push to capture greater market share in key international transit hubs.

Dead Man's Fingers Rum is a prime example of a Star within Halewood International's portfolio, demonstrating exceptional growth. Its net revenue surged by 31% in the financial year ending July 2023, a testament to its strong market performance.

The UK rum market, particularly for flavored variants, is experiencing robust expansion, projected to grow at a 5.1% CAGR from 2025 to 2030. This favorable trend directly supports Dead Man's Fingers' continued success.

Halewood's strategic focus on global travel retail activations for Dead Man's Fingers further cements its Star status, aiming to capitalize on its increasing market share in a dynamic segment.

Whitley Neill Premium Flavored Gins have secured the leading position in the UK premium gin market, showcasing remarkable resilience even amidst a general market slowdown. Flavors like Rhubarb & Ginger are particularly popular, highlighting strong consumer demand and brand dominance.

Aber Falls Single Malt Whisky represents Halewood's strategic entry into the growing whisky market, leveraging its unique Welsh heritage. As one of the few distilleries in Wales and the first in North Wales in over a century, it possesses a distinct market advantage.

Halewood's investment in global travel retail distribution for Aber Falls signals ambitious growth plans for this premium product. The global single malt whisky market, including the UK market valued at over £1.3 billion in 2023, offers significant opportunities for market share capture.

The Ready-to-Drink (RTD) cocktail market is a significant growth driver, valued at £968 million in the UK in 2024. This sector is anticipated to expand at a 16.2% CAGR between 2024 and 2030, reflecting strong consumer preference for convenience and quality.

Halewood's strategic approach to the RTD market prioritizes meeting consumer demand for convenience without compromising on premium quality. This focus positions its RTD offerings for substantial revenue generation and market leadership within this high-growth category.

| Brand | Category | Growth Indicator | Market Trend | Halewood Strategy |

|---|---|---|---|---|

| Dead Man's Fingers Rum | Spiced Rum | 31% Net Revenue Growth (FY ending July 2023) | UK Rum Market CAGR 5.1% (2025-2030) | GTR Activations |

| Whitley Neill Premium Gins | Premium Gin | UK's #1 Premium Gin | Premium Flavored Gin Popularity | International Expansion |

| Aber Falls Single Malt Whisky | Single Malt Whisky | Investment in GTR Distribution | UK Single Malt Market > £1.3bn (2023) | Global Market Penetration |

| Halewood RTDs | Ready-to-Drink Cocktails | Category Value £968m (2024) | RTD Market CAGR 16.2% (2024-2030) | Premiumization & Convenience |

What is included in the product

This BCG Matrix overview provides tailored analysis for Halewood International's product portfolio, highlighting which units to invest in, hold, or divest.

The Halewood International Ltd. BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit performance data.

Cash Cows

Whitley Neill London Dry Gin, a flagship product for Halewood International, operates within the established London Dry Gin market. Despite a broader trend of declining flavored gin sales in the UK, this core offering benefits from strong brand recognition and a mature market position. In 2024, the UK gin market, while experiencing shifts, still saw London Dry as a resilient category, with brands like Whitley Neill maintaining significant market share.

Halewood's core cider portfolio represents a significant Cash Cow for Halewood International Ltd. The company commands a 9% share of the global cider market, a sector projected to grow at a healthy 6.4% CAGR between 2025 and 2032.

Despite some individual product fluctuations, such as the reported decline in Crabbie's Ginger Beer, the overall cider range benefits from a mature market position. This maturity translates into consistent, reliable revenue generation with minimal need for extensive marketing spend.

Established JJ Whitley non-flavored vodka variants represent a core strength for Halewood International Ltd. within the broader vodka market. Despite market fluctuations, the non-flavored segment consistently holds the largest share in the UK, underscoring its enduring appeal as a staple. For instance, in 2023, the UK vodka market was valued at approximately £2.5 billion, with non-flavored variants accounting for a significant portion of this.

Once Halewood's supply chain disruptions are fully resolved, these JJ Whitley lines are poised to generate dependable cash flow. Their established brand recognition and consistent sales volume in a mature market mean they require less aggressive marketing investment, allowing them to act as reliable cash cows. This stability is crucial for funding growth in other areas of the business.

Lambrini (if still a significant part of the portfolio)

Lambrini, as a historical component of Halewood International's portfolio, likely occupied a significant position in the lower-alcohol and perry wine market. Its broad recognition and established consumer base would have contributed to consistent cash generation, allowing Halewood to leverage its market presence without substantial new investment.

Even with potentially slower market growth for traditional segments, Lambrini's established distribution network and brand loyalty would have ensured a reliable income stream. This characteristic aligns with the definition of a 'cash cow' in the BCG Matrix, where profits are harvested from a mature product.

While specific 2024 financial data for Lambrini's contribution to Halewood International is not publicly detailed, the company's overall performance in the UK alcoholic beverage market provides context. Halewood International reported revenues of £358 million in the year ending June 2023, indicating a robust operational scale that would support established brands like Lambrini.

- Brand Recognition: Lambrini has long been a familiar name in the UK, particularly in the fruit-based wine category.

- Market Segment: It targets a segment often characterized by accessibility and value, contributing to steady sales volume.

- Cash Flow Generation: The brand's maturity and established market share likely translate into predictable and significant cash flow for Halewood.

- Low Reinvestment Needs: As a mature product, Lambrini would require minimal R&D or marketing spend compared to newer or high-growth products.

City of London Distillery & Liverpool Gin (local market dominance)

The City of London Distillery and Liverpool Gin, under Halewood International, are prime examples of cash cows within their specific markets. While their global reach might not match that of brands like Whitley Neill, their strong presence in local and niche segments ensures steady revenue generation.

These distilleries likely benefit from direct-to-consumer sales, engaging distillery tours, and unique craft spirit experiences that resonate with local pride and enthusiast demand. This consistent cash flow, even within a potentially slower-growing niche, solidifies their cash cow status.

- Dominant Local Market Share: Both distilleries hold a significant share in their respective geographic areas, catering to a loyal customer base.

- Consistent Revenue Streams: Direct sales, popular distillery tours, and unique product offerings contribute to reliable cash flow.

- Niche Appeal: Their focus on local heritage and craft spirits attracts a dedicated segment of consumers, ensuring demand.

- Cash Generation: Despite potentially lower growth rates compared to stars, their established market positions allow them to generate substantial and consistent cash for the parent company.

Halewood's established JJ Whitley non-flavored vodka variants are strong cash cows. The non-flavored segment consistently holds the largest share in the UK vodka market, valued at approximately £2.5 billion in 2023. These products generate dependable cash flow due to their established brand recognition and consistent sales volume in a mature market, requiring less marketing investment.

| Product Category | Market Position | Cash Flow Contribution | Investment Needs |

|---|---|---|---|

| JJ Whitley Non-Flavored Vodka | Mature, High Market Share (UK) | Consistent, Reliable | Low Marketing & R&D |

| Whitley Neill London Dry Gin | Established, Resilient Category | Significant Revenue | Moderate Marketing Support |

| Halewood Cider Portfolio | 9% Global Market Share, Growing | Steady Income Stream | Limited Strategic Investment |

Preview = Final Product

Halewood International Ltd. BCG Matrix

The Halewood International Ltd. BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, detailing Halewood's product portfolio within the Boston Consulting Group framework, is ready for immediate strategic application. You'll gain access to the full, professionally formatted report, enabling you to make informed decisions regarding resource allocation and market positioning for each of Halewood's brands.

Dogs

Crabbie's Ginger Beer, a brand under Halewood International Ltd., is positioned as a Dog in the BCG Matrix. This classification stems from its reported decrease in revenue, with sales dropping by £14 million in the six months ending June 2024. This financial performance points to a low market share within a stagnant or declining market segment.

Halewood's stated strategy of divesting low-margin and unprofitable product lines further solidifies Crabbie's status as a Dog. The brand's declining sales and likely low profitability make it a candidate for such strategic pruning, indicating it does not align with the company's growth objectives.

JJ Whitley Vodka, a brand under Halewood International Ltd., experienced a significant setback due to the cessation of Russian supply chains. This disruption forced a pivot to UK production, impacting its market position.

The brand faced short-term supply chain challenges and a decline in sales, reflecting a low and potentially contracting market share within the highly competitive vodka segment.

In 2023, the UK vodka market was valued at approximately £3.2 billion, with JJ Whitley holding a minor share. The brand’s struggles place it in the cash trap quadrant of the BCG matrix, requiring substantial investment to maintain its position without guaranteed growth.

Halewood International Ltd.'s strategic refocus in 2024 led to a significant £33 million drop in net revenues. A substantial £25 million of this decline stemmed from exiting agency brands, third-party contracts, and delisting low-margin brands.

These divested or de-prioritized products, characterized by their low market share and limited growth potential, clearly fit the description of 'Dogs' in the BCG Matrix. Their divestment highlights Halewood's proactive approach to shedding underperforming assets that were consuming valuable company resources.

Some Older, Less Innovative RTD Lines

While the ready-to-drink (RTD) market is experiencing robust growth, some of Halewood International Ltd.'s older RTD lines might be lagging. These products, if they haven't adapted to changing consumer tastes for more sophisticated flavors or premium offerings, could be considered question marks in the BCG matrix. For instance, in 2023, the global RTD market was valued at over $40 billion, but niche segments with less innovation may not share in this expansion.

These less innovative RTD products could generate minimal cash flow and offer limited growth prospects. For example, if a particular RTD line saw sales decline by 5% in 2023 while the overall RTD category grew by 10%, it would indicate a weakening position. Such products might require careful management to either revitalize them or consider divestment.

- Market Lag: Older RTD lines may not align with current consumer demand for premiumization and complex flavor profiles.

- Low Growth Potential: Products failing to innovate risk stagnation even within a booming market.

- Minimal Cash Generation: These RTDs might contribute little financially, becoming a drain on resources.

- Need for Strategy: Halewood must assess these products for potential revitalization or strategic exit.

Specific Geographic Expansions that were Scaled Back

Halewood International Ltd. has notably scaled back its international expansion initiatives. This strategic shift is a direct response to prevailing macroeconomic headwinds and an internal focus on business restructuring.

Brands or product lines that were part of these curtailed international ventures, especially those that struggled to gain traction, would be categorized as Dogs in the BCG Matrix. These initiatives, while ambitious, consumed valuable resources without yielding significant market share or growth in their intended overseas markets.

- Curtailed Expansion: Halewood's decision to reduce international expansion reflects a cautious approach to global markets.

- Resource Allocation: Brands in this category represent investments that did not deliver expected returns.

- Focus on Core: The company is prioritizing its domestic market and restructuring efforts over less successful international ventures.

Dogs within Halewood International Ltd.'s portfolio are brands or product lines with low market share in slow-growing or declining industries. These often require significant investment to maintain their position without offering substantial returns. Halewood's strategic decision to divest low-margin and unprofitable products in 2024, which accounted for £25 million of a £33 million net revenue drop, directly addresses these underperforming assets.

The cessation of Russian supply chains for JJ Whitley Vodka, for instance, forced a pivot and impacted its market share in the competitive £3.2 billion UK vodka market in 2023. Similarly, Crabbie's Ginger Beer saw a £14 million revenue decrease in the first half of 2024, indicating a shrinking market presence.

These brands, characterized by their poor performance and limited growth prospects, are prime candidates for divestment or careful management to avoid becoming a drain on company resources. Halewood's focus on restructuring and exiting less successful ventures underscores its strategy to streamline operations and improve profitability.

Question Marks

Whitley Neill's introduction of limited-edition flavors like Black Cherry and non-alcoholic variants positions them as Question Marks in Halewood International's BCG Matrix. These innovations tap into the burgeoning no/low-alcohol market and aim to inject new life into the broader gin category, both areas exhibiting high growth potential.

Despite this promising market trajectory, these new offerings currently hold a small, unproven market share. Significant investment in marketing and distribution will be crucial to build brand awareness and capture a larger slice of these expanding segments, with the ultimate goal of transforming them into Stars.

Halewood International Ltd. is strategically growing its whisky offerings by incorporating brands such as Bonnington Single Malt, Bankhall British Whisky, and Irish expressions like The Pogues and Samuel Gelston's. This expansion taps into a whisky market that, as of early 2024, continues to show strong global growth trends, with reports indicating a compound annual growth rate (CAGR) of over 5% in key markets. These new brands, while entering a high-growth sector, are likely positioned as Question Marks in the BCG matrix due to their nascent market presence and the significant investment needed to establish brand awareness and distribution networks, aiming to capture a larger share of this expanding market.

Krupnik vodka, now distributed by Halewood International Ltd. in the UK, is positioned as a Question Mark in the BCG Matrix. This new distribution deal signals Halewood's strategic move to bolster its vodka portfolio, especially given the performance of its existing JJ Whitley brand.

The UK vodka market is substantial, but Krupnik enters it as a newcomer with a currently low market share. Its future growth trajectory is promising, but this hinges critically on Halewood's ability to execute strong marketing campaigns and robust distribution strategies to carve out a niche in this competitive and dynamic sector.

Emerging Premium/Craft Beer Offerings

Halewood International, a company with a broad range of products including craft beers, has recently streamlined its beer manufacturing. This strategic move positions them to better capitalize on emerging premium and craft beer trends.

The craft beer sector, though crowded, presents significant opportunities for differentiation and premium pricing. Halewood's investment in this area reflects a clear strategy to tap into consumer demand for artisanal and distinctive beverages.

Emerging premium/craft beer offerings from Halewood would likely be classified as Stars or Question Marks in a BCG matrix. These new, innovative lines, if successful, would possess low current market share but exhibit high growth potential, aligning with the market's increasing appetite for unique and high-quality brews.

- Market Share: Low, as new entrants typically start with a small footprint.

- Growth Rate: High, driven by the expanding premium and craft beer segments.

- Investment Needs: Significant investment required for brand building, production, and distribution to capture market share.

- Potential: High, if the offerings resonate with evolving consumer preferences for authenticity and quality.

International Expansion into New Markets (beyond GTR)

International expansion into new markets, beyond the established Global Travel Retail (GTR) presence, represents a significant strategic initiative for Halewood International Ltd. These ventures are classified as Stars within the BCG matrix, indicating high growth potential and a need for substantial investment to capture market share. For instance, in 2024, the global spirits market was valued at approximately $1.5 trillion, with emerging markets showing particularly robust growth trajectories.

Halewood’s focus on high-quality spirits brands globally means that entering untapped international regions offers considerable upside. However, these new market entries are characterized by low initial penetration and inherent risks, necessitating careful planning and resource allocation. The company’s strategic investments in brand building and distribution networks in these nascent markets are crucial for future success.

- High Growth Potential: Emerging markets offer substantial opportunities for brands like Halewood's premium spirits.

- Investment Needs: Significant capital is required for market entry, brand awareness, and distribution.

- Risk Factors: Regulatory hurdles, local competition, and economic volatility can impact success.

- Strategic Importance: These markets are vital for long-term global brand portfolio growth.

Halewood International's emerging premium spirits brands in new international markets are categorized as Question Marks. These ventures tap into the global spirits market, valued at approximately $1.5 trillion in 2024, with emerging regions showing strong growth. Despite this potential, these brands typically begin with a low market share, requiring substantial investment in marketing and distribution to gain traction.

The success of these new market entries hinges on Halewood's ability to navigate local competition and regulatory landscapes. For example, while the global spirits market is robust, specific emerging markets might present unique challenges and opportunities that demand tailored strategies to convert these Question Marks into future Stars.

| Product Category | BCG Matrix Classification | Market Share | Market Growth Rate | Investment Needs | Strategic Rationale |

|---|---|---|---|---|---|

| New International Spirits Market Entries | Question Mark | Low | High | High | Capture growth in untapped markets, build global brand presence |

BCG Matrix Data Sources

Our BCG Matrix for Halewood International Ltd. is constructed using a blend of internal financial reports, sales data, and market research. This includes competitor analysis and industry growth forecasts to accurately position each product.