Gaztransport & Technigaz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaztransport & Technigaz Bundle

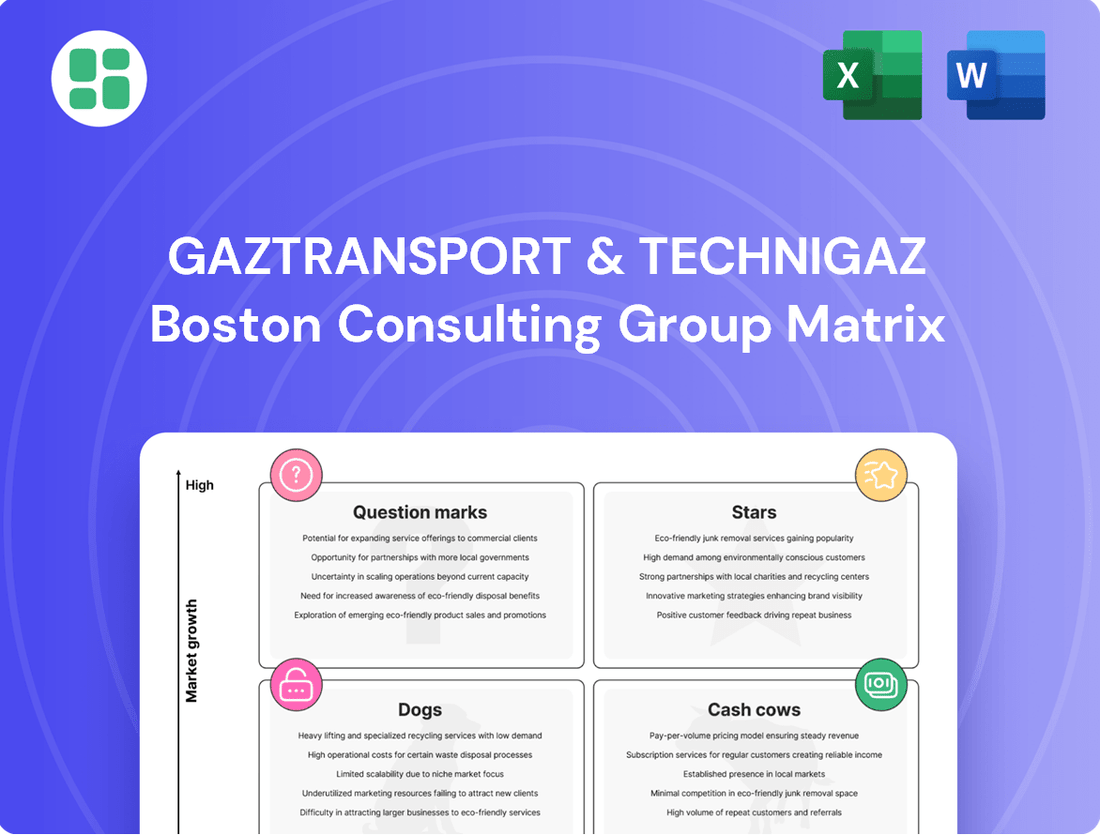

Gaztransport & Technigaz (GTT) operates in a dynamic market, and understanding its product portfolio through the BCG Matrix is crucial for strategic planning. This matrix helps categorize GTT's offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their market share and growth potential.

Don't miss out on the comprehensive analysis that goes beyond this overview. Purchase the full GTT BCG Matrix to unlock detailed quadrant insights, identify key growth drivers, and pinpoint areas for resource optimization.

Gain a competitive edge with actionable strategies derived from the complete BCG Matrix. This report provides the clarity needed to make informed decisions about GTT's product investments and future market positioning.

Stars

Gaztransport & Technigaz (GTT) continues to dominate the LNG carrier membrane containment systems market for new builds, a segment that forms the core of its business. The company reported robust commercial activity in the first half of 2025, with revenue from new construction projects showing a substantial uptick.

This upward trend in new build orders is directly linked to the expansion of global liquefaction capacity and the easing of regulatory pauses in critical markets. These factors collectively point to a thriving high-growth environment where GTT enjoys a commanding, almost exclusive, market share.

The increasing global adoption of Liquefied Natural Gas (LNG) as a marine fuel, spurred by tightening environmental regulations, positions LNG as a fuel containment system for vessels as a significant growth area for GTT. This segment is characterized by substantial order activity, reflecting strong market demand for GTT's advanced containment technologies.

GTT's dominance in this sector is evident from its order book, which included 12 new container ship orders for LNG fuel containment systems in the first quarter of 2025 alone. This robust pipeline underscores the high growth potential of this market and GTT's established leadership in providing essential technological solutions for the transition to cleaner marine fuels.

GTT's advanced membrane containment systems are seeing significant traction in the Very Large Ethane Carrier (VLEC) sector. The company secured seven VLEC orders in the first quarter of 2025, following four orders in the first half of 2024, highlighting a robust expansion in this specialized segment.

This growing demand for GTT's technology in VLECs underscores the increasing reliance on their proven expertise in cryogenic containment solutions. The VLEC market, while niche, represents a high-growth area for GTT, solidifying its strong market position in specialized gas carrier containment.

Integrated Maritime Digital Solutions

GTT's integrated maritime digital solutions, a burgeoning area for the company, are showing impressive traction. Acquisitions like VPS and Danelec, finalized in 2024-2025, have significantly amplified these capabilities. This strategic expansion is reflected in robust financial performance, with revenue from digital activities jumping 88% in Q1 2025 and a further 36% in Q2 2025.

These integrated offerings, encompassing vessel performance management and advanced data analytics, are solidifying GTT's position in the maritime digitalization market. This segment is emerging as a critical growth engine, driving increased market share and demonstrating the value of GTT's digital transformation strategy.

- Digital Revenue Growth: Q1 2025 saw an 88% surge, followed by a 36% increase in Q2 2025.

- Acquisition Impact: VPS and Danelec acquisitions in 2024-2025 were pivotal in bolstering digital activities.

- Key Offerings: Integrated solutions include vessel performance management and data analysis.

- Market Position: Digital solutions are a growing pillar, expanding GTT's maritime digitalization market share.

Cryogenic Systems for Floating LNG (FLNG) and Storage Units

Gaztransport & Technigaz (GTT) plays a pivotal role in the burgeoning FLNG and large-scale storage markets. Their advanced membrane containment systems are not merely for traditional carriers but are fundamental to the operational integrity of floating liquefied natural gas facilities and substantial onshore storage units. This technological indispensability positions GTT at the forefront of LNG infrastructure development.

The company's order book in 2024 reflects robust demand for its solutions in these critical areas. GTT secured multiple orders for FLNG vessels and Floating Storage and Regasification Units (FSRUs), underscoring their established leadership. This consistent demand highlights the essential nature of GTT's technology for the expanding global LNG infrastructure landscape.

- FLNG and FSRU Orders: GTT reported significant order intake for membrane containment systems for FLNG and FSRU projects throughout 2024.

- Market Leadership: These orders reaffirm GTT's dominant position in providing specialized cryogenic solutions for offshore and large-scale onshore LNG storage.

- Infrastructure Growth: The continued demand signifies the ongoing global investment in advanced LNG infrastructure, where GTT's technology is a key enabler.

Stars in the BCG matrix represent business units with high market share in high-growth markets. For GTT, their core membrane containment systems for new LNG carriers are a prime example. The company's dominance in this segment, coupled with the global expansion of LNG infrastructure, firmly places this offering in the Star category.

The increasing use of LNG as a marine fuel, alongside significant investments in FLNG and FSRU projects, fuels the high growth. GTT's secured orders in these areas, including 12 new container ship orders for LNG fuel containment systems in Q1 2025 and multiple FLNG/FSRU orders in 2024, demonstrate their strong market position within these expanding sectors.

GTT's expansion into integrated maritime digital solutions, significantly boosted by the 2024-2025 acquisitions of VPS and Danelec, also exhibits Star characteristics. The remarkable 88% revenue jump in digital activities in Q1 2025 and a further 36% in Q2 2025 highlight the high growth potential and increasing market share in this innovative area.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| LNG Carrier Containment Systems (New Builds) | High | Dominant/Exclusive | Star |

| LNG Fuel Containment Systems (Marine) | High | Leading | Star |

| Very Large Ethane Carrier (VLEC) Containment Systems | High | Strong | Star |

| FLNG & FSRU Containment Systems | High | Dominant | Star |

| Integrated Maritime Digital Solutions | High | Growing | Star |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Gaztransport & Technigaz's Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, visual map of GTT's business units, easing the complexity of strategic decision-making.

Offers a simplified framework for understanding GTT's portfolio, reducing the pain of market analysis.

Cash Cows

GTT's established LNG carrier fleet services represent a significant Cash Cow within its business portfolio. These services encompass crucial operational assistance, ongoing maintenance, and specialized training, all designed to support GTT's extensive installed base of LNG carriers. This mature market segment benefits from GTT's deep technological expertise and proprietary know-how.

The recurring revenue generated from these services is notably stable and characterized by high-profit margins. In 2023, GTT reported that its maintenance and services segment contributed significantly to its overall financial performance, reflecting the consistent demand for its specialized support. This segment leverages GTT's established technology leadership in a market where reliability and efficiency are paramount.

GTT's Mark III and NO96 membrane technologies are true cash cows, consistently generating significant royalties from the extensive global fleet of LNG carriers already in service. These mature, proprietary systems represent GTT's core business, requiring very little in terms of new capital expenditure to maintain their revenue streams. In 2023, GTT reported total revenue of €717.7 million, with its licensing business, largely driven by these established technologies, forming the bedrock of its profitability.

Consultancy and engineering services for existing infrastructure represent a significant cash cow for GTT. These offerings leverage GTT's extensive technical expertise to optimize and maintain current liquefied natural gas (LNG) transport and storage facilities.

This segment generates high-margin revenue from a loyal, established customer base. While not experiencing rapid growth, these services provide a stable and predictable income stream, reflecting their mature market position within GTT's portfolio.

Long-Term Technical Service Agreements

Long-term technical service agreements represent a significant cash cow for Gaztransport & Technigaz (GTT). These contracts, like the one signed with JOVO in 2024, ensure consistent and reliable revenue by providing essential operational support and specialized expertise for clients managing liquefied gas infrastructure. This predictable income stream is a hallmark of GTT's strong market position and the recurring need for their advanced technological solutions.

- Predictable Revenue: Long-term service contracts, such as the 2024 agreement with JOVO, offer GTT a stable and recurring income stream.

- Operational Support: These agreements leverage GTT's expertise to ensure the efficient and safe operation of clients' liquefied gas assets.

- Market Dominance: The demand for GTT's specialized technical services underscores their leading position in the LNG containment market.

- Asset Lifecycle Management: Service contracts cover the entire lifecycle of GTT's technologies, from installation to maintenance and upgrades.

Patented Cryogenic Membrane Technology Portfolio

GTT's patented cryogenic membrane technology portfolio is a prime example of a cash cow within the BCG matrix. This extensive collection of patents, developed over many years, creates a substantial hurdle for potential competitors looking to enter the market.

These patents are the bedrock of GTT's successful licensing model. They ensure a steady stream of revenue from both newly constructed vessels and the existing global fleet of LNG carriers equipped with their technology. This consistent income generation solidifies its position as a reliable cash generator for the company.

For instance, GTT's technology is integral to the vast majority of the world's LNG carriers. As of early 2024, over 90% of the global LNG carrier fleet utilizes GTT's containment systems, highlighting the widespread adoption and the ongoing revenue potential from these existing contracts and future new builds.

- Barrier to Entry: Decades of patent development create significant competitive advantage.

- Licensing Model: Patents directly support a recurring revenue stream through licensing agreements.

- Fleet Utilization: High adoption rate across the global LNG carrier fleet ensures continued cash flow.

- Market Dominance: Over 90% market share in LNG carrier containment systems underscores its cash cow status.

GTT's established LNG carrier fleet services are a prime example of a cash cow. These services, including operational assistance, maintenance, and training, support GTT's large installed base of LNG carriers. The recurring revenue from this mature segment is stable and highly profitable, with GTT's maintenance and services contributing significantly to its financial performance in 2023.

| Service Segment | Key Characteristics | Financial Impact (Illustrative) |

|---|---|---|

| LNG Carrier Fleet Services | Recurring revenue, high-profit margins, stable demand | Significant contribution to 2023 performance |

| Licensing (Mark III & NO96 Technologies) | Royalty-driven, minimal capex, mature market | Bedrock of profitability, 2023 revenue of €717.7 million |

| Consultancy & Engineering (Existing Infrastructure) | High-margin, loyal customer base, predictable income | Stable and predictable income stream |

| Long-Term Technical Service Agreements | Consistent revenue, operational support, expertise | Example: JOVO agreement in 2024 |

What You See Is What You Get

Gaztransport & Technigaz BCG Matrix

The Gaztransport & Technigaz BCG Matrix preview you are viewing is the definitive version you will receive upon purchase; it is not a sample or demo. This comprehensive report, meticulously crafted with industry-specific data and strategic insights, will be delivered in its entirety, ready for immediate application in your business planning. You can be confident that the analysis and formatting you see are precisely what you will gain access to, enabling informed decision-making and a clear understanding of Gaztransport & Technigaz's product portfolio.

Dogs

Elogen, GTT's electrolyzer division, is currently positioned as a 'Dog' in the BCG matrix. This classification stems from its recent financial performance, which shows a stark 63% revenue drop in the first quarter of 2025 compared to the same period in 2024.

While the hydrogen market holds considerable promise for future growth, Elogen's current standing within GTT's business units reflects a low market share and a downward revenue trend. This makes it a unit that is not currently contributing significantly to the company's overall profitability.

Niche or discontinued small-scale cryogenic products, while not a prominent feature in GTT's current public disclosures, would represent offerings that didn't achieve widespread adoption or were phased out. These items likely hold a very small market share and contribute negligibly to the company's overall revenue, placing them in the question mark category of the BCG matrix.

Before GTT's strategic acquisitions of VPS and Danelec, some of its legacy digital modules likely represented underperforming assets. These older solutions, perhaps lacking the integration or advanced features of newer offerings, may have consumed valuable resources without generating substantial market traction or revenue. For instance, if these modules represented less than 5% of the digital division's total revenue in early 2024, they would fit the profile of a 'dog' in the BCG matrix, especially considering the anticipated growth from the combined VPS and Danelec entities.

Infrequent Pre-Project Engineering Studies

Infrequent pre-project engineering studies, a service offered by Gaztransport & Technigaz (GTT), represent a segment with potential revenue but also inherent risks. While these studies contribute to GTT's service offerings, their financial impact is closely tied to their conversion into larger, more lucrative project orders.

In Q1 2025, GTT experienced a decrease in revenue from these pre-engineering studies, a trend identified as non-recurring. This decline highlights a critical aspect of their business model: the return on investment for such studies is heavily dependent on securing subsequent, larger contracts.

- Low Conversion Risk: If pre-engineering studies do not consistently lead to significant project orders, they can become resource-intensive activities with limited long-term growth potential.

- Resource Allocation: GTT's strategic focus must ensure these studies are undertaken with a high probability of conversion to justify the expenditure of resources and capital.

- Market Impact: A lack of conversion can dilute GTT's market impact, as valuable engineering expertise is deployed without generating sustained business growth or market share expansion.

Non-Core, Low-Adoption Hardware Components

Gaztransport & Technigaz (GTT) primarily operates on a licensing and services model, rather than direct hardware sales. However, if GTT were to engage in selling non-core hardware components that are commoditized or face significant competition, these would likely fall into the 'Dog' quadrant of the BCG matrix. These components would be characterized by low market penetration and potentially low profit margins, offering limited growth potential.

For example, if GTT were to sell standard valves or piping systems that are not proprietary and widely available from other manufacturers, these would be considered non-core. Such products typically have low adoption rates unless they are integrated into GTT's core licensed technology, and they would likely compete on price rather than innovation.

The financial performance of such hypothetical hardware sales would reflect these challenges. For instance, a component with less than 5% market share and experiencing flat or declining revenue growth would fit the 'Dog' profile.

- Low Market Share: Hypothetical sales of commoditized components with less than 5% market penetration.

- Low Growth Prospects: Anticipated flat or negative revenue growth for these non-core hardware items.

- Low Profitability: Likely thin profit margins due to intense competition and commoditization.

Gaztransport & Technigaz (GTT) has identified certain legacy digital modules as potential 'Dogs' within its product portfolio. These older solutions, possibly lacking the advanced features or integration of newer offerings, may have consumed resources without significant market traction. For example, if these modules represented less than 5% of the digital division's revenue in early 2024, they would fit the 'Dog' profile, especially as GTT invests in newer, high-growth digital solutions.

Infrequent pre-project engineering studies also lean towards a 'Dog' classification due to their reliance on conversion to larger contracts. In Q1 2025, GTT saw a non-recurring revenue drop from these studies, highlighting the risk of resource expenditure without guaranteed returns. This situation underscores the need for strategic allocation to ensure these studies have a high probability of conversion to justify the investment.

| Business Unit/Product | BCG Classification | Rationale |

|---|---|---|

| Elogen (Electrolyzers) | Dog | Significant revenue drop (63% in Q1 2025 vs Q1 2024), low market share in a promising but competitive sector. |

| Legacy Digital Modules | Dog | Low revenue contribution (potentially <5% of digital division in early 2024), superseded by newer, higher-growth offerings. |

| Infrequent Pre-Project Engineering Studies | Dog | Non-recurring revenue decline in Q1 2025, high dependency on conversion to larger contracts, potential resource drain if conversion is low. |

Question Marks

GTT is actively pursuing the development and obtaining Approvals in Principle (AIPs) for large-scale liquefied hydrogen (LH2) carriers. This strategic move positions them within a high-growth market, directly contributing to global decarbonization efforts. However, their current market share in LH2 transport is low, reflecting the early stage of commercial adoption for this technology.

GTT is actively developing technologies for transporting and utilizing liquefied ammonia as a marine fuel, having secured Approvals in Principle for these solutions. This positions them to capitalize on the burgeoning ammonia fuel market, a key component of shipping decarbonization efforts. While the potential is significant, GTT's current market share in this nascent ammonia transport sector is minimal, reflecting its early stage of development.

GTT's investment in novoMOF through its venture capital arm positions it within the burgeoning carbon capture market. NovoMOF's focus on advanced materials for compact CO2 capture suggests a high-growth potential sector, aligning with the characteristics of a question mark in the BCG matrix. While this strategic move signals GTT's ambition, its current market penetration in this specific technology area is likely minimal, reflecting its early-stage involvement.

Small-Scale LNG Applications

The small-scale LNG market, covering areas like ship bunkering and decentralized power, is poised for substantial expansion. Projections indicate a compound annual growth rate (CAGR) of 14.46% between 2025 and 2032, highlighting its increasing importance.

Gaztransport & Technigaz (GTT) is actively involved in LNG technology, but its penetration in the broader small-scale LNG sector is likely less pronounced than its leading position in large LNG carriers. This presents a clear opportunity for GTT to grow its market share in this high-potential segment.

- Market Growth: The small-scale LNG market is expected to grow significantly, with a projected CAGR of 14.46% from 2025 to 2032.

- Bunkering: LNG is increasingly used as a fuel for ships, a key driver for small-scale LNG demand.

- Distributed Power: Small-scale LNG also fuels decentralized power generation, especially in regions seeking cleaner energy alternatives.

- GTT's Opportunity: GTT's established expertise in LNG containment systems positions it well to capture a larger share of this expanding market.

Advanced AI and Connectivity Solutions (e.g., SASE, 5G/LEO integration)

Gaztransport & Technigaz (GTT) is actively investing in advanced AI and connectivity solutions as part of its digital transformation strategy. These efforts include developing proprietary AI for network and security services, aiming to enhance operational efficiency and data protection for its clients.

The integration of 5G and Low Earth Orbit (LEO) satellite connectivity represents a significant push into high-growth future technologies. GTT's strategic focus here is on leveraging these advancements to offer more robust and versatile communication solutions, particularly for maritime and land-based applications.

While these segments are characterized by substantial growth potential, GTT's market share within these highly specialized and competitive sub-sectors is still in its nascent stages of development. This positions these initiatives as potential Stars or Question Marks within a BCG matrix framework, depending on future market traction and competitive positioning.

- AI for Networking/Security: GTT's proprietary AI aims to optimize network performance and bolster cybersecurity, addressing growing demands for secure and efficient data transmission.

- 5G/LEO Integration: This focus on next-generation connectivity seeks to provide seamless and high-bandwidth communication, crucial for the evolving needs of global industries.

- Market Position: GTT's presence in these advanced technology areas is still emerging, indicating significant future potential but also requiring substantial investment and market penetration efforts.

GTT's ventures into liquefied hydrogen and ammonia transport represent significant bets on future decarbonization trends. While these markets are poised for growth, GTT's current market share in these nascent sectors is minimal, classifying them as question marks. Their investment in carbon capture technology through novoMOF also falls into this category, indicating high potential but early-stage market penetration.

The small-scale LNG market presents a substantial growth opportunity for GTT, with a projected CAGR of 14.46% between 2025 and 2032. This segment, driven by ship bunkering and decentralized power, offers a chance for GTT to expand its market share beyond large LNG carriers.

GTT's exploration of AI and advanced connectivity like 5G and LEO satellite technology positions it in high-growth, future-oriented markets. However, its market share in these emerging technological sub-sectors is still developing, making them potential question marks that require further investment and market penetration.

| Market Segment | Growth Potential | GTT's Current Position | BCG Classification |

|---|---|---|---|

| Liquefied Hydrogen (LH2) Transport | High | Minimal Market Share | Question Mark |

| Liquefied Ammonia Transport | High | Minimal Market Share | Question Mark |

| Carbon Capture (novoMOF) | High | Nascent Market Penetration | Question Mark |

| Small-Scale LNG | High (14.46% CAGR 2025-2032) | Developing | Question Mark / Potential Star |

| AI & Advanced Connectivity (5G/LEO) | Very High | Emerging Presence | Question Mark |

BCG Matrix Data Sources

Our Gaztransport & Technigaz BCG Matrix is built upon a foundation of comprehensive market data, encompassing financial disclosures, industry growth forecasts, and competitor analysis to provide strategic direction.