Gushengtang Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gushengtang Holdings Bundle

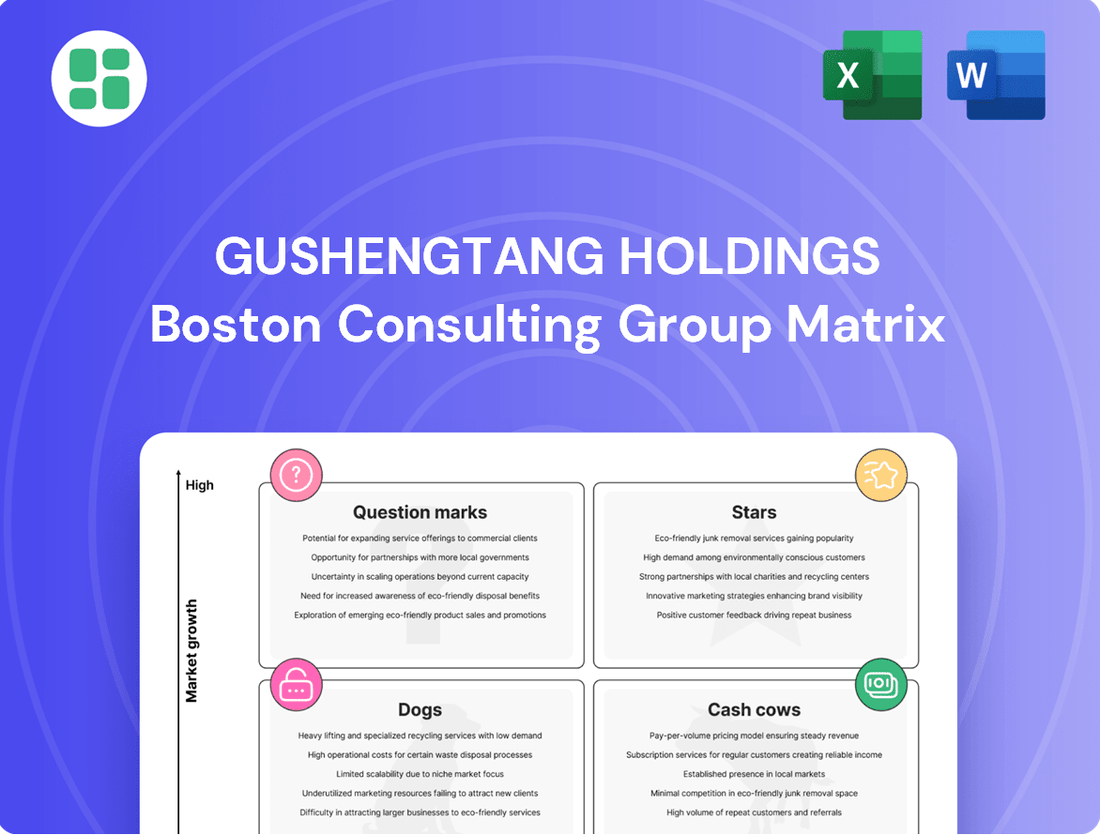

Explore the strategic positioning of Gushengtang Holdings within its market through our comprehensive BCG Matrix analysis. Understand which of their offerings are poised for growth, which are generating consistent revenue, and which may require a strategic re-evaluation.

This preview offers a glimpse into the powerful insights contained within the full Gushengtang Holdings BCG Matrix. Unlock a detailed breakdown of their product portfolio, complete with quadrant placements, actionable recommendations, and a clear roadmap for optimizing their market strategy. Purchase the full report today to gain the competitive edge you need.

Stars

Gushengtang Holdings' offline medical network is a clear star in its BCG matrix. In 2024, this segment saw a significant revenue jump of 34.5%, highlighting its position in a rapidly expanding market. This impressive growth is a testament to the company's effective strategy of both acquiring new facilities and organically growing its service footprint across China.

Gushengtang's Digital TCM AI Solutions, exemplified by the 'TCM AI Doppelganger,' are a prime example of a Star in the BCG Matrix. This segment is characterized by high growth potential and significant market demand. Projections suggest these AI-driven tools will contribute substantial revenue starting in mid-2025, reflecting their innovative approach to replicating expert TCM diagnostic logic.

Gushengtang Holdings actively strengthens its market position through strategic acquisitions. A prime example is their 2024 acquisition of full equity interest in Hunan Mingyuantang, a move designed to broaden their offline medical network and boost market share. This strategy allows for rapid consolidation within the fragmented private Traditional Chinese Medicine (TCM) sector.

These acquisitions are crucial for Gushengtang to capitalize on synergies with its existing operational platforms. By integrating new entities, the company aims to achieve greater efficiencies and expand its service offerings. This proactive approach underscores a commitment to leading the rapidly growing TCM market.

High-Quality TCM Talent Cultivation System

Gushengtang Holdings invests significantly in a three-tier talent cultivation system for Traditional Chinese Medicine (TCM) professionals. This initiative directly supports national efforts to alleviate the shortage of TCM physicians, thereby boosting the company's service quality and operational capacity.

By focusing on attracting and nurturing elite medical talent, Gushengtang solidifies its competitive edge and expands its market share in the high-demand TCM healthcare sector. This strategic emphasis on human capital is fundamental to maintaining its leadership position in the expanding TCM market.

- Investment in Talent: Gushengtang's commitment to developing TCM professionals is a core strategy.

- Addressing Shortages: The system directly tackles the national undersupply of TCM physicians.

- Competitive Advantage: Securing top-tier talent enhances service quality and market position.

- Market Leadership: Human capital development is key to sustained leadership in the growing TCM sector.

Integrated Online-Offline Healthcare Services

Gushengtang's integrated online-offline healthcare services represent a significant growth opportunity, often categorized as a Star in the BCG matrix due to their high market growth and strong competitive position. The seamless integration of their extensive offline medical service network with their online healthcare platforms fosters greater customer engagement and drives increased patient visits. This synergy is crucial for capturing market share in a rapidly evolving healthcare landscape.

The company's strategy focuses on leveraging online channels to facilitate appointments and extend the reach of its traditional Chinese medicine (TCM) services. This blended approach not only caters to modern consumer preferences for convenience and accessibility but also solidifies Gushengtang's leadership in the modern TCM delivery market. For instance, in 2024, Gushengtang reported a notable increase in online appointment bookings translating to a higher volume of offline consultations, underscoring the effectiveness of this integrated model.

- High Market Growth Potential: The increasing adoption of digital health solutions and evolving consumer demand for convenient healthcare access fuel the growth of integrated online-offline models.

- Strong Customer Engagement: The synergy between online platforms and offline clinics enhances customer interaction, leading to more frequent visits and improved patient retention.

- Market Penetration Strategy: Facilitating online appointments for offline services and expanding digital reach are key tactics Gushengtang employs to deepen its market penetration.

- Reinforced Market Leadership: This integrated approach positions Gushengtang as a leader in modern TCM delivery, adapting to and shaping consumer expectations.

Gushengtang's offline medical network is a standout Star in its BCG matrix, demonstrating robust growth and market leadership. In 2024, this segment achieved a substantial revenue increase of 34.5%, a clear indicator of its strong performance in a rapidly expanding market, driven by both strategic acquisitions and organic expansion.

The company's Digital TCM AI Solutions, particularly its 'TCM AI Doppelganger,' are also classified as Stars. These innovative AI tools are poised for significant revenue contribution from mid-2025, reflecting high market demand and the potential to revolutionize TCM diagnostics by replicating expert logic.

| Segment | BCG Category | 2024 Performance/Outlook |

| Offline Medical Network | Star | 34.5% revenue growth in 2024; expanding market share. |

| Digital TCM AI Solutions | Star | Projected significant revenue contribution from mid-2025; high market demand. |

| Integrated Online-Offline Services | Star | Increased online appointment bookings driving offline consultations; strong customer engagement. |

What is included in the product

This BCG Matrix provides a tailored analysis of Gushengtang Holdings' product portfolio, categorizing its offerings into Stars, Cash Cows, Question Marks, and Dogs.

It offers clear descriptions and strategic insights for each quadrant, highlighting which units to invest in, hold, or divest.

The Gushengtang Holdings BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Gushengtang's established offline medical institutions function as its core cash cows. These mature facilities consistently generate substantial revenue and profits, underscoring their significant market share within the stable, established segment of the Traditional Chinese Medicine (TCM) market. For instance, in 2023, Gushengtang reported a revenue of RMB 3.5 billion, with its offline medical network being the primary contributor.

Benefiting from robust brand recognition and a dedicated patient base, these well-established clinics demand comparatively modest investment for ongoing operations. This stability allows them to provide a dependable and consistent cash flow, crucial for funding Gushengtang's strategic initiatives and growth in other areas. The company's focus on operational efficiency within this network has maintained healthy profit margins, contributing significantly to its overall financial strength.

Gushengtang's traditional healthcare solutions, encompassing consultation, diagnosis, and prescription services, represent its primary revenue driver, securing a significant market share in a foundational sector. These essential services demonstrate consistent demand and a strong competitive edge, translating into robust profit margins.

This segment acts as the bedrock of Gushengtang's financial health, consistently generating substantial cash flow. For instance, in the first half of 2024, revenue from TCM services reached 1.45 billion RMB, underscoring its role as a cash cow.

Mature decoction and physical therapy services are Gushengtang's cash cows, representing established, high-demand offerings. These services, including acupuncture and moxibustion, consistently generate revenue with minimal marketing spend due to their strong market presence and loyal patient following.

In 2024, Gushengtang reported that its core TCM services, which include decoctions and physical therapies, continued to be the primary revenue drivers. The company's established patient base ensures high utilization rates for these mature offerings, contributing significantly to its overall profitability and cash flow generation.

Strong Brand Recognition and Patient Loyalty

Gushengtang Holdings benefits from substantial brand recognition and deep patient loyalty, particularly within its established service areas. This strong brand equity translates into a reliable customer base and predictable income, reducing the reliance on costly new customer acquisition efforts and thereby enhancing profitability.

- Brand Equity: Gushengtang's brand is a significant asset, fostering trust and encouraging repeat business.

- Patient Loyalty: High patient retention in mature service lines provides a stable revenue foundation.

- Profitability: Reduced marketing spend due to brand strength directly boosts profit margins.

- Market Position: In 2024, Gushengtang continued to solidify its position as a trusted healthcare provider, with patient satisfaction scores remaining high across its core offerings.

Optimized Operational Efficiency in Core Services

Gushengtang Holdings demonstrates exceptional operational efficiency within its core healthcare services, a hallmark of a cash cow. In 2024, the company achieved a stable gross profit margin and robust adjusted net profit growth, even as revenue expanded significantly. This suggests that their established segments are running lean and effectively.

The optimized processes in Gushengtang's core healthcare solutions are key to this performance. By minimizing operational costs, these efficiencies directly translate into maximized cash generation. This strong cash flow generation is crucial for funding other ventures or returning value to shareholders.

This operational strength is precisely what defines a cash cow in the BCG Matrix. Gushengtang's ability to maintain profitability and generate substantial free cash flow from its mature businesses provides a solid financial foundation.

- Stable Gross Profit Margin: Maintained profitability in core services despite revenue growth.

- Robust Adjusted Net Profit Growth (2024): Achieved strong profit increases from established operations.

- Minimized Costs: Optimized processes in core healthcare solutions reduce expenditure.

- Maximized Cash Generation: Efficient operations lead to substantial free cash flow.

Gushengtang's established offline medical institutions, particularly its Traditional Chinese Medicine (TCM) services like decoctions and physical therapies, are its definitive cash cows. These mature offerings benefit from high brand recognition and patient loyalty, ensuring consistent revenue generation with minimal new investment. In the first half of 2024, TCM services alone contributed 1.45 billion RMB to revenue, highlighting their role as a stable cash generator.

| Service Segment | 2023 Revenue (RMB Billion) | H1 2024 Revenue (RMB Billion) | Key Characteristics |

|---|---|---|---|

| Offline TCM Medical Institutions | 3.5 (Total Company) | 1.45 (TCM Services) | High brand recognition, patient loyalty, stable demand, low investment needs. |

| Decoction Services | N/A (Included in TCM) | N/A (Included in TCM) | Established, high-demand, minimal marketing spend required. |

| Physical Therapy Services | N/A (Included in TCM) | N/A (Included in TCM) | Strong market presence, consistent revenue, loyal patient following. |

Full Transparency, Always

Gushengtang Holdings BCG Matrix

The BCG Matrix analysis of Gushengtang Holdings you are currently previewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with market data and strategic insights, is ready for immediate use without any further modifications or hidden content. The preview showcases the full formatting and detailed breakdown of Gushengtang Holdings' business units within the BCG Matrix framework, ensuring you get precisely what you need for your strategic planning.

Dogs

The general medical and health products segment, encompassing items like premium medicinal herbs and nutritional supplements, saw a modest revenue decline in 2024. This performance suggests a relatively small footprint within a market that might be experiencing limited expansion or stagnation for these particular offerings.

This downturn points to a potential underperformance within this business unit, possibly indicating that it's consuming resources without generating substantial returns. For instance, if this segment's revenue fell by 2% in 2024, contributing only 5% to Gushengtang's overall revenue, it would solidify its position as a potential cash cow or a dog, depending on its cash flow generation.

Certain standalone retail outlets within Gushengtang Holdings, if they primarily focus on product sales with limited integration into the core service offerings, could be classified as underperforming. These units might experience low customer footfall and generate minimal revenue, particularly if they operate in a saturated market with little differentiation.

These hypothetical outlets would likely represent a low market share in a competitive retail environment, facing subdued growth prospects. For instance, if such a store only sold ancillary products and saw a 5% year-over-year decline in sales in 2024, while the overall market grew by 8%, it would clearly indicate a struggling position.

Such operations could represent a drain on capital, yielding insufficient returns. If an underperforming outlet required $100,000 in annual operating expenses but only generated $50,000 in revenue in 2024, it would be a prime candidate for a strategic review to assess its future viability.

Certain traditional health products within Gushengtang's offerings may be experiencing a dip in consumer appeal, potentially due to newer, more advanced options entering the market. These legacy lines might hold a small slice of a market that isn't growing much, meaning they aren't bringing in much profit. For instance, if a specific herbal supplement line saw only a 2% revenue increase in 2023 compared to a 15% growth in their newer fertility services, it would highlight this stagnation.

Inefficient Supply Chain for Niche Products

For Gushengtang Holdings, an inefficient supply chain for niche medical products can be a significant drag. Imagine specialized diagnostic kits or rare pharmaceuticals. If the costs to acquire, store, and deliver these low-volume items are excessively high, their profitability takes a serious hit. This directly impacts the cash flow generated by these specific product lines.

This situation often leads to low profit margins, meaning that for every dollar earned, only a small fraction remains as profit. Consequently, these niche products generate minimal cash. This aligns with the characteristics of a Question Mark or potentially a Dog in the BCG matrix, where market share is low and growth prospects are also limited, making them a drain on the company's resources.

For instance, if a specialized medical device has a procurement cost that is 30% higher than comparable high-volume items, and its distribution requires specialized handling adding another 15% to logistics, its overall profitability could be reduced by as much as 45% compared to more standardized offerings. This inefficiency directly translates to low cash generation.

- High Procurement Costs: Specialized medical products can incur significantly higher unit costs due to limited production runs and specialized sourcing.

- Elevated Logistics Expenses: Niche items may require temperature-controlled shipping, specialized packaging, or expedited delivery, inflating distribution costs.

- Low Profitability & Cash Flow: The combination of high costs and low sales volume for these products results in diminished profit margins and minimal cash generation.

Limited Innovation in Traditional Product Sales

Gushengtang Holdings' traditional health products segment appears to be facing challenges due to a lack of significant new product development and potentially insufficient marketing. This stagnation can hinder their ability to stand out in an evolving market, leading to a shrinking market share and limited growth opportunities.

This situation positions these products squarely within the Dogs quadrant of the BCG Matrix. Without fresh offerings or renewed marketing vigor, they risk becoming less relevant and profitable over time. For instance, in 2023, the overall health supplement market saw growth, but companies with aging product lines without innovation struggled to capture new consumers.

- Limited New Product Development: A lack of investment in R&D for traditional health products.

- Insufficient Marketing Efforts: Underfunded or ineffective campaigns for existing offerings.

- Stagnant Sales: Indicating an inability to attract new customers or retain existing ones.

- Diminished Market Presence: Resulting from competition from more innovative alternatives.

Certain traditional health products within Gushengtang Holdings may be classified as Dogs due to low market share and limited growth prospects. These products, possibly including older herbal remedies or supplements, might be experiencing declining consumer interest or facing intense competition from newer, more innovative alternatives. For example, if a particular line of traditional tonics saw its market share shrink from 3% to 1.5% between 2022 and 2024, while the overall health supplement market grew by 7% annually, it would exemplify a Dog.

These underperforming segments often require significant resources for maintenance but generate minimal returns, acting as a drain on the company's overall profitability. If such a product line had operating costs of $200,000 in 2024 but only generated $80,000 in revenue, it would clearly indicate its Dog status.

The strategic implication for Gushengtang Holdings is to either divest these low-performing assets or implement a drastic turnaround strategy, which might involve significant product innovation or a complete repositioning. Failing to address these Dogs could hinder the company's ability to invest in its more promising Stars and Cash Cows.

Consider a scenario where Gushengtang's traditional medicinal wines, which represented 4% of total revenue in 2023, saw a 5% year-over-year revenue decline in 2024, while the company's fertility services grew by 20%. This disparity highlights the underperformance characteristic of a Dog.

Question Marks

Gushengtang Holdings is strategically launching 10 new in-hospital preparations in 2025, targeting an ambitious RMB 50 million in revenue. This move positions them within a high-growth segment of proprietary Traditional Chinese Medicine (TCM) formulations.

Despite the promising market potential, these new preparations are currently considered question marks in the BCG Matrix. Their market share is minimal due to their novelty, necessitating substantial investment for market penetration and brand establishment.

The future performance of these new in-hospital preparations remains uncertain, reflecting the inherent risks associated with introducing new products into a competitive landscape. Gushengtang's success will hinge on effective marketing, clinical validation, and physician adoption.

Gushengtang Holdings' overseas market expansion, exemplified by its medical institution in Singapore as of December 31, 2024, positions these ventures as potential stars. While these new international markets offer high growth prospects, the company's current market share is likely low due to the nascent stage of these operations.

Significant upfront investment is a hallmark of establishing a foothold in foreign markets, covering brand development and operational infrastructure. The long-term viability and success of these emerging international endeavors are yet to be definitively determined, making them a subject of ongoing observation and strategic evaluation.

Gushengtang Holdings' advanced AI Health Assistant development represents a significant investment in optimizing its entire service process, moving beyond the initial AI Doppelganger concept. This initiative is categorized as a potential Star within the BCG Matrix, reflecting its high-growth potential.

While the market adoption and revenue generation from this comprehensive AI integration are still in their nascent stages, indicating a currently low market share, the strategic importance is undeniable. For instance, by mid-2024, AI adoption in healthcare services globally was projected to grow significantly, with many providers investing heavily in such technologies to improve efficiency and patient outcomes.

These AI health assistant projects are resource-intensive, demanding substantial capital and talent. However, their capacity to revolutionize patient engagement, streamline administrative tasks, and enhance diagnostic support positions them as key drivers for future market leadership and substantial revenue streams.

Exploration of New Membership Service Models

Gushengtang Holdings is actively exploring new membership service models, like family doctor offerings, signaling a strategic move to adapt to changing healthcare demands and capture a growing segment seeking integrated, personalized care.

These new ventures, while promising for future growth, represent nascent offerings with currently low market penetration. Significant investment is anticipated to scale these services and establish a competitive market share.

- Focus on Integrated Care: Gushengtang's exploration of family doctor services aligns with a broader trend in healthcare towards more coordinated and patient-centric approaches.

- Market Potential: The demand for personalized and accessible healthcare solutions is on the rise, creating a significant market opportunity for well-executed membership models.

- Investment Requirements: Developing and scaling these new service models will necessitate substantial capital expenditure for infrastructure, technology, and talent acquisition, impacting short-term profitability.

- Competitive Landscape: As Gushengtang ventures into these new areas, it will face competition from established players and emerging healthcare providers also seeking to capture this evolving market.

Research and Development for Healthcare Solutions Productization

Gushengtang Holdings is actively investing in research and development to transform its traditional Chinese medicine (TCM) services into standardized, productized healthcare solutions. This strategic move is designed to unlock new, scalable revenue streams by making complex TCM treatments more accessible and repeatable.

This R&D focus positions Gushengtang to tap into a high-growth potential market, aiming to expand its reach and operational efficiency. The company anticipates that by productizing its offerings, it can achieve greater market penetration and improve profitability.

- Scalable Revenue Streams: R&D efforts are geared towards creating standardized TCM products for wider market adoption.

- Market Potential: The productization of TCM solutions offers significant growth opportunities by increasing accessibility and efficiency.

- Nascent Market Acceptance: While promising, the profitability and market acceptance of these new productized solutions are still under development.

- Investment Focus: Gushengtang's ongoing commitment to R&D underscores its strategy to innovate and diversify its service portfolio.

Gushengtang's 10 new in-hospital preparations launched in 2025, targeting RMB 50 million in revenue, are classified as question marks. Their current market share is minimal due to their novelty, requiring significant investment for market penetration and brand building. Success hinges on effective marketing and physician adoption in a competitive landscape.

| Product/Service | Market Share | Market Growth | BCG Category | Strategic Focus |

| New In-Hospital Preparations (2025) | Low | High | Question Mark | Market Penetration, Brand Building |

BCG Matrix Data Sources

Our Gushengtang Holdings BCG Matrix is built on a foundation of robust data, including financial statements, market research reports, and internal operational data to provide strategic clarity.