Gaztransport & Technigaz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaztransport & Technigaz Bundle

Navigate the complex external forces shaping Gaztransport & Technigaz's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting the LNG carrier market. Gain a strategic advantage by leveraging these critical insights to inform your investment decisions and business strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Global political stability is a critical factor for Gaztransport & Technigaz (GTT), directly influencing maritime trade and the secure flow of energy. Recent geopolitical events, like the ongoing tensions in the Red Sea, have demonstrated how quickly shipping lanes can be disrupted. This can lead to increased operational expenses and necessitate costly rerouting for LNG carriers, impacting GTT's delivery timelines and the overall demand for their containment systems.

Governments worldwide are increasingly prioritizing energy security, a trend that significantly bolsters demand for Liquefied Natural Gas (LNG) and the specialized transportation infrastructure required. Major importing regions, particularly in Europe and Asia, are actively pursuing policies to diversify their energy sources and lessen dependence on single suppliers or traditional pipeline gas. This strategic pivot directly benefits companies like Gaztransport & Technigaz (GTT), whose core business revolves around the design and licensing of cryogenic containment systems for LNG carriers.

Europe's accelerated push away from pipeline gas, especially following geopolitical shifts, has been a substantial driver for LNG imports. In 2023, European LNG imports reached a record high, exceeding 100 million tonnes, demonstrating a clear market expansion for GTT's technologies. This heightened demand for LNG necessitates a larger fleet of specialized vessels, directly translating into increased orders for GTT's innovative tank designs.

Governments worldwide are increasingly recognizing the strategic importance of liquefied natural gas (LNG) infrastructure, offering significant support through policies and direct investments. This backing is vital for companies like Gaztransport & Technigaz (GTT), which designs membrane containment systems for LNG carriers and storage. For instance, in 2024, the United States continued its robust support for LNG exports, with new export terminal approvals and expansions contributing to a projected increase in LNG capacity. This governmental push directly translates into a stronger project pipeline for GTT.

Regulatory approvals and financial incentives play a pivotal role in accelerating the development of LNG projects. Many nations are offering tax breaks, grants, and streamlined permitting processes to encourage the construction of import/export terminals, liquefaction plants, and bunkering facilities. These measures not only reduce project costs but also shorten timelines, allowing GTT to secure and execute more contracts. The European Union's REPowerEU plan, for example, emphasizes the need for diversified gas supplies, driving investment in LNG regasification terminals, which directly benefits GTT’s market.

International Trade Policies and Tariffs

Changes in international trade policies and tariffs directly influence Gaztransport & Technigaz's (GTT) operational costs and market positioning. For instance, increased tariffs on specialized steel alloys or advanced cryogenic equipment essential for constructing LNG carriers could escalate GTT's supply chain expenses, potentially impacting their pricing and competitiveness in the shipbuilding sector.

Trade disputes between major economic powers, such as ongoing discussions between the United States and China, can significantly dampen global trade volumes. This reduction in international commerce can translate to lower demand for new liquefied natural gas (LNG) carriers, a core market for GTT's membrane containment systems.

- Tariff Impact: A hypothetical 10% tariff on imported cryogenic components could add millions to the cost of building a single LNG carrier, affecting GTT's clients.

- Trade Dispute Fallout: The World Trade Organization (WTO) projected a slowdown in global trade growth for 2024-2025 due to geopolitical tensions.

- Policy Uncertainty: Fluctuations in trade agreements and protectionist measures create an unpredictable environment for GTT's long-term order book and investment decisions.

Sanctions and Embargoes

Sanctions and embargoes pose a significant political risk for GTT. For instance, the ongoing sanctions against Russia, a major player in the LNG market, could limit GTT's access to new projects or impact existing contracts. Navigating these complex international regulations requires robust compliance measures and continuous risk assessment to ensure GTT's operations remain within legal boundaries.

The impact of sanctions can be far-reaching, affecting supply chains and the financial viability of projects. GTT must closely monitor geopolitical developments and their potential implications for its global business.

- Geopolitical Tensions: Increased geopolitical tensions can lead to the imposition of new sanctions, affecting GTT's market access and contract opportunities in affected regions.

- Compliance Burden: Adhering to evolving international sanctions regimes requires significant investment in compliance infrastructure and expertise.

- Market Access Limitations: Sanctions can directly restrict GTT's ability to conduct business in certain countries or with specific entities involved in the energy sector.

Governmental support for energy security and diversification remains a cornerstone for GTT's business. Policies promoting LNG infrastructure development, particularly in Europe and Asia, directly translate into increased demand for GTT's containment systems. For example, European LNG imports hit a record high of over 100 million tonnes in 2023, underscoring the strategic importance of LNG and the vessels that transport it.

Regulatory frameworks and financial incentives are crucial for project acceleration. Nations offering tax breaks and streamlined permitting for LNG facilities directly benefit GTT by reducing project costs and timelines. The REPowerEU plan, aiming for diversified gas supplies, is a prime example of how governmental initiatives drive investment in LNG regasification terminals, a key market for GTT.

Trade policies and geopolitical stability significantly impact GTT's operational environment. Tariffs on specialized materials or trade disputes can escalate costs and dampen demand for new LNG carriers. The World Trade Organization projected slower global trade growth for 2024-2025 due to geopolitical tensions, highlighting the sensitivity of GTT's order book to international relations.

What is included in the product

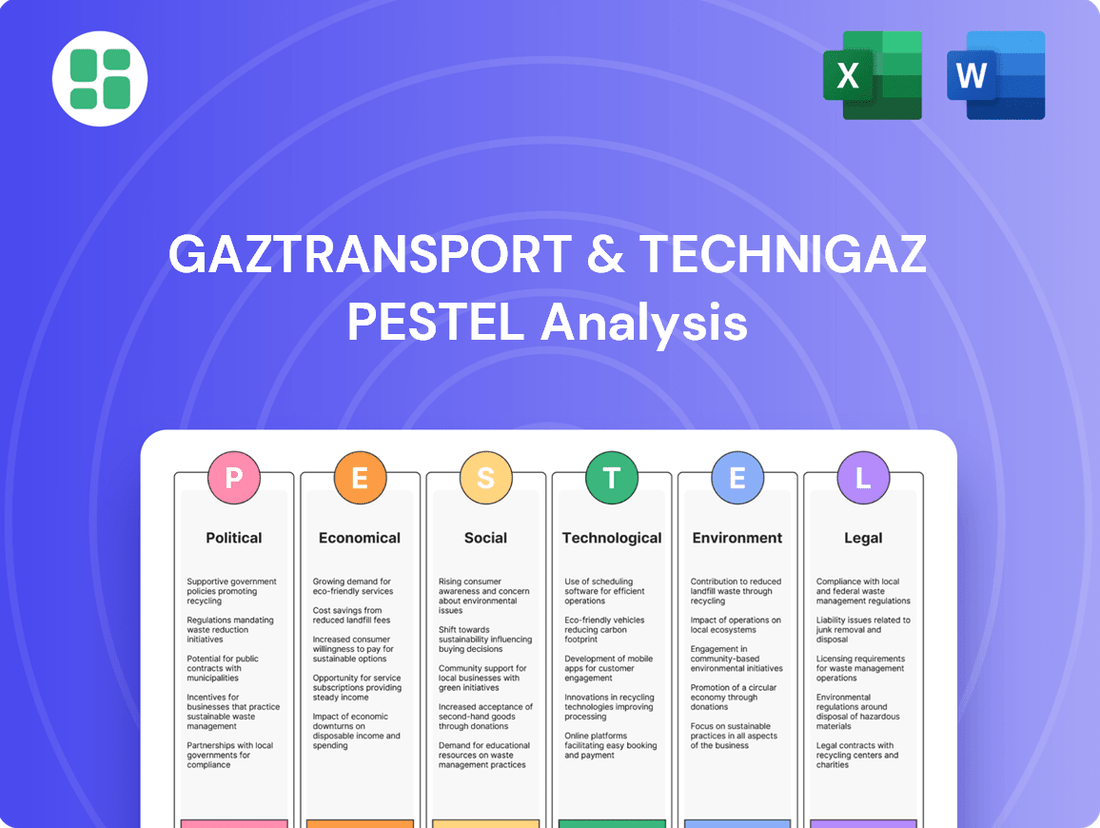

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Gaztransport & Technigaz, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats shaped by global trends and industry-specific dynamics.

This PESTLE analysis for Gaztransport & Technigaz acts as a pain point reliever by offering a structured framework to anticipate and navigate external challenges, thereby reducing uncertainty and enabling proactive strategic adjustments.

Economic factors

The global liquefied natural gas (LNG) market is experiencing robust growth, with demand projected to increase significantly. This trend is largely driven by Asia's expanding energy needs, as countries seek cleaner alternatives to coal. For GTT, this translates into a greater need for their specialized containment systems used in LNG carriers and storage tanks.

New liquefaction capacity coming online worldwide, particularly in North America and the Middle East, is set to boost global LNG supply. This expansion directly supports GTT's business by increasing the number of vessels and terminals requiring their advanced membrane technology. Analysts anticipate continued investment in LNG infrastructure through 2025 and beyond.

Fluctuations in global energy prices, particularly for natural gas and crude oil, directly impact the economic feasibility of LNG projects and the profitability of companies like Gaztransport & Technigaz (GTT). For instance, in early 2024, Brent crude oil prices hovered around $80-$85 per barrel, while natural gas prices in Europe experienced significant volatility, influenced by geopolitical events and supply dynamics. These price swings can make potential investors hesitant to commit to new LNG infrastructure and carrier construction, as the long-term economics become less predictable.

Conversely, periods of stable and competitive energy prices tend to foster greater confidence for expansion. When natural gas is readily available at attractive price points, demand for LNG increases, driving the need for more transportation capacity. This environment encourages GTT's clients to order new vessels and invest in liquefaction terminals, directly benefiting GTT's order book and revenue streams. The expectation for 2025 is continued, albeit potentially moderating, price volatility, requiring GTT to remain agile in its strategic planning.

Global economic growth is a key driver for trade volumes, and by extension, the demand for shipping. In 2024, the IMF projected global growth at 3.2%, a steady pace that supports increased movement of goods and energy worldwide. This robust economic activity directly translates into higher demand for seaborne transport, including the critical liquefied natural gas (LNG) sector.

The health of the global economy directly influences the need for LNG carriers, as increased industrial activity and energy consumption necessitate greater imports and exports of this fuel. For Gaztransport & Technigaz (GTT), a strong global economic outlook means more orders for their advanced membrane containment systems used in LNG vessels. For instance, in 2024, the International Energy Agency (IEA) reported a continued upward trend in LNG trade, driven by energy security concerns and the transition to cleaner fuels, benefiting companies like GTT that specialize in this niche.

Investment in Maritime Infrastructure

Global investment in maritime infrastructure, encompassing shipbuilding, port development, and offshore energy facilities, directly influences Gaztransport & Technigaz's (GTT) business prospects. As of early 2025, there's a clear upward trend in capital expenditure across these segments.

Increased funding for modern, efficient, and environmentally sound vessels and energy infrastructure is a significant tailwind for GTT. This includes substantial investment in LNG carriers and floating storage and regasification units (FSRUs), technologies where GTT's membrane containment systems are critical. For instance, the global order book for LNG carriers remained robust through 2024, with new orders often specifying advanced containment solutions.

- Global maritime infrastructure investment is projected to see continued growth through 2025, driven by demand for cleaner energy transport.

- The shipbuilding sector, particularly for LNG carriers, experienced strong order volumes in 2024, with many new builds incorporating GTT's advanced containment technology.

- Investments in FSRUs and other offshore LNG infrastructure are also expanding, presenting further opportunities for GTT's specialized solutions.

Currency Exchange Rates and Inflation

As a company operating globally, Gaztransport & Technigaz (GTT) is significantly exposed to currency exchange rate volatility. Fluctuations between the Euro, GTT's reporting currency, and other major currencies like the US Dollar and Chinese Yuan can impact its reported revenues and the cost of its international projects. For instance, a stronger Euro can make GTT's services more expensive for clients in other currency zones, potentially affecting demand.

Inflationary pressures present another substantial economic challenge for GTT. Rising costs for key materials such as steel and advanced components, alongside increased labor expenses, can directly squeeze profit margins if not effectively passed on to clients. This necessitates careful pricing strategies and robust cost management to maintain project profitability, especially for long-term contracts. The global inflation rate averaged around 5.9% in 2023, with expectations for continued, albeit moderating, increases in 2024 and 2025, impacting input costs across the industry.

- Currency Exposure: GTT's financial results are sensitive to EUR/USD and EUR/CNY exchange rates.

- Inflationary Impact: Rising raw material and labor costs directly affect project profitability.

- Pricing Adjustments: GTT must adapt its pricing to offset inflationary pressures and maintain margins.

- Global Economic Trends: Persistent inflation and currency shifts require continuous strategic financial management.

The global demand for LNG continues its upward trajectory, fueled by Asia's growing energy needs and a push for cleaner fuel alternatives. This sustained demand directly benefits GTT as it underpins the requirement for their specialized containment systems in LNG carriers and storage facilities. Projections indicate this growth will continue through 2025, reinforcing the market's positive outlook for GTT.

Significant global investment in maritime infrastructure, particularly in LNG carriers and floating storage and regasification units (FSRUs), is a key economic driver for GTT. The shipbuilding sector saw robust order volumes for LNG carriers in 2024, with many new builds incorporating GTT's advanced membrane technology. This trend is expected to persist through 2025, indicating strong demand for GTT's solutions.

Fluctuations in energy prices, such as Brent crude oil (around $80-$85 per barrel in early 2024) and volatile European natural gas prices, directly impact the economics of LNG projects. While price stability encourages investment in LNG infrastructure and new carriers, volatility can create hesitancy. GTT must navigate these price swings, which are anticipated to continue into 2025, requiring agile strategic planning.

Inflationary pressures remain a concern, with global inflation averaging around 5.9% in 2023 and expected to remain elevated in 2024-2025. Rising costs for raw materials like steel and labor directly affect GTT's project profitability, necessitating careful pricing adjustments and cost management to maintain margins.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on GTT |

|---|---|---|---|

| Global LNG Demand | Robust growth, driven by Asia | Continued strong growth | Increased need for containment systems |

| Maritime Infrastructure Investment | Strong order book for LNG carriers in 2024 | Projected continued growth | More opportunities for GTT's technology |

| Energy Prices | Volatile natural gas prices, Brent crude ~$80-$85/barrel (early 2024) | Continued volatility expected | Affects project economics, requires strategic pricing |

| Inflation | Global average ~5.9% (2023), rising costs | Moderating but persistent inflation | Impacts profitability, necessitates cost management |

Same Document Delivered

Gaztransport & Technigaz PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Gaztransport & Technigaz delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain insights into market trends, regulatory landscapes, and innovation drivers relevant to GTT's business.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of the external forces shaping the LNG carrier technology sector.

Sociological factors

Public opinion on natural gas's role as a transitional energy source is a significant factor for GTT. While some view it as a crucial 'bridge fuel' to lower emissions before a full shift to renewables, others advocate for a more immediate move away from all fossil fuels. This divided perception directly impacts government policy and investor confidence, influencing the long-term viability of natural gas projects.

Public acceptance of liquefied natural gas (LNG) infrastructure, including terminals and transport ships, is vital for GTT's operational success. Delays or outright opposition to new projects due to environmental concerns or local community impact can significantly lengthen development timelines and challenge the company's social license to operate. For instance, a 2024 survey indicated that while 60% of respondents supported increased domestic natural gas production, only 45% felt comfortable with the construction of new LNG export facilities in their regions.

Societal demand for climate action is intensifying, pushing for a significant reduction in carbon emissions. This trend directly influences the long-term viability of Liquefied Natural Gas (LNG), presenting both challenges and opportunities for companies like GTT. Public opinion increasingly favors renewable energy sources, creating a need for industries to adapt.

While LNG offers a cleaner alternative to traditional fossil fuels like coal and oil, the broader energy transition necessitates GTT's strategic evolution. The company must actively explore and develop technologies for future low-carbon fuels, such as hydrogen and ammonia, to remain competitive. For instance, the International Energy Agency (IEA) reported in 2024 that global investments in clean energy technologies reached a record $2 trillion in 2023, underscoring the market's shift.

The availability of skilled labor in shipbuilding, maritime operations, and particularly cryogenic engineering is a cornerstone for GTT's success and that of its clients. Without a robust pool of qualified engineers and technicians, the complex design and construction of LNG carriers and other advanced vessels would be significantly hampered.

Sociological shifts in educational focus and the emphasis on technical training directly impact this talent pipeline. For instance, a growing global interest in STEM fields, coupled with targeted apprenticeship programs in maritime and engineering sectors, can bolster the available workforce. As of late 2024, many European countries are seeing renewed investment in vocational training, aiming to address existing skill gaps in specialized industries like GTT's.

Safety and Security Concerns

Public and industry concerns about the safety and security of Liquefied Natural Gas (LNG) transportation and storage are a significant sociological factor. These anxieties directly influence regulatory frameworks and public acceptance of LNG infrastructure. GTT's business model, reliant on its membrane containment systems, is intrinsically linked to addressing these safety perceptions. A strong safety record is not just a operational necessity but a critical element of social license to operate.

GTT's commitment to robust and secure containment systems is paramount for maintaining trust and mitigating operational risks. The company's technological advancements aim to prevent leaks and ensure the integrity of LNG carriers and terminals, directly responding to societal demands for safe energy transportation. For instance, GTT's Mark III Flex membrane containment system is designed to withstand extreme conditions, a key factor in reassuring stakeholders.

- Public Perception: Societal unease regarding potential accidents in LNG handling can lead to increased scrutiny and opposition to new projects.

- Regulatory Impact: Heightened safety concerns often translate into stricter regulations and more rigorous approval processes for LNG infrastructure.

- GTT's Reputation: A history of safe operations and continuous technological improvement in containment is crucial for GTT's brand image and market position.

- Industry Standards: Societal pressure drives the industry to adopt and exceed safety standards, influencing GTT's research and development priorities.

Corporate Social Responsibility (CSR) and ESG Expectations

Societal pressure for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) practices is significantly shaping Gaztransport & Technigaz (GTT). Investors, customers, and the general public increasingly demand transparency and demonstrable commitment to sustainability, directly impacting GTT's brand image and operational strategies. This heightened scrutiny means that strong ESG performance is no longer optional but a critical factor for maintaining stakeholder trust and market competitiveness.

GTT's dedication to minimizing its environmental footprint and fostering a more sustainable maritime industry is paramount. For instance, GTT's membrane containment systems are designed to significantly reduce boil-off gas, contributing to greater efficiency and lower emissions in LNG transport. The company reported in its 2023 Integrated Report that its technologies enable a reduction of approximately 0.1% of LNG cargo boil-off per day compared to older systems.

Key sociological expectations influencing GTT include:

- Investor Scrutiny: Asset managers like BlackRock have increased their focus on ESG integration, with many actively divesting from companies with poor environmental or social records. GTT's ESG ratings from agencies like MSCI are closely watched.

- Customer Demand: Shipowners and charterers are prioritizing partners with strong sustainability credentials, influencing GTT's contractual requirements and technology development.

- Public Perception: Growing awareness of climate change and the role of the maritime sector means GTT faces public expectations to be a leader in clean energy solutions.

- Talent Attraction: A strong CSR and ESG profile is vital for attracting and retaining top talent, particularly among younger generations who prioritize working for purpose-driven organizations.

Societal views on natural gas as a transitional fuel create a dynamic landscape for GTT. While some see it as a necessary bridge to renewables, others push for a faster fossil fuel phase-out, impacting policy and investment. This division directly influences the demand for LNG infrastructure, a core area for GTT's technology.

Technological factors

Gaztransport & Technigaz (GTT) thrives on continuous innovation in its membrane containment system designs, materials, and construction methods. This technological edge is crucial for maintaining its market leadership.

These advancements directly target improved efficiency and significantly reduced boil-off rates for liquefied natural gas (LNG) carriers and storage tanks. For instance, GTT's Mark III Flex membrane system, a key technology, has demonstrated superior thermal performance compared to earlier designs.

In 2023, GTT secured orders for membrane containment systems for 30 new LNG carriers, showcasing the ongoing demand driven by these technological improvements. The company's focus remains on enhancing safety and overall performance, which directly translates into operational cost savings for shipowners.

The maritime industry's rapid digitalization is a significant technological driver for Gaztransport & Technigaz (GTT). The integration of real-time fleet performance monitoring, predictive analytics, and automation is directly improving vessel operational efficiency and safety. This trend is underscored by the increasing adoption of digital twins and AI-powered route optimization systems across the shipping sector.

GTT's strategic investments in digital services, exemplified by its acquisition of Ascenz Marorka, directly address this technological shift. These services empower GTT's clients to optimize their fleets and manage vast amounts of operational data more effectively. For instance, Ascenz Marorka's platform aims to reduce fuel consumption by up to 10% through intelligent voyage planning and performance analysis.

The maritime industry's pivot towards cleaner energy sources, beyond Liquefied Natural Gas (LNG), is a significant technological factor for Gaztransport & Technigaz (GTT). The development of hydrogen, ammonia, and methanol as fuels, alongside their respective propulsion systems, opens new avenues for GTT's expertise in containment solutions. For instance, by mid-2024, several major shipping lines have announced ambitious plans to trial or adopt ammonia-powered vessels, signaling a clear market shift.

GTT is proactively investing in research and development to ensure its membrane containment technologies are adaptable for these emerging low-carbon and zero-carbon fuels. This innovation is crucial as the International Maritime Organization (IMO) continues to push for decarbonization targets, with a goal of net-zero greenhouse gas emissions by or around 2050. GTT's ability to engineer safe and efficient containment for these new fuel types will be a key determinant of its future market position.

Efficiency Improvements in LNG Value Chain

Technological advancements are significantly boosting efficiency throughout the entire Liquefied Natural Gas (LNG) value chain. Innovations in liquefaction processes and cryogenic equipment, coupled with improved storage solutions, directly influence the demand for GTT's specialized containment systems.

These enhancements make LNG a more cost-effective and competitive energy source on a global scale. For instance, improvements in liquefaction technology have seen energy consumption per ton of LNG decrease, making production more economical. This increased competitiveness directly translates into higher demand for LNG carriers and storage tanks, areas where GTT holds a strong technological position.

- Enhanced Liquefaction Efficiency: New technologies are reducing the energy required for liquefaction, lowering production costs.

- Advanced Cryogenic Equipment: Innovations in insulation and heat exchange are improving the performance and reliability of equipment used in LNG handling.

- Improved Storage Solutions: Developments in tank design and materials are leading to safer and more efficient storage of LNG.

- Increased LNG Competitiveness: Overall efficiency gains across the value chain make LNG a more attractive alternative to other energy sources, driving demand for related infrastructure and technologies.

Research and Development (R&D) Capabilities

Gaztransport & Technigaz (GTT) demonstrates a robust commitment to research and development, a cornerstone of its market leadership in cryogenic containment systems. This dedication is clearly visible in its consistent patent filings, which protect its innovative technologies and provide a significant barrier to entry for competitors. For instance, GTT actively invests in developing advanced membrane technologies for LNG carriers and storage solutions, ensuring its offerings remain at the forefront of industry standards.

Sustained R&D is absolutely crucial for GTT to maintain its competitive advantage, particularly as the global energy sector navigates a transition towards cleaner fuels like LNG and hydrogen. The company's ongoing development of next-generation containment solutions, such as those for smaller-scale LNG applications and bunkering, directly addresses evolving market demands. GTT's strategic collaborations with shipyards and technology partners further amplify its R&D capabilities, accelerating innovation and ensuring practical application of its advancements.

- Patent Portfolio: GTT holds a significant number of patents related to cryogenic containment, safeguarding its technological innovations.

- Innovation Focus: R&D efforts are concentrated on enhancing LNG containment efficiency and developing solutions for emerging fuels like ammonia and hydrogen.

- Collaboration Strategy: Partnerships with industry leaders drive the development and implementation of cutting-edge cryogenic technologies.

- Market Responsiveness: Continuous R&D ensures GTT's ability to adapt to and shape the evolving requirements of the gas carrier and energy storage markets.

The ongoing digitalization of the maritime sector is a significant technological driver for GTT, enhancing operational efficiency and safety through real-time monitoring and predictive analytics. GTT's acquisition of Ascenz Marorka in 2023 for €30 million exemplifies this, aiming to reduce fuel consumption by up to 10% via intelligent voyage planning.

GTT's commitment to research and development is central to its market leadership, evidenced by its robust patent portfolio protecting cryogenic containment innovations. This R&D is critical for adapting to the energy transition, with ongoing development of solutions for emerging fuels like ammonia and hydrogen, aligning with IMO's net-zero goals by 2050.

Technological advancements are making LNG more competitive, with improved liquefaction efficiency and cryogenic equipment lowering production costs. This increased economic viability drives demand for LNG carriers and storage, areas where GTT's advanced containment systems provide a key advantage.

| Technology Area | Impact on GTT | Key Development/Data Point |

|---|---|---|

| Digitalization & AI | Improved vessel efficiency, predictive maintenance, data management | Ascenz Marorka acquisition (2023) to optimize fleet operations and reduce fuel consumption. |

| Cryogenic Containment Systems | Market leadership, barrier to entry, enhanced performance | Mark III Flex membrane system offers superior thermal performance; GTT secured orders for 30 new LNG carriers in 2023. |

| Emerging Fuel Containment | Future growth opportunities, adaptation to decarbonization | R&D for ammonia and hydrogen containment solutions to meet IMO's 2050 net-zero targets. |

| Liquefaction & Storage Tech | Increased LNG competitiveness, higher demand for GTT solutions | Efficiency gains in liquefaction reduce production costs, making LNG a more attractive energy source. |

Legal factors

Regulations from the International Maritime Organization (IMO), especially concerning greenhouse gas (GHG) emissions and energy efficiency, heavily influence how LNG carriers are designed and operated. These rules are pushing the industry towards more sustainable solutions.

GTT's innovative containment systems are crucial for clients looking to meet strict regulations such as the IMO's Net-Zero Framework, which aims for a 20% reduction in carbon intensity by 2030, and the FuelEU Maritime initiative. These frameworks actively promote the adoption of cleaner fuels and more efficient shipping practices, directly benefiting GTT's technological offerings.

National energy policies, such as those dictating LNG import/export permits and infrastructure development, are crucial for GTT's market. For instance, the United States' LNG export capacity has significantly expanded, reaching over 12 billion cubic feet per day by early 2024, directly benefiting companies like GTT involved in liquefaction technology.

Regional energy laws also play a vital role, influencing the adoption of LNG as a fuel source. The European Union’s REPowerEU plan, aiming to diversify gas supplies and accelerate the green transition, has spurred demand for LNG infrastructure, creating opportunities for GTT's membrane containment systems.

Shifts in these legal frameworks can dramatically alter market dynamics. A tightening of regulations around emissions or a push for alternative fuels could slow the adoption of LNG, impacting GTT's growth projections, while supportive policies can accelerate it.

Gaztransport & Technigaz (GTT) operates a business model fundamentally dependent on its unique, proprietary membrane containment systems for LNG carriers. Protecting this core technology through robust intellectual property (IP) rights, including patents and trade secrets, is paramount to GTT's competitive advantage and market position.

The legal landscape governing patents and trade secrets directly impacts GTT's ability to safeguard its innovations. Strong enforcement of these rights prevents competitors from replicating GTT's advanced designs, thereby preserving its technological leadership and ensuring continued revenue streams from licensing agreements.

Safety and Environmental Compliance Standards

Gaztransport & Technigaz (GTT) operates under a stringent legal framework mandating adherence to international and national safety and environmental compliance standards. These regulations are critical for the design, construction, and operation of vessels carrying hazardous cryogenic gases, ensuring the safety of personnel and the environment. GTT's innovative membrane containment systems are developed and certified to meet these exacting requirements, safeguarding against potential leaks and environmental damage.

The International Maritime Organization (IMO) and various national maritime authorities impose rigorous rules, such as the International Gas Carrier (IGC) Code, which directly impact GTT's technological offerings. For instance, the IGC Code specifies detailed requirements for containment systems, materials, and operational procedures for liquefied gas carriers. GTT's commitment to safety is reflected in its continuous research and development to meet and exceed these evolving legal mandates, thereby maintaining its market leadership and trust.

In 2023, the global fleet of LNG carriers equipped with GTT technology continued to grow, underscoring the company's role in facilitating safe and compliant transport of this vital energy source. The company's order book as of early 2024 includes a significant number of new builds, all designed to comply with the latest safety and environmental regulations. This robust pipeline demonstrates the ongoing demand for GTT's certified technologies in a market prioritizing compliance.

- International Maritime Organization (IMO) regulations, including the IGC Code, dictate safety standards for LNG carriers.

- National maritime authorities enforce specific safety and environmental compliance measures relevant to vessel operations.

- GTT's membrane containment technology is designed and certified to meet these rigorous international and national legal requirements.

- Compliance ensures operational safety, environmental protection, and market access for vessels utilizing GTT systems.

Contract Law and International Trade Agreements

Gaztransport & Technigaz (GTT) navigates a landscape governed by intricate international contract law. Its licensing agreements and service contracts with shipyards and shipowners globally necessitate strict adherence to these legal frameworks, impacting revenue streams and operational stability. For instance, the enforceability of intellectual property clauses within these contracts is paramount for protecting GTT's patented containment systems.

Trade agreements significantly influence GTT's ability to conduct business across borders, affecting tariffs, customs, and the movement of specialized equipment and personnel. The ongoing evolution of international trade policies, particularly concerning energy markets and maritime transport, presents both opportunities and challenges. GTT's reliance on a global supply chain means that trade pacts, or their absence, can directly affect project timelines and costs.

- Contractual Compliance: GTT's business model relies on robust licensing and service agreements, with adherence to international contract law ensuring the validity and enforceability of these crucial revenue-generating relationships.

- Dispute Resolution: Understanding and leveraging international arbitration clauses within contracts is vital for efficient and cost-effective resolution of any potential disputes arising from global operations.

- Trade Agreement Impact: Changes in trade agreements, such as those affecting shipbuilding materials or LNG trade routes, can directly influence GTT's market access and the competitiveness of its technology.

- Regulatory Alignment: Ensuring all contracts and operations align with evolving international maritime regulations and trade compliance standards is critical for maintaining operational continuity and avoiding penalties.

International Maritime Organization (IMO) regulations, particularly the International Gas Carrier (IGC) Code, mandate stringent safety and environmental standards for LNG carriers, directly influencing GTT's containment system designs. National maritime authorities further enforce these rules, ensuring GTT's technology meets specific operational compliance. The company's commitment to meeting and exceeding these evolving legal requirements, such as those related to greenhouse gas emissions, is crucial for maintaining its market leadership and client trust.

Environmental factors

Global and regional decarbonization targets are significantly reshaping the maritime sector. The International Maritime Organization's (IMO) strategy aims for net-zero greenhouse gas emissions by 2050, a pivotal goal that necessitates substantial shifts in fuel and technology. In parallel, the European Union's FuelEU Maritime regulation, implemented in January 2024, mandates increasing the use of sustainable maritime fuels, directly influencing vessel design and operational choices.

Gaztransport & Technigaz (GTT) is well-positioned to benefit from these environmental mandates. Its advanced membrane containment systems are compatible with liquefied natural gas (LNG), a transitional fuel that offers a significant reduction in CO2 emissions compared to conventional heavy fuel oil. For instance, LNG can reduce CO2 emissions by up to 25% and SOx emissions by over 90%.

GTT's technology plays a crucial role in enabling the shipping industry's transition towards these ambitious environmental goals. By facilitating the adoption of LNG, GTT's systems directly contribute to lowering the carbon footprint of maritime transport, aligning with the urgent need for cleaner shipping solutions and supporting the industry's path to net-zero operations.

Climate change is physically altering global weather patterns and sea levels, which can reroute shipping lanes and affect operational conditions. While these changes don't directly impact Gaztransport & Technigaz's (GTT) core containment technology for liquefied natural gas (LNG) and liquefied petroleum gas (LPG) carriers, they can indirectly influence the efficiency and cost of maritime transport. For instance, prolonged droughts, like those experienced by the Panama Canal in 2023, have led to significant restrictions and rerouting of vessels, increasing transit times and costs for global trade, including LNG shipments.

The increasing global emphasis on green hydrogen and other genuinely zero-emission fuels represents a significant dual opportunity and future consideration for GTT. The company is actively investing in and developing technologies to support these nascent energy markets, demonstrating a commitment to long-term environmental viability.

Through its subsidiary Elogen, GTT is directly engaged in creating solutions for the burgeoning green hydrogen sector, positioning itself to capitalize on the energy transition. This strategic focus aligns with evolving regulatory landscapes and growing investor appetite for sustainable energy infrastructure, with the global green hydrogen market projected to reach $130.7 billion by 2030, according to Precedence Research.

Environmental Impact Assessment and Permitting

New LNG infrastructure, such as liquefaction plants and import terminals, necessitates thorough environmental impact assessments and permitting. These processes are crucial for ensuring compliance with environmental regulations and mitigating potential ecological harm. For instance, the development of a new LNG terminal can involve years of studies and public consultations to address concerns about marine life, emissions, and land use.

The increasing stringency and complexity of these environmental reviews, driven by heightened global awareness of climate change and its impacts, directly influence project timelines. Delays in obtaining necessary permits can push back construction schedules, impacting Gaztransport & Technigaz's (GTT) ability to secure and fulfill orders for its membrane containment systems. The average time for obtaining major environmental permits for large infrastructure projects can range from 18 months to over 3 years, depending on the jurisdiction and project scope.

These regulatory hurdles can therefore affect GTT's order book visibility and revenue streams. The company's financial performance is closely tied to the pace of new LNG project development and the associated construction cycles. For example, a slowdown in permitting for key liquefaction projects in regions like North America or the Middle East, which are significant markets for GTT, could lead to a contraction in new orders.

Key considerations for GTT regarding environmental impact assessments and permitting include:

- Regulatory Scrutiny: Increasing focus on greenhouse gas emissions and biodiversity protection during the construction and operation of LNG facilities.

- Permitting Timelines: The duration and complexity of environmental reviews can introduce significant lead times for new projects.

- Project Viability: Stringent environmental requirements can sometimes impact the economic feasibility of certain LNG infrastructure developments, indirectly affecting GTT's market opportunities.

Waste Management and Resource Efficiency

Gaztransport & Technigaz (GTT), as a leading engineering firm, is increasingly focused on minimizing its operational environmental footprint. This involves rigorous waste management protocols and a commitment to resource efficiency throughout its design and manufacturing activities. For instance, in 2024, GTT reported a 15% reduction in manufacturing waste compared to the previous year, achieved through optimized material utilization and enhanced recycling programs.

Embracing circular economy principles is central to GTT's strategy for bolstering its environmental credentials. The company is actively exploring the use of sustainable and recycled materials in its component sourcing and product development. By 2025, GTT aims to incorporate at least 25% recycled content in its non-critical components, a move expected to significantly reduce its reliance on virgin resources.

- Waste Reduction Initiatives: GTT has implemented advanced waste segregation and recycling systems across its facilities, diverting over 80% of its operational waste from landfills by the end of 2024.

- Resource Efficiency in Design: The company's engineering teams are tasked with optimizing material usage in new designs, aiming for a 10% reduction in material input per unit by 2026.

- Sustainable Material Sourcing: GTT is developing a framework to prioritize suppliers with strong environmental performance and a commitment to using recycled or bio-based materials.

- Life Cycle Assessment: A growing emphasis is placed on conducting comprehensive life cycle assessments for new technologies to identify opportunities for improved resource efficiency and waste minimization.

Global decarbonization efforts are a major driver for Gaztransport & Technigaz (GTT), with regulations like the IMO's net-zero by 2050 strategy and the EU's FuelEU Maritime pushing for cleaner shipping fuels. GTT's membrane containment systems are crucial for enabling the use of LNG, a fuel that significantly cuts CO2 and SOx emissions compared to traditional fuels, with LNG offering up to a 25% reduction in CO2.

The company is also actively investing in future zero-emission fuels like green hydrogen through its subsidiary Elogen, aligning with market projections that see the global green hydrogen market reaching $130.7 billion by 2030. This positions GTT to capitalize on the energy transition, supported by a growing investor interest in sustainable energy infrastructure.

Environmental impact assessments and permitting for new LNG infrastructure present both challenges and opportunities, influencing project timelines and GTT's order book. Delays in these processes, which can take 18 months to over 3 years, can impact GTT's revenue streams, particularly if key projects in major markets like North America or the Middle East face slowdowns.

GTT is also focused on reducing its own operational environmental footprint. Initiatives include advanced waste management, aiming for over 80% of operational waste diversion from landfills by the end of 2024, and incorporating sustainable materials, with a target of 25% recycled content in non-critical components by 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis for Gaztransport & Technigaz is built on a comprehensive review of data from key governmental bodies, international organizations, and specialized industry publications. We analyze regulatory frameworks, economic forecasts, technological advancements, and environmental impact reports to provide a robust understanding of the macro-environment.