Gaztransport & Technigaz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaztransport & Technigaz Bundle

Gaztransport & Technigaz (GTT) operates in a market shaped by intense rivalry and significant barriers to entry, primarily due to its proprietary membrane containment technologies for LNG carriers. Understanding the bargaining power of their key customers, the major shipping companies, and the threat of substitute technologies is crucial for any stakeholder. This brief overview hints at the complexities GTT navigates.

The complete report reveals the real forces shaping Gaztransport & Technigaz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GTT's advanced membrane containment systems depend on highly specialized materials like Invar and specific stainless steel alloys. These materials, along with intricately engineered cryogenic components, are not readily available from numerous sources. The limited pool of qualified suppliers for these niche, high-specification inputs grants them considerable leverage.

The stringent quality and performance demands for LNG containment mean GTT faces significant hurdles if it needs to change suppliers. Such a transition would likely involve lengthy and costly requalification procedures, potentially impacting GTT's product development timelines and overall operational efficiency. This reliance on a select few suppliers for critical, specialized inputs underscores their bargaining power.

While Gaztransport & Technigaz (GTT) possesses a robust patent portfolio for its core membrane technologies, its reliance on third-party intellectual property for supporting systems or emerging technologies like hydrogen transport presents a potential avenue for supplier bargaining power. Suppliers of these crucial licensed components can leverage their proprietary rights, especially if their technology is critical for GTT's operations or expansion into new markets.

GTT's strategic acquisitions, such as those of VPS and Danelec, signal an effort to bring digital capabilities in-house. This move aims to decrease dependence on external software and data providers, thereby mitigating the bargaining power of those suppliers in the future.

The design, engineering, and maintenance of advanced cryogenic containment systems for LNG carriers are highly specialized, demanding a workforce with unique skills in naval architecture, material science, and cryogenics. This limited pool of highly skilled professionals, especially in an expanding LNG market, grants them significant bargaining power.

Gaztransport & Technigaz (GTT) actively invests in research and development and employee training, yet the availability of top-tier talent remains a crucial factor influencing their operations and costs. For instance, the global demand for experienced LNG engineers saw a notable increase in 2024, with specialized roles commanding competitive compensation packages.

Certification and Classification Societies

Certification and classification societies hold considerable sway over Gaztransport & Technigaz (GTT) due to the mandatory nature of their approvals for maritime transport and storage technologies. These entities, including prominent names like DNV GL, Lloyd's Register, and Bureau Veritas, function as essential gatekeepers. Their stringent standards and approval protocols can shape GTT's technological development and operational methodologies, effectively influencing market entry and product acceptance.

While not direct material suppliers, the indispensable role of these classification societies in validating GTT's designs grants them significant leverage. For instance, DNV GL, a major player, reported certifying over 13,000 vessels in 2023, highlighting the widespread impact of their standards across the maritime industry. This necessity for approval means GTT must align its innovations with the evolving requirements and interpretations of these bodies, impacting cost and time-to-market.

- Mandatory Approvals: GTT's containment systems require certification from societies like DNV GL, Lloyd's Register, and Bureau Veritas to operate in maritime applications.

- Influence on Design: Classification society standards can indirectly dictate GTT's design choices and material specifications.

- Market Access Gatekeepers: Failure to obtain certification from these societies blocks market access for GTT's technologies.

- Leverage through Standards: The indispensable nature of their validation process gives these societies significant bargaining power over GTT.

Limited Substitute Inputs for Core Technology

Gaztransport & Technigaz (GTT) benefits from a strong supplier bargaining power due to the highly specialized nature of its core technologies. The company's patented membrane containment systems for liquefied natural gas (LNG) carriers require unique inputs that few suppliers can provide. This scarcity of alternatives directly strengthens the hand of those suppliers who can meet GTT's stringent technical requirements.

This reliance on specialized suppliers for critical components, such as specific cryogenic materials and advanced welding techniques, creates a significant interdependence. GTT's proprietary Mark and NO systems, for instance, are designed around these unique supplier capabilities. Consequently, the few companies possessing the necessary expertise and manufacturing capacity for these inputs can command considerable leverage in negotiations.

For example, in 2023, GTT's order book for new LNG carriers remained robust, with over 100 vessels on order. This sustained demand for their containment systems means that suppliers of these specialized materials and fabrication services are in a strong position. The limited number of qualified suppliers for these high-specification components means they can often dictate terms, impacting GTT's cost structure and production timelines.

- Limited Supplier Pool: GTT's patented membrane technology necessitates highly specialized inputs, restricting the number of capable suppliers.

- Technical Interdependence: GTT's designs are tightly integrated with specific supplier capabilities for unique materials and manufacturing processes.

- Supplier Leverage: The scarcity of alternative suppliers for critical components grants them significant bargaining power over GTT.

- Market Demand Impact: Continued high demand for LNG carriers, as seen in GTT's substantial 2023 order book, reinforces the negotiating strength of these specialized suppliers.

Gaztransport & Technigaz (GTT) faces significant supplier bargaining power due to the highly specialized nature of its patented membrane containment systems. The reliance on niche, high-specification materials like Invar and specific stainless steel alloys, along with intricate cryogenic components, limits the available supplier pool. This scarcity of qualified providers for critical inputs grants them considerable leverage in negotiations, impacting GTT's cost structure and production timelines.

The stringent quality and performance demands for LNG containment necessitate lengthy and costly requalification procedures for any supplier changes, further entrenching the power of existing providers. This interdependence, where GTT's designs are tightly integrated with specific supplier capabilities, means that the few companies possessing the necessary expertise and manufacturing capacity can command significant influence.

For instance, GTT's robust order book for LNG carriers, exceeding 100 vessels in 2023, reinforces the negotiating strength of these specialized suppliers. Their proprietary technologies and unique manufacturing processes mean that GTT must often align with their terms, especially as the global demand for experienced LNG engineers and specialized fabrication services saw a notable increase in 2024.

Certification and classification societies, such as DNV GL, Lloyd's Register, and Bureau Veritas, also exert considerable bargaining power. As mandatory gatekeepers for maritime transport and storage technologies, their approval protocols and evolving standards can shape GTT's technological development and market access. DNV GL's certification of over 13,000 vessels in 2023 highlights the widespread impact of these societies on the industry.

| Factor | Description | Impact on GTT | Example/Data Point |

| Specialized Materials | Requirement for niche, high-specification cryogenic materials (e.g., Invar, specific stainless steel alloys). | Limited supplier options, increased costs, potential production delays. | Few suppliers can meet stringent material specifications for LNG containment. |

| Proprietary Technology Integration | GTT's designs are dependent on specific supplier capabilities for unique components and manufacturing processes. | High switching costs for suppliers, strong supplier negotiation leverage. | GTT's Mark and NO systems are designed around specific supplier expertise. |

| Certification & Classification | Mandatory approvals from societies like DNV GL, Lloyd's Register, Bureau Veritas. | Influence on design choices, market access gatekeepers, potential delays. | DNV GL certified over 13,000 vessels in 2023. |

| Skilled Workforce | Demand for highly specialized skills in naval architecture, material science, and cryogenics. | Increased labor costs, potential talent shortages impacting operations. | Global demand for experienced LNG engineers increased in 2024, commanding competitive compensation. |

What is included in the product

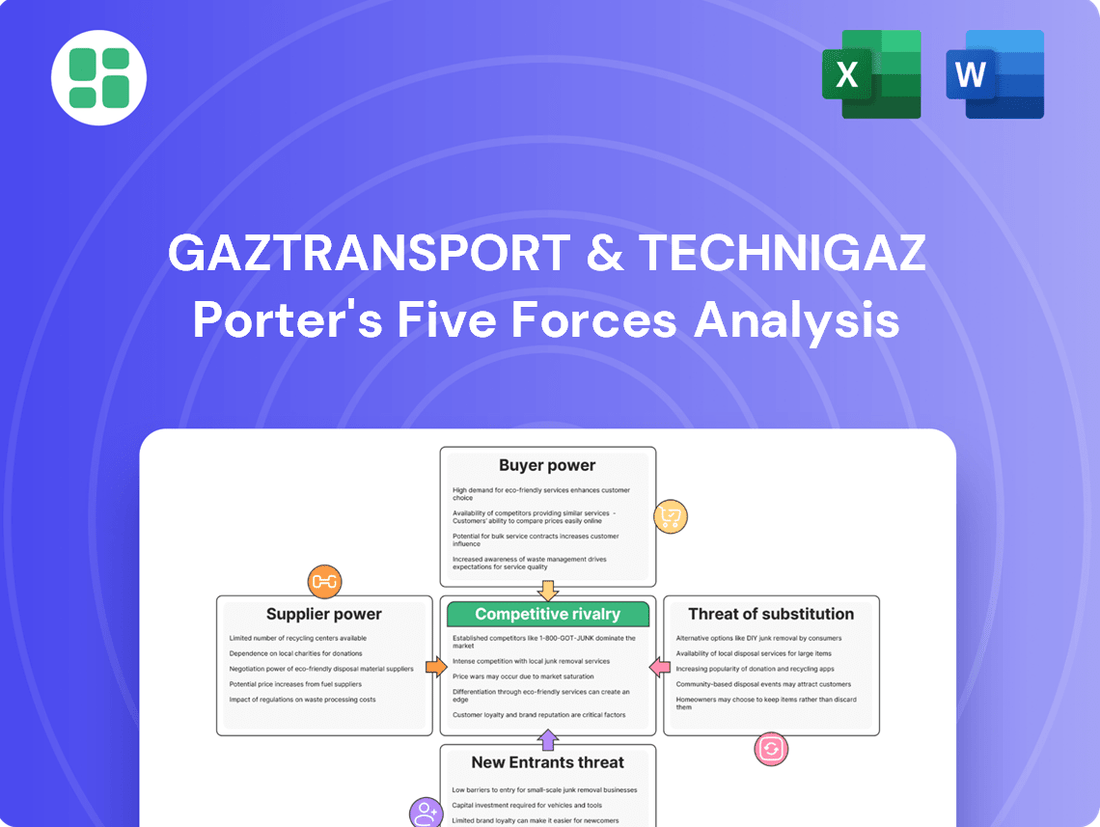

This analysis reveals the competitive intensity faced by Gaztransport & Technigaz, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players in the LNG containment system market.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Gaztransport & Technigaz.

Customers Bargaining Power

GTT's customer base is highly consolidated, primarily consisting of major global shipyards, particularly those in South Korea and China, and significant energy corporations driving LNG infrastructure development. These entities are colossal players, frequently commissioning substantial, multi-ship orders, which inherently grants them considerable bargaining strength during price and contract negotiations. For instance, in 2023, South Korean shipyards secured a dominant share of new LNG carrier orders, underscoring their pivotal role and leverage in the market.

Once a shipyard or project developer commits to a specific containment system technology, the switching costs for future projects can be substantial. This is due to established design processes, the need for specialized training for construction crews, and ongoing operational support requirements. For example, a shipyard investing in GTT's Mark III Flex technology for LNG carriers would face significant expenses to re-tool and re-qualify if they later decided to adopt a different system for subsequent builds.

This creates a degree of customer lock-in for GTT, as transitioning to an alternative containment system would necessitate considerable investment in new equipment and retraining. GTT's active involvement in providing technical, construction, and engineering services further strengthens these customer relationships, making it more challenging for competitors to dislodge them.

Some major shipyards, especially in South Korea, have explored creating their own LNG containment system technologies. For instance, DSME developed Solidus, SHI introduced KCS, and KOGAS launched KC-1. This move by potential customers to develop their own technology acts as a check on GTT's ability to raise prices, even though GTT has held onto its market share.

Project-Based Procurement and Long-Term Relationships

The bargaining power of customers for Gaztransport & Technigaz (GTT) is influenced by the nature of project-based procurement and the establishment of long-term relationships. LNG carrier and terminal projects are inherently long-term, high-value undertakings. This necessitates extensive negotiation and the creation of bespoke agreements between GTT and its clients, giving customers significant leverage.

These enduring relationships, combined with the critical strategic importance of LNG infrastructure, often lead clients to request comprehensive support and advantageous terms that extend beyond the initial licensing agreements. GTT's robust order book, which provides revenue visibility for several years, underscores the mutually beneficial, though high-stakes, nature of these customer partnerships.

- Long-Term Project Nature: LNG projects require significant upfront investment and extended timelines, allowing customers to negotiate favorable terms due to the high commitment involved.

- Bespoke Agreements: GTT's technology is often customized for specific projects, giving clients a degree of influence over pricing and contract conditions.

- Strategic Importance of LNG: The critical role of LNG in global energy supply chains strengthens the negotiating position of major project developers and operators.

- Customer Retention: GTT's reliance on repeat business from major shipyards and LNG players means they must balance pricing with maintaining strong client relationships.

Market Demand and Customer Influence on Design

The bargaining power of customers in the LNG carrier market, a key factor for Gaztransport & Technigaz (GTT), is shaped by substantial demand and the strategic leverage of major industry players. The overall global demand for Liquefied Natural Gas (LNG) directly impacts the need for specialized containment systems, giving large energy companies and prominent shipowners considerable influence over GTT's business operations and contract terms.

Customer preferences are a powerful driver of innovation for GTT. Shipowners' specific requirements regarding vessel size, fuel efficiency, and environmental performance directly steer GTT's research and development efforts. For instance, the increasing focus on reducing boil-off gas and enhancing operational economics compels GTT to continuously refine its Mark and NO containment systems, aligning with evolving regulatory landscapes and shipowner financial objectives.

- Market Demand: Global LNG demand is projected to grow, with estimates suggesting a significant increase in LNG trade volumes through 2030, directly impacting the need for new LNG carriers and GTT's containment solutions.

- Customer Influence: Major LNG producers and charterers, such as Shell and TotalEnergies, often dictate vessel specifications and technology choices, thereby exerting considerable influence on GTT's product development roadmap.

- Technological Advancement: GTT's ongoing advancements in its membrane containment systems, such as the Mark III Flex Plus and NO96 Max, are direct responses to shipowner demands for improved thermal performance, reduced fuel consumption, and compliance with stricter environmental regulations like those from the IMO.

GTT's customers, primarily large shipyards and energy companies, possess significant bargaining power due to the high value and long-term nature of LNG projects. Their ability to place substantial, multi-ship orders, coupled with the high switching costs associated with GTT's proprietary technology, grants them considerable leverage in negotiations. For example, major players like Shell or TotalEnergies, who often charter LNG carriers, can influence technology choices and contract terms based on their vast project portfolios and market influence.

| Customer Type | Bargaining Power Factors | Example Influence |

|---|---|---|

| Major Shipyards (e.g., South Korean yards) | Volume orders, potential for in-house technology development | Secured majority of LNG carrier orders in 2023, creating leverage for pricing |

| Energy Corporations (e.g., Shell, TotalEnergies) | Project scale, long-term charter agreements, influence on vessel specifications | Dictate vessel requirements, driving GTT's R&D towards efficiency and environmental compliance |

| Project Developers | High upfront investment, need for customized solutions | Negotiate bespoke agreements and favorable terms due to project commitment |

Full Version Awaits

Gaztransport & Technigaz Porter's Five Forces Analysis

This preview showcases the comprehensive Gaztransport & Technigaz Porter's Five Forces Analysis, detailing the competitive landscape for liquefied natural gas (LNG) containment systems. You're looking at the actual document, meaning the exact, professionally formatted analysis you'll receive, complete with insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, will be available for immediate download upon purchase.

Rivalry Among Competitors

The market for advanced LNG containment systems is quite concentrated, with a few major companies dominating. GTT is a prime example, holding a significant lead in membrane technology. This means while there aren't many small competitors, the rivalry among the few large players is fierce, often focusing on technological innovation and service offerings.

GTT's market position is further solidified by its strong performance in recent order books. For instance, in 2024 and extending into Q1 2025, GTT secured a substantial share of new LNG carrier orders, underscoring its leadership and the intense, albeit limited, competition it faces from other capable entities in this specialized sector.

Gaztransport & Technigaz (GTT) enjoys a significant competitive edge due to its proprietary membrane containment technologies, specifically the Mark and NO systems. These innovations provide tangible advantages such as enhanced cargo capacity and reduced shipbuilding expenses when contrasted with competing solutions.

GTT's commitment to ongoing innovation is evident in its proactive patent strategy, exemplified by the filing of 62 patents in 2024. This consistent pursuit of intellectual property protection is fundamental to sustaining its market differentiation and technological leadership.

Rival companies face a substantial barrier to entry, necessitating considerable investment in research and development to engineer alternative systems capable of replicating GTT's established performance benchmarks and safety standards.

While Gaztransport & Technigaz (GTT) holds a strong position in membrane containment technology, the competitive landscape includes alternative containment systems. Spherical tanks, like the Moss Maritime system, offer a different design approach. Additionally, South Korean shipyards are developing new independent tank designs such as KCS, Solidus, and KC-1. These emerging solutions present a challenge by offering alternative containment options that could gain traction, particularly for specific vessel types or projects.

Global Shipbuilding Capacity and Market Dynamics

The competitive rivalry in the global shipbuilding sector, particularly for LNG carriers, is intense and directly influenced by the growth in global LNG trade. As of early 2024, the demand for these specialized vessels is robust, driven by new liquefaction projects coming online and the ongoing need for energy security worldwide. This sustained demand keeps major shipyards operating at high capacity, intensifying competition.

South Korea remains a dominant force, with its shipyards consistently securing a large portion of global LNG carrier orders. Their technological advancements, including the development of proprietary containment systems, directly challenge Gaztransport & Technigaz's (GTT) market position. For instance, in 2023, South Korean yards like HD Hyundai Heavy Industries and Samsung Heavy Industries continued to win significant contracts, underscoring their competitive strength.

- Dominant Players: South Korean shipbuilders like HD Hyundai Heavy Industries, Samsung Heavy Industries, and Hanwha Ocean (formerly DSME) consistently lead in LNG carrier order books.

- Technological Advancement: Development of independent containment systems by shipyards poses a direct competitive threat to GTT's established technology.

- Market Influences: Potential shifts in U.S. shipbuilding regulations or trade policies could alter the global competitive landscape, impacting order flows and shipyard activity.

Competition in Adjacent and Diversifying Segments

Gaztransport & Technigaz (GTT) is actively broadening its reach beyond its foundational LNG carrier containment systems. The company is making strategic moves into adjacent markets such as LNG as a marine fuel, floating LNG production and storage facilities (FLNG), and onshore LNG storage solutions. This diversification naturally exposes GTT to a wider array of competitors, many of whom are already established specialists in these particular niches.

In these expanding segments, GTT encounters competition from diverse players. For instance, in the LNG as fuel sector, GTT competes with companies offering integrated bunkering solutions. Similarly, the development of FLNG and onshore storage projects involves competition from engineering, procurement, and construction (EPC) firms and technology providers with expertise in cryogenic infrastructure.

GTT's recent acquisitions, such as its purchase of VPS and Danelec, underscore its ambition to bolster its presence in the digital maritime sector. This strategic move places GTT in direct competition with a host of established technology companies already offering fleet management, performance monitoring, and other digital services to the shipping industry. For example, companies like Wärtsilä and ABB are significant players in the maritime digital solutions space, offering a comprehensive suite of services that GTT aims to challenge.

- Diversification into New Markets: GTT's expansion into LNG as fuel, FLNG, and onshore storage brings it into competition with specialized providers in these areas.

- Competition in Digital Solutions: The acquisition of VPS and Danelec positions GTT against established maritime technology firms in the digital services landscape.

- Broader Competitive Landscape: GTT's strategic growth means it now contends with a more varied set of rivals, ranging from EPC contractors to dedicated software and hardware providers.

The competitive rivalry for Gaztransport & Technigaz (GTT) is characterized by a few dominant players in its core membrane technology market, primarily South Korean shipbuilders who are also developing their own containment systems. While GTT maintains a technological lead with its proprietary Mark and NO systems, the intense demand for LNG carriers, particularly evident in 2024 order books, fuels competition. This competition is not just about technology but also about securing shipbuilding contracts, where South Korean yards like HD Hyundai Heavy Industries and Samsung Heavy Industries are consistently strong performers.

The rivalry extends into new markets GTT is targeting, such as LNG as fuel and FLNG, where it faces established EPC firms and technology providers. Furthermore, GTT's recent acquisitions in the digital maritime sector place it against major players like Wärtsilä and ABB. This broadens the competitive front, requiring GTT to innovate and differentiate across multiple fronts to maintain its market leadership.

| Competitor Type | Key Players | Competitive Focus | 2024/2025 Relevance |

|---|---|---|---|

| Membrane Technology Rivals | Limited, but emerging independent systems from shipyards | Technological parity, cost-effectiveness | Ongoing development of alternatives challenging GTT's dominance |

| Shipbuilding Competitors (LNG Carriers) | HD Hyundai Heavy Industries, Samsung Heavy Industries, Hanwha Ocean | Order book acquisition, technological integration | Secured significant share of 2024/Q1 2025 LNG carrier orders |

| Adjacent Market Competitors (LNG as Fuel, FLNG) | EPC firms, specialized cryogenic technology providers | Integrated solutions, project execution | Growing market segments with established players |

| Digital Maritime Solutions Providers | Wärtsilä, ABB | Fleet management, performance monitoring, data analytics | Direct competition following GTT's acquisitions (VPS, Danelec) |

SSubstitutes Threaten

While Gaztransport & Technigaz (GTT) dominates the membrane containment system market for Liquefied Natural Gas (LNG), other containment technologies pose a threat of substitution. Spherical Moss-type tanks and various independent tank designs, such as Type A, B, and C, are established alternatives. These are offered by different manufacturers, providing direct substitutes for GTT's specialized systems in specific LNG shipping and storage applications.

The development of new materials, particularly advanced steel alloys, is also creating cost-saving substitutes for traditional containment technologies. These innovations can potentially reduce the overall cost of LNG infrastructure, offering an alternative to the higher-specification materials often associated with membrane systems.

For regional gas transport, pipelines directly substitute for Liquefied Natural Gas (LNG) shipping, especially in landlocked regions or over shorter distances. The expansion of pipeline networks, or greater use of existing ones, could lessen the need for LNG liquefaction, transport, and regasification, which in turn impacts demand for Gaztransport & Technigaz's (GTT) containment systems.

However, pipelines are not a practical alternative for intercontinental gas trade, limiting their overall substitutability for GTT's core business. For instance, in 2024, over 70% of global LNG trade involved voyages exceeding 3,000 nautical miles, a distance where pipeline feasibility is negligible.

The shipping industry's push for decarbonization is driving significant exploration of fuels beyond Liquefied Natural Gas (LNG). By 2024, the interest in green methanol, ammonia, and hydrogen as viable alternatives is substantial, with many new vessel designs incorporating these options. This diversification of fuel choices poses a threat to GTT's core business, as a widespread adoption of these non-LNG fuels could diminish the demand for traditional LNG carriers.

Onshore vs. Offshore LNG Storage and Regasification

While Gaztransport & Technigaz (GTT) technology is integral to both maritime LNG transport and storage, the growing LNG terminal market presents potential substitutes. Increased investment in onshore LNG terminals and regasification units, as well as the development of Floating Storage and Regasification Units (FSRUs) by competing providers, could offer alternative solutions for specific GTT applications.

The global LNG regasification terminal market is projected to expand significantly, with various technological approaches emerging. For instance, the market was valued at approximately $6.8 billion in 2023 and is expected to reach around $10.5 billion by 2030, growing at a CAGR of roughly 6.3% during this period. This expansion indicates a robust demand for LNG infrastructure, but also a competitive landscape where different technologies can fulfill similar needs.

- Growing LNG Infrastructure: The global LNG regasification terminal market is expanding, creating opportunities for various technological solutions.

- Onshore vs. Offshore Competition: Advancements in onshore terminals and FSRUs from other providers can serve as substitutes for GTT's maritime-focused solutions in certain contexts.

- Market Value Growth: The LNG regasification terminal market was valued at approximately $6.8 billion in 2023 and is forecast to reach $10.5 billion by 2030.

Cryogenic Energy Storage (CES) as Energy Alternative

Cryogenic energy storage (CES) technologies, such as those utilizing liquid air or nitrogen, present a potential indirect substitute threat to the broader energy market, including natural gas. As these systems mature and become more cost-competitive for grid-scale energy storage, particularly for integrating intermittent renewable sources, they could gradually reduce the long-term demand for natural gas. For instance, by mid-2024, several pilot projects for liquid air energy storage (LAES) were demonstrating increased efficiency and capacity, with some aiming for commercial deployment within the next few years.

The economic viability of CES is a key factor in its substitutive potential. While initial capital costs can be high, ongoing improvements in technology and economies of scale are expected to drive down prices. By 2024, the levelized cost of storage for some CES systems was projected to become competitive with other forms of grid-scale storage, potentially making them a more attractive option for utilities. This evolving cost landscape could influence investment decisions away from traditional fossil fuel infrastructure.

- Growing Renewable Integration: CES offers a solution for storing excess renewable energy, directly competing with natural gas peaker plants.

- Technological Advancements: Innovations in cryogenics and expander turbines are improving the efficiency and cost-effectiveness of CES.

- Grid Stability Support: CES can provide rapid response and grid services, mimicking some of the flexibility offered by natural gas.

- Environmental Considerations: As a cleaner energy storage solution, CES may gain favor in regions with stringent environmental regulations.

The threat of substitutes for Gaztransport & Technigaz (GTT) is multifaceted, encompassing alternative containment technologies and entirely different energy transport methods.

While GTT's membrane containment systems are dominant for LNG, spherical Moss-type tanks and independent designs represent direct substitutes in specific applications, offered by various manufacturers.

Furthermore, pipelines offer a direct substitute for regional gas transport, bypassing the need for liquefaction and specialized carriers, though this is limited to shorter, landlocked routes.

The growing interest in alternative fuels like green methanol, ammonia, and hydrogen by 2024 also presents a significant threat, as widespread adoption could reduce the demand for LNG carriers.

| Substitute Technology | Nature of Substitution | Key Considerations |

|---|---|---|

| Spherical Moss-type Tanks | Direct containment system alternative | Established technology, different design principles |

| Independent Tank Designs (Type A, B, C) | Direct containment system alternative | Suitability varies by vessel size and cargo type |

| Pipelines | Alternative for gas transport | Limited to regional and landlocked applications |

| Alternative Fuels (Methanol, Ammonia, Hydrogen) | Reduces demand for LNG carriers | Growing industry interest and vessel development |

Entrants Threaten

The barrier to entry for new competitors in the LNG containment system market is incredibly high due to the substantial capital required for research, development, and specialized infrastructure. Companies must invest heavily in advanced testing facilities and possess the expertise to integrate with intricate shipbuilding processes, a feat that takes years to achieve.

This capital intensity, coupled with the need for specialized knowledge, significantly deters potential new entrants. For instance, the development and certification of a new membrane containment system can cost hundreds of millions of dollars, making it a daunting prospect for any newcomer aiming to challenge GTT's established position.

Gaztransport & Technigaz (GTT) benefits from extensive intellectual property and patent protection, creating a significant barrier for potential new entrants. The company has meticulously built a vast portfolio of patents safeguarding its innovative membrane containment system designs over many years. In 2024, GTT continued this strategy by filing 62 new patents, actively strengthening its intellectual property moat and making it exceptionally difficult for newcomers to replicate their technology without infringing on existing rights.

The liquefied natural gas (LNG) sector is intensely regulated because cryogenic gas is inherently hazardous. This necessitates rigorous safety standards and approvals from global classification bodies. For instance, in 2023, the International Maritime Organization (IMO) continued to emphasize stricter safety protocols for gas carriers, impacting design and operational requirements.

Gaztransport & Technigaz (GTT) benefits from its extensive history of certified systems, a process that is both time-consuming and expensive for any new competitor to replicate. Acquiring these certifications, which are crucial for market entry, represents a substantial financial and temporal commitment, effectively acting as a significant barrier to new entrants.

Long-Standing Relationships and Brand Reputation

Gaztransport & Technigaz (GTT) benefits significantly from its deeply entrenched, long-standing relationships with key players in the global energy sector, including major shipyards and energy corporations. These partnerships are the result of decades of consistent, reliable performance and successful project execution, making GTT a trusted name. For instance, GTT's order book as of the first quarter of 2024 demonstrates continued demand, with 169 vessels on order, reflecting the ongoing trust from its established customer base.

The company's brand is virtually synonymous with the highest standards of safety and efficiency in the critical area of liquefied natural gas (LNG) containment. This strong reputation presents a formidable barrier to entry. New companies entering the market would face immense difficulty in replicating the level of trust and proven track record necessary to win contracts from these large, inherently risk-averse clients, who prioritize proven solutions for their substantial investments.

- Decades of Proven Performance: GTT's history of successful LNG containment solutions builds a strong foundation of trust.

- Brand Recognition for Safety and Efficiency: GTT is recognized globally for its reliable and effective technologies.

- Customer Loyalty: Long-term relationships with major shipyards and energy firms are difficult for new entrants to disrupt.

- High Switching Costs: The complexity and capital investment involved in LNG containment systems make customers hesitant to switch from a trusted provider like GTT.

Requirement for Deep Technical Expertise and Experience

The design and licensing of GTT's cryogenic membrane containment systems require immense technical knowledge in areas like thermodynamics, material science, and naval engineering, built over decades. This deep expertise is not easily acquired by newcomers.

GTT boasts 60 years of experience and a commitment to ongoing research and development, creating a substantial knowledge base that new entrants would struggle to match in a short timeframe. This significant barrier to entry makes it challenging for new companies to establish themselves in this specialized market.

- Technical Expertise: Thermodynamics, material science, and naval engineering are critical for GTT's containment systems.

- Experience Barrier: 60 years of GTT's R&D creates a knowledge gap for potential competitors.

- Steep Learning Curve: The complex nature of the technology deters new market participants.

The threat of new entrants for Gaztransport & Technigaz (GTT) is very low due to the immense capital, specialized knowledge, and extensive patent protection required to enter the LNG containment system market. GTT's established reputation for safety and efficiency, coupled with decades of proven performance and strong customer relationships, further solidifies its position.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Hundreds of millions of dollars for R&D, specialized infrastructure, and testing facilities. | Extremely high, deterring most potential competitors. |

| Intellectual Property | Extensive patent portfolio safeguarding GTT's membrane containment systems. 62 new patents filed in 2024. | Makes replication of technology difficult and legally risky. |

| Regulatory Hurdles | Rigorous safety standards and approvals from global classification bodies for hazardous cryogenic gas. | Time-consuming and costly to obtain, requiring deep understanding of evolving regulations. |

| Technical Expertise | Decades of accumulated knowledge in thermodynamics, material science, and naval engineering. | A steep learning curve for newcomers, making it hard to match GTT's capabilities. |

| Brand Reputation & Customer Loyalty | Synonymous with safety and efficiency; strong, long-standing relationships with shipyards and energy firms. 169 vessels on order in Q1 2024. | Difficult for new entrants to gain trust and secure contracts from risk-averse clients. |

Porter's Five Forces Analysis Data Sources

Our Gaztransport & Technigaz Porter's Five Forces analysis is built upon a foundation of robust data, drawing from GTT's annual reports, industry-specific market research from firms like Clarkson Research, and regulatory filings from maritime authorities to provide a comprehensive view of the competitive landscape.