Halewood International Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halewood International Ltd. Bundle

Halewood International Ltd. navigates a competitive landscape shaped by moderate buyer power and the looming threat of substitutes in the spirits market. Understanding the intensity of rivalry among existing competitors and the influence of suppliers is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Halewood International Ltd.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Halewood International Ltd.'s suppliers is significantly influenced by market concentration and the uniqueness of their offerings. For essential inputs like grains and fruits, or specialized packaging such as custom-designed glass bottles and unique labels, a limited number of providers can exert considerable influence.

Halewood's strategic emphasis on artisanal spirits, which often demand specific, less common ingredients and bespoke packaging, can further amplify supplier leverage. This reliance on niche inputs means suppliers of these unique materials may hold a stronger negotiating position, potentially impacting Halewood's cost structure and product development timelines.

The bargaining power of suppliers for Halewood is influenced by the switching costs involved. If Halewood faces significant hurdles in changing suppliers, such as contractual obligations or specialized equipment needs, existing suppliers gain leverage. For instance, if Halewood's bottling lines are calibrated for specific bottle neck sizes from a particular glass supplier, switching to a new supplier would necessitate costly retooling, thereby empowering the original supplier.

In 2024, the global beverage industry, including spirits like those produced by Halewood, experienced ongoing supply chain volatility. Reports indicated that the cost of key raw materials, such as grains and glass, saw fluctuations. For Halewood, the difficulty in finding readily available, cost-competitive alternatives for specialized packaging or fermentation agents could lock them into existing supplier relationships, increasing supplier bargaining power.

Suppliers generally hold less sway when the inputs they provide are easily sourced from multiple suppliers or when Halewood can readily switch to alternative inputs without impacting product quality or expense. For example, while certain botanicals used in gin production might be specialized, the grains essential for vodka or whisky are often more standardized commodities, thereby diminishing supplier leverage in those particular product lines.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Halewood International Ltd.'s alcoholic beverage production is relatively low. The substantial capital required for distilleries, extensive distribution networks, and establishing strong brands within the alcoholic beverage sector presents a significant barrier. For instance, establishing a new distillery in the UK can easily cost upwards of £50 million, a prohibitive sum for most raw material suppliers.

Halewood's existing infrastructure, including its own distilleries and production facilities, already gives it considerable control over its value chain. This vertical integration means Halewood is less reliant on external manufacturers and can absorb much of the production process internally. This reduces the leverage suppliers might otherwise have if Halewood were solely dependent on contract manufacturing.

- High Capital Investment: The alcoholic beverage industry demands significant upfront investment, estimated in the tens of millions of pounds for new production facilities.

- Established Distribution Channels: Suppliers would need to build or acquire their own complex and costly distribution networks to reach consumers effectively.

- Brand Building Costs: Creating and marketing a successful beverage brand requires substantial expenditure, often in the millions annually.

- Halewood's Vertical Integration: Halewood's ownership of distilleries and production lines limits the need for external manufacturing, thus mitigating supplier power.

Importance of Halewood to Suppliers

The bargaining power of suppliers to Halewood International Ltd. is significantly influenced by Halewood's importance as a customer. When Halewood constitutes a substantial portion of a supplier's overall revenue, that supplier's leverage is diminished. They become more dependent on continuing the business relationship, making them less likely to impose unfavorable terms.

Conversely, if Halewood represents a minor client for a large and diversified supplier, Halewood's own bargaining power is consequently weakened. In such scenarios, the supplier has less incentive to accommodate Halewood's demands, as the loss of Halewood's business would not critically impact their operations.

- Supplier Dependence: Halewood's purchasing volume directly impacts supplier reliance.

- Market Share: A supplier's market position relative to Halewood's needs is crucial.

- Alternative Buyers: The availability of other customers for a supplier affects their power.

- Supplier Concentration: If few suppliers exist for critical inputs, their power increases.

The bargaining power of suppliers for Halewood International Ltd. is a key factor in its operational costs and profitability. In 2024, the spirits industry continued to grapple with supply chain challenges, impacting the cost of raw materials like grains and specialized packaging. For Halewood, this means suppliers of unique ingredients or bespoke bottles can wield significant influence, especially when switching costs are high due to specialized equipment or contractual ties.

Suppliers generally have less power when inputs are easily available from multiple sources or when Halewood can readily substitute materials without compromising quality. For instance, while certain gin botanicals might be niche, the grains for vodka are often commoditized, reducing supplier leverage in those specific product lines.

The threat of suppliers integrating forward into Halewood's production is minimal due to the high capital investment, estimated in the tens of millions of pounds for distilleries, and the need for established distribution and brand-building capabilities. Halewood's own vertical integration further limits supplier power by controlling its value chain.

| Factor | Impact on Supplier Bargaining Power | Example for Halewood |

|---|---|---|

| Market Concentration of Suppliers | High power if few suppliers exist | Limited providers for specialized glass bottles |

| Uniqueness of Inputs | High power for specialized or proprietary materials | Specific artisanal grains or unique botanicals |

| Switching Costs for Halewood | High power if switching is costly (e.g., retooling) | Bottling lines calibrated to specific bottle neck sizes |

| Halewood's Customer Importance | Low power if Halewood is a major customer | Supplier reliant on Halewood's volume |

| Supplier Integration Threat | Low power due to high industry barriers | High capital for distilleries (£50M+) and distribution |

What is included in the product

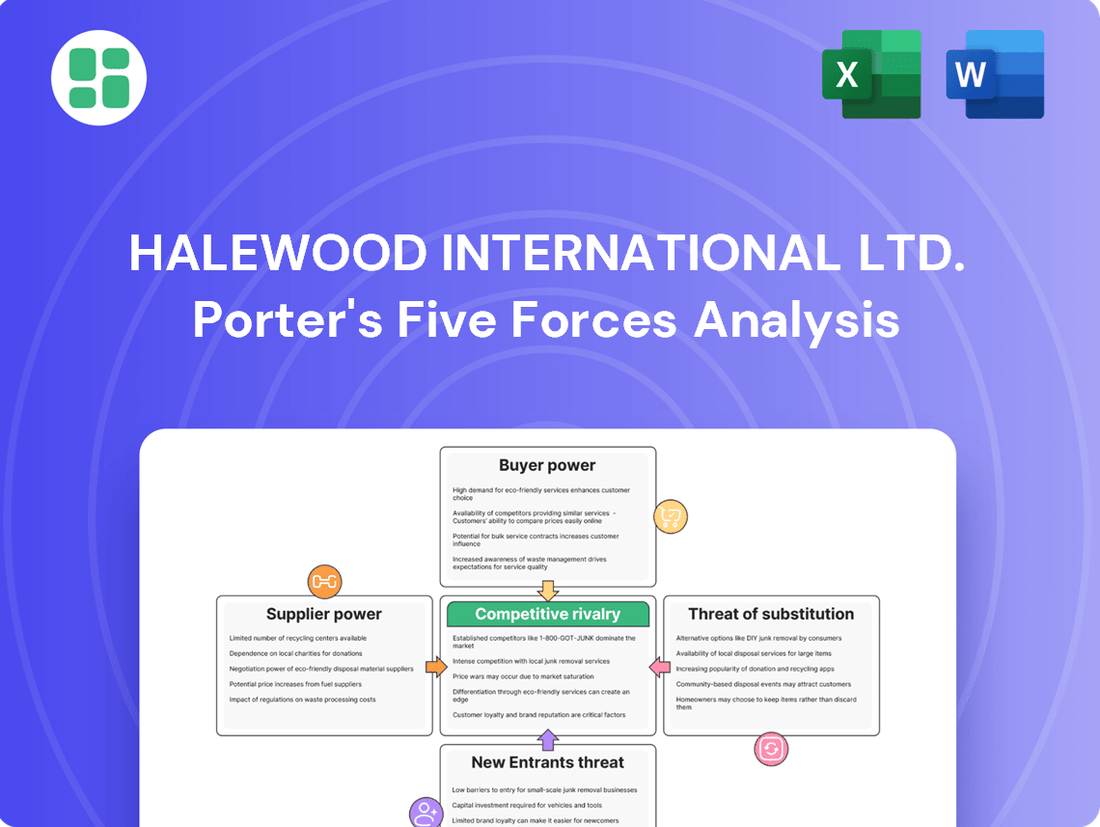

Analyzes the competitive intensity within the spirits and beverages market, examining buyer and supplier power, the threat of new entrants and substitutes, and the overall competitive rivalry impacting Halewood International Ltd.

Effortlessly identify and address Halewood International Ltd.'s competitive challenges with a visual, actionable breakdown of Porter's Five Forces.

Gain clarity on the impact of each force, enabling targeted strategies to mitigate threats and capitalize on opportunities within the spirits industry.

Customers Bargaining Power

Halewood International's customers, including major supermarket chains and large pub/bar groups, wield significant bargaining power. These entities often purchase in massive volumes, allowing them to negotiate favorable pricing and promotional terms. For example, a single major supermarket chain might account for a substantial percentage of Halewood's total sales, giving them considerable leverage.

For retailers, the cost of switching from one alcoholic beverage supplier to another, like Halewood International Ltd., is generally quite low. These costs might include minor adjustments to inventory management software or reconfiguring shelf space, which are not significant deterrents to changing suppliers.

This low switching cost significantly enhances the bargaining power of customers. They can easily shift their business to competitors if they find better pricing, more favorable payment terms, or superior product offerings from other alcohol manufacturers.

Consequently, Halewood International Ltd. faces pressure to maintain competitive pricing and cultivate strong brand loyalty among its retail customers to mitigate this customer power and ensure retention in a dynamic market.

Customer price sensitivity is a significant factor for Halewood International Ltd., especially as economic pressures mount. Consumers, and the retailers that serve them, are actively seeking value, making them more inclined to switch brands or opt for cheaper alternatives. This trend was evident in 2024, with many consumers re-evaluating their spending on discretionary items like alcoholic beverages.

Changes in alcohol duty, which have seen increases in recent years, directly impact the final price of products. This forces consumers to be more mindful of their purchases, often leading them to seek out brands that offer a more attractive price point. For Halewood, this means that competitive pricing is crucial to retaining market share and attracting price-conscious buyers.

Availability of Substitute Products for Customers

The bargaining power of customers is significantly amplified by the sheer volume of substitute products available. Consumers in the beverage market have an extensive selection of alcoholic and non-alcoholic options, making it easy to switch if a particular brand doesn't meet their expectations on price or distinctiveness.

This wide availability means that if Halewood International's offerings are perceived as too expensive or lacking unique appeal, customers can readily opt for alternatives. This includes established competitors and emerging categories like low- and no-alcohol beverages, which have seen substantial growth. For instance, the global low and no-alcohol drinks market was valued at approximately $11.4 billion in 2023 and is projected to reach over $27 billion by 2030, indicating a strong consumer shift and a vast competitive landscape.

- Extensive Choice: Customers can choose from a vast array of alcoholic and non-alcoholic beverages, increasing their leverage.

- Price Sensitivity: If Halewood's pricing is not competitive, customers can easily switch to more affordable alternatives.

- Differentiation Importance: Lack of product differentiation makes it simpler for customers to find comparable substitutes from other brands.

- Growth of Alternatives: The increasing popularity of low- and no-alcohol segments provides a significant pool of substitutes, impacting Halewood's market position.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while less frequent in the alcoholic beverage sector, remains a consideration for Halewood International. Large retailers, such as major supermarket chains, possess the financial clout and market access to potentially develop their own-label alcoholic beverages or even acquire existing production capabilities to bypass suppliers like Halewood. This would directly impact Halewood's sales volumes and potentially its pricing power.

Halewood's past actions, including the termination of third-party and own-label manufacturing agreements, hint at a strategic response to pressures within the industry, which could include managing customer demands or a deliberate shift to prioritize its own branded portfolio. For instance, in 2023, the UK grocery market saw significant consolidation, with the top four retailers holding over 70% of the market share, amplifying their bargaining leverage.

- Retailer Power: Major retailers can leverage their scale to demand lower prices or threaten to develop private-label alternatives.

- Production Control: Customers integrating backward gain control over product quality, supply chain, and profit margins.

- Strategic Shifts: Halewood's past decisions to end own-label agreements suggest a proactive management of customer relationship dynamics and a focus on brand equity.

Halewood International's customers, primarily large retailers and pub groups, exert considerable bargaining power due to their substantial purchasing volumes. This allows them to negotiate favorable pricing and promotional terms, as even a small percentage of their business represents significant revenue for Halewood. The ease with which these customers can switch suppliers, given low switching costs, further amplifies their leverage.

The wide array of substitute products available in the beverage market, including the rapidly growing low- and no-alcohol segments, means customers have ample alternatives if Halewood's offerings are not competitively priced or sufficiently differentiated. For instance, the global low and no-alcohol drinks market was valued at approximately $11.4 billion in 2023. This broad choice empowers customers to demand better value.

Customers' price sensitivity, heightened by economic conditions and factors like alcohol duty increases, forces Halewood to maintain competitive pricing. The threat of backward integration by major retailers, who could develop their own brands, also pressures Halewood to manage customer relationships and pricing effectively. In 2023, the top four UK grocery retailers controlled over 70% of the market share, underscoring their significant influence.

| Customer Type | Bargaining Power Factors | Impact on Halewood |

| Major Supermarket Chains | High volume purchases, low switching costs, threat of private labels | Price pressure, demand for promotional support |

| Large Pub/Bar Groups | Significant order sizes, potential for alternative suppliers | Negotiation leverage on pricing and product selection |

| Price-Sensitive Consumers (via Retailers) | High price sensitivity, readily available substitutes | Need for competitive pricing, importance of value proposition |

Preview Before You Purchase

Halewood International Ltd. Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Halewood International Ltd., detailing the competitive landscape within the spirits and beverage industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry for Halewood.

Rivalry Among Competitors

The UK alcoholic beverage market, Halewood International's operational arena, is a fiercely contested space. It's populated by a vast array of competitors, from multinational corporations with extensive portfolios to nimble craft producers carving out niche markets.

Halewood's competitive landscape is further complicated by its presence across diverse product categories. Whether it's spirits, wines, beers, or the increasingly popular ready-to-drink (RTD) segment, each area boasts its own formidable set of established players and emerging challengers, intensifying the rivalry.

In 2024, the UK spirits market alone is projected to reach approximately £13.8 billion, showcasing the sheer scale and attractiveness of the sector. This broad market means Halewood faces competition not only from direct rivals in specific product types but also from companies offering alternative beverage choices.

The UK spirits market is expected to see a slight dip in volume, with the overall alcoholic drinks sector experiencing fluctuating sales. This suggests a mature or slow-growth market, a scenario where competition naturally heats up as firms battle for existing share rather than expanding with the market. For instance, in 2023, the UK off-trade alcohol market saw a 0.4% volume decline, according to IWSR Drinks Market Analysis.

Halewood International Ltd. strives for a premium, artisanal image with brands such as Whitley Neill gin and Dead Man's Fingers rum. However, certain market segments, particularly in the broader spirits and ready-to-drink (RTD) categories, experience significant commoditization.

While robust brand loyalty can soften competitive pressures, a substantial portion of consumers remain receptive to exploring new offerings. This trend is amplified by the growing popularity of novel flavors and the convenience of RTDs, necessitating ongoing investment in product innovation and marketing campaigns to maintain market share.

High Fixed Costs and Exit Barriers

The alcoholic beverage sector, including companies like Halewood International Ltd., is characterized by substantial fixed costs. These include investments in distilleries, bottling plants, and extensive distribution infrastructure. For instance, establishing a modern distillery can cost tens of millions of pounds.

High exit barriers further intensify competitive rivalry. These barriers can include the specialized nature of production assets, which are difficult to repurpose, and long-term commitments to established distribution agreements. Companies may find it financially prohibitive to exit the market, even when facing profitability challenges, leading them to continue competing aggressively.

- Significant Capital Investment: The alcoholic beverage industry requires heavy upfront investment in production facilities and distribution networks.

- Specialized Assets: Production equipment and facilities are often highly specialized, limiting resale value and increasing exit costs.

- Distribution Channel Commitments: Existing contracts and relationships within distribution channels create a barrier to leaving the market.

- Halewood's Cost Management: Halewood International has actively managed these cost pressures through strategic restructuring and the divestment of non-core assets. For example, in 2023, the company continued to streamline its operations to improve efficiency.

Strategic Objectives of Competitors

Competitors in the spirits market often pursue divergent strategic goals, impacting the intensity of rivalry. For instance, some may aim to capture a larger slice of the market by aggressively pricing, even at the expense of immediate profit margins. Others might focus on premiumization and higher profitability within their existing segments.

The burgeoning no- and low-alcohol category presents another strategic divergence. Companies investing heavily in this area, like Diageo with its Seedlip brand, are seeking to tap into new consumer trends, potentially shifting focus away from traditional alcoholic beverages. This pursuit of new growth avenues can create unpredictable competitive dynamics.

For Halewood International Ltd., this means navigating a landscape where rivals might prioritize different metrics. A competitor focused solely on market share might engage in price wars, forcing Halewood to react. Conversely, a profit-focused competitor might cede market share to maintain higher margins, creating different competitive pressures.

- Market Share Focus: Competitors like Pernod Ricard often aim to grow their global market share, as evidenced by their consistent investment in brand building and distribution networks.

- Profitability Focus: Companies such as Sazerac may prioritize optimizing their portfolio for profitability, potentially exiting lower-margin segments or focusing on premium brands.

- Category Expansion: The significant growth in the no/low-alcohol segment, with companies like Heineken investing in brands like Heineken 0.0, demonstrates a strategic objective to capture emerging consumer preferences.

- Unpredictable Behavior: This mix of objectives means rivals might engage in aggressive promotional activity to gain volume, or conversely, pull back from price-sensitive segments, creating a dynamic competitive environment for Halewood.

Competitive rivalry within the UK alcoholic beverage market is intense, driven by a large number of players, including global giants and niche producers. Halewood International operates across multiple categories, facing varied competitive pressures in each. The sheer size of the market, with the UK spirits sector alone valued at approximately £13.8 billion in 2024, attracts significant competition.

The market's maturity, indicated by slight volume declines in 2023, means companies fiercely compete for existing market share. This often leads to aggressive pricing and promotional activities, as seen in the 0.4% volume decline in the UK off-trade alcohol market in 2023. Halewood must continually innovate and market its brands effectively to retain its position.

High fixed costs associated with production and distribution, coupled with significant exit barriers, compel companies to remain active competitors. This can result in sustained aggressive strategies, even in challenging market conditions, as companies are reluctant to abandon substantial investments.

Competitors adopt diverse strategic objectives, ranging from market share dominance through aggressive pricing to a focus on premiumization and profitability. The growing no- and low-alcohol segment also introduces new competitive dynamics as companies like Heineken invest in brands such as Heineken 0.0, creating a complex and unpredictable landscape for Halewood.

| Competitor Strategy | Example Company | Impact on Rivalry |

|---|---|---|

| Market Share Growth | Pernod Ricard | Aggressive brand building and distribution expansion, potentially leading to price competition. |

| Profitability Focus | Sazerac | Portfolio optimization, possibly exiting lower-margin areas, creating pressure on companies with broader portfolios. |

| Category Expansion | Heineken (with Heineken 0.0) | Capturing emerging consumer trends in no/low alcohol, potentially diverting consumer spend from traditional alcoholic beverages. |

| Premiumization | Diageo (with premium gin brands) | Focus on higher-margin products, potentially influencing pricing strategies across the premium spirits segment. |

SSubstitutes Threaten

The alcoholic beverage market, including Halewood International Ltd., faces a substantial threat from substitutes, particularly the booming no- and low-alcohol (NoLo) beverage segment. This growing category offers non-alcoholic alternatives to traditional beers, wines, and spirits, effectively replicating the drinking experience without alcohol. In 2024, the global NoLo market was projected to reach over $11 billion, demonstrating a clear and present alternative for consumers.

No- and low-alcohol (NoLo) alternatives present a significant threat to traditional alcoholic beverages by offering a compelling price-performance trade-off. Consumers are increasingly seeking moderation or health benefits without compromising on taste or experience, and many NoLo options now deliver this effectively. For instance, the UK NoLo market saw substantial growth, with sales reaching an estimated £1.5 billion in 2023, indicating a strong consumer shift towards these alternatives.

As the quality and variety of NoLo products continue to improve, their appeal grows, especially when factoring in economic pressures. Rising alcohol duties and the general increase in living costs make traditional alcoholic drinks less affordable for many. This economic reality further enhances the attractiveness of NoLo substitutes, which often come with a lower price point, making them a more budget-friendly choice for consumers looking to moderate their spending on beverages.

The growing consumer focus on health and wellness presents a significant threat of substitutes for Halewood International. A notable trend, particularly among younger demographics, involves a conscious effort to moderate alcohol consumption or adopt entirely alcohol-free lifestyles. This shift directly impacts the demand for traditional alcoholic beverages, a core offering for Halewood.

Data from 2024 indicates this trend is substantial. For instance, reports suggest that a considerable percentage of UK adults are actively reducing their alcohol intake or choosing not to drink at all. This growing segment of the market actively seeks alternatives to alcoholic drinks, thereby increasing the threat of substitution for Halewood's product portfolio.

Accessibility and Marketing of Substitutes

The increasing availability of non-alcoholic beverages across both bars, restaurants (on-trade), and supermarkets, liquor stores (off-trade) presents a significant threat. More establishments are dedicating shelf space and menu options to these alternatives, making them as easy to find as traditional alcoholic drinks.

Aggressive marketing campaigns and product innovation in the NoLo (no and low alcohol) sector are further amplifying this threat. For instance, celebrity endorsements and the introduction of unique flavor profiles in 2024 have significantly boosted the appeal and visibility of these substitutes, directly impacting the market share of alcoholic beverages.

- Expanding Distribution: Non-alcoholic options are becoming ubiquitous in both hospitality venues and retail environments.

- Marketing Prowess: High-profile marketing, including celebrity involvement and novel product launches, drives consumer interest in NoLo drinks.

- Market Growth: The global NoLo market was projected to reach substantial figures, with continued strong growth anticipated through 2025, indicating a rising consumer preference for alternatives.

Impact of Regulatory and Social Pressures

Increasing regulatory scrutiny, particularly around alcohol marketing and advertising, presents a significant threat. For instance, in 2024, several countries continued to debate or implement stricter rules on alcohol promotion, potentially limiting Halewood's reach. This regulatory environment, coupled with growing social acceptance of non-alcoholic options, as evidenced by the continued popularity of initiatives like Dry January, encourages consumers to explore substitutes.

The rise of the non-alcoholic beverage sector, bolstered by evolving consumer preferences and a focus on health and wellness, directly impacts the threat of substitutes. In 2024, the global low- and no-alcohol market was projected to continue its robust growth, with some analysts forecasting double-digit expansion for specific segments.

- Growing regulatory pressures on alcohol marketing and advertising are intensifying.

- Social movements like Dry January normalize and encourage the consumption of non-alcoholic alternatives.

- The **non-alcoholic beverage market** is experiencing significant growth, offering readily available substitutes.

- These converging factors make **choosing substitutes increasingly common and accepted** by consumers.

The threat of substitutes for Halewood International is substantial, primarily driven by the rapidly expanding no- and low-alcohol (NoLo) beverage market. This segment offers consumers alternatives that mimic the experience of traditional alcoholic drinks, catering to a growing demand for moderation and health-conscious choices. The global NoLo market was projected to exceed $11 billion in 2024, highlighting its significant presence.

Consumers are increasingly drawn to NoLo options due to their perceived health benefits and the ability to enjoy social occasions without alcohol. This trend is further amplified by economic factors, as rising alcohol duties and general cost-of-living increases make traditional alcoholic beverages less affordable. The UK NoLo market, for example, reached an estimated £1.5 billion in sales in 2023, underscoring a tangible shift in consumer spending.

| Category | 2023 Value (UK Estimate) | 2024 Projection (Global) | Key Driver |

|---|---|---|---|

| NoLo Beverages | £1.5 billion | >$11 billion | Health & Wellness, Moderation |

| Traditional Alcoholic Beverages | Significant Market Share | Stable to Moderate Growth | Established Consumer Habits |

Entrants Threaten

The alcoholic beverage sector demands significant capital. Building distilleries, breweries, and advanced production lines requires millions, as does creating widespread marketing and distribution channels. This high financial barrier effectively discourages many potential new players from entering the market.

For instance, establishing a new craft distillery in the UK can easily cost upwards of £1 million, encompassing equipment, licensing, and initial ingredient stock. Halewood International Ltd. itself has invested heavily in its end-to-end platform, operating multiple distilleries and bottling plants, demonstrating the scale of investment needed to compete effectively.

Securing access to key distribution channels, such as major supermarkets and popular pubs and bars, presents a substantial hurdle for newcomers looking to enter the alcoholic beverage market. Established companies like Halewood International often leverage decades of built relationships and guaranteed prime shelf space, making it a tough fight for new brands to get noticed.

In 2024, the dominance of major retail chains in the UK grocery sector, with the top four holding over 70% of the market share, underscores this challenge. While online sales are growing, the physical presence in these high-traffic retail environments remains critical for broad consumer reach and brand visibility.

For Halewood International Ltd., the threat of new entrants is significantly influenced by brand loyalty and differentiation. Building strong brand recognition and consumer trust in the competitive spirits market is a substantial hurdle. New companies must overcome ingrained consumer preferences for established, trusted brands, necessitating considerable investment in marketing and unique product offerings to carve out a niche.

Halewood benefits from its portfolio of highly-awarded brands, such as Whitley Neill gin, which has seen significant growth. For example, in 2023, Whitley Neill gin continued its strong performance, contributing to Halewood's overall market presence. This established brand equity acts as a barrier, making it harder for newcomers to attract consumers who are already loyal to these recognized names.

Regulatory Hurdles and Licensing

The alcoholic beverage sector presents considerable challenges for newcomers due to stringent regulatory frameworks. These include intricate licensing procedures, substantial excise duties, and limitations on advertising and sales channels.

For instance, in the UK, obtaining a personal licence to sell alcohol can cost around £37, with a further £100 for a premises licence, and these are just initial steps. Navigating such requirements demands significant investment in time and resources, effectively deterring many potential entrants.

The threat of new entrants is therefore moderated by these substantial regulatory barriers:

- Complex Licensing: Obtaining and maintaining various alcohol licenses is a costly and time-consuming process, requiring specialized legal and administrative expertise.

- Excise Duties and Taxation: High excise duties and varying tax rates across different product categories and regions add a significant cost burden, impacting profitability for new businesses.

- Marketing and Distribution Restrictions: Regulations on advertising, promotion, and the sale of alcoholic beverages can limit a new company's ability to reach its target market and build brand awareness.

Economies of Scale and Experience Curve

Existing players like Halewood International benefit from significant economies of scale in production, procurement, and distribution. This allows them to achieve lower per-unit costs, a critical advantage in the competitive beverage market. For instance, in 2024, major beverage manufacturers often reported production costs that were 10-15% lower than smaller, emerging players due to their sheer volume.

New entrants face a substantial hurdle in matching these efficiencies. They typically lack the established infrastructure and purchasing power to negotiate favorable terms with suppliers or optimize logistics from the outset. This cost disadvantage can make it difficult for them to compete on price, particularly in segments where consumers are highly price-sensitive.

- Economies of Scale: Halewood's established operations in 2024 likely provided cost savings of 5-10% in procurement and distribution compared to new market entrants.

- Experience Curve: Years of operational experience allow for process optimization, potentially reducing production costs by an additional 3-7% for established firms.

- Capital Investment: New entrants require massive upfront capital to build comparable production and distribution networks, creating a significant barrier.

- Price Sensitivity: The UK spirits market, for example, often sees price promotions, making cost advantages crucial for market penetration.

The threat of new entrants for Halewood International Ltd. is generally considered moderate to low, primarily due to the substantial barriers to entry in the alcoholic beverage industry.

High capital requirements for production facilities, distribution networks, and marketing campaigns represent a significant hurdle. For example, establishing a new distillery in the UK can cost over £1 million. Furthermore, securing shelf space in major retail chains, which control over 70% of the UK grocery market as of 2024, is a considerable challenge for newcomers.

Brand loyalty, exemplified by Halewood's successful brands like Whitley Neill gin, also acts as a deterrent. Navigating complex licensing, excise duties, and advertising restrictions further complicates market entry. Established players like Halewood benefit from economies of scale, with production costs potentially 10-15% lower than smaller competitors in 2024, creating a significant competitive advantage.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Halewood International Ltd. is built upon a foundation of industry-specific market research reports, financial disclosures from publicly traded competitors, and trade association data to capture the dynamics of the spirits industry.