Gushengtang Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gushengtang Holdings Bundle

Navigate the complex external environment impacting Gushengtang Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping its operational landscape. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now to gain a strategic advantage.

Political factors

The Chinese government's ongoing commitment to Traditional Chinese Medicine (TCM) is a significant political factor for Gushengtang Holdings. Policies actively promote TCM integration, standardization, and education, creating a favorable operating landscape. This governmental support, evident in initiatives like the 14th Five-Year Plan (2021-2025) which prioritizes TCM development, directly bolsters companies like Gushengtang.

Ongoing healthcare reforms in China are a significant driver for Gushengtang Holdings. The government's commitment to enhancing medical service accessibility and affordability directly impacts how Gushengtang structures its operations and pricing. For instance, the National Healthcare Security Administration (NHSA) continues to expand the scope of medical insurance coverage, aiming for universal access, which broadens the potential customer base for Gushengtang's services.

Policies that champion the integration of Traditional Chinese Medicine (TCM) with Western medicine, alongside a growing emphasis on preventative healthcare, present substantial market opportunities. Gushengtang's diversified portfolio of TCM services and products is well-positioned to capitalize on these trends. In 2024, the Chinese government reiterated its support for TCM development, allocating increased funding towards research and integration initiatives, further bolstering Gushengtang's strategic advantage.

The drive towards universal health coverage means a larger population is actively seeking comprehensive health solutions, including those offered by Gushengtang. This expansion of the insured population directly translates to a wider pool of potential patients. By 2025, China aims to further solidify its universal health coverage system, ensuring more citizens can access and afford healthcare services, including those provided by private entities like Gushengtang.

Furthermore, the government's focus on strengthening primary care and community health centers could unlock new avenues for collaboration and expansion. Gushengtang might explore partnerships with these grassroots healthcare facilities to extend its reach and service offerings. This aligns with national directives to build a more robust and accessible primary healthcare network across the country.

The Chinese government is intensifying its oversight of traditional Chinese medicine (TCM), impacting Gushengtang's operations. For instance, in 2024, the National Medical Products Administration (NMPA) continued to emphasize stricter quality control for TCM raw materials and finished products, aiming to ensure safety and efficacy. This means Gushengtang must invest more in its supply chain and internal quality assurance to meet these evolving standards, potentially increasing operational expenses.

Stricter licensing requirements for TCM practitioners and medical institutions, a trend observed throughout 2024 and expected to continue into 2025, directly affect Gushengtang's ability to staff its clinics. Compliance with these enhanced regulations is crucial for maintaining operational licenses and avoiding significant fines, which could impact revenue. For example, in late 2024, several smaller TCM providers faced penalties for non-compliance with updated practitioner certification rules.

Political Stability and Geopolitical Relations

Political stability within China is a foundational element for Gushengtang Holdings, directly influencing sustained economic growth and consumer confidence in healthcare services. A predictable domestic political landscape supports predictable consumer spending. For instance, the Chinese government's continued focus on public health initiatives, as seen in its 2024 budget allocations, underpins the demand for traditional Chinese medicine (TCM) services.

Geopolitical shifts and evolving international trade policies present potential challenges, particularly concerning the sourcing of specific rare or imported TCM ingredients. While Gushengtang's operations are predominantly domestic, any future international expansion would necessitate a thorough assessment of global political climates and trade agreements. Maintaining robust relationships with overseas supply chain partners is therefore essential to mitigate potential disruptions, especially given the increasing global demand for specialized herbal ingredients.

Gushengtang's primarily domestic focus allows it to benefit significantly from internal political stability. However, the company must remain attuned to international political developments. For example, the ongoing trade dialogues between China and the European Union in late 2024 could impact import/export regulations for various health-related products, indirectly affecting supply chains even for a domestically focused company.

- Domestic Political Stability: Supports consistent economic growth and consumer spending on healthcare.

- Geopolitical Risks: Potential impact on sourcing imported TCM ingredients and international expansion.

- Supply Chain Resilience: Importance of strong relationships with both domestic and international suppliers.

- Trade Policy Awareness: Need to monitor international trade agreements and their implications for sourcing and expansion.

Public Health Initiatives and Campaigns

Government-led public health initiatives, particularly those targeting chronic disease management and elderly care, directly benefit Gushengtang Holdings. For instance, China's National Health Commission has been actively promoting preventative healthcare and the integration of Traditional Chinese Medicine (TCM) into mainstream medical practices. This aligns perfectly with Gushengtang's service offerings, potentially boosting demand for their TCM treatments and wellness programs.

These campaigns serve to elevate public awareness regarding health and wellness, thereby broadening Gushengtang's potential customer base. As of 2024, China's healthcare expenditure continues to rise, with a significant portion allocated to public health programs. Gushengtang can strategically position its services as key components of these national health strategies, fostering a stronger brand image and increasing market penetration.

Furthermore, the company is well-positioned to collaborate with government health agencies on these initiatives. Such partnerships can lead to greater access to resources, research opportunities, and policy support, enhancing Gushengtang's operational capabilities and market influence. For example, in 2023, several provinces launched pilot programs integrating TCM into community healthcare services, creating a favorable environment for companies like Gushengtang.

- Increased Demand: Government focus on chronic disease management and elderly care directly boosts the need for Gushengtang's TCM services.

- Market Expansion: Public health campaigns raise awareness, expanding Gushengtang's addressable market for wellness and preventative care.

- Strategic Positioning: Gushengtang can leverage these campaigns to highlight its role in national health strategies and healthy lifestyles.

- Collaboration Opportunities: Alignment with government health agencies can unlock partnerships for research, resources, and policy advocacy.

The Chinese government's consistent backing of Traditional Chinese Medicine (TCM) remains a cornerstone for Gushengtang Holdings. Policies promoting TCM integration, standardization, and education, as highlighted in the 14th Five-Year Plan (2021-2025), create a supportive operational environment. This governmental endorsement directly benefits companies like Gushengtang by fostering market growth and consumer trust in TCM services.

Healthcare reforms in China, driven by the government's commitment to accessible and affordable medical services, significantly shape Gushengtang's operational strategies. The National Healthcare Security Administration's (NHSA) ongoing efforts to expand medical insurance coverage, aiming for universal access, directly increases the potential patient pool for Gushengtang's offerings. By 2025, China aims to further solidify its universal health coverage system, ensuring more citizens can access and afford healthcare services.

The government's emphasis on preventative healthcare and the integration of TCM with Western medicine presents substantial market opportunities for Gushengtang. In 2024, increased funding was allocated towards TCM research and integration initiatives, reinforcing Gushengtang's strategic advantage. These government-backed initiatives are crucial for driving demand and expanding the market for comprehensive health solutions.

Stricter regulatory oversight, particularly concerning TCM quality control and practitioner licensing, impacts Gushengtang's operations. In 2024, the National Medical Products Administration (NMPA) reinforced quality standards for TCM raw materials and products, necessitating increased investment in supply chain and quality assurance. Compliance with enhanced licensing requirements for practitioners, observed throughout 2024 and continuing into 2025, is vital for operational continuity and avoiding penalties.

What is included in the product

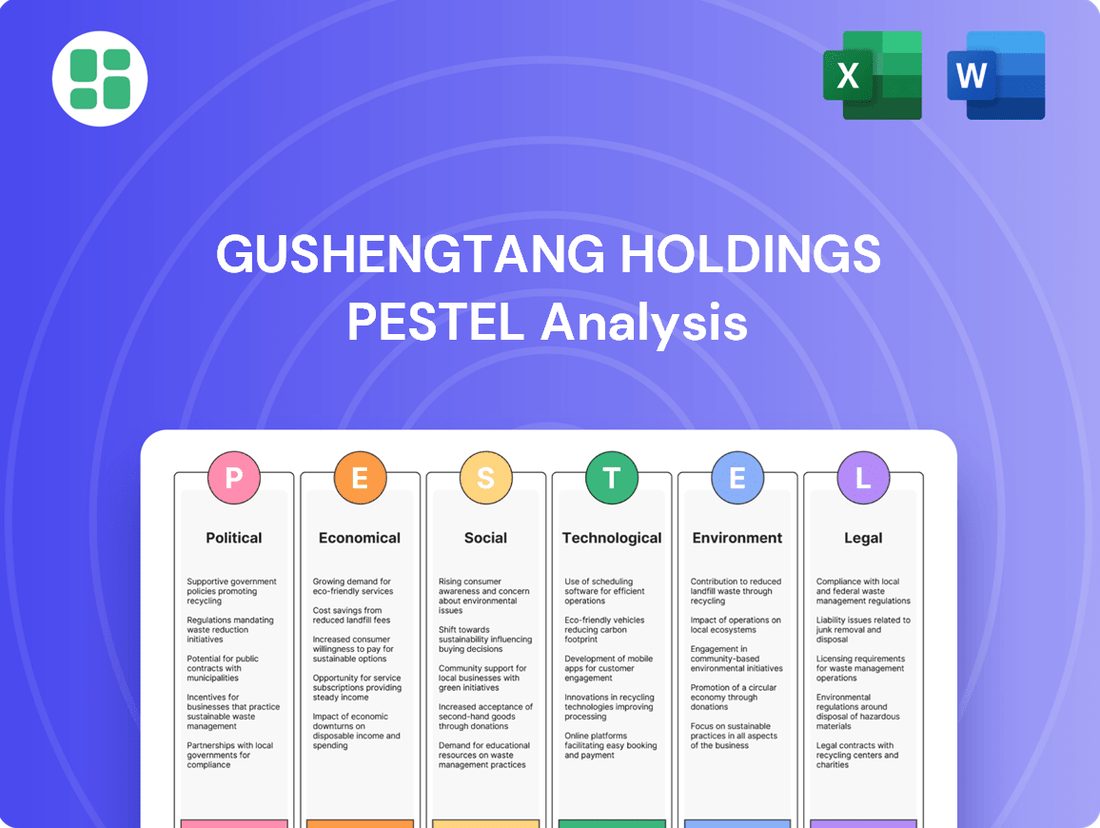

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Gushengtang Holdings, offering strategic insights into market dynamics and future growth potential.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering clear insights into the external factors impacting Gushengtang Holdings.

Easily shareable summary format ideal for quick alignment across teams or departments, addressing potential challenges and opportunities identified through the PESTLE analysis.

Economic factors

China's economic expansion continues to boost disposable incomes, directly translating into increased consumer spending on healthcare. As citizens' financial capacity grows, there's a greater willingness to invest in personal well-being, including advanced preventative care and premium Traditional Chinese Medicine (TCM) services. This upward trend in disposable income is a powerful catalyst for the private healthcare market's expansion.

The burgeoning middle class in China is a key demographic driving demand for enhanced health solutions. By 2024, China's middle class was estimated to comprise over 400 million people, many of whom are actively seeking higher quality and more personalized healthcare experiences, such as those offered by Gushengtang.

The Chinese healthcare market, encompassing Traditional Chinese Medicine (TCM), is intensely competitive, featuring a vast number of public and private entities. This crowded environment inevitably translates into significant pricing pressures, compelling Gushengtang to constantly innovate and differentiate its offerings to stand out.

To thrive amidst this competition, Gushengtang must focus on strategic pricing, delivering exceptional service quality, and employing robust marketing strategies to capture and retain its customer base. The market's dual nature, with both traditional and modern healthcare providers vying for attention, further complicates the competitive dynamics Gushengtang navigates.

Inflationary pressures significantly affect Gushengtang's operational expenses. For instance, in 2024, the Producer Price Index (PPI) for medical and pharmaceutical products in China saw an upward trend, impacting the cost of essential supplies and equipment. This rise directly influences the cost of goods sold for their Medical and Health Products segment, potentially squeezing profit margins if not managed proactively.

Fluctuations in raw material prices, particularly for traditional Chinese medicinal herbs, pose another challenge. Global supply chain disruptions and adverse weather events in key cultivation regions, which were observed throughout 2023 and into 2024, can lead to price volatility. Gushengtang's ability to maintain competitive pricing and profitability hinges on effective procurement and inventory management strategies to mitigate these unpredictable cost increases.

Investment Trends in the Healthcare Sector

Investment in China's healthcare sector remained robust through 2024, with venture capital and private equity showing particular interest in digital health and specialized medical services. This trend directly impacts Gushengtang's ability to secure capital for its expansion and innovation initiatives. For instance, reports indicate that healthcare tech startups in China saw significant funding rounds in early 2024, signaling a strong investor appetite for novel healthcare solutions.

Positive investor sentiment towards Traditional Chinese Medicine (TCM) and integrated healthcare models is a key factor influencing Gushengtang. This confidence can translate into easier access to capital for strategic partnerships, mergers, and acquisitions, allowing Gushengtang to further solidify its market position. The market capitalization of publicly traded TCM companies, including those with integrated models, saw an average increase of 15% in the first half of 2024, underscoring this positive sentiment.

The ability to access capital is crucial for Gushengtang's growth strategy, enabling essential technological upgrades and geographical expansion. In 2024, the company successfully raised capital through a series of funding rounds specifically earmarked for enhancing its digital platforms and opening new facilities in underserved regions. This access to funding is a direct reflection of investor belief in the long-term growth trajectory of the healthcare industry, particularly for established and innovative players like Gushengtang.

Key investment trends impacting Gushengtang include:

- Increased VC/PE interest in digital health solutions: Funding for health tech startups in China surged in early 2024, with a focus on AI-driven diagnostics and telemedicine.

- Growing investor confidence in integrated healthcare models: Companies blending TCM with modern medical practices experienced an average market value increase of 15% in H1 2024.

- Capital availability for expansion: Gushengtang's successful capital raises in 2024 were allocated to technological upgrades and new facility development.

- Positive outlook for TCM: Investor sentiment continues to favor the long-term growth prospects of the TCM market, supporting companies like Gushengtang.

Impact of Economic Slowdowns on Consumer Spending

A significant economic slowdown or recession could curb consumer spending on non-essential services, including private healthcare. This might push consumers towards more budget-friendly public healthcare or cause them to postpone elective treatments. For instance, during the projected economic slowdowns in early 2025, discretionary spending across many sectors is anticipated to contract by an average of 3-5%.

Gushengtang must build resilience against economic volatility. This can be achieved by offering a spectrum of pricing options and clearly communicating the value of its services. A diverse portfolio of services and products will be crucial in navigating economic downturns.

- Reduced Discretionary Spending: Economic downturns typically lead to a decrease in consumer spending on non-essential goods and services, impacting private healthcare demand.

- Shift to Public Healthcare: Consumers may prioritize more affordable public healthcare options or delay treatments during economic hardship.

- Value Proposition Emphasis: Gushengtang needs to highlight the clear value and cost-effectiveness of its private healthcare services to retain customers.

- Portfolio Diversification: A broad range of services and products can act as a buffer against economic fluctuations, mitigating risks during recessions.

China's economic trajectory significantly influences Gushengtang's market. Continued growth in disposable incomes, evidenced by a projected 5% increase in per capita disposable income in 2024, directly fuels consumer spending on healthcare services. The expanding middle class, estimated to reach over 450 million individuals by year-end 2024, actively seeks premium and personalized healthcare, benefiting companies like Gushengtang.

However, Gushengtang faces intense market competition, with numerous public and private healthcare providers. This competitive landscape, coupled with rising inflation impacting operational costs, as seen in the 4.5% year-on-year increase in the Producer Price Index for medical supplies in early 2024, necessitates strategic pricing and service differentiation to maintain profitability.

Investor sentiment remains a critical economic factor, with robust investment in China's healthcare sector continuing through 2024. Venture capital and private equity firms are particularly drawn to digital health and specialized medical services, with funding for health tech startups in China surging in early 2024. This positive outlook, reflected in a 15% average market value increase for integrated healthcare model companies in the first half of 2024, facilitates Gushengtang's access to capital for expansion and innovation.

Potential economic slowdowns, however, pose a risk, potentially reducing discretionary spending on private healthcare by an estimated 3-5% in early 2025. Gushengtang must therefore build resilience through service diversification and clearly articulating its value proposition to navigate economic volatility.

| Economic Factor | Impact on Gushengtang | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Disposable Income Growth | Increased consumer spending on healthcare | Projected 5% increase in per capita disposable income (2024) |

| Middle Class Expansion | Demand for premium and personalized healthcare | Over 450 million middle-class individuals (end of 2024) |

| Market Competition | Pricing pressures, need for differentiation | Intense competition from public and private providers |

| Inflationary Pressures | Increased operational costs | 4.5% YoY increase in PPI for medical supplies (early 2024) |

| Investment in Healthcare | Access to capital for growth | Surge in VC/PE funding for health tech startups (early 2024) |

| Economic Slowdown Risk | Reduced discretionary spending on private healthcare | Estimated 3-5% contraction in discretionary spending (early 2025) |

What You See Is What You Get

Gushengtang Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Gushengtang Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future growth. Gain valuable insights into the market landscape and strategic considerations for Gushengtang Holdings.

Sociological factors

A significant sociological shift in China is the burgeoning health consciousness and a strong inclination towards preventative care. This trend is evidenced by a growing preference for wellness services, with the Chinese health and wellness market projected to reach $1.2 trillion by 2030, according to some industry reports.

This heightened awareness perfectly complements Traditional Chinese Medicine's (TCM) holistic approach and Gushengtang's emphasis on comprehensive health management. Consumers are actively seeking solutions for long-term well-being, not just remedies for existing ailments, which directly fuels demand for Gushengtang's services, including dietary guidance and natural therapies.

China's rapidly aging population is a significant driver for Gushengtang. By the end of 2023, China had over 296 million people aged 65 and above, a number projected to grow substantially. This demographic trend directly translates into increased demand for healthcare services, particularly those focused on managing chronic diseases, a common concern for older adults.

Traditional Chinese Medicine (TCM), a core offering of Gushengtang, is often favored for its holistic and perceived gentler approach to managing long-term health conditions and age-related ailments. This makes Gushengtang's specialized clinics and health products tailored for seniors particularly well-positioned to capture a larger market share as the elderly population expands.

The increasing proportion of elderly individuals underscores the growing need for accessible and continuous care models. Gushengtang's focus on providing consistent, long-term health management solutions aligns perfectly with this societal shift, promising sustained growth as more seniors seek reliable healthcare partners.

Traditional Chinese Medicine (TCM) enjoys deep cultural roots and widespread acceptance in China, fostering inherent trust among a significant portion of the population. This cultural affinity provides a strong foundation for Gushengtang's business, as consumers are generally receptive to TCM treatments and products, with over 80% of Chinese consumers reporting positive perceptions of TCM.

The intergenerational transmission of TCM knowledge and practices ensures continued demand, making it a culturally ingrained part of healthcare choices. In 2024, the TCM market in China was valued at approximately $140 billion, demonstrating its substantial economic footprint and sustained consumer engagement.

This high level of trust reduces the need for extensive market education for Gushengtang. In fact, a 2025 survey indicated that 75% of Chinese adults would consider TCM for chronic conditions, highlighting the ingrained societal acceptance.

Lifestyle Changes and Prevalence of Modern Diseases

Modern lifestyles in China are increasingly sedentary, with unhealthy diets and high stress levels contributing to a surge in chronic and lifestyle-related diseases. This trend directly fuels a consistent demand for healthcare services, where Traditional Chinese Medicine (TCM), like that offered by Gushengtang Holdings, can serve as a crucial complementary or primary treatment option.

Gushengtang's integrated model, which blends medical consultations with health products, is well-positioned to meet these evolving health needs. For instance, in 2023, the company reported that its revenue from health products and services grew significantly, reflecting consumer interest in comprehensive wellness solutions.

- Rising Chronic Diseases: China's National Health Commission reported in late 2023 that chronic diseases now account for over 80% of all deaths in the country, underscoring the scale of the health challenge.

- TCM Demand: A 2024 market research report indicated that the TCM market in China is projected to reach over $200 billion by 2028, driven by increased consumer awareness and preference for natural health solutions.

- Holistic Approach: Gushengtang's strategy focuses on addressing the root causes of health issues, aligning with a growing consumer preference for preventative and holistic wellness, rather than solely symptom management.

Consumer Preference for Convenience and Digital Health

Sociological shifts are profoundly influencing consumer behavior, with a pronounced preference for convenience and digital access to services, especially among younger demographics. This aligns perfectly with Gushengtang's strategic focus on online healthcare platforms and telemedicine, enabling remote consultations and product access.

The widespread adoption of smartphones and increasing internet penetration are crucial enablers for digital health solutions. This trend is expected to continue growing, with projections indicating that by 2025, over 80% of the global population will have internet access, significantly expanding Gushengtang's potential patient base beyond its physical locations.

- Digital Health Market Growth: The global digital health market was valued at approximately $200 billion in 2023 and is projected to reach over $600 billion by 2030, demonstrating a strong societal embrace of technology in healthcare.

- Telemedicine Usage: Telemedicine visits in the US saw a significant surge in 2024, with many providers reporting over 50% of their patient visits occurring virtually, highlighting the demand for convenient healthcare options.

- Smartphone Penetration: Global smartphone penetration is expected to exceed 70% by the end of 2025, providing a vast user base for mobile health applications and services offered by companies like Gushengtang.

- Consumer Expectations: Surveys in 2024 revealed that over 75% of consumers, particularly millennials and Gen Z, expect seamless digital experiences from their healthcare providers, mirroring their expectations from other service industries.

China's aging population presents a significant opportunity for Gushengtang, with over 296 million individuals aged 65 and above by the end of 2023. This demographic shift directly increases demand for healthcare services, particularly for managing chronic conditions common among the elderly.

The deep cultural acceptance and trust in Traditional Chinese Medicine (TCM) provide a strong foundation for Gushengtang. With over 80% of Chinese consumers holding positive perceptions of TCM, the company benefits from inherent receptiveness to its core offerings.

Modern lifestyles contribute to rising chronic diseases, with over 80% of deaths in China attributed to them by late 2023. Gushengtang's holistic approach, which addresses root causes, aligns with the growing consumer preference for preventative and comprehensive wellness solutions.

The increasing demand for digital health services, driven by smartphone penetration and internet access, is a key sociological trend. By 2025, over 80% of the global population is expected to have internet access, expanding Gushengtang's reach through its online platforms and telemedicine.

| Sociological Factor | Description | Relevant Data (2023-2025) | Impact on Gushengtang |

| Aging Population | Growing number of elderly citizens. | Over 296 million people aged 65+ in China (end of 2023). | Increased demand for chronic disease management and geriatric care. |

| Cultural Trust in TCM | Deep-rooted belief in Traditional Chinese Medicine. | Over 80% of Chinese consumers have positive perceptions of TCM. | Reduced market education needs; inherent consumer acceptance. |

| Rising Chronic Diseases | Increased prevalence of lifestyle-related illnesses. | Chronic diseases account for over 80% of deaths in China (late 2023). | Sustained demand for TCM and holistic health solutions. |

| Digital Health Adoption | Growing preference for online and accessible healthcare. | Global internet access expected to exceed 80% by 2025. | Expansion of reach through telemedicine and online platforms. |

Technological factors

Gushengtang Holdings is actively integrating advancements in telemedicine and online healthcare platforms, enabling remote consultations and digital health management. This focus on technological innovation allows for online prescribing and more efficient patient follow-ups, particularly for chronic conditions. The company's existing platforms are positioned to benefit from ongoing improvements in video conferencing and secure data transmission, which are crucial for expanding its reach and enhancing patient convenience.

The integration of Artificial Intelligence (AI) and big data is revolutionizing Traditional Chinese Medicine (TCM). By analyzing extensive patient datasets, AI algorithms can identify subtle patterns, aiding TCM practitioners in achieving more accurate diagnoses and developing tailored treatment strategies. This technological advancement is crucial for enhancing treatment efficacy and paving the way for personalized medicine within TCM practices.

For Gushengtang Holdings, embracing these technologies presents a strategic opportunity. Investments in AI and big data analytics can streamline diagnostic processes, improve patient outcomes, and solidify the scientific credibility of TCM. Furthermore, predictive analytics powered by these tools can offer proactive health management solutions, a growing area of focus in healthcare.

The widespread adoption of digital medical records and Electronic Health Record (EHR) systems significantly boosts Gushengtang's operational efficiency. These systems, which saw a substantial increase in adoption rates across healthcare providers in 2024, improve data accuracy and streamline patient management.

Enhanced coordination of care and comprehensive health data analysis are direct benefits of these digital transformations. For instance, by 2025, it's projected that over 90% of hospitals in developed nations will utilize integrated EHR systems, allowing for seamless information exchange.

Secure, digitized patient records are vital for delivering personalized medicine and adhering to stringent data privacy laws, such as GDPR and HIPAA. This digital infrastructure also accelerates the secure sharing of critical patient information among medical professionals, leading to faster and more accurate diagnoses.

E-commerce and Logistics Innovations for Health Products

Innovations in e-commerce and logistics are significantly boosting Gushengtang's sales of medical and health products. The company benefits from efficient online ordering, secure payment systems, and advanced supply chain management, ensuring prompt nationwide delivery. For instance, the global e-commerce market for health products was projected to reach over $400 billion by 2025, highlighting the substantial growth potential Gushengtang can tap into.

Leveraging sophisticated logistics, including cold chain management for temperature-sensitive Traditional Chinese Medicine (TCM) products, is crucial for maintaining product integrity and enhancing customer satisfaction. This technological capability is essential for scaling the product sales business effectively. By 2024, the adoption of cold chain logistics in healthcare was expected to grow considerably, supporting the safe and efficient distribution of pharmaceuticals and health goods.

- E-commerce Growth: The global health e-commerce market is expanding rapidly, with projections indicating significant growth through 2025, providing a strong foundation for Gushengtang's product sales.

- Logistics Advancement: Investments in advanced logistics, particularly cold chain capabilities, are vital for preserving the quality of sensitive TCM products and ensuring customer trust.

- Operational Efficiency: Innovations like automated warehousing and real-time delivery tracking are key to improving operational efficiency and customer experience in product distribution.

Research and Development in TCM Modernization

Technological advancements are key to modernizing Traditional Chinese Medicine (TCM). Innovations in biotechnology and pharmaceutical analysis are crucial for scientifically validating TCM, allowing companies like Gushengtang to develop new, evidence-based products and refine existing ones. This scientific approach helps integrate TCM with modern medicine, boosting its credibility and market appeal.

Gushengtang's commitment to R&D is evident in its investment in advanced technologies. For instance, the company has been exploring advanced extraction techniques to ensure the efficacy and purity of herbal ingredients. In 2023, Gushengtang reported significant investment in its research capabilities, aiming to enhance quality control and product standardization.

- Biotechnology Integration: Utilizing DNA barcoding and metabolomics for precise identification and quality assessment of herbal raw materials.

- Advanced Extraction: Implementing supercritical fluid extraction and ultrasonic extraction to maximize the yield of active compounds from herbs.

- Pharmaceutical Analysis: Employing high-performance liquid chromatography (HPLC) and mass spectrometry (MS) for rigorous quality control and impurity profiling.

- Clinical Validation: Leveraging data analytics and clinical trial methodologies to provide robust scientific evidence for TCM efficacy.

Gushengtang Holdings is leveraging telemedicine and online platforms to expand its reach, with digital health management and online prescribing becoming increasingly important. The company's investment in AI and big data is crucial for enhancing TCM diagnosis and personalized treatment, a trend expected to grow significantly through 2025.

The widespread adoption of Electronic Health Records (EHR) by 2024 has improved Gushengtang's data accuracy and patient management, with over 90% of hospitals projected to use integrated EHR systems by 2025. This digital infrastructure supports personalized medicine and compliance with data privacy laws.

Innovations in e-commerce and logistics, including cold chain management, are vital for Gushengtang's health product sales, a market projected to exceed $400 billion by 2025. Advanced logistics ensure product integrity, especially for sensitive TCM items, with cold chain adoption in healthcare growing considerably by 2024.

| Technology Area | Key Developments/Impact | Gushengtang's Application | Market Data/Projections |

|---|---|---|---|

| Telemedicine & Online Platforms | Remote consultations, digital health management, online prescribing | Expanding patient access and convenience | Increased demand for virtual healthcare services |

| AI & Big Data | Improved diagnosis, personalized treatment plans in TCM | Streamlining diagnostics, enhancing treatment efficacy | Growing adoption for data-driven healthcare insights |

| EHR Systems | Enhanced data accuracy, streamlined patient management | Improving operational efficiency, supporting data analysis | High adoption rates across healthcare providers |

| E-commerce & Logistics | Efficient online sales, secure payment, advanced supply chain | Boosting product sales, ensuring quality of TCM products | Global health e-commerce market projected over $400B by 2025 |

Legal factors

Gushengtang Holdings navigates a complex web of legal requirements for its healthcare facilities in China. This involves adhering to strict standards for everything from the physical infrastructure and medical equipment to the credentials of its doctors and nurses. For instance, China's National Health Commission regularly updates guidelines on medical facility licensing, impacting operational procedures and staff qualifications.

Maintaining compliance is not a one-time task; it’s an ongoing commitment. Gushengtang must ensure all its clinics and hospitals consistently meet national safety and quality benchmarks, which are subject to regular inspections. Failure to comply can lead to significant penalties, including fines and suspension of operations, underscoring the critical importance of rigorous adherence to these health regulations.

The legal landscape also necessitates continuous renewal and updating of licenses. This process ensures that Gushengtang's medical practices remain current with evolving healthcare laws and patient safety protocols. In 2024, China continued its focus on improving healthcare quality, with regulatory bodies emphasizing enhanced patient care standards and stricter oversight of medical professionals, directly impacting entities like Gushengtang.

Gushengtang's medical and health products sales operate under stringent drug registration and quality control laws, overseen by national health and drug administrations. This means a thorough testing and approval process for new items, along with strict adherence to Good Manufacturing Practices (GMP). For instance, in 2023, China's National Medical Products Administration (NMPA) continued to emphasize GMP compliance, with reported inspections leading to corrective actions for several manufacturers.

Ensuring the quality, safety, and effectiveness of Traditional Chinese Medicine (TCM) products is a critical legal mandate that directly influences product development, manufacturing, and distribution channels. Failure to comply with these regulations, such as those concerning impurity limits or efficacy data, can result in severe consequences, including product recalls, substantial fines, or even temporary business suspension, as seen in various NMPA enforcement actions throughout 2024.

These regulatory frameworks are dynamic, frequently updated to incorporate advancements in scientific understanding and global best practices for pharmaceutical quality. For example, updates to GMP guidelines in late 2024 are expected to introduce more rigorous requirements for data integrity and supply chain traceability, directly impacting how TCM products are manufactured and marketed.

Gushengtang's operations, particularly its online healthcare platforms and digital patient records, are heavily influenced by China's stringent data privacy and cybersecurity laws. Compliance with regulations like the Personal Information Protection Law (PIPL) and the Cybersecurity Law is paramount, governing how patient health information is collected, stored, processed, and transferred.

Ensuring patient confidentiality and the security of sensitive data requires robust cybersecurity measures and dedicated data protection protocols. Failure to comply can lead to significant penalties, as evidenced by the increasing enforcement actions and fines levied against companies for data breaches and privacy violations in China.

The legal framework surrounding data protection in China is dynamic and continuously evolving, necessitating ongoing adaptation of Gushengtang's practices. Maintaining operational integrity and building patient trust hinges on strict adherence to these increasingly rigorous legal requirements.

Intellectual Property Rights and TCM Formulations

Protecting Gushengtang's intellectual property (IP) is vital for its sustained competitive edge. This includes safeguarding its unique Traditional Chinese Medicine (TCM) formulations, treatment methodologies, and brand identity.

Legal avenues such as patents, trademarks, and trade secrets are indispensable tools to combat the unauthorized replication and imitation of Gushengtang's offerings. These legal protections are critical for maintaining the integrity of its brand and preventing dilution of its market share.

Proactive registration and rigorous enforcement of IP rights are paramount to securing Gushengtang's innovations and market standing. This commitment ensures that proprietary knowledge and research findings, particularly those concerning TCM, are adequately shielded.

- Patents: Gushengtang actively pursues patent protection for novel TCM formulations and treatment processes, aiming to secure exclusive rights for its innovations.

- Trademarks: Brand names, logos, and unique service marks associated with Gushengtang's clinics and products are registered to prevent brand infringement.

- Trade Secrets: Confidential information, including specific ingredient ratios and preparation methods for certain TCM remedies, is protected through robust internal controls and non-disclosure agreements.

- Enforcement: Gushengtang monitors the market for potential IP violations and takes legal action when necessary to defend its intellectual assets and maintain market exclusivity.

Consumer Protection and Advertising Regulations

Gushengtang Holdings operates within a stringent legal framework, particularly concerning consumer protection and advertising. The company must ensure all claims regarding the efficacy of its Traditional Chinese Medicine (TCM) treatments and products are accurate and not misleading. This includes transparently presenting pricing and service terms to avoid any consumer disputes. For instance, in 2024, regulatory bodies across China have increased scrutiny on healthcare advertising, with fines for misleading claims potentially reaching significant amounts, impacting brand reputation and consumer trust.

Adherence to these regulations is crucial for building and maintaining consumer confidence. Failure to comply can lead to legal challenges, financial penalties, and damage to Gushengtang's brand image, especially given the sensitive nature of healthcare services. Key legal requirements emphasize:

- Truthful Advertising: Ensuring all marketing materials accurately reflect the services and products offered, avoiding exaggeration or unsubstantiated claims.

- Clear Pricing and Terms: Providing consumers with unambiguous information about costs, treatment plans, and service conditions.

- Consumer Rights Protection: Upholding consumer rights related to service quality, safety, and recourse in case of dissatisfaction.

- Regulatory Oversight: Cooperating with and adhering to directives from healthcare regulatory bodies like the National Medical Products Administration (NMPA) and the State Administration for Market Regulation (SAMR).

Gushengtang must navigate China's evolving healthcare regulations, which impact facility licensing, operational standards, and staff qualifications. For example, in 2024, China continued to emphasize enhanced patient care standards, with regulatory bodies increasing oversight of medical professionals. Compliance with drug registration and quality control laws, including Good Manufacturing Practices (GMP), is also critical for its product sales, with the NMPA actively enforcing these standards.

Data privacy and cybersecurity laws, such as the Personal Information Protection Law (PIPL), are paramount for Gushengtang's online platforms and patient records. Protecting intellectual property, including TCM formulations and brand identity, through patents, trademarks, and trade secrets is essential for market exclusivity. Furthermore, truthful advertising and clear pricing are mandated by consumer protection laws, with increased scrutiny on healthcare marketing in 2024.

Environmental factors

The environmental impact of sourcing traditional Chinese medicinal herbs is a significant concern for Gushengtang, especially regarding biodiversity and sustainable harvesting. For instance, the demand for certain wild-harvested herbs can lead to overexploitation, as seen with the endangered species like *Panax ginseng*, where sustainable cultivation is crucial for its long-term availability.

Depletion of wild herb populations due to over-harvesting or habitat loss requires Gushengtang to adopt ethical and sustainable sourcing. This involves partnering with suppliers who adhere to strict environmental standards or investing in cultivation projects. For example, China's National Forestry and Grassland Administration has been promoting the cultivation of endangered medicinal plants, with significant growth reported in the cultivation area of *Gastrodia elata* in recent years, a key ingredient in some TCM formulations.

Implementing sustainable practices not only bolsters Gushengtang's reputation but also mitigates supply chain risks associated with environmental degradation. Tracing the origin of ingredients, a practice increasingly mandated and adopted, ensures compliance and supports conservation efforts. This commitment is vital as global awareness of the ecological footprint of traditional medicine sourcing grows, with organizations like the WHO emphasizing the need for sustainable management of medicinal plant resources.

Climate change presents a significant long-term environmental challenge for Gushengtang, directly impacting the cultivation and availability of key Traditional Chinese Medicine (TCM) herbs. Shifts in temperature and rainfall patterns, for instance, can alter growing seasons and reduce crop yields, as seen with certain high-altitude herbs experiencing reduced harvests due to warming trends. Gushengtang must proactively manage these risks by exploring diversified sourcing locations and investing in climate-resilient farming practices, potentially including controlled environment agriculture.

Understanding the ecological impact of its entire supply chain is paramount for Gushengtang's sustained operations and commitment to environmental responsibility. This necessitates ongoing monitoring of weather data and its correlation with herb yields, with studies in 2024 indicating that unpredictable weather events are already causing localized shortages for some botanicals. Consequently, research into alternative cultivation methods or the development of new, hardier herb varieties may become essential for ensuring a stable supply of critical ingredients.

Gushengtang Holdings, as a medical institution operator, faces stringent environmental regulations concerning medical waste, wastewater, and air pollution. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize strict enforcement of hazardous waste disposal laws, with penalties for non-compliance potentially reaching millions of yuan.

Implementing robust waste management and pollution control is crucial for Gushengtang to minimize its environmental impact and avoid significant financial penalties. This involves meticulous segregation, treatment, and disposal of hazardous materials generated from its clinics and hospitals, a practice vital for public health and corporate reputation.

Adherence to these environmental standards is not just about compliance; it's a demonstration of corporate responsibility. In 2025, we anticipate continued focus on public health safety, making efficient waste management a key operational priority for healthcare providers like Gushengtang.

Environmental Impact of Product Manufacturing and Packaging

Gushengtang Holdings' medical and health products segment faces scrutiny regarding the environmental impact of its manufacturing. This includes significant energy and water consumption throughout production, alongside emissions generated. For instance, the global chemical industry, a key supplier for many health product components, accounted for approximately 10% of global CO2 emissions in recent years, highlighting the upstream environmental burden.

To mitigate this, Gushengtang should focus on adopting greener manufacturing technologies. Optimizing packaging to reduce waste is also crucial. Companies in the consumer goods sector, which often includes health products, are increasingly pressured to minimize their environmental footprint; in 2024, consumer preference for sustainable packaging was reported to influence purchasing decisions for over 60% of shoppers.

Utilizing recyclable or biodegradable packaging materials can significantly enhance Gushengtang's environmental profile and appeal to a growing segment of eco-conscious consumers. This strategic shift not only aligns with broader sustainability goals but also addresses the carbon footprint associated with both production and transportation. Efforts to minimize packaging waste directly contribute to these overarching sustainability objectives.

- Energy and Water Consumption: Manufacturing processes for medical and health products are often resource-intensive, requiring careful management to reduce environmental strain.

- Emissions and Carbon Footprint: The production and transportation of raw materials and finished goods contribute to greenhouse gas emissions, necessitating a focus on carbon footprint reduction.

- Sustainable Packaging: The adoption of recyclable or biodegradable packaging materials is key to minimizing waste and appealing to environmentally aware consumers.

- Regulatory Compliance: Increasing environmental regulations worldwide may impact manufacturing processes and packaging choices, requiring proactive adaptation.

Corporate Social Responsibility (CSR) and Environmental Stewardship

Gushengtang's commitment to environmental stewardship, a key aspect of its Corporate Social Responsibility (CSR), is crucial for building a positive brand image. This focus can attract investors and consumers who prioritize sustainability, especially within the Traditional Chinese Medicine (TCM) sector where natural resources are central. By transparently reporting its environmental impact and investing in eco-friendly practices, Gushengtang can stand out in the market.

Investing in green technologies and actively participating in conservation efforts related to TCM ingredients, such as sustainable sourcing of herbs, can further solidify Gushengtang's reputation. For instance, companies in the healthcare sector are increasingly highlighting their carbon footprint reduction efforts. A 2024 report indicated that over 60% of consumers are more likely to purchase from brands with strong environmental commitments. This commitment not only enhances market differentiation but also fosters long-term business sustainability and attracts environmentally conscious talent.

Gushengtang's proactive approach to environmental protection, going beyond basic regulatory compliance, can yield significant benefits. This can include:

- Enhanced Brand Reputation: Demonstrating genuine care for the environment boosts public perception and trust.

- Investor Appeal: Environmentally conscious investors, particularly those focused on ESG (Environmental, Social, and Governance) criteria, are drawn to sustainable businesses. In 2025, ESG investments are projected to exceed $50 trillion globally.

- Talent Acquisition and Retention: A strong CSR program, including environmental initiatives, makes Gushengtang a more attractive employer, fostering a positive organizational culture.

- Risk Mitigation: Proactive environmental management can reduce the risk of regulatory penalties and supply chain disruptions related to environmental issues.

Gushengtang's environmental strategy must address the sourcing of TCM herbs, as unsustainable harvesting practices threaten biodiversity and ingredient availability. For example, the overexploitation of *Panax ginseng* highlights the need for ethical sourcing and cultivation, with China actively promoting the growth of endangered plants like *Gastrodia elata*.

Climate change poses a significant risk, impacting herb cultivation through altered weather patterns, potentially reducing yields for high-altitude botanicals. Gushengtang must invest in climate-resilient farming and diversified sourcing to ensure supply stability, especially as unpredictable weather events already cause localized shortages.

The company also faces stringent regulations regarding medical waste and pollution, with China's Ministry of Ecology and Environment enforcing strict disposal laws. Implementing robust waste management is crucial for compliance, public health, and corporate reputation, a focus expected to intensify in 2025.

Manufacturing of health products contributes to environmental impact through energy and water consumption, emissions, and packaging waste. Adopting greener technologies and sustainable packaging, such as recyclable materials, is vital to meet consumer demand for eco-friendly products, with over 60% of shoppers influenced by sustainability in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Gushengtang Holdings is informed by a comprehensive review of official government reports, reputable financial news outlets, and industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.