Gushengtang Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gushengtang Holdings Bundle

Gushengtang Holdings navigates a competitive landscape shaped by moderate buyer power and a growing threat of substitutes in traditional healthcare. Understanding the intensity of these forces is crucial for any strategic decision.

The complete report reveals the real forces shaping Gushengtang Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for Gushengtang's essential Traditional Chinese Medicine (TCM) herbs and skilled practitioners is a key factor. If a small number of suppliers control rare or highly sought-after herbs, or if there's a limited pool of reputable TCM doctors, these suppliers can exert significant leverage on pricing and contractual conditions.

Gushengtang's operational success hinges on its capacity to secure a diverse range of high-quality ingredients and to attract and retain top-tier TCM talent. For instance, in 2023, the TCM industry in China saw continued demand for premium herbs, with some specialty ingredients experiencing price increases due to limited cultivation or supply chain disruptions.

The uniqueness and specialization of inputs, such as rare Traditional Chinese Medicine (TCM) herbs and the expertise of highly regarded TCM practitioners, can significantly bolster supplier leverage. When these essential components are difficult to substitute, Gushengtang's reliance on specific suppliers or individuals intensifies, thereby enhancing their bargaining power.

Gushengtang's stated commitment to 'conscientious physicians, reliable pharmaceuticals' underscores a potential dependence on inputs that are not only of high quality but also potentially proprietary or difficult to source elsewhere. This focus directly translates to suppliers of these specialized inputs holding a stronger negotiating position.

High switching costs for Gushengtang to change suppliers for critical Traditional Chinese Medicine (TCM) ingredients or to replace established TCM practitioners significantly bolster supplier power. These costs encompass the rigorous processes of identifying new, reliable sources, implementing stringent quality assurance for novel herbs, and the substantial time and effort needed to recruit and integrate new doctors into their vast network. For instance, in 2024, Gushengtang's reliance on a select group of premium TCM ingredient suppliers meant that any shift would incur significant upfront investment in vetting and establishing new supply chains, potentially impacting product consistency and availability.

Supplier's Ability to Forward Integrate

The potential for suppliers to forward integrate into providing TCM healthcare services themselves represents a significant lever of bargaining power. If suppliers of traditional Chinese medicine (TCM) herbs or even skilled TCM practitioners could establish their own clinic networks, they could directly compete with Gushengtang. This threat compels Gushengtang to maintain favorable terms to secure its supply chain and retain access to essential resources and expertise.

However, the high capital investment and stringent regulatory hurdles associated with building and operating a comprehensive TCM clinic network, akin to Gushengtang's existing infrastructure, generally serve as a substantial barrier to entry for most suppliers. This complexity limits the immediate feasibility of widespread supplier forward integration, thereby mitigating the immediate threat to Gushengtang's market position.

- Supplier Forward Integration Threat: Suppliers could potentially establish their own TCM clinics, directly competing with Gushengtang.

- Impact on Gushengtang: This forces Gushengtang to offer better terms to suppliers to maintain supply and expertise.

- Barriers to Integration: High capital requirements and regulatory complexities for establishing clinic networks limit supplier forward integration.

Importance of Gushengtang to Suppliers

The degree to which Gushengtang's business is crucial to its suppliers directly impacts their bargaining leverage. If Gushengtang constitutes a major revenue stream for a supplier, that supplier may have less power, as they'll likely prioritize preserving the business relationship.

Conversely, if Gushengtang is merely one of many customers for a supplier, the supplier is likely to wield more influence. Gushengtang's significant revenue growth to RMB3,022.4 million in 2024 underscores its considerable purchasing capacity, potentially mitigating supplier power.

- Supplier Dependence: If Gushengtang represents a substantial portion of a supplier's sales, the supplier's bargaining power is diminished.

- Gushengtang's Market Share: A larger share of Gushengtang's procurement from a specific supplier increases that supplier's reliance on Gushengtang.

- Revenue Growth Impact: Gushengtang's 2024 revenue of RMB3,022.4 million suggests increased purchasing volume, potentially strengthening its position with suppliers.

The bargaining power of Gushengtang's suppliers is influenced by the concentration of suppliers for essential Traditional Chinese Medicine (TCM) herbs and skilled practitioners. If a few suppliers control rare herbs or a limited pool of reputable TCM doctors, they can significantly impact pricing and contract terms. Gushengtang's 2024 revenue of RMB3,022.4 million highlights its substantial purchasing capacity, which can potentially reduce supplier leverage if Gushengtang represents a significant portion of a supplier's sales.

| Factor | Impact on Gushengtang | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | Potentially High Leverage | Limited suppliers for rare herbs or top TCM practitioners. |

| Switching Costs | Increases Supplier Power | Time and investment needed for new herb sourcing and doctor integration. |

| Supplier Dependence on Gushengtang | Reduces Supplier Power | Gushengtang's RMB3,022.4 million revenue in 2024 indicates significant purchasing volume. |

| Forward Integration Threat | Mitigated by Barriers | High capital and regulatory hurdles for suppliers to establish competing clinics. |

What is included in the product

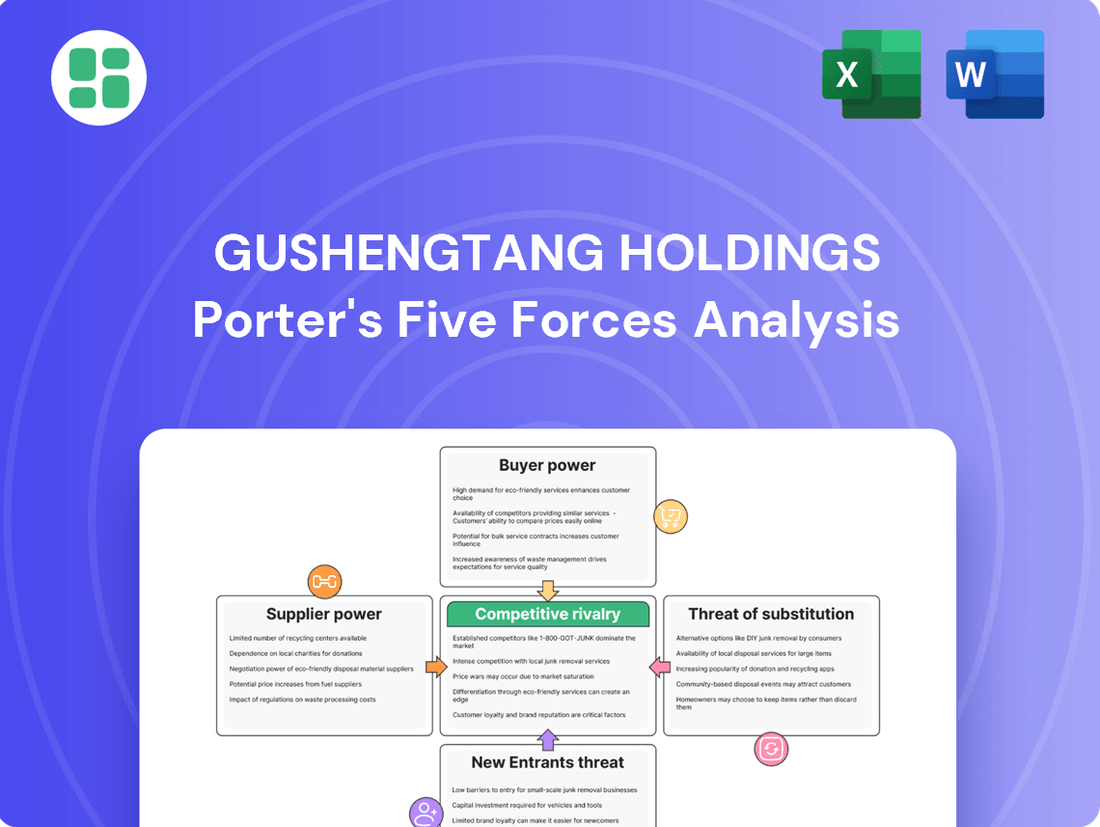

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Gushengtang Holdings' position in the traditional Chinese medicine and healthcare services market.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Gushengtang Holdings' Porter's Five Forces, simplifying strategic planning.

Gain actionable insights into market dynamics by clearly visualizing the intensity of each force, enabling Gushengtang Holdings to proactively address potential pain points.

Customers Bargaining Power

Gushengtang's customer base is largely made up of individual patients seeking Traditional Chinese Medicine (TCM) services and products. This fragmentation means that no single patient holds significant sway over the company's pricing or terms.

In 2023, Gushengtang reported serving millions of patient visits, underscoring the wide distribution of its customer base. This broad reach inherently dilutes the bargaining power of any individual customer.

The company's strategy to grow its membership program further solidifies customer loyalty, making it less likely for individual members to exert significant bargaining pressure.

The availability of numerous substitute healthcare options significantly bolsters customer bargaining power for Gushengtang Holdings. These alternatives range from Western medicine and other Traditional Chinese Medicine (TCM) providers to readily accessible self-care and over-the-counter remedies. This ease of switching necessitates Gushengtang's continuous efforts in service and product differentiation to maintain customer loyalty.

The broader TCM market, which saw a global market size of approximately $50 billion in 2023, is experiencing growth driven by the increasing adoption of complementary and alternative therapies. This trend further empowers consumers, as more options become available, allowing them to compare and select services based on factors like price, perceived efficacy, and convenience.

Customer price sensitivity is a key consideration for Gushengtang Holdings. While many value the quality and established reputation of Traditional Chinese Medicine (TCM), a segment of consumers remains highly attuned to price, particularly for standard treatments or items not fully covered by insurance.

This price sensitivity can be influenced by broader economic trends and government policies. For instance, the inclusion of more TCM services in China's basic medical insurance catalogs, as updated in 2024, potentially moderates price sensitivity and can stimulate demand for these covered services.

Customer Information

Customers of Gushengtang Holdings are increasingly well-informed, readily accessing details on treatment options, pricing, and the quality of various Traditional Chinese Medicine (TCM) providers and alternative therapies. This access, amplified by Gushengtang's own online platforms, empowers customers to easily compare different services, thus increasing their bargaining power.

The company's reliance on word-of-mouth publicity underscores the significant impact of customer experience and information sharing. Positive customer testimonials and shared experiences can drive business, but conversely, negative feedback can quickly deter potential clients, further highlighting the leverage customers hold.

- Informed Consumers: Patients can research TCM efficacy, compare provider credentials, and review pricing structures across the market.

- Digital Comparison: Gushengtang's online presence facilitates direct comparison with competitors, intensifying price and quality scrutiny.

- Reputation Sensitivity: Positive word-of-mouth is crucial, meaning customer satisfaction directly influences new patient acquisition and retention.

Customer's Ability to Backward Integrate

For Gushengtang's core offerings like consultations, diagnoses, and prescriptions, customers typically lack the ability to backward integrate. They cannot realistically replicate these specialized medical services themselves. This significantly limits their bargaining power in these crucial areas.

However, when it comes to basic health products or simpler herbal remedies sold by Gushengtang, customers might possess a limited capacity for backward integration. They could potentially source raw materials or less complex formulations independently. This slight ability to self-supply in specific product segments can marginally enhance their bargaining power.

- Limited backward integration for core medical services: Gushengtang's primary revenue streams, consultation, diagnosis, and prescription, are highly specialized and not easily replicated by end consumers.

- Potential for backward integration in product sales: For medicinal materials and nutritional products, customers may have some ability to source raw ingredients or simpler alternatives, a factor that slightly shifts power.

- Impact on overall customer power: While not a dominant force across all Gushengtang's offerings, the ability to self-source certain products provides a minor counter-balance to the company's market position.

Gushengtang's customer base is highly fragmented, meaning individual patients have minimal bargaining power due to the sheer volume of patients served. For instance, in 2023, Gushengtang reported millions of patient visits, illustrating this broad reach.

While customers possess limited ability to backward integrate core medical services like consultations, they can source certain medicinal materials or simpler remedies independently, slightly increasing their leverage for these specific products.

The increasing availability of information and substitute TCM providers, coupled with price sensitivity for standard treatments, empowers customers. This is further influenced by 2024 policy updates expanding TCM coverage in basic medical insurance, potentially moderating price sensitivity and stimulating demand.

Full Version Awaits

Gushengtang Holdings Porter's Five Forces Analysis

This preview showcases the exact Porter's Five Forces Analysis of Gushengtang Holdings you will receive immediately after purchase, providing a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within the traditional Chinese medicine industry. You're looking at the actual document, which offers a comprehensive strategic overview of Gushengtang Holdings' competitive landscape, ready for your immediate use upon completing the transaction.

Rivalry Among Competitors

The Traditional Chinese Medicine (TCM) market in China is characterized by a fragmented competitive landscape. Gushengtang Holdings, with its 78 medical institutions across various cities as of December 2024, stands as a substantial entity. However, it faces competition from a wide array of players, including well-established brands like Tongrentang, which boasts a long history and significant brand recognition, as well as a growing number of smaller, independent clinics and an increasing presence of online health platforms offering TCM services.

The Traditional Chinese Medicine (TCM) market in China is a significant driver of industry growth, with projections indicating a compound annual growth rate (CAGR) of 9.5% between 2024 and 2031. This strong expansionary trend can potentially moderate the intensity of competitive rivalry, as companies have room to grow by capturing new demand rather than solely battling for existing market share.

This robust market growth is fueled by several factors, including a growing consumer preference for alternative and natural therapies and increasing support from the Chinese government. Such favorable conditions allow players like Gushengtang Holdings to expand their operations and customer base more readily, which can ease some of the direct competitive pressures.

Gushengtang Holdings stands out by emphasizing its core value of 'conscientious physicians, reliable pharmaceuticals.' This commitment underpins its integrated approach, blending offline and online service platforms to offer a seamless patient experience.

The company further differentiates itself by focusing on high-caliber medical resources, including partnerships with renowned institutions. Gushengtang's investment in AI for Traditional Chinese Medicine (TCM) development is also a key differentiator, aiming to elevate service quality and innovation within the sector.

Switching Costs for Customers

Customer switching costs in the Traditional Chinese Medicine (TCM) market are generally moderate. While it's relatively straightforward for consumers to explore different clinics or online TCM platforms, the process of establishing trust with a new practitioner and cultivating a long-term healthcare relationship presents a degree of inertia.

Gushengtang Holdings benefits from this dynamic, as evidenced by its impressive member return rate exceeding 85%. This high rate of customer loyalty signifies that once patients find a TCM provider they trust, they are less inclined to switch, thereby creating a significant barrier for competitors seeking to attract Gushengtang’s established clientele.

- Moderate Switching Costs: While trying new TCM providers is easy, building trust and long-term relationships creates some switching barriers.

- High Customer Loyalty: Gushengtang's member return rate of over 85% demonstrates strong customer retention.

- Barrier to Entry: This loyalty acts as a deterrent for new entrants aiming to capture Gushengtang's customer base.

Exit Barriers

Exit barriers in the Traditional Chinese Medicine (TCM) clinic and healthcare product market are notably high. Significant sunk costs are tied to establishing physical clinic locations, procuring specialized medical equipment, and cultivating a strong brand reputation alongside a loyal patient base. These substantial fixed costs can effectively trap less successful competitors, forcing them to persist in the market and thereby intensifying the overall rivalry.

Gushengtang Holdings' ongoing strategy of expanding its physical clinic network further elevates these exit barriers. As of the first half of 2024, Gushengtang operated 199 clinics, a number that continues to grow. This expansion means new entrants face an increasingly difficult challenge in matching the established physical presence and associated operational scale of incumbents like Gushengtang.

- High Sunk Costs: Investment in physical infrastructure, specialized equipment, and brand building creates significant barriers to exit.

- Brand Loyalty and Patient Networks: Established relationships with patients are difficult and costly for competitors to replicate.

- Gushengtang's Network Expansion: The company's continuous growth in clinic numbers increases the scale advantage for existing players.

- Intensified Rivalry: High exit barriers can lead to prolonged competition as struggling firms remain in the market.

The competitive rivalry within China's Traditional Chinese Medicine (TCM) sector is moderately intense, influenced by a fragmented market and strong brand loyalty. Gushengtang Holdings, operating 199 clinics as of the first half of 2024, competes against established names like Tongrentang and numerous smaller players, as well as emerging online platforms.

Despite the numerous competitors, Gushengtang's high member return rate, exceeding 85%, suggests that customer switching costs, while not prohibitively high, are significant enough to foster loyalty. This loyalty acts as a considerable barrier for new entrants seeking to capture market share from Gushengtang's established patient base.

The market's projected 9.5% CAGR from 2024 to 2031 offers growth opportunities that can temper direct competition. However, high exit barriers, stemming from substantial investments in physical infrastructure and brand building, mean that less successful firms may remain in the market, contributing to ongoing rivalry.

| Competitor Type | Key Characteristics | Impact on Gushengtang |

|---|---|---|

| Established Brands (e.g., Tongrentang) | Long history, strong brand recognition | Direct competition for brand-conscious consumers |

| Smaller Independent Clinics | Local presence, potentially lower overheads | Fragmented competition, can capture niche markets |

| Online Health Platforms | Convenience, digital reach | Growing threat, requires integrated online/offline strategy |

| Gushengtang Holdings | Extensive clinic network (199 as of H1 2024), high customer loyalty (>85% return rate), AI integration | Strong competitive position due to scale and loyalty, differentiation through innovation |

SSubstitutes Threaten

The price-performance trade-off of substitute treatments, particularly Western medicine, presents a notable threat to Gushengtang Holdings. While Traditional Chinese Medicine (TCM) focuses on holistic well-being, Western medicine often offers quicker relief for acute conditions and enjoys broader insurance coverage, impacting patient decisions based on immediate cost and perceived effectiveness. In 2023, the global pharmaceutical market reached an estimated $1.6 trillion, highlighting the scale of the Western medicine alternative.

Customer propensity to substitute for Gushengtang Holdings' Traditional Chinese Medicine (TCM) services is influenced by a blend of cultural beliefs, perceived effectiveness, and awareness of alternative healthcare options. While TCM is deeply ingrained in Chinese culture, growing familiarity with Western medicine and its advancements presents a potential avenue for substitution, particularly for specific ailments where conventional treatments are perceived as more immediately effective.

The global trend towards holistic health and wellness, however, offers a counterbalancing force, potentially boosting the appeal of TCM. In 2024, the global TCM market was valued at approximately $240 billion, with projections indicating continued growth, suggesting that while substitution exists, the overall market sentiment remains favorable for TCM providers like Gushengtang.

The threat of substitutes for Gushengtang Holdings is significant, as consumers have a wide array of alternatives for managing their health and wellness. These include other Traditional Chinese Medicine (TCM) providers, readily available self-care remedies, dietary supplements, and a broad spectrum of Western medical treatments.

For instance, a customer experiencing pain might opt for acupuncture, a core TCM service offered by Gushengtang, or they could choose pharmaceutical pain relievers, a common Western medical approach. This highlights how Gushengtang's services directly compete with numerous other health solutions available in the market, impacting customer choice and potentially limiting pricing power.

Switching Costs to Substitutes

Switching costs for consumers considering alternatives to Gushengtang's Traditional Chinese Medicine (TCM) services can be multifaceted. These include the psychological hurdle of moving away from a trusted, familiar treatment approach, the financial outlay for new consultations, prescriptions, or diagnostic tests, and the logistical hassle of identifying and establishing relationships with new healthcare providers.

Despite these potential barriers, for many prevalent health concerns, the cost of switching between TCM and conventional Western medicine, or even opting for self-care remedies, can be quite low. This ease of transition for common ailments presents a significant competitive pressure.

Consider the market for common colds or minor digestive issues. Patients can readily access over-the-counter medications or readily available herbal remedies without substantial financial or time investment. For instance, in 2024, the global over-the-counter (OTC) drug market was valued at approximately $160 billion, indicating a vast array of accessible alternatives.

- Psychological Cost: Abandoning a long-held belief in TCM's efficacy or the comfort of a familiar practitioner.

- Financial Cost: Expenses related to new doctor visits, diagnostic tests, and alternative treatments.

- Inconvenience: The effort required to research, find, and build trust with a new healthcare provider.

- Low Switching Costs for Common Ailments: For minor health issues, readily available Western medicine or self-care options offer low barriers to switching.

Awareness and Acceptance of Substitutes

The awareness and acceptance of substitute healthcare options, including Western medicine and various alternative therapies, are notably high across China. This broad acceptance means that consumers have a wide range of choices when seeking health solutions.

Government initiatives actively promote integrated medicine, further boosting consumer awareness of different treatment modalities. This policy direction encourages a more holistic view of healthcare, where traditional and modern approaches are often considered complementary.

The COVID-19 pandemic significantly amplified public focus on immunity and self-care practices. This heightened awareness has likely accelerated the adoption and acceptance of both Traditional Chinese Medicine (TCM) and other health-promoting products and services as consumers seek to bolster their well-being.

- High Consumer Awareness: Chinese consumers are well-informed about and readily accept both Western and alternative medical treatments.

- Government Support for Integration: Policies encouraging integrated medicine increase familiarity with diverse healthcare options.

- Pandemic's Impact: COVID-19 heightened interest in immunity and self-care, potentially speeding up the adoption of TCM and other wellness products.

The threat of substitutes for Gushengtang Holdings is substantial due to the wide availability of alternative healthcare solutions. Consumers can easily switch to Western medicine, self-care remedies, or other TCM providers, especially for common ailments where switching costs are low. The global over-the-counter drug market, valued at approximately $160 billion in 2024, exemplifies the vast array of accessible alternatives.

The low switching costs for minor health issues, coupled with high consumer awareness of diverse healthcare options in China, intensify this threat. Government support for integrated medicine and a post-pandemic focus on self-care further broaden the competitive landscape, making it easier for customers to explore and adopt substitute treatments.

Gushengtang's services compete directly with numerous other health solutions, impacting customer choice and potentially limiting its pricing power. For instance, while the global TCM market was valued at around $240 billion in 2024, it operates within a much larger global healthcare ecosystem. The global pharmaceutical market alone reached an estimated $1.6 trillion in 2023, underscoring the scale of alternative treatment options.

Entrants Threaten

New entrants into the Traditional Chinese Medicine (TCM) healthcare market, particularly those aspiring to replicate Gushengtang Holdings' integrated offline and online model, would encounter substantial hurdles in achieving economies of scale. Gushengtang's established and expansive network of clinics, coupled with its considerable purchasing power for medical supplies and pharmaceuticals, creates a cost advantage that is difficult for newcomers to match.

The sheer volume of operations allows Gushengtang to negotiate better prices from suppliers, reducing its per-unit costs for everything from herbal medicines to diagnostic equipment. For instance, in 2023, Gushengtang reported operating 171 clinics, a scale that significantly lowers its operational expenses compared to a smaller, emerging player. This cost efficiency makes it challenging for new entrants to compete on price and achieve profitability without a similar scale.

The capital requirements for entering the medical services sector, particularly for a chain like Gushengtang Holdings, are significant. Establishing a network of physical medical institutions, coupled with the development and maintenance of a robust online healthcare platform, demands substantial upfront investment. This financial barrier makes it challenging for new players to compete effectively from the outset.

Gushengtang's growth strategy, which involves both building new facilities and acquiring existing ones, further escalates the capital needed for market entry. For instance, in 2023, the company continued its expansion, adding new clinics and services, which inherently increases the financial threshold for any aspiring competitor aiming to replicate its scale and reach.

New entrants into the Traditional Chinese Medicine (TCM) sector, particularly those looking to compete with Gushengtang Holdings, will find it challenging to secure access to established patient flows and distribution networks. Gushengtang's extensive physical clinic footprint, coupled with its robust online presence, has cultivated a significant and loyal customer base. This makes it difficult for newcomers to rapidly acquire market share, as they lack the pre-existing patient relationships and trust that Gushengtang has diligently built over time.

Furthermore, Gushengtang's integrated Online-to-Offline (OMO) platform presents a substantial competitive advantage. This platform seamlessly connects patients with TCM services across various touchpoints, streamlining access and enhancing the overall patient experience. For new entrants, replicating this integrated ecosystem and the associated patient engagement strategies would require considerable investment and time, creating a high barrier to entry.

Government Policy/Regulations

Government policy and regulations significantly shape the threat of new entrants in China's Traditional Chinese Medicine (TCM) sector. While the Chinese government actively promotes TCM, evidenced by initiatives like the 14th Five-Year Plan for TCM Development, it also imposes stringent licensing and operational requirements. For instance, establishing a new TCM medical institution requires adherence to specific facility standards, physician qualifications, and drug sourcing regulations. In 2024, the National Medical Products Administration (NMPA) continued to refine its oversight of TCM products, emphasizing quality control and efficacy. These regulatory hurdles can deter smaller or less capitalized new entrants, inadvertently benefiting established players like Gushengtang Holdings who possess the resources and expertise to navigate the compliance landscape. New companies must invest heavily in understanding and meeting these evolving standards, which can be a substantial barrier.

The Chinese government's support for TCM, including subsidies and favorable policies for TCM institutions, can lower operating costs for existing firms. However, this same support is often tied to specific development goals and quality standards that new entrants must meet to qualify for benefits. For example, government-backed training programs for TCM practitioners aim to improve the overall quality of care, but require new institutions to demonstrate a commitment to talent development. This creates a dual effect: government support can foster industry growth, but the associated regulatory framework and quality expectations act as a barrier to entry for those not already aligned with these objectives. Navigating these policies is crucial for any new company seeking to compete in the Chinese TCM market.

Brand Loyalty/Differentiation

Gushengtang Holdings has successfully fostered strong brand loyalty by emphasizing high-quality physicians and dependable pharmaceutical offerings. This is reflected in their impressive member return rates, indicating a significant competitive advantage.

New entrants face a substantial hurdle in replicating this loyalty. They would need to make considerable investments in brand building and differentiation strategies to attract customers away from Gushengtang's established reputation.

- Brand Loyalty: Gushengtang's focus on physician quality and reliable pharmaceuticals has built a loyal customer base.

- High Return Rate: The company boasts a high member return rate, a testament to customer satisfaction and trust.

- Entry Barrier: New entrants must overcome this established loyalty through significant investment in brand building and differentiation.

- Differentiation Challenge: Attracting customers from Gushengtang requires a compelling value proposition that sets new players apart.

The threat of new entrants for Gushengtang Holdings is moderate, primarily due to significant capital requirements and regulatory complexities in China's Traditional Chinese Medicine (TCM) sector. While government support for TCM exists, stringent licensing and operational standards, as emphasized by the NMPA in 2024, create substantial barriers. New players must invest heavily in compliance and infrastructure to match Gushengtang's established scale of 171 clinics in 2023.

Gushengtang's established patient flows and integrated Online-to-Offline (OMO) platform further deter new entrants. Replicating the trust and seamless patient experience built over time requires considerable time and investment. Additionally, Gushengtang's brand loyalty, driven by physician quality and reliable pharmaceuticals, necessitates significant marketing and differentiation efforts from newcomers to gain traction.

| Factor | Gushengtang's Position | Impact on New Entrants | 2023/2024 Data Point |

| Capital Requirements | High (171 clinics) | Significant barrier to entry | Expansion continued in 2023 |

| Regulatory Landscape | Navigated effectively | Complex and costly to comply | NMPA refined TCM oversight in 2024 |

| Brand Loyalty & Patient Flow | Strong, high return rates | Difficult to replicate | Focus on physician quality |

| OMO Platform Integration | Seamless O2O model | Requires substantial investment to match | Enhances patient access |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gushengtang Holdings is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific data from reputable market research firms and healthcare sector publications to provide a comprehensive view of the competitive landscape.